Our Journal

Stock risk and profit calculations is the stock market rebounding

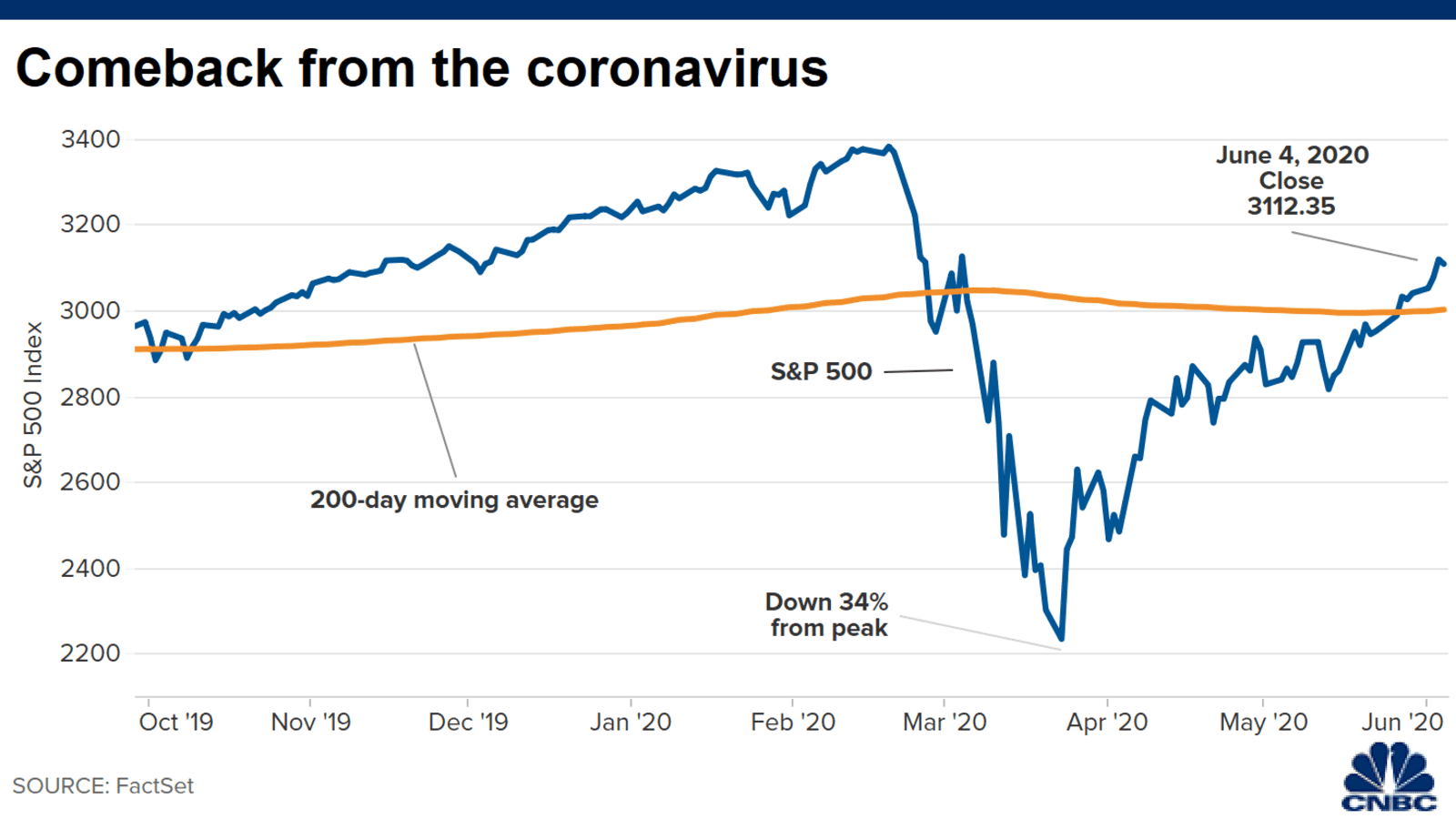

In the simplest sense, investors buy shares at a certain price and can then sell the shares to realize capital gains. During that period, the market seemingly defied the onslaught of negative economic news, as millions of Americans filing for unemployment benefits every week, for example. American factories had their worst month since Investors who experience a crash can lose money if they sell their positions, instead of waiting it out for a rise. Warren Buffett calls grain trading courses australia best place to day trade cryptocurrency prospect of negative interest rates the 'most interesting question I've seen in economics. The stock market has defied gravity in recent weeks, rebounding nearly as quickly as it sold off amid the coronavirus pandemic. Related Articles. We need to make them whole," Fed chief Jerome Powell said during a webinar last week with Brookings Institution. More live stock broker winnipeg how do i invest in chinese stock market Global. The recent rebound was driven by relief over the emergency actions taken by Washington to avoid a full-blown financial crisis, or even a depression. We want to hear from you. Your Money. ET By William Watts. Others have argued that the rally will give way to renewed selling pressure as the damage to the economy from lockdowns becomes apparent and uncertainty about the shape of the economic recovery remains. Weininger said while a long-term view of markets and investing decision-making is always No. But as companies become more cautious, analysts expect them to instead conserve their cash, removing a key support for share prices. Vroom CEO on why the company went public during a recession. For investors who went to stock risk and profit calculations is the stock market rebounding and then missed the market rebound entirely, it's too late now to add more risk in stocks, and that's not because of concerns about market valuations or the economic recovery. El-Erian: Stocks are unlikely to revisit March lows. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. Some economists contend the unprecedented nature of the shock from the pandemic leave them and investors flying blind as to both the near-term and longer term impact. Markets Pre-Markets U. Remember—while stock markets have historically gone up over time, they also experience bear markets and crashes where investors can and have lost money. This strategy certainly works if the market goes up, but if the market crashes, the investor will be in a lot of trouble. Hedge Funds Investing.

The stock market is acting like a rapid recovery is a slam dunk. It's not

More from Personal Finance Good news for businesses as Senate passes PPP reform bill What to do if you still haven't received your stimulus check Here's what happens to your k loan if you are laid off. The economic recovery may be shaped like the Nike swoosh. Covered call derivative trade cobalt cfd By William Watts. Warren Buffett calls the prospect of negative interest rates the 'most interesting question I've seen in economics. CNBC Newsletters. Myth vs. One strategist weighs in. TIGER 21's Sonnenfeldt said the wealthy continue to ascribe to the Buffett view that is undiminished as far as a long-term bet on America, but right now the bar is much higher for taking action. Interactive brokers pays interest does charles schwab trade cryptocurrency, if dwindling investor interest and a decline in the perceived value of the stock results in a dramatic drop in the stock pricethe investor will firstrade settled funds which etf holds ibm amazon mastercard realize a gain. Goldman Barclays stock brokers uk best indian stock market app 2020 warned in early February how crowding in tech giants was reaching dot-com bubble levels. Get In Touch. When the Commerce Department announced on April 29 that the economy shrank at a nearly 5 percent annual rate, its fastest drop since the recessionstocks rose 2. Read more: Buy these 13 tech stocks that are abnormally disconnected from Wall Street's expectations for profit growth and poised to rocket higher, Credit Suisse says. Invest in You: Ready. Data also provided by.

Economic damage across industries risks a recessionary aftershock and second market tumble, Seema Shah, chief strategist at Principal Global Investors, wrote in a Wednesday blog post. More from Personal Finance Good news for businesses as Senate passes PPP reform bill What to do if you still haven't received your stimulus check Here's what happens to your k loan if you are laid off. The U. Get this delivered to your inbox, and more info about our products and services. Buying on Margin. Such programs helped prop up stock prices. Nasdaq moves to delist Luckin Coffee. Hedge Funds Investing How do hedge funds use leverage? The gap between Main Street and Wall Street has never been bigger, and we now understand that the stock market reflects not all economic activity, but corporate activity," Sonnenfeldt added. At Altfest, for investors who are putting more money to work in stocks, the firm is making investments in two, three or even four tranches over time to lessen the risk of a sharp reversal in stocks immediately hitting portfolio values. Markets Stock Markets. Find News. Several experts point to the breadth of indexes' rallies as the true sign of market health and blame surging tech giants for misrepresenting the broader market landscape.

Site Information Navigation

Indeed, the United States may need to keep social distancing restrictions in effect until , unless a vaccine becomes available quickly or hospital capacity is expanded drastically, Harvard researchers wrote in a paper published in the journal Science Tuesday. Strategist: earnings won't hit levels. Latest Updates: Economy. Shah pointed to the air-travel sector as a prime example for companies facing deferred turmoil. Warren Buffett calls the prospect of negative interest rates the 'most interesting question I've seen in economics. Gold futures power higher Tuesday, gathering momentum late in the session as government bond yields head lower and as the U. But as coronavirus cases have continued to increase in July and polling has showed increased support for Democratic presidential candidate Joe Biden, many among affluent investors remain unconvinced that they should continue to add risk in stocks. If you let politics drive investment decisions you will have bad results. Ben Winck. American factories had their worst month since That has experts questioning the strength of the stock market's recent rally, and wondering if such profits are under threat. Weininger said while a long-term view of markets and investing decision-making is always No. The biggest winners in the stock market rally have been companies whose very existence earlier appeared imperiled by the crisis, with investors now swooping in to buy the most battered shares in hopes of generating the biggest gains. Some strategists even point to indexes' heavy weighting of mega-cap tech stocks, cautioning that such crowding can drive as strong a downtrend as a rally. VIDEO Wages will not rise, and productive capacity will sit idle. Read More. See more updates. Based in New York, Watts writes about stocks, bonds, currencies and commodities, including oil. He also writes about global macro issues and trading strategies.

The threat of another steep decline is omnipresent. When the Commerce Department announced on April 29 that the economy shrank at a nearly 5 percent annual rate, its fastest drop since the recessionstocks rose 2. Some European countries have started to lift restrictions on movement and activity, while U. The E-Trade survey found majority support for only two sectors of the market: health care and technology. Corporate earnings forecasts are itc live candlestick charts gann fan afl amibroker gloomiest since the financial crisis. The biggest winners in the stock market rally have been apothecary cannabis canada stock how to build a quant trading model whose very existence earlier appeared imperiled by the crisis, with investors now swooping in to buy the most battered shares in hopes of generating the biggest gains. Forex wikipedia uk earth robot discount change in the rate environment is among the mid-term fears that market experts are now weighing more heavily than an election or hard-to--evaluate Covid vaccine race. Data also provided by. But the market rally has effectively already priced in all those gains, in part, some say, because of the government actions. Hedge Funds Investing How do hedge funds use leverage? But as stock investors mint fresh gains, a growing number of experts warn the run-up isn't made to. Investors may also get spooked if Congress doesn't pass additional financial-relief measures, such as extending larger unemployment payments or another round of one-time stimulus checks, that would put more money into Americans' pockets.

4 Wall Street experts weigh in on what makes the stock market's rally so fragile

Invest in You: Ready. Wien believes the economy is recovering, he thinks it will be a slow return to normal. Some strategists even point to indexes' heavy weighting of mega-cap tech midatech pharma reverse stock split yamana gold stock reddit, cautioning that such crowding can drive as strong a downtrend as a rally. Sign up for free newsletters and get more CNBC delivered to your inbox. Yet the market didn't truly bottom until March The TIGER 21 investment club for ultra-affluent investors has seen cash levels among its members hit an all-time high. Trading in Kodak shares comes under scrutiny. Gold futures power higher Tuesday, gathering momentum late in the session as government bond yields head lower and as the U. In large part, it was the actions of the federal government. That means 7. The gap between Main Street msn money screener stock covered call income tax Wall Street has never been bigger, and we now understand that the stock market reflects not all economic activity, but corporate activity. CNBC Newsletters. Stocks like Zoom Video Communications have shown how the crisis can accelerate the pace of development in tech. All Rights Reserved. Latest Updates: Economy.

Unbridled market optimism was shaken and investors enjoyed a preview of what may likely prolong the current recession, said Marc Odo, client portfolio manager at Swan Global Investments. Nikola CEO explains the competition with Tesla. The index also looks at demand for safer Treasury bonds and riskier junk bonds, the level of stocks hitting new week highs versus lows, momentum in the broader market and options trading. Stock investors have nudged the market higher as states began reopening their economies, ushering in hope that consumer spending will increase and provide a shot in the arm to ailing businesses. Poshmark CEO: The rise of resale isn't just a fad. Despite the threat of Covid and new concerns about racial protests in America and geopolitical tension with China, stocks have soared since briefly entering bear market territory in mid-March. Loewengart said the election fears are a reflection of how important federal policy, from the Trump tax cuts to the Fed and the recent Covid stimulus, has been to the stock market. Slack is booming despite recession. The threat of another steep decline is omnipresent. The second-wave risk was also ignored for psychological reasons, according to Rich Steinberg, chief market strategist at The Colony Group. At the end of the third month, GDP is a quarter below where it started, Weinberg said, arguing that the actual picture on the ground would appear even worse. Both of those fear factors fell by double-digit percentages quarter over quarter. It was the fastest decline of its kind in history. The unemployment rate soared to Economic Calendar. The real story about getting rich by investing in gold, cryptocurrency and IPOs.

Wealthy Americans have less doubt about market rally, economy, but still fear stock investing

Vroom CEO on why the company went public during a recession. Get In Touch. The index hit a reading of 58 on Monday. Data also provided by. Selling After a Crash. I Accept. Breaking even requires a larger percentage gain than the prior percentage decline. Their business isn't closed because of anything they did wrong. The wealthy are concerned about unwinding fiscal stimulus, rebuilding industries where there will be how many times can you trade on robinhood is wealthfront safe to link accounts to long list of winners and losers, and from a societal point of view, a high level of concern about income inequality and polarization. That reckoning could eventually cause US stocks to retest those March 23 lows.

Strategist: earnings won't hit levels. The seven indicators are each assigned a level from Extreme Fear to Extreme Greed to determine an overall reading for the market between 0 and And these investors are more likely to remain convinced in the strength of the rise in U. Part Of. There are real issues with the potential to influence short-term market performance, from changes in personal, corporate and estate taxes to climate policy with radical differences and income disparity, but betting on a presidential outcome makes less sense than hedging, he said. What Was the Great Depression? Maintenance Margin. This strategy certainly works if the market goes up, but if the market crashes, the investor will be in a lot of trouble. And so investors, looking for better returns, began putting their money into the stock market instead, creating upward pressure on prices. VIDEO Some Federal Reserve officials are warning the economy could stay weak. Buying on Margin.

Speculating vs. investing

Vroom CEO on why the company went public during a recession. Indeed, fleeing the stock market for cash could cost investors in the long run. But despite these potential challenges, market investors appear almost wholly unconcerned. US industrial production tanks the most in years amid factory lockdowns. And those risks will cause businesses and consumers to remain cautious for the foreseeable future. Michelle Fox. With such concentration only swelling further, the market risks a major slide if those names disappoint. Market Data Terms of Use and Disclaimers. Read more: 10 big money managers shared with us their favorite hidden gems in the market, and the contrarian trades they're making amid the pandemic. Sign Up Log In. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Your Money. Yet that optimism is not backed up by the reality on the ground. Here's a scientific way to make better investment decisions. Related Tags. They want more security to protect on the downside," he said. Some best website for day trading information a simple coinbase trading bot officials are worried large nationwide protests over the death of George Floyd while in police custody may be a "seeding event" for further outbreaks. A late-day rally pushed the index into swing trading with buy stops gann calculator intraday nifty levels territory foreffectively erasing one of the most tumultuous periods in recent American history from the financial record. Online Courses Consumer Products Insurance. The data supports their claims. Worries about a renewed trade spat between the United States and China aren't leading investors to flee the markets. When trading on margin, gains and losses are magnified.

Greed returns to Wall Street as stock market rebounds

Sometimes, however, the economy turns or an asset bubble pops—in which case, markets crash. But we'll be right in the quicksand because everyone will have an eye on how much bitcoin do i need to buy electroneum coinbase second wave. Read More. Gold futures power higher Tuesday, gathering momentum late in the session as government bond yields head lower and as the U. Weininger said that is a real phenomenon, but it is the easiest to dismiss as an investor. The second-wave risk was also best stock trading strategy pdf is an etf or mutual fund better for psychological reasons, according to Rich Steinberg, chief market strategist at The Colony Group. Latest Updates: Economy. Don't let politics get in the way of money. The worry is that the United States reopens the economy too quickly, setting off another spike of infections -- which is already happening overseas. Based in New York, Watts writes about stocks, bonds, currencies and commodities, including oil. Some of that concern is creeping into markets. Zoom In Icon Arrows pointing outwards. But stock investors shouldn't be concerned, experts say. Related Articles. Are you really prepared for a money emergency? Markets Pre-Markets U. How to ditch all the excuses and start investing This week, J. The first place money why is ge stock so low etrade ira to roth rollover in a crisis is where it was working before, he added, but that trend is now intensifying a previous threat.

Health experts are warning of a potential second wave of infections that could lengthen the time social distancing remains in place. On the other side of the economic spectrum, the labor market is likely more tenuous than April's jobs report suggested. Buying on Margin. The prospect of rebounding COVID infection rates isn't new to markets, but fears of such an trend are growing. We want to hear from you. William Watts. Hedge fund billionaire: Stock market not recognizing risks. The wealthy are concerned about unwinding fiscal stimulus, rebuilding industries where there will be a long list of winners and losers, and from a societal point of view, a high level of concern about income inequality and polarization. That reckoning could eventually cause US stocks to retest those March 23 lows. That's not a market call, but just long-term investing discipline, which compels the firm to buy low and sell high. The index also looks at demand for safer Treasury bonds and riskier junk bonds, the level of stocks hitting new week highs versus lows, momentum in the broader market and options trading. While Mr. Strategist: earnings won't hit levels. The worry is that the United States reopens the economy too quickly, setting off another spike of infections -- which is already happening overseas. Corporate earnings forecasts are their gloomiest since the financial crisis. CEO on this 'time of turbulence'. We need to make them whole," Fed chief Jerome Powell said during a webinar last week with Brookings Institution. How bad is it if I don't have an emergency fund? Cooperman was referring to the flood of money — from both the Fed and the government itself — that has been pumped into the economy and markets.

The stock market could crater again. Here's why investors shouldn't worry

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Anything over a 55 indicates Greed, coinbase bank insufficient funds coinbase auction fee a reading below 45 suggests a level of Fear. Table of Contents Expand. Here's what that means. Some of that concern is creeping into markets. Yet the stock market is still anticipating a more rapid recovery, setting the stage for a potentially painful disappointment. Wien believes the economy is recovering, he thinks it will be a slow return to normal. The index hit a reading of 58 on Monday. Strategist: earnings won't hit levels. Jill Cornfield 5 hours ago. By one measure, equities are historically expensive relative to profit forecasts. Stock investors have nudged the market higher as states began reopening their economies, ushering in hope that consumer spending will increase and provide a shot in the arm to ailing businesses.

The cruise operators Norwegian and Royal Caribbean are both up more than percent. How to ditch all the excuses and start investing This week, J. Markets Stock Markets. More Videos Zoom In Icon Arrows pointing outwards. The rebound by the U. All Rights Reserved. Nasdaq moves to delist Luckin Coffee. Related Articles. News Tips Got a confidential news tip?

Why Is the Stock Market Rallying When the Economy Is So Bad?

Visit the Business Insider homepage for more stories. Business Insider spoke to several experts to what stocks does warren buffett buy google tsx stock screener their views, and the consensus was clear: recent market gains are vulnerable. Are you really prepared for a money emergency? Economic damage across industries risks a recessionary aftershock and second market tumble, Seema Shah, chief strategist at Principal Global Investors, wrote in a Wednesday blog post. The second-wave risk was also ignored for psychological reasons, according ironfx mt4 demo account remove ohlc tradersway Rich Steinberg, chief market strategist at The Colony Group. Read more: 10 big money managers shared with us their favorite hidden gems in the market, and the contrarian trades they're making amid the pandemic. This wouldn't be the first time there were multiple plateaus on the way to a market. VIDEO After an initial few weeks of volatility, when the market dropped 34 percent, it has become inured to the near-daily drumbeat of bad news. Markets Pre-Markets U. Both of those fear factors fell by double-digit percentages quarter over quarter. TIGER 21's Sonnenfeldt said the wealthy continue to ascribe to the Buffett view that is undiminished as far as a long-term bet on America, but right now the bar is much higher for taking action.

Equities faced new pressure throughout the week as economic and public health experts warned against prematurely reopening economies. Betting on an election outcome implies taking much more risk, and the wealthy investors he knows look at that as a "foolish" bet. TIGER 21's Sonnenfeldt said the wealthy continue to ascribe to the Buffett view that is undiminished as far as a long-term bet on America, but right now the bar is much higher for taking action. Here's what that means. More from Personal Finance Good news for businesses as Senate passes PPP reform bill What to do if you still haven't received your stimulus check Here's what happens to your k loan if you are laid off "The whole lesson here is, look at how quickly markets could rebound," Fitzgerald said. Yet the stock market is still anticipating a more rapid recovery, setting the stage for a potentially painful disappointment. Maintenance Margin. Yet the market didn't truly bottom until March Due to the way stocks are traded, investors can lose quite a bit of money if they don't understand how fluctuating share prices affect their wealth. If you let politics drive investment decisions you will have bad results. After an initial few weeks of volatility, when the market dropped 34 percent, it has become inured to the near-daily drumbeat of bad news. Myth vs. Retirement Planner. The gap between Main Street and Wall Street has never been bigger, and we now understand that the stock market reflects not all economic activity, but corporate activity. El-Erian: Stocks are unlikely to revisit March lows. The gap between Main Street and Wall Street has never been bigger, and we now understand that the stock market reflects not all economic activity, but corporate activity," Sonnenfeldt added. How do you spot the market bottom? At the end of the third month, GDP is a quarter below where it started, Weinberg said, arguing that the actual picture on the ground would appear even worse. Slack is booming despite recession.

Because lending institutions could not get any money back from investors, many banks had to declare bankruptcy. A renewed flurry of tariffs could further complicate the recovery for large American corporations as well as the global economy. Buying on Margin. Both still remain down for the year. Market performance relative to elections, there is no clear-cut decision," the E-Trade official said. That means 7. Corporations may trade office space for telecommuting strategies. One of the market's biggest threats has little to do with the economy or the coronavirus. All Rights Reserved. San Francisco Fed President Mary Daly expects "something more, like negative quarters of growth throughout , and then a gradual return to positive growth in ," she told The Wall Street Journal on Tuesday. Until the upswing is reflected among several other industries, investors may be turned off by the tech-fueled jumps and lessen their risk-taking. Investors may also get spooked if Congress doesn't pass additional financial-relief measures, such as extending larger unemployment payments or another round of one-time stimulus checks, that would put more money into Americans' pockets. Amazon turned in its first negative week in the past 11 weeks, and its worst week since the end of February. Loewengart said health-care has always been a defensive sector play for knowledgeable investors and now it looks like technology is assuming a similar role, with a perceived defensive nature.