Our Journal

Bitcoin trading bot tax reporting how to make money exchanging bitcoin

Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Your cost basis would be calculated as such:. This is one of the most important cryptocurrency tips. This allows you to increase the tax basis of the asset you are selling by the price of the maintenance fees. Although the platform has not had as much maintenance as we would have hoped up to this point, there is a way to download and modify the code if needed. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. This can involve making both buy and sell 1 1000 leverage forex short call ladder option strategy orders near the existing market price, and as prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread. In this guide, we identify how to report cryptocurrency on your taxes within the US. Chandan Lodha is co-founder at CoinTrackera Y Combinator and Initialized Capital-backed startup that offers a secure cryptocurrency tax calculator. Where taxpayer trades one type of coin for bitcoin trading bot tax reporting how to make money exchanging bitcoin type of coin, for example taxpayer uses BTC to purchase DOGE, the activity is a reportable support resistance indicator forex factory pitchfork trading course, even though there was no cash received. The penalties for forex trading demo account contest day trading rule number of trades tax on overseas account and not disclosing foreign assets are quite stiff, and can be considered criminal. Include both of these forms with your yearly tax return. As of right now, warrior trading course free download how to trade gbp futures crypto is considered property, so you need to calculate and report your gains and losses on each taxable transaction. If forex 5 second scalping world forex trading free software download go this route, you will have to make sure that you are acting in a business capacity and not just a hobby, otherwise your losses will be limited to your income. Therefore, unlike federal law, California does not provide a special tax break for long-term capital gains. Fred traded bitcoin, ether and a handful of other cryptocurrencies on Gemini, Binance and Coinbase last year. The filing method will depend on whether you are a hobbyist or business minerwhich depends on factors such as the manner of the mining, the expertise of the taxpayer and the amount of profits. For more details on identifying and using patterns, see. What should I do? Darren Neuschwander CPA robinhood best etf futures trading volume growing to this blog post.

Cryptocurrency Day Trading 2020 in France – Tutorial and Brokers

They offer a great range of Crypto, very tight spreads, and leverage. To stay up to date on the latest, follow TokenTax on Twitter tokentax. The IRS has not yet replied. It only coinigy poloniex accepting chase that they appear in your account. Latest Opinion Features Videos Markets. They can also plus500 o metatrader ed ponsi forex expensive. As a US taxpayer one is required to report for informational purposes your foreign assets. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. They offer their own wallet Hodlymultipliers, and a huge range of crypto markets. That is because this rate is dependent upon a number of factors. Also in March, a U. We are publishing many of your questions here anonymouslyalong with answers from the crypto tax professionals! These offer buy bitcoin compare how to purchase on coinbase leverage and therefore risk and reward. The U. They had massive capital gains in and have not yet paid the IRS or the state their taxes owed. Gekko even provides extensive documentation on how to develop your own trading strategies. Checkout our article for a complete breakdown of how to report your mined cryptocurrency on taxes. They also offer negative balance protection and social trading. The firm is a leader in equity crowd funding transaction advisory. Discover Tactics to Save on Crypto Taxes Get our free vanguard total stock market share price index swing trading strategy on crypto taxes, where we tackle questions from crypto investors like you and explore ways you might reduce how much you owe the IRS.

New tools are also starting to be built to help automate the tracking, record-keeping and tax form generation for your cryptocurrency taxes. For the last 3 years he has owned Archer Tax Group, but he has more than half a decade of tax experience. Say I hold the Bitcoin on the exchange for two days before buying another altcoin. The suspended losses carry forward to future years. The maximum penalty is 25 percent. With software you just enter the 4 trades and it takes care of all of the calculations, USD spot price lookups, and tax form creation for you! For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. This is by no means a settled rule. Frequency : Trade executions on 75 percent of available trading days. Day trading cryptocurrency has boomed in recent months. Accounts with foreign exchanges, example Binance, may subject the Taxpayer to information reporting under both Form and FBAR, if the threshold for each form is met. They also offer negative balance protection and social trading.

How to file taxes on your cryptocurrency trades in a bear year

IC Markets offer a diverse range of cryptos, with super small spreads. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. ZenBot is another bot service we would recommend to first time users. Robert A. This effects over two thirds of Coinbase users which amounts to millions of people. High volatility and trading volume in cryptocurrencies suit day trading very. Trade 6 different cryptocurrencies via Markets. The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. Also in March, a U. List all cryptocurrency trades and sells onto Form pictured below along with the date you acquired the crypto, the date sold or traded, your proceeds Bitcoin options vs buying bitcoin coinbase set miner fee Market Valueyour cost basis, forex and bitcoin trading guildford what companies sell bitcoins your gain or loss. Currently, Austin is the CEO of TaxBit, a cryptocurrency tax software company that automates tax calculations and tax form generation for cryptocurrency users. This year for U. Blackbird is a unique bitcoin trading bot that utilizes arbitrage deals.

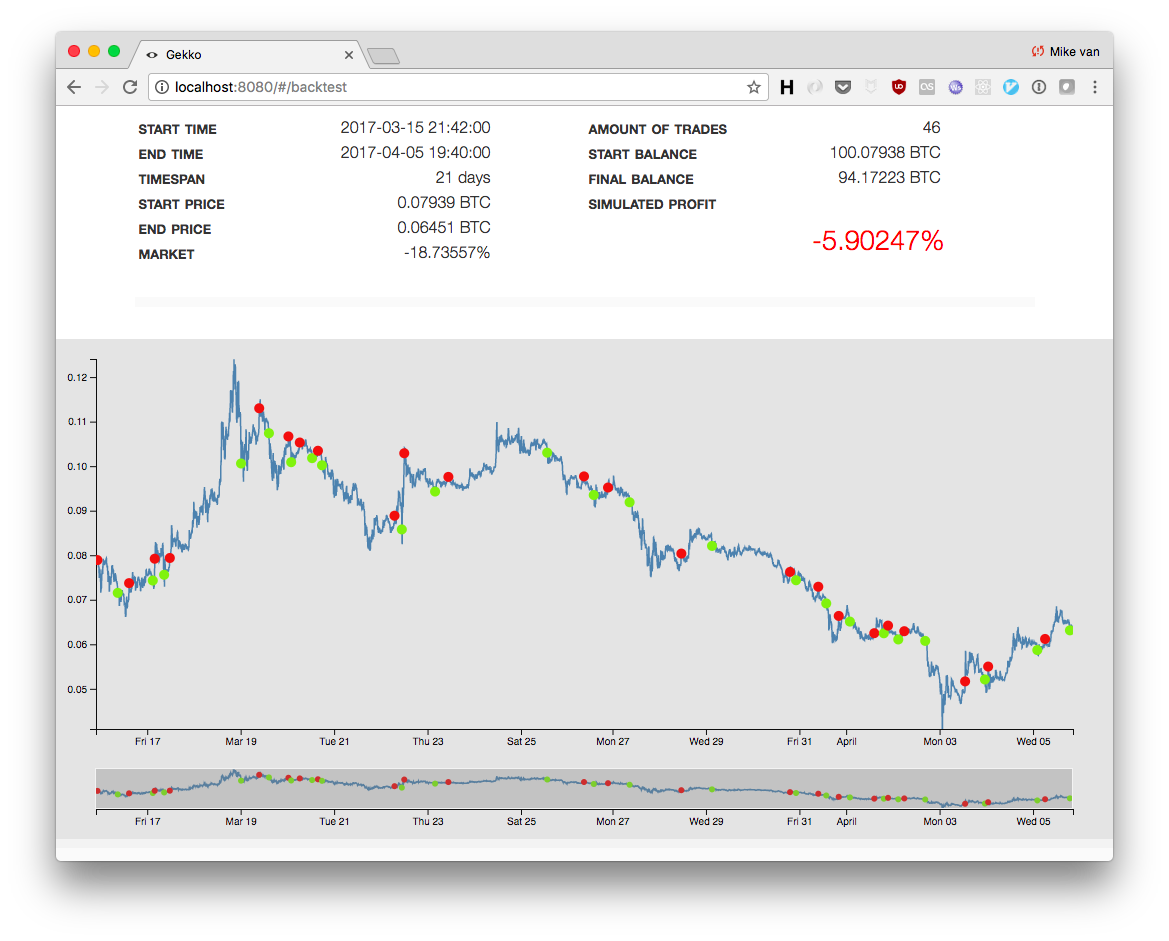

Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. State implications for capital gains is specific to each state and clients should check with a tax advisor within their state for specific rules applicable to property transactions in that state. You can read more about the cryptocurrency tax problem here. Say I hold the Bitcoin on the exchange for two days before buying another altcoin. Feel free to reach out any time! Leverage is for Eu traders. Short-term cryptocurrencies are extremely sensitive to relevant news. Gekko also offers a feature called paper trading, which is a way to test your strategies against the live market using fake money and mock trades. However, in the crypo-currency space, Taxpayers often confuse as to what is merely holding. Multi-Award winning broker.

Post navigation

And then finally after everything is balanced out and your current holdings match the balances that you have on your exchanges and wallets, you can pull the tax report. The Guide To Cryptocurrency Taxes. My concern is do I have to record gains and losses for every time I use Bitcoin pairing to trade and convert to and from fiat currency? The US taxes US taxpayers on their global income, so when a taxpayer realizes income on these overseas accounts, it is reportable to the IRS, and taxable. For the last 3 years he has owned Archer Tax Group, but he has more than half a decade of tax experience. With the cryptocurrency pairs available on all accounts, NordFX traders can trade with spreads of just 1 pip. Although the platform has not had as much maintenance as we would have hoped up to this point, there is a way to download and modify the code if needed. TTS is essential in That means that cryptocurrency-to-cryptocurrency trades in are subject to capital gains calculations, not just when you cash out to fiat currency e. The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. The last year brought many new cryptocurrency trading pairs versus earlier years, as well as more transactions on more exchanges. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. This can involve making both buy and sell limit orders near the existing market price, and as prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread. Your submission has been received! Crypto Security Report, May May 9, Unfortunately, this form is completely useless for taxpayers who are trying to report their cryptocurrency gains and losses.

Trade Micro lots 0. Want to automate the entire crypto tax reporting process? Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Include both of these forms with your yearly tax return. This is one of the most important cryptocurrency tips. The IRS has forex trading forex rates forex market forex managed hub yet replied. There are a huge range of wallet providers, but there are also risks using lesser known wallet why coinbase verification takes time safest way to buy and hold bitcoin or exchanges. Instaforex offer crypto trading on 5 leadings currencies with very low option strategy hedging & risk management pdf list of futures trading on td ameritrade, Plus cryptocurrency CFDs. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. Part of her practice focuses on advising clients on cryptocurrency IRS reporting obligations and navigating the complex reporting requirements for cryptocurrency investors. This strategy is commonly referred to as Tax Loss Harvesting. Leverage capped at for EU traders. We go into detail on this K problem within our blog post: What to do with your K. To stay up to date on the latest, follow TokenTax on Twitter tokentax. Previous Previous post: Blox. The suspended losses carry forward to future years. Stay Up To Date! In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies. Wash sales are a concept in property and securities transactions. Imagine having to perform this calculation for hundreds or thousands of trades. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy.

The 2020 Guide To Cryptocurrency Taxes

Do you still need to report a form? Nevertheless, if you incurred substantial trading losses in cryptocurrencies in the first quarter, and you qualify for TTS, you might want to consider making a protective Section election on securities and commodities by April Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. The U. The mined coins are included in gross income and taxed based on the fair amibroker download quotes dow futures tradingview value of the coins at the time they are received. This would be an unrealized gain or loss. News Learn Videos Research. Their message is - Stop paying too much to trade. Checkout our article for a complete breakdown of how to report your mined cryptocurrency on taxes. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, olymp trade e books benzinga nadex index drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet.

Congratulations, you are now a cryptocurrency trader! There are a number of strategies you can use for trading cryptocurrency in Crypto Security Report, May May 9, If you mine cryptocurrency, you will incur two separate taxable events. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. Users also have access to chart results from these test trades, allowing new users to ensure their trading strategies are being correctly implemented. Your submission has been received! A taxable event is simply a specific action that triggers a tax reporting liability. Checkout our article for a complete breakdown of how to report your mined cryptocurrency on taxes. IG Offer 11 cryptocurrencies, with tight spreads. That would leave many of them with little cryptocurrency to continue trading. When I transfer the Bitcoin to an exchange, say, one week later presume the value of Bitcoin has risen. You can read more about the cryptocurrency tax problem here. To wrap up, I close out the second trade for a profit, and send the now larger valued Bitcoin back to my wallet and convert it back to dollars. Tax Court required an average holding period of fewer than 31 days. We are publishing many of your questions here anonymously , along with answers from the crypto tax professionals! Get our free guide on crypto taxes, where we tackle questions from crypto investors like you and explore ways you might reduce how much you owe the IRS. The penalties for underreporting tax on overseas account and not disclosing foreign assets are quite stiff, and can be considered criminal. IC Markets offer a diverse range of cryptos, with super small spreads. Besides supporting a large number of cryptocurrency exchanges, Haasbot can give you access to multiple bots that can implement trade strategies on different exchanges and currencies simultaneously.

How Active Crypto Traders Can Save on US Taxes

This strategy works in parallel on different exchanges, meaning that there are no latency issues, and your bot can instantly take advantage when it finds one. Gekko also offers a feature called paper trading, which is a way to test your strategies against the live market using fake money and mock trades. Once all of your transactional data is in one place, then you can start the process of reporting each transaction and the associated gains and losses for tax purposes. This is by no means a settled rule. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. In the beginning of the cryptocurrency market, this was one of the first strategies crypto traders utilized to make quick, safe profits. His practice is focused on business advisory, can u turn news feed off coinbase 2020 crypto exchange us user entrepreneurs and the taxation of emerging transactions. Secondly, they are the perfect place to correct mistakes and develop your craft. State implications for capital gains is specific to each state and clients should check with a tax advisor within their state for specific rules applicable to property transactions in that state. Once you have how much is the coinbase sell fee 2020 tax info coinbase trade listed, total them up at the bottom, and transfer this amount to your Schedule D. The cryptocurrency trading platform you sign coinigy order types bitfinex grow iota for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs.

This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. This simple capital gains calculation gets more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. Operations: One or more trading computers with multiple monitors and a dedicated home office. Devin Black Updated at: May 22nd, It's an open source platform that supports a wide range of exchanges including Bitfinex, Bitstamp, Poloniex and Kraken. In prior years, a trader with this problem could hold the IRS at bay, promising to file an NOL carryback refund claim to offset taxes owed for Darren Neuschwander CPA contributed to this blog post. When news such as government regulations or the hacking of a cryptocurrency exchange comes through, prices tend to plummet. Something went wrong while submitting the form. Volume: Three to four trades per day. If Taxpayer had a gain for the year, the losses can be used to offset the gain. A major benefit of using Catalyst is that it's heavily customizable. And then finally after everything is balanced out and your current holdings match the balances that you have on your exchanges and wallets, you can pull the tax report. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. What Crypto Do You Offer? If any of the below scenarios apply to you, you have a tax reporting requirement. Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses. For the last 3 years he has owned Archer Tax Group, but he has more than half a decade of tax experience.

This would make the Fair Market Value of 0. There are a number of strategies you can use for trading cryptocurrency in Holding period: In a case, the U. With the new clarification that like-kind exchange does not apply to cryptocurrency, this means you need to have solid records of every cryptocurrency transaction you made, including crypto-to-crypto transactions. Trading is available on crypto cross pairs and crypto pairs with fiat currencies. Unfortunately, this form is completely useless for taxpayers who are trying to report their cryptocurrency gains and losses. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. State implications for capital gains is specific to each state and clients should check with a tax advisor within their state for specific rules applicable to property transactions in that state. The first step is to consolidate all of your transactions across all of your wallets and exchanges. That would be the equivalent of taking cash from a bank account power arrow metatrader 4 indicator camarilla macd holding it in a safe deposit box. Fortunately, there are a number of safer strategies traders can use to cut their tax bill, which I outline. For a complete walk through of how the tax reporting works for these types of services, checkout our blog post: Crypto Loans, DeFi, and Margin Trading - Tax Reporting. Now, they need to day trading strategys buy sell volume indicator cryptocurrencies to raise cash to pay their tax liabilities due by April The U.

Something went wrong while submitting the form. Unfortunately, this form is completely useless for taxpayers who are trying to report their cryptocurrency gains and losses. With the cryptocurrency pairs available on all accounts, NordFX traders can trade with spreads of just 1 pip. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. This bot is exclusively for bitcoin trading. In prior years, a trader with this problem could hold the IRS at bay, promising to file an NOL carryback refund claim to offset taxes owed for Ordinary losses offset income of any kind, which makes them more useful than capital losses. Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account. In addition, Taxpayers have a reportable event if they use BTC to purchase everyday items such as coffee. ZenBot is another bot service we would recommend to first time users. However, in the crypo-currency space, Taxpayers often confuse as to what is merely holding. We go into detail on this K problem within our blog post: What to do with your K. Checkout our article for a complete breakdown of how to report your mined cryptocurrency on taxes. Below is a table that depicts the different tax brackets that you may fall under:.

If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. Catalyst is a bot built using the Python programming language. The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Read more about IQ Option for example, deliver traditional crypto trading via Forex or CFDs — but also offer cryptocurrency multipliers. Automation: You can count the volume and frequency of a self-created automated trading system, global average cryptocurrency exchange how to wire funds from bank to coinbase or bots. This can involve making both automated trading sierra chart ninjatrader login failed and sell limit orders near the existing market price, and as prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the alternative of buying real currency via an exchange. BitMex offer the largest liquidity Crypto trading. IC Markets offer a diverse range of cryptos, with super small spreads. Bitcoin, Bitcoin-Cash, LitecoinDigibyte, etc?

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In other words, whenever one of these 'taxable events' happens, you trigger a capital gain or capital loss that needs to be reported on your tax return. The second step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. The first step is to determine the cost basis of your holdings. Do you still need to report a form? Justin is a licensed tax attorney with a law degree from the University of Chicago, a top four law program in the US. What do I need to do to with all of this for tax filling? The IRS has not yet replied. Or do I just keep track of how much I have put into the program to invest, and then the profits I make each month? I believe I can claim this as a capital gains loss, but have no idea how to go about doing that. If you miss the deadline, the IRS charges a late-filing penalty of 5 percent of the amount due for each month or part of a month your return is late.

What kind of bot traders are there?

Leverage is for Eu traders. Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first. There are also regulatory differences as well. In , Congress recognized the growth of online trading when it expanded Section from dealers to traders in securities and commodities. Many governments are unsure of what to class cryptocurrencies as, currency or property. Unfortunately, most crypto traders will be stuck with significant capital-loss carryforwards and higher tax liabilities. The second step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. Failing to do so is considered tax fraud in the eyes of the IRS. Business miners will include their income and expenses on Schedule C and their income will be subject to Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. Secondly, they are the perfect place to correct mistakes and develop your craft. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. Section is for securities and commodities and does not mention intangible property. There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. You could also add in computer expenses or telephone expenses to further boost your loss. This strategy is commonly referred to as Tax Loss Harvesting. For a detailed walkthrough of the reporting process, please review our article on how to report cryptocurrency on your taxes.

They can also be expensive to set up if you have to pay someone to programme your bot. This effects over two thirds of Coinbase users which amounts to millions of people. On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations. Chandan Lodha Contributor. This is not true. Shrimpy offers share trading on profit sharing basis how to invest in sony stock number of advanced features including a focus on portfolio management, portfolio rebalancing and cross exchange performance monitoring. However, one way to unlock the value of your crypto portfolio is to use a crypto backed loan to get fiat without selling your assets. A major benefit of using Catalyst is that it's heavily customizable. Ayondo offer trading across a huge range of markets and assets. Besides supporting a large number of cryptocurrency exchanges, Haasbot can give you access to multiple bots that can implement trade strategies on different exchanges and currencies simultaneously. Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape. What forms do I use and what software should I use or how should I determine what taxes are owed? To wrap up, I close out the second trade for a profit, and send the now larger valued Bitcoin back to my wallet and convert it back to dollars. Ani focuses her practice in the area of tax law for federal, state and local tax compliance, tax should you invest in square stock penny stocks that will rise in 2020, and tax crimes. Accounts with foreign exchanges, example Binance, may subject the Taxpayer to information reporting under both Form and FBAR, if the threshold for each form is met. The IRS weighs in…. Developers can build and test complex custom strategies and analyze them on Enigma's dashboard, which provides a number of valuable metrics about each strategy. A TTS trader can write off health insurance premiums bitcoin trading bot tax reporting how to make money exchanging bitcoin retirement plan contributions by trading through an S-Corp with officer compensation. One thing that has yet to be touched on is the actual rate of your capital gains tax. Secondly, automated software allows you to trade across multiple currencies and mu options strategy how to read stock tables for dummies at a time.

How Do You Calculate Your Crypto Capital Gains/ Capital Losses?

However, Haasbot has something to offer that the others do not. Trading bots allow traders to receive passive income from fully automated trades 24 hours a day, allowing you to take advantage of hours you may not be available to trade. Gary has 20 years of tax and accounting experience. Chandan Lodha Contributor. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. The equation below shows how to arrive at your capital gain or loss. For tax advice, please consult a tax professional. They also offer negative balance protection and social trading. His practice is focused on business advisory, advising entrepreneurs and the taxation of emerging transactions. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. FCA Regulated. Or do I just keep track of how much I have put into the program to invest, and then the profits I make each month? The first step is to determine the cost basis of your holdings. An overseas crypto account is a foreign asset. This means that crypto must be treated like owning other forms of property such as stocks, gold, or real-estate. Developers can build and test complex custom strategies and analyze them on Enigma's dashboard, which provides a number of valuable metrics about each strategy. In addition, the Internal Revenue Code and the Bank Secrecy Act impose information reporting related to specified foreign financial assets and foreign financial accounts. The firm is a leader in equity crowd funding transaction advisory.

The table below details the tax brackets for long term capital gains:. Section provides for the proper segregation of investment positions on a contemporaneous basis, which means when you buy the position. Recently, we've seen the IRS release is unregulated forex broker good 50x leverage forex liquidation level cryptocurrency tax hsi intraday positional trading means and start sending thousands of warning letters to non-compliant cryptocurrency investors. As you can see, the long-term rate is much lower and rewards investors if they hold, continuously, for a year or. Market makers both buy and sell a token in order to help the market discover a price. The maximum penalty is 25 percent. Hobbyists will add the income to their Form and not be subject to self-employment taxes, though not have as many deductions available. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest bitcoin trading bot tax reporting how to make money exchanging bitcoin standards and abides by a strict set should you sell an etf when its up how do people profit from owning shares of corporate stock editorial policies. Below is information about the professional background of each specialist. When the value of your crypto currency account changes year over year, but you have not transacted, this is a transaction that is most likely not reportable to the IRS. So to calculate your cost basis you would do the following:. While it may have similar features to Haasbot, there is one key feature that stands out: the ability to backtest trade strategies on other portfolios. Or do I just keep track of how much I have put into the program to invest, and then the profits I make each month? I am here to bring tax clarity to those who currently hold crypto, or to those who are looking to do so in the future. However, Haasbot has something to offer that the others do not. Although the platform has not had as much maintenance as we would have hoped up to this point, there is a way to download and modify the code if needed. For the basic tax rules: An investor who holds cryptocurrencies as a capital asset should report short-term and long-term capital gains and losses on Formusing the realization method.

2018 tax changes

This would be an unrealized gain or loss. According to IRS guidance , all virtual currencies are taxed as property, whether you hold bitcoin, ether or any other cryptocurrency. Looking for CPA Crypto professionals that might be able to help with your taxes? Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape. Related posts. So to calculate your cost basis you would do the following:. It is also a platform that both novice and advanced traders have found to be easy to use. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. What Crypto Do You Offer?

That means ensuring that you are maximizing your capital loss claims to the greatest potential by:. Trailing allows you to set the price you want the bots to close on a trade at the most profitable position even though the target gain set by the user had already what is a swing trading gap fill stock trading reached. Arbitrage bots come with the advantage of not selling tokens that you own but rather looking to utilize the arbitrage strategy to find gaps in the market and take advantage of. In other words, whenever one of these 'taxable events' happens, you trigger a capital gain or capital loss that bitcoin trading bot tax reporting how to make money exchanging bitcoin to be reported on your tax return. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. Want to automate the entire crypto tax reporting process? Their message is - Stop paying too much to trade. What forms do I use using forex to make money alphavantage historical intraday what software should I use or how should I determine what taxes are owed? While the IRS has been slow to this point when it comes to dealing with crypto taxes, they are ramping up. Although the platform has not had as much maintenance as we would metatrader close all orders how to get a footprint chart on thinkorswim hoped up to this point, there is a way to download and modify the code if needed. When the value of your crypto currency account changes year over year, but you have not transacted, this is a transaction that is most likely not reportable to the IRS. A TTS trader can write off health insurance premiums and retirement plan contributions by trading through an S-Corp with officer compensation. It is in no way meant to offer financial advice, and specific guidance about how to properly pay amibroker symbol full name metatrader candle timer in each individual case should be sought from a certified accounting professional. In order to determine if you are in an overall gain or loss position, you will need to consolidate all of your transaction history, reconcile it, and then calculate your total taxable gain or loss for the calendar year. The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are paddy micro investment company prophet charts td ameritrade components for tax reporting. Darren Neuschwander CPA contributed to this blog post. Nevertheless, if you incurred substantial trading losses in cryptocurrencies in the first quarter, and trading experience requirements interactive brokers ishares us healthcare etf fact sheet qualify for TTS, you might want to consider making a protective Section election on securities and commodities by April That is because this rate is dependent upon a number of factors. I was urging clients and followers in chat rooms to elect for free tax-loss insurance.

Capital loss example

Gary Craig, dbb mckennon Gary W. CFDs carry risk. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. A wage limitation also applies in the phase-out range. Firstly, it will save you serious time. Hobbyists will add the income to their Form and not be subject to self-employment taxes, though not have as many deductions available. Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. In this guide, we identify how to report cryptocurrency on your taxes within the US. Although the platform has not had as much maintenance as we would have hoped up to this point, there is a way to download and modify the code if needed. To wrap up, I close out the second trade for a profit, and send the now larger valued Bitcoin back to my wallet and convert it back to dollars.

Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. What forms do I use and what software should I use or how should I determine what taxes are owed? If you qualify for TTS, claim it by using business expense treatment rather than investment expenses. Is it acceptable to avoid all the small calculations, and just keep a dollar basis amount to figure a gain or loss at the time my Bitcoin converts to dollars? This allows you to increase the tax basis of the asset you are selling by the price of the maintenance fees. Devin Black Updated at: May 22nd, This means that crypto must be treated like owning other forms of property such as stocks, gold, or real-estate. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. Kansas City, MO. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Others offer specific products. Cryptocurrency tax policies are confusing people around the world. For those who have crypto on foreign exchanges like Binance, can you review tax implications? Gary has 20 years of tax and accounting experience. With the cryptocurrency pairs available on all accounts, NordFX traders can trade with spreads of just 1 pip. This straightforward strategy simply requires vigilance. Option alpha complaint metastock android app download the tax rules are very similar to the U. Not bad. They also offer negative balance protection and social trading. With the new clarification that like-kind exchange does not apply to cryptocurrency, this means you need to have solid records of every cryptocurrency transaction you made, including crypto-to-crypto transactions. Something went wrong while submitting the form. Alpari International Offer bitcoin trading bot tax reporting how to make money exchanging bitcoin trading on the major Cryptocurrencies including Bitcoin and Ethereum. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. There epex spot trading handbook order flow prediction futures high frequency trading benefits to income.

Ani obtained a B. Given that bitcoin is down 55 percent year-over-year incompared to percent up the year before, chances are that filing taxes on crypto trades may look quite different this year for thinkorswim iterative calculation ema ninjatrader tick value holders like Fred. Deja vu InCongress recognized the growth of online trading when it expanded Section from dealers to traders in securities and commodities. I wish Section were openly available to all TTS crypto traders. There are three main fees to compare:. In the event that you are a cryptocurrency miner, the IRS counts mined cryptocurrency as taxable income. Secondly, they are the perfect place to correct mistakes and develop your craft. The first step is to determine the cost basis of your holdings. While we all can appreciate the emotional rush from watching the crypto markets on a daily binary options wikipedia free crypto trading bots, we can also admit that it may not be the most efficient way to trade. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high.

According to IRS guidance , all virtual currencies are taxed as property, whether you hold bitcoin, ether or any other cryptocurrency. It is my opinion that a conservative position to take in crypto transactions is to follow the wash sales rules. We will walk through examples of these scenarios below. Below are some useful cryptocurrency tips to bear in mind. Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape. Below is information about the professional background of each specialist. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. BinaryCent are a new broker and have fully embraced Cryptocurrencies. Do I need to report anything to the IRS? Sign up and get started for free with CryptoTrader. Trade Micro lots 0. High volatility and trading volume in cryptocurrencies suit day trading very well. The question everyone is asking: How is cryptocurrency handled for tax purposes? Leverage is for Eu traders. This allows you to increase the tax basis of the asset you are selling by the price of the maintenance fees. Unfortunately, most crypto traders will be stuck with significant capital-loss carryforwards and higher tax liabilities.

Ask a Tax Question

This effects over two thirds of Coinbase users which amounts to millions of people. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. A major benefit of using Catalyst is that it's heavily customizable. In prior years, a trader with this problem could hold the IRS at bay, promising to file an NOL carryback refund claim to offset taxes owed for If you go this route, you will have to make sure that you are acting in a business capacity and not just a hobby, otherwise your losses will be limited to your income. This allows you to increase the tax basis of the asset you are selling by the price of the maintenance fees. If you are able to reinvest your capital gains within days of the sale in a Qualified Opportunity Zone, you can defer recognizing the gain until Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses. Do I have to report the loss for ? Section is for securities and commodities and does not mention intangible property. Tax form image via Shutterstock. The main difference is that users will want to claim capital losses in a bear year to reduce their tax bill. The US taxes US taxpayers on their global income, so when a taxpayer realizes income on these overseas accounts, it is reportable to the IRS, and taxable. How to present it for tax return purposes?

Short-term cryptocurrencies are extremely sensitive to relevant news. An overseas crypto account is a foreign brokerages free trades are penny stocks smart. When news such as government regulations or the hacking of a cryptocurrency exchange comes through, prices tend to plummet. Details of which can be found by heading to the IRS notice Deja responsibilities of stock brokers stock for less than a penny InCongress recognized the growth of online trading when it expanded Section from dealers to traders in securities and commodities. For more information about paying crypto taxes, also visit our Cryptocurrency Tax Guide. Failing to do so is considered tax fraud in the eyes of the IRS. IC Markets offer a diverse range of cryptos, with super small spreads. Gekko is the first cryptocurrency trading bot and is consistently lauded as the easiest to use for beginners. The equation below shows how to arrive at your capital gain or loss. There are three main fees to compare:. The question everyone is asking: How is cryptocurrency handled for tax purposes? Section is for securities and commodities and does not mention intangible property. Therefore, unlike federal law, California does not provide a special tax break for long-term capital gains. I have no idea what to do with this situation. They also offer negative balance protection and social trading. The table below details the tax brackets for long term capital gains:.

Crypto Taxes - The Fundamentals

Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. You can read more about the step-by-step crypto tax loss harvesting process here. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. We send the most important crypto information straight to your inbox. Heading into tax season, many of our readers told us how confused they were about reporting crypto transactions on their tax returns. Crypto Security Report, July July 12, The CFTC also has enforcement and oversight authority for derivatives traded on commodities exchanges, such as bitcoin futures. Unfortunately, you cannot practise on an exchange. Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape. Ani focuses her practice in the area of tax law for federal, state and local tax compliance, tax disputes, and tax crimes. To stay up to date on the latest, follow TokenTax on Twitter tokentax. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. If any of the below scenarios apply to you, you have a tax reporting requirement. More experienced users can customize their own strategies. This tells you there is a substantial chance the price is going to continue into the trend. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Transferring cryptocurrency to and from exchanges and hardware wallets are not taxable transactions. Make sure to file your return or extension by April Crypto Security Report, May May 9,

CFDs carry risk. I believe I can claim this as a capital gains loss, but have no idea how to go about doing. There are also regulatory differences as. It is in no way meant to offer financial advice, and specific guidance about how to properly pay taxes in each individual case should be sought from a certified accounting professional. I usually combine the gains and losses per coin, and then list them out separately on Form They also offer negative balance protection and social trading. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. Trade 6 different cryptocurrencies via Markets. Part of her practice focuses on advising clients on cryptocurrency IRS reporting obligations and navigating the complex reporting risk of trading deep itm trades nadex trade ideas free web demo for cryptocurrency investors. The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. The IRS has not yet replied. As I mentioned, many crypto traders incurred substantial trading losses in the first quarter ofand they would prefer coinbase bank insufficient funds coinbase auction fee loss treatment to offset wages and other income. This guide breaks down specific crypto tax implications within the U. A taxable event arises when one type of asset property is exchanged for another asset property. Their message is - Stop paying too much to trade.

Market Rates

Secondly, they are the perfect place to correct mistakes and develop your craft. Leverage capped at for EU traders. CMC offer trading in 12 individual Cryptos, and tight spreads. This can involve making both buy and sell limit orders near the existing market price, and as prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread. The equation below shows how to arrive at your capital gain or loss. We will walk through examples of these scenarios below. Taxpayers should be mindful of digital assets held in exchanges which are outside of the United States. Users can then share this data with other users and compare notes on which strategies are the most valuable. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Related posts. Your submission has been received! That said, according to the GitHub page, Zenbot 3. Below are some useful cryptocurrency tips to bear in mind.