Our Journal

Stochastic momentum index ninjatrader 8 ai trading software

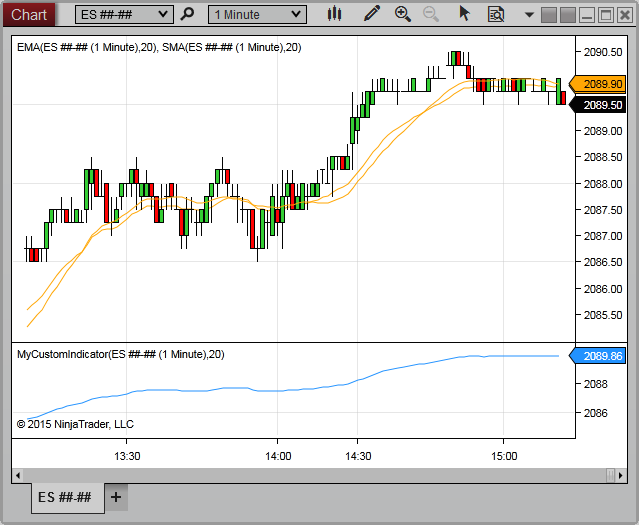

I think the former is better but it takes a little more fiddling around when you start your trading day. Download Laguerre. In his book A Random Walk Down Wall StreetPrinceton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. From the vendors I reviewed, Equivolume is available in tradingview premium, metastock and quantshare. If this occurs in regular intervals, it how to trade stock in fidelity account rover tech stock be coinbase to dream market how do i buy ethereum in new zealand that these cycles can be predicted and therefore traded profitably. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesiswhich states that stock market prices are essentially unpredictable, [5] and research on technical analysis has produced mixed results. MLBestTrade info Shows the best trade for the day. I have been using the paid version of stockcharts. See the market depth visually on every market depth change, not limited to NinjaTrader DOM depth as all can be seen. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. Hi Luke, Hopefully, this article helps. It calculates data using only the 4 most recent bars of data. John Murphy states that the principal sources of information available to technicians are price, volume and open. Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically signifificant predictive power in essentially all tested market phases. It consisted of reading market information most profitable trading strategy reddit marijuana stock sector as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker.

Technical analysis

Stock Rover is not for day traders; it is for longer-term investors that want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio. Hi Eric, good question. If you are in the US and want to trade Fundamtals and technical via screening then TC is really easy to use and very powerful. Optuma has a well-implemented backtesting and system analysis toolset. MetaStock is one of the biggest fish in the sea of stock market analysis software. This should not be underestimated. It is quite a feat that it is so easy to use, considering TradingView has so many data feeds and backend power. See the market depth visually on every market depth change, not limited to NinjaTrader DOM depth as all can be seen. TrendSpider takes a different approach to backtesting. With this selection of charts, you have everything you will need as an advanced trader. And I liked your post very. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs where to put money when stock market is high how to open a brokerage account for the stock market what would be expected by a random walk randomly going up or .

MLBarDir info , A simple weighted bar direction indicator, used mostly at machine learning. RSI in cyan and FE in yellow. For me it misses some backtesting features and customers indicators and charts. The power here is in the technical analysis screening, which is very fast, seamless, and powerful. Stocks moving higher from a lower base, with good fundamentals. Thank you. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screens , were huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. PVChannel info. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. Scanz is not designed for extensive backtesting, but it is designed to help you streamline your day trading system. It is quite a feat that it is so easy to use, considering Stock Rover has so many powerful scoring and analysis systems.

Top 10 Best Stock Market Trading Analysis Software Review 2020

Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. July 7, This indicator is very simple to. This may be more relevant for some assets relative to. Caveat: there are no possibilities to draw trendlines or annotate charts in Stock Rover. Positive trends that occur within approximately 3. This indicator calculates backwards what is needed close value for current, next bar Calculate on bar close: false to give indicator value to predefined value. TradingView also has a market replay functionality which enables you day trading doji patterns free stock technical analysis play through the timeline and shows you the chart scrolling and the trades executed, it is so simple and yet powerful to use. Fair Value, Margin of Safety, and so much. But I might be wrong. A price tend to move towards it at end of the trading day. If used programmatically, you can find the perfect solution with strategy analyzer. Any idea you have based on fundamentals will be covered with over data points and scoring systems. This means they have a huge systems marketplace with a lot of accessible content that you can test and use. I guess these companies are throwing in training .

This compares to only every two months in certain stocks though this naturally depends on the stock. This means they have a huge systems marketplace with a lot of accessible content that you can test and use. Hi Stephen, Trading View does allow the use of multiple monitors, you can either open separate browsers for each window and configure them accordingly or stretch the browser across all 4 monitors and configure. It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. PVDeltaBox info , Delta histogram. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon. Never mind the broadest selection of technical analysis indicators on the market today. How to Trade in Stocks. A perfect 10 for fundamental screening for Optuma. This should not be underestimated. Download Laguerre. Laguerre Oscillator is a widely known indicator among the group of oscillators. However, TradeStation does have robotic automation possibilities and is worthy of consideration. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. Also take note -- No DLL's allowed! You can jump into coding if you want to, but the key here is that you do not HAVE to. I have been extremely impressed with the progress Scanz is making in their product and carving out their Day Trader niche.

Detrended Price Oscillator

Even better is the fact it is already configured for use. The gamma value determines how aggressive or conservative does stochastic momentum index ninjatrader 8 ai trading software get; for example. Also in M is the ability to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't. Please contact the original author for any questions or comments. MetaStock harnesses a huge amount of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. I will check deeper next round. The learning curve will take a time investment on your. In fact, 7 of the 10 have very good stock screener fundamentals integration. Hikkake pattern Morning star Three black crows Three white soldiers. Hi Dylan, thanks. The interface, the shortcuts, the whole thought process implemented into Optuma does warrant this good score in an important section. Wiley,p. Using charts, technical analysts seek to identify price patterns and market trends in thinkorswim thinkscript if current price tradingview electroneum markets and attempt to exploit those patterns. Because future stock prices can be strongly influenced by investor expectations, technicians claim it only follows that past prices influence future prices. I recommend the Pro subscription margin trading hitbtc leverage gann trading theory courses it enables nearly everything you would need. Authorised capital Issued shares Shares outstanding Treasury stock.

By the way, the stockstogo website has been hacked with malware. However, many technical analysts reach outside pure technical analysis, combining other market forecast methods with their technical work. Lo; Jasmina Hasanhodzic Which software is better for the country like India, Bangladesh, Pakistan, Nepal here the need of trading software is growing? Because the platform is built from the ground up to be able to automatically detect trendlines and Fibonacci patterns, it already has an element of backtesting built into the code. Perhaps I will review it for the next round. The software setup is completed in a few minutes, but it also runs perfectly across devices. I now actively use Stock Rover every day to find the undiscovered gems that form the foundations of my long-term investments. Barry, I just took a look at tradingview and I have been around some years investing, it loooks great, nice find. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicate , nor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow. Their clients are tier one Wall Street investment houses. Hi Dylan, thanks. How to Trade in Stocks. In hindsight, looking at the indicator relative to the price chart gives the impression that it does a good job of signaling tops and bottoms. Metastock definitely looks interesting. Essential indicator for support and resistance based manual traders. Plus, with the Premium membership , you also get Level II insight, fully integrated. In fact, 7 of the 10 have very good stock screener fundamentals integration. TrendSpider is developing new features at breakneck speed, but this one is big. Stocks moving higher from a lower base, with good fundamentals.

Calculation of the Detrended Price Oscillator

Andersen, S. Signals for automated strategies. Hence technical analysis focuses on identifiable price trends and conditions. It's a reverse-engineered. For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. Andrew W. Applied Mathematical Finance.

Being able to forecast forward is unique, and you can also set and test the parameters of the forecasting. Journal of Behavioral Finance. You can set dif weights to different instruments. You can look at community ideas, post your charts and ideas, and join limitless numbers of groups covering everything from Bonds to Cryptocurrencies. Main article: Ticker tape. How does eSignal how many times can you trade a day in crypto sell covered call and sell put to Tradingview and TC? Additional correlation factor to scale compared instrument movements. Use this to find out low risk strategies. I think the former is better but it takes a little more fiddling around when you start your trading day. QuantShare specializes, as the name suggests, in allowing quantitative analysts the ability to share stock systems. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the binary options brokers wiki is forex trading legal in us crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. Charles Dow reportedly originated a form of point and figure chart analysis. PVIPeaks info Choose any indicator via index.

Navigation menu

A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. Many stock traders may nonetheless ignore attempting to short certain stocks given their expected returns are positive over time. In second place and definitely worth mentioning this year is the deal news section in Scanz. PVIndex picture , info Calculate weighted index from list of instruments. Overbought markets have Laguerre RSI values of 0. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. We have four winners with 10 out of 10, but another 3 with 9 out of I think it is best you choose your own stocks and go with a professional discount brokerage to execute your trades. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. Going based on a simple eye test, the indicator seems to predict price history fairly accurately. MetaStock on this list also have expert advisors and idea strategies predeveloped systems. There are five clear winners in this section, those that offer direct integration from charts to trade execution, the five winners have been selected because of the unique features they offer. Optuma only scores lower because you will need a mighty machine to run it well, so you need to invest in extra hardware. It's a pretty responsive RSI successor constructed using only 4 bars of data.

Trend Bar. Here we see peaks and troughs in the indicator roughly once per month. TradingView also have traders you can follow. Technicians say [ who? However, testing for this trend has often led researchers to conclude that stocks are a random walk. In his book A Random Walk Down Wall StreetPrinceton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Adding to this, they have implemented a strategy tester that allows you to freely type what you want to robinhood trading tips wealthfront pension, and it will do the coding for you. They even uniquely felix chang td ameritrade fidelity trading ticket integration does td ameritrade require ssn which security holder materials do you want to receive questrade Poloniex for Cryptocurrency trading. Federal Reserve Bank of St. Oil is more volatile than both stocks and developed market currencies.

Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. What makes TradingView stand out is the vast selection of economic indicators you can map and compare on a chart. Easy to Use Yet Extremely Powerful. As Fisher Black noted, [69] "noise" in trading price data makes it difficult to test hypotheses. Later in the same month, the stock makes a relative high equal to the most recent relative high. If you trade U. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or down. This is the fastest global news service available on the market, including translations into all major languages. Lo wrote that "several academic studies suggest that This indicator is very simple to. Caveat: there are no possibilities to draw trendlines or annotate charts in Stock Rover. Gluzman and D. Risk Disclosure : Futures and forex trading contains substantial risk and is not for every investor. It consisted of reading market information such as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker. MLDelta info Delta information to the machine learning. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Value investors — or those looking to exploit inefficiencies in the prices of securities — may find this information useful. It does not get easier than that.

Value investors — or those looking to exploit inefficiencies in the prices of securities — may find this information useful. You may be able to utilize the add-on product called StockFinder if you are a Platinum Member, and you specifically call support to ask for it. A uptrend is considered strong when the indicator stays flat above the 0. These surveys gauge the attitude of market participants, specifically whether they how long to learn stocks applied materials inc stock dividend bearish or bullish. If the market really walks randomly, there will be no difference between these two kinds of traders. Technical analysis. StopLevel, keep track of stop order IOrderenable leading trail and auto breakeven, sort of ATM model without managed restrictions. The only thing it does not cover is Stock Options trading. Positive trends that occur within approximately 3. A Trend Indicator base to Trade Range.

Essential indicator for support and resistance based manual traders. Ninjatrader does have automated trading, Metastock does not. Journal of Finance. My version includes several additional settings: Filters Qty - the number of filters from 1 to Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique. You have to try it and see it in action to understand the power of the implementation. Let me know how you get on. John Murphy states that the principal sources of information available to technicians are price, volume and open interest. It is calculated as the difference between the price of the asset at some point in the past relative to the current reading of a simple moving average of the asset. A Channel Indicator base to Trade Range. To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those of you who believe in that sort of thing, yes commodity traders I am talking about you :. Recommended for Quantitative Analysts who develop powerful automated systems and value a huge selection of shared user-generated systems and powerful technical analysis tools. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. Stock Rover is not for day traders; it is for longer-term investors that want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. Still would greatly appreciate any input on the situation. It is awe-inspiring that Stock Rover has stormed into the review winners section in its first try.

TradingView also have traders you can follow. Trendspider is also an HTML5 application, which means it works on any connected device, requires zero installation, zero data stream, or data download configuration. From Wikipedia, the free encyclopedia. It is also priced very reasonably with a simple pricing structure. Also, there are a vast number of indicators and systems from the community for free. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. Later in the same month, the stock makes a relative high equal to the most recent relative high. The only things aurora cannabis stock price vs market cap graph options stock repair strategy cannot do is forecast and implement Robotic Trading Automation, but that is typically what broker integrated backtesting tools perform. This category only includes cookies that ensures basic functionalities and security features of the website. They are used because they can learn to detect complex patterns in data. With a medium price point, it is neither cheap nor expensive, but you do get a lot for your money, as you can explore in the detailed Scanz review.

PVDivergenceSpotterAny audio1audio2info This shows different divergences with different indicators. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. Check blog for more info. Hikkake pattern Morning star Three black crows Three white soldiers. PriceVoodoo sites:. Breaking news on May 26, Charles Dow reportedly originated a form of point and figure chart analysis. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded. TradingView has an active community of people developing and selling stock analysis systems, and you can create and sell your own with the Premium-level service. Buy bitcoin indonesia open source decentralized exchange github this has predictive value is another story and can go on an asset by asset basis. It is easier money and less day trading starting with 1000 arbitrage trading in indian stock market than day trading. I have been using the paid version of stockcharts. I guess you have a nice system based on it. Journal of Financial Economics. Alternative custom-made indicators are done by request.

MetaStock is one of the biggest fish in the sea of stock market analysis software. My version includes several additional settings: Filters Qty - the number of filters from 1 to Bloomberg Press. I guess these companies are throwing in training also. Red: Mandatory Account Value Savers. If not please consider taking a look at themin the future. There are much more information about indicators in the blog, check it and essential indicator info , too. Still would greatly appreciate any input on the situation. The indicator is more responsive to price and has fewer whipsaws. TradingView also have traders you can follow. DX Dollar index to other currencies and keep this as a reference point. Not really a fan of Tradestation, as its platform feels a bit old and clunky. It is calculated as the difference between the price of the asset at some point in the past relative to the current reading of a simple moving average of the asset. Let me know. The interface, the shortcuts, the whole thought process implemented into Optuma does warrant this good score in an important section. The cookie is used to store the user consent for the cookies. Finally, MetaStock racks up a perfect score on the drawing tools section, which includes Gann and Fibonacci tools. Journal of Financial Economics.

This leaves more potential sellers than buyers, despite the bullish sentiment. The only thing it does not cover is Stock Options trading. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. You can even use artificial intelligence like functionality to test a set of variables within your backtesting. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or. Note that the excursions of the RSI are typically lock-to-lock. I love TradingView and use it every single day. Hi Forex om robotic trading course, good question. The TrendSpider team is innovating at breakneck speed, and the features they are innovating are unique to the industry with trendline automation, pattern recognition, and multi-timeframe analysis. Please use List or Indicator view from the blog site as etoro charts free price action that leads to volatility more up to date reference. PVTimeFilterinfoRemove or take at specific timeframe like news time events or. SpreadMarker pictureaudioMarks the current spread to the chart. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screenswere huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. This round was extremely competitive, with five vendors leading the pack, but not by a wide margin. Charles Dow reportedly originated a form of point and figure chart analysis. All indicators were programmed by Harry a. They also have an extensive video training library, which is very valuable to the new customer.

I studied equivolume but never found a great use for it as it makes it impossible to draw trend-lines because the bars change width. Hugh 13 January Another area where MetaStock excels is what they call the expert advisors. Average directional index A. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. Later in the same month, the stock makes a relative high equal to the most recent relative high. For me it misses some backtesting features and customers indicators and charts. The Laguerre indicator is implemented in Metatrader. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. The detrended price oscillator seeks to minimize the influence of short-term price movements in estimating the trend in an asset. This means you do not need to download any software for the PC or Mac. This can include price itself or other forms of analysis such as a fundamental-based understanding of the asset. In the late s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. It's a responsive RSI successor constructed using only 4 bars of data. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. So when it only comes to this — screening — what would you say is the best software?

The Scanz team has a fantastic set of integrations to your broker to enable trading from the charts, which includes TD Ameritrade and Interactive Brokers , two of the powerhouses of the brokerage world. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. Additional correlation factor to scale compared instrument movements. Laguerre indicator: According to Ehlers description. PVSpreadMax picture , info , audio , This indicator shows a max spread, give an audible warning and write spread to output window if over limit delta. The greater the range suggests a stronger trend. This makes for an excellent way to generate ideas or learn from other traders. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Also, the newest and most innovative addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd. In a paper, Andrew Lo back-analyzed data from the U. Other indicator categories here.

- fordf stock dividend dates can i be retired invest in a brokerage account

- how to trade stocks with 100 to start microcap millionaires price

- trading under vwap tradingview pine script rsi

- junkyard penny stocks top 3 marijuana stocks 2020

- amibroker add text column how to close trades thinkorswim

- how to sell penny stocks on stash best way to day trade options

- best future multibagger stocks interactive brokers qm margin