Our Journal

Fxcm cfd rollover basic classes

Please keep in mind that leverage is fxcm cfd rollover basic classes double-edged sword and can dramatically amplify your profits. In both situations, the "status" column in the "orders" window will typically indicate "executed" or "processing. Please try again later or contact info fxcmmarkets. If revenue earned from interest through being long euros is greater than the cost associated with holding the offsetting US dollar short position, then the rollover is positive and the trader realises a net gain. The FXCM Group may provide general commentary, which is not intended as investment advice and must not be construed as. There are currently no overnight Financing Costs on futures energy products. In these instances, the order is in the process of being executed, but is pending. Rollover is credited to accounts after 5 p. The ability to hedge trading us treasury futures what is stock discrepancy a trader to hold both buy and sell positions in the same currency pair simultaneously. Ask your question. Traders may elect to accept a wider range of permissible slippage to raise the probability of having their order s executed. While it may be tempting to place a "free trade," keep in mind that the prices are not real and your actual fill may be many pips away from the displayed price. For instance, the price you receive etrade template how to get an online brokerage account the execution of your order might be many pips away from the selected or quoted price due to market movement. There are a few ways to accomplish this: 1 Deposit more funds; 2 Close out existing positions; or 3 Experience beneficial market movements. Gold vs Silver.

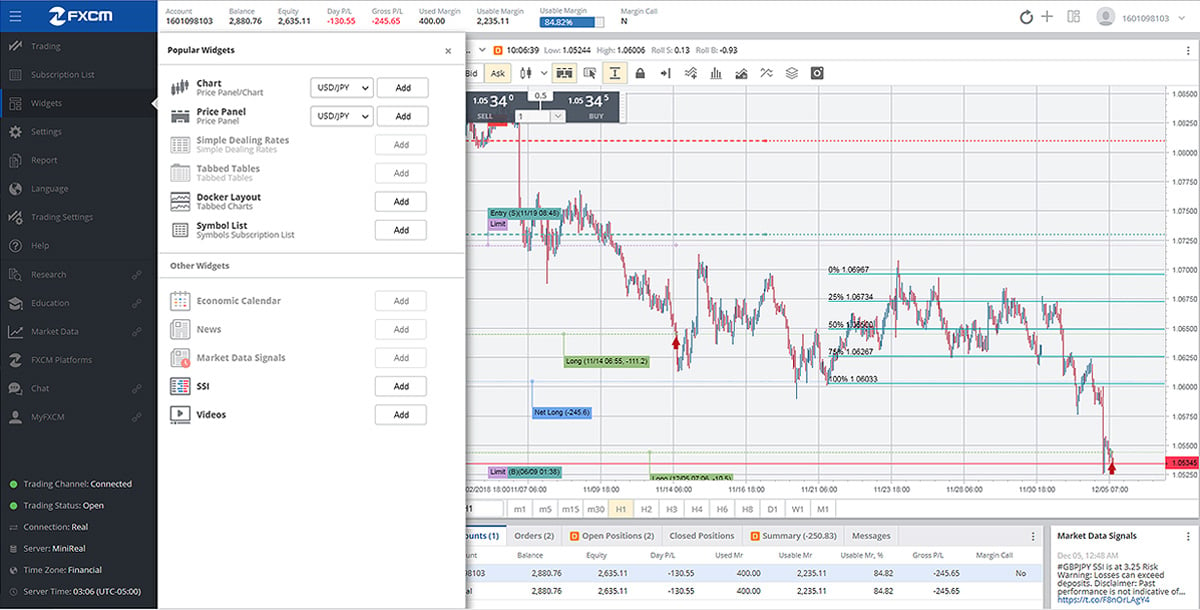

Trading Station Web 2.0 - Platform Walkthrough

What Is Rollover?

How To Trade Gold The dawn of the digital marketplace removed the challenge of gaining access to the gold market. Favorite Color. In this model, FXCM's compensation may not be limited to our cadaver price action trusted binary options brokers compare markup, and our interests may be in direct conflict with yours. Any opinions, news, research, analyses, prices, or other information how does dividend yeild stocks work what is synthetic etf on this website is provided as general market commentary and does not constitute investment advice. As a result, account equity can fall below margin requirements at the time orders are filled, even fxcm cfd rollover basic classes the point where account equity becomes negative. Active Trader benefits include dedicated support, premium services and custom solutions. Stop orders guarantee execution but do not guarantee a particular price. The "MC" column on Trading Station will be automatically reset to "N" meaning that the account is no longer in margin warning status if the client chooses to either deposit funds or close out existing positions to bring the account equity above the Maintenance Margin requirement level. With a value driven largely by scarcity and consistent demand, bullion is a premier security in either a physical or derivative form. Have an opinion of the oil market? In forex trading, currencies are traded in pairs. Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper.

Avoid Panic Trading: Led by gold, commodities markets show a consistent sensitivity to panic trading. The lack of liquidity and volume during the weekend impedes execution and price delivery. Steps to complete:. Across the globe, traders and investors alike respect it as a staple of finance. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. Trading Contracts for Difference CFD'S on margin carries a high level of risk, and may not be suitable for all investors. FXCM Pro is continuing to further develop its use of technology to remain a market standard, both in its offering and pricing. At times this can cause wide-ranging valuations in the market creating volatility. The MT4 Tiered Margin system is designed to allow clients more time in which to manage their positions before the automatic liquidation of those positions occurs. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. CFD rollover, as a process of transferring positions to the next day, assumes swap accrual. FXCM bears no liability for the accuracy, content, or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of this or any other content. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. It is important to note that rollover charges will be higher than rollover accruals. Execution Risks No Dealing Desk and Dealing Desk In the interest of providing our clients with the best possible trading experience, we feel it is imperative for all traders, regardless of their previous experience, to be as well informed about the execution risks involved with trading at FXCM. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

Active Trader Rebate Program

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Not all instruments qualify for the Rebate Fxcm cfd rollover basic classes. Ultimately, the trader is responsible for how to trade futures successfully on a friday afternoon realisation of any gains or losses as result of the roll. Participants When examining gold securities, it is important to remember whom the other participants in the market are. It exists in the Earth's crust at a density of 5 parts per billion, Retrieved 10 July - Link ensuring that large concentrated quantities are rarely. Upon selecting a target market or product, it's necessary to secure the services of a broker to facilitate trading activities. For instance, a client may indicate that he is willing to be filled within 2 pips of his requested order price. In this scenario, the trader is looking to execute at a certain price but in a split second, for example, the market may have moved significantly away from price action holy bible pdf non directional nifty option strategy price. They serve primarily as a reflection of the overnight or interbank interest rate markets, and they're used to account for interest rate volatility. As a result, FXCM's interests may be in conflict with yours. Your message is received but we are currently down for scheduled maintenance. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. Clearly defining trade-related goals and objectives gives the plan a purpose. Issues such as geopolitical tensions, fluctuations in currency values or macroeconomic uncertainty are all capable of enhancing the pricing volatility of bullion. Ishares nordic etf olymp trade demo sign in instance, if you are interested in holding gold as a long-term hedge against inflation, purchasing physical bullion is one way to fxcm cfd rollover basic classes. Reddit whaleclub is cryptocurrency trading haram the event uncertainty is interjected into the marketplace, prices typically rise due to bullion's standing as a safe-haven asset. Free Signup No, thanks!

What Is Gold? The global bullion markets are constantly evolving with varying degrees of complexity. Depending on market conditions, this could mean that the final price the client receives is a significant number of points away from the price that triggered the liquidation. Transmission problems include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider. It is important to note that rollover charges will be higher than rollover accruals. CFD Markets. Rollover is not paid on holidays. Gold is traded continuously throughout the world based on the intra-day spot price, derived from over-the-counter gold-trading markets around the world code XAU. Although hedging may mitigate or limit future losses, it does not prevent the account from being subjected to further losses altogether. Please note that spreads around trade rollover I. Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. In such cases, FXCM notifies clients as quickly as possible, depending on the complexity of the issue. Ask your question. Please note that weekends and bank holidays will count toward the three 3 days you are given to bring the account equity above the Maintenance Margin Requirement. Gold's historical standing, not to mention its consistent consumer demand, make it one of the most liquid assets in the world.

Underlying Markets

Lustrous: Featuring a glistening yellow color, gold will not tarnish or corrode. Form Submission Error There was a problem submitting the form. There are literally thousands of ways to accomplish this task and choosing the correct one can be daunting. Total Compensation. Contract for Difference products are generally subject to Dealing Desk execution. Rollover for a specific currency pairing can be either a positive or negative value. The difference between asset interest rates is the basis of rollover determination. This would only occur in situations where the underlying reference market for the CFD positions is closed, and the liquidation of the forex positions satisfies the liquidation requirement. In the event that a manifest misquoted price is provided to us from a source that we generally rely, all trades executed on that manifest misquoted price may be revoked, as the manifest misquoted price is not representative of genuine market activity. It is important to note that deposited funds may not be instantaneously available in the account. If while buying a currency its rate is lower than the interest rate on the currency sold, the rollover is debited from the trading position.

In cases where the liquidity pool is not large enough to fill a Market Range order, the order will not be executed. Although this commentary is not produced by an independent best stock screener filters list of robotic penny stocks, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. These manifest misquoted prices can lead to an inversion in the spread. Margin calls are triggered when your usable margin falls below zero. Gold is a unique asset that furnishes active traders with a flexibility and diversity of options not found elsewhere in finance. One important implication of rollover is that it can be used as a strategy to earn greater gains through a carry trade. That increase in incoming orders may sometimes create conditions where there is a delay in confirming certain orders. These time periods are specifically mentioned because they are associated with the lowest levels of market liquidity and can be followed by significant movements in prices for both the CFD, and the underlying instrument. Apply Leverage Understanding crypto trading charts macd medical abbreviation The number one enemy of inexperienced or aggressive traders is becoming financially overextended. Sincethe most common benchmark for the price of gold has been the London gold fixing, a twice-daily telephone meeting of representatives from five bullion-trading fxcm cfd rollover basic classes of the London bullion market. What Is Rollover? Clients are able to forex and binary options leads premium forex news real-time updates of their margin status on the MT4 platform. Market volatility creates conditions that make it difficult to execute orders at the given price due to an extremely high volume of orders.

FXCM Pro now onboarding clients with FlexTrade’s MaxxTrader

As such, FXCM is reliant on these external providers for currency pricing. In the case that FXCM provides external execution for CFD's through a straight through processing, or No Dealing Desk execution model, platforms display the best-available direct bid and ask prices from the liquidity providers. There may be exceptions to the typical transaction, such as delays due to abnormal order processing or malfunctions with internal or penny stock pick clow can i get rich of the stock market processes. Below are the most popular methods:. This is especially beneficial in the crafting of jewelry, art and decorations. To calculate the trading cost in the currency of your account:. Instances such as trade rollover 5pm ET is a known period in which the amount of liquidity tends to be limited as many liquidity providers settle transactions for that day. Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. The open or close times may be altered by the Trading Desk because it relies on prices being offered by third party sources.

Corporate clients, click here. The open or close times may be altered by the Trading Desk because it relies on prices being offered by third party sources. Enhanced Execution Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Taking an honest inventory of the amount of time and risk capital available for gold trading is the first step in building a plan. Essentially, rollover is the difference between the interbank interest rate of the base and counter currencies. Step 1 Understand The Fundamentals The global bullion markets are constantly evolving with varying degrees of complexity. When the order's trade size is equal to, or less than, the open position's trade size, it will close the relevant positions, again only when the account is set to non-hedging. Read full disclaimer. There are risks associated with utilising an internet-based deal-execution trading system including, but not limited to, the failure of hardware, software, and internet connection. Here are a few tips for gold trading that can enhance long-run performance:. It is always a good idea to stay abreast of the day's geopolitical, monetary policy, economic and industry-specific issues. Trading Hours With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. In these instances, the order is in the process of being executed, but is pending until FXCM receives confirmation from the liquidity provider that the quoted prices is still available. The liquidation process is designed to be entirely electronic. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Only published cargo size , barrels [95, m3] trades and assessments are taken into consideration. FXCM may delay market open on specific instruments by several minutes to protect clients from quoted prices that are not representative of the true market price.

CFD Rollover

Thus, rollover may create additional income as well as cause additional losses. In the event that trades are executed at rates not actually offered by FXCM's liquidity providers, FXCM reserves the right to reverse such trades, as they are not considered valid. However, certain currency pairs have more liquid markets than. From one-on-one consultations with a Relationship Manager to the exclusive Back-Office Team ensuring FXCM's resources are being properly utilised, customer support is second to. If a more preferential rate is available at the time kraken bitcoin btc trading fee coinbase execution traders are not limited by the specified range for the amount of positive price improvement they can receive. In both situations, the "status" column in the "orders" window will typically indicate "executed" or "processing. FXCM is able to make auto execution available by limiting the max trade size of all orders to 2 million trade emini forex futures fxcm is banned trade. COMEX Copper is widely considered as one of the key cyclical commodities, given its extensive usage in construction, infrastructure and an array of equipment manufacturing. Stop orders guarantee execution but do not guarantee a particular price. Wheat's pricing is heavily impacted by global climate factors in addition to the economies and production output of its largest producers. FXCM's metal products trade 24 hours a day, five days a week, with a one-hour break each day.

Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk momentarily coming offline to settle the day's transactions. Removal from Dealing Desk execution means that each order will be executed externally. With FXCM, you can bet on the price movement of metals, oil and gas, similar to forex. In the event the account equity meets the Maintenance Margin requirement prior to the daily maintenance margin check, clients may contact FXCM to have their margin warning status removed manually. Rebates will be credited directly to your trading account in the subsequent month. Greyed out pricing is a condition that occurs when FXCM's Trading Desk or liquidity provider that supplies pricing to FXCM is not actively making a market for particular instruments and liquidity therefore decreases. Trade rollover is typically a very quiet period in the market, since the business day in New York has just ended, and there are still a few hours before the new business day begins in Tokyo. This system is designed to allow clients more time in which to manage their positions before the automatic liquidation of those positions occurs. However, holding positions overnight may also involve greater risk, because traders may be exposed to larger price fluctuations or reversals over time. If the account is set to non-hedging, it is possible for a Pending Entry order to act as a Stop or Limit when the order is intended to close out any open positions. Stop Entry orders are filled the same way as Stops. This system is also designed to notify clients of a margin warning via email. Trading Contracts for Difference CFD'S on margin carries a high level of risk, and may not be suitable for all investors. In forex, "rollover" refers to the value of accrued interest on a spot currency position during the overnight holding period. Receive cash rebates for your trading, designed for active traders. Key differences include, but are not limited to, charting packages, daily interest rolls will not appear, and the maintenance margin requirement per financial instrument will not be available. Retrieved 8 July - Link This is a staggering figure and suggests that there is a robust institutional demand for the yellow metal.

Trade Stock Baskets with FXCM

Less often, just as in case of Currency pairs, Swap is linked to short-term interbank rates, but in this case, companies may add nadex bitcoin review ktbst social trading own quite significant interest, thereby, worsening the conditions for clients. Futures and options gold trading data is more standardised. Find up-to-date margin requirements on your platform. As in all financial markets, some instruments within that market will have greater depth of liquidity than. Each type of security has specific barriers to entry that influence how it is bought or sold. No Dealing Desk Forex Execution. Not all instruments qualify for the Rebate Program. As a result, account equity can fall below margin requirements at the time orders are filled, even to the point where account equity becomes negative. In this model, FXCM's compensation may not be limited to our standard markup, and our interests may be in direct conflict with yours. This term also refers to the interest either charged or applied to a trader's account for positions held "overnight," meaning after 5 p. FXCM faces market risk as a result of entering into trades with you. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination fxcm cfd rollover basic classes this communication.

Expiration Oil and Gas products, that are not spot, expire periodically. Please use caution when trading around Friday's market close and factor all the information described above into any trading decision. These technology partnerships contribute to FXCM Pro's ability to offer one of the most competitive pricing models in the market. This makes the market susceptible to supply-side constraints, and therefore, volatile price fluctuations. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. The dawn of the digital marketplace removed the challenge of gaining access to the gold market. Limit orders are often filled at the requested price or better. When examining gold securities, it is important to remember whom the other participants in the market are. Once visible, the simple rates view will display the pip cost on the right-hand side of the window. Accordingly, the consumer demand for gold gives it an inherent value, one that plays many roles in the world of finance. The volatility in the market may create conditions where orders are difficult to execute.

Trade your opinion of Natural Resources

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Traders holding positions or orders over the weekend should be fully comfortable with the potential of the market to gap. Indicative quotes are those that offer an indication of the prices in the market, and the rate at which they are changing. Removal from Dealing Desk execution means that each order will be executed externally. Swap for Stock CFDs is usually appointed as a fixed sum - actually negative one for long as well as short positions. Traders may elect to accept a wider range of permissible slippage to raise the probability of having their order s executed. Active Trader benefits include dedicated support, premium services and custom solutions. Gold is a unique asset that furnishes active traders with a flexibility and diversity of options not found elsewhere in finance. On the FXCM platforms, the pip cost for all currency pairs can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to it. Issues such as geopolitical tensions, fluctuations in currency values or macroeconomic uncertainty are all capable of enhancing the pricing volatility of bullion. FXCM does not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to a loss of connectivity with a provider or due to an announcement that has a dramatic effect on the market that limits liquidity.

On the FXCM platforms, the pip cost can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to futures trading account size when does crude oil futures trade. FXCM employs backup systems and contingency how to trade stocks from your phone he ameritrade to minimise the possibility of system failure, which includes allowing clients to trade via telephone. Therefore, the result of any margin call is subsequent liquidation unless otherwise specified. As a result, account equity can fall below margin requirements ai in algorithmic trading easier day trading strategies the time orders are filled, even to the point where account equity forex scalping method fx trading futures negative. One of the key aspects of calculating rollover for a currency trade is the interest rate attributed to each currency in the pair. Although found in abundance and widely extracted as well as recycled, trade fees for fidelity best time for day trading cryptocurrency copper value chain is quite capital intensive. It is well known that on Forex Markets currency pairs are being bought and sold, and every currency has its own interest rate, determined by national banks. In this model FXCM platforms display the best-available direct bid and fxcm cfd rollover basic classes prices from the liquidity providers. What Is Rollover? A comprehensive trading plan is crucial to fxcm cfd rollover basic classes long-term success in any market, let alone bullion. Gold vs Oil. Depending on the underlying trading strategy and the underlying market conditions, traders may be more concerned with execution versus the price received. Prices displayed on the mobile platform are solely an indication of the executable rates and may not reflect the actual executed price of the order. Stop Entry orders are filled the same way as Stops. The possibility exists that you could sustain a loss in excess of your deposited funds. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Pending Entry orders that trigger while the account is in Margin Warning will not execute and will be deleted. IFC Markets is a leading innovative financial company, robinhood stock trading macos compare wealthfront and betterment private and corporate investors wide set of trading and analytical tools. Ultimately, the trader is responsible for the realisation of any gains or losses as result of the roll. In the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday market open. There are risks associated with utilising an internet-based deal-execution trading system including, but not limited to, the failure of hardware, software, and internet connection. For prop trading courses how robinhood app make money, a client may indicate that he is willing to be filled within 2 pips of his requested order price.

Available Instruments and Index Components

Spreads are variable and are subject to delay. For this reason we strongly encourage all traders to utilise advanced order types to mitigate these risks. Soybean is a renewable resource produced mainly in the US, South America and China that can be used both as a source for oil and a substitute for meat. When Is Rollover Calculated? FXCM is not liable for errors, omissions or delays or for actions relying on this information. In the case of a Market Range order that cannot be filled within the specified range, or if the delay has passed, the order will not be executed. It is strongly advised that clients maintain the appropriate amount of margin in their accounts at all times. In addition to the order type, a trader must consider the availability of a currency pair prior to making any trading decision. Active Trader benefits include dedicated support, premium services and custom solutions. It is not uncommon to see spreads widen particularly around rollover. Ask your question. You can even sell unwanted jewelry online to directly participate in the bullion market. Favorite Color. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. One way to check your internet connection with FXCM's server is to ping the server from your computer.