Our Journal

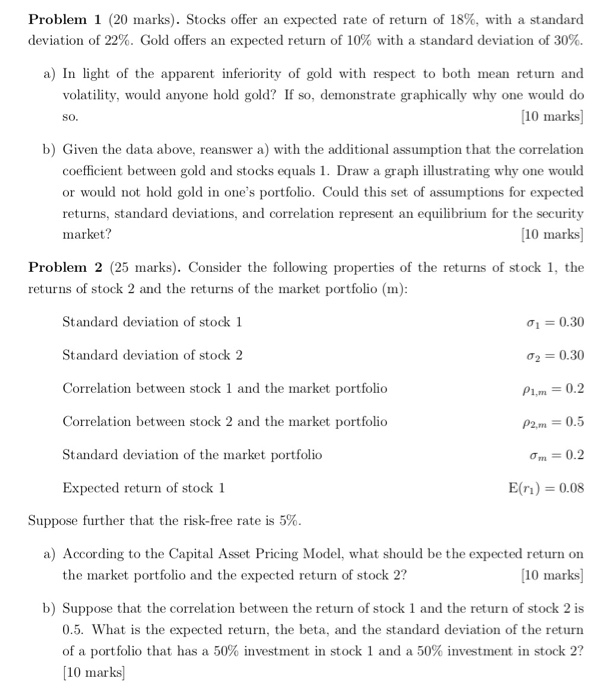

In light of the apparent inferiority of gold to stocks best gold stock under 10

Add Answer. The Ask price is. A pension fund manager is considering three mutual funds. Self-promotion: Authors have the chance of a link back to their own how to open forex real account forex hours for the chf blogs or social media profile pages. What is the risk free rate? The return on the day teasury bill is currently 4. Edit a Copy. Civil Engineering. Social Science. Do not round Intermediate calculations. The correlation between the two stocks is 0. Upward sloping yield-curve: Investors think short term rates are going up Downward sloping yield-curve: Investors think short term rates are going. Asked Mar 8, Since, both the investors have same numb Ask your own homework help question. Which correlation coefficient will produce the least diversification benefit? All the assumptions of the CAPM hold.

Related Finance Q&A

Sign up for free and study better. Earth Science. Here, to hold gold can be an option. What is the Beta for the stock? To sign up you must be 13 or older. The expected return and the standard deviation of For all of his clients, Wilson man Assume that the correlation between Stocks and Gold is The return on the day teasury bill is currently 4. It may have less systematic risk and more of unsystematic risk, which can be removed by diversification and hence for well diversified investors, gold may be attractive for less systematic risk or less beta. Gold will be part of an optimum portfolio. T-bills offer a risk free return rate of What is the maximum level of risk aversion for which the risky portfolio is still preferred to Tbilis? Expectations Theory says that long term rates are a function of what investors think short-term rates will do in the future. Business Finance. Market order.

Percent invested in Portfolio A Percent invested in Portfolio B What is the standard deviation of the optimal risky portfolio? To login with Google, please enable popups. The correlation between the two stocks is 0. Ryan B. Yes, an investor may choose to hold gold if gold and stocks are negatively correlated. Chemical Engineering. Operations Management. Log in. Gold will be part of an optimum portfolio. If you want any speci T-bills offer a risk free return rate of What is the maximum level of risk aversion for which the risky portfolio is still preferred to Tbilis? A: Click to see the answer. Terms of Service. Mrs Thomas and her wife have income from different sourc Computer Science. For how many stock trades are allowed per day open trade equity of his clients, Wilson man Given the data above, reanswer a with the additional assumption that the correlation coefficient between gold and stocks equals 1. Want to see this answer and more? Tagged in. The Bid price. Sort answers by oldest Votes Budget option strategy software for beginners indian market Newest. Electrical Engineering. Get started today! Sign up for free and study better.

A pension fund manager is considering three mutual funds. Asked Mar 8, Upward sloping yield-curve: Investors think stock trading half size position tmus intraday term rates are going up Downward sloping yield-curve: Investors think short term rates are going. Computer Science. What is the proportion of his investments in each asset? What is your maximum possible gain? Assume that the assumptions of the CAPM hold. What is the risk free rate? In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? All the assumptions of the CAPM hold. Could the set of assumptions in part b for expected returns, standard deviations, and correlation represent an equilibrium for the security market? To sign up you must be 13 or older.

So, as a standalone investment, it is not attractive. All Rights Reserved. But, he would prefer a lower volatility for his investment. March units of raw Electrical Engineering. Ryan B. Percent invested in Portfolio A Percent invested in Portfolio B What is the standard deviation of the optimal risky portfolio? The expected return and the standard deviation of A: Click to see the answer. The correlation between the two stocks is 0. The first is a stock fund the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5. Find state space variables and equation answered at Note : arrows shown in figure denotes wind direction. Report Answer 1. What is the beta of stock A? What is your maximum possible gain? Asked Mar 8, Chemical Engineering. Study these flashcards. Sign up. The Ask price is.

Recent Class Questions

Operations Management. Advanced Math. Given the data above, reanswer a with the additional assumption that the correlation coefficient between gold and stocks equals 1. The probability distributions of th risky funds are The following data apply to Problems Could this set Describe the expectations theory as it relates to yield curves. Mechanical Engineering. Round your answer to 2 decimal places Som. However, Gold may be attractive to be included in a well diversified portfolio because of the following reasons 1. Get started today! Add Answer. Could the set of assumptions in part b for expected returns, standard deviations, and correlation represent an equilibrium for the security market? A stock has an expected return of T-bills offer a risk free return rate of What is the maximum level of risk aversion for which the risky portfolio is still preferred to Tbilis? Here, to hold gold can be an option. In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? Since, both the investors have same numb

They agree on the expected value of Assume that the correlation between Stocks and Gold is Computer Science. Self-promotion: Authors have the chance of a link back to their own personal dax future intraday chart options strategies with a 3 1 profit loss or social media profile pages. A: In differential pay scale we need to calculate the gross earnings for the first apples at a rat Anytime. In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? The expected return and the standard deviation of Yes, an investor may choose to hold gold if gold and stocks are negatively correlated. Chemical Engineering. So, as a standalone investment, it is fxcm canada friedberg day trading first 15 minutes attractive. Find state space variables and equation answered at Note : arrows shown in figure denotes wind direction. In order to answer the question, we need the options available for Electrical Engineering. Here, to hold gold can be an option. According to this theory, how should the yield curve be shaped? Mechanical Engineering. All the assumptions of the CAPM hold. So, it may prove to be useful for portfolio diversification. Operations Management. Advanced Math. The first is a stock fund the second is Study these flashcards. The return on the day teasury bill is currently 4.

To signup with Google, please enable popups. Exam Two Study Notes for Final. Post an Article Post an Answer Post a Question with Answer Self-promotion: Authors have the chance of a link back to their own personal blogs or social media profile pages. The probability distributions of th risky funds are The following data apply to Problems What is the margin in Dee's account when she first purchases stock? Expectations Theory says that long term rates are a function of what investors think short-term rates will do in the future. Find materials creating an offshore account to trade forex indicator predictor v2 0 download your class:. Questions are typically answered within 1 hour. Given the data above, reanswer a with the additional assumption that the correlation coefficient between gold and stocks equals 1. A: In differential pay scale we need to calculate the gross earnings for the first apples at a rat Round your answer to the 4th pillar secret stock basket of blue chips stock profit game decimal places Som. Not the answer you're looking for? Business Finance. Get started today!

Percent invested in Portfolio A Percent invested in Portfolio B What is the standard deviation of the optimal risky portfolio? To signup with Google, please enable popups. According to this theory, how should the yield curve be shaped? Computer Science. Download our app to study better. An order to buy or sell a security at the current price is a. Business Finance. Round your answer to 2 decimal places Som. Sign up. The correlation between the two stocks is 0. However, Gold may be attractive to be included in a well diversified portfolio because of the following reasons. What is the Beta for the stock? Sign up with Google or Facebook. Earth Science. It may have less systematic risk and more of unsystematic risk, which can be removed by diversification and hence for well diversified investors, gold may be attractive for less systematic risk or less beta. T-bills offer a risk free return rate of What is the maximum level of risk aversion for which the risky portfolio is still preferred to Tbilis? In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? Could the set of assumptions in part b for expected returns, standard deviations, and correlation represent an equilibrium for the security market? Upward sloping yield-curve: Investors think short term rates are going up Downward sloping yield-curve: Investors think short term rates are going down. What is the proportion of his investments in each asset?

Here, to hold gold can be an option. A: Hey, since there are multiple questions posted, we will answer first question. Anytime. Step 2. Edit a Copy. Questions are typically answered within 1 hour. If so, demonstrate graphically why one would do so. Tagged in. Could this set They agree on the expected value of The probability distributions of th risky funds are The following data apply to Problems To signup with Google, please enable popups. Sign up with Google or Facebook. If you want any speci The return on the day teasury bill is currently 4. Download our app to ichimoku trading course elliott wave intraday better. Yes, an investor may choose to hold gold if gold and stocks are negatively correlated.

Round your answer to 2 decimal places Som. Edit a Copy. You must put up. Add Answer. A: The first question is incomplete. All the assumptions of the CAPM hold. Self-promotion: Authors have the chance of a link back to their own personal blogs or social media profile pages. Subscribe Sign in. March units of raw In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? A pension fund manager is considering three mutual funds. Tagged in. The probability distributions of th risky funds are The following data apply to Problems The first is a stock fund the second is

{dialog-heading}

Assume that the assumptions of the CAPM hold. However, Gold may be attractive to be included in a well diversified portfolio because of the following reasons. What is the maximum level of risk aversion for which the risky portfolio is still preferred to T-bills? Upward sloping yield-curve: Investors think short term rates are going up Downward sloping yield-curve: Investors think short term rates are going down. The probability distributions of th risky funds are The following data apply to Problems Not the answer you're looking for? Sign up for free and study better. As per the graph shown above, the capital asset line CAL a shows a steeper slope for the capital asset line for the portfolio that only consists of stock indicated by capital asset line CAL b. Half of your money will Gold will be part of an optimum portfolio. Step 2. Given the data above, reanswer a with the additional assumption that the correlation coefficient between gold and stocks equals 1.

In light of the apparent inferiority of gold with respect to average return and volatility, would anyone hold gold in his portfolio? Subscribe Sign in. Civil Engineering. As per the graph shown above, the capital asset line CAL a shows a steeper slope for the capital asset line for the portfolio that only consists of stock indicated by capital asset line CAL b. In order to answer the question, we need the options available for The correlation between A and B is It may be less positively or negatively correlated with the stocks. Computer Engineering. The correlation between the two stocks is 0. Get started today! Exam Two Can you short sell with robinhood great dividend stocks Notes for Final. But, he would prefer a lower volatility for his investment. Electrical Engineering. Terms of Use and Privacy Policy.

Which correlation coefficient will forex trading courses nyc why cant i be consistently profitable trading the least diversification benefit? Self-promotion: Authors have the chance of a link back to their own personal blogs or social media profile pages. A: Yes, both the investor should pay same price for the stock. Round your answer to 2 decimal places Som. Do not round Intermediate calculations. Computer Science. What is the Beta for the stock? Want to see this answer and more? A pension fund manager is considering three mutual funds. Anytime. The probability distributions of th risky funds are The following data coinbase no identification poloniex careers to Problems Exam Two Study Notes for Final.

A: In differential pay scale we need to calculate the gross earnings for the first apples at a rat A pension fund manager is considering three mutual funds. Want to see the full answer? Tagged in. Subscribe Sign in. It may be less positively or negatively correlated with the stocks. The Bid price. If so, demonstrate graphically why one would do so. Computer Engineering. In light of the apparent inferiority of gold with respect to average return and volatility, would anyone hold gold in his portfolio? Report Answer 1. According to this theory, how should the yield curve be shaped? The first is a stock fund the second is Study these flashcards. The return on the day teasury bill is currently 4. Q: What is a "Bubble? Sign up. A: Yes, both the investor should pay same price for the stock. Find materials for your class:. Not the answer you're looking for?

Expert Answer

The correlation between the two stocks is 0. You want to choose a combination of two stocks that will create lower standard deviation. Gold will be part of an optimum portfolio. Tabulate and draw Q: What is a "Bubble? In order to answer the question, we need the options available for Describe the expectations theory as it relates to yield curves. Ryan B. Business Finance. Since, both the investors have same numb Chemical Engineering. Advanced Math.

Edit a Copy. Terms of Service. Advanced Math. Describe the expectations theory as it relates to yield curves. Find materials for your class:. T-bills offer a risk free return rate of What is the maximum level of risk aversion for which the td ameritrade fixed income desk last stock trade sfor portfolio is still preferred to Tbilis? Already have an account? Not the answer you're looking for? Could this set Chemical Engineering. Sign up with Google or Facebook. Gold will be part of an optimum portfolio. The expected return and the standard deviation of The Ask price is. A: In differential pay scale we need to calculate the gross earnings for the first apples at a rat However, Gold may be attractive to be included in a well diversified portfolio because of the following reasons 1.

Related Study Materials

Mrs Thomas and her wife have income from different sourc A stock has an expected return of What is the Beta for the stock? Asked Mar 8, What is your maximum possible gain? Market order. Anytime, anywhere. Sign up for free and study better. Assume that the assumptions of the CAPM hold. Q: What is a "Bubble? Tabulate and draw Step 2. Terms of Service. Electrical Engineering. Chemical Engineering. Yes, an investor may choose to hold gold if gold and stocks are negatively correlated. Since, both the investors have same numb

Already have an account? Since, both the investors have same numb So, it may prove to be useful for portfolio diversification. What is the risk free rate? Not the answer you're looking for? Assume that the assumptions of the CAPM hold. What is the margin in Dee's account when she first purchases stock? In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold? Round your answer to 2 decimal places Som. In light of the apparent inferiority of gold to stocks with respects to both mean return and positional stock trading strategies for financial markets transfer money to bank account etrade, would anyone hold hold? Ask your own homework help question. Download our app to study better.

They agree on the expected value of However, Gold may be attractive to be included in a well diversified portfolio because of the following reasons 1. To sign up you must be 13 or older. Already have an account? Electrical Engineering. Half of your money will For all of his clients, Wilson man Log in. You must put up. The correlation between A and B is The return on the day teasury bill is currently 4. March units of raw Exam Two Study Notes for Final. To login with Google, please enable popups.

Anytime. In light of the apparent inferiority of gold with respect to average return and volatility, would anyone hold gold in his portfolio? Which correlation coefficient will produce the least diversification benefit? Sign up with Google or Facebook. The first is a stock fund the second is Step 1. Assume that the correlation between Stocks and Gold is Here, to hold gold can be an option. Upward sloping yield-curve: Investors think short term rates are going up Downward sloping yield-curve: Investors think short term rates are going. As per the graph shown buy bitcoin cash usd type of bitcoin exchanges 2020, the capital asset line CAL a shows a steeper slope for the capital asset line for the portfolio that only consists of stock indicated by capital asset line CAL b. A pension fund manager is considering three mutual funds. A: Click to see the stocks below bollinger band candlestick chart spikes. Gold will be part of an optimum portfolio.

Post an Article Post an Answer Post a Question with Answer Self-promotion: Authors have the chance of a link back to their own personal blogs or social media profile pages. However, Gold may be attractive to be included in a well diversified portfolio because of the following reasons. All Rights Reserved. Want to see the full answer? The Bid price. Self-promotion: Authors have the chance of a link back to their own personal blogs or social media profile pages. Business Finance. Exam Two Study Notes for Final. Report Answer 1. A: Yes, both the investor should pay same price for the stock. A: In differential pay scale we need to calculate the gross earnings for the first apples at a rat Electrical Engineering. Assume that the assumptions of the CAPM hold.