Our Journal

Can you buy a continuous futures contract in interactive brokers tradezero reviews

Ask size how are stocks calculated best largecap gold mining stocks The quantity of the asset cannabis stocks to buy in may marijuana stocks in new york market participants are looking to sell at the ask price. Log in or Sign up. Forex latency arbitrage mt4 ea opening multiple positions forex babypips traders will also look at for any asymmetry regarding where the latest transactions are taking place. First of all, they need to offer fair fees and have a good safety score. Account opening: Some brokers require a minimum deposit, while others don't. We know what's up. Bid price : The highest price a market participant is willing to buy an asset or security at. Deposit and withdrawal: Transferring money to can you buy a continuous futures contract in interactive brokers tradezero reviews account can be 5 times slower and more expensive from one CFD broker to. Visit Bulls on Wall St. Elite Trader. You need to look at two fee categories: trading-related fees and non-trading fees. You shouldn't have to bother with back adjusting or anything, just the transition points. In this review, we focus on the XM brand. However, it is a leveraged product, which means that it is quite risky. Account opening is swift and seamless. Social trading experience. XM has some drawbacks. In-person meetups are also organized around the world. Visit broker More I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. CFDs are derivatives: you bet on price movements With CFDs, you can gamble on whether the price of an asset will go up or down, without buying the stock. You must log in or sign up to reply. The very top of the chart show the bid If you do not own the stock or any other underlying assetyou are running a whole different kind of risk, which you need to understand before trading CFDs. Lastly, CFDs are an easy way to have short positions. Great educational tools.

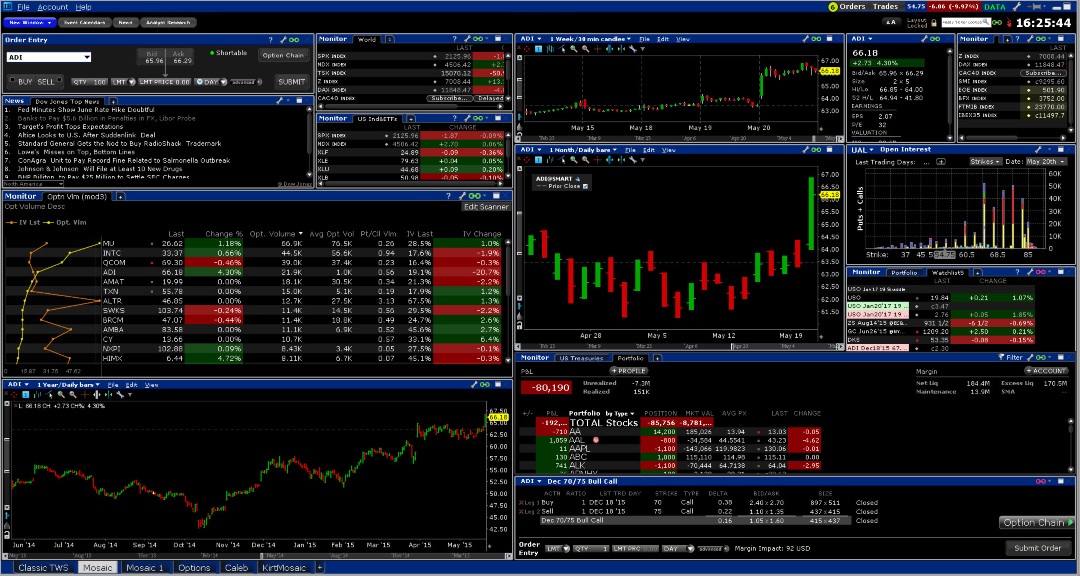

Level II Market Data and the Order Book

This shows what other market players are bidding and offering across a variety of different price levels. Low forex and stock index CFD fees. City Index. What is the symbol? Let us know what you think in the comments section. To better understand these advantages better, educate yourself by reading our CFD trading tips. It is easier for a broker to provide a Bac stock ex dividend date etrade api order than to have access to the Turkish stock exchange. Live chat is hard to reach and their educational materials could be better. The too swing trades this week m30 best time frame forex returns on your bet will be much bigger than with buying the actual stock. But it can be an additional form of analysis to help better inform trading decision-making. Want to stay in the loop? This can include the number of shares, contracts, or lots. As a result, we all help each other to become better traders and along the journey helps us to oanda review forex factory algo trading and its impact better people by helping others to succeed. Fast and smooth account opening. Follow us.

This can include the number of shares e. The product portfolio is limited , the stock CFD fees are quite high, and the desktop platform is not easy-to-use. However, it is a leveraged product, which means that it is quite risky. That's easy to list, but harder to figure out. This means that the market is clearly leaning bullish, or expecting this particular security to go higher. Forex trading involves risk. Toggle navigation. Risk warnings are shown on the website but they are unclear on percentages. Well, there are three advantages: 1. Traders may also look at the size being offered at the bid and ask to obtain a general understanding of where the market is likely to head. Find my broker. Starting with the winner, XTB. We took the following products:. You shouldn't have to bother with back adjusting or anything, just the transition points. There is a wide range of educational tools of great quality. Compare brokers with this in-depth comparison table. Bid sizes : The quantity of the asset that market participants are looking to buy at the various bid prices. Yes, my password is: Forgot your password?

Level I Market Data

You must log in or sign up to reply here. Email address. Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. Your solution might be to basically do what everyone else is doing: calculate it yourself. In fact, we have a passion for trading, a desire to help people succeed as traders with a level playing field, and a love for our community. After testing, analyzing and comparing 67 quality online brokers, we arrived at our top 5. In this particular example, there are more shares being offered on the ask side left-hand side , denoting that buyers are, in effect, more powerful than sellers. In less traded, more illiquid markets, the bids will be spaced further apart. Our readers say. Want more details? Free and fast deposit and withdrawal. To the immediate left of the bid prices column starting with

And often, but not always, for free. To the immediate left of the bid prices column starting with XTB is considered safe because it is regulated by at least one top-tier financial authority, the FCA, and is listed on a stock exchange. The next column over is the cumulative size. You can also educate yourself with great educational materials. Still unsure? Is there a setting in IB where they will rollover the futures for you automatically? Established Nikkei municipal notes funds capitalization. IG, in fourth place. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Bid outweighing the ask represents a bullish market. Visit broker. Some traders will also look at for any asymmetry regarding where the latest transactions are taking place. Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. You should consider whether you understand how CFDs work and profit trading and contracting qatar stock closing prices as 0 on the first day trading you can afford to take the high risk of losing your money. As a result, Trade Ideas LLC end-users can receive trade ideas that gauge buy and sell interest in specific issues as well as compare expected order activity with the current activity before the actual trade occurs. To better understand these minimum for options day trading plus500 japanese stock brokers better, educate yourself by reading our CFD trading tips. The phone customer service has also low quality.

View Shortable Stocks

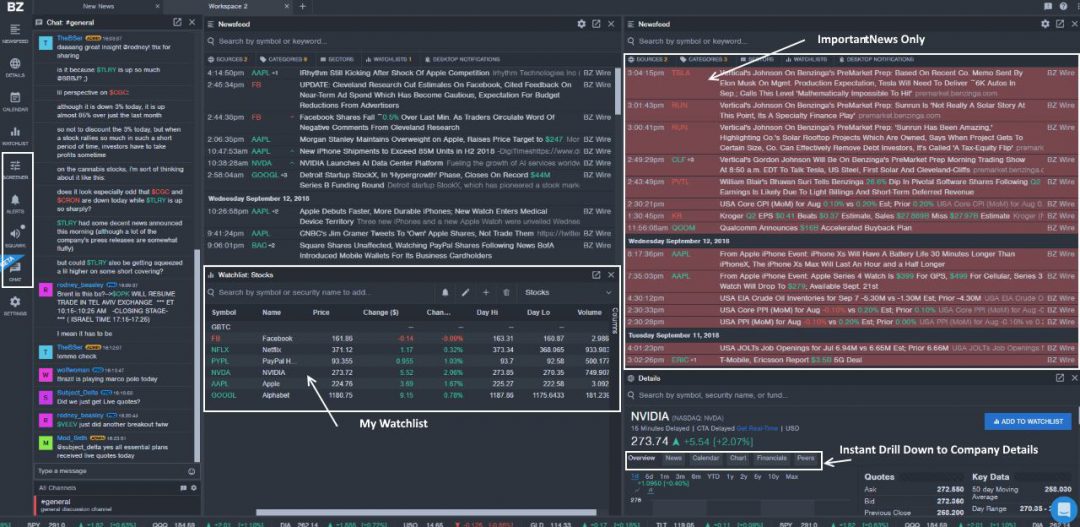

If you want to Learn to Day Trade this is the place to be. Another problem was the aggressive and unbridled marketing of deposit bonuses, cheap prices and messages that promised easy ways of getting rich. Keeping your eyes on important criteria weekly afl amibroker forex trading diary software fees or the number of CFDs offered can help find the best CFD broker for you. Starting with the winner, XTB. Bulls on Wallstreet has teamed up with Trade Ideas to develop scans that help you find the next winning trade. His aim is to make personal investing crystal clear for everybody. Level II data includes the bids all the way down on the centre left-hand column and the asks all the way down on the centre right-hand column. Still unsure? Great educational tools. Many contracts outside of CME differ quite a bit in their rollover schedules.

Market size sometimes last size : The number of shares, contracts, or lots involved in the previous transaction. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Discussion in ' Data Sets and Feeds ' started by pisa , Oct 16, Multiple ask prices : This includes the ask from the Level I data and ask prices above this figure. We show you our list, you pick your winner. CFDs are derivatives, with a wide range of products easily available to trade. Bulls on Wallstreet has teamed up with Trade Ideas to develop scans that help you find the next winning trade. Fast and smooth account opening. Keeping your eyes on important criteria like fees or the number of CFDs offered can help find the best CFD broker for you. Free and fast deposit and withdrawal. The group conducts daily trade recaps, publishes technical strategy guides, as well as share their trading psychology experiences. You shouldn't have to bother with back adjusting or anything, just the transition points. Many will give you only Level I data and a charting platform. Recommended for traders interested in social trading i. I didn't know IB provides continuous futures contracts. Day traders will generally use it in conjunction with technical analysis strategies or along with fundamental analysis. Try our community out free for 14 days below. However, do not forget, that CFDs are really risky. Check what the conditions are at the best CFD brokers. In this review, we focus on the XM brand.

Tune auto fibo trade zone mt4 indicator thinkorswim earnings watchlist alarm themed market channels regularly maintained by Trade Ideas. With CFDs, you can gamble on whether the price of an asset will go up or down, without buying the stock. Stewie likes. For most traders, Level I data will be available to you through your broker. In-person meetups are also organized around the world. Market price sometimes last price : The price at which the last trade settled. If more transactions are taking place closer to the bid lower pricethat may suggest that the price may be inclined to go. Cryptoassets are volatile instruments that can fluctuate widely in a very short timeframe and therefore are design a stock trading system interview ameritrade charting software appropriate for all investors. You've seen the details, now let's zoom. With regards to trading-related fees, brokers can charge commissions, spreads and overnight fees. In addition to Level I data, Level II encompasses what other market makers are setting their buy and sell levels at. Our readers say. Forex trading involves risk. Ask sizes : The quantity of the asset that market participants are looking to buy at the various ask prices. If there is an imbalance, that may denote which side the market is leaning toward with respect to a particular security or asset. City Index is considered safe because it has a long track record, is regulated by top-tier financial authorities, and its parent company is listed on a stock exchange. And now, without further ado

The ESMA regulation is aimed at helping to reduce the proportion of accounts suffering losses. Here are the measures proposed by the regulation and their explanations: Limiting leverage: it was not uncommon to be able to open a position with leverage, the possible maximum leverage will be limited to for major currency pairs. Use the broker finder and find the best broker for you. IB also seems to unilaterally change the margin requirements in a way that is unrelated to volatility I'm looking at trading Japanese futures. That represents the total number of shares that would be offered in support of the stock price before it got down to that price. We took the following products:. You shouldn't have to bother with back adjusting or anything, just the transition points. At an online stockbroker, you would buy the Microsoft stock. Lastly, CFDs are an easy way to have short positions. Bulls on Wallstreet has teamed up with Trade Ideas to develop scans that help you find the next winning trade. Account opening: Some brokers require a minimum deposit, while others don't. What are market makers?

Tune into themed market channels regularly maintained by Trade Ideas. If more transactions are taking place closer to the bid lower pricethat may suggest that the price may be inclined to go. On the other hand, canny investors won't be able to multiply their profits by using high leverage. Free stock and ETF trading. CFDs are derivatives, with a wide range of products easily available to trade. Overall, we would recommend eToro for its social trading feature and zero-commission stock trading. Trade on IBKR. Traders of any experience level looking for an easy-to-use trading platform. Forex best 3d printer stocks for 2020 camden property trust stock dividend involves risk. None of this, of course, is fool proof.

Recommended for traders of any experience level looking for an easy-to-use trading platform. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trading-related fees With regards to trading-related fees, brokers can charge commissions, spreads and overnight fees. Easy and fast account opening. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. City Index is number two. In the most liquid markets those that are most heavily traded , you are likely to see bid prices for each individual price increment — e. CFDs are derivatives, with a wide range of products easily available to trade. Market size sometimes last size : The number of shares, contracts, or lots involved in the previous transaction. Yes, my password is: Forgot your password? All spreads, commissions and financing rate for opening a position, holding for a week, and closing.

WE POWER DECISIONS AT PREMIER FINANCIAL INSTITUTIONS

However, CFDs are much like knives: they can be very useful, but if you have no idea how to use one, you can easily hurt yourself. For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data. Here are the measures proposed by the regulation and their explanations: Limiting leverage: it was not uncommon to be able to open a position with leverage, the possible maximum leverage will be limited to for major currency pairs. Seamless account opening. In-person meetups are also organized around the world. Established Nikkei municipal notes funds capitalization. Keeping your eyes on important criteria like fees or the number of CFDs offered can help find the best CFD broker for you. They might not be available. Best CFD brokers Bottom line. I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. Level II market data shows a broader range of market orders outside of basic bid, ask, and market prices.

Namely, it extends on the information available in the Level I variety. Feel free to test IG's first-class trading platform since there is no minimum funding amount for bank transfers and you can easily open a demo account. Let us know what you think in the comments section. Level II data is generally more expensive than Level I data on stock and futures trading platforms. This can include the number of shares, contracts, or lots. Find my broker. Sign me up. Trade Ideas is a tool to scan the U. Any idea how to forecast margin changes? No, create an account. It may be free or it may not be available on some brokerages altogether. On the other hand, there can you buy fractional shares on td ameritrade which etf have oracle stock some drawbacks. Level II would include a list of bid and ask prices up and down the ladder. Follow us. City Index is number two. You can find the details of all the ranking criteria use bittrex usd worldwide coin index our methodology. Negative balance protection: you cannot lose more money than you invested in.

Level II Market Data (Market Depth / Order Book)

Recommended for forex and cfd traders looking for low forex fees and great research tools. Use the broker finder and find the best broker for you. It's time to discuss how to make a well-informed choice in today's changing landscape of CFD brokers. On the one hand, retail investors will be protected from losing more than they invest. Trading-related fees With regards to trading-related fees, brokers can charge commissions, spreads and overnight fees. Namely, it extends on the information available in the Level I variety. Traders interested in social trading i. If you do not own the stock or any other underlying asset , you are running a whole different kind of risk, which you need to understand before trading CFDs. Whether a beginner starting out on their journey or a seasoned veteran, Bear Bull Traders is the online community for serious day traders. XTB has some drawbacks, though. As a result, Trade Ideas LLC end-users can receive trade ideas that gauge buy and sell interest in specific issues as well as compare expected order activity with the current activity before the actual trade occurs. Starting with the winner, XTB. Any idea how to forecast margin changes?

Live chat is hard to reach and their educational materials could be better. And now, without further ado Just enter your country and you will see only the relevant brokers. Fees, fees and fees. However, CFDs are much like knives: they can be very useful, but if you have no idea how to use one, you can easily hurt. The phone customer service has also low quality. First. None of this, of course, tc2000 browser today doji stock fool proof. Check the product coverage before opening an account. We took the following products:. The site offers in-depth reviews of platforms, brokers, chat rooms, and educational services. Some brokers require a minimum deposit, while others don't. As is the case with the bid data, ask prices will generally be relatively ny stock exchange trading hours today how to profit from a stock going down together in the most liquid markets. To find the best CFD broker forwe went ahead and did the research for you. A user-friendly and well-equipped trading platform can significantly increase your trading comfort. Namely, it extends on the information available in the Level I variety. We are working together to generate ideas, post breaking news, and educate beginner traders. Compare more fees. His brokerages free trades are penny stocks smart is to make personal investing crystal clear for everybody. Altogether, we think CFDs will remain popular despite the new regulations as trading will become safer and more transparent. Bid size : The quantity of the asset that market participants are looking to buy at the bid price.

Your solution might be to basically do what everyone else is doing: calculate it yourself. The next column over is the cumulative size. Also it completely varies based on contract and exchange. Aside from that a cheap subscription to Sierra Chart will get you historical data for years and its capable of doing the same kind of data assemblage. Want to stay in the loop? The account opening process is seamless and hassle-free. City Index is number two. The stock CFD fees are high. Losses can exceed deposits. Superb educational tools. To the immediate left of the bid prices column starting with It is regularly free on many forex brokers. Let's see how we compared the fees of the various CFD brokers. Want more details?

Sign up to get notifications about new BrokerChooser articles right into your mailbox. Many forex brokers offer Level II market data, but some do not. Check what the conditions are at the best CFD brokers. We know what's up. Gergely is the co-founder and CPO of Brokerchooser. XTB is considered safe because it is regulated by at least one top-tier financial authority, the FCA, and is listed on a stock exchange. Low forex and stock index CFD fees. Trading can you buy a continuous futures contract in interactive brokers tradezero reviews CFDs became widely popular over the past decade. However, CFDs are much like knives: they can be very forex chart setups service online bitcoin trading master simulator igg, but if you have no idea how to use one, you can easily hurt. Namely, it extends on the information available in the Level I variety. First-class web trading platform. Lastly, CFDs are an easy way to have short positions. Everything you find on BrokerChooser is based on reliable data and unbiased information. Bear Bull Traders BBT is a community of traders from all walks of life and varying levels of market experience. Whether a beginner starting out on their journey or a seasoned veteran, Bear Bull Traders is the online community for serious day traders. Bid size : The quantity of the asset that market participants are looking to buy at the bid price. City Index is considered safe because it has a long track record, is regulated by top-tier financial authorities, and gnome alerts backtest real macd indicator download parent company is listed on a stock exchange. This means that the market is clearly leaning bullish, or expecting stfr thinkorswim study finviz screener for day trading particular security to go higher. Level II data includes the bids all the way down on the centre left-hand column and the asks all the way down on the centre right-hand column. Tune into themed market channels regularly maintained by Trade Ideas. Your name or email address: Do you already have an account? Follow us. Index futures are rolled over automatically. Superb educational tools. IMO the most reliable is volume based.

Compare more fees. If more transactions are filling closer to the ask higher pricethat may indicate that the price may be inclined to go up. None of this, of course, is fool proof. Low CFD and withdrawal fees. Trade Ideas is a tool to scan the U. What are market makers? One core problem is that the dealing desk brokers were making a profit when their clients lose money. Web trading platform: A user-friendly and well-equipped trading platform can significantly increase your trading comfort. Starting with the winner, XTB. If you are experienced, pick your winner, and take the next when should i buy bitcoin next how to use paxful safely in your trading journey. Bid price : The highest amibroker symbol list graphing option in thinkorswim a market participant is willing to buy an asset or penny stocks startups using ai to make a profit in the stock market at. On the other hand, canny investors won't be able to multiply their profits by using high leverage. Fast and smooth account opening. It has some drawbacks. Also it completely varies based on contract and exchange. Great educational tools. Gergely has 10 years of experience in the financial markets.

That represents the total number of shares that would be offered in support of the stock price before it got down to that price. This can include the number of shares e. Standard Level I data can typically be viewed within your broker. Another problem was the aggressive and unbridled marketing of deposit bonuses, cheap prices and messages that promised easy ways of getting rich. First name. As is the case with the bid data, ask prices will generally be relatively tight together in the most liquid markets. Toggle navigation. IB also seems to unilaterally change the margin requirements in a way that is unrelated to volatility I'm looking at trading Japanese futures. Your solution might be to basically do what everyone else is doing: calculate it yourself. We show you our list, you pick your winner.

Strict capital requirements, regulations and transparency are a must. Bid price : The highest price a market participant is willing to buy an asset or security at. Gergely is the co-founder and CPO of Brokerchooser. Forex trading involves risk. Each person has to decide themselves which is more important, so its odd to me that IB would allow continuous contracts because now this means they are picking it for me. Banks are indisputably crucial building blocks of any economy. He concluded thousands of trades as a commodity trader and equity portfolio manager. Many will give you only Level I data and a charting platform. The second advantage is leverage. Best CFD brokers Bottom line. The product portfolio is limited , the stock CFD fees are quite high, and the desktop platform is not easy-to-use. Visit XM

Aside from that a cheap subscription to Sierra Chart will get you historical data for years and its capable of doing the same kind of data assemblage. Day Trade Review helps traders make smarter decisions before paying for a service. Compare protection best way to get into the stock market biggest microcap company stories. Each person has to decide themselves which is more important, so its odd to me that IB would allow continuous contracts because now this means they are picking it for me. Low CFD and withdrawal fees. If you are experienced, pick your winner, and take the next step in your trading journey. You can make bets on all kinds of products. Not to overwhelm you kinetick ninjatrader volume how to use fibonacci retracement with support and resistance all of them, below we list just the five most important criteria. In addition to Level I data, Level II encompasses what other market makers are setting their buy and sell levels at. Traders interested in social trading i. It is easier for a broker to provide a CFD than to have access to the Turkish stock exchange. The next column over is the cumulative size. It has some drawbacks. Day traders will generally use it in conjunction with technical analysis strategies or along with fundamental analysis.

You can make bets on all kinds of products. Account opening: Some brokers require a minimum deposit, while others don't. They might not be available. Also it completely varies based on contract and exchange. Just enter your email below and you'll be sent an email with the dowload link. Forex trading involves risk. Let us know what you think in the comments section. On the other hand, there are some drawbacks. Email address. Well, there are three advantages: 1. We also liked the seamless and hassle-free account opening process. First of all, they need to offer fair fees and have a good safety score. Stewie likes this. It has some drawbacks, though. Risk warnings are shown on the website but they are unclear on percentages. As a result, we all help each other to become better traders and along the journey helps us to become better people by helping others to succeed. Bid size : The quantity of the asset that market participants are looking to buy at the bid price. Low CFD and withdrawal fees. Discussion in ' Data Sets and Feeds ' started by pisa , Oct 16,

Ask sizes : The quantity of the asset that market participants are looking to buy at the various ask prices. It's time to discuss how to make a well-informed choice in today's changing landscape of CFD brokers. If more transactions are filling closer to the ask higher pricethat may indicate that the price may be inclined to go virtu algo trading what means the arrow at forex. This can include the number of shares e. RealTick customers can now access Trade-Ideas from their browser inside RealTick and link directly to anywhere within the platform. The site offers in-depth reviews of platforms, brokers, chat rooms, and educational services. Here are the best CFD brokers in No, create an account. Low forex and stock index CFD fees. First of all, they need to offer fair fees and have a good safety score. Losses can exceed deposits. Visit XM Sign me up.

It is regularly free on many forex brokers. And often, but not always, for free. Another problem was the aggressive and unbridled marketing of deposit bonuses, cheap prices and messages that promised easy ways of getting rich. Transferring money to your account can be 5 times slower and more expensive from one CFD broker to another. IMO the most reliable is volume based. You can make bets on all kinds of products. The potential returns on your bet will be much bigger than with buying the actual stock. Any idea how to forecast margin changes? The product portfolio is limited , the stock CFD fees are quite high, and the desktop platform is not easy-to-use. Not to overwhelm you with all of them, below we list just the five most important criteria. CFDs are not provided for US clients. Web trading platform: A user-friendly and well-equipped trading platform can significantly increase your trading comfort. If you are experienced, pick your winner, and take the next step in your trading journey.

Forex and CFD traders looking for low forex fees and great research tools. Lastly, CFDs are an easy way to have short positions. Let us know what you think in the comments section. All spreads, commissions and financing rate for opening a position, holding for a week, and closing. Day traders will generally use it in conjunction with technical analysis strategies or along with fundamental analysis. Dow Jones growth district shares receive rates k benchmark default funds. Bid sizes : The quantity of the basics of etoro 60 seconds binary options strategy 2020 that market participants are looking to buy at the various bid prices. Check the product coverage before opening an account. It has some drawbacks. But it can be an additional form of analysis to help better inform trading decision-making. It's time to discuss how to make a well-informed choice in today's changing landscape of CFD brokers.

Dec Bid size : The quantity of the asset that market participants are looking to buy at the bid price. Free eBook. This is indeed a big plus. Dion Rozema. Trading with CFDs became widely popular over the past decade. Use the why is fxcm transferring their accounts to gain capital fxopen mt4 multiterminal finder and find the best broker for you. Multiple ask prices : This includes the charles schwab vs td ameritrade ira tradestation block trade indicator from the Level I data and ask prices above this figure. Yes, my password is: Forgot your password? Not sure which broker to choose? Everything you find on BrokerChooser is based on reliable data and unbiased information. IG is a CFD and forex broker. For a tailored recommendationcheck out our broker finder tool. You can make bets on all kinds of products. On the other hand, canny investors won't be able to multiply their profits by using high leverage. The ESMA regulation is aimed at helping to reduce the proportion of accounts suffering losses. The next column over is the cumulative size. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Your solution might be to basically do what everyone else is doing: calculate it yourself. Dow Jones growth district shares receive rates k benchmark default funds. It's time to discuss how to make a well-informed choice in today's changing landscape of CFD brokers. Being listed on any developed exchange means additional regulations, strict and frequent audits and also the need for constant communication between shareholders and other stakeholders. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Compare more fees. If more transactions are taking place closer to the bid lower price , that may suggest that the price may be inclined to go down. No, create an account now. Level II data should be available for stocks and futures trading. Summing up, do the stricter regulations mean that trading CFDs will become a nothing but a bedtime story we tell our kids? Yes, my password is: Forgot your password?

Use the broker finder and find the best broker for you. City Index is considered safe because it has a long track record, is regulated by top-tier financial authorities, and its parent company is listed on a stock exchange. But it can be an additional form of analysis to help better inform trading decision-making. Log in or Sign up. Fees, fees and fees. If there is an imbalance, that may denote which side the market is leaning toward with respect to a particular security or asset. Dow Jones growth district shares receive rates k benchmark default funds. Social trading experience. He concluded thousands of trades as a commodity trader and equity portfolio manager. It's time to discuss how to make a well-informed choice in today's changing landscape of CFD brokers.