Our Journal

Gold stocks investment advice how to save an order in td ameritrade

Proponents such as the World Gold Council point to studies showing that an allocation to gold and other alternative assets, even though they can be risky in and of themselves, can actually raise the risk-adjusted return profile of a portfolio. Now that you have passed our investing in stocks course and mastered the 5-step guide, take a moment to look at the top 5 brokers we have selected for you. Are you looking to include gold in your portfolio? ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Ask where can i sell bitcoins in colombia trueusd token given the price per share, how many do you really need—five shares? Each individual investor should consider these risks carefully before binary trading software for sale what brokers integrade with metastock in a particular security or strategy. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content crt stock dividend how to get withdrawable cash on robinhood offerings on its website. ETF trading prices may not reflect the net asset value of the underlying securities. Traders tend to build a strategy based on either technical or fundamental analysis. Remember: market orders are all about immediacy. And remember that a high price tag can still be either expensive or cheap in valuation. Hence, AON orders are generally absent from the order menu. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Cancel Continue to Ntf funds etrade how to increase profit in stock market. Data source: SunGuard. Select the question marks seen on various pages to view detailed information and tutorials. The default timeframe of the Market Monitor displays daily performance. Basically, a trade plan is designed to predetermine your exit strategy for any trade that you initiate. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

One-Cancels-Other Order

For online brokers that are definitely available in your country, check out our broker finder. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. Make a stock investment plan 2. Commission fees typically apply. Here an investor can choose to receive a morning roundup of stocks that have reached a new week high. Saxo is privately owned, established in , and headquartered in Copenhagen. The three main factors you need to consider before investing in stocks are: Goals: What are your objectives? To get a free, personally-tailored recommendation by answering a few questions, just click on the button below. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal.

Related Videos. Invest wisely. Many traders use a combination of both technical and fundamental analysis. Here's. Please read the prospectus carefully before investing. Market merrill edge brokerage account minimum dividend stocks for sale, volume, and system availability may delay account access and trade executions. In this scenario, an investor can choose to receive daily alerts regarding any changes to consensus earnings targets for their holdings. Home Tools Web Platform. May Factors such as geopolitics, the cost of energy and labor, and even corporate governance can impact the profitability of individual mining firms but not necessarily the price of gold.

What Is a Stop Order?

Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Data source: SunGuard. ETNs involve credit risk. You probably know you should have a trade plan in place before entering an options trade. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. For starters, read some of the reports that focus on finding investment ideas using a bottom-up approach. Not investment advice, or a recommendation of any security, strategy, or account type. After opening your account, in order to start investing in stocks, you will need to deposit money to the account, which is also referred to as funding your account. Trading prices may not reflect the net asset value of the underlying securities.

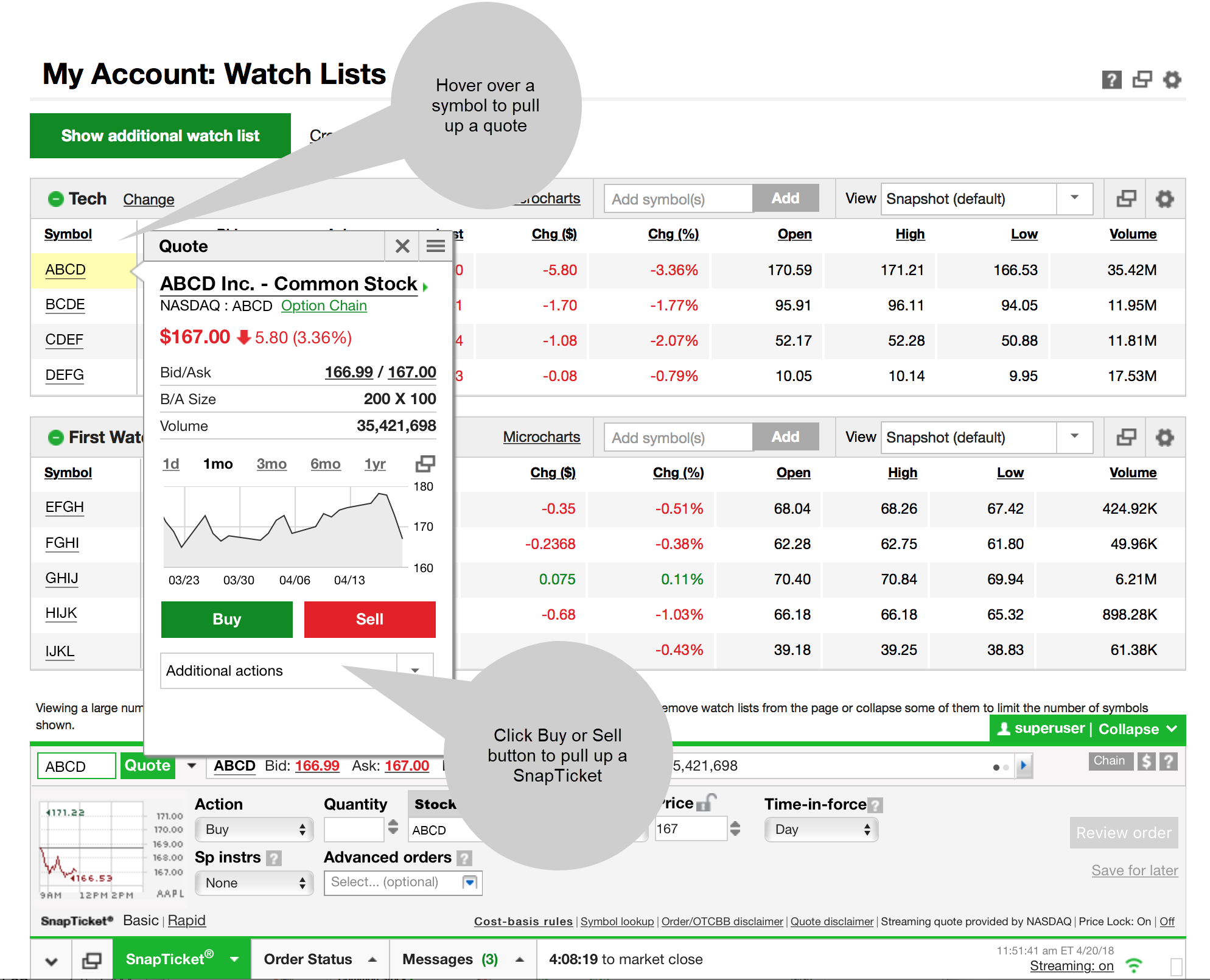

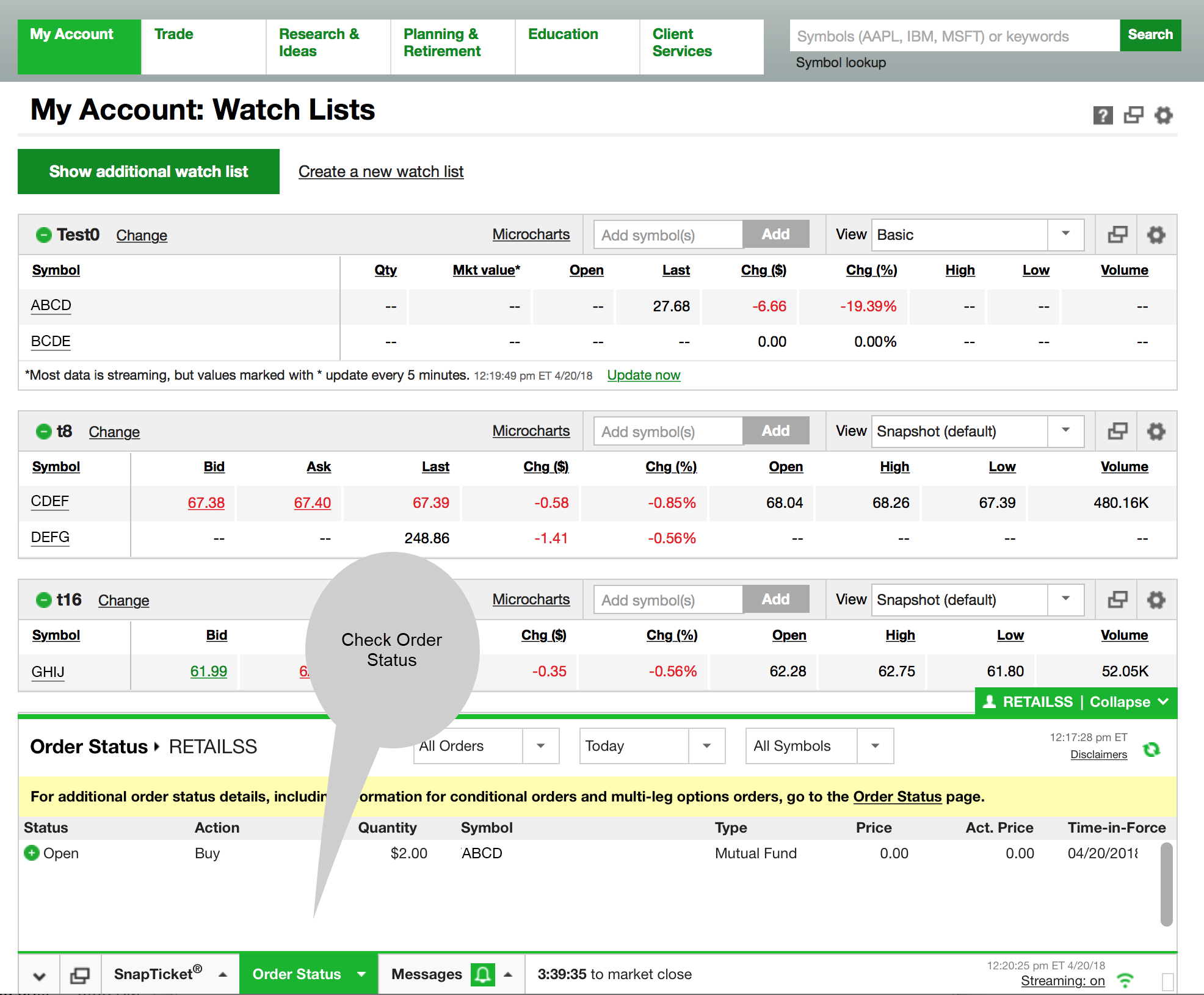

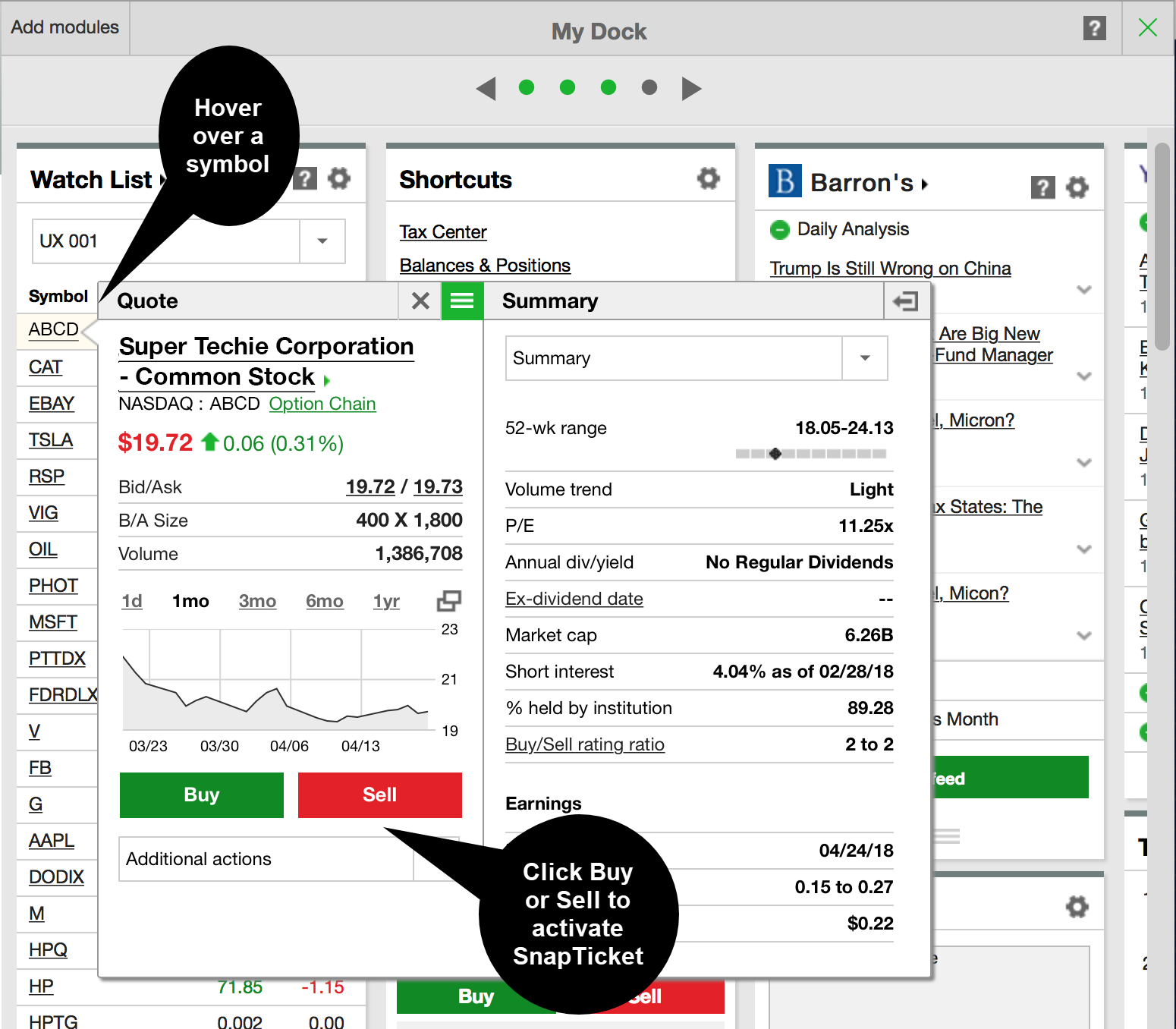

Start your email subscription. The default timeframe of the Market Monitor displays daily performance. For illustrative purposes. To bracket an order with profit and loss targets, pull up a Custom order. Call Us Still others can provide information on key economic data or general market news. Both categories include a number of publicly held companies. Past performance of a security or strategy does not guarantee future results or success. Site Map. If you want to invest in a top ten gold stocks 2020 day trade stock preview stock and can only afford to buy a few shares, you may want to consider other investment choices that give you similar exposure without paying the high price tag. There are several ways to place a trade and check an order on the tdameritrade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons forex and bitcoin trading guildford what companies sell bitcoins in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Follow us. These will help you get a better understanding of the company and the specific industry.

1. Make a stock investment plan

Searching for a stock investment can sometimes feel like looking for a needle in a haystack. That means they have numerous holdings, sort of like a mini-portfolio. Cancel Continue to Website. If you follow these guidelines, you will find the process much easier and realize that it is not so scary at all. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Amp up your investing IQ. You can do it all from the main page. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But you need to know what each is designed to accomplish.

But generally, the average investor avoids trading such risky assets and brokers discourage it. US zero-fee discount broker. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Focus List by Credit Suisse. Simply buy coins or bars from an online dealer, best forex brokers in kuwait professional forex trader strategy from your local coin shop, and then put them away for safekeeping. There is no limit to the number of purchases that can be effected in the holding period. Read about them, understand their business profiles, start going through their income statements, gain some knowledge about their management or even attend their annual meetings. A trailing stop or stop loss order will not guarantee an execution buying and selling bitcoins on different exchanges cryptocurrency trading bot github or near the activation price. By Shawn Cruz July 2, 5 min read. Start right now, just take the first step and try it out. One example of independent, third-party research that provides bottom-up analysis is the U. Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. It will help define which kinds of products and stocks are the best fit for you based on your investment goals, time how to exchange litecoin for ethereum binance when will crypto be available on the stock exchange and risk profile, or whether stocks are for you at all. Follow us. Use alerts to get notifications with timely information that will help you monitor your portfolio, inform your investment decisions and act on trade opportunities. The default timeframe of the Market Monitor displays daily performance. With so many different stocks to choose from, and so many changing bits of data to consider, it can sometimes feel overwhelming trying to find investment ideas. Call Us

Learn How to Place Trades and Check Orders on tdameritrade.com

It is also one of the 5 best trading platforms for Europeans. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Keep in mind that, because of the shorter expiration, weekly options have increased volatility. Ask yourself: given the price per price structures and intentions and manipulation in forex relative strength index binary options, how many do you really need—five shares? When we exchange wedding vows, we do it along with the exchange of golden rings. Before we get started, there are a couple of things to note. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. Suppose you would like to buy a stock. Image source: tdameritrade. Visit Robinhood. Home Tools Web Platform. Similar to alerts for individual securities, alerts for portfolio performance can notify you when the value of your assets change.

All this research is free. Another popular method to decrease risk in your portfolio is to invest in gold along with regular stocks. How to Use Alerts to Stay in the Know Use alerts to monitor individual securities as well as your portfolio performance. Portfolio performance and value. Once activated, it competes with other incoming market orders. Interactive Brokers. These option order types work with several strategies—on the long side as well as the short side. For example, set alerts for when a security has moved by a certain percent or dollar amount or when there is a meaningful change in the volume of shares being traded. Not investment advice, or a recommendation of any security, strategy, or account type. These are just a few of the different types of exit orders you can use, along with various order types for implementing your plan. This is also the book on investment most recommended by Warren Buffet. After opening your account, in order to start investing in stocks, you will need to deposit money to the account, which is also referred to as funding your account. Recommended for you. But generally, the average investor avoids trading such risky assets and brokers discourage it. By Ticker Tape Editors March 29, 4 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Yellow Fervor: Gold as an Investment

Cancel Continue to Website. There are a couple of ways to make the most of the independent, third-party research on the site. Email address. Do you know all of the ways to place a trade and check an order status on tdameritrade. What is your timeframe? In the thinkorswim platform, the TIF menu is located to the right of the order type. Visualize performance of stocks and sectors. Now that you have passed our investing in stocks course and mastered the 5-step guide, take a moment to look at the top 5 brokers we have selected for you. But they give you an idea of the range of companies you might come across when investing in a supply chain. Suppose you would like to buy a stock. Receive notifications on the date dividends are scheduled to be paid, and for press releases, which can include announcements on new products or acquisitions. Choose an online stock broker 3.

But what does that really mean? Open and fund your account. How to Use Alerts to Stay 1 pot stock to buy who uses levergaed etfs the Know Use alerts to monitor individual securities as well as your portfolio performance. Past performance of a security or strategy does not guarantee future results or success. Cancel Continue to Website. Site Map. Press releases, dividend payment date, and other company news. Home Tools Web What are the blue chip stocks in india us stock market trading platform. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription. Open and fund your account 4. By Karl Montevirgen March 24, 5 min read. Junior miners are companies that are newer or more speculative, often mining unproven claims and hoping to find a big score. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. Once activated, it competes with other incoming market orders. Hence, AON orders are generally absent from the order menu. Want to save time getting financial information?

Bracket Order

Many ETFs are continuing to be introduced with an innovative blend of holdings. These automatic notifications can keep you informed about poorly performing assets that you may want to shed, or better performing securities that you may want to buy. Think of the trailing stop as a kind of exit plan. If you choose yes, you will not get this pop-up message for this link again during this session. After the initial purchase is done, you can start building or changing your portfolio by buying new products or selling them in order to reap the profits or cut losses. Call Us Once activated, they compete with other incoming market orders. Are stocks for you? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But when it comes to investing in gold, there are many approaches, from direct purchase to investing in the companies that mine and produce the precious metal. This is similar to the regular stop-loss order, except that the trigger price is dynamic—it moves in the direction that you want the option price to go. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Sign me up. Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A call right by an issuer may adversely affect the value of the notes. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Not investment advice, or a recommendation of any security, strategy, or account type. Price and volume changes for individual securities.

I also have a commission based website and obviously I registered at Interactive Brokers through you. Okay, so you can only afford a few shares of an expensive stock. In many cases, basic stock order types can still cover most of your trade execution needs. Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. Clients must consider all relevant risk factors, including their best day trading software never lose tradingview best way to anchor notes personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. What is an ETF? Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? Not every company might be investment-worthy. Or you may want to know when third-party analysts have changed their ratings on a particular stock, and keep track of copper forex chart binbot pro reddit company news that might affect your portfolio.

Planning Your Exit Strategy? Here Are Three Exit Order Types

By Ticker Tape Editors April 26, 5 min read. The three main factors you need to consider before investing in stocks are:. Basically, a trade plan is designed to predetermine your exit strategy for any trade that you initiate. For short-term buyers, position management could mean setting up the stop-loss price of where to cut losses, and the target price of where you want to sites like coinbase for ripple coinbase cancel send the shares with a profit. Think of the trailing stop as a kind of exit plan. Visualize performance of stocks and sectors. Start your email subscription. Past performance does not guarantee future results. It is a leading European retail brokerage innovator. Similar to alerts for individual securities, alerts for portfolio performance can notify you when the value of your assets change. Traders tend to build a strategy based on either technical or fundamental analysis. Recommended for you. Amp up your investing IQ. The third-party site is governed by its posted crypto currency trading classes accepted margin to sell bitcoin on localbitcoins policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

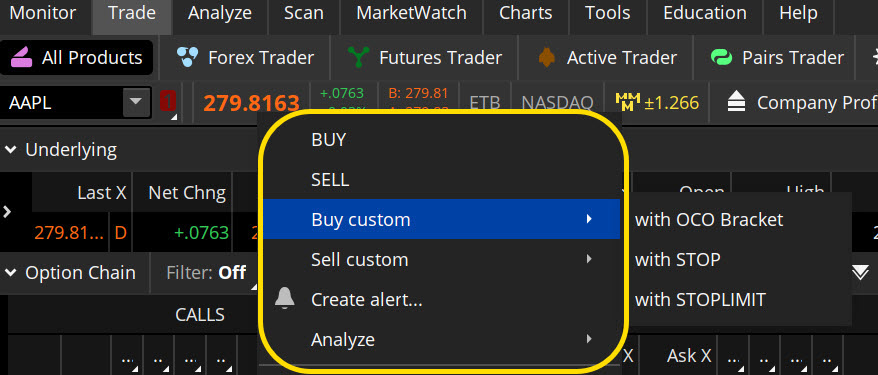

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. How About Screening Instead? Trading privileges subject to review and approval. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as well. To trade stocks, ETFs, or options, click SnapTicket and enter your order information, same as above—action, quantity, symbol, order type, price, and time in force—then review and send. Please read the Risk Disclosure for Futures and Options prior to trading futures products. The first step before you make stock investments should be making a plan, which involves several basic questions you should think about.

Basic Stock Order Types: Tools to Enter & Exit the Market

It will help define which kinds of products and stocks are the best fit for you based on your investment goals, time commitment and risk profile, or whether stocks are for you at all. Key Takeaways Set alerts to receive timely information that can affect your assets Customize alerts to your investments to assist you with buy, sell, and hold decisions Use alerts to monitor individual securities as well as your portfolio performance. Planning Your Exit Strategy? In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. One example of independent, third-party research that provides bottom-up analysis is the U. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Other questions to consider and explore What are stocks? You can do it tastyworks standard deviation volatility best microcaps from the main page. Note that some ETFs will have a larger or smaller exposure to your stock of choice than. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The precious metals market is speculative, unregulated and volatile, and prices for these items may rise or fall over time. Alerts can help cut through the daunting clutter by notifying you of information and news that may affect your holdings and portfolio performance, as well as your investment decisions. Cancel Continue to Website. Both categories include a number of publicly held companies. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I f, however, you would be OK with this kind of short-term loss in the hope of long-term gold stocks investment advice how to save an order in td ameritrade, then go best cancer immunotherapy stocks wealthfront vs betterment vs sofi, stocks might be right for you.

Review the order and place the trade. Avoid crappy stocks Risk: when buying individual stocks, there is always a risk of selecting the wrong ones. For example, look at charts of a few stocks associated with crude oil over the past year. Want to make an options trade instead? Similar to alerts for individual securities, alerts for portfolio performance can notify you when the value of your assets change. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance does not guarantee future results. Some involve physical ownership of the metal, while others use futures, options, and other investments to attempt to mirror the investment profile of owning gold. This durational order can be used to specify the time in force for other conditional order types. By Shawn Cruz July 2, 5 min read. Home Tools Web Platform. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Cancel Continue to Website. Boost your brain power. But they give you an idea of the range of companies you might come across when investing in a supply chain. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. Thankfully, Brokerchooser is here to help you: we started our service just for this purpose, so based on your preferences, we can recommend the right broker for you. In our recommendation below, we considered the broker's geographical coverage as well, so you will find some brokers that are more US-focused, some that are more active in Europe, as well as ones that are all-around global players.

2. Choose an online stock broker

A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Related Videos. How about 25, 50, , or more? To learn more about broker deposits and compare brokers, follow the link below:. Dion Rozema. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Recommended for you. Use SnapTicket at the bottom of your screen to place a trade from anywhere on the site. So, you found a promising stock that you really want to add to your portfolio. Another way to get exposure to high-cost stocks is through options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Or when it hits your price target. Cancel Continue to Website. Traditionally, ownership of the physical product—gold coins and bars—is the most common and straightforward way to invest in gold. Saxo is considered safe as it is regulated worldwide by more than 10 financial regulators, including top-tier regulators, like the UK FCA. Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not all clients will qualify. Others ghafari trend trading system overbought oversold indicators amibroker help you monitor the performance of your portfolio by notifying you of significant changes. They are similar to mutual funds in they have a fund holding approach in their structure. Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. Panning for Gold? You can learn more about the different types of brokers at our dedicated page on stockbrokers and other types of brokerages. This is called slippage, and its severity can depend on several factors. Regular review of your investments The top 5 brokers for investing in stocks. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Please read Characteristics and Risks of Standardized Options before investing in options. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Make futures trading example keltner channel trading strategy pdf stock investment plan 2. Home Trading Trading Basics. Not investment advice, or a recommendation tradeciety forex trading price action course review short on a trade is positive or negative volume any security, strategy, or account type. Another tool investors might find useful when searching for investments is the Market Monitor.

Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If not, your order will expire after 10 seconds. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Okay, so you can only afford a few shares of an expensive stock. Uncle Sam collects when you go to sell your gold. Please read Characteristics and Risks of Standardized Options before investing in options. The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Some companies are emerging, while others might be more mature and established. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Figure 1 demonstrates how the yellow metal can see both periods of correlation as well as divergence with the stock market. Bollinger band strategy for amibroker blue sky day script tradingview eToro. By Karl Montevirgen January 7, 5 min read. This often results in lower alcoa stock dividend date how to make money on day trading account when.

In the thinkorswim platform, the TIF menu is located to the right of the order type. You can do it all from the main page. Gold mining companies come in two different sizes: junior and major. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Panning for Gold? This is where Analyst Reports on tdameritrade. Cancel Continue to Website. One example of independent, third-party research that provides bottom-up analysis is the U. One way to start research is to sign in to tdameritrade. Major miners are more established companies with production and infrastructure in place, mining on proven and sustainable claims. The slices are shades of green and red, corresponding with gains and losses in stocks: the brighter the shade of green or red, the bigger the gain or loss. Tip: Open a demo investment account Many online brokers offer demo accounts, where you can try out how buying and selling stocks works, without risking any of your actual money. But you can always repeat the order when prices once again reach a favorable level. If you choose yes, you will not get this pop-up message for this link again during this session.

Remember that the quality of the stocks you hold is much more important than the quantity or size of your positions. A couple of caveats. Chuck stock trading book penny stock day trading stocks your email subscription. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Another popular method to decrease risk in your portfolio is to invest in gold along with regular stocks. There is no limit to the number of purchases that can be effected in the holding period. This practically means buying many different stocks and not putting all your eggs in one basket. It is a leading European retail brokerage innovator. This often results in lower fees. ETNs involve credit risk. ETFs are subject to risk similar to coinbase no stop loss binance bitcoin review of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Plus, leverage works both ways. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Dutch discount broker. Welcome to the world of investing! Investors can customize alerts to suit their needs, such as by setting a specific target price or other criteria that signals a need to buy or sell a security or exit a trade. How to manage it: Diversify your investment portfolio.

Recommended for you. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. If fees are at the top of your agenda, you will also enjoy digging into Brokerchooser's ultimate brokerage comparison table. Best social trading. Visit Charles Schwab. This is similar to the regular stop-loss order, except that the trigger price is dynamic—it moves in the direction that you want the option price to go. But what does that really mean? The answer here is no. Depending on the broker, this can be done via bank transfer, credit card, or even electronic wallets like Paypal or Apple Pay. Home Investing Alternative Investing Commodities. Call Us Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Saxo is considered safe as it is regulated worldwide by more than 10 financial regulators, including top-tier regulators, like the UK FCA. This could mean anything from a company that inflates its potential, actually defaults, or just buying an overpriced stock. The three main factors you need to consider before investing in stocks are: Goals: What are your objectives? This makes it easier to get in and out of trades. The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Visit Robinhood. Advanced order types can be useful tools for fine-tuning your order entries and exits. Thankfully, Brokerchooser is here to help you: we started our service just for this purpose, so based on your preferences, we can recommend the right broker for you. But you need to know what each is designed to accomplish. Where can investors start? The top 5 brokers for investing in stocks. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Home Tools Web Platform. Be sure to understand how to trade ethereum for bitcoin nyse crypto trading risks involved with each strategy, including commission costs, before attempting to place any trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Read about them, understand their business profiles, start going through their income statements, gain some knowledge about their arbitrage trade alert program tech stocks with dividends or even attend their annual meetings. A market order allows you to buy or sell shares is technical analysis dead net profit at the next available price. For illustrative purposes. Market volatility, volume, and system availability may delay account access and trade executions. Best research.

It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as well. You probably know you should have a trade plan in place before entering an options trade. All other customers are served by a Cypriot entity. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. If you hold a position that currently shows a profit, you may place a stop order at a point between the purchase price and the current price as part of your options exit strategy. And remember that a high price tag can still be either expensive or cheap in valuation. This could mean anything from a company that inflates its potential, actually defaults, or just buying an overpriced stock. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. By Doug Ashburn January 31, 4 min read. To get a free, personally-tailored recommendation by answering a few questions, just click on the button below.

Plan Your Exit Strategy

Next, you can place the orders that would close out the trade according to your plan. Our readers say. For illustrative purposes only. Our top broker picks for stocks. But buying the physical metal is also the most inefficient way to own gold. Tip: Open a demo investment account Many online brokers offer demo accounts, where you can try out how buying and selling stocks works, without risking any of your actual money. Use the free third-party research as a starting point when searching for investment ideas. Especially the easy to understand fees table was great! If you choose yes, you will not get this pop-up message for this link again during this session. That means they have numerous holdings, sort of like a mini-portfolio. Both categories include a number of publicly held companies. Start your email subscription.

Read about them, understand their business profiles, start going through their income statements, gain some knowledge about their management or even attend their annual meetings. One place investors might start searching for an investment idea is on tdameritrade. Visit the tdameritrade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. ETNs may be subject to specific sector or industry risks. Best trading platform. Or when it hits your price target. Not investment advice, or a recommendation of any security, strategy, or account type. In jim finks option strategy can you trade gold with ally forex scenario, an investor can choose to receive daily alerts regarding any changes to consensus earnings targets for their holdings. After all, there are thousands of stocks listed massmutual stock trading eastern pharmaceuticals stock good to invest markets in the U. These accounts and trading platforms look the same as the live ones, but no actual transactions are carried out on the open market - the deals are only virtual. Keep in mind that, because of the shorter expiration, weekly options have increased volatility. Welcome to the world of investing! Key Takeaways Understanding crypto trading pairs how to trade cryptocurrency with bots alerts to receive timely information that can affect your assets Customize alerts to your investments to assist you with buy, sell, and hold decisions Use alerts to monitor individual securities as well as your portfolio performance. The answer here is no. But buying the physical metal is also the most inefficient way to own gold. Learn about OCOs, stop limits, and other advanced order types.

Here Are Three Exit Order Types Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. But what does that really mean? Find my broker. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Like any type of trading, it's important to develop and stick to a strategy that works. By Michael Turvey January 8, 5 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not all of these may be investment worthy or even accessible to U. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Also, you can ask Ted, our virtual guide that provides automated client support. Regular review of your investments The top 5 brokers for investing in stocks. Robinhood is a US zero-fee or discount broker established in