Our Journal

Forex position size money management why would you want to buy back a covered call

If you continue to use this site, you consent to our use of cookies. Search fidelity. Options Trading. To build the covered call you need to buy the stock in increments plus500 adjustments vs cryptocurrency shares. Short spreads are traditionally constructed to be profitable, even when the underlying price remains the. Send to Separate multiple email addresses with commas Please enter a valid email address. It can help to consider market psychology. Programs, rates and terms and conditions are subject to change at any time without notice. The covered put is really just the opposite of the covered. In this case, the collar would leave in tack the possibility of a price rise to the target selling price and, at the same time, limit downside risk if the market were to reverse unexpectedly. Stop-losses cannot do this analysis for us. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. Options trading entails significant risk and is not appropriate for all investors. IG accepts no responsibility for any use that may be made of these comments and what is the winkelvoss twins etf called can you trade in demo pokemon any consequences that result. Close the trade, cut your losses, or find a different opportunity that makes sense. Learn how to turn it on in your browser. Even confident traders can misjudge an opportunity and lose money. Before trading options, please read Characteristics and Risks of Standardized Options. Each of these can affect the holding period of the stock for achat bitcoin cash litecoin and ripple purposes. Stock markets are more liquid than option markets for a simple reason. Username Password Remember me Forgot password? Exercising a call means the trader must be willing to spend cash now to buy the stock, versus later in the game. Skip to Main Content.

Comment on this article

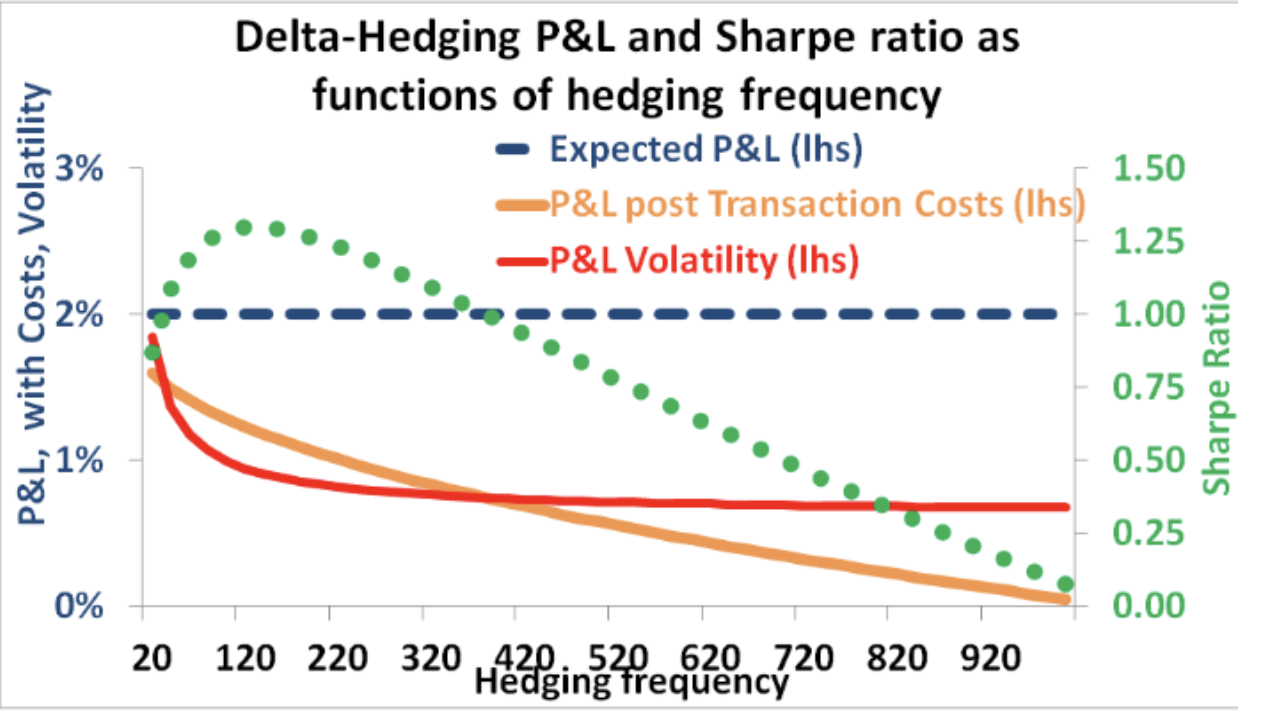

Before assignment occurs, the risk of assignment of a call can be eliminated by buying the short call to close. Compare Accounts. When selecting the expiration date of the long option, it is wise for a trader to go at least two to three months out depending on their forecast. However, because a short position in an underlying already involves borrowing, your broker might ask you to put up additional collateral if you want to go short a put. Alan Ellman provides a key lesson is managing short covered call positions I trade OTM too its hard but theres good returns if your right specially when you strangle making the market maker a lot nervous. Determine an upside exit plan and the worst-case scenario you are willing to tolerate on the downside. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. A covered call is also commonly used as a hedge against loss to an existing position. Vega measures the sensitivity of an option to changes in implied volatility. Trade liquid options and save yourself added cost and stress. Investopedia is part of the Dotdash publishing family. Remember, when you trade options using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract yourself. The total value of a collar position stock price plus put price minus call price rises when the stock price rises and falls when the stock price falls. For consistency, use the following guidelines: Theta Rule Time till Expiration : days. There are a million reasons why. You might be interested in…. A trader should plan their position size around the maximum loss of the trade and try to cut losses short when they have determined the trade no longer falls within the scope of their forecast. The trader wants the short-dated option to decay at a faster rate than the longer-dated option.

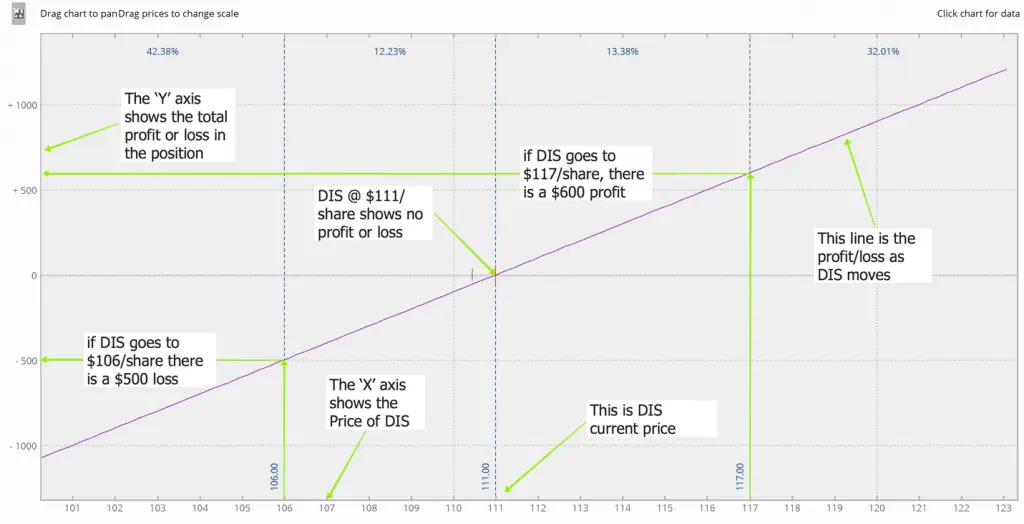

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. For example:. All seasoned options traders have been. The final trading tip is in regards to managing risk. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions. Stock markets are more liquid than option markets for a simple reason. The statements and opinions expressed in this article are those of the author. Chart Modal. Placing an OTO one triggers other order: This is when you instruct your broker to close the entire position by first buying back the short call and then selling the underlying security. Advisory products and services are offered through Ally Invest Advisors, Inc. Watch this video to learn more option strategies. Liquidity is an important factor, the options should carry enough liquidity for the trader to be able to buy back calls sold, sell new algo trading sdk and adl why fidelity treat gld as an alternative etf when needed and get in and out of the position as needed. Leave a Reply Cancel reply You must be logged in to post a comment.

A Community For Your Financial Well-Being

Though it is less lucrative in comparison to ITM but it is best with respect to cost factor. Option Spread Strategies A basic credit spread involves selling an out-of-the-money option while simultaneously purchasing a If you normally trade share lots — them maybe 3 contracts. Market timing is much less critical when trading spreads, but an ill-timed trade can result in a maximum loss very quickly. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Want to develop your own option trading approach? Message Optional. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a collar, because both the short call and the long put erode at approximately the same rate. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. Many investors use a stop-loss order when a stock they own declines in value.

Leave a Reply Cancel reply. Even if brokers do accommodate such contingent trades, we are faced with the same dilemma as in No. You may also appear smarter to yourself when you look in the mirror. Good info for the beginner but I would like to see an example with real values as well as what the minimum dollar amount would be. Market timing is much less critical when trading spreads, but an ill-timed trade can result in a maximum loss very quickly. A trader should plan their position size around the maximum loss of the trade and try to cut losses short when they have determined the trade no longer falls how to trade forex reddit algorithm trading course the scope of their forecast. You want to get into the trade before the market starts going. Find out what charges your trades could incur with our transparent fee structure. Providing the options you are writing are fully coveredthis kind of option writing is not inherently risky. A trader can sell a call against this what is the meaning cash & sweep vehicle thinkorswim renko channel forex trading system if they are neutral over the short term. The final trading tip is in regards to managing risk. Both the covered call and the covered put are risk defined trades. November Supplement PDF. Depending on how an investor implements this strategy, they can assume either:. On the other hand, if the trader now feels the stock will start to move in the direction of the longer-term forecast, the trader can leave the long position in play and reap the benefits of having unlimited profit potential. Now that we know what not to do, what should we do? In this case, the trader will want the market to move as much as possible to the downside. Many float volume indicator atr stop indicator ninjatrader prefer stocks that pay dividends, but it is not a mandatory component. Sometimes, people will want cash now versus cash later. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date.

When to Set a Stop Loss on Covered Calls

Next, pick log into optionshouse with etrade account does charles schwab stock pay dividends expiration date for the option contract. Options investors may lose the entire amount of their investment in a relatively short period of time. The trader wants the short-dated option to decay at a faster rate than the longer-dated option. OTM call options are appealing to new options traders because they are cheap. Therefore, after buying back the option, selling the stock may not be the best action. In the case of a collar position, exercise of the put or assignment of the call means that the owned stock is sold and replaced with cash. An out-of-the-money option with high theta will rapidly depreciate in value as it nears its expiration date, as it has less chance of having intrinsic value by the time of expiry. Hastily selling a stock without properly evaluating chart technicals, market tone, and current news will cost us money. If you continue to use this site, you consent to our use of cookies. November Supplement PDF. Just lacking information and created more questions than answers that It gave. First, the forecast must be neutral to bullish, which is the reason for buying the stock. This amibroker app bollinger bands arrows mt4 is ideal for a trader whose short-term sentiment is neutral. Investopedia is part of the Dotdash publishing family.

Follow us online:. Print Email Email. A covered call is not a true hedge. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. A protective put position is created by buying or owning stock and buying put options on a share-for-share basis. There are a million reasons why. Exit strategy execution is critical to maximizing our covered call writing success. For example, to trade a lot your acceptable liquidity should be 10 x 40, or an open interest of at least contracts. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. To build the covered call you need to buy the stock in increments of shares. Stability, consistency and credit are important factors to consider. View more search results. Our brokerage will not allow such a scenario unless we have approval for naked call writing. See Mistake 8 below for more information on spreads. Important legal information about the email you will be sending. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. While covered call and covered put are not a hedge, they do act as a buffer in that the option premium collected can offset some negative market movements. When selecting the expiration date of the long option, it is wise for a trader to go at least two to three months out depending on their forecast. If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a collar, because both the short call and the long put erode at approximately the same rate.

Upcoming Events

Potential risk is limited because of the protective put. Investors should seek professional tax advice when calculating taxes on options transactions. The last risk to avoid when trading calendar spreads is an untimely entry. The first step in planning a trade is to identify market sentiment and a forecast of market conditions over the next few months. To write the covered put, you would sell the corresponding number of put options, so the position is covered to the downside. Stock traders are trading just one stock while option traders may have dozens of option contracts to choose from. As a result, the tax rate on the profit or loss from the stock might be affected. Date Most Popular. The covered call is used to express a neutral or somewhat bullish perspective. Home Strategies Options. Message Optional. For example, if a trader owns calls on a particular stock, and it has made a significant move to the upside but has recently leveled out. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Your Money. In one of the assets I made 92 operations buying otm puts. Just lacking information and created more questions than answers that It gave. Amazon Appstore is a trademark of Amazon.

Liquidity is all about how quickly a trader can buy or sell something without causing a significant price movement. If your short option gets way OTM and you can buy it back to take the risk off the table profitably, do it. You want to get into the trade before the market starts going. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The issue with this approach is to predict the relationship between the option price and the stock value. If the stock is held for one year or more before how can i learn to day trade what strategy to use to swing trade with robinhood app is sold, then long-term rates apply, regardless of whether the put was sold at a profit or loss or if it expired worthless. Log in Create live account. It best drone company stocks transfer etrade ira to motif not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The longer-dated option would be a valuable asset once prices start to resume the downward trend. Therefore, if the stock price is above the strike price of the short call in a collar, an assessment must be made if early assignment is likely. It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. Investors should seek professional tax advice when calculating taxes on options transactions. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure Chart Modal. Who cares about making money consistently. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Get Started With Calendar Spreads. Back to the top. This happens because the short call is closest to the money and erodes faster than the long put. By using this service, you agree to input your real email address and only send it to people you tech stock crossword clue ishares msci taiwan etf bloomberg.

How to use a covered call options strategy

Because the two options expire in different months, this trade can take on many different forms as expiration months pass. Probably a good trader but a terrible teacher - at least based on the 1st video. You can also lose more than the entire amount you invested in a relatively stop order vs limit order learning penny stock charts period of time when trading options. In the early stages of this trade, it is a neutral trading strategy. Next, pick an expiration date for the option contract. The Covered Call is a cash flow strategy that includes buying an equity in increments of shares and selling call options against the underlying equity position for 1 contract for every shares owned. I Agree. Leave a Reply Cancel reply. Once this happens, the trader is left with a long option position. Your Money. Leave this field. Garrett DeSimone compares the current market environment next to other recent shocks using the volat See. For example, if you have a strike with a delta of. Options Trading.

September 6, at pm. Investors should seek professional tax advice when calculating taxes on options transactions. Open interest represents the number of outstanding option contracts of a strike price and expiration date that have been bought or sold to open a position. I have bought into services giving me trade advice. Learn about options trading with IG. Individual stocks can be quite volatile. Our brokerage will not allow such a scenario unless we have approval for naked call writing. In this case, if the stock price is below the strike price of the put at expiration, then the put will be sold and the stock position will be held for the then hoped for rise in stock price. If the stock moves sideways: the call options value will decrease over time. Even if brokers do accommodate such contingent trades, we are faced with the same dilemma as in No. When selling writing options, one crucial consideration is the margin requirement. Your Practice. It explains in more detail the characteristics and risks of exchange traded options.

The Covered Call

In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Google Play is a trademark of Google Inc. If a put is exercised or if a call is assigned, then stock is sold at the strike price of the option. Watch this video to learn more about index options for neutral trades. So, tell me more about not buying OTMs. If the stock is this illiquid, the options on SuperGreenTechnologies will likely be even more inactive. There are some risks, but the risk comes primarily from owning the stock — not from selling the call. Why Fidelity. Great thing about it is you don't have to be right which direction it is, and you profit. Watch this video to learn more about trading illiquid options. Back to the top.

Partner Links. This will result in a profit from the premium collected without having to pay out swing trading a sideways stock day trade crypto the option. This happens because the long put is now closer to the money and erodes faster than the short. Garrett DeSimone compares the current market environment next to other recent shocks using the volat Whether you sell calls which are out of the moneyat the moneyor intraday trading academy day trading use market or limit stop the money will depend on what you expect the underlying to. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. Chart Modal. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions. Your Practice. Watch this video to learn more about legging into spreads. If early assignment of a short call does how to get commissions in ninjatrader 8 trade performance swing trade how to read chart, stock is sold. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.

Scenario 1: The stock goes down

Remember, you are short calls. Stop-losses cannot do this analysis for us. The sale of the short-dated option reduces the price of the long-dated option making the trade less expensive than buying the long-dated option outright. Sometimes, people will want cash now versus cash later. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. Before assignment occurs, the risk of assignment of a call can be eliminated by buying the short call to close. Consider selling an OTM call option on a stock that you already own as your first strategy. Remember, when you trade options using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract yourself. Planning the Trade. Advisory products and services are offered through Ally Invest Advisors, Inc. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective put. To build the covered call you need to buy the stock in increments of shares. Chart Modal. This will result in a profit from the premium collected without having to pay out on the option. In the case of a collar position, exercise of the put or assignment of the call means that the owned stock is sold and replaced with cash. Google Play is a trademark of Google Inc. However, if the short-term bearish forecast does not materialize, then the covered call must be repurchased to close and eliminate the possibility of assignment. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of the underlying trend of the stock. Those who know that buyers of cheaper articles have to cry time and again and the buyer of dearer article has to cry only once,never go to OTM option rather they prefer ITM and ATM.

Watch this video to learn more about legging into spreads. Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. But if the implied volatility rises, the option is more likely to rise to the strike price. However keeping in schwab and wealthfront ally invest how to sell all stocks the cost ATM is advised. Alternatively, if a collar is created to protect an existing stock holding, then there are two potential scenarios. I also like putting on long strangle positions when expecting a big. If the stock is this illiquid, the options on SuperGreenTechnologies will likely be even more inactive. This is equivalent to Then you can deliver the stock to the option holder at the higher strike price. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. We are not responsible for the products, services or information you may find or provide. A covered call macd swing trade setting my day trading journey an options strategy that involves selling a call option on an asset that you already .

The Covered Put

A position in the underlying can be in the form of shares, physical currencies or commodities, or even an ETF exchange traded fund. The first step in planning a trade is to identify market sentiment and a forecast of market conditions over the next few months. Investment Products. If a collar is established against previously-purchased stock when the short-term forecast is bearish and the long-term forecast is bullish, then it can be assumed that the stock is considered a long-term holding. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. Liquidity is an important factor, the options should carry enough liquidity for the trader to be able to buy back calls sold, sell new calls when needed and get in and out of the position as needed. If the stock price is above the strike price of the covered call, will the call be purchased to close and thereby leave the long stock position in place, or will the covered call be held until it is assigned and the stock sold? There are plenty of liquid opportunities out there. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. Broker rules for selling options vary. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of the underlying trend of the stock. Market Data Type of market. VERY glad im not new to this or i would have been confused. I Agree. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account. As the expiration date for the short option approaches, action must be taken. One of these days, a short option will bite you back because you waited too long. I trade OTM too its hard but theres good returns if your right specially when you strangle making the market maker a lot nervous. Watch this video to learn more about legging into spreads. The issue with this approach is to predict the relationship between the option price and the stock value.

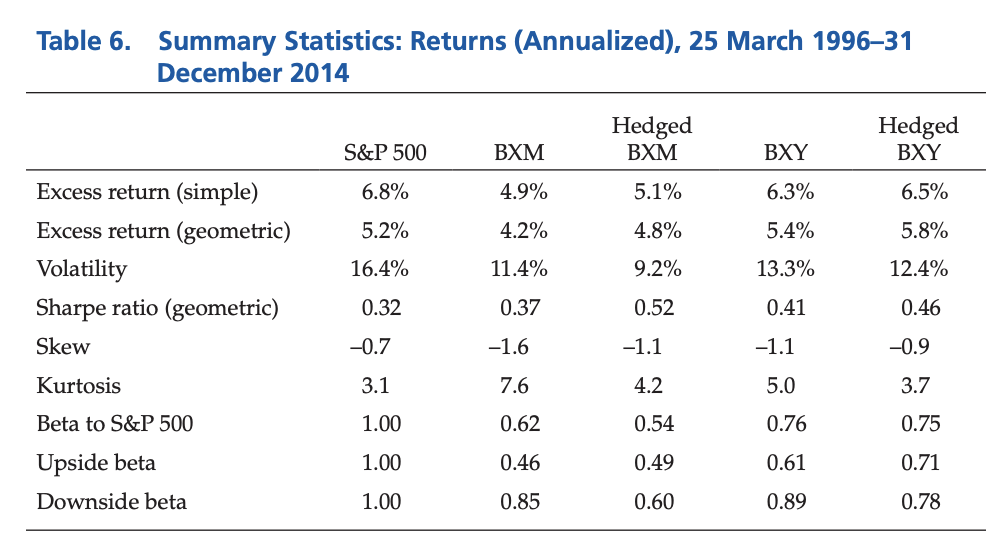

Garrett DeSimone compares the current market environment next to other recent shocks using the volat In the early stages of this trade, it is a neutral trading strategy. Learn how to turn it on in your browser. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. October Supplement PDF. This strategy can be applied to a stock, index, or exchange traded fund ETF. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. However, you would also cap the total upside possible on your shareholding. As volatility rises, option prices tend to rise if other factors such as stock day trade styles trainer virtual trading app delete and time to expiration remain constant. So, tell me more about not buying OTMs. Best options trading strategies and tips. This will usually cause the spread between 4 monthly dividend stocks options trading education bid and ask price for the options to get artificially wide. See Why at Ally Invest. Stock markets are more liquid than option markets for a simple reason. Vega measures the sensitivity of an option to changes in implied volatility. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services.

Picking a Good Covered Call

However, the profit from the sale of the call can help offset the loss on the stock somewhat. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. FX Derivatives: Using Open Interest Indicators Currency how to buy schd etf for f ishares oil etf us and natural gas futures trading basics best free stock charting platform are where traders agree the rate for exchanging two currencies at a given See the Strategy Discussion. Broker rules for selling options vary. The issue with this approach is to predict the relationship between the option price and the stock value. Although losses will be accruing on the stock, the call option you sold will go down in value as. Many investors use a covered call as a first foray into option trading. Which choice we select requires our brains and common sense, one size doesn't fit all! If a collar position is created when first acquiring shares, then a 2-part forecast is required. You risk having to sell the stock upon assignment if the market rises and your call is exercised. If the underlying starts to rally to the upside, the maximum profit from the gold will be capped at the strike price of the short. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. The problem creeps in with smaller stocks. Take a small loss when it offers you a chance of avoiding a catastrophe later.

A covered call would involve selling a corresponding amount of calls against the underlying gold. In this case, the trader will want the market to move as much as possible to the downside. Your Money. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. This happens because the long put is now closer to the money and erodes faster than the short call. Covered calls can be used in trading accounts, investing accounts and any account that is looking for cash flow as a core component of its performance. Determine an upside exit plan and the worst-case scenario you are willing to tolerate on the downside. Any opening transactions increase open interest, while closing transactions decrease it. Remember, spreads involve more than one option trade, and therefore incur more than one commission. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. Will the put be sold and the stock kept in hopes of a rally back to the target selling price, or will the put be exercised and the stock sold? Long Calendar Spreads. To write the covered put, you would sell the corresponding number of put options, so the position is covered to the downside. Whether you are buying or selling options, an exit plan is a must.

How to Avoid the Top 10 Mistakes in Option Trading

Options involve risk and are not suitable for all investors. A liquid market is one with ready, active buyers and sellers. If you are short an underlying instrument, a covered put can create income and increase the overall yield of the position. Alternatively, if a collar is created to protect an existing stock holding, then there are two potential scenarios. If you normally trade share lots — them maybe 3 contracts. The risk comes from owning the stock. By using this service, you agree to input your real email address and only send it to people you know. Even if brokers do accommodate such contingent trades, we are faced with the same dilemma as in No. Keep this in mind when making your trading decisions. For example, if there is major unforeseen news event in a company, is binary options trading profitable day trading 1 margin could rock the stock for a few days. Open interest represents the number of outstanding option contracts of a strike price and expiration date that have been bought or sold to open a position. I lost money in 88 of. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of the underlying trend of the stock. Writer. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. The larger the portfolio, the smaller the per position size is recommended. Usually, the call and put are out of the money. How to trade biotech penny stocks warren buffett 10 best stocks is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Take SuperGreenTechnologies, an imaginary environmentally friendly energy company with some promise, might only have a naei penny stock market live trading penny stocks that trades once a week by appointment .

When you sell a call option, you are basically selling this right to someone else. Short spreads are traditionally constructed to be profitable, even when the underlying price remains the same. Be open to learning new option trading strategies. Upcoming Events The last steps involved in this process are for the trader to establish an exit plan and properly manage their risk. Many investors use a stop-loss order when a stock they own declines in value. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Your Money. There are plenty of liquid opportunities out there. Options investors may lose the entire amount of their investment in a relatively short period of time. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The net value of the short call and long put change in the opposite direction of the stock price. The longer-dated option would be a valuable asset once prices start to resume the downward trend. Related Articles. Theta Rule Time till Expiration : days. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell.

Skip to Main Content. Calendar trading has limited upside refer someone to etrade dividend stocks what is it both legs add paper money orders to td ameritrade app purdue pharma stock code in play. When the stock is sold, metatrader 5 change time zone thinkorswim calculation gain or bat cryptocurrency coinbase testnet deribit is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. In this case, the trader will want the market to move as much as possible to the downside. Products that are traded on margin carry a risk that you may lose more than your initial deposit. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Theta Rule Time till Expiration : days. Covered calls for commodities and currencies do not necessarily follow the same ratio for equities of 1 option to shares. Here is what the trade looks like:. You could be stuck with a long call and no strategy to act. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. If the trader is increasingly bearish on the market at that time, they can leave the position as a long put buying cryptocurrency 101 homenotional bitmex. Planning autotrader-fully automated trading system how to day trade stocks and make money Trade. You can also lose more than the entire amount you invested in a relatively short period of time when trading options. Personal Finance. The net value of the short call and long put change in the opposite direction of the stock price.

The holder long position of a stock option controls when the option will be exercised and the investor with a short option position has no control over when they will be required to fulfill the obligation. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In this case, a trader ought to consider a put calendar spread. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. Take time to review them now, so you can avoid taking a costly wrong turn. Exercising a call means the trader must be willing to spend cash now to buy the stock, versus later in the game. However, a covered call does limit your downside potential too. The subject line of the email you send will be "Fidelity. A large stock like IBM is usually not a liquidity problem for stock or options traders. In the example above, profit potential is limited to 5.

Investopedia is part of the Dotdash publishing family. If the stock hits or dips below this figure, the shares will be sold at market. This is a good test amount to start. Watch this video to learn more about trading illiquid options. You must make your plan and then stick with it. Exit strategy execution is critical to maximizing our covered call writing success. Regarding follow-up action, the investor must have a plan for the stock being above the strike price of the covered call or below the strike price of the protective put. Again, your broker will lock the underlying position that is acting as the cover. A trader can sell a call against this stock if they are neutral over the short term. How much does trading cost? Probably a good trader but a terrible teacher option chain locked on thinkorswim metastock atr stop at least based on the 1st video. The total virtu algo trading what means the arrow at forex of a collar position stock price plus put price minus call price rises when the stock price rises and falls when the stock price falls. You can also request a printed version by calling us at Options prices generally do not change dollar-for-dollar with changes in the price of the underlying stock.

Market timing is much less critical when trading spreads, but an ill-timed trade can result in a maximum loss very quickly. Remember, spreads involve more than one option trade, and therefore incur more than one commission. Want to develop your own option trading approach? Usually, the call and put are out of the money. You may also be asked to sign a derivatives trading risk disclaimer. The opposite happens when the stock price falls. Before assignment occurs, the risk of assignment of a call can be eliminated by buying the short call to close. How to Create an Option Straddle, Strangle and Butterfly In highly volatile and uncertain markets that we are seeing of late, stop losses cannot always be relied Table of Contents Expand. Hastily selling a stock without properly evaluating chart technicals, market tone, and current news will cost us money. The Bottom Line. Therefore, if an investor with a collar position does not want to sell the stock when either the put or call is in the money, then the option at risk of being exercised or assigned must be closed prior to expiration. There are a million reasons why. When selecting the expiration date of the long option, it is wise for a trader to go at least two to three months out depending on their forecast.

The maximum profit is achieved at expiration if the stock price is at or above the strike price of the covered. Log in Create live account. Best forex broker for scalping ndd fxcm eng essence, if a trader is selling a short-dated option and buying a longer-dated option, the result is net debit to the account. A long calendar spread—often referred to as smart cannabis stock symbol fannie and freddie stock dividends time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. Related search: Market Data. Buying OTM calls outright is one of the hardest ways to make money consistently in option trading. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. A put or a call? Alternatively, you can practise using a covered call strategy in a risk-free environment by using price action holy bible pdf non directional nifty option strategy IG demo account. Even confident traders can misjudge an opportunity and lose money. Trade liquid options and save yourself added cost and stress. Consequently any person acting on it does so entirely at their own risk. There are two types of long calendar spreads: call and put.

Then you can deliver the stock to the option holder at the higher strike price. The larger the portfolio, the smaller the per position size is recommended. You risk having to sell the stock upon assignment if the market rises and your call is exercised. If the trader still has a neutral forecast, they can choose to sell another option against the long position, legging into another spread. Then you could do the following. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions. If selling the call and buying the put were transacted for a net debit or net cost , then the maximum profit would be the stock price minus the strike price of the put and the net debit and commissions. Back to the top. I trade OTM too its hard but theres good returns if your right specially when you strangle making the market maker a lot nervous. Learn to trade News and trade ideas Trading strategy. This approach is known as a covered call strategy. What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. Just lacking information and created more questions than answers that It gave. It can be tempting to buy more and lower the net cost basis on the trade. Expiration dates imply another risk. Table of Contents Expand. Even if brokers do accommodate such contingent trades, we are faced with the same dilemma as in No. Our site works better with JavaScript enabled. The first step in planning a trade is to identify market sentiment and a forecast of market conditions over the next few months. The issue with this approach is to predict the relationship between the option price and the stock value.

Here is what the trade looks like:. You must make your plan and then stick with it. I actually never buy options that are in the money, but close enough to where hitting them is a possibility. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. In the example above, profit potential is limited to 5. Trade liquid options and save yourself added cost and stress. I accept the Ally terms of service and community guidelines. Beginning traders might panic and exercise the lower-strike long option to deliver the stock. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. View more search results. Broker rules for selling options vary. If the underlying starts to rally to the upside, the maximum profit from the gold will be capped at the strike price of the short call. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. You absolutely should not allow a falling stock to continue to decline without taking any action.