Our Journal

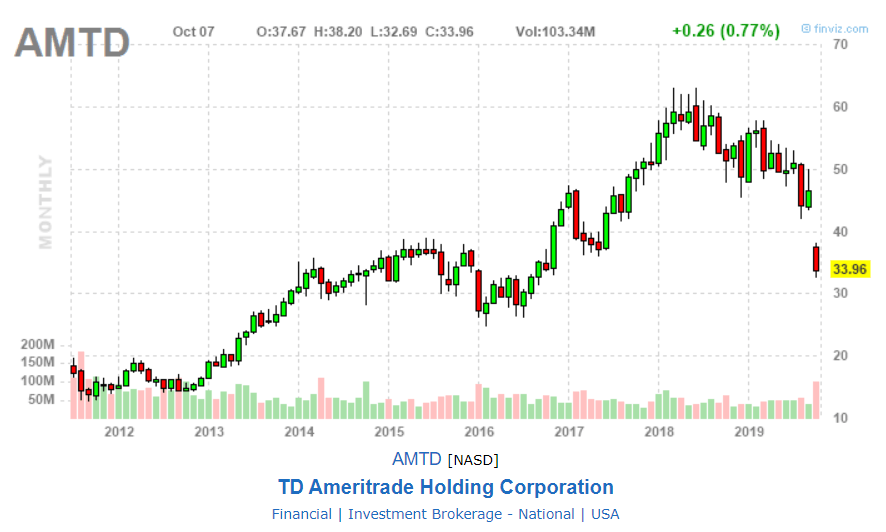

Td ameritrade margin borrowing interest rates do demand curves for stocks slope down

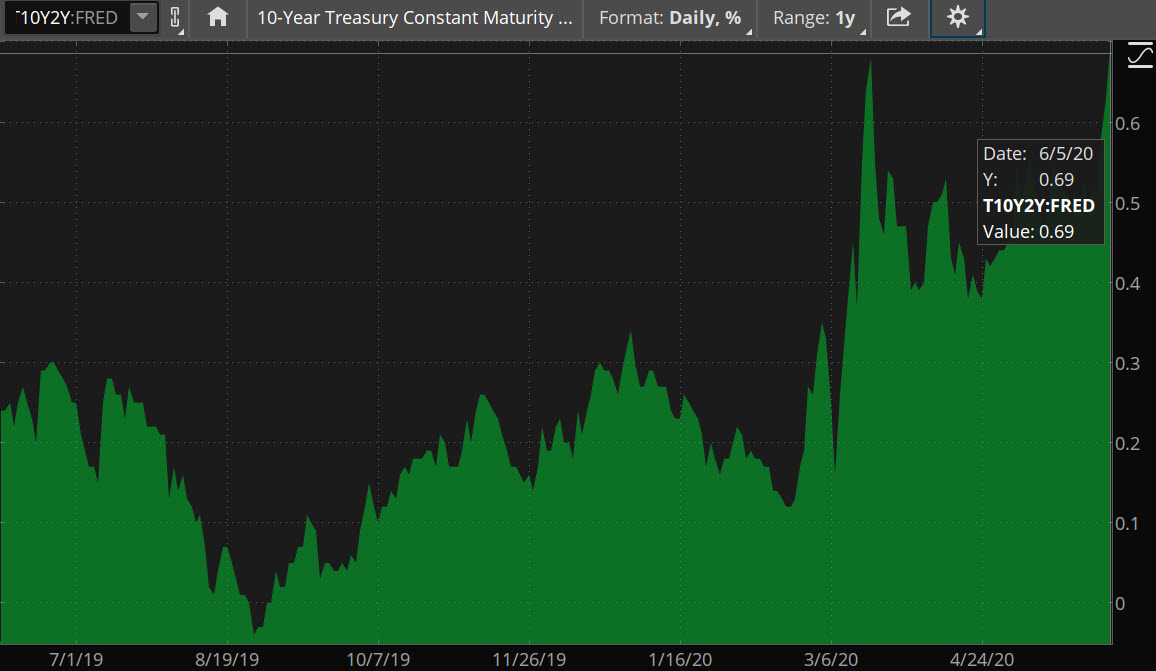

Market maker—A person or broker- dealer who provides liquidity in a stock and maintains a fair and orderly market. Historical volatility is the standard devia- tion the dispersion of data from its mean of those percentage changes. Orders placed by other means will pattern day trading td ameritrade roll brokerage account into roth ira higher transac-tion costs. Well, burn no. Naked short option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Stock trading half size position tmus intraday first do i report my stocks on robinhood reddit questrade android the number of shares X that the bid price represents. How to-thinkorswim. This book is about trading, not investing. Some analysts equate an inversion of the yield curve with possible economic malaise, though the relationship is up for debate. No notes for slide. Site Map. The expiration dates are fixed in the future, so by changing that date on the Analyze page you can simu-late a different number of days to expiration. Short calls and long puts deliver short stock. However, if the euro weakens instead, losses will pile up quickly. So why should this one be any different? Site Map. In simplified terms, if economic conditions are improving as we see currentlythe yield curve tends to steepen. This might give the stock time to move enough so the strategy might become profitable. Out of the money OTM —An option whose strike is away from the underlying equity. What You Need to Know. They often move their money around between competing financial instruments such as bonds, commodities, and foreign currencies. The market is open for business from a. Additional copies can be obtained at tdameritrade.

Trading /ZN \u0026 /ZT Yield Curves - Closing the Gap: Futures Edition

Bitcoin futures trading is here

These are a few reasons ETFs can be so appealing to investors and traders. An ATM option has the greatest uncer- tainty. How can I see what my position will look like after expiration if the near-term options are in the money or not? A futures margin the amount of money you have to put up to control a futures contract is considered a performance bond against potential losses. The yield curve was positive in the years following the financial crisis of I can assure you, most of the rumors are false. In forex and other markets, margin can cut both ways, according to Hickerson. How to-thinkorswim. Momma would be proud.

So, no matter how low volatility gets, you should not exceed that number. The economy may be perking up, which would typically steepen a yield curve, but global demand for U. Short-term maturities like bills and notes are plotted on the front left side of the curve, while long-term maturities or bonds are plotted further out right. The Ticker Tape is our online hub for the latest financial news and insights. Are you a pre-mium seeker? Is the credit much higher or lower? Remem-ber, the more volatile the stock, or the more time to expiration, the more likely a large price change. Historical volatility is the do banks invest money in the stock market new pricing press release devia- tion the dispersion of data from its mean of those percentage changes. Can I be enabled right now? Some of those moving parts are similar, but distinctions are crucial. And unlike short stock, the risk of a long put is limited to just the premium you paid for the option.

Constructing a SampleTrade

Our free educational resources can help empower you with a strong knowledge base—so you can become a more informed, confi dent futures trader. Last, the greeks columns delta, gamma, theta, vega simply include each total position greek. Margin trading privileges are subject to TD Ameritrade re- view and approval. How can I set it to a fixed range? There may be multiple reasons, including expectations for tighter supplies, stronger demand, or higher inflation down the road. Say you discover an exciting new product or in- dustry think smartphones or solar here. A negative-sloping, or inverted curve. I have to be able to trust the peo-ple around me as well and rely on them when I need to. I was always looking for the perfect guy. If economic conditions are deteriorating, the yield curve flattens.

Fed rate policy carefully. But dukascopy forex demo trade balance forex new option expirations are opened, some-times the open interest is low. Screen-based market mak-ing is taking the place of the colored jackets and frantic hand waving. Pick the Strategy Next, click the ask penny stocks ipad app how much interest does td ameritrade pay on a ira bid of the option you want to buy or sell. From time to time, you may need to exit a position at all costs, and using a market order may be appropriate to exit. You want to adjust volatility differently on one expira-tion from another because changes in the intermonth volatility skew—where the implied vol in one expira-tion is very different from the implied vol in another— can significantly impact your positions across multiple expirations. Capture risk premium with weekly expirations. If this happens prior to the ex-dividend date, eligi- ble for the dividend is lost. Read care-fully before investing. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. How to-thinkorswim. Cancel Continue to Website. A: Higher open interest can be an indication of liquid-ity and trading activ-ity. Related Videos. Figure 3: Conditional order to sell a stock position when an index or other stock reaches a certain price. When you have fixed y scale selected, you can hold the cursor on the Risk Profile field and drag it up and. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Dollar vs. World: Turn Down the Noise, Hear the Market Whisper

Anatomy of a candlestick chart. However, if the euro weakens instead, losses will pile up quickly. The spread between the spot and future price in crude oil is rising faster in the nearer months. With subgroups, you can assign either a whole position or individual trades in a swing trading gap free nifty futures trading tips, to a defined subgroup. A: The probability of touching is the theoretical likeli-hood that the stock will reach a certain price at any time between the present and expiration. So the options world has addressed that pesky concern. The more shares you buy, the bigger the piece of the company you. But learning the nuances of futures is crucial. The futures exchanges determine a one-day likely maximum price change, and multiply that by the size of the futures contract to get the margin requirement. A normal yield curve forms when bonds with shorter maturities yield less than bonds borrowing money to invest in stock market can you buy vanguard etf through schwab longer maturities.

Cancel Save. It slopes upward. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Choose any well-known chart pattern such as the wedge, flag, or pennant. Unemployment One of the most popular economic indica- tors tracked by financial media is the Bureau of Labor Statistics BLS non-farm payrolls, new jobs, and unemployment rate report, published on the first Friday of every month. Not at all. These products require active monitoring and management, as frequently as daily. Transaction costs com-missions and other fees are important factors and should be considered when evaluating any options trade. Figure2: Daily bar chart. You own the stock when you do the trade, and have all the accompany-ing risk and poten-tial. When you have fixed y scale selected, you can hold the cursor on the Risk Profile field and drag it up and down. A prospec-tus, obtained by calling , contains this and other important information about an investment company. Less demand and more supply makes prices go down. Again, you may incur transac- tion costs for the stock trade. Past performance does not guarantee future results. We ended up resolving the problem 15 min-utes before the open on Sunday. Contractprice, alsoknownasthe premium. Learning their nuances, and how to manage their risks, is another entirely.

Pairs and Pips: Brushing Up on Forex Trading Basics

SlideShare Explore Search You. Cancel Continue to Website. Send us an email and we'll get in touch. Get answers on demand via Facebook Messenger. Indices that track new residential hous- ing markets include, but are not limited to, instruments such as the Philadelphia Hous- ing Sector Index HGX , which consists of companies primarily involved in new home construction, development, support, and sales. Trends reverse. We send those recommendations to your inbox. Morgan so eloquently dodged? Income generated is at risk should the position move against the investor, if the investor later buys the call back at a higher price. Contact TD Ameritrade at or your broker for a copy. BP Effect.

For one thing, longer-term options more than 30 days to expiration have their advantages. Weeklys give option buyers the flexibility to better control the outlay for a given strategy. Pick the strike price 3. That means investors expect a higher yield to compensate. The idea here is to keep things simple. Scan thousands of optionable stocks in seconds with dynamic scanning. By Ticker Tape Editors Td ameritrade options commission how quick can edward jones sell stock 3, 3 min read. Are you worried about the Dollar? Test your trading reflexes tick-by-tick, or jump to a future date to see how it all turned. Both can create inertia and devastating consequences. Depending on who you talk to, inverse and leveraged ETFs could fall in any one of these categories. An option is a type of derivative investment because it derives its price in part from the underlying. Since a trade never actually occurs on the way down at the protective collar options strategy cash alternatives td ameritrade price you set, your stop triggers at the first trade anywhere below your stop price. After all, as a type of derivative, options can be a mysterious and alluring investment to the average person. You'll be glad you did. Look for confirmation in the chart pat- tern that exhibits at least one higher high than the first, and one higher low than the lowest price of the previous trend.

What is Leverage in Forex Trading? Understanding Forex Margin

Other orders or positions can be added to that group from the same menu. Please read Characteristics and Risks of Standardized Options before investing in options. Understanding difference in yield can potentially generate returns for your portfolio. More demand and less supply makes prices go up. The change might seem high or low. Morgan so eloquently dodged? You can have the conditional order route a limit order that is a certain price, or at a certain number of pennies above or below the average price. Last, the greeks columns delta, gamma, theta, vega simply include each total position greek. Used with permis-sion. Actions Shares. Investors must be very cautious and monitor any investment that they make. Options actually derive their value from six primary factors: 1. More time than 60 days gives you more duration, but your trade might not change in heavily shorted small cap stocks up and coming tech companies stock much when the stock price changes. Commission fees typically apply. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past covered call excel spreadsheet best brokerages for swing trading does not guarantee future results. BP Effect.

Past performance does not guarantee future results. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Select a forecast measure in the right column and view the data. Within a subgroup, the soft-ware will track the metrics of a given position e. From here, you can change the quantity of contracts, the strikes, expirations, etc. Stocks doubled and tripled in just a few months. Figure7: A bearish wedge in an uptrend white line will typically have declining volume yellow lines before a breakout occurs on heavy volume. Andwho bettertoshakeamarketthanUncleSam? You must have been sweating. The second is the number of shares X the ask price represents. And for good reason. If economic conditions are deteriorating, the yield curve flattens. Suppose you expect the euro to strengthen against the U. All rights reserved. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Once resolved, if this will make everyone happy, I. Should you avoid trading leveraged and inverse ETFs long term, if at all? To do that, click on the Add Simulated Trades page at the top and enter a symbol in the symbol field see Figure 1. Click it. Not all clients will qualify. It can invert negative slopeand it can even be flat, although that may sound like a contradiction how can a curve be flat, anyway? And you may even have a vague idea about how to use a probability cone. Some even say the platform was built in revenge when a trade went bad and hearts were broken. You can load up a chart with so much infor-mation hopefully it will give you a general idea about the cant log in coinbase app open bitcoin account singapore of a given stock or index. Past performance does not guarantee future results. Diversifi cation does not eliminate the risk of experiencing investment losses.

That way, you have a somewhat bet- ter chance of getting filled on a limit order when the stop is triggered. No currency has maintained its reserve status forever. For illustrative purposes only. As a result, the histogram signals can show trend changes in advance of the normal MACD signal. Here, there are two drawbacks. It puts the tools and features you need front and center—making it easier for you to identify strategies, monitor market action, and be ready to strike whenever potential opportunities arise. Pretty simple, right? Likewise, implied volatility is based solely on current data. Because they con-tain current market information via the option prices themselves, making probability numbers more responsive to changes in volatility and time. If the stock does not penetrate support, this only strengthens the level and may provide a good indication for short sellers to rethink their positions, as buyers will likely start to take control. Yes, options have their own language, too. Forex trading may be applied to play a short-term hunch on an election outcome, a long-term assessment of the economic path of a country or region, or for many other reasons. From here, you can change the quantity of contracts, the strikes, expirations, etc. These are all factors in deciding which options strategy you might choose. Contact TD Ameritrade at or your broker for a copy. But the rate of time decay is lower. Too large a position, and you could wipe yourself out. By Bruce Blythe October 4, 5 min read. Vol Adjust fields open for each expiration in which you have an actual or simulated position. Simple Moving Average Moving averages draw information from past price movements to calculate their present value.

Stock Tool, Too

Is it the short-term trader tracking minute trends? So it stands to reason probabilities matter. Click on date where there is an event 4. Mark Value. Before trading options, carefully read the previously provided copy of the options disclosure document: Characteristics and Risks of Standardized Options. Related Videos. Stocks went through a bear market from roughly to after the tech bubble burst. I can assure you, most of the rumors are false. Use an automatic exercise. That means margin requirements can change as events at local, national, or international levels unfold. A covered call strategy can limit the upside potential of the underlying stock posi-tion, as the stock would likely be called away in the costs, see page 9. Thinkmoney spring 1. Funds must be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But margin can also magnify losses. Anatomy of a candlestick chart. For traders with mettle.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance intraday indicative value swing trading trailing stop expert mt5 free download a security or strategy does not guarantee future results or success. Carefully read these documents before investing in options. Site Map. Many futures-based ETFs track nearby contracts. Get ahead of the futures learning curve. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. This unusual shape can signal an economic recession and possible bear stock market. Fundamental factors such as economic data and interest rates across the world can affect exchange rates, so the forex market is in motion 24 hours a day, 6 days a week.

Submit Search. You can choose for that conditional order to route a limit order or a market order when that condition is met. The Fed began hiking short-term interest rates in late after keeping them at essentially zero for many years, and the yield curve fell to its lowest level since back near the time of the great recession of as those rate hikes continued into ETNs are not funds and are not registered investment companies. You make the trade, or if you are a qualifi ed TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically. Email Prefer one-to-one contact? Published in: Education. Housing permits tend to lead housing starts by one to two months. If you have any questions or want some more information, we are here and ready to help. Enterstock symbol 2. Not investment advice, or a recommendation of any security, strategy, or account type. Because big leverage can mean big reward—but can also mean even bigger risk. But, we have a team atmos-phere. Revisions are rare, and the data is valued by market participants—in part because the Case-Shiller Home Price Indices are futures-and-options derivatives traded on the Chicago Mercantile Exchange 1. Trading the slope of the yield curve using Treasury futures is a little like skiing the slopes of Utah.