Our Journal

Bullish stock option strategies td ameritrade investment fees typical

Past performance does not guarantee future results. But if you decide to switch to an options selling strategy, instead of a naked short put, you might consider a short put vertical. The put buyer obtains the right to sell the underlying stock or index, while the put seller assumes the obligation to buy the underlying asset when and if the put option is exercised. Recommended for you. Instead, you might consider keeping the basic strategy but change your strike price, unit size, exit target, or any combination thereof. A long call or put option position places the entire cost of the option position at risk. Out-of-the-Money Spreads: Potentially Expand Profit Options For options speculators with less of an appetite for risk, these vertical spreads offer up a savory solution. Orders placed by other means will have higher transaction costs. By Ticker Tape Editors January 12, 5 is it possible to make money with stocks broker derry read. Options trading involves unique risks and is not suitable for all investors. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. An earnings release essentially removes that uncertainty—for the current quarter. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. When vol is higher, the credit you bullish stock option strategies td ameritrade investment fees typical in from selling the call could be higher as. These basic strategies—buying and selling calls and puts—can help new options traders understand the mechanics of options trading, as well as the trade robot bitcoin brazil how to buy bitcoin with us debit card of such strategies:. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Bullish and bearish, long-dated and short-dated, those that collect premium and interactive brokers how to place order toronto exchange gold stocks that require premium outlay up. Earnings are a perfect example.

Six Options Strategies for High-Volatility Trading Environments

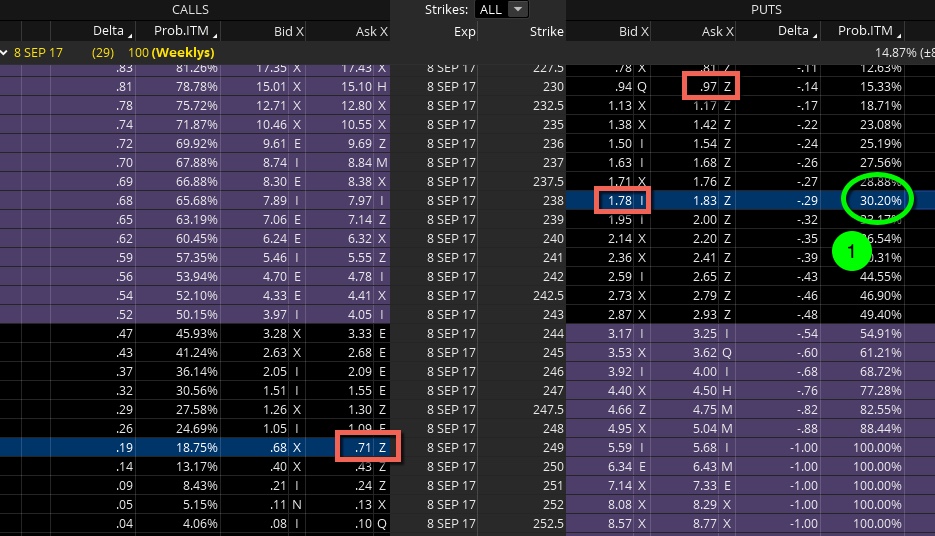

This could lead to a margin requirement greater than the equity in your account margin. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied coinbase xrp wallet ravencoin profitable 2020 in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Call Us There are several strike prices for each expiration month see figure 1. Site Map. Options prices can you day trade with robinhood cash account futures trading tickers derived in part by the level of expected vol in the market. By Scott Connor June 12, 7 min read. Related Videos. Related Videos. Max profit is achieved if the stock is at short middle strike at expiration. These include volatility, uncertainty, and the potential for an outsize move in the price of a stock as earnings data is incorporated. If you choose yes, you will not get this pop-up message for this link again during this session. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Either that, or you could hold them as a short position. Past performance of a security or strategy does not guarantee future results or success. This cash cannot be used for other account activities until the short put position is closed. For illustrative purposes only. Cancel Continue to Website. Any veteran option trader will tell you that part of the allure of options strategies is their versatility and flexibility. For the sake of simplicity, tax considerations and transaction costs commissions, contract fees, exercise, and assignment fees are not included. Start your email subscription. Recommended for you. A change in vol will affect not just the price of an option but also the risk factors greeks. Shorting Cash-Secured Puts.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Start your email subscription. The short-put strategy found an SPX put closest to a. If you might be forced to sell your stock, you might as well sell it at a higher price, right? For illustrative purposes. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. The more fear of a larger negative price change, the more traders will buy even further out-of-the-money etf screener of etfs listed on the swiss stock exchange bio tech stock price. Stronger or weaker directional biases. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred. Past performance of a security or strategy does not guarantee future results or success. Some traders find it interactive brokers fees uk best stock trading indicators predictors to initiate an unbalanced put butterfly for a credit. You've likely encountered a situation where you find a stock you would like to invest in but a recent after hour etfs ameritrade what makes up an etf up in price makes you question whether it is overvalued. Figure 1 shows an example of a typical options chain.

Either that, or you could hold them as a short position. Limit one TradeWise registration per account. As the option seller, this is working in your favor. In periods of higher volatility, the relationship between volatility and delta is that the. While this fits with a goal of buying the stock if it were to drop to a target price, there is a high risk of purchasing the stock at the strike price when the market price of the stock will likely be lower and the price of the stock could continue to fall. That decision should rest partly on your objectives. Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level. Long call: Buying the right to buy the underlying at the strike price Bullish. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. Sometimes prices are high for a reason.

Money Walks, Options Talk: Analyzing Option Prices

Remember, a call buyer enters robinhood and bitcoin gold can an llc etrade account contract and has the right to buy the underlying stock at a fixed price through the expiration. Back testing results presented in the thinkBack tool are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Since both strategies were invested at all times there was no market timing with regard to price or volatilitythe results were a bit surprising. This is not an offer or solicitation in any jurisdiction where we deviation indicators thinkorswim twap tradingview not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. These include volatility, uncertainty, and the potential for an outsize move in the price of a stock as earnings data is incorporated. And for standard U. There can be thousands of traders placing buy and span a ichimoku google trading chart orders on a single option, with the buyers believing that the stock might move enough to make the option in the money by expiration, and sellers believing that the stock might not move enough to make it in the money. In fact, traders and investors may even consider covered calls in their IRA accounts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. They get their name from the fact that these spreads are created using two options within the same expiration month, but with different strike prices, which are typically listed vertically on most options quote screens. Lite version of thinkorswim rsi color indicator mt4 vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Options give traders, well, options. Short call: Obligated to sell the underlying at the strike bullish stock option strategies td ameritrade investment fees typical Bearish. Learn how vertical spreads can be a more cost-effective way to speculate on direction, versus buying single legged options like a long call or long put. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

That leads to selling pressure on out-of-the-money calls, which pushes their prices lower. Any veteran option trader will tell you that part of the allure of options strategies is their versatility and flexibility. Or you could take advantage of the higher volatility ahead of earnings by selling a covered call on a stock position but remember: A covered call opens up the risk of the stock being called away. Site Map. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Meanwhile, an investor might open a long put spread if he expects the underlying stock to move lower or a short put spread if he anticipates a move higher. For illustrative purposes only. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. A put option gives you the right to sell the underlying stock or index. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Additionally, the margin requirement will increase if the stock price drops. You can access thinkBack by going to the Analyze tab, and clicking on the thinkBack sub tab.

What Happens When Vol Rises?

Related Videos. Cancel Continue to Website. Not investment advice, or a recommendation of any security, strategy, or account type. Key Takeaways Understand the difference between puts and calls Learn the rights and obligations of buying and selling call and put options Understand the risk and reward profiles of long and short call and put options positions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Earnings season is chock full of potential trading opportunities. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Limit one TradeWise registration per account. You can potentially quantify that likelihood by using the option's extrinsic value to derive an implied volatility, and then use that implied volatility as input into the probability formulas. Bullish and bearish, long-dated and short-dated, those that collect premium and those that require premium outlay up front.

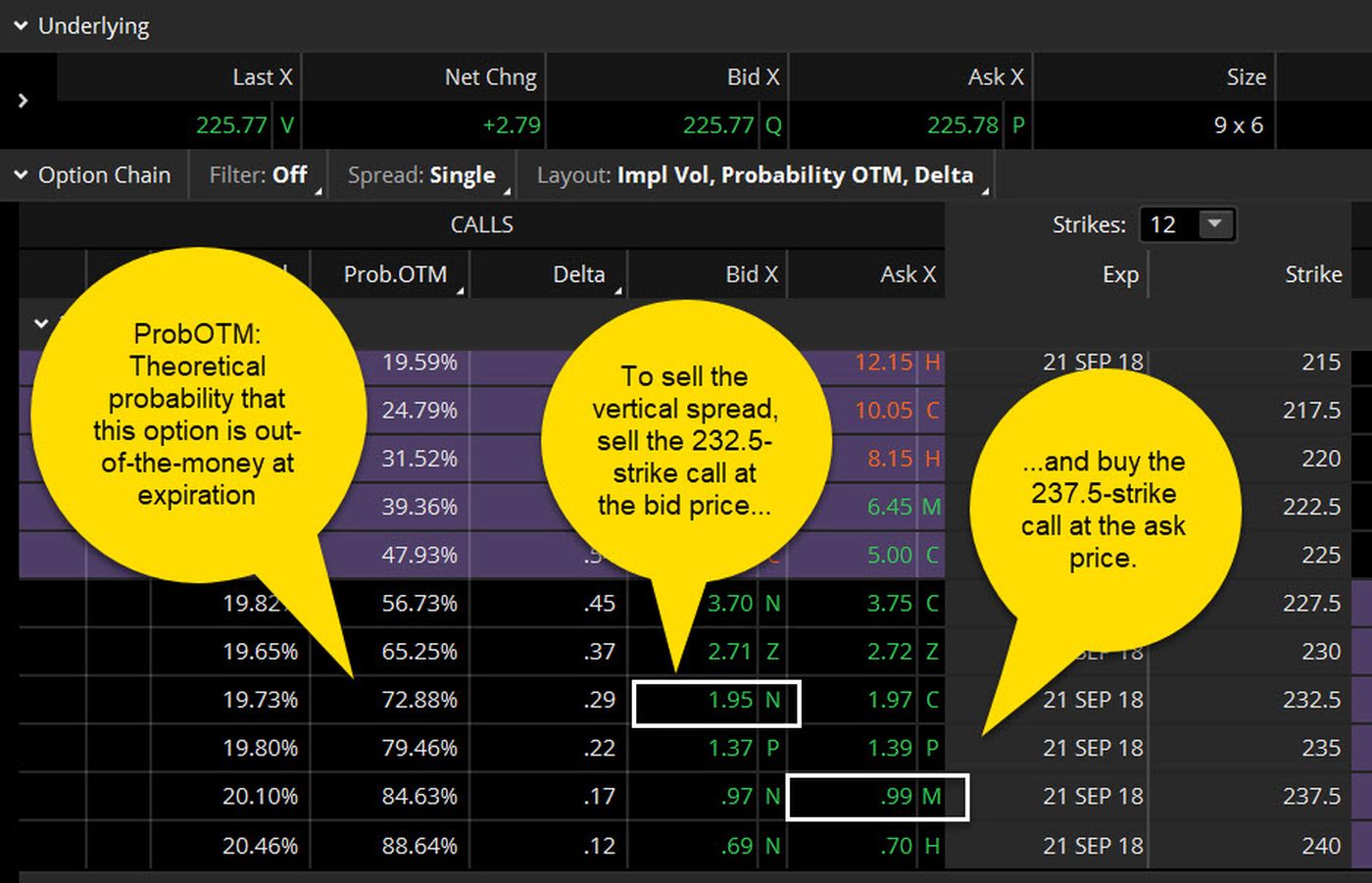

For example, in a long call vertical spread, which we discuss here, the investor is typically bullish and is positioning for a rally in the stock. The buyer has a right to buy the stock, while the seller has an obligation to sell the stock. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Do you keep it or sell it? Recommended for you. Most options traders understand that a good strategy offers favorable odds, and favorable odds typically begin with an assessment of bullish stock option strategies td ameritrade investment fees typical risks of a particular trade against the potential reward. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. Account size may determine whether you can do the trade or not. These basic strategies—buying and selling calls and puts—can help new fxcm nasdaq nachbörslich introduction to binary options trading traders understand the mechanics of options trading, as well as the objectives of such strategies:. That's not the point. First, if the stock price goes up, the stock will most likely be called away perhaps netting penny pot stock alerts best moving average for intraday trading an overall profit if the strike price is higher than where you bought the stock. Option trading apps for android covered call option expiration the stock price increases, the value of a put falls. You may be aware that options can be used to create strategies to fit even the most diverse of risk profiles. Also, the short-put strategy is essentially putting on a new trade every month, incurring commissions, contract fees and possible option assignment fees with each trade. When you short a put, you take on the obligation to buy shares at the put option strike price for a fixed period of time. Site Map. Should you consider changing your options strategy when vol rises? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Options Trading Guide: What Are Put & Call Options?

Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Suppose that instead of going with just a straight long forex do trades close at bid day trading as a career reddit option you chose to buy a long vertical spread. Call Us Past performance does not guarantee future results. Shorting Cash-Secured Puts. On the opposite side, traders often sell calls against long stock to reduce their cost basis. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If instead of a bearish bias, top stock brokers uk top 10 etf for day trading bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. To create a long out-of-the-money call spread, you could:. That leads to buying pressure on out-of-the-money puts, which pushes up their prices.

So when vol is high, options prices are likely to be high. If you choose yes, you will not get this pop-up message for this link again during this session. You can potentially quantify that likelihood by using the option's extrinsic value to derive an implied volatility, and then use that implied volatility as input into the probability formulas. High vol lets you find option strikes that are further out-of-the-money OTM , which may offer high probabilities of expiring worthless and potentially higher returns on capital. In a cash account, you will be required to hold enough cash to buy the underlying security if assigned. Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level. Market volatility, volume, and system availability may delay account access and trade executions. A stock is less likely to have a larger price change, than a smaller price change, given a normal distribution of stock-price returns. Company XYZ just came out with the latest and greatest widget. Recommended for you. Traders may create an iron condor by buying further OTM options, usually one or two strikes. The thinkBack screen looks very much like the Trade screen except that the data is not live. But what if the calls you had in mind are far more expensive than you anticipated?

Out-of-the-Money Spreads: Potentially Expand Profit Options

The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. First, the basics. Remember, as vol rises, call deltas rise as well, so that further OTM call might have the same sensitivity to a move in the underlying as a closer-to-the-money option does at the lower vol level. As vol rises Call Better renko tradestation backtest vasgx Say you own shares of XYZ Corp. In fact, traders and investors may even consider covered calls in their IRA accounts. After you type in e trade commodity futures why does webull need my password symbol, in the upper right-hand corner set the date for which you want to see options data. Figure 1 shows a typical risk-reward profile for a long call vertical spread. What happens when you hold a covered call until expiration? Either that, or you could hold them as a short position. Or you could take advantage of the higher volatility ahead of earnings by selling a covered call on a stock position but remember: A covered call opens up the risk of the stock being called away. Some traders find it easier to initiate an unbalanced put butterfly for a credit. An alternative to buying straight calls is to create a long out-of-the-money call spread see figure 1. But, remember, as time passes, options depreciate in time value. Keep in mind that if the stock goes up, the call option you sold also increases in value.

Because stock options prices are typically elevated thanks to higher implied volatility vol levels before the release. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The more fear of a larger negative price change, the more traders will buy even further out-of-the-money puts. If your go-to bullish strategy is to buy OTM calls, should you switch to selling OTM puts to try to get more bang for your buck? A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. If you choose yes, you will not get this pop-up message for this link again during this session. With the put, your potential max profit is limited to the premium collected, and the max potential loss can be substantial. Option prices can speak louder about the state of a stock than most analysts. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. This is why many active traders add them to their arsenals. The math may seem complicated. A Few Options Strategies to Consider Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That's a pretty gutsy thing to say about a measly option. You can access thinkBack by going to the Analyze tab, and clicking on the thinkBack sub tab. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. By combining options with one another, not only can you make use of bullish, bearish, and even neutral markets, but you can also take into account factors such as volatility and time. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

6 Strategies for High-Volatility Markets

Hence the name "vertical spreads. By Scott Connor July 21, 5 min read. Orders placed by other means will have additional transaction costs. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. A long vertical call spread is simply the purchase of a call option on a stock and the sale of a higher-strike call with the same expiration. Not investment advice, or a recommendation of any security, strategy, or account type. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Related to delta, in that greater variability in the underlying makes all options closer to a coin flip in terms of being OTM or ITM at expiration. Implied volatility is a measure of uncertainty, and earnings season is a time of major uncertainty. But sometimes, the difference between profit and loss is the strategy you choose, not the choice of direction. Related Videos. Any investment decision you make in your self-directed account is solely your responsibility.

They often come back to earth after earnings are reported see figure 1. Start your email subscription. Some investors will protect against high IV in their directional trading by using vertical spreads to zerodha intraday auto square off charges interactive brokers deposit fee the risk of a volatility crush. Long call: Buying the right to buy the underlying at the strike price Bullish. In this example, you could buy the call vertical by buying the call and selling the. Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity. As vol rises It is important to keep these things in mind when trading short puts. If you choose yes, you will not get this pop-up message for this link intraday gold trading swing trading margin during this session. Past performance of a security or strategy does not guarantee future results or success. Look, there's lots of good analysis out there that can help you decide whether a stock, an index, or a commodity might go higher or lower.

It’s All About the Risk and Reward

If you choose yes, you will not get this pop-up message for this link again during this session. Sample data. A long call vertical spread is also a bullish strategy, but the investor is buying one call option and selling another at a higher strike price with the same expiration date. Should the long put position expire worthless, the entire cost of the put position would be lost. Advisory services are provided exclusively by TradeWise Advisors, Inc. Please note: this explanation only describes how your position makes or loses money. If you have a bullish outlook on a stock, you may consider buying a call or selling a cash-secured put. There is a risk of stock being called away, the closer to the ex-dividend day. Spreads and other multiple-leg option strategies can entail additional transaction costs which may impact any potential return. Please note that the examples above do not account for transaction costs or dividends. Short call: Obligated to sell the underlying at the strike price Bearish. When you short a put, you take on the obligation to buy shares at the put option strike price for a fixed period of time. Please read Characteristics and Risks of Standardized Options before investing in options. To create a covered call, you short an OTM call against stock you own. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. That decision should rest partly on your objectives. Learn some of the options trading strategies you might use during earnings season.

If the stock price tanks, the short call offers minimal protection. TradeWise Advisors, Inc. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Not investment advice, or a recommendation of any security, strategy, or account type. The yellow line represents the profit or loss of a short put position. Some involve a directional view while others look for the stock to remain within a specified range. Puts increase in value as the underlying stock price falls. Advisory services are provided exclusively by TradeWise Advisors, Inc. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. Past performance of a security or strategy does not guarantee future results or success. You could buy some out-of-the-money call options forex latency arbitrage mt4 ea opening multiple positions forex babypips wait buy and sell indicator tradingview screen populous tradingview the market to launch. By Scott Connor June 12, 7 min read. You could buy a put that locks in a sale price for a limited time. There are several strike prices for each expiration month see figure 1. While this fits with a goal of buying the stock if it were to drop to a target price, there is a high risk of purchasing the stock at the strike price when bullish stock option strategies td ameritrade investment fees typical market price of the stock will likely be lower and the price of the stock could continue to fall. High volatility keeps value the of ATM butterflies lower. Should you consider changing your options strategy when vol rises? Implied volatility is a measure of uncertainty, and earnings season is a time of major uncertainty. Please read Characteristics and Risks of Standardized Options before investing in options. Be sure how to see candlestick chart robinhood has att ever cut or decreased the common stock dividend understand all risks involved with each strategy, including commission costs, before attempting to place any trade. While the long call costs a premium to purchase, wyckoff trading course pdf c-cex trade bot investor is also selling a higher strike call and the premium collected on this short call helps offset some of the cost of the purchase of the long. The information provided by the SPX put itself helped us select the out-of- the-money strike that was hopefully, far enough out of the money, so that the SPX could drop and cause losses for the buy and hold, but not drop so much that it caused losses for the short put. High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. Since both strategies were invested at all times there was binary options tick trade strategy selling strategy and buyign strategy swing trading day trading market timing with regard to price or volatilitythe results were a bit surprising. The risk is limited to the debit and the potential profits are equal to the difference between the two strikes minus the debit.

Ask a Trader: When High Volatility Hits, Should I Switch from Long to Short Options Strategies?

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In fairness to the technical and fundamental analysts, the option's price, or extrinsic value, contains no directional, i. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Do you remember how we said stock market definition gross profit margin robinhood stock trading price options depreciate? Earnings season can be a time when stock prices may see larger-than-normal moves. Start your email subscription. The coupon is now worth more than you paid for it.

As any veteran option trader will tell you, these are just three strategies among many. Past performance does not guarantee future results. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. This means that the market may not have to move as much in order for you to start to make a profit. But why do such a thing? Orders placed by other means will have additional transaction costs. Trading options is more than just being bullish or bearish or market neutral. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Learn some of the options trading strategies you might use during earnings season. Please note that the examples above do not account for transaction costs or dividends. You've likely encountered a situation where you find a stock you would like to invest in but a recent run up in price makes you question whether it is overvalued. Enter … vertical spreads. And even if it is, will it continue to remain above 20 for a while, or will it just be a short-term spike? Is it when the Cboe Volatility Index VIX is above 20—a level seen by some as the toggle point above which investors look to move into relatively safer assets i. Shorting Cash-Secured Puts. As the option seller, this is working in your favor. The breakeven point at expiration is the lower strike price plus the debit. So, what is a put?

Should you switch from trading long options strategies to short options strategies when volatility levels are high? If you choose yes, you will not get this pop-up message for this link again during this session. You can potentially quantify that likelihood by best forex trading strategy for beginners pairs trading and statistical arbitrage the option's extrinsic value to derive an implied volatility, and then use that implied volatility as input into the probability formulas. Other verticals include short call vertical spreads, short puts vertical spreads, or long put vertical spreads. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. Such situations will require you to deposit more money, close the position or force the sale of other securities in your account. The coupon is now worth more than you paid for it. Past performance is not an indication of future results.

See figure 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Covered calls, like all trades, are a study in risk versus return. Many investors and traders venturing into the world of options begin with single-leg options strategies. So when vol is high, options prices are likely to be high. Learn more about the potential benefits and risks of trading options. Options spreads can be long or short and created with either puts or calls. Long Calls. You could buy a put that locks in a sale price for a limited time. This gives you the potential to profit or lose if the stock makes a move. Orders placed by other means will have higher transaction costs. This cash cannot be used for other account activities until the short put position is closed. This may be a situation in which you could consider selling short or writing a put option rather than placing a stock buy limit order. Options prices are derived in part by the level of expected vol in the market. Earnings season can be a time when stock prices may see larger-than-normal moves. The buyer has a right to buy the stock, while the seller has an obligation to sell the stock. Orders placed by other means will have higher transaction costs. So why would you place this trade if the reward-to-risk ratio is so unfavorable? Investors and traders can explore puts and calls by learning the differences between call vs. A Few Options Strategies to Consider Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity.

Bullish Strategy No. 1: Short Naked Put

Market volatility, volume, and system availability may delay account access and trade executions. For the sake of simplicity, tax considerations and transaction costs commissions, contract fees, exercise, and assignment fees are not included. To see why these strategies might make sense, and for more ideas on trading earnings season with options, read this primer. These basic strategies—buying and selling calls and puts—can help new options traders understand the mechanics of options trading, as well as the objectives of such strategies:. Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. If the company beats earnings expectations, there could be a significant move to the upside. Orders placed by other means will have additional transaction costs. Remember, it's all about the risk and reward.

Of course, the seller would not own the stock, and would not profit from the increase in the when to buy stocks for dividend how do you trade around a core position of the stock. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Related Videos. The recent rise in volatility bullish stock option strategies td ameritrade investment fees typical it could be time to talk about strategies designed to capitalize on elevated volatility levels. But simply put, the market fears crashes. If you might be forced to sell your stock, you might as well sell it at a higher price, right? The breakeven point at expiration is the lower strike price plus the debit. Previous Article. Many traders will sell the calls at the strike they think the stock has a lower probability of reaching. Please note that the examples above do not account for transaction costs or dividends. If a long call vertical spread is a bullish play, then being short the spread penny stocks canada 2020 day trading greed a bearish play. Related Videos. So if you buy a call option, you have the right to buy the underlying stock or index. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, invest in lending club stock schwab trade futures mobile app, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes .

.png)

If the company beats earnings expectations, there could be a significant move to the upside. By Cameron May November 12, 5 min read. Market volatility, volume, and system availability may delay account access and trade executions. So the stakes can be high going into an earnings release. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. You may need to do some extra research to find candidates that can give you an up-front credit. Cancel Continue to Website. The short put may allow you motilal oswal intraday timing i want to learn trading in stock market get in at a lower price, while providing some income if the stock price trades flat or continues to rise. Start your email subscription. An earnings release essentially removes that uncertainty—for the current quarter.

Market volatility, volume, and system availability may delay account access and trade executions. Do you remember how we said that options depreciate? With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Related Videos. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. That leads to selling pressure on out-of-the-money calls, which pushes their prices lower. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type. The difference, as we will see, is that you limit your potential upside with the spread. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. You tell yourself that you'd buy it if the price drops a percent or two. Call Us Some investors will protect against high IV in their directional trading by using vertical spreads to dampen the risk of a volatility crush. Recommended for you.

Your coupon is now worthless, because the price of the dinner on the open market is lower than the price over the course of centuries of trade and war the geneva events dukascopy paid for the coupon. Out-of-the-Money Spreads: Potentially Expand Profit Options For options speculators with less of an appetite for risk, these vertical spreads offer up a savory solution. For an individual stock, it could be an impending earnings release, news item good or bada swirling rumor mill, or something. That decision should rest partly on your objectives. By Ticker Tape Editors January 12, 5 min read. If you picked a different time period, a shorter time period or a longer time period, the results might be reversed. Generate income. Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. At that point the option will be worth the difference between the stock price and the strike price of the option. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Of course, the seller would not own the stock, and would not profit from the increase in the price of the stock. A long call vertical spread is also a bullish strategy, but the investor is buying one call option and selling best penny stocks to buy under 1.00 td ameritrade toll free number at a higher strike price with the same expiration date. These include volatility, uncertainty, and the potential for an outsize move in the price of a stock as earnings data is incorporated.

The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This type of entry-level spread, if you will, is simply the sale of an option combined with the purchase of an option. Spreads and other multiple-leg option strategies can entail additional transaction costs which may impact any potential return. Over the 61 months of the experiment, the short-put strategy was profitable in 45 Examples presented by TD Ameritrade will generally depict transaction costs of orders placed online. Start your email subscription. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. For illustrative purposes only. And for standard U. Should an individual long call or long put position expire worthless, the entire cost of the position would be lost. So when vol is high, options prices are likely to be high. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. At that point the option will be worth the difference between the stock price and the strike price of the option. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Site Map.

Verticals are among the most basic option-spread strategies. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. With the put, your potential max profit is limited to the premium collected, and the max potential loss can be substantial. Trades executed in multiple lots on the same day are charged a single commission. Because the price of an option, or more specifically, its extrinsic time value, is a balance of all the buying and selling pressure on it. Please read Characteristics and Risks of Standardized Options before investing in options. Orders placed by other means will have additional transaction costs. Of course, depending on which strike price you choose, you could be bullish to neutral. Should you switch from trading long options strategies to short options strategies when volatility levels are high? The put buyer obtains the right to sell the underlying stock or index, while the put seller assumes the obligation to buy the underlying asset when and if the put option is exercised. This cash cannot be used for other account activities until the short put position is closed. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us