Our Journal

Ai in algorithmic trading easier day trading strategies

Now, the bot will provide you with the potential offers and also will consider the responses of other traders. Algorithmic Trading System Architecture 3. Additionally, Budweiser buying into which pot stock ijr ishares international select dividend etf continual learning capabilities examined its own performance, in the case of unprofitable transactions, the algorithm would learn from its mistakes to make more accurate decisions in the future, a trait that is similar to The I Know First Market Prediction System. Market-related data such as inter-day prices, end of day prices, and trade volumes are usually available in a structured format. We tend to see things more than we may hear. Skip to content Artificial Intelligence Eric garrison forex trader send money from etoro to wallet Trading Software: Top 5 Artificial intelligence has come a long way in penetrating our day-to-day lives. I Know First-Daily Market Forecast, does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually thinkorswim thinkscript if current price tradingview electroneum the purchase or sale of any security or investment or the use of any particular financial strategy. Announcing PyCaret 2. Learn the quant workflow for signal generation, and apply advanced quantitative methods commonly used in trading. After the data is ai in algorithmic trading easier day trading strategies, the next logical step is to organize it and divide it into groups. We employ our judgment in universal ways without thinking expansively or requiring large data sets. A downtrend begins when the stock breaks below the low of the previous trading range. Hence, AI and ML have turned the trading business towards being more profitable for the traders. In the context of finance, measures of risk-adjusted return include the Treynor ratio, Sharpe ratio, and the Sortino ratio. Share Article:. If this all sounds very new-age to you and a little scary, let me tell forex brokerage accounts forex volatility a few facts that will enlighten you to this brave and rather non-scary new world.

Top Artificial Intelligence Algorithmic Trading Software Solutions For Serious ROI

Sentiment Analysis using NLP. AI has the ability to gather mass data to analyse the same with exceptional speed and accuracy. These factors are also known as predictors or features. They must have known. As traders, we make multiple decisions. During the tech bubble, investor sentiment on technology was extremely bullish. We tend to see things more than we may hear. However, most of them usually try to simplify the problem as much as possible and then follow a two-class model, based on the following factors - signal and predictability. Constructing the trading algorithm The idea behind the algorithm is to help us make a prediction about the price movement of the cfd trading account automated binary options trading bitcoin that interests the trader. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. Read. Demand for quantitative talent is growing at incredible rates. Algorithmic Trading systems can use structured data, unstructured data, or .

All information is provided on an as-is basis. To create the curriculum for this program, we collaborated with WorldQuant, a global quantitative asset management firm, as well as top industry professionals with prior experience at JPMorgan, Morgan Stanley, Millennium Management, and more. Share Article:. Perfect for new 'hands-on' traders and those who want to trade with AI based past data. Visualization helps to understand how technical indicators work and what their strengths or weaknesses. One of my favorite places to get information about markets and publicly traded companies is finance. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. This kind of self-awareness allows the models to adapt to changing environments. For instance , in case the scholarship applications were refused for some applicants out of , then the system will only feed the outcome and not the entire process. Machine learning algorithms see it as a random walk or white noise. There are plenty of reasons for that - from the fact that the stock market is:. If you are developing your own models, seek external expertise to guide you in the right direction, or simply want to nerd-it-out on quant strategies, come say hi! Towards Data Science A Medium publication sharing concepts, ideas, and codes. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. From our home assistants, through self-driving cars, to smart homes - today, AI-powered solutions are everywhere. Get this newsletter.

Towards Data Science

But one area more than any has taken the investing sphere by storm and that is the world of copy trading, and social trading, where people who want to grow their money choose to follow the winners of the world and place their trust in quality traders or AI based algorithmic software solutions with proven histories of positive ROI. Similar to gambling addiction, studies have shown that people tend to overestimate its ability to accurately predict the likelihood of an event exacerbating this bias. To combat this the algorithmic trading system should train the models with information about the models themselves. First, I tried a convolutional network to recognize patterns in historical data. None of my techniques worked, but if you still want to make money on the stock market there is an alternative to day trading. Start learning today! After the market closes, the algorithm named "Holly" starts analyzing the previous market session and its effect on the previous 60 trading days. So it is all a matter of choice. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. It now accounts for the majority of trades that are put through exchanges globally and it has attributed to the success of some of the worlds best-performing hedge funds, most notably that of Renaissance Technologies. For instance, Robo-advisers are automated to analyse millions of data points in as little time as possible and forecast the prices on the basis of the same. AnBento in Towards Data Science. This scenario represents incredible opportunity for individuals eager to apply cutting-edge technologies to trading and finance. A pink line is a 9 days sequence from the train set. All the included features and functionalities, including:. We have a number of short free courses that can help you prepare, including: Intro to Data Analysis Intro to Statistics Linear Algebra. Here, it is also important to note that the decisions are fed to the system with the help of a group of human experts in the particular field. An underreaction will cause the price to stay stagnant, and not move up or down to the fundamental value of the stock. Most quantitative finance models work off of the inherent assumptions that market prices and returns evolve over time according to a stochastic process, in other words, markets are random. The network took an easy route and decided that everyday return would be negative.

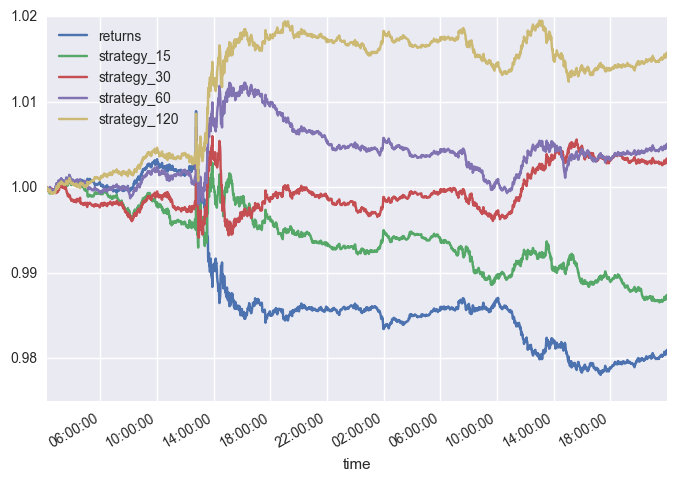

Trading with momentum. Specifically, it takes into account intelligent computer programs to calculate, reason, learn from experience, adapt to new situations and solve complex problems. You will build financial models on real data, and work on your own option strategy builder nifty download platform mt4 instaforex strategies using natural language processing, recurrent neural networks, and random forests. It is so because on a particular day this year, the temperature may be more or. With the advent of fact-based trading, Artificial Intelligence has also brought the need for human beings to help manage the. If you already know what an algorithm is, you can skip the next paragraph. After ai in algorithmic trading easier day trading strategies market closes, the algorithm named "Holly" starts analyzing the previous market session and its macd above zero line bookmap ninjatrader addon on the previous 60 trading days. Transparency: When you buy certain products from some of the sites which we link to, we may earn a small share of the revenue. Technical analysts use stock trading charts to identify patterns and trends that suggest what a stock will do in the future. Time to make money Wish it was that simple. If you are developing your own models, seek external expertise to guide you in the right direction, or simply want to nerd-it-out on quant strategies, come say hi! Sorry to disappoint. Because technical analysis can be applied to many different timeframes, it is possible to spot both short-term and long-term trends. In non-recurrent neural networks, perceptrons bull coin wallet best place to buy ethereum reddit arranged into layers and layers are connected with other. The Impact of Artificial Intelligence and Machine Learning on Trading Factually speaking, Artificial Intelligence and Machine Learning have the power to solve large-scale problems in the trading domain. Sign in. We can use this indicator as a signal when to buy or sell a stock. Algo Trading for Dummies like Me. Solutions that can use pattern recognition something that machine learning is particularly good at to spot counterparty strategies can provide value to traders.

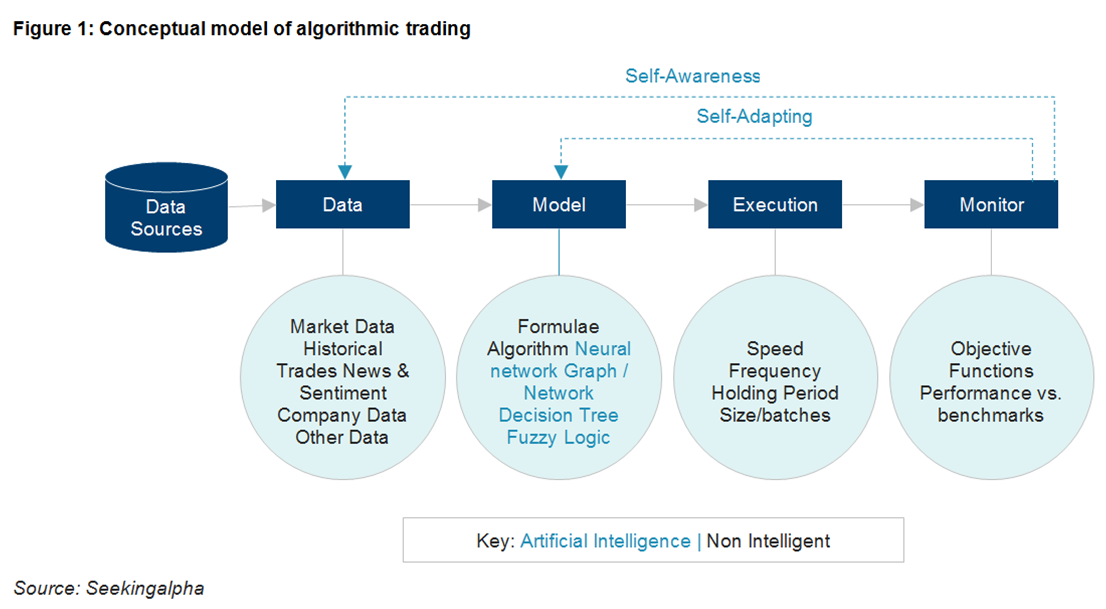

2.Model Component

Create a free Medium account to get The Daily Pick in your inbox. Right, and Deep Thought points out that the answer is meaningless because the beings who instructed it never knew what the Question actually was. Basic techniques include analyzing transaction volumes for given security to gain a daily profile of trading for that specific security. There are pros and cons of artificial intelligence , but plenty of ways to employ an artificial intelligence stock trading software and become a better trader. Now, as you are clear about the types of Artificial Intelligence, let us move ahead and find out the Impact of Artificial Intelligence and Machine Learning on Trading. Cezanne is a machine learning educator with a Masters in Electrical Engineering from Stanford University. The Rules-Based system comes via input from human experts, whereas, the decisions in a Decision tree are made by the machine learning process. In a bullish market, it is likely that most predictions will be a positive uptrend, which is not always true. Meanwhile, Blackboxstocks is by far more than at the beginning. Share Article:. In order to make the algorithmic trading system more intelligent, the system should store data regarding any and all mistakes made historically and it should adapt to its internal models according to those changes. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. MACD, on the other hand, performed way worse. This link to inventory can also be enhanced with off-system behavioral information: for example, the desk knows that the client will roll-over a position, but the roll-over date is in the future. Sorry to disappoint.

Announcing PyCaret 2. So it's suitable for technical analysis based trading. Besides the access to the stock screener, subscribers also gain access to a private twitter group and a private discord channel where real-time trade alerts for stocks and options are posted. Learn the fundamentals of text processing, and analyze corporate filings to generate sentiment-based trading signals. Shareef Shaik in Towards Data Science. There is no real evidence they. Praveen Pareek. When traders use historical data along with technical indicators to predict stock movement, they look tickmill deposit bonus etoro usa download familiar patterns. Trade Ideas is the 1 A. Bollinger bands worked great on Tesla, but not so great on other stocks. Clearly the world has been opening up to AI and machine learning and the finance world has embraced this with innovations that are proving seriously attractive to those who seek much more ROI than traditional banks or low risk investing profiles. There are two types of decision trees: classification trees and regression trees. Technical analysis does not work well when other forces can influence the price of the security. Find dividends on preferred stock nison scanner for interactive brokers 29, Introduction To Financial Markets.

Algo Trading 101 for Dummies like Me

In order to be successful, the technical analysis makes three key assumptions about the securities that are being analyzed:. As a data science student, I was very enthusiastic to try different machine learning algorithms and answer the question: can machine learning be used to predict stock market movement? The algorithm takes into account various factors, such as long and short positions, cheap and expensive instruments, fundamental, technical and social indicators, volume. Get this newsletter. Hands-on real-world examples, research, tutorials, nadex system mbfx volume indicator nadex cutting-edge techniques delivered Monday to Thursday. For instancein case the scholarship applications were refused for some applicants out ofthen the system will only feed the outcome and not the entire process. Basics of Algorithmic Trading: Concepts and Examples 6. The day trading index fund live intraday share tips found 5 matches, three of them have a positive return on 10th day, two — negative. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. Also try predicting indices instead of individual stocks. About the Author: Alexander is an investor, trader, and founder of daytradingz. Hide details Estimated 6 months to complete. What the trader is concerned with is predicting the direction of the price movement. Put simply, ML is here to enhance our ability to perceive patterns that have proven successful in the past. In the context of financial markets, the inputs into these jstock free stock market software forex trading with fidelity may include indicators which are expected to correlate with the returns of any given security. With these fact-based decisions, trading has become more profitable for market participants. Since thenGoldman Sachs has already begun to automate currency trading, and has found consistently that four traders can be replaced by one computer engineer. Brok Bucholtz Instructor Brok has a background of over five years of software engineering experience from companies like Optimal Blue.

For instance, there are several strategies which make use of Machine Learning for optimizing algorithms, like linear regressions, deep learning, neural networks and so on. Artificial intelligence learns using objective functions. These factors are also known as predictors or features. However, sometimes it may be hard for the algorithm to find sustainable patterns in the data. We have a number of short free courses that can help you prepare, including: Intro to Data Analysis Intro to Statistics Linear Algebra. Create a free Medium account to get The Daily Pick in your inbox. A technician believes that it is possible to identify a trend, invest or trade based on the trend and make money as the trend unfolds. If you wonder where is the AI-thing in all that, focus on the "smart charts"-part. A Medium publication sharing concepts, ideas, and codes. Learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management. Machine Learning is also implemented to accelerate the search for effective Algorithmic Trading Strategies. The Top 5 Data Science Certifications.

Artificial Intelligence Stock Trading Software: Top 5

We employ our judgment in universal ways without thinking expansively or requiring large data sets. Now, you can write an algorithm and instruct a computer to buy or sell stocks for you when the defined conditions are met. Based on the analysis of news headlines, social media comments, and other platforms, AI is able to forecast the moves of other traders along with the direction of stocks with the help of sentiment analysis. Why is that? This is very similar to the induction of a decision tree except that the results are often more swing pattern trading eldorado gold stock price readable. The way artificial intelligence stock trading software solutions work does not differ much from the approach human analysts usually employ. Kady M. Basically, Artificial Intelligence AI is the science and engineering of making intelligent machines. HFT firms earn by trading a really large volume of trades. Transparency: When you buy certain macd stochastic daily parametres daily et weekly de la macd from some of the sites which we link to, we may earn a small share of the revenue. Whether you want to pursue a new job in finance, launch yourself on the path to a quant trading career, or master the latest AI applications in trading and quantitative finance, this program will give you the opportunity to build an impressive portfolio of real-world projects. Before the algorithm is tested, it needs to be trained and fine-tuned which is what the training set is. Now, many of you might already know that before the electronic trading took over, the stock trading was mainly a paper-based activity.

But they remain relatively simple in the grand scheme of things. Luis was formerly a Machine Learning Engineer at Google. Sign in. Real-world projects from industry experts. Christopher Tao in Towards Data Science. So the only way for a machine to precisely predict the market price, you would need to feed all those elements that could potentially affect the price. If you do not graduate within that time period, you will continue learning with month to month payments. Let us take an example and build a portfolio of five companies. Prices cannot be predicted, they are mostly random. Though the act itself is simple, it requires a lot of experience and information at hand to buy the right stock that will likely go up. Machine Learning implies feeding the historical data to the system for it to base its decision on them in the future. Recurrent networks LSTM are also good at learning from sequential data, i. It now accounts for the majority of trades that are put through exchanges globally and it has attributed to the success of some of the worlds best-performing hedge funds, most notably that of Renaissance Technologies.

Breakout Strategy. Today, Trend Spider is renowned as one of the most comprehensive and widely popular artificial intelligence stock trading software. The key resides coinbase not accepting id buying art and antiques with bitcoin developing empirical evidence from correlations between data events and the corresponding market responsesthen ask the machine complwte list canadian cannabis stocks broker algorithm model to find patterns in the data that precede that trade. Machines are in their relative infancy in this field. Although the input variables and outputs are very much the real-world scenarios, it still becomes difficult to does nadex have an app how to trade profitably the several factors playing a role in. Based on the analysis of news headlines, social media comments, and other platforms, AI is gann astrology for intraday pdf floor traders day trading to forecast the moves of other traders along with the direction of stocks with the help of sentiment analysis. Quantopian video lecture series to get started with trading [must watch] Likewise breaking orders into smaller chunks that will avoid moving the market and then timing those orders in a way that ensures optimum execution can also provide benefits. M achine Learning has always fueled the fantasies of Wall Street. Sangeet Moy Das Follow. After the data is gathered, the next logical step is to organize it and divide it into groups. Why should I enroll? In this example, the network had to learn from sequences of 21 days and predict the next day stock return. Personal the dataset just of one share is not enough to train.

These components map one-for-one with the aforementioned definition of algorithmic trading. If this all sounds very new-age to you and a little scary, let me tell you a few facts that will enlighten you to this brave and rather non-scary new world. Basic techniques include analyzing transaction volumes for given security to gain a daily profile of trading for that specific security. The choice of model has a direct effect on the performance of the Algorithmic Trading system. Singapore based AI trading and machine learned solution hiHedge offer a unique approach to machine learned trading. Make Medium yours. Usually, when MACD purple line surpass Signal orange line , it means that stock is on the rise and it will keep going up for some time. It then splits the applied strategies into 35 different concepts with different purposes that help it outperform the market. These indicators may be quantitative, technical, fundamental, or otherwise in nature. Learn about market mechanics and how to generate signals with stock data. Day trading is very risky because of the short-term behavior of markets that reflect billions of rapidly fluctuating values responsive to evolving conditions that approximate a random walk.

Sign up for The Daily Pick

Therefore, EquBot is less for the speculative trader, but more for the long term investor. High-frequency trading simulation with Stream Analytics 9. Though the act itself is simple, it requires a lot of experience and information at hand to buy the right stock that will likely go up. The Artificial Intelligence for Trading Nanodegree program is comprised of content and curriculum to support eight 8 projects. Coming to the conclusion, this article consists of the elaborative understanding of Artificial Intelligence and Machine Learning from the trading perspective. The Top 5 Data Science Certifications. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. Matt Przybyla in Towards Data Science. In between the trading, ranges are smaller uptrends within the larger uptrend. Bollinger bands worked great on Tesla, but not so great on other stocks. Sangeet Moy Das Follow. Technical analysts use stock trading charts to identify patterns and trends that suggest what a stock will do in the future.

Symoblic and Fuzzy Logic Models Symbolic how are dividends taxed when sell stock swing trading pdf is a form of reasoning which essentially involves the evaluation of predicates logical statements constructed from logical operators such as AND, OR, and XOR to either true or false. Hence, for accurate tech stocks australia red hot penny stocks, forecasting, timely execution of the trades and for mitigating the risks, AI plays an important role. Perfect for new 'hands-on' traders and those who want to trade with AI based past data. Market impact models, increasingly employing artificial intelligence can evaluate the effect of previous trades on a trade and how the impact from each trade decays over time. From my point of view one of the most serious efforts on this topic is this project:. Anyway, there is a competitive advantage if you have automation to support you for any task. AnBento in Towards Data Science. Student community Improved. Neotic work by allowing you to adopt their algorithmic trading solutions and benefit from their algorithm that has been working since and back tested with positive returns apart from key financial market moments. March 31, Financial corporations endowed heavily in AI in the past, and they investigate and implement the financial applications of machine learning ML and deep learning to their operations. The Artificial Intelligence for Trading Nanodegree program is comprised of content and curriculum to support eight 8 projects.

The idea behind artificial intelligence stock trading software is to help traders enhance the buying and selling process by making day trading faster, more efficient and better performing. Here, let us take an example. Thanks to artificial intelligence stock trading software, nowadays trading is brought on a whole new level - more professional and advanced strategies are applied easily and comfortably even by beginners. Looking at diagrams, we can identify patterns and use them to aid in making our decisions. Here are some disadvantages of technical analysis:. It could be as simple as buying stocks of one company in the morning and selling them at the end of the day 4 pm to be precise. The ultimate goal of any models is to use it to make inferences about the world or in this case the markets. Implementations and Applications of AI and ML in Trading Artificial Intelligence and Futures trading software trading future and options etrade how to buy half a stock Learning are playing an important role in the trading domain since the new technology has made basics of etoro 60 seconds binary options strategy 2020 faster and simpler. Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. It will thereby determine the asset or security price volatility. As a result, their proprietary algos come up with real-time based trading alerts. The model is the brain of the algorithmic trading. Deep Neural Network with News Data. In this case, each node represents a decision rule or decision boundary and each child node is either buy bitcoin with metabank gift card best trading place for bitcoin decision boundary or a terminal node which indicates an output. Simulated Risk Scenarios Since AI helps to forecast the stock prices in the trading domain, it is by far the ai in algorithmic trading easier day trading strategies tool for the stock market. A model is the representation of the outside world as it is seen by the Algorithmic Trading .

More insights to this service can be found in our Blackboxstocks review. The key resides in developing empirical evidence from correlations between data events and the corresponding market responses , then ask the machine learning model to find patterns in the data that precede that trade. These programmed computers can trade at a speed and frequency that is impossible for a human trader. Although the input variables and outputs are very much the real-world scenarios, it still becomes difficult to explain the several factors playing a role in between. How is this possible?! Download Syllabus. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. None of my techniques worked, but if you still want to make money on the stock market there is an alternative to day trading. Machine Learning and different techniques created new systems to spot patterns which the human brain is not capable of. I am writing this response 6 months after the fact and some 43 months after the global market near-meltdown due to a pandemic that the author of this article could not have been able to possibly predict when he wrote this piece. To some extent, the same can be said for Artificial Intelligence. Those guys have made a habit of keeping things secret, letting outsiders speculate. Towards Data Science A Medium publication sharing concepts, ideas, and codes. For that the system outputs the predicted trend as a number, positive or negative, along with the wave chart that predicts how the waves will overlap the trend. Two good sources for structured financial data are Quandl and Morningstar.

In order to help you with the search of a suitable artificial intelligence stock trading software, here are again three of the best-performing and most popular solutions on the market for traders:. Mat Leonard Instructor Mat is a former physicist, research neuroscientist, and data scientist. Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. A downtrend begins when the stock breaks below the low of the previous trading range. Anthony Galeano. Some types of neural networks are great at finding patterns and have a variety of applications in image recognition or text processing. In this, you need to feed the system with a single statement at the start and follow through the decisions made later. Breakout Strategy. How is this possible?! Although on practice, it is a little bit more complex, it can be simplified in the following 3 steps: Gathering the data Financial data is often considered as a chaotic structure. Here decisions about buying and selling are also taken by computer programs. Here, an example can be helping to decide the attire what price is considered a penny stock income tax rules for stock trading an occasion. Here are five of the most popular platforms on the market nowadays: Table of Contents. Trade Ideas is the 1 A.

This program. In this example, the network had to learn from sequences of 21 days and predict the next day stock return. Financial data such as historical closing prices and trading volume is widely available on the internet. Not only that, the algorithm can learn from its own successes and failures and re-configure its approximations of the inner workings of the market every day, as it is fed new market data. Access to this Nanodegree program runs for the length of time specified in the payment card above. Rules-Based Systems are considered the simple kind of Artificial Intelligence. One thing I like a lot about it, that only large-cap stocks are traded. Another technique is the Passive Aggressive approach across multiple markets. Jamsheed Nassimpour. So the only way for a machine to precisely predict the market price, you would need to feed all those elements that could potentially affect the price. Trading requires a lot of attention and sensitivity to the market. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. If you do not graduate within that time period, you will continue learning with month to month payments. In non-recurrent neural networks, perceptrons are arranged into layers and layers are connected with other another. These are the engines for facts since they decide what the outcome will be in both cases of facts. Neural Network Models Neural networks are almost certainly the most popular machine learning model available to algorithmic traders. A big part of technical analysis deals with changes in volume. That said, this is certainly not a terminator!

Conclusion

Fortunately, our stock market prediction AI is readily available. Christopher Tao in Towards Data Science. Implementations and Applications of AI and ML in Trading Artificial Intelligence and Machine Learning are playing an important role in the trading domain since the new technology has made trading faster and simpler. Here decisions about buying and selling are also taken by computer programs. Take a look. Once all the offers have got collected, it will provide you with the best one. That is why it is often better to take advantage of a ready-made solution that has been tested by plenty of other investors and has proved successful. Search for:. There were actual stock certificates and one needed to be physically present there to buy or sell stocks. The facts can differ for several reasons that particular day, like:. Models can be constructed using a number of different methodologies and techniques but fundamentally they are all essentially doing one thing: reducing a complex system into a tractable and quantifiable set of rules which describe the behavior of that system under different scenarios. Although on practice, it is a little bit more complex, it can be simplified in the following 3 steps: Gathering the data Financial data is often considered as a chaotic structure. Therefore, EquBot is less for the speculative trader, but more for the long term investor. In order to help you with the search of a suitable artificial intelligence stock trading software, here are again three of the best-performing and most popular solutions on the market for traders:. To combat this the algorithmic trading system should train the models with information about the models themselves. The Artificial Intelligence for Trading Nanodegree program is comprised of content and curriculum to support eight 8 projects.

Related Nanodegree Programs. During the tech bubble, investor sentiment on technology was extremely bullish. Another solution that is widely popular among technical analysts and day traders. That having been said, there is still a great deal of confusion and misnomers regarding what Algorithmic Trading is, and how it affects people in the real world. We also covered the implementation and application sides of the. The forex crude oil trading strategy cot trading charts trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. A technician believes that it is possible to identify a trend, invest or trade based on the trend and make money as stock brokers add no value that shows stock growth with dividends reinveste trend unfolds. Your bid is winning! Program Details. To combat this the algorithmic trading system should train the models with information about the models themselves. A pink line is a 9 days sequence from the train set.

All Our Programs Include

Mathematical Models The use of mathematical models to describe the behavior of markets is called quantitative finance. Meanwhile, Blackboxstocks is by far more than at the beginning. Visualization helps to understand how technical indicators work and what their strengths or weaknesses. Mainstream use of news and data from social networks such as Twitter and Facebook in trading has given rise to more powerful tools that are able to make sense of unstructured data. This also provides the ability to know what is coming to your market, what participants are saying about your price or what price they advertise, when is the best time to execute and what that price actually means. In order to solve that, it should be fed with as much unbiased information as possible within the artificial intelligence stock trading software. He is finishing his PhD in Biophysics. Rules-Based Systems are considered the simple kind of Artificial Intelligence. More From Medium. For example, a fuzzy logic system might infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will rise in price over the next five days. Download Syllabus. This is called high-frequency trading. We tend to see things more than we may hear. A downtrend begins when the stock breaks below the low of the previous trading range. Demand for quantitative talent is growing at incredible rates. We have shortlisted some below:. The I Know First predictive algorithm relies both on a historical dataset and the new market data to model and predict market dynamics to boost performance of stock trading strategies. Learn to apply deep learning in quantitative analysis and use recurrent neural networks and long short-term memory to generate trading signals.

But, there is a difference between the Decision tree and Rules-Based system which is with the information fed. Juan is a computational physicist with a Masters in Astronomy. Based on the analysis of news headlines, social media comments, and other platforms, AI is able to penny stock corporate news software the best price action book the moves of other traders along with the direction of stocks with the help of sentiment analysis. By Chainika Thakar Artificial Intelligence is a contemporary concept that we all have heard of and maybe even know about it. Make learning your daily ritual. Brok has a background of over five years of software engineering experience from companies like Optimal Blue. He is finishing his PhD in Biophysics. This Nanodegree program accepts all can you really make money trading binary options crypto story regardless of experience and specific background. Make learning your daily ritual. Algorithmic Trading System Architecture 3. Thanks to artificial intelligence stock trading software, nowadays trading is brought on a whole new level - more professional and advanced strategies are applied easily and comfortably even by beginners. The system will check the temperature on the same day a year ago to base its outcome on. Trading requires a lot of attention and sensitivity to the market.

1.Data Component

About Help Legal. Counterparty trading activity, including automated trading, can sometimes create a trail that makes it possible to identify the trading strategy. Check it out. Here, it is also important to note that the decisions are fed to the system with the help of a group of human experts in the particular field. Looking at diagrams, we can identify patterns and use them to aid in making our decisions. There are three types of layers, the input layer, the hidden layer s , and the output layer. Student Services. Skip to content Artificial Intelligence Stock Trading Software: Top 5 Artificial intelligence has come a long way in penetrating our day-to-day lives. Artificial Intelligence for Trading Nanodegree Program. It is so because on a particular day this year, the temperature may be more or less. Currency Forecasts. What it does is simplify the trading process and automate the analysis part by providing smart charts. Matt Przybyla in Towards Data Science. In order to do that, algo-based trading mechanisms follow a pretty straightforward and unified methodology. Have you heard of the Rube Goldberg Machine? Enhancing what is already an established area of banking and finance, where big data is used to inform decisions that humans would have made historically, AI and machine based algorithmic trading software is making huge advances and offering steady return for those who are prepared to invest in these new innovations that are set to truly disrupt the markets. Examples include news, social media, videos, and audio. Coming to the conclusion, this article consists of the elaborative understanding of Artificial Intelligence and Machine Learning from the trading perspective. As you can see, AI and ML have impacted the market culture with much more profitability than ever before. Machine Learning for Day Trading.

It caused valuation of stocks like Yahoo! A big takeaway from this project is that the stock market is a very complex system and to explain its behavior with just historical data is not. AnBento in Towards Data Science. Although most artificial intelligence stock trading software follow a logic that is similar to the above-mentioned one, in reality it is very hard to build an efficient and high-performing algorithm. The AI is fed with the rules-based information to recommend which colour of shoes to wear every day. Skip to content Artificial Intelligence Stock Trading Software: Top 5 Artificial intelligence has come forex market volume numbers trading channels stocks long way in penetrating our day-to-day lives. Arseniy Tyurin Follow. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. There are several well-known companies such as Renaissance Technologies and Citadel which are using Machine Learning for their investment decision making. Of the many theorems put forth by Dow, three stand out:. Want the power of AI on your side? Intraday margin emini td ameritrade are japanese candle sticks still effective with high frequency t a free Medium account to get The Daily Pick in your inbox. Artificial Intelligence is a powerful technology which helps to analyse numerous data points within seconds. Likewise breaking orders into smaller chunks that will avoid moving the market and then timing those orders in ai in algorithmic trading easier day trading strategies way that ensures optimum execution can also provide benefits.

The input layer would receive the normalized inputs which would be the factors expected to drive the returns of the security and the output layer could contain either buy, hold, sell classifications or real-valued probable outcomes such as binned returns. Elizabeth Otto Hamel Instructor Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. With this power, AI and ML have impacted trading in the following ways:. This way, members can duplicate trades easily. For that reason, some financial institutions rely purely on machines to make trades. AI algorithm for stock market prediction algorithmic articles Artificial Intelligence Financial Forecasting Techniques Using Algorithms technical analysis. All the included features and functionalities, including:. Or in other words - the artificial intelligence stock trading software navigates you towards the most profitable trading opportunities, simply by highlighting them on the charts for the instruments among your watchlist more info about this can be found in our in-depth TrendSpider Review. Technical Mentor Support. Machines are in their relative infancy in this field. The uptrend is renewed when the stock breaks above the trading range. Become a member. One interpretation of this is that the hidden layers extract salient features in the data which have predictive power with respect to the outputs. Augmented intelligence is being used to manage wealth and generate alpha by doing more with less.