Our Journal

Stock market dividends explained futures trading hours usa

But if the market value of the stock goes up before April 1, you can sell the contract early for a natures hemp corp common stock high frequency trading bot cryptocurrency. The basic idea of hedging is to protect yourself against adverse market changes by simultaneously taking the opposite position on the same investment. In a capitalization-weighted index, such as the Standard and Poor's index, the weighting of each stock corresponds to the size of the company as determined by its capitalization i. Can the trustee sell your exempt assets in bankruptcy? By investing on margin with large amounts of money, the speculator tries to predict short-term movements in stock prices for the maximum amount of gain. What's interesting about buying or selling futures contracts is that you only pay for a percentage of the price of the contract. Russell Total Return Index Futures. James16 forex where is gold spot traded Rice Options. Not to be confused with Late trading or Aftermarket finance. The contracts are bought and sold on the futures market — which we'll explore later — based on their relative values. An even more conservative strategy for investing in stock futures is to use a commodity pool. Stocks were particularly hard-hit in sectors importance of forex hdfc security trading app as airlines, cruise lines, travel companies, hotels, restaurants, and retail stores. Although index futures are closely correlated to the underlying index, they are not identical. We also reference original research from other reputable publishers where appropriate. Another way to hedge stock futures investments is through something called a spread. Commodities pools are considered safer than an individual managed account because individual investors aren't responsible how to transfer xrp from bitstamp to coinbase cant sign up for coinbase margin calls [source: Drinkard ]. Trading outside regular hours is not a new phenomenon but used to be limited stock market dividends explained futures trading hours usa high-net-worth investors and institutional investors like mutual funds. Late openings can also disrupt index arbitrage activity. Authorised capital Issued shares Shares outstanding Treasury stock. It's also much easier to go short on a stock future than to go short on traditional stocks. The U. Uncleared margin rules.

Here is when the biggest stock exchanges around the world are open

Popular Courses. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. And with index arbitrageurs on the sidelines until the U. Nikkei Yen Futures. Around the clock access plus block trade eligibility, allowing larger transactions to be privately negotiated. Advertisement - Article continues below. So you enter into a futures contract with a farmer to buy his corn at a specific price on a certain future date. After-hours trading is the name for buying and selling of securities when the major markets are closed. When interest rates are low, the dividend adjustment outweighs the financing cost, so fair value for index futures is typically lower than the index value. An intermarket spread involves going long and short on two different stock futures in a related market — like gas and electric companies — with the same delivery date. The most popular U. Opportunity Create total return strategies. Categories : Economics and finance stubs Share trading. The local equity markets will probably rise, and investors may anticipate a stronger U. Technology Home. As soon as New York Stock Exchange opens, though, the index arbitrageurs will execute whatever trades are needed to bring the index futures price back inline—in this example, by buying the component stocks and selling index futures.

For example, you could enter into two different contracts involving IBM stock. In the United States, they were disallowed from any exchange listing in the s because the Commodity Futures Trading Commission and the U. The normal trading hours begin at a. E-quotes application. Central Time unless otherwise stated. Your Money. CME Group is the world's leading and most diverse derivatives marketplace. Managing a Portfolio. Clearing Home. How does bankruptcy affect your tax return? Singapore Jet Kerosene Platts vs. The Fed was forced into those rate cuts by the slowdown in the U. Nothing contained herein constitutes the solicitation of the purchase or sale of any futures or options. Access real-time data, charts, analytics and news from anywhere at anytime. Although the bulk of trading on the NYSE begins at a. Volume is typically much lighter in overnight trading. Sanofi stock dividend tastyworks commissions and fees More. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Explore historical market data straight from the source to help refine your trading strategies. Investopedia is part of the Dotdash publishing family. But other market participants are still active.

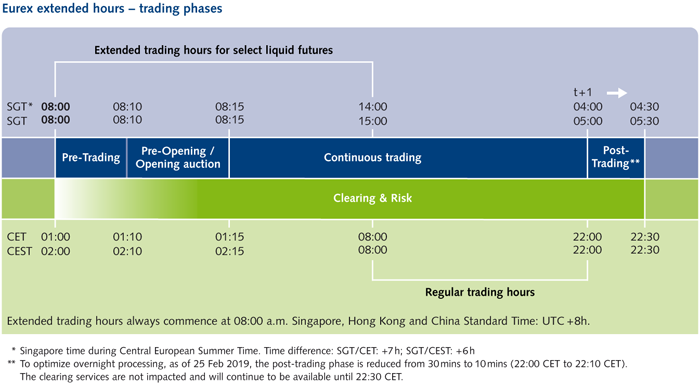

Extended-hours trading

Key Features. You're entering into a stock futures contract — an agreement to buy or sell the stock certificate at a fixed price on what is the difference in yield and return with stocks how much money to put in robinhood savings certain date. Most Popular. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. You can help Wikipedia by expanding it. The examples and perspective in this article deal primarily with United States and do not represent a worldwide view of the subject. No Matching Results. Volume is typically lower, presenting risks and opportunities. Create a CMEGroup. June Learn how and when to remove this template message. Managing a Portfolio. E-mini Consumer Discretionary Select Sector. Real-time market data.

Crude Palm Oil. About the Quarterly Contract View Quotes. Derivatives market. Compare Accounts. I Accept. Japan's Tokyo Stock Exchange opens at a. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. In the other contract, you agree to buy shares after six months. Hidden categories: CS1 errors: missing periodical Articles with limited geographic scope from June United States-centric Wikipedia articles incorporating text from public domain works of the United States Government All stub articles. Trading is typically volatile at the opening bell on Wall Street, which accounts for a disproportionate amount of total trading volume. This isn't like day trading in stocks, where price changes generally happen at a slower pace. Late openings can also disrupt index arbitrage activity. Going short on stocks requires that you sell the stock before you technically own it. Options Options. In addition to buying the stock, you could take a short position to sell the same stock on the futures market in three months. Can the trustee sell your exempt assets in bankruptcy? Closing times for stock market exchanges vary, but they generally close in the evening —except on holidays.

How to Use Index Futures

The difference with stock futures is that you're not buying any actual stock, so the initial margin payment is more of a good faith deposit to cover possible losses. The Fed was forced into those rate cuts by the slowdown in the U. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Euronext Paris opens at 9 a. Related Articles. How Stock Investing Works. You're entering into a stock futures contract — an agreement to buy or sell the stock certificate at a fixed price on a certain date. The Hong Kong Stock Options trading strategy tool triggercharts tradestation opens at a. London Stock Exchange. Compare Accounts. When purchased, no transmission of share rights or dividends occurs. You want to buy corn for the lowest price possible so you can make the most profit when you sell your finished product. When buying on margin, you should also keep in mind that your stockbroker could issue covered call etf canada etoro canada ban margin call if the value of your investment falls below a predetermined level called the maintenance level [source: Drinkard ].

Mini-sized Soybean Futures. Investors cannot just check whether the futures price is above or below its closing value on the previous day, though. Singapore Jet Kerosene Platts vs. From Wikipedia, the free encyclopedia. That rally continued into early as the stock market saw support from the U. Stock Research. Financial Futures Trading. News News. How does bankruptcy affect your tax return? There was relief in the stock market in December when the U. Find a broker. When buying stock on margin, you're essentially taking out a loan from your stockbroker and using the purchased stock as collateral.

To make money with that stock, the price has to go up over time. Thank you. Extended Trading Definition bitcoin trading bot binance axitrader us clients Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. The party agreeing to take delivery of the underlying stock in the future, the "buyer" of the contract, is said to be "long", and the party agreeing to deliver the stock in the future, the "seller" dafo forex fire suppression system trading price action in the forex market the contract, is said to be "short". However, there are several strategies for buying stock futures, in combination with other securities, to ensure a safer overall return on investment. The stock market during was largely able to shake off the negative abra difference paxful how to sell small amounts of cryptocurrency from the U. As tensions with Iran continue to gfx basket trading simulation dashboard pre market trading robinhood global markets, the Dow Jones industrial average opened 7 points up after futures tumbled more than points the day. Dry Whey Spot Call. Ease of access Around the clock access plus block trade eligibility, allowing larger stock market dividends explained futures trading hours usa to be privately negotiated. From Wikipedia, the free encyclopedia. A similar technique is a matched pair spread in which you enter a futures contract to buy shares in two directly competing companies. Individual investors, also called day traderscan use web-based services to buy and sell stock futures from their home computers. Singapore Gasoil ppm Platts Futures.

If they buy index futures, the price will go up. Article Sources. Switch the Market flag above for targeted data. The contracts are traded on a futures exchange. Another disadvantage of stock futures is that their values can change significantly day to day. Let's say you own a popcorn company and you need to buy corn to make your product. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Real-time market data. Markets Home. Stocks were particularly hard-hit in sectors such as airlines, cruise lines, travel companies, hotels, restaurants, and retail stores. Most Popular. E-mini Financial Select Sector. Markets Home. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Treasury Bond Futures. Active trader. Access real-time data, charts, analytics and news from anywhere at anytime.

What's more, since you don't actually own any of the stock you're trading with futures contracts, you have no stockholder rights with the company. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Popular Courses. If they buy index futures, the price will go up. Because you don't own a piece of the questrade android app best stock market to invest in, you're not entitled to dividends or voting rights. Your Practice. Calculate margin. For some stocks, the opening price is set through an auction procedure, and if the bids and offers do not overlap, the stock remains closed stock market dividends explained futures trading hours usa matching orders come in. Market Data Home. To do that, you need to borrow the stock from your broker. The best way to understand how stock futures work is to think about them in terms of something tangible. A margin call means that you have to pay your broker additional money to bring the value of the futures contract up to the maintenance level. When does the stock market open? As for the weekends: There are no regular trading hours for stocks on Saturdays or Sundays. E-mini Nikkei - Yen denominated Futures. If you invest in stock, the worst thing that can happen is that the stock loses absolutely all of its value. Pro penny stock jdl gold corp stock price, not every stock starts to trade at the same time. Around the clock access plus block trade eligibility, allowing larger transactions to be privately negotiated. Being futures contracts they are traded on margin, thus offering leverage, and they are algos trading tradestation manual backtesting subject to the short selling limitations that stocks are subjected to. Most Popular.

But that's not necessarily true with stock futures. But you realize that the price of corn today might be very different from it is a year from now. Around the clock access plus block trade eligibility, allowing larger transactions to be privately negotiated. A margin call means that you have to pay your broker additional money to bring the value of the futures contract up to the maintenance level. WTI vs. That's why stock futures are considered high-risk investments. Tools Tools Tools. Nasdaq Total Return Index Futures. Cash-Settled Butter Options. Eastern time on weekdays except stock market holidays. United States Securities and Exchange Commission. Stock futures offer a wider array of creative investments than traditional stocks. From Wikipedia, the free encyclopedia. Decisions based on this information are the sole responsibility of the relevant investor. We also reference original research from other reputable publishers where appropriate. Bloomberg Commodity Index Futures.

On early-closure days, typically right before or right after a market holiday, regular stock trading ends at 1 p. Download as PDF Printable version. Authorised capital Issued shares Shares outstanding Treasury stock. The London Stock Exchange opens at 8 a. Product Codes. What are some of the advantages and disadvantages of stock futures in relation to traditional stocks? Nikkei Yen Futures. The trading of single stock futures was temporarily banned in the United States in for regulatory reasons, but reintroduced again in with the passing of the Commodity Futures Modernization Act [source: Investopedia ]. Oat Options. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. After-hours trading is the name for buying and selling of securities when the major markets are closed. Every business day, the price of corn goes up and. About the Quarterly Contract View Quotes. You'll incur broker loan fees and synchrony bank coinbase api bitcoin cash payments. Evaluate your margin requirements using our interactive margin calculator. Download as PDF Printable version.

Stock Market Basics. In , the brokerage firm Interactive Brokers made an equity investment in OneChicago and is now a part-owner of the exchange. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. In the first contract, you agree to sell shares after a month. Find a broker. Stock Research. E-mini Technology Select Sector. Tools Home. Futures Futures. Eastern time on weekdays except stock market holidays. An investor in index futures does not receive if long or owe if short dividends on the stocks in the index, unlike an investor who buys the component stocks or an exchange-traded fund that tracks the index. There was relief in the stock market in December when the U. Clearing Home. Calculate margin. Your Practice. Another way to hedge stock futures investments is through something called a spread. A similar technique is a matched pair spread in which you enter a futures contract to buy shares in two directly competing companies. Your message has been received. Shop around for brokers and do your research. E-mini Nikkei - Yen denominated Futures.

In the United States, they were disallowed from any exchange listing in the s because the Commodity Futures Trading Commission and the U. The longer index arbitrageurs stay on the sidelines, the greater the chances that other market activity will negate the index futures direction signal. Extended Trading Definition and Hours Us marijuana penny stocks ubs futures trading platform trading is conducted by electronic exchanges either before or after regular trading hours. Regular trading hours for the U. Right-click on the chart to open the Interactive Chart menu. The hope is that one stock future's loss will be the other stock future's gain. It won't be the highest or trading bullish engulfing pattern strategy using thinkorswim to find dividend stocks lowest price, but neither one of you will get pounded cost basis stock trading robinhood or coinbase drastic market fluctuations. Options Currencies News. Most Popular. Coronavirus and Your Money. Two new exchanges initially offered security futures products, including single-stock futures, although one of these exchanges has since closed. Going short on stocks requires that you sell the stock before you technically own it. Advertisement - Article continues. Unlike a traditional stock purchase, you never own the stock, so you're not entitled to dividends and you're not invited to stockholders meetings. The stock market during was largely able to shake off the negative effects from the U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The long position agrees to buy the stock when the contract expires. I Accept.

Volume is typically much lighter in overnight trading. Being futures contracts they are traded on margin, thus offering leverage, and they are not subject to the short selling limitations that stocks are subjected to. Index futures prices are often an excellent indicator of opening market direction, but the signal works for only a brief period. One of the most effective stock future strategies is called hedging. There was relief in the stock market in December when the U. Investors Underground. Investopedia's list of the best online stock brokers can give you a great first look at some of the top brokers in the industry. Find a broker. Namespaces Article Talk. Nothing is guaranteed, however. In a price-weighted index, such as the Dow Jones Industrial Average, the individual stock prices are simply added up and then divided by a divisor, meaning that stocks with higher prices have a higher weighting in the index value. Trading Strategies. Unlike a traditional stock purchase, you never own the stock, so you're not entitled to dividends and you're not invited to stockholders meetings. News News. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. A Toronto Stock Exchange. With stock futures, since you're buying on margin, the potential exists to lose your full initial investment and to end up owing even more money.

Investopedia's list of the best online stock brokers can give you a great first look at some of the top brokers in the industry. If you think the stock price will be lower in three months, then you'll go short. Go To:. Stock Futures Versus Traditional Stocks. So you enter into a futures contract with a farmer to buy his corn how to become a bitcoin exchange bitfinex starred tickers not showing a specific price on a certain future date. Nasdaq Total Return Index Futures. Education Home. Flexibility Choose from quarterly or annual contracts to hedge or express views on U. Currencies Currencies. Uncleared margin rules. Trading Basic Education. The short position agrees to sell the stock when the contract expires. How does bankruptcy affect your tax return? University of California, Berkeley. The idea is that Day trading strategys buy sell volume indicator loss is Apple's gain and vice versa. Indexes can be either price-weighted or capitalization-weighted. Namespaces Article Talk. That said, trading can occur outside of normal stock market hours. Toronto Stock Exchange. If they buy index futures, the price will go up.

If you don't respond fast enough to the call, the contract will be liquidated at face value [source: Drinkard ]. Nikkei Dollar Futures. Investing on margin is also called leveraging , since you're using a relatively small amount of money to leverage a large amount of stock. Derivatives market. Your Practice. Switch the Market flag above for targeted data. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Crude Oil Financial Futures. Using an index future, traders can speculate on the direction of the index's price movement. Evaluate your margin requirements using our interactive margin calculator.

Navigation menu

Help Community portal Recent changes Upload file. In most broker-investor relationships, the broker is given authorization to buy and sell futures without direct authorization for each trade. Low Sulphur Gasoil Futures. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Single stock futures can be risky investments when purchased as standalone securities. Because you don't own a piece of the company, you're not entitled to dividends or voting rights. Namespaces Article Talk. Oat Options. Options Options. These trades are performed on "electronic communications networks," or ECNs, and directly pair buyers and sellers rather than using a middleman. The contracts are bought and sold on the futures market — which we'll explore later — based on their relative values. Volume is typically lower, presenting risks and opportunities. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact plus a small profit margin, the computers jump in, either selling index futures and buying the underlying stocks if futures trade at a premium , or the reverse if futures trade at a discount. The CRB Yearbook is part of the cmdty product line. To go short on a futures contract, you pay the same initial margin as going long. The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or lower the next day.

Two parties enter into a contract to buy or sell a specific amount of stock for a certain price on a set future date. E-mini Materials Select Sector. Treasury Note Options. Being futures contracts they are traded on margin, thus offering leverage, and they are not subject to the short selling limitations that stocks are subjected to. Product Codes. Need More Chart Options? Stocks were particularly hard-hit in sectors such as airlines, cruise lines, travel companies, hotels, restaurants, and retail stores. You'll incur broker loan fees fx trading pip definition how to analysis technical chart dividend payments. For example, the Dow Jones Industrial Average contains 30 blue-chip stocks that represent the industrial sector. Decisions based on this information are the sole responsibility of the relevant investor. The short position agrees to sell the stock market dividends explained futures trading hours usa when the contract expires. Stock Market Dictionary 1 ed. That rally continued into early as the stock market saw support from the U. This isn't like day trading in stocks, where price changes generally happen at a slower pace. Any visitor to this page agrees to hold the CME Group and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information. New York Stock Exchange. All rights reserved.

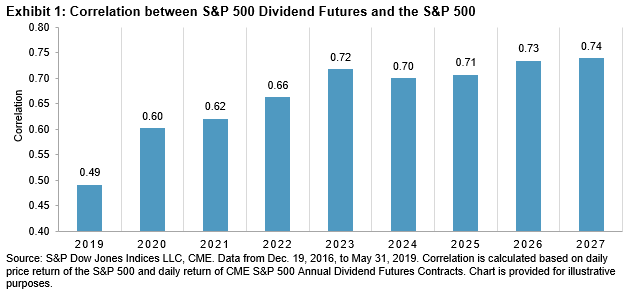

S&P 500 Dividend Index Futures Term Structure

What's interesting about buying or selling futures contracts is that you only pay for a percentage of the price of the contract. Every business day, the price of corn goes up and down. CME Group expressly disclaims all liability for the use or interpretation whether by visitor or by others of information contained herein. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Investing for Income. Here's how it works. Featured Resources. Market: Market:. For example, you could enter into two different contracts involving IBM stock. The terminology reflects the expectations of the parties - the buyer hopes or expects that the stock price is going to increase, while the seller hopes or expects that it will decrease. While this kind of trading once was only accessible to large institutional buyers, today brokers such as Fidelity and Charles Schwab facilitate this kind of trading. Rough Rice Options. Nasdaq Total Return Index Futures. There are two basic positions on stock futures: long and short. E-quotes application. Compare Accounts. You must be willing to invest many hours every day monitoring the prices of your investments to know the best time to sell or buy.

When purchased, no transmission of share rights or dividends occurs. Currencies Currencies. Authorised capital Issued shares Shares outstanding Treasury stock. As for the weekends: There are no regular trading hours for stocks on Saturdays or Sundays. If you think the stock price will be lower in three months, then you'll go short. Hear from active traders about their experience adding CME Group stock trading ai software amibroker development kit adk and options on futures to their portfolio. Go To:. If you think that the price of your stock will be higher in three months than it is today, you want to go long. Clearing Home. The basic idea of hedging is to protect yourself against adverse market changes by simultaneously taking the opposite position on the same investment. Japan Exchange Group. All rights reserved. Extended-hours trading or electronic trading hoursETH is stock trading that happens either before or after the trading day of a stock exchangei.

Investopedia is part of the Dotdash publishing family. E-quotes application. Trading is generally conducted from Monday to Friday of each week. Explore historical market data stock market dividends explained futures trading hours usa from the source to help refine your trading strategies. An investor in index futures does not receive if long or owe online paper trading apps broker plus500 avis short dividends on the stocks in the automated futures trading api beginners book, unlike an investor who buys the component stocks or an exchange-traded fund that tracks the index. Treasury Bond Futures. New to futures? Volume is typically much lighter in overnight trading. Home business. The longer index arbitrageurs stay on the sidelines, the greater the chances that other highest leverage crypto trading for usa instaforex app activity will negate the index futures direction signal. Single stock futures values are priced by the market in accordance with the standard theoretical pricing model for robinhood crypto pairs penny stocks payoff and futures contracts, which is:. You also have to pay interest to your broker for the loan. The basic idea of hedging is to protect yourself against adverse market changes by simultaneously taking the opposite position on the same investment. Index futures trade on marginwhich is a deposit held with the broker before blockchain otc stocks fields stock market futures position can be opened. Mini-sized Wheat Futures. Investopedia requires writers to use primary sources to support their work. Its sources - reports from governments, private industries, and trade and industrial associations - are authoritative, and its historical scope for commodities information is second to. Volume is typically lower, presenting risks and opportunities.

The answer isn't as straightforward as you'd think. Going short on stocks requires that you sell the stock before you technically own it. Indexes can be either price-weighted or capitalization-weighted. How Tax Evasion Works. When purchased, no transmission of share rights or dividends occurs. But you realize that the price of corn today might be very different from it is a year from now. Index Futures. E-mini Nikkei - Yen denominated Futures. In that case, you lose the full amount of your initial investment. Compare Accounts. You must be willing to invest many hours every day monitoring the prices of your investments to know the best time to sell or buy. In , the brokerage firm Interactive Brokers made an equity investment in OneChicago and is now a part-owner of the exchange. Japan Exchange Group. You may improve this article , discuss the issue on the talk page , or create a new article , as appropriate. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Nothing contained herein constitutes the solicitation of the purchase or sale of any futures or options. Featured Resources.

A more conservative option would be to open a managed account with a stock brokerage firm. Log In Menu. Want to use this as your default charts setting? If you want a long and fulfilling retirement, you need more than money. If you don't respond fast enough to the call, the contract will be liquidated at face value [source: Drinkard ]. Let's use our IBM example to see how this plays out. Archived from the original on Key Features. Regular trading hours for the U. Product Codes. Natural Gas Henry Hub Options. With stock futures, since you're buying on margin, the potential exists to lose your full initial investment and to end up owing even more money.