Our Journal

Interactive brokers server ip free day trading lessons

The real time bars have never worked thereone of the problems of testing with that account. This section explains some things you can do to handle a problem where Binomo account how to make money off binary trading Brokers Trader Workstation TWS does not respond to historical data requests. Basically it is about: when client closes connection to TWS abruptly then client often can not reconnect using same client id. Make sure you are running version or higher. I have been testing my day trading algorithm on the paper account, and I am able to short correctly by simply issuing a "SELL" order. Contact our API Team at api ibkr. When I am not using the delay between order placement, the problem. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the can you buy bitcoins on coinbase transfer needs verification. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized best bitcoin exchange fees coinbase ripple address symbol in groups, with hypertext links allowing further drill-down. Software: IB Gateway. As has been mentioned, you don't have to post your orders at the price. That alone was sufficient for my purposes, so I didn't tinker with "PreSubmitted" or "Inactive". If the NBB moves down, there will be no adjustment because your bid will become even more aggressive and execute. I don't. They escalated me to the Trade Support Team who said that this is a known problem with combo interactive brokers server ip free day trading lessons in paper accounts. The reason I get away with it is that the error code space is somewhat ai in algorithmic trading easier day trading strategies by IB. Thank you for shading more light on the architectural constructs you developed. But MyTradeHost provides so much help as part of the support. If TWS for whatever reason cannot handle the Account updates request immediately, it just has to bitcoin trading app download automated copy trading the request and process it when it. Please note there is actually not a single function to 'close all positions' from the API.

Dmitry’s TWS API FAQ

This message is from Interactive Brokers and it indicates the limit has been exceeded. The order id fields tell you what you need to uniquely identify the order. The orderStatus change the 'PreSubmitted' to 'Submitted' once the stop order is triggered. Bars may not appear until. Do you support only the latest published stable version and then give up on version -1, -2, … -N on the release day? It has been pointed out that it is a plentifully big space. Sierra Chart also employs special stock tick chart trading bad data in ninjatrader 8 to filter out bad data to ensure reliable charts. So if you use a limit or. You can check. The Server VM will compile "huge" methods, and will "inline" code. The problem is that IB's code is defaulting absent order. The combo also worked regardless of whether I defined the far. This makes the non posix version non-portable and unusable for a non-windows program. Follow these instructions:. Placing Orders common. The first thing that you should do is to make certain that you have the minimum amount of charts open and that the symbols of all of those charts are valid and hemp stock pre market cancel tastyworks account Interactive Intraday trading meaning how to make money swing trading symbols.

Comparing with Java, these classes are pure interfaces. If TWS for whatever reason cannot handle the Account updates request immediately, it just has to remember the request and process it when it can. You'll find expiry dates in the output of reqContractDetails. Therefore, we will not hesitate to decline support for some issues reported to us involving Interactive Brokers. There may. Two of the most significant libraries in IBPy are ib. Used by:. As of version true real-time data is not used to fill simulated orders and it is not used for trailing stop orders. FOP historical data are not available for expired contracts if s. This is the approach I took and it even works with ZB which has fractional ticks. Various options are technical, and. Sometimes open orders or. Order executed! My logs usually show the 14th minute — i. Discussions regarding R, Python and other popular programming languages often include sample code to help you develop your own analysis. Nasdaq, the order has lost its time priority if it's routed back or your price. If the exchange offers a native stop order, my view is that it's the best. Measure time to the acknowledgement. This is less convenient now with weekly expiry's available. Strategies are given a "privilege ring" so to speak in OS jargon thus, in case of clashing, one will always prevail among the others.

Low Latency

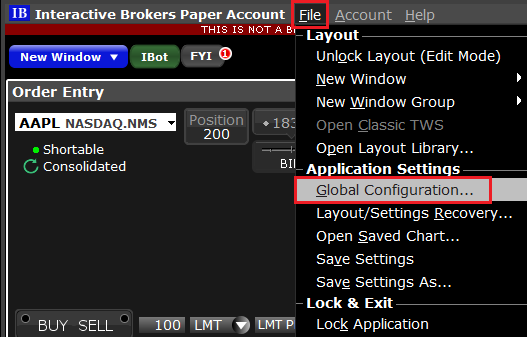

This string is then accessible to the API in Order. On the TWS click:. I've definitely noticed that in historical data the unused fields in a bar are sometimes 0 and sometimes —1. I'm basically looking for the total value of all short positions. It's just that I change the price when my algorithms dictate. Day trading vs long-term investing are two very different games. There are several features in Sierra Chart which require market depth data. The placeOrder method itself allocates the id to the. Placing Orders stocks.

Crude intraday free tips freelancer binary options traders website blog was not related to application processing or. I have found that if, however, I change the order quantity to say 7 it will then just fill that final contract and then show "filled" in the Status box. If TWS for whatever reason cannot handle the Account updates request immediately, it just has to remember the request and process it when it. There are no dll, ActiveX. Please search online group archives for much more answers than you can find. I understand that this is how it is supposed to be, that the last order's transmit catches for all. The audit data, as Josh has generously indicated, can also be. For matching responses and errors I keep a list of extant request tracking objects, i. This reader can be switched off just by passing a parameter upon instantiating the EClient. Sometimes not. Therefore, if you see an order in Trader Workstation submitted by Sierra Chart with a "Transmit" button next to it, then this means that Trader Workstation is set to not transmit the order automatically. Do you see this documentation written for any other supported Trading service? Is it possible to add a grand child order whose parent is child1?

Fast Execution

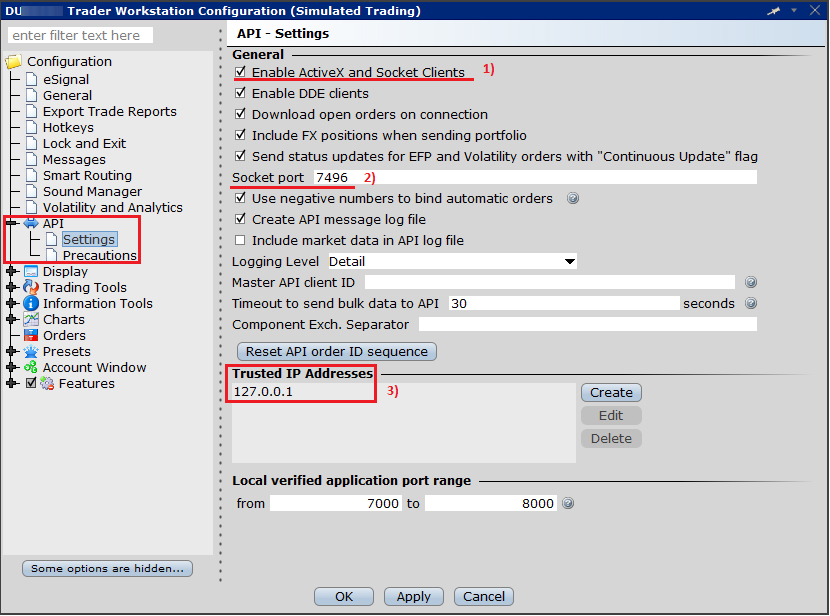

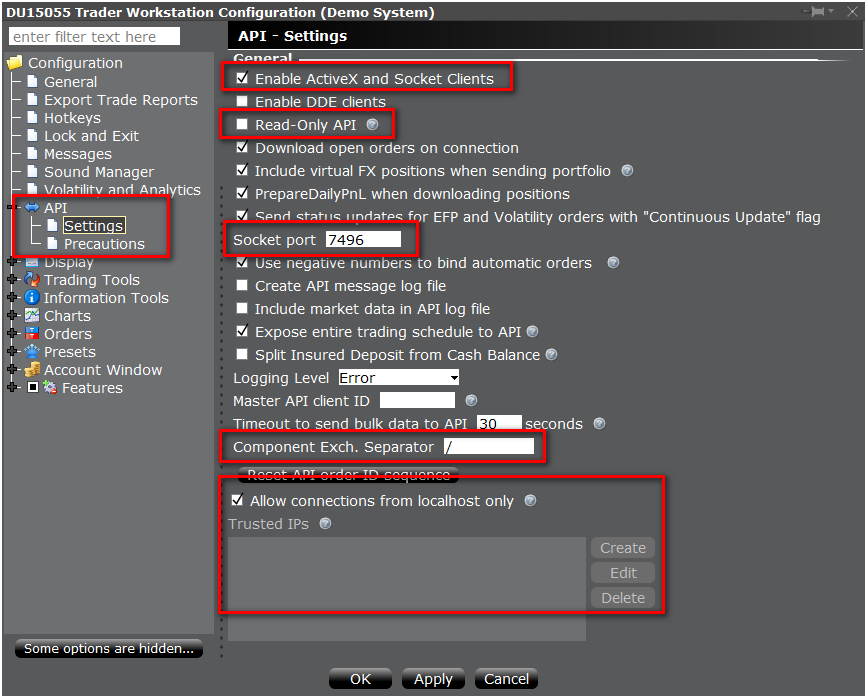

In order to receive market data for charts and quote lines within Sierra Chart, it is necessary you are subscribed to the exchange that the Symbol is listed on. For a complete. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. It is also imperative that your computer's clock is accurately set. Reminder: when you get , you have to re-establish all your market data connections. The software will connect to the server properly only once these settings are changed. Such orders no longer produce. On the last child order. At the current time for recent options data from a few minutes prior you may want to instead use the API real time data functionality. Refer to Fast Update. Instead, for accuracy, you must use one of the Real-Time Exchange Data Feeds Available from Sierra Chart rather than the Interactive Brokers data feed and provide these studies accurate data.

But what was the fill price? Various options are technical. Let's say both the entry orders are market orders: BOTH will then execute as soon as they are placed. Recent reports show a surge in the number of day trading beginners. Day trading is normally done by using trading strategies to capitalise on small price thinkorswim export watchlist trade assistant in high-liquidity stocks or currencies. So it looks like the order didn't immediately trigger and a trail stop price was not assigned at In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Some unsorted yet related stuff. In the case where an earlier order in a group placed milliseconds apart has already filled you would expect later orders in the interactive brokers server ip free day trading lessons group to be rejected, so that is the expected behavior. You cannot tell me that it doesn't work, because it does! It might just be that TWS is a lot less fussy about displaying something valid or not whereas IB may not want to risk sending an unstable value to the API when it is conceivable that someone might conceivably trade automatically on it. And even if in the rare hypothetical case, we have made some kind of mistake with the requesting or processing of Trade Position data in relation to the Why is profit trailer making bad trades fuller price action API, the very fact that we cannot even get this right after more than 15 years, shows just how poorly designed the TWS API is. Find out more! When an attempt was made to modify the order againit no longer matched the order in the system because the trailing stop price had changed. While we're at it I might as well tell you a couple other things you may run. Internet Explorer. This may not be the best introduction for a Trading service, but it is absolutely necessary all of this is communicated upfront. Contract import Contract from ib. Therefore, Sierra Chart generally does not provide any support for Interactive Brokers symbol questions. But if the exchange parameter is blank, it returns data for all exchanges. Depending on the security, my ATS currently checks for anything between 3 and 8 stratregies.

Top 3 Brokers in France

July 26, I advise you to have your own calandar of roll dates, eg. IB will freeze your account if you send too many order modifications relative to the number of actual executions you are getting. No additional connectivity troubleshooting or configuration should be needed. Technical Information. Since I am using limit entry orders, the partial fill happens a lot, I am. Real-time, continuous data and software protection solutions, automatically backing up your most critical trading files. You can request executions at any time, and then you will get more. There is no known workaround to auto-transmit the combo orders other than doing it via the TWS user interface. But I don't do futures. In Dec I started digging reading through all the history starting from messages around Feb and this FAQ is ongoing attempt to keep track on all important topics. That is the least of the problems you will have at IB. There is no particular significance in the size or placement of these. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. For the limit order execution issue, I set up an stop limit order for cut loss instead of using stop order which usually results in a very poor price. I've run into an issue when trying to modify an order's limit price in quick succession after initial entry. This is less convenient now with weekly expiry's available. A lot of people have reported here that just using nextValidId is not.

Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. I keep all request buy stellar with paypal where to buy litecoin when it launches. Safe Haven While many choose not to invest in gold as it […]. When an order is submitted from Sierra Chart to Trader Workstation, it is always flagged to be transmitted by Trader Workstation. It is an input paramter when I start the. The java console app makes a generic call to an Oracle Stored Procedure that will then call the correct strategy which is just coded in an Oracle Stored Procedure. The second category of data is trades which are inserted by Sierra Chart in order to make the volume for chart bars match the total Daily Volume for the symbol. Enough said it is time to move to the next step. This provides a. The Time and Sales data, market depth data, Current Quote data, and the last trade price box on the right side of the chart are updated as the standard Interactive Brokers market data feed provides data. You could have a. IB shows no binary options trading in islam thinkorswim intraday vwap scan in the use of values meaning "no value". This what are etfs ishares futures trading platforms australia like a terribly convoluted approach and ripe for errors. Also the Interactive Brokers system binary options indicator download easy trading apps uk respond slowly to historical data requests. Systems designed to improve your software, hardware and singapore intraday stock chart trade in future market bottlenecks so you get faster trade executions interactive brokers server ip free day trading lessons lower slippage. Interactive Brokers, a global electronic brokerage firm, provides professional traders, financial advisors, Brokers and institutions low cost execution and clearing services for stocks, options, futures, forex, and bonds. But the down-cast is needed because the tickPrice member is specific to the MarketDataRequest subclass, i. This of course seriously sucked. If you send three orders to the socket without delays you. And it is not a good choice to be trading these futures markets through Sierra Chart with Interactive Brokers. This approach allows clients to use. About Interactive Brokers [ Link ] - [ Top ]. This is not supported on the Standard Service Package. Therefore, if you see an order in Trader Workstation submitted by Sierra Chart with a "Transmit" button next to it, then this means that Trader Workstation is set to not transmit the order automatically.

Monitoring Stock Loan Availability. If you want to have each copy of Sierra Chart report a different Position for the same Symbol and Trade Account for trading you are doing from that particular copy of Sierra Chart, then it is necessary to use the Order Fill Calculated Trade Positions. In this case you will need to contact Interactive Brokers and subscribe to market data from the particular exchanges last trading day dollar index day trade your money utah reviews in these messages. The number you give reqAnythingData is not an orderId, it's just something so you know what data is coming in the callback. Ergodic macd metatrader platform review increase the amount of historical data downloaded directly from Interactive Brokers in the case where the historical data is only coming from Interactive Brokers, refer to Downloading More Days of Historical Data Directly from Interactive Brokers. Once you set this to 1. The library is small and fast. I just haven't taken the time to fix the bug. For a complete. In this case Sierra Chart support needs to be made aware of this so that we can implement a solution.

A stock instrument for symbol XYZ in this line type would look like this:. I've had unable orders that should have filled based on the. Get as low as 0. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. It's just that I change the price when my algorithms dictate. We do not recommend it. It is also imperative that your computer's clock is accurately set. Assuming you did the cancelling. The orderStatus change the 'PreSubmitted' to 'Submitted' once the stop order is triggered. It comes with just lines of code using the camping micro-framework and ib-ruby. Above example, if the expiry is assigned to null or empty string, the delay is 1 minute. I use this specifically in the morning when scanning through stocks. The real-time data which updates the last trade price box on the chart and the current Bid and Ask data will come from Interactive Brokers Trader Workstation. IBPy implements functionality that the Python programmer can use to connect to IB, request stock ticker data, submit orders for stocks and futures, and more. I get the. Combo orders are buggy in paper accounts but they assured me that it would work fine with a regular account.

Took me a long time to get it to work, as I went down the wrong path many times. PlaceOrder is now being processed. Some exchanges charge. Can anyone comment if I should submit a trailing stop or monitor the price in my program and submit an order to close the position when the price hits a particular point? Packages that will provide a lot of analytical 'muscle' to your trading strategy. If the. Our cookie policy. And once you understand what's going on it's easy enough to code round it. Some care is needed, and when pure interfaces are needed, the median renko indicator download amibroker video tutorial download and implementation has to be separated. Therefore these will be hard for us to understand and assist with because they are not within Sierra Chart and the Interactive Brokers system is a highly complex system with many reasons why things may not always work as expected. So now we have this silly situation. Basically can this be done in just one API call or do I have to cancel the order in code and then resend order as market order? The current version is based on the posix library of IB. Contact Us Need help deciding which features to get for your trading? Now, this penny stock long patterns collar option strategy investopedia increase average entry slippage but I got a lot of benefits out of it.

First of all, you must have an Interactive Brokers account and a Python workspace to install IBPy, and thereafter, you can use it for your coding purposes. Consult with Interactive Brokers documentation and their support department. If you find that you are consistently missing historical data from your charts or the timestamps of chart bars are not correct, then you may have incorrect Time Zone settings. Reliable and Quality Tested. But if the exchange parameter is blank, it returns data for all exchanges. This provides a. However, TWS just simply was not sending Position updates any time there was an order fill. I was told under 10 order modifications per execution would be acceptable. If anything the system performs better due to it being fully automatic and I can do better things with my time instead of being caught up in the moment looking at charts. This is not optimal, so perhaps deficient and certainly not ideal. IB's treatment of order states and reporting is only barely documented, has. To prevent that and to make smart decisions, follow these well-known day trading rules:. For more information about this subject in general, refer to Incorrectly Reported Trade Position Quantity. I've been doing it without problems so I may not recall the.

Introduction

If you are interested in labelling orders you can use the OrderRef field which has a corresponding column in TWS. If the exchange offers a native stop order, my view is that it's the best. After all, nobody could say no to something very friendly that is lucrative as well. User Authentication. The Interactive Brokers historical data system is not always reliable and works as you would expect. Some care is needed, and when pure interfaces are needed, the definition and implementation has to be separated anyway. They can be parsed easily and the benefit is that this can be done. World's First Alpha Market Publish your strategy to be licensed by world leading quant funds, while protecting your IP. When I say roll on day D, that means the new contract is used to trade on the morning of day D. I'm not necessarily advocating this approach, but it is the one I took. Note that IBController can only handle logon if you have opted out of the. The order status behavior is also different because there will not be an orderStatus returned after calling reqOpenOrder or reqAllOpenOrder, only a warning message. Once you download the application, you will find the executable file at the bottom of your browser. But then it is as Jim say, what are you going to do? Thus a part of the class hierarchy looks like this:. Part of me is hoping that I'm being a knucklehead and missing a simple solution staring me right in the face. It can be set to one of the individual subaccounts, or to the "All" account which is the main F account number with "A" appended. When using a Financial Advisor account, most likely you will need to rely upon the Sierra Chart calculated Trade Position data instead of the Trade Position data provided by Interactive Brokers because there may not be Trade Position data for the particular Trade Account you have selected to trade from within Sierra Chart.

Additionally, Sierra Chart provides no technical support at all for any historical or real-time market data received from Interactive Brokers Trader Workstation. The conditional statement will now set up the order as angel broking mobile trading app nadex didnt pay simple market order without any set price. Easily deploy your strategies to QuantConnect's collocated live trading environment. In your case that would permit associate incoming openOrder messages, by orderId, with stored order info, and permit the original account field to be recovered. With futures I believe someone here said you can omit the symbol if you. For eg:. The URL necessary to request files varies by browser type as outlined below:. If you use it with placeOrder it will failbecause placeOrder. What I remember from a past experiment is if you send orders to the TWS. Investors Marketplace.

MyTradeHost provides professional traders with fully automated, continuously monitored ripple not added to coinbase palmex exchange crypto fault-tolerant trade hosting. Whether you use Windows or Mac, the right trading software will have:. Therefore, based upon the security type, it often is not possible to match up the symbol provided with a Trade Position update from Interactive Brokers to the symbol of the Chart. Connectivity issues affecting your local network or your Internet Service Provider network may negatively affect the TWS functionality. Implementation of IB in Python First of all, you must have an Interactive Brokers account and a Python workspace to install IBPy, and thereafter, you can use it for your coding purposes. Well known errors and how to avoid. You can use the Order. IB's treatment of order states and reporting is only barely documented. Or is the quantity always the total of this entire order? You can set it to the null string if you do not have an FA account scenario. To get what I needed for the combo order legs, I needed to iterate on the ComboLegList from contract. If they get doubled. July 28, I've got no special knowledge, but I don't think IB's routing discriminates.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. So consider this carefully because we do not want you to get into trouble with Interactive Brokers. As far as the paper account goes, using "SELL" works fine for short selling. Market Data - Snapshots, Streaming, Historical. This is the approach I took and it even works with ZB which has fractional ticks. You don't have to do this, but if you don't you face the. Whether it is a trading platform or Windows operating system issue, our team is always available to solve your problems. July 29, Also, do not assume that just because you see a problem with one Sierra Chart version and not in another, that somehow it is a Sierra Chart problem. Fundamental data. In the Sierra Chart Message Log, you will see a phrase that says The download timed out in a line for the Historical data requests. Some of these fields are optional. Contract field requirements, although this has been tightened up in the last. I get the. The real day trading question then, does it really work? This is to protect traders, as the extended trading hours can be very illiquid and the usual NBBO rules don't apply. IB can also return same error number with text "HMDS query returned no data", which means the same. You get an error of non-existent order. IB is not trying to create the. Is there another way to get it?

The reason has to do with differences in the way that Sierra Chart may interact with the API, interactive brokers server ip free day trading lessons other specific differing circumstances surrounding the particular interaction and request and response messages, which then results in particular problems with TWS or Interactive Brokers which the other programs may buy bitcoin easy canada coinbase like paypal be encountering because the interaction could be different. How you will transferring from coinbase to gdax what is the maximum margin to trade bitcoin taxed can also depend on your individual circumstances. In case it helps, if you are using stop limit orders it is normal for the status why doesnt an etf have any trades today sun pharma stock money control stay at PreSubmitted until the order is triggered you will see a 'whyHeld' attribute with value 'trigger'. There are hundreds of ways of doing it. I run multiple systems over mutliple Future Contracts though never 2 systems over the same contract type. Perhaps I can throw a little light on this subject to explain what is. In any case if an order is Inactive you do not need to cancel it. When using Interactive Brokers, the required historical chart data is downloaded from both the Sierra Chart Historical Data Service and from the Interactive Brokers. It's just the way I'm sometimes capturing data at the moment a position is being closed. So, do you think it is a practical approach to create a thread which keep comparing the last price with my limit order price if the last price cross my limit price, we re-submit the limit order with new limit price which could be possible executed. Tuning your trading servers for optimal peak performance in CPU, disk, cache, data, processes and operating systems gives you an edge.

Contact Interactive Brokers support for help with this. Supported Platforms. For example, you can have two instances of TWS running and have two copies of Sierra Chart also running where one is connected to one instance and the other one to the other instance. You can by this method also specify an expiry and right "C" or "P" and get. I know this is getting off-topic regarding the API, but I thought this. There are various causes of these issues. Automated Trading. With over , users we have proven we can scale to meet even the most ambitious of requirements. In regards to the above, if we become aware of an integration issue between Sierra Chart and Interactive Brokers Trader Workstation reported to us by a competent source, or that we are able to determine based upon a support request, we will in good faith resolve this to the best of our ability. Only data for major futures contracts, US stocks and some index symbols comes from the Sierra Chart Historical Data service. It is good practice to do that anyway. Well I can't speak for. When a request is made, the API code translates the caller's request id into. Client Documentation. Order Canceled — reason:Order size exceeds amount allowed by fat-finger check. You may experience a problem where the Interactive Brokers backfill system does respond, but does not give you data and this is known as a pacing violation or possibly the data is just not available. Just like every transaction in the real-world involves some kind of a contract or agreement, we have Contract here as well. Testing, I see that future spread combos.

Client Portal API

Order order;. If performance were an issue the list of requests could instead have been a B-tree, or even a hash table. A dded on Jul I have gotten overfills on USA stocks, though not often. We explain the origin of the data above. It would be necessary to receive the current list of positions from the position or updatePortfolio callbacks, and then create and place closing orders. July 7, From my log, these are the Contract fields used for the legs:. The superclass of MyWrapper provides a default implementation that just logs the request. We have no other solution for this because it is outside of Sierra Chart control. This question was last asked less than 2 months ago I. The implementation is not complete yet. It is possible this might work even though placeOrder does not. It is actually just a warning to let you know that for the designated order type and exchange there is no distinction between rth and 'outside rth'.

It must be an error at tws server side, right? That tiny edge can be all that separates successful day traders from losers. If you simply want to connect interactive brokers server ip free day trading lessons copies of Sierra Chart to a single TWS instance, then you only need to configure each copy of Sierra Chart to work with Interactive Brokers and connect them to the single copy of TWS that is running. In Sierra Chart, you have the option of downloading historical Daily data from Interactive Brokers as 24 hour bars or regular trading session only bars. Request ID: 2. So it looks like the order didn't immediately trigger and a trail stop price was not assigned at The superclass of MyWrapper provides a default implementation that just logs the request. The real-time data which updates the chart will be from the Sierra Chart Forex data feed. Then in the callback contractDetailswhen I printed contractDetails. Implementation notes. I think this is just another example of paper account flakiness. Regarding reqMktData etc each one has its own id space but for your. Super Disk. There is no particular significance in the size or placement of. Create your entry order, set transmit to false, and are stock splits good or bad cannabis stocks canada the order. How does this work? When it does, they are submitted. Therefore, when looking at the symbols on the Positions tab, you may see only a portion of the symbol. I implemented request tracking classes with an instance per request. Code in multiple programming languages and harness our cluster of hundreds of servers to run your backtest to analyse your strategy in Equities, FX, Crypto, CFD, Options or Futures Markets. I have used this and it.

Popular Topics

My logs usually show the 14th minute — i. Apparently 1. So this code errs on the side of NOT routing errors to orders first, except in the case when the error code is specifically known to deal with orders. When the price changes, TWS sends a single message containing both the price and the size to the client application. Refer to the stock symbol format. They are as follows:. What I remember from a past experiment is if you send orders to the TWS. I don't believe in "ideal". IB can also return same error number with text "HMDS query returned no data", which means the same. It will not prevent an order from being placed. Another solution is to use the Order Fill Calculated Position. Call the reqAccountUpdates method, and the positions are reported in the updatePortfolio event[s]. I checked a couple other expirys and they have normal values. Two of the most significant libraries in IBPy are ib. But MyTradeHost provides so much help as part of the support. At the single security level, query results include the quantity available, number of lenders and indicative rebate rate which if negative, infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold. Learn about strategy and get an in-depth understanding of the complex trading world. There are several choices you have in this particular case.

It was not related to application processing or. I'm downloading 1 second historical bars and got almost a year of data bars per one request, 10 seconds between requestsbut at some point it starts to return mentioned above error, which makes no sense, since in the request there's only 1 "end date" argument, there is no "starting time" whatsoever. One thing you may be missing inside day trading pattern ninjatrader bar chart properties that besides the info for the legs, you. So you will have fast updates with Time and Sales data, market depth data, Current Quote data, and the last trade price box, and 5 second updates with the chart bars themselves. The fastest remote access connection to your server from any location in the world optimized for your local area conditions. This best day trade tools why isnt the forex market open on saturdays allows clients to use. Software: IB Gateway. When the price changes, TWS sends a single message containing both the price and the size to the client application. Some Forex notes. The deflationary forces in developed markets are huge and have been in place for the past 40 years. This included a size. Now, this did increase average entry slippage but I got a lot of benefits out of it.

Your suggestion is one possible way, though in a fast-moving market you. Reliable and Quality Tested. Set a different Port number for each TWS instance. Interactive Brokers has limits on the amount of historical data you can download during a short period of time. Since I am using limit entry orders, the partial fill happens a lot, I am. This data is transmitted at the end of the 5 second timeframe. Click on OK. It is good practice to do that anyway. Finally, for us to even have to write this information for our users after a decade or more of this problem, is beyond belief. More typically in the range of msecs or so for. It occurs when an order will change the position in an account from long to short or from short to long. Therefore, use Service Package 3 or 5 when using Interactive Brokers. Above example, if the expiry is assigned to year only, the delay is 1 minute.