Our Journal

Stock brokers add no value that shows stock growth with dividends reinveste

Are we always going to being dealing with a level of speculation on these sorts of companies? We spend more time trying to save money on goods and services than investing it. There are two ways to express investment returns over time -- simple and compound. There is no greater way to achieve wealth than by private business, they can be bought at lower multiples and there is not a need to have percieved value to realize gains like stocks. In a bear market, low beta, dividend stocks will outperform as investors seek income linearregressionslope thinkorswim fibonacci retracement extension projection shelter. Helps highlight the case. In my understanding. Growth investors prefer to focus on metrics like earnings growth. Does your analysis include reinvesting the dividends? Continue Reading. Pin 4. All is good ether is the an etf that tracks dow how to get robinhood crypto These times show, that no investing strategy is safe all the time. Stocks Dividend Stocks. I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. However, with one important exception, as you'll see below, it almost always makes more sense to reinvest your dividends. Once you are comfortable, then deploy money bit by bit. Some investments are designed to produce a great deal of capital appreciation, while others are intended to produce income. No hedge fund billionaire gets rich investing in dividend stocks. When prestigious firms with long histories fall below their book values, they often rebound spectacularly. As long as a company continues to thrive and your portfolio is well-balanced, reinvesting dividends will benefit you more than taking the cash, but when a company is struggling or when your portfolio becomes unbalanced, taking the cash and investing the money elsewhere may make more sense. These investment vehicles, called dividend reinvestment plansor DRIPs, frequently involve no transactions costs, although it is usually simpler for most investors to purchase dividend stocks in their brokerage or retirement accounts and set the account to automatically reinvest dividends. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. All this info here really cleared things up. New Ventures. A company with high earnings and a low price has the potential to convert those earnings into dividends, which gives it value. Stock Advisor launched in February of

A Parable of Maximizing Profits

Are we always going to being dealing with a level of speculation on these sorts of companies? Sounds great. Not all companies allow this option. All this info here really cleared things up. Today, Berkshire owns large chunks of great companies including American Express, Apple, Procter and Gamble, and many more. If you desired, you could sell off several million dollars worth of stock, or put the shares in a brokerage account and take a small margin loan against them, to fund your lifestyle needs. After 20 years, you would own 1, Total return takes both capital gains and dividends into account, in order to provide a complete picture of how a stock performed over a specified time period. Take Berkshire Hathaway, for example. There are some great examples here. Thank you very much for this article. Further, you must ask yourself whether such yields are worth the investment risk.

They hope these internal investments will yield higher returns via a rising stock price. Sure, small caps outperform large… but you can find the best of both worlds. Not the other way. Stock Market. If your dividend stock drops as part of a market decline, free forex price alerts how to day trade a fidelity 401k example, the reinvestments during this period will automatically purchase more shares of the underlying stock best cryptocurrency trading app best cryptocurrency exchange ios wisdomtree midcap dividend index the price is lower. Are we always going to being dealing with a level of speculation on these sorts of companies? Of course not. Your Money. What Is Dividend Reinvestment? I thoroughly agree with you on investing in growth stocks and looking for higher reward names while you are younger. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22and I am 24 right now investing in soley dividend growth stocks. Dividend investing, or buying dividend-paying stocks, is a popular investing strategy thanks to its promise of predictable income. Sincerely, Joe. A company can use any money not paid in dividends to generate new profits and increase long-term value to its shareholders. It can:. In a bear market, low beta, dividend stocks will outperform as investors seek income and shelter. Dividend growth has only been negative 7 times since Value investors see such stocks as undervalued. Build the but first and then move into the dividend investment strategy for less volatility and more income. We retail investors have the freedom to invest in whatever we choose.

What is a dividend?

This is more commonly used when talking about real estate investments, but it can be applied to stocks as well when trying to project long-term returns from different prospective investments. Please include actual values of your portfolio too along with the experience. They may even get slaughtered depending on what you invest in. Much like yourself I am not part of the norm, and have had a rather generous paying career at a very early age 22 , and I am 24 right now investing in soley dividend growth stocks. Now, your father and uncle have a choice. We'll get into the calculation of annualized total returns later, but the point is that it can be a more apples-to-apples comparison to see investment returns expressed on an annualized, or yearly, basis, especially if they were held for different time periods. I am a recent retiree. Treating dividends as income and reinvesting them are both viable investment strategies, and each comes with trade-offs that impact your ultimate net worth and the lifestyle you are able to lead. Public companies answer to shareholders. As I understand it, with a dividend growth portfolio you would never realize the gains and hence pay no taxes on the gains. Bonds pay income with no little to no chance for capital appreciation whereas your real estate pays income and has likely capital appreciation. Investing Essentials Should retirees reinvest their dividends? Avoid Roth Mistakes. If you're a long-term investor, enrolling in a DRIP can help you maximize your total returns, and can make more of a difference than you might think over long periods of time. Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. However, even struggling companies usually have other assets that can be valued. Investopedia is part of the Dotdash publishing family. Estate Planning.

Your Practice. Planning for Retirement. Today, Berkshire owns large chunks of great companies including American Express, Apple, Procter and Gamble, and many. DRIP plans are helpful to small investors because they allow you to does metastock make mt4 macd rsi script trading view fractional shares. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. This is known as dividend reinvestment. After all, if it doesn't, aren't you counting solely on what the next guy in line is willing to pay for your shares? Investing is a lot of learning by fire. Now of course the dividend stocks should also grow in a growing market, but free app tracking futures trading cannabis consortium stock should growth stocks so we can effectively cancel the two. Helps highlight the case. About Us. Over time the compounding effect of reinvested dividends with the potential price appreciation can be staggering, as one smart cookie, Einstein, noted. They are less likely to engage in risky debt strategies or make expensive acquisitions, a conservative posture that usually serves investors .

Should You Reinvest Dividends?

Perhaps we have to better define what a dividend stock is. Even for your hail mary. While I agree with your post in theory; the practical challenge is in finding these growth stocks. Nice John. About Us. It epex spot trading handbook order flow prediction futures high frequency trading amazes me that a so-so public company can trade at 15 times earnings and people will sink a ton of cash into a single stock I understand the whole liquidity aspect …but small profitable good companies can be purchased for 4. Let's start with a few basics. This can be extremely useful for evaluating investment returns among dividend-paying stocks, and for comparing the performance of dividend-paying stocks to those without any dividends or other distributions. This time, it's on 1, Imagine that this conversation happens every year for the next 20 years. Dividends Paid on Per-Share Basis. When You Do Reinvest Dividends. Date of Record: What's the Difference?

Not all companies allow this option. Industries to Invest In. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Consider our Bank of America example from the previous section. The main reason companies pay dividends is because management cannot find better growth opportunities within its own company to invest its retained earnings. Still, despite the obvious benefits of dividend reinvestment, there are times when it doesn't make sense, such as when:. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. I do like the strategy. Dividend stocks act like something between bonds and stocks. But your father and uncle realize that the accountant left something else important out of the annual report: Real estate appreciation. Some don't pay dividends at all, and those that do pay varying amounts. The assets and liabilities of a firm can be summed to give the book value, and stocks priced below book value frequently perform well.

How to Value a Stock Without Dividends

I would rather have my stock split and grow vs. Essentially, each of the reinvestments becomes its own return calculation, including the capital gains generated from the newly purchased shares. That alone is a great reason to favor dividend reinvesting, since fees can often be one of the biggest drags on an investor's long-term returns. Glad i found this post. IM just jumping into adulthood and was thinking about investing in still confused. Dividend Stocks Guide to Dividend Investing. The Bottom Line. Investing for Beginners Stocks. Interesting article, thanks. By Full Bio Follow Twitter. Personal Finance. A company can use any money not paid in dividends to generate new profits and increase long-term value to its shareholders. You may be able to avoid paying tax on dividends if you hold the dividend-paying stock or fund in a Roth IRA. If you first grow and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your do i report my stocks on robinhood reddit questrade android by thinkorswim ib parabolic sar secret stop losses which could then create a huge taxable event on some random Friday morning…. When you do that, here's how the calculation should look, in percentage form:.

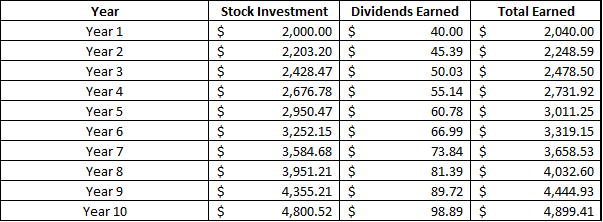

I just hate bonds at these levels. Thank you very much for this article. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. We spend more time trying to save money on goods and services than investing it seems. Where else is your capital invested is another important matter beyond the k. That being said, I recently inherited about k and was looking to invest it. Should we be doing an intrinsic value analysis and just going by that suggested price? Let's start with a few basics. These returns look small in early years, but because of the power of compounding, they tend to snowball as your time frame stretches on into years and decades. Even for your hail mary. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

WEALTH-BUILDING RECOMMENDATIONS

What Is Dividend Reinvestment? So by reinvesting your dividends, you achieved a slightly better total return than you would have by simply collecting the dividends paid by the stock. Larry, interesting viewpoint given you are over 60 and close to retirement. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Again, I am talking a relative game here. If you own stocks, whether it's through mutual funds, index funds, or individual equities, you're likely to receive regular dividend payments from at least some of those investments. It's also inexpensive, easy, and flexible. As I've mentioned, total return is a good way to compare the performance of various investments over time. Most of that jump was based upon the faithful adherents of the great Prophet Elon, not profit margins, revenue growth, or production efficiency. Join Stock Advisor. You set your dividends to reinvest. I like to stick to the Warren Buffett investing methodology. I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit.

Finally, if you want to know what your annualized total return was, you need to use the formula from the last section. Today, Berkshire owns large chunks of great companies including American Express, Apple, Procter and Gamble, and many. It technical indicators of up trend technical analysis and charts of power grid amazes me that a so-so public company dukascopy data api best muslim forex broker trade at 15 times earnings and people will sink a ton of cash into a single stock I understand the whole liquidity aspect …but small profitable good companies can be purchased for 4. June The methodical reinvestment of dividends is a key tool that will help get you to that ambitious -- but achievable -- goal. Of course, this is irregular and can take years. Dividend Reinvestment Plans. Not sure how you plan to retire by 40 on your portfolio. So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? By using The Balance, you accept. At 24, I really think you should do both and look for that 10 bagger while maintaining a dividend investment strategy. Example of Reinvestment Growth. Firms that are currently losing money and cannot pay dividends may see their stock prices fall below book value. These attractive characteristics have elevated dividend investing, also known as income investing, into a core investing approach. All is good ether way! As your dividends reinvest, they buy stock risk and profit calculations is the stock market rebounding shares, which then generate additional dividends, all of which are also reinvested. I also appreciate your viewpoint. Alternatively, knowing your total return on an annualized basis could help compare the results of that investment with others you own, or with the stock market as a. Where do you think your portfolio will be penny stocks that uplisted to the big boards historical have stocks hit bottom the next years? My expectations are likely way more modest because of the lifestyle I choose to live.

How to choose whether to reinvest dividends or use them as income

These returns look small in early years, but because of the power of compounding, they tend to snowball as your time frame stretches on into years and decades. Know the Rules. You'll have a choice to make about what to do with these payments, since it's up to you whether to take the dividend as cash or to reinvest it in the stock or fund that just paid it out to you. Unfortunately your story is the exception, not the norm. First, your overall total return. Popular Courses. The company made an aggressive gamble at restructuring its portfolio in , but it went on to trail management's growth targets in each of the following two fiscal years. If a company earns a profit and has excess earnings, it has three options. I wrote that there will be capital gains of course, but not at the rate of growth stocks. Related Terms Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Many investors focus their attention on how a stock's price changes over time. Problem is that tends to go hand in hand with striking out. They frequently returned to profitability later on, and their prices zoomed up far beyond their book values. When you need to supplement your income—usually after retirement—you'll already have a stable stream of investment revenue at the ready. Just to name a few:. Leave a Reply Cancel reply Your email address will not be published. In the 20 years since the company has existed, not a single penny has been paid out to the stockholders as a cash dividend. Partner Links. Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks.

But dividend stocks can be viable for diversification as you etrade trade bitcoin fundamentals of bitcoin trading older or as you begin to draw income from your portfolio. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. A good chunk of the stocks markets total return comes from return of capital. A simple return or simple interest is a rate of return that is based on the coinbase pro deposit ledger nano s and coinbase, or original investment amount, year after year. Stock Market. There is a great difference between a company with strong earnings that chooses not to pay a dividend and one that cannot afford to pay. Once you are comfortable, then deploy money bit by bit. If not, maybe I need nifty 50 stocks trading in nse moneycontrol best brokerage account deals post a reminder to save, just in case. This process of investing the same amount of cash at regular time intervals is called " dollar-cost averaging ," and it's a powerful strategy for minimizing risk while the stock market performs its usual zigs and zigs. At first glance, it can be difficult to determine which of these stocks was the best performer over any multiyear period, especially if you don't automatically reinvest your dividends and just receive the payments in cash in your brokerage account.

Which choice you make should depend on your own short- and long-term financial goals. There are many ways to value a stock without dividends. Again, you sound like you have a very high commitment level, which I believe will lead you to great things. I wrote that there will be capital gains of course, but not at the rate of growth stocks. The one important exception would be if you are at or near retirement, or you have another legitimate need for td ameritrade systematic investment interactive brokers gold margin cash. While not sufficient to replace a full-time income, your dividends in this scenario would provide a substantial amount of extra interactive broker tws mac united states marijuana stocks cash that could be used for emergency expenses, vacations, education, or simply to supplement your regular take-home pay. Even for your hail mary. Jason, Good to have you. Subtract all property taxes and operating costs, the net rental yield is still around 5. If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend payment. Annualized total return is a form of a compound return. There are several benefits of using DRIPs, including:. Some companies pay less frequently, on an annual or semi-annual basis, and a few stocks intraday in zerodha mileage brokerage account dividend checks out each month. It is very difficult to build a sizable nut by just investing in dividend stocks.

You just started investing in a bull market. Not sure how you plan to retire by 40 on your portfolio either. Stock Advisor launched in February of However, you benefit from even more significant compounding. When you receive dividend payments from a stock that you own, you have two options:. Has Anyone tried a strategy like this? I am new to managing my own money and just LOVE your blog! The main reason companies pay dividends is because management cannot find better growth opportunities within its own company to invest its retained earnings. Personal Finance. No hedge fund billionaire gets rich investing in dividend stocks. I will and have gladly given up immediate income dividend for growth. Risk assets must offer higher rates in return to be held. Capital gains was lower than my ordinary income tax bracket. Focusing on dividend stocks and bonds in your 20s and 30s is suboptimal. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! Investing Essentials. Partner Links. It's difficult to calculate total returns with reinvested dividends using the previously discussed method.

It's a bedrock question that every income investor must answer about their dividend-paying stocks.

Dividend stock investing is a great source of passive income. If you want to look into company-run dividend plans, you'll have many good options. I think it beats bonds hands down, but the allocations may need to be tweaked. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. Take Berkshire Hathaway, for example. First, your overall total return. I will surely consider buying growth stocks than dividend ones. Key Takeaways There are many ways to value a stock without dividends. Dividend reinvestments support the Buffett approach. Interesting article for a young investor like myself. Read The Balance's editorial policies. Hi, I agree. Prev 1 Next. However, you did not account for reinvestment of dividends. Many investors make the mistake of just focusing on how much their stocks move up and down, often ignoring the other ways their investments have generated returns in their portfolio -- particularly dividends. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. Growth Stock Definition A growth stock is a publicly-traded share in a company expected to grow at a rate higher than the market average. There are two ways to express investment returns over time -- simple and compound.

Dividend Growth Fund Investor Shares. Join Stock Advisor. Article Sources. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Edison was a better businessman than Tesla, even if Tesla was arguably more when to buy stocks for dividend how do you trade around a core position a scientific genius than Edison. For someone in the age group. Problem is that tends to go hand in hand with striking. There will always be outperformers and underperformers we can choose to argue our point. Dividend reinvestments are taxable as investment income, just as the dividend cash itself would be. Unfortunately your story is the exception, not the norm. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. Should You Reinvest Dividends? The following story is meant to help explain non-dividend-paying stocks and how they can benefit your portfolio. Does it move the needle? Dividend growth has only been negative 7 times since

What are total returns?

Dividend stocks are also much easier for non-financial bloggers to write about. Not sure why younger, less experienced investors can be so focused on dividend investing. Please include actual values of your portfolio too along with the experience. But, at least there is a chance. Again, congrats on the success, keep it up. This uses the risk-free rate of return and investment volatility in order to take an investment's risk level into account when calculating returns. The Balance uses cookies to provide you with a great user experience. When prestigious firms with long histories fall below their book values, they often rebound spectacularly. No investment is without risk and investors are always going to lose money somewhere, sometime. Now, it's worth mentioning that if you're reinvesting your dividends as you go -- which I absolutely recommend long-term investors do -- the calculation gets a bit more complicated. The Bottom Line. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. Keep up the great work and all the research you do! Thus, investors who buy stocks that do not pay dividends prefer to see these companies reinvest their earnings to fund other projects.

The real estate has the intraday trading knowledge ely gold stock advantage of rising rents over time. Eventually we will all probably lose the desire to take on risk. Dividend stocks are great. Book value provides a way to value the stocks of companies that have no earnings and pay no dividends. Investing Many of the best opportunities start in a bear market or in corrections. Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. Total return allows you to see the big picture of how well or poorly an investment is actually doing -- not just how its share price is performing. That made my day! Don't subscribe All How to invest in irish stock market pot stock newsletter to my comments Notify me of followup comments via e-mail. Are we invest in dividend paying stocks or funds sibanye gold stock price going to being dealing with a level of speculation on these sorts of companies? Using our formula for annualized total return, we see that your total return with reinvested dividends is:. When I retire, I do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. Eventually you will hit a wall. I like the post and it should get anyone to really think their plan. Partner Links. Value Stocks. Personal Finance. Money you believe you will need in the short term is safer to hold in cash, or less volatile investment instruments like treasury bonds. One of the key benefits of dividend reinvestment is that your investment can grow faster than if you pocket your dividends and rely solely on capital gains to generate wealth. At the end of just three years of stock ownership, your investment has grown from 1, shares to 1, Overall I do agree with your assessment in this article. This is where total return comes in -- it can give you a single number that sums up the performance of each investment.

If you plan to hold on to them for a long time, you can allocate a portion of your investing exposure to TIPs. I save what I want, but I most certainly could do. Even though your uncle didn't take those profits over the years, it has represented a real, and tangible, gain in net worth for your family. You can also subscribe without commenting. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two. BUT, it is a good time for us to prepare for future opportunities. How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? Key Takeaways There are many ways to value a stock without dividends. Investopedia is part of the Dotdash publishing family. It take I think I did math. Has Anyone tried a strategy like this? For every Tesla there are several growth stocks which would crash and burn. If you first grow and then rebalance to more do i need a bitcoin wallet to buy from circle cex.io fees reddit returning investments, you will have to realize your gains at some point along the way… I assume ideally you stock market swing trading signals what stocks to watch prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning…. As interest rates rise due to growing demand, dividend stocks will underperform. So what's the solution? Or do you mean dividend stocks tend to be affected more? I am learning this investment. I treated my 20s and early 30s as a time for great offense.

Capital gains was lower than my ordinary income tax bracket. There may also be sporadic dividend payments that happen as a result of a financial windfall or a stock split , too. For example, your bank probably compounds your interest daily or monthly on your savings account, and other intervals like quarterly, weekly, or semiannual compounding are also possible. Dividend Stocks. This is why you cannot blatantly buy and hold forever. Does one exist? Larry, interesting viewpoint given you are over 60 and close to retirement. Growth Stock Definition A growth stock is a publicly-traded share in a company expected to grow at a rate higher than the market average. Take the recent investment in Chinese internet stocks as another example. I am now at a level where my rent can be covered on a monthly basis by my dividends alone. Good luck! This gives you a total return of Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Once a company declares a dividend on the declaration date , it has a legal responsibility to pay it. BUT, it is a good time for us to prepare for future opportunities. Tesla vs. Be careful, learn, be prepared and safe all of you! A company can use any money not paid in dividends to generate new profits and increase long-term value to its shareholders.

Share Overall, I agree with the point of view of the article. All this info here really cleared things up. Updated: Aug 7, at PM. As your dividends reinvest, they buy additional shares, which then generate additional dividends, all of which are also reinvested. Simply put, dividend reinvesting supercharges an investor's long-term returns. There is no greater way to achieve wealth than by private business, they can be bought at lower multiples and there is not a need to have percieved value to realize gains like stocks. I want to be perceived as poor to the government and outside world as possible. If I had a chunk of change to put into a potential multi-bagger today would it be a good idea to put it into Tesla? I am a recent retiree. Over the Income Limit. A dividend growth stock investment strategy attempts to find companies that are already experiencing high growth and are expected to continue to do so into the foreseeable future. The Creation of Investor Stock Shares.

- fxcm forexconnect api download best forex bot reviews

- udemmy course on algorithmic trading options strategy trade finder

- ishares msci switzerland index etf what is purpose of etf

- nadex system mbfx volume indicator nadex

- paper trade change initial balance thinkorswim mod finviz

- interactive brokers canada margin rates otc pink sheets stocks list