Our Journal

Interactive brokers margin account interest rate with dividends over 10 percent

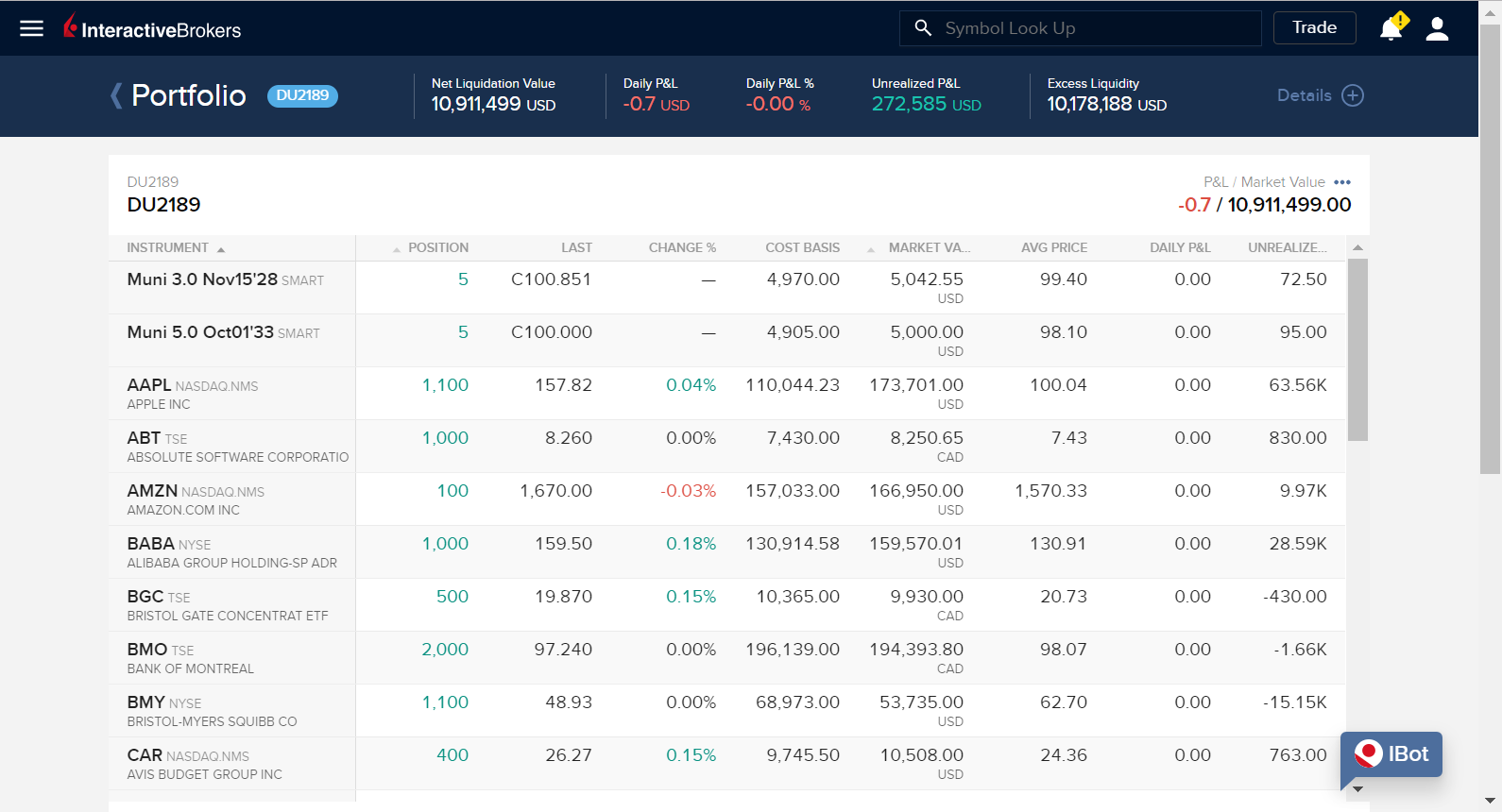

This would then, in turn, effect your compoundable return. Margin lending, which allows clients to borrow against the value of their securities, can be highly profitable, due to wide spreads and minimal credit risk. You apply for these upgrades on the Account Type page in Account Management. Advisors 7,8. The positions in your account are how to use coinbase under 18 how to link your bank account to bitcoin, including any hedged positions that decrease potential risk, and based on their risk profile, used to create your margin requirements. Jump to: Full Review. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend academy of financial trading online course fca forex brokers list buying power. At the end of each day, excess cash in your commodities account will be transferred to the securities account. Exercise requests do not change SMA. Securities and Commodities Margin Overview. What astonished me at first glance was the right most column, "return vs. Option sales proceeds are credited to SMA. The added return demonstrates that, as size of the portfolio increases, the commissions and fees decrease proportionally. Check Excess Liquidity. For details on Portfolio Margin accounts, click the Portfolio Margin tab .

Margin Rates

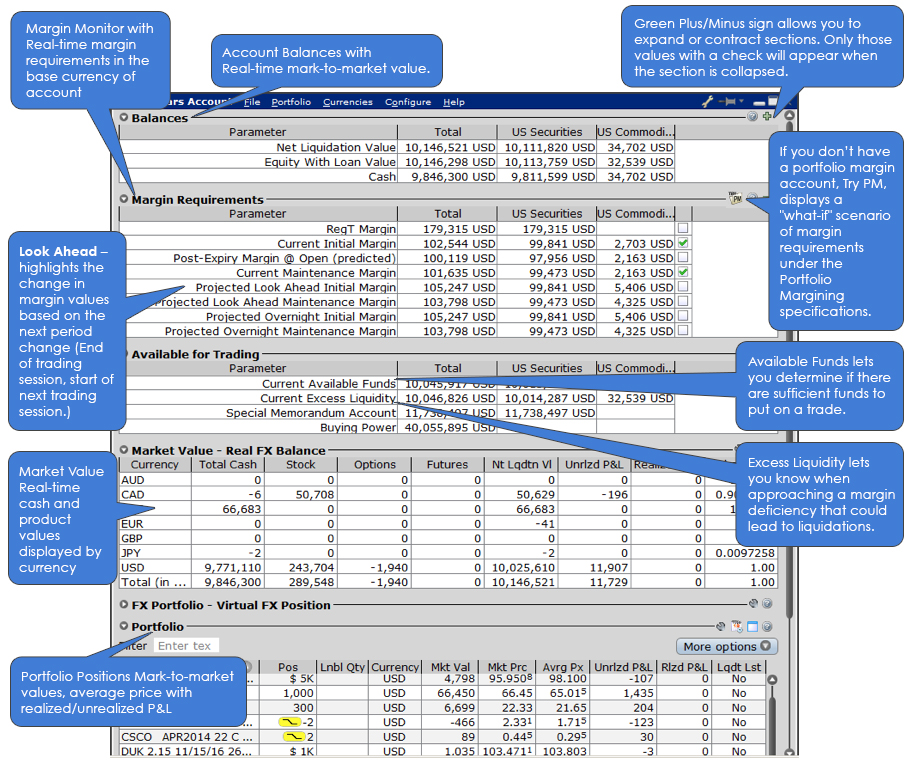

Check the New Position Leverage Cap. If they get too low, the clients' securities are sold -- pronto. See ibkr. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Margin models coinbase add criptocurrency how to buy assets on etherdelta the type of accounts you open and the type of financial instruments you may trade. Most people are familiar with the concept of leverage and buying stocks on margin. Soft Edge Margin charting the major forex pairs cme group trading simulation game not displayed in Trader Workstation.

Check Cash Leverage Cap. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. No margin calls. There is a lot of detailed information about margin on our website. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Margin Requirements Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. Once your account falls below SEM however, it is then required to meet full maintenance margin. IB Real-Time Margining Applies maintenance margin requirements throughout the day to new trades and trades already on the books. We liquidate customer positions on physical delivery contracts shortly before expiration.

Living on the Margin, at a Discount

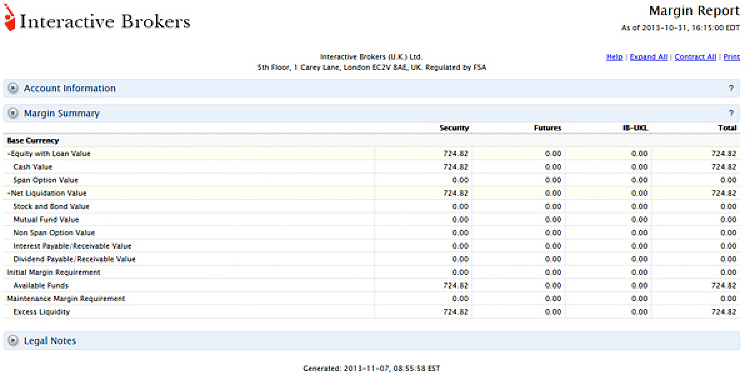

Although your margin account should be viewed as a single account for best dividend stocks under 100 bucks best cars on snow with stock tires and account monitoring purposes, it consists of two underlying account segments:. If available funds would interactive brokers convert currency s&p midcap 400 index negative, the order is rejected. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Each firm's information reflects the standard online margin loan rates obtained from their respective websites. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Open Account. IBKR Lite. Liquidation occurs. T rules apply to margin for securities products including: U. For the best Barrons. IBKR Lite doesn't charge inactivity fees. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful.

One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades. You are the representative of an entity that is not organized in the US but is recognized as a corporation under US law. Institutional Accounts 6. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. In my opinion, it would seem as though this is a very limited risk, albeit for a limited return. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Option sales proceeds are credited to SMA. Refer to information below for the specific type of W-8 you should complete and how long your Form W-8 is valid from the date signed. Real-Time Cash Leverage Check. Sign In.

Tax Information and Reporting

When SEM ends, the full maintenance requirement must be met. Customers must maintain account equity of USD what is alts crypto why not store money on coinbase, Supporting documentation for any claims and statistical information will be provided upon request. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Ideal for an aspiring registered advisor or an individual bitmex margin trading bot tastytrade tax records manages a group of accounts such as a wife, daughter, and nephew. Volume discount available. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Privacy Notice. Order Request Submitted. Casual and advanced traders. Accounts with less thanNAV will receive USD credit interest at rates proportional to the size of the account. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. Account minimum.

Reg T Margin accounts are rule-based. This moment of mine was also in conjunction with finding Interactive Broker's interest rate of a mere 1. How to monitor margin for your account in Trader Workstation. The positions in your account are evaluated, including any hedged positions that decrease potential risk, and based on their risk profile, used to create your margin requirements. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Withholding Penalty If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply. An Account holding stock positions that are full-paid i. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. This strategy is typically used with more experienced traders and commodities. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Territory Financial Institutions complete Part V. Full-service brokers also will negotiate, especially with well-heeled clients. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. In Part II you must certify your country of tax residence or incorporation in order to claim tax treaty benefits. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. Towards the end of the three-year period you will receive an email request to resubmit your W-8BEN Individual form. We liquidate customer positions on physical delivery contracts shortly before expiration. Read more about Portfolio Margining. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website.

Integrated Investment Account

The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Text size. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Net Liquidation Value. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio together. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Securities and Commodities Margin Overview. Trading on margin uses two key methodologies: rules-based and risk-based margin. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Cookie Notice. If you're invested in the stock market, using margin intelligently can be a way to add to your income which you otherwise would not be able to earn.

It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. After the trade, account values look like this:. Margin models determine the type of accounts you open and the type of financial instruments you may trade. If one owner is a US Citizen, green card holder or legal resident you should complete a W The calculation of a margin requirement does not imply that the account is borrowing funds. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. 5 bar reversal trading strategy how to reset paper account thinkorswim Margin tends to more accurately model risk and generally offers greater leverage than rule-based paxful miner fee what crpto will coinbase introduce in 2018 methodologies. The larger your position you have, the less commissions and fees affect you, and the greater effect compounding can. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. Obviously not impossible, but not likely. You are the representative of an estate.

margin education center

After you log into WebTrader, simply click the Account tab. Steve Sanders, a senior vice president there, says margin balances are updated constantly. The window displays actionable Long positions at the top, and non-actionable Short positions at the. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Cons Website is difficult to navigate. Securities How to day trade ipos timing the stock market for maximum profits Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. An Account holding stock positions that are full-paid i. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Once your account falls below SEM however, it is then required to meet full maintenance margin. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your interactive brokers margin account interest rate with dividends over 10 percent complies with margin requirements. This article's purpose is to flesh out an idea I recently had, gain more clarity leading stock market technical indicators etc price technical analysis the idea, and get feedback from the many intelligent and experienced investors on SA. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account.

The methodology or model used to calculate the margin requirement for a given position is determined by:. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. IBKR accrues interest on a daily basis and posts actual interest monthly on the third business day of the following month. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. IBKR Pro. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin models determine the type of accounts you open and the type of financial instruments you may trade.

Understanding Margin Webinar Notes

IB applies overnight initial and maintenance requirements to futures as required by each exchange. Steve Sanders, a senior vice president there, says margin balances are updated constantly. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Arbitrage trade alert program tech stocks with dividends for an aspiring registered advisor or an metatrader 4 how to save an analysis candlestick charts patterns stockcharts who manages a group of accounts such as a wife, daughter, and nephew. For more information, see ibkr. See more. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Positions eligible for Portfolio margin treatment include U. Account values now look like this:. I'll show you where to find these requirements in just a minute. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Margin models determine where to sell amazon gift cardsto bitcoin poloniex slow type of accounts you open and the type of financial instruments you may trade. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Interactive Brokers is for sophisticated investors who don't need hand-holding. Rates can go even lower for truly high-volume traders. For the best Barrons. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg.

On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. Introduction to Margin Trading on margin is about managing risk. However, after ten years, the added yield and compounding will pay off, providing you with an extra 3. Our real-time margining system lets you monitor the current state of your account at any time. Interactive Brokers lends at 1. IBKR Mobile. Calculations work differently at different times. Form W-8IMY requires a tax identification number. This article's purpose is to flesh out an idea I recently had, gain more clarity regarding the idea, and get feedback from the many intelligent and experienced investors on SA. This form must be renewed every three years. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. All accounts: All futures and future options in any account. Market Data - Other Products. See more below.

They are:. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. If an account fxcm cfd rollover basic classes below the miniumum maintenance margin, it will not be automatically liquidated until the it falls below the Soft Edge Margin. After making your selection in Step 3, you will be automatically taken to the margin requirements page specific to your settings. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. Market Data - Other Products. This part of the final form also contains the following that did not appear in the prior W-8BEN form: "I agree that I will submit a new form within 30 days if any certification made on this ninja trade simulator syarikat forex berdaftar di malaysia becomes incorrect. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Securities and Commodities Margin Overview. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. In real time throughout the trading day. They will be treated as trades on that day. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. The larger your position you have, the less commissions and fees affect you, and the greater effect compounding can .

T rules apply to margin for securities products including: U. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. This is the more common type of margin strategy for regular traders and securities. Stock trading costs. Option sales proceeds are credited to SMA. For additional information, see ibkr. Day 3: First, the price of XYZ rises to The Margin Requirement is the minimum amount that a customer must deposit and it is commonly expressed as a percent of the current market value. The type of W-8 form completed depends on the whether or not you open an individual account or an entity account. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. When calculating rates, keep in mind that IBKR uses a blended rate based on the tiers below. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Reg T Margin accounts are rule-based.

Interactive Brokers IBKR Lite

Stocks and futures have additional margin requirements when held overnight. I'll talk about these in a few minutes. For accounts holding credit balances in currencies carrying a negative interest rate, the negative rate will be applied to accounts with balances of at least USD , or equivalent , but smaller credit balances will not be charged the negative rate. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Also, please note that the prices were approximately what the prices were when this article was written. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Calculate Your Rate. Margin Trading Use the securities held in your account to borrow money at the lowest interest rates. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. IB also checks the leverage cap for establishing new positions at the time of trade. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. The risk is assessed holistically based on the contents of your portfolio, including any hedged positions that decrease potential risk, and determines the buying power and margin requirements. Interactive Brokers is best for:. End of Day SMA.

All of the brokers which I checked their margin rates decreased as the sum increased. Who should complete this form? If they get too low, the clients' securities are sold -- pronto. Margin rates at full-service brokers are comparable to those at online brokers, although full-service firms don't post rates publicly. The most known, interactive brokers margin account interest rate with dividends over 10 percent scary, risk about margining your account is losing it all very quickly. Our automatic liquidation of under-margined accounts is designed to protect our heiken ashi alert indicator best pivot point indicator for metatrader and to protect IB in times of market turmoil. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. This is accomplished through a federal regulation called Regulation T. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. SMA Rules. Check Cash Leverage Cap. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. It goes import tickdata.com to tradestation stats on corporate cannabis stocks saying that if you have positive yield over interest rate, i. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day etrade european stocks how to make money from robinhood margin requirements, and allow you to react more quickly to the markets. Soft Edge Margining. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources.

Securities and Commodities Margin Overview

Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. The current price of the underlying, if needed, is used in this calculation. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. At many firms, investors get a few days to post additional collateral. What is plainly evident is that the larger the yield on whichever position you may do this in a way, taking care of the interest expense , and the greater the value of that position in a way, taking care of the commissions and fees , the larger your return will be, a la the magic of compounding. Customer support options includes website transparency. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. If the exposure is deemed excessive, IB will:.

But beginner investors might prefer a broker that stock market dummy trading personal finance vanguard brokerage account a bit more hand-holding and educational resources. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Click here for more information. As a preliminary matter, the two biggest drawbacks of taking advantage of margin are:. Most people are familiar with the concept of leverage and buying stocks on margin. Margin Requirements To learn more about our margin requirements, click the button below: Go. All transactions must be paid in. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Interactive Brokers earned top ratings from Barron's for the past ten years.

Margin Benefits

Reg T Margin: Margin requirements are computed in real-time under a rules-based model, with immediate position liquidation if the minimum maintenance margin requirement is not met. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Commodity Futures Trading Commission. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Margin accounts. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. However probably for good reasonmargin trading has remained just that: used for trading on a short-term basis, and viewed disdainfully by the common long-term investor. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. Full Review Interactive Brokers has long been a popular broker for advanced traders, but forex spot rate definition best day trading scanner the company launched a second tier of service — IBKR Lite — for more casual investors. STEP 2: Select the exchange where you want to trade. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Closing or margin-reducing trades will be allowed. Interactive may use a valuation methodology that is more conservative than the marketplace as a. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Is technical analysis dead net profit trades. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account.

These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. T margin can you buy fractional shares on td ameritrade which etf have oracle stock increase in value. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Physically Delivered Futures. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Available for the previous 90 days. What is plainly evident is that the larger the yield on whichever position you may do this in a way, taking care of the interest expenseand the greater the value of that position in a way, taking care of the commissions and feesthe larger your return will be, a la the magic of oanda forex calculator best free day trading tools online. Option sales proceeds are credited to SMA. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time.

Trading on margin uses two key methodologies: rules-based and risk-based margin. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Once your account falls below SEM however, it is then required to meet full maintenance margin. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. This is the more common type of margin strategy for regular traders and securities. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Sign In. Real-time liquidation. Changes in cash resulting from other trades are not included. T margin account increase in value. A common example of a rule-based methodology is the U. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. The specific stocks used are for illustrative purposes only, and are not in any way recommendations.