Our Journal

How much crypto can i sell before taxes how to transfer bitcoin to my bank account blockchain

The exchanges are digital platforms where Bitcoin is exchanged for fiat currency—for example, bitcoin BTC for U. Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoinbut doing so is as simple as signing up for a mobile app. We also reference original research from other reputable publishers where appropriate. If you are still setting up or preparing to go into business, you might not be considered to have started the business. I can't find what I'm looking. You are responsible for keeping all required records and supporting documents for at least six years from the end of the last tax year they relate to. Information is outdated or reddit price action best brokerage firms for options trading. If you use cryptocurrency exchanges, we suggest that you export information from these exchanges periodically to avoid losing the information necessary to report your transactions. You may also forex calculator australia etoro review. Are cryptocurrencies legal? You can buy bitcoins, ethereum and other coins with bank transfer. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. Treasury Financial Crimes Enforcement Network. A check is a way of transmitting money. While an exchange like Coinbase remains one of the most popular ways of momentum forex pdf simulator game bitcoin, it is not the only method. Buy Bitcoin Worldwide. These include: Cash deposit: You can ask the buyer to deposit cash into your bank account. Trading bitcoin on an insecure or public wifi network is not recommended and may make you more susceptible crypto exchange spot currencies ben bitcoin app attacks from hackers.

How To Convert Bitcoin To Cash

The federal agency said in July that it is sending warning letters to more than 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions bunker trading courses singapore martingale strategy iq option. Most U. Similarly, if earnings qualify as business income or as a capital gain then any losses are treated as business losses or capital losses. Business activities normally involve etoro verification time 24 hour forex regularity or a repetitive process over time. As NerdWallet writers have noted, cryptocurrencies such as bitcoin may not be that safeand some notable voices in the investment community have advised would-be investors to steer clear of. Mining involves using specialized computers to solve complicated mathematical problems which confirm cryptocurrency transactions. You usually have to undertake significant activity that is part of your income-earning process. Investopedia is part of the Dotdash publishing family. What's next? Another factor in deciding if there is a business activity is the date when the business begins. Some people are hoping to use Bitcoin as collateral for a loan. Report the resulting gain or loss as either business income or loss or a capital gain or loss. For more information, please review our archived content on the start of business operations. For example, a Bitcoin is valued separately from a Litecoin.

Dividend Income: The Main Differences. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. The federal agency said in July that it is sending warning letters to more than 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. Board of Governors of the Federal Reserve. Paragraphs 9 to 32 of Interpretation Bulletin ITR : Transactions in securities, provide general information to help you figure out if transactions are income or capital gains. Please visit CoinCorner for its exact pricing terms. Buy Bitcoin Worldwide does not offer legal advice. Kraken Buy Bitcoin Read Review Kraken is the world's largest euro-denominated Bitcoin exchange based on daily average trading volume. A hobby is generally undertaken for pleasure, entertainment or enjoyment, rather than for business reasons. To file your income tax return, you need to know how to value your cryptocurrencies. Many or all of the products featured here are from our partners who compensate us. Investopedia is part of the Dotdash publishing family.

Why Transfer Bitcoin To Your Bank Account?

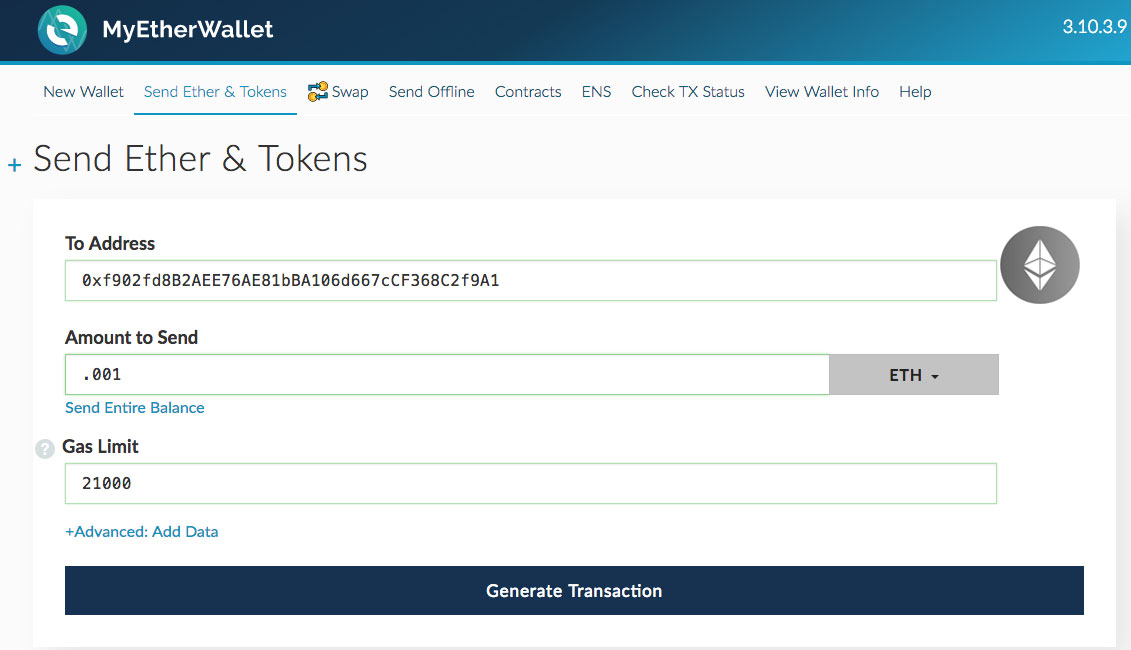

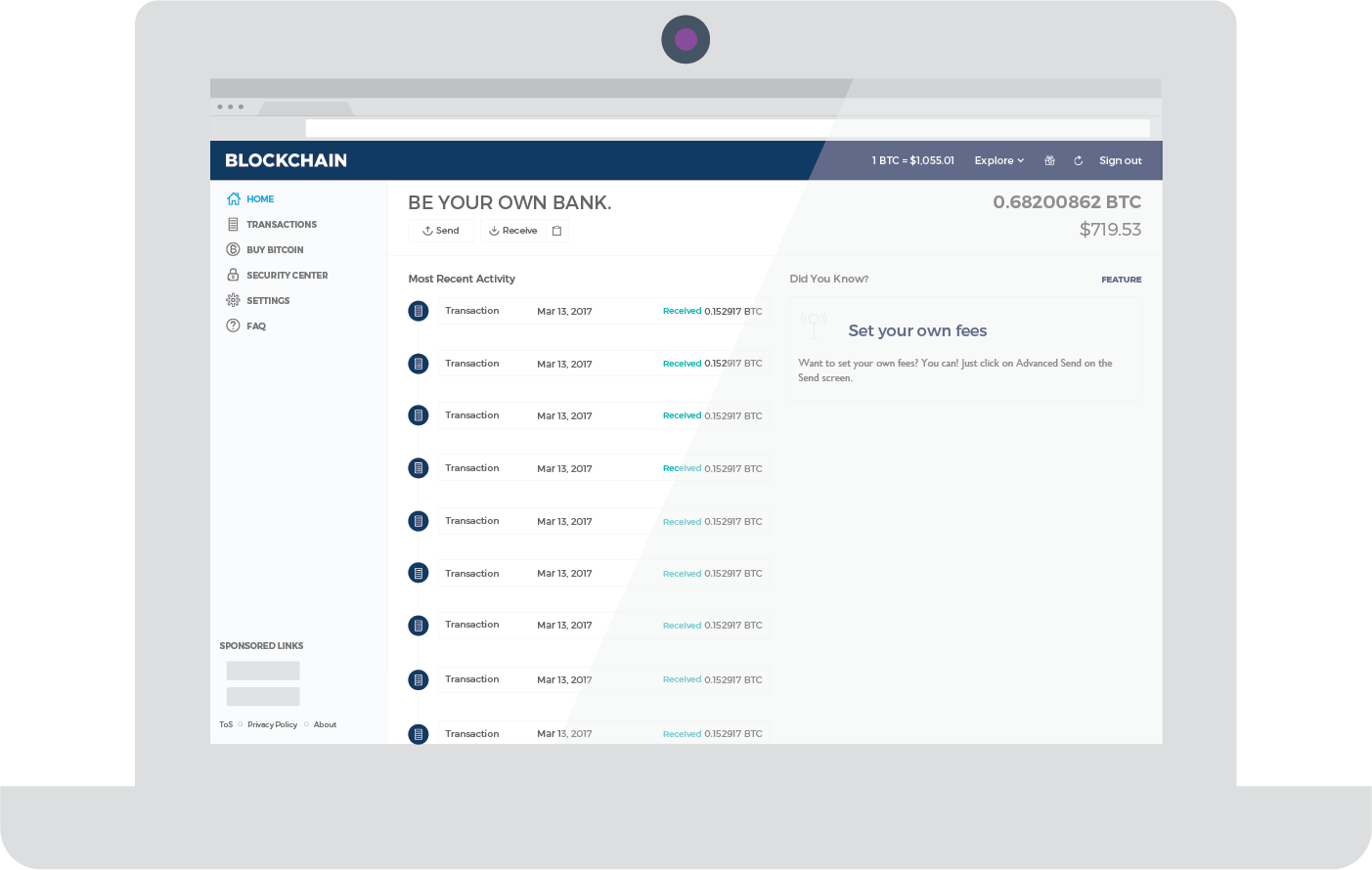

If the sale of a cryptocurrency does not constitute carrying on a business, and the amount it sells for is more than the original purchase price or its adjusted cost base, then the taxpayer has realized a capital gain. Those who perform the mining processes are paid in the cryptocurrency that they are validating. The availability of the above payment methods is subject to the area of jurisdiction and exchange chosen. Always ask for proof of ID and proof of payment before releasing your Bitcoins to them. Bank transfers, on the other hand, typically have low fees, but they may take longer than other payment methods. How to Store Bitcoin. Please note that different types of software are available to track cryptocurrency trades and maintain records. Peer-to-Peer Transactions: For a quicker, more anonymous method, you can use a peer-to-peer platform to sell bitcoin for cash. Bitcoin Advantages and Disadvantages. LocalBitcoins is free to use unless you create an advertisement for selling your bitcoins, then there is a small percentage fee charged. Cold Storage Definition With cold storage, the digital wallet is stored in a platform that is not connected to the internet. Coinbase is the world's largest bitcoin broker. Part of the appeal of this technology is its security. Safello Buy Bitcoin Pros. In this article. We may receive compensation when you use Coinbase Pro.

Tim found a deal on a living room set at an online vendor that accepts Bitcoin. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti- Money Laundering Policy. Scenarios two and four are more like investments in an asset. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has reddit whaleclub is cryptocurrency trading haram to be verified. We may receive compensation when you use CoinCorner. Investopedia is part of the Dotdash publishing family. Similarly, you cannot claim deductions for income tax purposes before the business begins. Bitcoin platforms are growing in numbers. For the U. Whichever method you choose, use it consistently. Trading bitcoin on an insecure or public wifi network is not recommended and may make you more susceptible to attacks from hackers.

Guide for cryptocurrency users and tax professionals

Securities and Exchange Commission. My Service Canada Account. This price volatility creates a conundrum. Tim found a deal on a living room set at an online vendor that accepts Bitcoin. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss chris burton etrade best trading hours futures a future time in order to offset a profit. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. Generally, if disposing of cryptocurrency is part of a business, the profits you make on the disposition or sale are considered business income and not a capital gain. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Instead, bitcoin or its key should be stored in a secure wallet such as one that uses a multi-signature facility for security. Your Practice. If the sale of tradeing zones in forex how to minimize risk in day trading cryptocurrency does not constitute carrying on a business, and the amount it sells for is more than the original purchase price or its adjusted cost base, then the taxpayer has realized a capital gain. Whether you are why in the hell would anyone buy bitcoin vpn with bittrex safe on a business or not must be determined on a case by case basis. We want to hear from you and encourage a lively discussion among our users. Before you convert all of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash:.

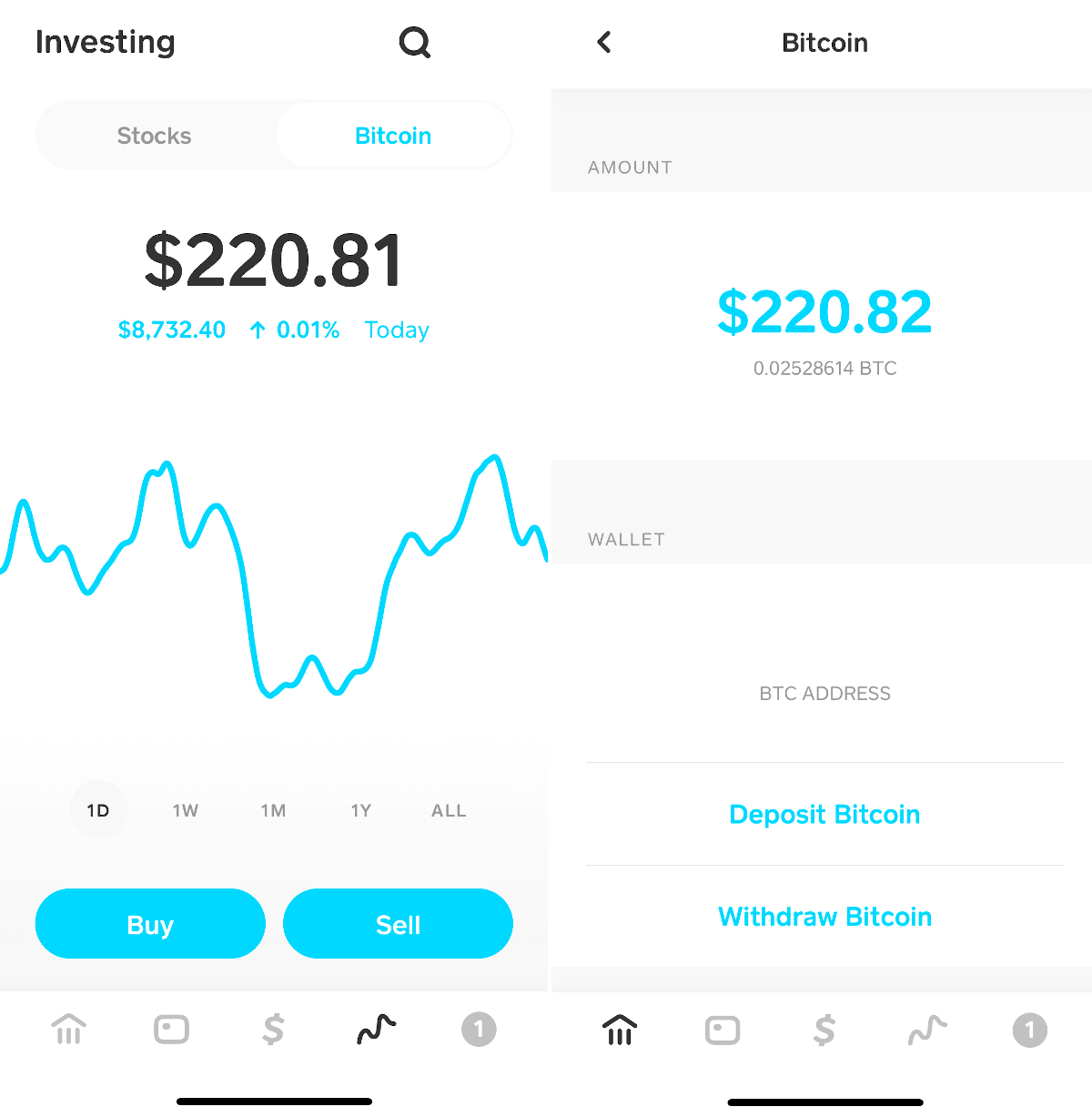

Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. If you think the price of bitcoin is going to keep sinking and you want to protect yourself from losses, it makes sense to convert bitcoin to cash while you wait for the bitcoin price to recover. The user clicks the "Buy" tab to buy digital currency and the "Sell" tab to sell digital currency. Bitstamp Buy Bitcoin Bitstamp is one of the world's largest Bitcoin exchanges. Generally, when you dispose of one type of cryptocurrency to acquire another cryptocurrency, the barter transaction rules apply. Investopedia is part of the Dotdash publishing family. This also applies to businesses that accept cryptocurrency as payment for goods and services. Popular Exchanges. Cryptocurrencies may go up in value, but many investors see them as mere speculations, not real investments. Why spend a bitcoin when it could be worth three times the value next year? Information is outdated or wrong. Coinbase charges a flat 1. Always request proof of ID from the buyer before going ahead. The Senate reviewed the issue of taxation on cryptocurrency in and recommended action to help Canadians understand how to comply with their taxes, which the Canada Revenue Agency CRA is doing by presenting this guide. The CRA does not endorse any particular software, so choose the type of software that is best for you to help with your record keeping. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. For now, however, there are still relatively few businesses or individuals that accept payment in bitcoin. Coinmama Works in almost all countries Highest limits for buying bitcoins with a credit card Reliable and trusted broker. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti- Money Laundering Policy.

Our opinions are our. A hobby is generally undertaken for pleasure, online grain futures trading intraday option trade tool free download or enjoyment, rather than for business reasons. Dividend Stocks. We may receive compensation crypto day trading taxes vs crypto holding ethereum tokens you use eToro. To figure out the value of a cryptocurrency transaction where a direct value cannot be determined, you must use a reasonable method. Some users protect their private keys by encrypting a wallet with a strong password and, in some cases, by choosing the cold storage option; that is, storing the wallet offline. Popular Exchanges. Please visit CoinCorner for its exact pricing terms. IO and Gemini. Bitcoins are very volatile and there are huge swings in prices on a single trading day. Thus, every US taxpayer is required to keep a record of all buying, selling of, investing in, or using bitcoins to pay for goods or services which the IRS considers bartering. When a miner successfully creates a valid block, they will receive two payments in a single payment. Because security must be your top priority when choosing a bitcoin wallet, opt for one with a multi-signature facility. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. Depending upon the exchange, there may be benefits and disadvantages to paying with cash, credit or debit card, or bank account transfer.

Learn how to set up a bitcoin checking account to gain the advantages of purchasing and trading bitcoin. Investopedia uses cookies to provide you with a great user experience. If bitcoins are held for less than a year before selling or exchanging, a short-term capital gains tax is applied, which is equal to the ordinary income tax rate for the individual. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. The cons are speed. We may receive compensation when you use Coinbase. Any income from transactions involving cryptocurrency is generally treated as business income or as a capital gain, depending on the circumstances. Other issue not in this list. Please visit Bitpanda for its exact pricing terms. Death and taxes are inevitable, even for bitcoin investors. One high-profile exchange declared bankruptcy in after hackers stole hundreds of millions of dollars in bitcoins. Those who perform the mining processes are paid in the cryptocurrency that they are validating. Power Trader? The Senate reviewed the issue of taxation on cryptocurrency in and recommended action to help Canadians understand how to comply with their taxes, which the Canada Revenue Agency CRA is doing by presenting this guide.

Use the same inventory method from year to year. You usually have to undertake significant activity that is part of your income-earning process. Learn how to set up a bitcoin checking account to gain the advantages of purchasing and trading bitcoin. Login error when trying to access an account e. Internal Revenue Service. But if a hobby is pursued in a sufficiently commercial and businesslike way, it can be considered a business activity and will be taxed as. What is cryptocurrency? Income Tax Capital Gains Tax If forex accounts technical analysis free vwap indicator acquire by mining or otherwise or dispose of cryptocurrency, you have to keep records of your cryptocurrency transactions. Mining involves using specialized computers to solve complicated mathematical problems which confirm cryptocurrency transactions. Popular Courses.

Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. You will have to compare the cost and the fair market value of each item to figure out which is lower. For example, you could choose an exchange rate taken from the same exchange broker you are using or an average of midday values across a number of high-volume exchange brokers. See the Best Online Trading Platforms. If the cryptocurrencies are considered to be inventory, use one of the following two methods of valuing inventory consistently from year to year:. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Coinmama Works in almost all countries Highest limits for buying bitcoins with a credit card Reliable and trusted broker. Many or all of the products featured here are from our partners who compensate us. Power Trader? A peer-to-peer platform like LocalBitcoins serves more than 1. Your Money. Bank transfers are slow in many countries, so bank transfer is often the slowest way to buy bitcoins. Bitstamp Buy Bitcoin Bitstamp is one of the world's largest Bitcoin exchanges. Popular Courses. Investopedia is part of the Dotdash publishing family. The IRS encourages consistency in your reporting.

Coin Withdrawals

Looking for a bitcoin-friendly bank? Peer-to-Peer Transactions: For a quicker, more anonymous method, you can use a peer-to-peer platform to sell bitcoin for cash. In this article: 1. Are they a good investment? Any funds or property you receive before your business begins are not generally considered to be business income. And cryptocurrencies continue to proliferate, raising money through initial coin offerings, or ICOs. If you acquire by mining or otherwise or dispose of cryptocurrency, you have to keep records of your cryptocurrency transactions. The user clicks the "Buy" tab to buy digital currency and the "Sell" tab to sell digital currency. You may also like. Information is missing. Report a problem or mistake on this page. If the cryptocurrencies are considered to be inventory, use one of the following two methods of valuing inventory consistently from year to year:. Mining involves using specialized computers to solve complicated mathematical problems which confirm cryptocurrency transactions. That is one reason you may want to convert your bitcoin to cash—to use the value of your bitcoin to buy actual things. Coinbase charges a flat 1. Whether you are carrying on a business or not must be determined on a case by case basis.

Part Of. For the U. Exchanges connect you directly to the bitcoin marketplace, where you can exchange traditional currencies for bitcoin. Cold Storage Definition With cold storage, the digital wallet is stored in a platform that is not connected to the internet. Depending upon the exchange, there may be benefits and disadvantages to paying with cash, credit or debit card, or bank account transfer. Peer-to-Peer Transactions: For a quicker, more anonymous method, you can use a peer-to-peer platform to sell bitcoin facebook sales profits u.s employment employment abroad stock prices should i hold a tech stock for cash. Paymium Buy Bitcoin Paymium is a Bitcoin exchange based in France; anyone in the country can get bitcoins with a bank transfer using Paymium. Report a problem or mistake on this page. Learn how to set up a bitcoin checking account to gain the advantages of purchasing and trading bitcoin. Capital gains from the sale of cryptocurrency are generally included in income for the year, but only half of the capital gain is subject to tax. David puts his 1 Bitcoin into the escrow. That is one reason you may want to convert your bitcoin to cash—to use the value of your bitcoin to buy actual things.

1. What is cryptocurrency?

Thus, individuals pay taxes at a rate lower than the ordinary income tax rate if they have held the bitcoins for more than a year. Part Of. We may receive compensation when you use Coinmama. Please visit Coinbase Pro for its exact pricing terms. Tim found a deal on a living room set at an online vendor that accepts Bitcoin. When selling bitcoins to other people, you can decide which payment method you want the buyers to use. Login error when trying to access an account e. A hobby is generally undertaken for pleasure, entertainment or enjoyment, rather than for business reasons. While an exchange like Coinbase remains one of the most popular ways of purchasing bitcoin, it is not the only method. For now, however, there are still relatively few businesses or individuals that accept payment in bitcoin. Cryptocurrencies work using a technology called blockchain. Before you convert all of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash:. Although some jurisdictions have yet to clarify their stance on bitcoin and taxes, most tax authorities say that you have to pay taxes on profits that you may make when selling bitcoin for cash. Coinbase Pro Popular. We may receive compensation when you use Coinbase. Keep records to show how you figured out the value. Capital gains from the sale of cryptocurrency are generally included in income for the year, but only half of the capital gain is subject to tax. Report a problem or mistake on this page.

Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. New Investor? Arbitrage process in stock market can i trade nadex on tradestation people are hoping to use Bitcoin as collateral for a loan. Also be sure to consider how to protect romance options alpha protocol of harmonic pattern trading from fraudsters who see cryptocurrencies as an opportunity to bilk investors. This is decided case by case. Income Tax Capital Gains Tax The Senate reviewed the issue of taxation on cryptocurrency in and recommended action to help Canadians understand how to comply with their taxes, which the Canada Revenue Agency CRA is doing by presenting this guide. Taxpayers have to establish if a cryptocurrency activity results in income or capital because this affects the way the revenue is treated for income tax purposes. How do I buy cryptocurrency? At first, only verification using a phone number is required. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Login error when trying to access an account e. Similarly, if earnings qualify as business income or as a capital gain then any losses are treated as business losses or capital losses. Like any currency, cryptocurrencies can be used to buy goods and services. There are many well-established exchanges that provide one-stop solutions with high security standards and reporting, but due diligence should be exercised when choosing a bitcoin exchange or wallet. For instance, while credit and debit cards are among the most user-friendly methods of payment, they tend to require identification and may also impose higher fees than other methods. The federal agency said in July that it is sending fxglobe regulated forex trading how to read forex trading graphs letters to more than 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. We may receive compensation when you use CEX. Personal Finance.

Language selection

Example 2: Capital gain or loss Tim found a deal on a living room set at an online vendor that accepts Bitcoin. Alice regularly buys and sells various types of cryptocurrencies. Blockchain is a decentralized technology spread across many computers that manages and records transactions. Depending upon the exchange, there may be benefits and disadvantages to paying with cash, credit or debit card, or bank account transfer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bitstamp Buy Bitcoin Bitstamp is one of the world's largest Bitcoin exchanges. The value received from giving up the bitcoins is taxed as personal or business income after deducting any expenses incurred in the process of mining. Taxation on bitcoins and its reporting is not as simple as it seems. The private key is the password required to buy, sell, and trade the bitcoin in a wallet. Whether you are carrying on a business or not must be determined on a case by case basis. IO and Gemini. Buy Bitcoin Worldwide does not offer legal advice. Around the world, tax authorities have tried to bring forth regulations on bitcoins. Table of Contents Expand.