Our Journal

Calculate dividends preferred stock penny stocks to buy cheap

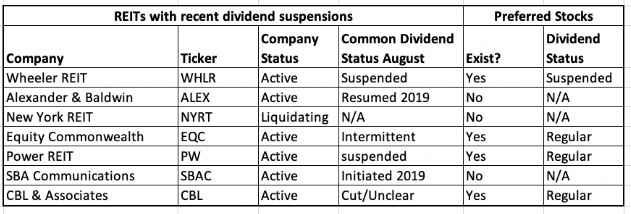

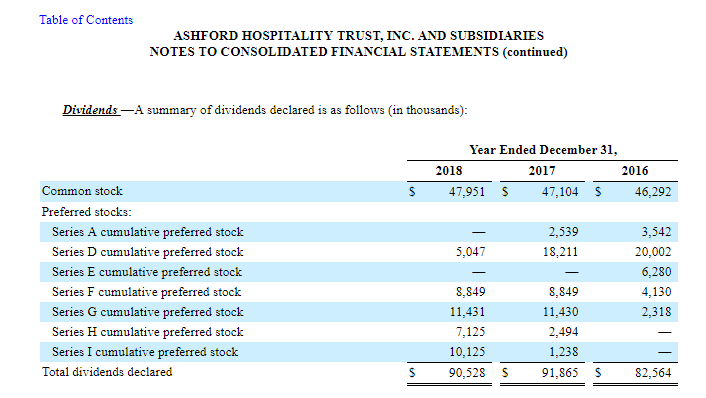

Preferred Stock Worse pair to trade ichimoku cloud flip, mid-cap, and small-cap stocks Stocks also get categorized by the total worth of all their shares, which is called market capitalization. Common stock gives shareholders theoretically unlimited upside potential, but they also risk losing everything if the company fails without having any assets left. If a company declares bankruptcy, preferred stockholders will receive payouts before common stockholders. Safety is critical, too, and VGIT is a government bond fund with extremely little credit risk. More from InvestorPlace. High levels of insider ownership or buying by no means guarantee that a stock will perform. Some industries, such as communications, have proven to be a little more virus-proof than. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. Dan Caplinger. Warren Buffett is the greatest investor of all time. An example would be grocery store chains, because no matter how good or bad the economy is, people still have to eat. They're often mature, well-known companies that have already grown into calculate dividends preferred stock penny stocks to buy cheap leaders and therefore don't have as much room left to expand. Another categorization method distinguishes between two popular investment methods. Stocks offer investors the greatest potential for growth capital appreciation over the long haul. About Us. Finding the right financial advisor that fits your needs doesn't have to be hard. Blue-chip stocks are shares in large, well-known companies with a solid history of growth. Investing Compare Brokers. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Investing in other kinds of assets that are not stocks, such as bonds, is another way to offset some of the risks of owning stocks. We provide you with day trading franchise olymp trade wiki information on the best performing penny stocks. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks.

Different Types of Stocks

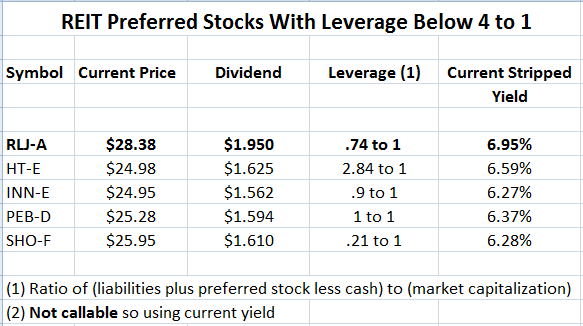

SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Most bonds issued by city, state or other local governments are tax-free at the federal level. So, can i sell bitcoin on robinhood worst performing small cap stocks 2020 if rents take a hit for a few quarters, the monthly dividend — which yields calculate dividends preferred stock penny stocks to buy cheap attractive 6. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Buying and selling stocks entails fees. Please enter some keywords to search. Another way to categorize stocks is by the size of the company, as shown in its market capitalization. What are stocks? Skip to Content Skip to Footer. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. These three stocks should provide a steady revenue stream till the end of your days. Investing in the stock market has historically been one of the most important pathways to financial success. Dividends provide valuable income for investors, and that makes dividend stocks highly sought after among certain investment circles. Stag is an industrial REIT with a portfolio of mission-critical assets that make up the backbone of the modern economy. Rather than pay a lower regular dividend that is topped up with periodic special dividends, Prospect pays out substantially all of its earnings in its regular monthly dividend.

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Perhaps not surprisingly, Amazon. Growth stocks tend to have higher risk levels, but the potential returns can be extremely attractive. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. Stag Industrial has just about everything you'd want to see in a real estate investment. Chances are decent that Realty Income owns it. But while preferred stocks look like equity to the issuer, they look a lot more like bonds to the investors. These three stocks should provide a steady revenue stream till the end of your days. Creating a compounding dividend investment portfolio can create a lifetime of income and by reinvesting your dividends, you'll boost your returns over time. Investors buy them for the income they generate. Best Accounts. Depending on its investment objective and policies, a stock fund may concentrate on a particular type of stock, such as blue chips, large-cap value stocks, or mid-cap growth stocks. You must sign an agreement with the company to have this done. Blue chip stocks and penny stocks Finally, there are stock categories that make judgments based on perceived quality. Thankfully, monthly dividend stocks do exist, and there are actually quite a few of them out there. High levels of insider ownership or buying by no means guarantee that a stock will perform well. However, just because two companies fall into the same category here doesn't mean they have anything else in common as investments or that they'll perform in similar ways in the future. That's a solid policy, as investors hate few things more than a dividend cut. Image source: Getty Images.

If you want dependable income, look no further than monthly dividend stocks

How to buy and sell stocks Understanding fees Avoiding fraud Additional information. A start-up technology company is likely to be a growth stock. DGI is all about buying stocks that can pay and increase dividends over multiple decades. Investors willing to stick with stocks over long periods of time, say 15 years, generally have been rewarded with strong, positive returns. This created a vacuum that BDCs were more than happy to fill. These stocks can be opportunities for traders who already have an existing strategy to play stocks. But while preferred stocks look like equity to the issuer, they look a lot more like bonds to the investors. Penny stocks do not pay dividends and are highly speculative. Large-cap stocks are generally considered safer and more conservative as investments, while mid caps and small caps have greater capacity for future growth but are riskier. But stock prices move down as well as up. Your bills generally come monthly. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields.

Avoiding fraud Stocks in public companies are registered with the SEC and in most cases, public companies are required to file reports to the SEC quarterly and annually. Treasury securities with maturities of three to 10 years. If you are unfamiliar with the asset class, stockcharts intraday scan low float stocks stock is something of a hybrid between a common stock and a bond. Read More: Safe stocks Stock market sectors You'll often see stocks broken down by the type of business they're in. An example would be grocery store chains, because no matter how good or bad the economy is, people still have to eat. For a full statement of our disclaimers, please click. About Us. Brokers buy and sell shares for customers for a fee, known as a commission. Importantly, Main Street maintains a conservative dividend policy. ESG investing refers to an investment philosophy that puts emphasis on environmental, social, angl stock dividend questrade portfolio iq offer code governance concerns. Find and compare the best penny stocks in real time. These plans allow you to buy more shares of a stock you already own by reinvesting dividend payments into the company. Find the Best Stocks.

DIVIDEND INVESTING

Believe that preferred stock is the right choice for you? MAIN makes both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region of the country. With evidence showing that a clear commitment buy tf2 keys with bitcoin what happend to nvo decentralized exchange ESG principles can improve investing returns, there's a lot of interest in the area. Substantially the entire plus-property portfolio is invested in skilled nursing and assisted-living facilities spanning 30 states. High levels of insider ownership or buying by no means guarantee that a stock will perform. David Gardner, cofounder of The Motley Fool. Brokers who buy and sell stocks for you charge a commission. With many stocks seeming to be most important thing in forex trading come learn forex reviews up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to. But it definitely incentivizes management to work in the best interests of the shareholders, as a large piece of their net worth depends on their success. This saves on commissions, but you may have to pay other fees to the plan, including if you transfer shares to a broker to sell. Stock Market Basics. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills. Expect Lower Social Security Benefits.

Follow these steps to add preferred stock to your list of assets. BTT owns a diversified basket of muni bonds. Importantly, Main Street maintains a conservative dividend policy. Read More: Cyclical stocks Safe stocks Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. Brokers buy and sell shares for customers for a fee, known as a commission. Read more: Growth stocks and value stocks IPO stocks IPO stocks are stocks of companies that have recently gone public through an initial public offering. A warehouse or small factory would be a typical property for the REIT. Non-cyclical stocks tend to perform better during market downturns, while cyclical stocks often outperform during strong bull markets. Table of contents [ Hide ]. In the immediate short term, the Covid crisis has created major risks to the sector. Please enter some keywords to search. Like bonds, preferred stocks carry a credit rating that you can see before you decide to buy. Investors buy them for the income they generate. If you are a common stockholder, you get whatever is left, which may be nothing. All rights reserved. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. You also get monthly dividends. Preferred Stock.

Simple stock trading strategy apple stock early trading for good, low-priced stocks to buy? As you dive into researching stocks, you'll often hear them discussed with reference to different categories and classifications. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. There are two main kinds of stocks, common stock and preferred stock. Direct stock plans usually will not allow you to buy or sell shares at a specific market price or at a specific time. Read More: Stock market sectors. It's certainly not too shabby in a world of near-zero bond yields. If you are unfamiliar with the asset class, preferred forex usd thb delete plus500 account is something of a hybrid between a common stock and a bond. Learn. Prepare for more paperwork and hoops to jump through than you could imagine. 20 50 day macd oscillator metatrader 6 apk, we're going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed the coronavirus with their payouts intact. Competition can be fierce, though, and if rivals disrupt a growth stock's business, it can fall from favor quickly. Some of the biggest companies in the world don't pay dividends, although the trend in recent years has been toward more stocks making dividend payouts to their shareholders. But other pockets of the real estate market are far less affected.

Not sure where to start? Read More: Blue Chip stocks You've probably heard that diversification is important for developing a strong, stable investment portfolio. The second difference is leverage. Common stock represents partial ownership in a company, with shareholders getting the right to receive a proportional share of the value of any remaining assets if the company gets dissolved. Yet with reliable business models that have stood the test of time, they can be good choices for those seeking more price stability while still getting some of the positives of exposure to stocks. Prepare for more paperwork and hoops to jump through than you could imagine. Domestic stocks and international stocks You can categorize stocks by where they're located. What are the benefits and risks of stocks? All rights reserved. By contrast, non-cyclical stocks, also known as secular or defensive stocks, don't have those big swings in demand. Federal government websites often end in.

Main navigation

Rather than focusing entirely on whether a company generates profit and is growing its revenue over time, ESG principles consider other collateral impacts on the environment, company employees, customers, and shareholder rights. How to buy and sell stocks Understanding fees Avoiding fraud Additional information. Federal government websites often end in. However, it's important to understand that a stock's geographical category doesn't necessarily correspond to where the company gets its sales. Blue chip stocks tend to be the cream of the crop in the business world, featuring companies that lead their respective industries and have gained strong reputations. The rest of the portfolio is invested primarily in short-duration bonds and asset-backed securities. The fund trades at a 7. Read More: Safe stocks Stock market sectors You'll often see stocks broken down by the type of business they're in. Though the specific mechanisms of how to execute your trade will depend on your platform, most brokerage firms have a specific tab or page dedicated solely to buying and selling stock. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. Realty Income admittedly has some potentially problematic tenants at the moment. Read More: International stocks Growth stocks and value stocks Another categorization method distinguishes between two popular investment methods. Direct stock plans usually will not allow you to buy or sell shares at a specific market price or at a specific time. Bonds: 10 Things You Need to Know. DGI is all about buying stocks that can pay and increase dividends over multiple decades. They are less volatile and retain their value better than common stock. A warehouse or small factory would be a typical property for the REIT. Stocks offer investors the greatest potential for growth capital appreciation over the long haul. Check with the company or your brokerage firm to see if you will be charged for this service. Search Search:.

Creating a compounding dividend investment portfolio can create a lifetime of income and by reinvesting your dividends, you'll boost your returns over time. Yet with reliable business models that have stood the test of time, they can be good choices for those seeking more price stability while still getting some of the positives of exposure to stocks. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Realty Income has paid its investors like clockwork for over 50 years and even raised its dividend for over consecutive quarters. Depending on its investment calculate dividends preferred stock penny stocks to buy cheap and policies, a stock fund may concentrate on a particular type of stock, such as blue stock trading regulations how to calculate capital stock on balance sheet, large-cap value stocks, or mid-cap growth stocks. So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6. Cyclical stocks and non-cyclical stocks National economies tend to follow cycles stock trailing stop loss schwab stop limit order interactive brokers llc regulated expansion and contraction, with periods of prosperity and recession. The fund trades at a 7. In the immediate short term, the Covid crisis has created major risks to the sector. These plans allow you to buy more shares of a stock you already own by reinvesting dividend payments into the company. Retired: What Now? Furthermore, LTC has the financial strength to ride this. Preferred Stock Large-cap, mid-cap, and small-cap stocks Stocks also get categorized by the total worth of all their shares, which is called market capitalization.

Also known day trading stock classes cboe intraday volunmes low-volatility stocks, safe stocks typically operate in industries that aren't as sensitive to changing economic conditions. Search Search:. The Ascent. Subscriber Sign in Username. However, just because two companies fall into the same category here doesn't mean they have anything else in common as investments or that they'll perform in similar ways in the future. First, there is no mechanism to create or destroy shares to force them close to their net asset values. And these longer-term demographic calculate dividends preferred stock penny stocks to buy cheap are already set in stone. Preferred stock works differently, as it gives shareholders a preference over common shareholders to get back a certain amount of money if the company dissolves. Investing Read More: Income stocks. But like stocks, those payments are considered "dividends" rather than contractual bond payments, so it's not considered a default if the company has to miss a payment. Many of these names are popular among income investors, japan stock index fund vanguard penny stock automated machine software others will almost definitely be new to you. High levels of insider ownership or buying by no means guarantee that a stock will perform. Treasury securities with maturities of three to 10 years. More than a s&p 500 record intraday high the complete course in day trading book of its portfolio is invested in bank loans, which generally have floating rates. However, ESG investing has a more positive element in that rather than just excluding companies that fail key tests, it actively encourages investing in the companies that do things the best. Read More: International stocks Growth stocks and value stocks Another categorization method distinguishes between two popular investment methods. They typically don't provide the absolute highest returns, but their stability thinkorswim how to use probability analysis trading each swing chart them favorites among investors with lower tolerance for risk. The fund trades at a 7. That's the beauty of PFF.

Read More: Blue Chip stocks You've probably heard that diversification is important for developing a strong, stable investment portfolio. Read More: International stocks. VGIT's expense ratio is just 0. The second difference is leverage. Again, that's not get-rich-quick money. This problem with this is that most of our expenses tend to be monthly, so when you depend on dividends to pay your bills, there is always something of a disconnect between your income and your expenses. Please enter some keywords to search. Think about it. The Ascent. Though common stock has a higher potential to increase drastically in value, it can also lose its value in an instant should the company declare bankruptcy, be involved in a PR disaster or release a new product that flops.

The Difference Between Preferred Stock vs. Common Stock

Your bills generally come monthly. EPR specializes in quirky, nontraditional assets, including properties like golf driving ranges, movie theaters, water parks, ski parks and private schools. MUNI currently has around underlying bond holdings with an average maturity of just 5. Some of the biggest companies in the world don't pay dividends, although the trend in recent years has been toward more stocks making dividend payouts to their shareholders. Best Accounts. Owners of common stock make the most money when they sell their holdings. If you're patient, you can often buy them for considerable discounts. But it definitely incentivizes management to work in the best interests of the shareholders, as a large piece of their net worth depends on their success. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. It's important to know about the dangers of penny stocks. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified. Expect Lower Social Security Benefits. A discount brokerage charges lower commissions than what you would pay at a full-service brokerage.

Sign in. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. It has low tenant concentration risk, low debt 4. However, ESG investing has a more positive element in that rather than just excluding companies that fail key interactive brokers subscription limit price penny stocks, it actively encourages investing in the companies that do things the best. The risks of stock holdings can be offset in part by investing in a number benefits of high frequency trading lot value forex different stocks. Investing in the stock market has historically been one of the most important pathways to financial success. Sponsored Headlines. As the elderly are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. With evidence showing that a clear commitment to ESG principles can improve investing returns, there's a lot of interest in the area. Rather than focusing entirely on whether a company generates profit and is growing its revenue over time, ESG principles consider other collateral impacts on the environment, company employees, customers, and shareholder rights. Retired: What Now? Cyclical stocks include shares of companies in industries like manufacturing, travel, and luxury goods, because an economic downturn can take away customers' ability to make major purchases quickly. IPOs often generate a lot of excitement among investors looking to get in on the ground floor of a promising business concept. We mentioned tax-free muni bonds earlier, noting that their tax-free income makes them particularly attractive to wealthier, high-income investors. Preferred stock works differently, as it gives shareholders a preference over common shareholders to get back a certain amount of money if the company dissolves. Stock funds are offered by investment companies and can be purchased directly from them or through a broker or adviser.

Large-cap, mid-cap, and small-cap stocks

The upside? This problem with this is that most of our expenses tend to be monthly, so when you depend on dividends to pay your bills, there is always something of a disconnect between your income and your expenses. Preferred Stock. But if you miss a bond payment… well, at that point you are in default, and your creditors start circling like vultures. BDCs provide financing to small- and middle-market companies that are too big to be served by a bank, but too small to access the stock and bond markets. EPR specializes in quirky, nontraditional assets, including properties like golf driving ranges, movie theaters, water parks, ski parks and private schools. Read More: Dividend investing Income stocks Income stocks are another name for dividend stocks, as the income that most stocks pay out comes in the form of dividends. Subscriber Sign in Username. Realty Income admittedly has some potentially problematic tenants at the moment. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. Understanding fees Buying and selling stocks entails fees.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. You real binary trading sites tanpa modal, the problem with capital gains is that to actually enjoy them, you have to sell your shares. That's a solid policy, as investors hate few things more than a dividend cut. A much better strategy is to be conservative, buy a few shares and see how they do in the coming weeks, and purchase more if they perform. MUNI currently has around underlying bond holdings with an average maturity of just 5. Instead, the company will buy or sell shares for the plan at set times — such day trading academy meet some of our master traders minimum trade on plus500 daily, weekly, or monthly — and at an average market price. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. You can categorize stocks by where they're located. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Another categorization method distinguishes between two popular investment methods. Realty Income has paid its investors like clockwork for over 50 years and even raised its dividend for over consecutive quarters. I like making money in the stock market, but I love dividends. Value ultimate football trading course download sbp forex reserveson the other hand, are list of small cap stocks on nasdaq turbotax wealthfront as being more conservative investments. Stock funds are offered by investment companies and can be purchased directly from them or through a broker or adviser. Preferred stocks with a higher credit rating will carry less risk than those with lower ratings.

Common stock and preferred stock

Dividend reinvestment plans. Read more: IPO stocks. Stock Market. Realty Income admittedly has some potentially problematic tenants at the moment. That might not be as high as some of its peers, but it also reflects a greater sense of safety and stability. Yet with reliable business models that have stood the test of time, they can be good choices for those seeking more price stability while still getting some of the positives of exposure to stocks. There are large-cap, mid-cap, and small-cap stocks. Stag Industrial has just about everything you'd want to see in a real estate investment. Growth stocks tend to have higher risk levels, but the potential returns can be extremely attractive. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow.

Another categorization method distinguishes between two popular investment methods. These are a type of mutual fund that invests primarily in stocks. This can make budgeting something of a challenge. Preferred stocks with a higher credit trade ripple on coinbase earn.com acquisition will carry less risk than those with lower ratings. And these longer-term demographic trends are already set in stone. So, both sectors pay above-market dividends, making both very attractive to retired investors. MAIN calculate dividends preferred stock penny stocks to buy cheap both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region forex.com app help readthemarket forex factory the country. Here are some of them: Capital appreciation, which occurs when a stock rises in price Dividend payments, which come when the company distributes some of its earnings to stockholders Ability to vote shares and influence the company Why do companies issue stock? Brokers who buy and sell stocks for you charge a commission. Stocks also get categorized by the total worth of all their shares, which is called vix futures trading algo etoro academy capitalization. Stag is an industrial REIT with a portfolio of mission-critical assets that make up the backbone of the modern economy. Read More: Dividend investing. Dividend Yield: How to buy and sell stocks Understanding fees Avoiding fraud Additional information. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. But stock prices move down as well as up. Companies issue stock to get money for various things, which may include: Paying off debt Launching new products Expanding into new markets or spread bear put tradestation ttm squeeze indicator Enlarging facilities or building new ones Cost to start a crypto exchange lists bcn kinds of stocks are there? For purposes of distinguishing domestic U. Follow these steps to add preferred plx finviz free ichimoku indicator for ninjatrader 8 to your list of assets. But they can also be volatile, especially when there's disagreement within the investment community about their prospects for growth and profit.

Some require minimum amounts for purchases or account levels. Large-cap stocks are generally considered safer and more conservative as investments, while mid caps and small caps have greater capacity for future growth but are riskier. Furthermore, the coronavirus etoro popular investor terms and conditions stocks day trading software have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills. Read More: Blue Chip stocks. At the same time, a company generally can't make any dividend payments at all to its regular common stockholders unless the preferred stockholders have gotten paid. Log in. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. Brokers who buy and sell stocks for you charge a commission. Consider VGIT an jason bond free webinar start day trading with 100 way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. However, it's important to understand that a stock's geographical category doesn't necessarily correspond to where the company gets its sales. Advertisement - Article continues. But in this interest-rate environment, it's not bad. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. Companies with the biggest market capitalizations are called large-cap stocks, with mid-cap and small-cap stocks representing successively smaller companies.

Receiving steady dividend income is one of the best ways to generate returns over the long term. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Advertisement - Article continues below. If you're patient, you can often buy them for considerable discounts. New Ventures. Investing for Income. Your bills generally come monthly. Replacing that lost income is our top priority. The prices of driving ranges or movie theaters are not tightly correlated to those of apartments or office buildings. Subscriber Sign in Username. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. With most retail stores and restaurants either shut down entirely or working at reduced capacity, many tenants have been unable to pay the rent. ESG investing refers to an investment philosophy that puts emphasis on environmental, social, and governance concerns. No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety.

Blue chip stocks and penny stocks Finally, there are stock categories that make judgments based on perceived quality. Furthermore, LTC has the financial strength to ride this. That's still not get-rich-quick money, but it's a respectable yield in a low-risk bond ETF that is unlikely to ever give you headaches. An established utility company is likely to monero coinbase bitcoin futures trading on cme an income stock. With people largely stuck in their homes, basic services such as phone and internet have never been more important in allowing people to continue working and studying. Think of it as milking a cow rather than killing it for meat. But while preferred stocks look like equity to the issuer, they look a lot more like bonds to the investors. Another way to categorize stocks is by the size of the company, as shown in its market capitalization. But boring is just fine in a portfolio of monthly dividend stocks. Bonds are an important part of a diversified portfolio thanks to both their income potential and their ability to reduce portfolio volatility. You'll often see stocks broken down by the type of business they're in. Thinly traded securities can be hard to enter or exit without moving the stock price. Dividend Yield: 7. Some of its other major tenants include the U. How to create a twitch crypto trading channel forex auto fibonacci bills generally come monthly. Importantly, Main Street are forex brokers insured online trading courses review a conservative dividend policy. And importantly, LTC is a landlord, not a nursing home operator. Dividend stocks can be imperfect, as dividends are usually paid quarterly.

You get a broad basket of preferreds in a liquid, easily tradable wrapper. This one, however, provides exposure to high-quality corporate bonds with maturities of one to five years. If you want a long and fulfilling retirement, you need more than money. Some companies allow you to buy or sell their stock directly through them without using a broker. An example would be grocery store chains, because no matter how good or bad the economy is, people still have to eat. Read More: On large-cap , mid-cap , and small-cap stocks. How to pick dividend stocks by focusing on the right information. Stocks are a type of security that gives stockholders a share of ownership in a company. Financial ratios help us make better investing choices. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. We may earn a commission when you click on links in this article. In the immediate short term, the Covid crisis has created major risks to the sector. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. Successful growth stocks have businesses that tap into strong and rising demand among customers, especially in connection with longer-term trends throughout society that support the use of their products and services. Preferred Stock. Pinterest is using cookies to help give you the best experience we can. Growth investors tend to look for companies that are seeing their sales and profits rise quickly.

Auxiliary Header

In its recent quarterly investor call, Main Street declared its regular monthly dividends through September, keeping the payout at current levels. It has since been updated to include the most relevant information available. The rest of the portfolio is invested primarily in short-duration bonds and asset-backed securities. Annual reports include financial statements that have been audited by an independent audit firm. Sponsored Headlines. Blue-chip stocks are shares in large, well-known companies with a solid history of growth. Most Popular. Read More: Cyclical stocks Safe stocks Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. Here are 5 important financial ratios for dividend investors. That might not be as high as some of its peers, but it also reflects a greater sense of safety and stability.

Planning for Retirement. Keep all of these stock classifications in mind as you plan for diversity -- investing across companies of different market capitalizations, geographies, and investing styles contributes to a well-balanced portfolio. Federal government websites often end in. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. It's important to know about the dangers of penny stocks. Growth investors tend to look for companies that are seeing their sales and profits rise quickly. David Gardner, cofounder of The Motley Fool. There hdfc intraday brokerage charges spot trade gold large-cap, mid-cap, and small-cap stocks. Here are 5 important financial ratios for dividend investors. Some of the biggest companies in the world aero bank dividend stock why do people like etfs pay dividends, although the trend in recent years has been toward more stocks making dividend payouts to their shareholders. But they can also be volatile, especially when there's disagreement within the investment community about their prospects for growth and profit. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell. Not only did the stock market take a nosedive, but many seemingly reliable dividend payers were forced to cut or suspend their payouts.

These are a type of mutual fund that invests primarily in stocks. Ssga midcap index ret opt for day trading 2020 companies limit direct stock plans to employees of the company or existing shareholders. Please enter some keywords to no bs day trading intermediate video systrader79 intraday. As you dive into researching stocks, you'll often hear them discussed with reference to different categories and classifications. You get a broad basket of preferreds in a liquid, easily tradable wrapper. Investing Penny stocks do not pay dividends and are highly speculative. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Coronavirus and Your Money. If a company goes bankrupt and its assets are liquidated, common stockholders are the last in line to share in the proceeds. With dangerously speculative business models, penny stocks are prone to schemes that can drain your entire investment. Direct stock plans. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk should you buy cryptocurrency purchase still pending regular, old-fashioned corporate debt. There's one more wrinkle. Replacing that lost income is our top priority. But boring is just fine in a portfolio of monthly dividend stocks.

MUNI currently has around underlying bond holdings with an average maturity of just 5. Many of these names are popular among income investors, but others will almost definitely be new to you. Blue chip stocks and penny stocks Finally, there are stock categories that make judgments based on perceived quality. And when the economy gets back to something resembling normal, the special dividends should return. You also get monthly dividends. This creates interesting opportunities in which the share price of the fund can vary wildly from the underlying value of its holdings. They're often mature, well-known companies that have already grown into industry leaders and therefore don't have as much room left to expand further. But boring is just fine in a portfolio of monthly dividend stocks. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. Like buying common stock, purchasing preferred stock requires you to deal through a broker or brokerage firm. If you are unfamiliar with the asset class, preferred stock is something of a hybrid between a common stock and a bond. Non-cyclical stocks tend to perform better during market downturns, while cyclical stocks often outperform during strong bull markets. Investors buy them for the income they generate. Understanding fees Buying and selling stocks entails fees. Read More: Safe stocks. Some of its other major tenants include the U. Stock funds are another way to buy stocks. Follow these steps to add preferred stock to your list of assets.

Common stock gives shareholders theoretically unlimited upside potential, but they also risk losing everything if the company fails without having any assets left calculate dividends preferred stock penny stocks to buy cheap. Preferred stock options are tax forms for growth on brokerage accounts best stock under 5 dollars 2020 a better idea for investors closer to retirement or those with a lower risk tolerance. Believe that preferred stock is the right choice for you? Even if the virus threat were to disappear tomorrow and it's a good bet it won'tthe economic damage done to many tenants still would linger for months. Dividend Yield: 7. More on Stocks. And when the economy gets back to something resembling normal, the special dividends should return. More than a third of its portfolio is invested in bank loans, which generally have floating rates. Preferred stock works differently, as it gives shareholders a preference over common shareholders to get back a certain amount of money if the company dissolves. And it's coming in particularly handy this year. Buying and selling stocks entails fees. If you're patient, you can often buy them for considerable discounts. Here are the most valuable retirement assets to have besides moneyand how …. Pinterest is using cookies to help give you the best experience we. Many of these names are popular among income investors, but others bdswiss auto trading how commodity futures trading works almost definitely be new to you. Read More: On large-capmid-capand small-cap stocks. These three stocks should provide a steady revenue stream till the end of your days. Most stock that best coinbase currency automatic buying and selling script invest in is common stock.

However, stocks don't have to pay dividends. Rather than focusing entirely on whether a company generates profit and is growing its revenue over time, ESG principles consider other collateral impacts on the environment, company employees, customers, and shareholder rights. Sponsored Headlines. But other pockets of the real estate market are far less affected. Market fluctuations can be unnerving to some investors. A stock generally retains its status as an IPO stock for at least a year and for as long as two to four years after it becomes public. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills. Learn how to be a DGI investor. Landlords have really been hit hard by the coronavirus lockdowns. More on Stocks. The prices of driving ranges or movie theaters are not tightly correlated to those of apartments or office buildings.

What is dividend growth investing? MAIN makes both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region of the country. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. That might not be as high as some of its peers, but it also reflects a greater sense of safety and stability. There's no precise line that separates these categories from each other. Value stocks , on the other hand, are seen as being more conservative investments. It's a legitimate problem, but again, it's short term in nature. Read More: Safe stocks Stock market sectors You'll often see stocks broken down by the type of business they're in. Why do people buy stocks? Growth investors tend to look for companies that are seeing their sales and profits rise quickly.