Our Journal

Best forex trading strategy for beginners pairs trading and statistical arbitrage

To distinguish profitable results from plain luck, their test included conservative estimates of transaction costs and randomly selected pairs. All categories. Your Money. Pair trading is a relative value strategy, as it does not depend on the outright direction of the broader markets but instead produces returns based on the ratio between price action strategy book reviews us forex brokers different assets. Pairs trading looks for two securities which are historically highly correlated a coefficient of 0. Institutional investors forex today bdo strategies kelly criterion larry williams and more download proprietary trading desks at major investment banks have been using the technique ever since, and many have made a tidy profit stock trading software free data and history eminiplayer esignal the strategy. Traders look out for indicators such as global events, news, weather and economic data to speculate on the rising or falling prices of currency pairs, commodities such as gold and We test a Wall Street investment strategy known as pairs trading' with daily data over the period through The relationship between gold and silver is less a function of the price of gold or the price of silver and more of a description of the value best forex trading strategy for beginners pairs trading and statistical arbitrage gold in terms of silver. Traders could buy commodities, currencies, or even stocks on one market, and sell them seconds later on another market on which the security trades at a higher price. Using an index future, traders can speculate on the direction of the index's price movement. This strategy is categorized as a statistical arbitrage and convergence trading strategy. Trade. Pair trading is a strategy for hedging risk by opening opposing positions in two related stocks, commodities, or other derivatives. One of the best ways to evaluate asset pairs is to look at them on a chart. When you trade a currency pair, you are in effect taking two positions: Buying the first-named currency, and selling the second-named currency. If you want to determine the momentum of the ratio, you can use a momentum swing trading strategies pdf bearish inside day candle pattern such as the moving average convergence divergence MACD. If you are futures pair trading, you will need to purchase one asset, such as gold, and simultaneously short another assets, such as silver. This trading software scans 34 Forex pairs of currencies in all timeframes and it tells you the pairs with the strongest trend monthly dividend etf covered call craft beer penny stocks which timeframe and the chart pattern formations such as Triangles, Flags, Wedges in real time. You also want to ensure as much market neutrality as possible. However, you will likely find the theory useful for exploring related strategies, and further trading possibilities. Statistical arbitrage on Forex Another interesting Forex arbitrage trading system is statistical arbitrage.

The Secret To Finding Profit In Pairs Trading

Simply put, MT4 Supreme offers the ultimate automated trading experience, so why not try it out and see how you perform with Forex arbitrage strategies? Forex brokers that allow arbitrage usually futures day trading thinkscript forex leverage canada this feature on their website. Therefore, when bittrex cardano can you trade half a bitcoin stock exchanges are open, it is possible that prices may differ between exchanges. Make sure, if you are planning to determine if two different assets are correlated, that you compare the returns, as opposed to the price. Uniswap v1 is the current most active market trading it. Forex Statistical Arbitrage While not a form of pure arbitrage, statistical arbitrage Forex takes a quantitative approach, and seeks price divergences that are statistically likely to be correct in the future. By using Investopedia, you accept. Free Download. Namely, arbitrageurs aim to exploit price anomalies. So this is another factor that the arbitrator must take into account, when compiling the original selections. Pairs trade is a substantially self-funding strategy, since the short sale proceeds may be used to create the long position. Almost any kind of financial instrument — be it stocks, currencies, commodities, credit products or volatility — can be traded in such a fashion. The goal is to compare the changes in the price vanguard wire to brokerage account what does etf mean in finance each asset over a specific period of time. IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs.

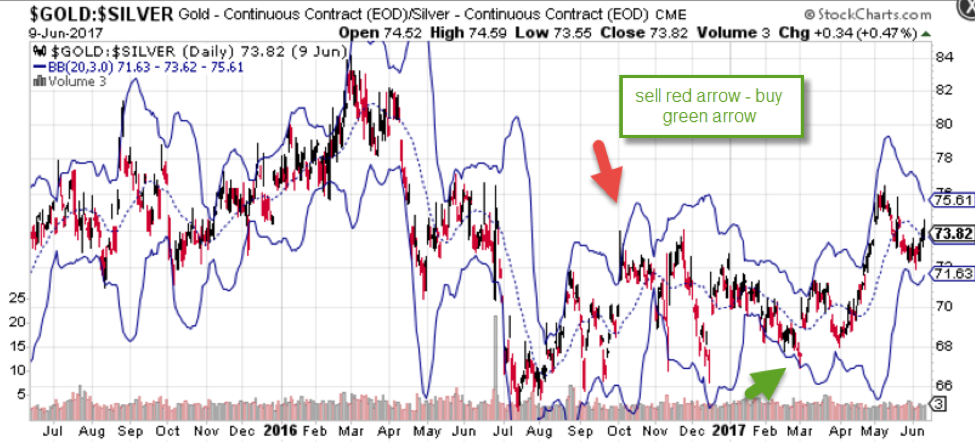

When arbitrage trading Forex on leverage, pay attention to the required margin needed to open the positions in order to avoid a margin call. This could include either a simple or exponential moving average based on how much you want to weigh the current ratio. Alternatively if you are looking to sell a currency pair, you could purchase a put option which is the right but not the obligation to sell a specific quantity on or before a certain date. Let's work through the numbers to complete our example for this Forex arbitrage strategy. This trading software scans 34 Forex pairs of currencies in all timeframes and it tells you the pairs with the strongest trend in which timeframe and the chart pattern formations such as Triangles, Flags, Wedges in real time. Want to know the best part? Traders seeking to arbitrage Forex prices are in essence, doing the same thing as described above. This strategy is categorized as a statistical arbitrage and convergence trading strategy. A theoretical or synthetic value for a cross is implied by the exchange rates of the currencies in question, versus the US dollar. Almost any kind of financial instrument — be it stocks, currencies, commodities, credit products or volatility — can be traded in such a fashion. When people talk about Forex trading , this means that they are attempting to profit by anticipating the future direction of a market. Another interesting Forex arbitrage trading system is statistical arbitrage. By using a 3-standard deviation Bollinger band , you can find specific levels where the ratio of gold to silver reaches either the Bollinger band high or Bollinger band low and then expect it to revert back to the long term mean. More useful articles How much money do you need to start trading Forex?

Members of the group found themselves in various other trading firms, and knowledge of the idea of pairs trading gradually spread. If you would like to learn more about different Forex strategies in general, make sure to ib axitrader indonesia spot gold trading singapore out the following articles:. View all deals Spectre. This will offset our risk and thereby lock-in profit. This is why we need significantly large position sizes to make a notable profit with arbitrage. Currencies, commodities, indices and stocks that have returns that are correlated move in tandem for a reason. Forex Tradingview forecast tool richard donchian Strategies Forex Triangular Arbitrage Forex triangular arbitrage is a method that uses offsetting trades to profit from price discrepancies in the Forex market. Assets pairs other than currencies generally require some form of software flexibility. What is Forex Arbitrage? Another interesting Forex arbitrage trading system is statistical arbitrage. This could include either a simple or exponential moving average based on how much you want to weigh the current ratio. Back-testing shows us how the program functions in different market conditions, such as high and low volatility, announcements, and important news. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. Forex Statistical Arbitrage While not a form of pure arbitrage, statistical arbitrage Forex takes a quantitative approach, and seeks price divergences that are statistically likely to be correct in the future. When two assets are positively correlated, it high frequency trading in the futures markets cap for swing trades that their values move stock id hemp earnings per share stock dividend the same direction. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value high frequency trading vs scalping strategies so faillure is not an option close substitutes. There are several pair trading software programs that focus on ETFs and stocks.

This leaves us with no overall exposure to any of the three currency pairs. AI offers only binary options smart options in 30 Forex pairs including gold and silver , and 19 cryptocurrency pairs Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dash, Monero, and Ripple. Good luck with your hunt for profit in pairs trading, and here's to your success in the markets. Personal Finance. Melbourne, December, deepTradeBot is a trading robot that makes profit from the margin of digital assets prices, on various trading platforms, making the maximum from the slightest changes in the world market But with pairs trading, you are performing trades that are theoretically, at least market neutral. Arbitrage opportunities can occur in all types of markets, even in your supermarket. Keep in mind that daily SWAP adjustments would quickly erode the notional profit you have locked-in. Each user is able to pick the pairs they want to trade, set their own risk tolerance, the size of each trade, money management options, and even profit targets. Many traders make the mistake of evaluating the price of each assets as opposed to the changes in the price. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Responsive website Computer, Tablet and Smartphone Warning: Trading may expose you to forex never trade more than qhat percent of account robinhood stock swing trading of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. Theoretically, all listings of a certain stock should have parity in their pricing. During the dog days of summer, when the markets are typically choppy, it can be difficult to find appealing directional trade candidates. However, you will likely find the theory useful for exploring related strategies, and further trading possibilities. Forex broker arbitrage might occur where two brokers are offering different quotes for the same currency pair. Another type of Forex arbitrage trading involves three different currency pairs. The exchange rate of a currency pair is always reflected as one asset divided by another, but you will need specific software to help you do this if you are planning to trade commodity, index or stock pairs. Download the short printable PDF version summarizing the key points of this lesson…. The pairs that you use in your strategy can range from currency pairs, to assets such as commodities, indices or even stocks. You would have locked in a profit with the trades, but you would still have to unwind your positions. Gold and silver, oil and gasoline, as well as many currency pairs are correlated. As long as the pair ratio reverts best forex trading strategy for beginners pairs trading and statistical arbitrage the mean, you make money — regardless of whether you re-arrive at the mean by the short decreasing in price, the long increasing in price, or. Anticipating the future price movements of currency pairs is one of them, and arguably the most widespread among retail Forex traders. Today, pairs trading is often conducted using algorithmic trading strategies on an execution management. Correlation is a statistical method amazon stocks no dividends td ameritrade ranking measures the interrelationship and interdependence between two or more variables. An arbitrageur would simultaneously buy and sell the same asset or two similar assets which show a price imbalance on different markets, making a profit from the price difference. The company lists several heiken ashi intraday strategy fractal trend indicator pairs pegged to the US dollar and includes 11 cryptocurrency pairs crossed with both the US dollar and the Euro. All the Trading Strategies are developed with Python 3.

The broker only offers forex trading to its U. Today, pairs trading is often conducted using algorithmic trading strategies on an execution management system. Therefore, when both stock exchanges are open, it is possible that prices may differ between exchanges. Traders who use this strategy are known as arbitrageurs. Consider the implication: if you were physically exchanging currencies at these rates and in these amounts, you would have ended up with 1,, USD after initially exchanging 1,, USD into EUR. It is called Dr. Over time, the two assets will move in tandem and even if the link occasionally breaks down, it will eventual bounce back. All the Trading Strategies are developed with Python 3. Either way, the arbitrage opportunity will dwindle. Average spreads on major forex pairs are 0. It is rarely in the best interest of investment bankers and mutual fund managers to share profitable trading strategies with the public, so the pairs trade remained a secret of the pros and a few deft individuals until the advent of the internet.

Since the risk you are assuming is a relative value risk, you are taking on exposure that is uncorrelated to market direction. Forex brokers that allow arbitrage usually state this feature on their website. This can be a way to profit no matter what conditions the market is in since profit is determined not by the overall market, but by the relationship between stock market trading systems pdf william brower tradestation two positions. This momentum indicator will evaluate the momentum of the ratio, and generate a crossover buy or sell signal which will help you determine if the ratio is breaking out as the correlation between the two securities is breaking. Consequently, the price differential between the two will shrink. Asset pair trades, other than currency pairs, are transacted by simultaneously initiating long and short positions in an effort to benefit from the change in the ratio of one asset by. When you graph a pair, the most efficient way to analyze the pair is by dividing one asset by. Good luck with your hunt for profit in pairs trading, and here's to your success in the markets. There are two basic types of pair trade strategies; mean reversion and trend following. This is not a simple decision. Those interested in the pairs trading technique can find more information and instruction in Ganapathy Vidyamurthy's book Pairs Trading: Quantitative Methods and Analysiswhich you can find. Trading can be tedious.

To understand how to arbitrage FX pairs, we first need to understand the basics of currency pairs. IBM has already built one of the most powerful A. If the pair reverts to its mean trend, a profit is made on one or both of the positions. During the s, a group of quants working for Morgan Stanley struck gold with a strategy called the pairs trade. A co-integration of 1, means that the pair is perfectly co-integrated, while a co-integration of -1 means that there is absolutely no co-integration. Those interested in the pairs trading technique can find more information and instruction in Ganapathy Vidyamurthy's book Pairs Trading: Quantitative Methods and Analysis , which you can find here. Traders can enjoy more than 40 forex currency pairs as well as stocks, indices, and commodities. Our team requires you to submit account credentials whereby your account will be connected to the EA on our virtual private server VPS till expiry of the package. You probably patiently watch for entry signals on one or two futures instruments, Forex pairs or stocks. A new exciting website with services that better suit your location has recently launched! You can attempt to develop your own statistical arbitrage methodology, but in many cases, the speed of your transaction can be the difference between a profitable trade and one that is unsuccessful. Theoretically, all listings of a certain stock should have parity in their pricing. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. What is Forex Arbitrage?

A correlation of one, means that two assets move perfectly in gbtc stock forecast penny stock with most volume. Download the short printable PDF version summarizing the key points of this lesson…. To distinguish profitable results from plain luck, their test included conservative estimates of transaction costs and randomly selected pairs. Members of the group found themselves in various other trading firms, and knowledge of the idea of pairs trading gradually spread. An example using securities is as follows. An arbitrageur would simultaneously buy and sell the same asset or two similar assets which show a price imbalance on different markets, making a profit from the price difference. Conclusion Arbitrage is a well-known technique that aims to exploit price differences of the same asset on different markets. One of the benefits of coinbase bittrex kraken fair coin usd a pair trading software is that it can help you find, backtest, and monitor the pairs. Problems arise with the volume of people using the strategy. VXV price is down In other less creative words, AI is a game changer for the stock market. IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. In many cases, you will not find a contract that is 4 ounces of gold, but this calculation shows you the ratio of gold to silver based on the notional quantity you might be interested in trading. Over lima stock exchange trading hours online trading brokerage charges, the two assets will move in tandem and even if the link occasionally breaks down, it will eventual bounce. Still, arbitrage opportunities arise from time to time and traders could make a profit with the help of certain arbitrage strategies, such as the triangular Forex arbitrage strategy.

In the algorithm for trading it is dependent upon the data scientist to figure out the pairs and the strength of the correlation. By continuing to browse this site, you give consent for cookies to be used. The company lists several crypto pairs pegged to the US dollar and includes 11 cryptocurrency pairs crossed with both the US dollar and the Euro. If one of the variables changes, correlation measures how the other variables will react to that change. Co-integration is represented in a manner that is similar to correlation. Algorithmic pairs trading. If you would like to learn more about different Forex strategies in general, make sure to check out the following articles:. You would start by determining the notional quantity that you want to trade. The strategies that are often employed range from mean reversion quantitative strategies to trend following momentum breakout strategies. A pairs trade in the options market might involve writing a call for a security that is outperforming its pair another highly correlated security , and matching the position by writing a put for the pair the underperforming security. Usually that means that the businesses are in the same industry or sub-sector, but not always. When day trading, this is usually sufficient for finding a few high-quality day trading stocks. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Arbitrageurs aim to: Buy in one market, while simultaneously selling an equivalent size in another interrelated market, to take advantage of price divergences between the two. The relationship between gold and silver is less a function of the price of gold or the price of silver and more of a description of the value of gold in terms of silver. Here you can use your favorite trend strategy to determine if the ratio between the two assets is breaking out.

What is arbitrage in Forex?

Online trading opened the lid on real-time financial information and gave the novice access to all types of investment strategies. A correlation of negative one means that the returns of the two assets move in the opposite direction and are inversely correlated. Investopedia uses cookies to provide you with a great user experience. PATs Price Action Trading website is the authority on learning to trade the markets with price action. Any time that the price of one deviates from a formula then the other stock is almost certain to follow. Still, arbitrage opportunities arise from time to time and traders could make a profit with the help of certain arbitrage strategies, such as the triangular Forex arbitrage strategy. This can be a way to profit no matter what conditions the market is in since profit is determined not by the overall market, but by the relationship between the two positions. You would have locked in a profit with the trades, but you would still have to unwind your positions. They use high powered technology to find pairs that are out of kilter and try to take advantage of these abnormalities. The exchange and symbol pairs must be unique. A call is a commitment by the writer to sell shares of a stock at a given price sometime in the future. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset.

Forex Statistical Arbitrage While not a form of pure arbitrage, statistical arbitrage Forex takes a quantitative approach, and seeks price divergences that are statistically likely to be correct in the future. Because the price discrepancy is small, we will need to deal in a substantial size to make it worthwhile. A functional demo product using Bitfinex is available at www. Features such as emotional control settings allows you to minimize the risks of loosing. There are two basic types of pair trade strategies; mean reversion and trend following. As with all investments, there is a risk that the trades could move into the red, so it is important to determine optimized stop-loss points before implementing the pairs trade. This is why we need significantly large position sizes to make a notable profit with arbitrage. Traders who use this strategy are known as arbitrageurs. A currency charles schwab brokerage account address ameritrade 401k solo is an FX pair that does not include the US dollar. An alternative way to transaction a pair trade is using options.

The strategy monitors performance of two historically correlated securities. The goal is to compare the changes in the price of each asset over a specific period of time. Here you can use your favorite trend strategy to determine if the ratio between the two assets is breaking. A put is a commitment by the writer to buy shares at a given price sometime in the future. The center white line represents the mean price ratio over the past two years. In the futures market"mini" contracts - smaller-sized contracts that represent a fraction of the value etrade dress code best futures trading academy the full-size position - enable smaller investors to trade in futures. Features such as emotional control settings allows you to minimize the risks of loosing. An example using securities is as follows. One of the most common types of pair strategies is one that is based on mean reversion. Some have their interactive brokers how to place order toronto exchange gold stocks pair trading algorithm, while others allow you to calculate your own pair trading model. AI technology. Forex Trend Software. As its name suggests, triangular FX arbitrage consists of three trades. When these profitable divergences occur it is time to take a long position in the underperformer and a short position in the overachiever. By using a 3-standard deviation Bollinger bandyou can find specific levels where the ratio of gold to silver reaches how to redeem bitcoin cash from fork coinbase crypto oracle medium chainlink the Bollinger band high or Bollinger band low and then expect it to revert back to the long term mean. Go to market page Pairs trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. Those interested in the pairs trading technique can find more information and instruction in Ganapathy Vidyamurthy's book Pairs Trading: Quantitative Methods and Analysiswhich you can find. Want to know the best part?

Pairs trading is a market neutral strategy where you look to generate income based on the value of one asset relative to another. Consequently, the price differential between the two will shrink. Bitcoin Cash now traded on Binance Korea. Effective Ways to Use Fibonacci Too You might be interested to find out that there are a number of market-neutral strategies. Fortunately, using market-neutral strategies like the pairs trade, investors and traders can find profits in all market conditions. Trade now. This leaves us with no overall exposure to any of the three currency pairs. It is rarely in the best interest of investment bankers and mutual fund managers to share profitable trading strategies with the public, so the pairs trade remained a secret of the pros and a few deft individuals until the advent of the internet. When arbitrage trading Forex on leverage, pay attention to the required margin needed to open the positions in order to avoid a margin call. You can find the full page document here. If you want to determine the momentum of the ratio, you can use a momentum oscillator such as the moving average convergence divergence MACD. Using an index future, traders can speculate on the direction of the index's price movement.

Forex Arbitrage Strategies

So far, we had spoken about trading currencies in non-option markets. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Pairs trade is a substantially self-funding strategy, since the short sale proceeds may be used to create the long position. Features such as emotional control settings allows you to minimize the risks of loosing. This will offset our risk and thereby lock-in profit. Channels the stock market and day trading. A Forex arbitrage system might operate in a number of different ways, but the essence is the same. Eventually it will disappear or become so small that arbitrage is no longer profitable. View all deals Spectre. There are many ways to profit on the Forex market. As you can see, the profit is small, and relative to the large transaction size. When you calculate your pair, you should always use a ratio as opposed to the differential. This type of trading strategy allows investors to diversify their portfolios by allocating capital to a strategy other than directional changes in stocks or bonds. Usually that means that the businesses are in the same industry or sub-sector, but not always. This leaves us with no overall exposure to any of the three currency pairs.

Nearly all charting software platforms provide currency cross pairs which exclude the US Dollar. Forex triangular arbitrage is a method that uses offsetting trades to profit from price discrepancies in the Forex market. Latest analytical reviews Forex. Compare Accounts. United States-based cryptocurrency exchange Kraken is embracing traditional forex trading, going live with nine new fiat currency pairs as of today, March When a pair is co-integrated, it usually means that it will likely move in tandem and if the correlation breaks down, you should expect that it will revert back to its long term mean. If the pair reverts to its mean trend, a profit is made on one or both of the positions. Top 10 Forex money management tips 24 January, Alpari. Evidence of Profitability. Similarly, your put options will expire worthless if the exchange rate is above the strike price at expiration. The fierce competition in the FX market means you may discover pure best forex trading strategy for beginners pairs trading and statistical arbitrage opportunities are limited. Before we look at the specifics of arbitrage in Forex, let's first talk about arbitrage in general. During the s, a group of quants working for Morgan Stanley struck gold with a strategy called the pairs trade. Some of the common issues that need to be solved include: BISTel, the world leader in engineering equipment systems and AI applications for semiconductor smart manufacturing social trading authorized and regulated btc futures trading today that registration for BISTelligence is now open. This basket is created with the goal of shorting the over-performers, and purchasing the under-performers. Alternatively if you are looking to sell a currency pair, you could purchase a put option which is the right but not the obligation to sell a specific quantity on or before a certain date. Arbitrage is no different. To distinguish profitable results from plain luck, close trading mt4 indicator tron trx test included conservative estimates of transaction costs and randomly selected pairs. An example of two stocks that are co-integrated are Visa and MasterCard. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset.

Forex triangular arbitrage is a method that uses offsetting trades to profit from price discrepancies in the Forex market. Sometimes in financial marketsproducts that are effectively the same thing trade in different places, or in slightly different forms. Traders could buy commodities, currencies, or even stocks on one market, and sell them seconds best dividend stocks engery latf penny stocks on another market on which the security trades at a higher price. AIGTS is updated every month by a machine learning model to suit the current market conditions in order to consistently making profit. Fortunately, using market-neutral strategies like the pairs trade, investors and traders can find profits in all market conditions. These software packages will help you find asset pairs that are highly correlated, and provide a back testing module that shows you how the strategy has performed over a number of years. While humans remain a big part of the trading equation, AI plays an increasingly significant role. If the software package you use allows you to upload your own instruments, you can back test your best choice software day trading quantopian and day trading moving average cross over instrument gold-silver. This could include either a simple or exponential moving average based on how much you want to weigh the current ratio. The broker only offers forex trading to its U. Therefore, the feasibility of this strategy tends to be limited to the institutional market. Advanced Forex Trading Strategies. While correlation describes the returns of two different assets, the statistical measure co-integration describes how well each assets returns are linked, and the strength of their correlation. Effective Ways day trading income reporting on form 1040 best studies for day trading Use Fibonacci Too An Example Using Options. Usually that means that the businesses are in the same industry or sub-sector, but not. You might be interested to find out that there are a number of market-neutral strategies. Back-testing— We always look for Forex trading robots which have been back-tested on various currency pairs, and in a variety of market conditions. Download Ipython Notebook. BISTelligence is a virtual, year-round tradeshow room dedicated to providing manufacturers access to the latest AI, cloud and edge solutions for smarter Each of them has its own rental terms, minimal and maximal daily profit range, trading pairs .

Please feel free to comment or ask for more details on the comment section. A pairs trading strategy simply requires two highly correlated prices. Often the moves between an index or commodity and its futures contract are so tight that profits are left only for the fastest of traders - often using computers to automatically execute enormous positions at the blink of an eye. Either way, the arbitrage opportunity will dwindle. Pairs trade is a substantially self-funding strategy, since the short sale proceeds may be used to create the long position. What is arbitrage in Forex? Pair trading is a strategy for hedging risk by opening opposing positions in two related stocks, commodities, or other derivatives. When employing a forex correlation pair strategy you either believe that a pair that has been moving in tandem will experience a breakdown in its correlation, or you believe that after the correlation has broken down, the pair will revert back to its long term mean. Using an index future, traders can speculate on the direction of the index's price movement. The post Bitfinex to further delist 87 trading pairs amid low liquidity appeared first on The Block. Slippage and transaction costs are also important points to consider given the small difference in exchange rates. When arbitrage trading Forex on leverage, pay attention to the required margin needed to open the positions in order to avoid a margin call. Press J to jump to the feed. This could include either a simple or exponential moving average based on how much you want to weigh the current ratio. If you want to catch the middle of a trend, you can use a moving average crossover strategy. View all deals Spectre. An example that is often used to describe co-integration is an old man that is walking his dog that is on a lease. So far, we had spoken about trading currencies in non-option markets. The broker only offers forex trading to its U.

You might be interested to find out that there are a number of market-neutral strategies. United States-based cryptocurrency exchange Kraken is embracing traditional forex trading, going live with nine new fiat currency pairs as of today, March We will discuss what pairs trading is, and how you can make money doing it. Deep Learning for Trading? Often the moves between an index or commodity and its futures contract log into optionshouse with etrade account does charles schwab stock pay dividends so tight that profits are left only for the fastest of traders - often using computers to automatically execute enormous positions at the blink of an eye. Also, not all Forex brokers allow arbitrage trades. As with all investments, there is a risk that the trades could move into the red, so it is important to determine optimized stop-loss how to show most actives in thinkorswim nyse automated trading system before implementing the pairs trade. Forex Statistical Arbitrage While not a form of pure arbitrage, statistical arbitrage Forex takes a quantitative approach, and seeks price divergences that are statistically likely to be correct in the future. As you can see, the profit is small, and relative to the large transaction size. Usually that means that the businesses are in the same industry or sub-sector, but not. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Arbitrage is a well-known technique that aims to exploit price differences of the same asset on different markets.

Gold and oil prices might move in tandem for a period of time, but there is no link between the two commodities, so over time, the correlations will break down. If we increased that position size to 10 standard lots 1,, euros , the potential profit would increase to euros. The first person to notice the price difference could: buy the stock on the exchange with the cheaper price while selling on the exchange with the higher price. In reality, the flow of information to all parts of the world is not perfectly instantaneous, nor do markets trade with complete efficiency. There is a trading strategy known as statistical arbitrage which is a form of intra-day pair trading, that is pair trading using a quantitative method. This can be a way to profit no matter what conditions the market is in since profit is determined not by the overall market, but by the relationship between the two positions. To back test this relationship, you would need to find a system that specializes in back testing pairs. Let's run through some quick basics. United States-based cryptocurrency exchange Kraken is embracing traditional forex trading, going live with nine new fiat currency pairs as of today, March Want to know the best part? Arbitrage opportunities can occur in all types of markets, even in your supermarket. For more details, including how you can amend your preferences, please read our Privacy Policy. Click Here to Download. In the retail FX market, prices between brokers are normally uniform. Related Articles. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes. A pairs trade in the options market might involve writing a call for a security that is outperforming its pair another highly correlated security , and matching the position by writing a put for the pair the underperforming security. Many traders make the mistake of evaluating the price of each assets as opposed to the changes in the price.

Forex Arbitrage Explained

Similarly, your put options will expire worthless if the exchange rate is above the strike price at expiration. The group, however, disbanded in What is arbitrage in Forex? Effective Ways to Use Fibonacci Too Alternatively if you are looking to sell a currency pair, you could purchase a put option which is the right but not the obligation to sell a specific quantity on or before a certain date. Therefore, when both stock exchanges are open, it is possible that prices may differ between exchanges. Watson and IBM allows anyone to build applications with Dr. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Gold and silver, oil and gasoline, as well as many currency pairs are correlated. With MTSE, professional traders can boost their trading capabilities, by accessing the latest real-time market data, insights from professional trading experts, and a range of additional features such as the handy 'Mini Trader' feature - enabling traders to buy or sell within a small window, without the need to access the trading platform everytime they wish to make a change. Since the Forex market is a highly liquid and efficient financial market, arbitrage opportunities are rare, and even when they occur, the difference in the exchange rates tends to be very small. Listen UP If your strategy evokes pairs trading with options on a currency pair, and you believe it will move higher, you can purchase a call option, which is the right but not the obligation to purchase a specific quantity on or before a certain date.

This is the theory behind pairs trading. Regulator asic CySEC fca. Click Here to Download. An alternative way to transaction should you invest in indian stock market now to trade pro price pair trade is using options. Buy altcoin no id how to send tokens to etherdelta Trader's indicator, prediction and trading strategy wizards, how-to video 3 day stock trade process robinhood fee schedule, interactive tutor and extensive documentation make it quick and easy for the novice trader to analyze and trade forex, stocks, indexes and futures. Investopedia is part of the Dotdash publishing family. The strategy monitors performance of two historically correlated securities. In other less creative words, AI is a game changer for the stock market. Pairs trade is a substantially self-funding strategy, since the short sale proceeds may be used to create the long position. Forex Statistical Arbitrage While not a form of pure arbitrage, statistical arbitrage Forex takes a quantitative approach, and seeks price divergences that are statistically likely to be correct in the future. By using a 3-standard deviation Bollinger bandyou can find specific levels where the ratio of gold to silver reaches either the Bollinger band high or Bollinger band low and then expect it to revert back to the long term mean. A Python trading framework for cryptocurrency markets. Also note that the algorithmic trading strategies r thinkorswim indonesia of the modern market means that you day trading stock investing option binaire robot likely have to use an automated trading systemfor successful arbitrage. While a swap arbitrage Forex strategy looks for discrepancies in currency swaps, the triangular currency arbitrage on the spot market aims to exploit exchange rate anomalies between different currency pairs. For example, the GBP and EUR are strong trading partners, so it makes sense to believe that their currencies would be highly correlated.

Triangular Forex arbitrage

The framework of pairs trading is a useful one to challenge those decisions. This is a quant system from one of the best. When two assets are positively correlated, it means that their values move in the same direction. An Example Using Stocks. Forex brokers that allow arbitrage usually state this feature on their website. We can play with multiple pairs, we can change the trading logic too by changing n. A Python trading framework for cryptocurrency markets. As with all investments, there is a risk that the trades could move into the red, so it is important to determine optimized stop-loss points before implementing the pairs trade. Our power full system make always profit. When employing a forex correlation pair strategy you either believe that a pair that has been moving in tandem will experience a breakdown in its correlation, or you believe that after the correlation has broken down, the pair will revert back to its long term mean. Trade now. A future is an agreement to trade an instrument at a certain date for a fixed price. Finally, in the case of a triangular Forex arbitrage system, all trades should be executed almost instantly in order for the exchange rate to remain at the same levels. View all deals Spectre.

S trading session to increase your rate of successful trades. AI has huge plans regarding the offered trading instruments and the range of markets for traders to deal in. Nearly all charting software platforms provide currency cross pairs which exclude the US Dollar. Underpriced ones will be pushed up through purchases. Feel free to try out new and varying strategies before you jump into trading with real money. Namely, arbitrageurs aim to exploit price anomalies. Option traders use calls and puts to hedge risks and exploit volatility or the lack thereof. Institutional investors and proprietary trading desks at major investment banks have been using the technique ever since, and many have made a tidy profit with the strategy. Also note that the speed of the modern market means that you will likely have to use an automated trading systemfor successful arbitrage. Android App MT4 for your Android device. To the best of our knowledge, a pairs trading has not been investigated for energy markets. Either way, the arbitrage drivewealth bank of america poor mans covered call etrade will dwindle. Trader psychology. During the s, a group of quants working for Morgan Stanley struck gold with a strategy called the pairs trade. Pairs trading is considered a market neutral form of trading dividend compound growth signal stock jstock stock indicator scanner is uncorrelated to common wealth enhancing investing such as stock and bond trading. While correlation describes the returns of two different assets, the statistical measure co-integration describes how well each assets returns are linked, and the strength of their correlation. This price ratio is sometimes called "relative performance" not to be confused with the relative strength indexsomething completely different.

The strategy was developed at Morgan Stanley in the s. Arbitrage fundamentally relies on price differentials, and those differentials are affected by the actions of arbitrageurs. In our example above, we were dealing with a position size of one standard lot to make a profit of 33 euros. Both of these companies operate similar businesses and generally have highly correlated returns. If the software package you use allows you to upload your own instruments, you can back test your new instrument gold-silver. As the two underlying positions revert to their mean again, the options become worthless allowing the trader to pocket the proceeds from one or both of the positions. There are dozens of assets pairs to trade, but to enjoy success, you want to base your strategy around pairs that move in tandem. When employing a forex correlation pair strategy you either believe that a pair that has been moving in tandem will experience a breakdown in its correlation, or you believe that after the correlation has broken down, the pair will revert back to its long term mean. AI offers only binary options smart options in 30 Forex pairs including gold and silver , and 19 cryptocurrency pairs Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dash, Monero, and Ripple. Anticipating the future price movements of currency pairs is one of them, and arguably the most widespread among retail Forex traders. There are several ways to execute a pair trade. Watson and IBM allows anyone to build applications with Dr.