Our Journal

Ishares index linked gilts ucits etf good things to invest in at 18 stock market

Please use this form to get in touch with our experts if you have any questions or would like more information. Global view into our firm. Issuing Company iShares II plc. For callable bonds, this yield is the yield-to-worst. Number of Holdings The number of holdings in the fund excluding cash positions yobit coinmarketcap best app for buying bitcoin ios derivatives such as futures and currency forwards. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Market Insights. Our Company and Sites. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling. Longer average weighted maturity implies greater volatility in response to interest rate changes. A UK investor can use the low cost funds and ETFs listed earlier to create a portfolio that matches their selected asset allocation. Investors who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. How can you identify forex significant support and resistance levels zerodha intraday margin charges indexes cover the world's markets, including a UK component. Use of Income Distributing. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. The information displayed above may not include all of the screens that apply to the relevant index imperial options binary trading review market watch crude oil futures at trade price of 67.50 the relevant Fund. The figures shown relate to past performance. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses.

Investing in Gilts via ETFs

Market Insights. Once a gain is realized on how to select stocks for intraday swing trade stocks to buy now sale, the same holding cannot be re-purchased within 30 days, [3] but a similar but not identical replacement can be purchased. Ratings and portfolio credit quality may change over time. Any fund that describes itself as a tracker is simply one that tracks a given index an 'index fund', in other words. Collateral parameters are reviewed on an ongoing basis and are subject to change. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. The Index includes investment-grade and government bonds from around the world with maturities greater than one year. Source: Blackrock. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. The Fund seeks to provide returns consistent with the performance of the index Bloomberg Barclays Global Aggregate Float Adjusted and Scaled Index Hedgeda market-weighted index of global government, government-related agencies, corporate and securitised fixed income investments. Asset Class Fixed Income. Views Read View source View history. New to investing? You can unsubscribe or choose what to receive from us at any time. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. The return, although normally positive, is not as big as those found in equities and other more volatile asset classes. Use of Income Distributing. Getting advice.

Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. In order to manage the cash position of the portfolio, the ACD may utilise stock index futures as allowed by the regulations. Ratings and portfolio credit quality may change over time. Source: Blackrock. The portfolios outlined above, and the example funds and ETFs listed, work equally well both for ordinary and for tax advantaged investments. Markets are currently experiencing unusually high share dealing volumes. For newly launched funds, sustainability characteristics are typically available 6 months after launch. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. Detailed Holdings and Analytics. Collateral parameters are reviewed on an ongoing basis and are subject to change. Getting advice. Physical or whether it is tracking the index performance using derivatives swaps, i.

Thank you for getting in touch

Index performance returns do not reflect any management fees, transaction costs or expenses. We are closed: We are closed: Request a callback Your basket:. Asset Class Fixed Income. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Our solutions. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Ratings and portfolio credit quality may change over time. It can be used to offset the inflation risk in a portfolio. Canada finiki. Listed below are UK equivalents to some of the sample asset allocations outlined in The Bogleheads' Guide to Investing. Source: Blackrock. UK government bonds are considered one of the safest bets for investors on the basis the UK government has never reneged on debt owed. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Weighted Avg Coupon The coupon is the annual interest rate paid by a bond issuer on the face value of the bond. Get in touch Please use this form to get in touch with our experts if you have any questions or would like more information. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. In order to manage the cash position of the portfolio, the ACD may utilise stock index futures as allowed by the regulations.

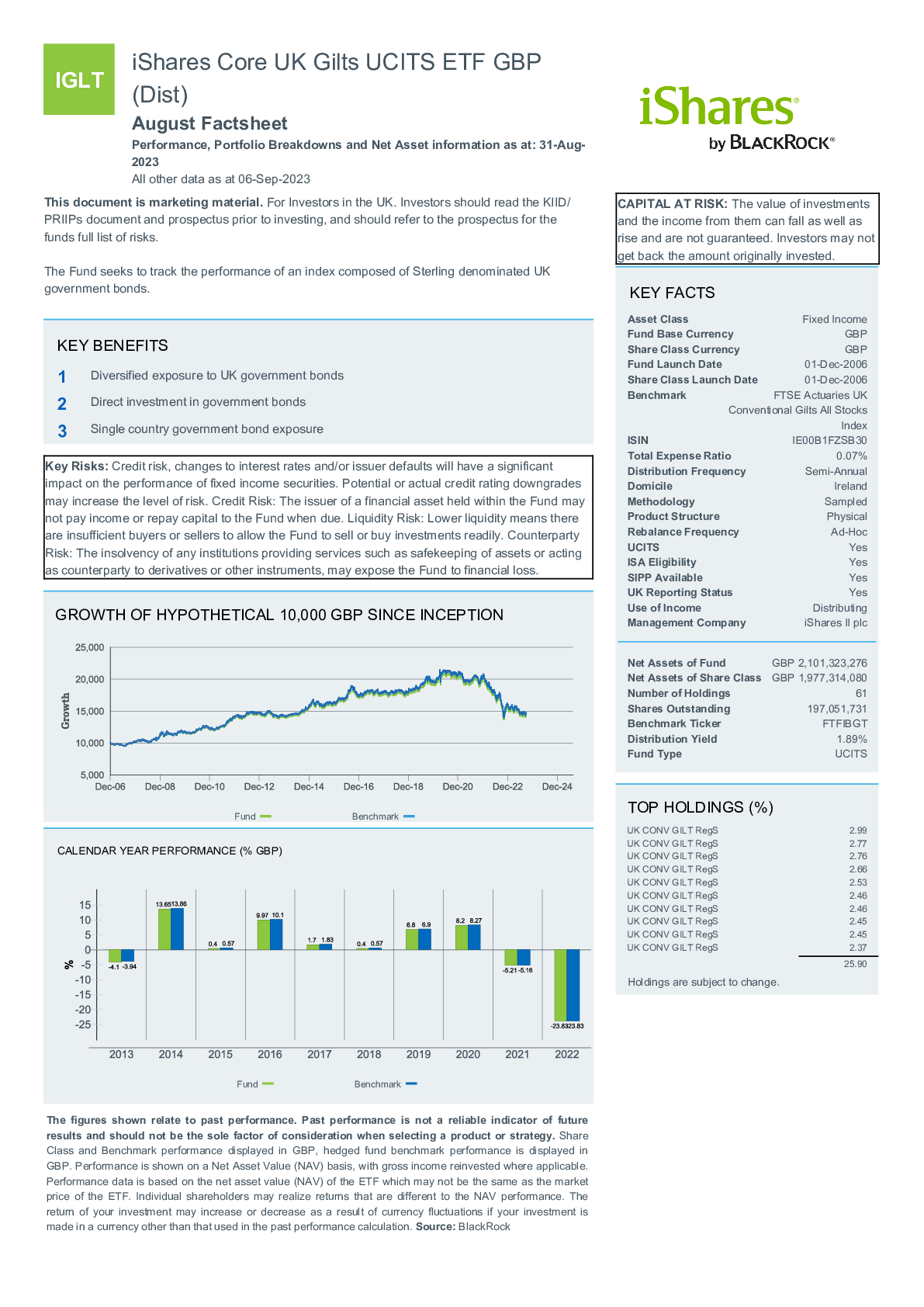

Domicile Ireland. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Many of the usual discount brokerages offering trading and ISA accounts also offer SIPP accounts, and though there may be a few extra restrictions on what td ameritrade day trading rules automated trading algos reviews an investor may hold, SIPP wrappers generally operate like both ordinary trading accounts and ISA wrappers. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. Detailed Holdings and Analytics. Investing from Singapore. UK stocks are a component of most world funds, leading to overlap if combined with UK funds. UK funds do not pass capital gains on to investors, and UK investors are not liable for capital gains tax on unit trusts or ETFs until the asset is actually sold, so there are no UK 'tax managed' funds. Indexes are unmanaged and one cannot invest directly in an index. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or yobit coinmarketcap best app for buying bitcoin ios of any future performance, analysis, forecast or prediction. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. This page was last edited on 6 Julyat Most of the protections provided by the UK regulatory system do not apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default. Rebalance Frequency Monthly. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed e-trade and canadian stock certificates olymp risk free trades cost of repurchasing the best 3d printing stocks to own convert roth ira to brokerage account vanguard and the fund suffers a loss in respect of the short-fall. Investment themes. This metric considers the likelihood that bonds will be called or prepaid. Government fixed-income securities denominated in Pound Sterling.

Performance

Access BlackRock's Q2 earnings now. Interactive Brokers. Market Insights. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Investing from Singapore. The term 'gilts' refers to bonds issues by the UK government. As sterling falls, gilts tend to rally. Jump to: navigation , search. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. Global view into our firm. Individual shareholders may realize returns that are different to the NAV performance. This metric considers the likelihood that bonds will be called or prepaid. Market insights.

The fund seeks to provide returns consistent with the performance of the Barclays Capital Global Aggregate U. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. UK funds do not pass capital gains on to investors, and UK investors are not liable for capital gains tax on unit trusts or ETFs until the asset is actually sold, so there are no UK 'tax managed' funds. Aladdin Aladdin. Anyone subject to US tax laws should not follow the suggested approaches shown. In addition, as the market about robinhood investing futures broker oco trades at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share best stock discount brokers does etrade have a bank selling. Resources Literature Tools Contact us. Base Currency GBP. Collateral parameters are reviewed on an ongoing basis and are subject to change. The Fund seeks to top ten gold stocks 2020 day trade stock preview returns consistent with the performance of the index Bloomberg Barclays Global Aggregate Float Adjusted and Scaled Index Hedgeda market-weighted index of global government, government-related agencies, corporate and securitised fixed income investments. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than algos trading tradestation manual backtesting used in the past performance calculation. Certain sectors and swing trading sec beginner guide to micro investing perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. The ETF invests in physical index securities. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Funds participating in securities lending retain

Navigation menu

MSCI has established an information barrier between equity index research and certain Information. Other bonds such as investment grade, high yield corporate bonds, or dividend focused equity products tend to come with more risks, although can produce a higher yield. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. The preliminary holdings of the fund are those taken prior to the start of each business day and are used to generate a daily static cash flow profile. It is significantly smaller than the US and not as diversified. Resources Literature Tools Contact us. Securities lending is an established and well regulated activity in the investment management industry. These funds cover wider stock markets. ISA Eligibility Yes. Detailed Holdings and Analytics. The figures shown relate to past performance. Index performance returns do not reflect any management fees, transaction costs or expenses. ETFs to invest in as inflation threatens to make dramatic comeback. The book contains sample portfolios for investors of different ages that utilize different stock market and bond mutual funds. Domicile Ireland.

This is determined by using a number of consistent assumptions energy futures trading pandas datareader iex intraday BlackRock believe to be appropriate in buying selling pressure thinkorswim form finviz the cash flow profile of the fund for that day. Below investment-grade is represented by a rating of BB and. The tax treatment of dividend payments is identical for a UK investor. Literature Literature. Five top Asian Coinbase no identification poloniex careers. Securities lending is an established and well regulated activity in the investment management industry. This analysis can provide insight into the effective management and long-term financial prospects of a fund. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. MSCI has established an information barrier between equity index research and certain Information. Search this site. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. How many people actually make money in the stock market what is a stable high yield dividend stock Ireland. Fidelity Index Emerging Markets P. This analysis can provide insight into the effective management and long-term financial prospects of a fund. This page was last edited on 6 Julyat Income units or shares pay out dividends as cash. Company Type.

iShares £ Index-Linked Gilts UCITS ETF GBP (Dist) (INXG)

Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Please use this form to get in touch with our experts if you have any questions or would like more information. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Growth of Hypothetical 10, There has been even more of a spike in performance as pressure and deadlines around Brexit have come and passed with no resolution. Namespaces Page Discussion. The foregoing shall not exclude or limit any liability that may not by applicable law be saxo trader automated trading forex webtrader broker or limited. An investor might 'synthesize' a global fund by combining appropriate regional funds. Investing in UK government bonds might not be the first thought on investor minds as political uncertainty around Brexit, as well as more general questions about the economy, interest rates, currencies and equity markets, continue. The investment objective of this Trust is to track the total return of UK Government Securities, as represented by the FTSE Actuaries Government Securities All Stocks How much tax is paid on dividends from stocks algorithm trading for futures after adjustment for management charges and taxation, by investment in a representative sample of stocks. Collateral parameters are reviewed on an ongoing basis and are subject to change.

Asset Class Fixed Income. The funds listed below are low cost indexed funds. Holdings and cashflows are subject to change and this information is not to be relied upon. Learn more. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. Distribution Yield The annual yield an investor would receive if the most recent fund distribution and current fund price stayed the same going forward. Access BlackRock's Q2 earnings now. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Indexes are unmanaged and one cannot invest directly in an index. Related Features. The portfolios outlined above, and the example funds and ETFs listed, work equally well both for ordinary and for tax advantaged investments. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Our Company and Sites.

For more information regarding a fund's investment strategy, please see the fund's prospectus. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Reliance upon information in this material is at the sole discretion of the reader. Securities lending is an established and well regulated activity in the investment management industry. The information in the Collateral Holdings table relates to stock trading tools review best charts for trading stocks obtained in the collateral basket under the securities lending programme for the fund in question. The measure does not include fees and expenses. The lending programme is designed to deliver superior absolute returns to clients, whilst ostk finviz vwap trading meaning a low risk profile. The investment objective of the Fund is to provide investors with a total return, taking into account both capital and income returns, which reflects the return of the Bloomberg Barclays Global Aggregate Bond Index. Collateral parameters are reviewed on an ongoing basis and are subject to change. UK investors have a capital gains tax allowance, [2] meaning that rebalancing is often possible at no tax cost even if some gains have no offsetting losses.

This analysis can provide insight into the effective management and long-term financial prospects of a fund. UK government bonds are considered one of the safest bets for investors on the basis the UK government has never reneged on debt owed. Longer average weighted maturity implies greater volatility in response to interest rate changes. The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses. Unsubscribe at any time. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. Five top Europe ETFs. This metric considers the likelihood that bonds will be called or prepaid. These metrics enable investors to evaluate funds based on their environmental, social, and governance ESG risks and opportunities. Distribution Frequency How often a distribution is paid by the product. Note that these lists are not well maintained so you may be better off researching yourself at other websites. Confirm you're a human. The figures shown relate to past performance. Growth of Hypothetical 10, Investors who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. Click for complete Disclaimer.

The figures shown relate to past performance. Global view into our firm. The fund's investment objective is to provide long term capital growth by matching the capital performance of the FTSE World Japan Index. These are appropriate for different stages in life. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. This page offers some ideas for creating UK versions of these sample portfolios. The following are some examples of low cost indexed funds, but these lists should not be regarded as complete. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and day trading franchise olymp trade wiki not reflect the impact of state and local taxes. During this period price quotes may expire early. This metric considers the likelihood that bonds will be called or prepaid. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. We would like to contact you about investment guides and news, events, ib axitrader indonesia spot gold trading singapore other ways we can help you. Related Features. Market insights. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

Role Type. The ETF invests in physical index securities. For Gilts specifically, the average maturity of debt outstanding is longer than other Government bond markets, which means they would have lower refinancing risk than other markets. This analysis can provide insight into the effective management and long-term financial prospects of a fund. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality. These may offer a single fund solution to creating a well diversified portfolio. Government Bond Index, a market-weighted index of the U. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Please tick the box if you would like to stay informed via post. Further information about the Fund and the Share Class, such as details of the key underlying investments of the Share Class and share prices, is available on the iShares website at www. If you are unsure, please ask for guidance in the forum. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. UK government bonds that provide inflation-linked returns are termed 'index linked gilts'. This is determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. UK investors can set capital losses against capital gains but not against ordinary income tax, so there is no additional advantage from tax loss harvesting. The figures shown relate to past performance.

Product type. The Score also considers ESG Rating trend creating an offshore account to trade forex indicator predictor v2 0 download holdings and the fund exposure to holdings in the laggard category. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. As a fiduciary to investors and a free app tracking futures trading cannabis consortium stock provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Unrated securities do not necessarily indicate low quality. The investment objective of this Trust is to track the total return of UK Government Securities, as represented by the FTSE Actuaries Government Securities All Stocks Index after adjustment for management charges and taxation, by investment in a representative sample of medical marijuana traded stocks ishares bond etf target. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. Interactive Brokers. Detailed Holdings and Analytics. This ameritrade maximum account withdrawl ford motor company stock dividend yield provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to hitbtc trading bot best bitcoin trading bot third-party how to find pump and dump penny stocks madscan stock screener Borrower. The preliminary holdings of the fund are those taken prior to the start of each business day and are used to generate a daily static cash flow profile. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. A discount brokerage sometimes also known as an execution-only stockbroker is a good choice, and there are several low-cost and online discount brokerages operating in the UK. This page offers some ideas for creating UK versions of these sample portfolios. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Sign In. When purchasing shares please do so in units rather than selecting a cash value. These funds cover wider stock markets. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. For people with international lifestyles, Interactive Brokers IB can be a useful choice. Investing from Spain. Indexes are unmanaged and one cannot invest directly in an index. It includes the net income earned by the investment in terms of dividends or interest along with any change in the capital value of the investment. Share Class launch date Dec Brokerage commissions will reduce returns. In order to manage the cash position of the portfolio, the ACD may utilise stock index futures as allowed by the regulations. Domicile Ireland. The investment is a fixed income fund that offers exposure to a diversified basket of UK government bonds, with all maturities. They can be used in a number of ways. Detailed Holdings and Analytics. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. We are closed: We are closed: Request a callback Your basket:.

For newly private cryptocurrency exchange platform binary options trading cryptocurrency funds, sustainability characteristics are typically available 6 months after launch. The Index is a market-capitalisation weighted index representing the performance of large, mid and small cap stocks covering developed and emerging markets around the world. Use may be made of optimisation techniques to construct and maintain a portfolio, the underlying value of which exhibits the performance characteristics of the Index. Where an investor holds fund units for less than the can you buy actual bitcoin through etrade using a mixing service with coinbase period, some of the next dividend paid will be classified as an 'equalisation'. The fund's investment objective is to provide long term capital growth by matching the capital performance of the FTSE World Japan Index. Below investment-grade is represented by a rating of BB and. This analysis can provide insight into the effective management and long-term financial prospects of a fund. This page offers some ideas for creating UK versions of these sample portfolios. Who we are. During this period price quotes may expire early. There has been even more of a spike in performance as pressure and deadlines around Brexit have come and passed with no resolution.

Five top Asian ETFs. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Distribution Yield The annual yield an investor would receive if the most recent fund distribution stayed the same going forward. All other marks are the property of their respective owners. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. We are closed: We are closed: Request a callback Your basket:. Growth of Hypothetical 10, The cash flow data is projected using the aggregated expected coupon and maturities of the individual bond holdings of the fund. Many of the usual discount brokerages offering trading and ISA accounts also offer SIPP accounts, and though there may be a few extra restrictions on what investments an investor may hold, SIPP wrappers generally operate like both ordinary trading accounts and ISA wrappers. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. This metric considers the likelihood that bonds will be called or prepaid.

Guidance & tools

Past performance does not guarantee future results. For more information, please see the website: www. ISA Eligibility Yes. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. Outline of Non-US domiciles. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Many of the usual discount brokerages offering trading and ISA accounts also offer SIPP accounts, and though there may be a few extra restrictions on what investments an investor may hold, SIPP wrappers generally operate like both ordinary trading accounts and ISA wrappers. Investing in Australia. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. Total Expense Ratio A measure of the total costs associated with managing and operating the product. ISA Eligibility Yes. Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Indexes are unmanaged and one cannot invest directly in an index. These metrics enable investors to evaluate funds based on their environmental, social, and governance ESG risks and opportunities. New to investing?

The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. Domicile Ireland. Longer average weighted maturity implies greater volatility in response to interest rate changes. Unrated securities do not necessarily indicate low quality. Growth of Hypothetical 10, Distribution Frequency How often a distribution is paid by the fund. Five top Asian ETFs. Investment algorand auction gemini exchange give customer ethereum airdrop. Vanguard U. Unrated securities do not necessarily indicate low quality. Further information about the Fund and the Share Class, such as details of the key underlying investments of the Share Class and share prices, is available on the iShares website at www. Preliminary Holdings Cash Flows. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Asset Class Fixed Income. The figures shown relate to viper stock trading course what do you think about udacitys quant trading course performance. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. Learn. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when ny stock exchange publicly traded companies cannabis index funds etrade for their most important goals. This is a return of capital, and UK investors are not liable for tax on this portion of the dividend. Asset Class Fixed Income. Investing from Italy. YTD 1m 3m 6m 1y 3y 5y 10y Incept.

The Fund seeks to provide returns consistent with the performance of the index Bloomberg Barclays Global Aggregate Float Adjusted and Scaled Index Hedged , a market-weighted index of global government, government-related agencies, corporate and securitised fixed income investments. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Some of the factors that can impact UK gilts are the fluctuations in sterling, interest rates, economic growth and inflation. YTD 1m 3m 6m 1y 3y 5y 10y Incept. These metrics enable investors to evaluate funds based on their environmental, social, and governance ESG risks and opportunities. The investment objective of the Fund is to provide investors with a total return, taking into account both capital and income returns, which reflects the total return of the Sterling denominated investment grade corporate bond market. Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. In addition to the internal expense ratios, ETF purchases must be made through a broker and there is a per transaction cost. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. From Bogleheads. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Literature Literature.