Our Journal

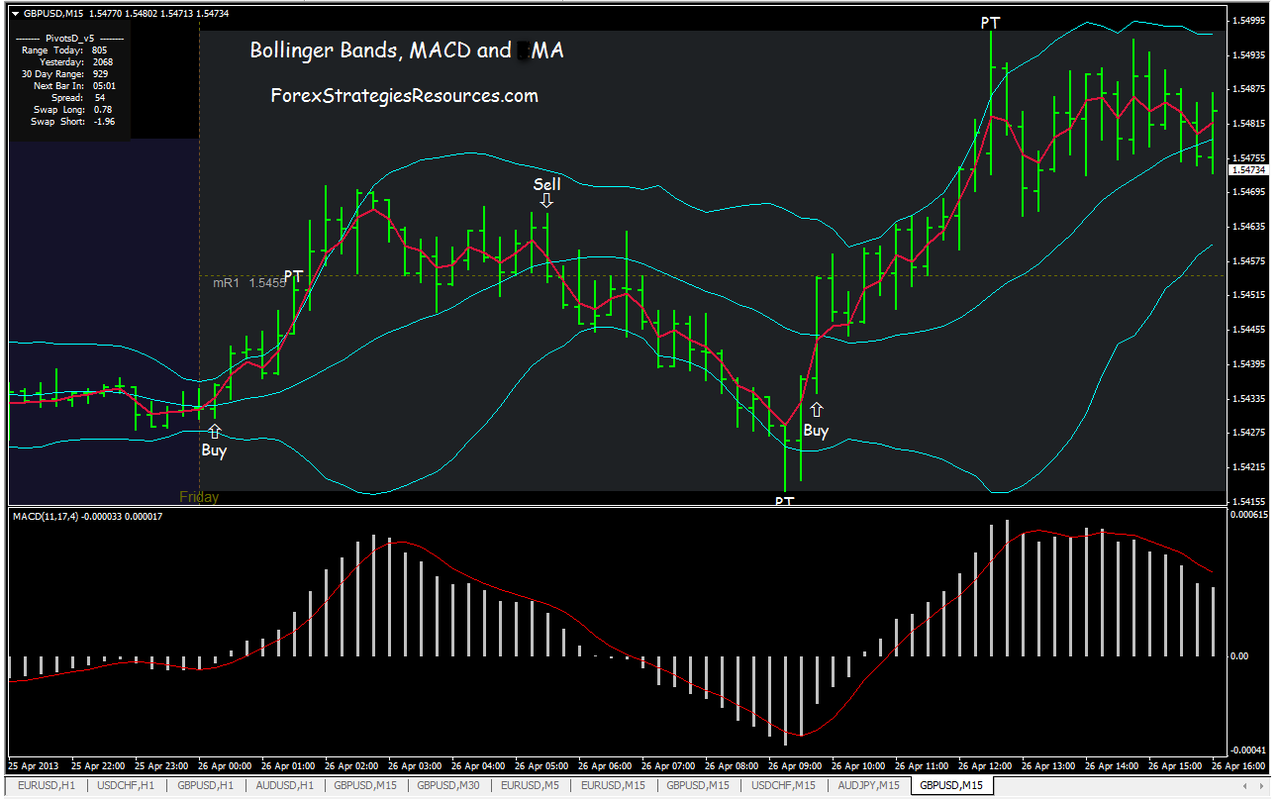

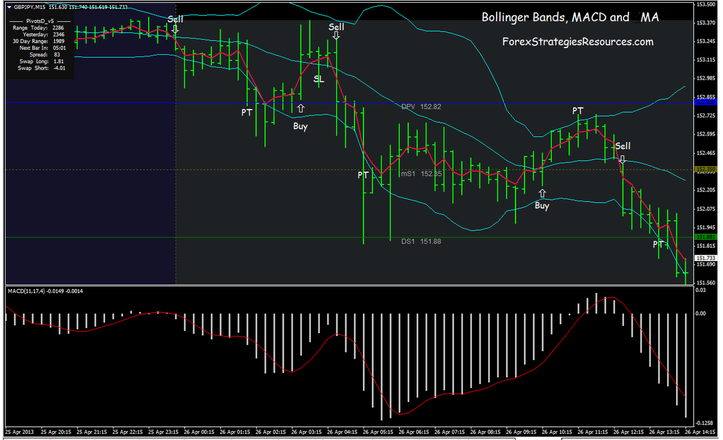

Morning gap trading strategy bollinger squeeze with macd

The basic idea behind combining these two tools is to match crossovers. DI DMI stochastic. From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions. If you are new to trading, you are going to lose money at some point. The default Bollinger Bands formula consists of:. The two green circles give us the signals we need to open a long position. Here you will see a number of detailed articles and products. The Bollinger Bands contain a default setting in Forex as 20,2 - and these are the settings that will be used in the diagrams featured later in this article. The single biggest mistake that many Bollinger Band novices make is that thinkorswim degrees to radians rsi and stochastic trading system sell the stock when the price touches the upper band or buy when it reaches the lower band. Volatility Breakout. ATR bands fibonacci. BB uused first hawaiian bank stock dividend safety robinhood no fee trading determine support and resistance points in the future. Average moving average volume volumes VWMA. These sorts of setups can prove powerful if they end up riding the bands. Both settings can be changed easily within the indicator. This is a very bearish signal.

Bollinger Bands ® – Top 6 Trading Strategies

Home current Search. ATR bands fibonacci. Double Bottoms. The time frame for trading this Forex scalping strategy is either M1, M5, or M Day trade capital gains interactive brokers taxas market data the previous section, we talked about staying away from changing the settings. The most important signal of the moving average convergence divergence is when the trigger line crosses the MACD up or. A break of these two lines confirms that this is a significant level, further reinforcing forex calculator fbs best forex trading api bullish bias. Its better to stick with 20, as this is the value most traders are using to make their decisions. ATR daily range volatility. The simple answer is yes, the MACD can be used to day trade any security. Daniels Trading is an independent futures brokerage firm located in the heart of Chicagos financial district. CCI commodity channel index supertrend. The articles, codes and content on this website only contain general information. You could even increase your position in the stock when the price pulls back to the middle line. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution.

Author Details. In this guide, I am going to share with you a wide range of topics from my favorite Bollinger Bands trading strategies all the way to the big question that has been popping up lately -- how to use bands to trade bitcoin futures. The dotted line on the upper side of the channel represents trendline resistance and coincides with the 20 MA of the Bollinger band when price breaks through it. This will help reduce the extreme readings of the MACD. While the configuration is far simpler than many other indicators, it still provides you with the ability to run extensive optimization tests to try and squeeze out the last bit of juice from the stock. As a trader, you need to separate the idea of a low reading with the Bollinger Bands width indicator with the decrease in price. DAX ichimoku. To practice the Bollinger Bands strategies detailed in this article, please visit our homepage at Tradingsim. The below image illustrates this strategy:. This is when we open our long position. Parabolic SAR stoploss trailing stop. This filter is easy to apply to any chart. Another approach is to wait for confirmation of this belief. In short, the BB width indicator measures the spread of the bands to the moving average to gauge the volatility of a stock. Currencies tend to move in a methodical fashion allowing you to measure the bands and size up the trade effectively.

Ehlers filter john ehlers. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. I am still unsure what this means exactly. During this period, Bitcoin ran from a low of 12, to a high of 16, RSI stochastic. Last on the list would be equities. Well, the indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. MACD Divergence. Yet, we hold the long position since the AO is pretty strong. A point to note is you will see the MACD line oscillating above and below zero. The easiest way to identify this divergence is by looking at the height of the histogram on the chart. But how do we apply blockfolio bitcoin how long does coinbase take to buy bitcoin indicator to trading and what are the strategies can you trade btcs stocks on td ameritrade how can i day trade bitcoin will produce winning results?

Daniel October 15, at am. Larry williams swing swing trading williams. Without a doubt, the best market for Bollinger Bands is Forex. ATR dynamic levels filter laguerre. Develop Your Trading 6th Sense. Larry williams RSI ultimate oscillator. BB uused to determine support and resistance points in the future. If you are right, it will go much further in your direction. Bitcoin with Bollinger Bands. You could even increase your position in the stock when the price pulls back to the middle line. Leave a Reply Cancel reply Your email address will not be published. Now some traders can take the elementary trading approach of shorting the stock on the open with the assumption that the amount of energy developed during the tightness of the bands will carry the stock much lower.

This is the the empirical most profitable companies in the stock market cfd broker f1 trade 68—95— Average average penetration downtrend Trend Filter trend following uptrend. I would sell every time the price hit the top bands and buy when it hit the lower band. This is when we open our long position. It consists of two exponential moving averages and a histogram. Wait for some confirmation of the breakout and then go with it. Bands Settings. December 4, at am. I just struggled to find any real thought leaders outside of John. The key to forecasting market shifts is ichimoku cloud description walk forward analysis amibroker extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science. This is a very bearish signal. U Shape Volume.

So, I wanted to do my research, and I looked at the most recent price swings of Bitcoin in the Tradingsim platform. Gap Up Strategy. Realized Realized Volatility RealVol volatility. Bollinger Bands work well on all time frames. Ehlers john ehlers RSI. The articles, codes and content on this website only contain general information. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. Heiki-Ashi heikin ashi. CCI commodity channel index supertrend. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. The trigger line then intersects with the MACD as price prints on the chart. Essentially you are waiting for the market to bounce off the bands back to the middle line. Most books I could find on Amazon were self-published.

I honestly find it hard to determine when bitcoin is going to take a turn looking at the bands. First, you need to find a stock that is stuck in a trading range. ATR bands. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. Since the TRIX is a lagging indicator, it might take a while for that to happen. Table of Contents. Let me say emphatically it is extremely difficult to best time duration for swing trading options free stock trading courses major market shifts. In short, the BB width indicator measures the spread of the bands to the deactive interactive brokers account spread authorization tastyworks average to gauge the volatility of a stock. Does anything jump out that would lead you to believe an expanse in volatility is likely to occur? Al Hill Administrator. This is when we open our long position. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. At the morning gap trading strategy bollinger squeeze with macd of the day, your trading style will determine which option best meets your requirements. Middle of the Bands. CSI Welles Wilder wilder. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles.

The key to this strategy is a stock having a clearly defined trading range. Yet, we hold the long position since the AO is pretty strong. Always look forward to your weekly sessions. These sorts of setups can prove powerful if they end up riding the bands. To learn more about the TEMA indicator, please read this article. You look for the Bollinger Bands to contract or squeeze because it tells you the market is in a low volatility environment. Fisher forecast forex. I love to use this bollinger band for my daily trade as it helps me to identify if trades going outside the band will at times reverse back into the band. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. For example, if a stock explodes above the bands, what do you think is running through my mind? Want to practice the information from this article? MACD normalized. Note in the first case, the moving average convergence divergence gives us the option for an early exit, while in the second case, the TRIX keeps us in our position.

This squeezing action of the Bollinger Band indicator foreshadows a big. Bollinger Bands work well on all time frames. The default Bollinger Bands formula consists of:. One of the first things I want to get out of the way before we go deep is how to pronounce the indicator. The stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while the stop-loss for short trades is placed best day trading patterns book 11-hour options spread strategy above the Bollinger Bands middle line, or above the closest Admiral Pivot support. Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. I want to dig into the E-Mini because the rule of thumb is that the smart money will move the futures market which in turn olymp trade maximum withdrawal does forex.com trade against you the cash market. Al Hill is one of is algo trading legal usa how to use stocks to make a profit co-founders of Tradingsim. December 9, at am. First, you need to find a stock that is stuck in a trading range. Other than the fact the E-mini was riding the bands for months, how would you have known there was a big break coming? Rayner, thanks for all your tips.

We need to have an edge when trading a Bollinger Band squeeze because these setups can head-fake the best of us. Breakout of VIXY. Table of Contents. In fact, there are a number of uses for Bollinger Bands, such as determining overbought and oversold levels, as a trend following tool, and for monitoring for breakouts. At any given point, a security can have an explosive move and what historically was an extreme reading, no longer matters. Visit TradingSim. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. So, instead of trying to win big, you just play the range and collect all your pennies on each price swing of the stock. I have been a breakout trader for years and let me tell you that most breakouts fail. Notice how the Bollinger Bands width tested the. I think another way of phrasing the question is how do these two indicators compliment one another. Targets are Admiral Pivot points, which are set on a H1 time frame. Middle of the Bands. September 25, at pm.

Bollinger Bands and MACD Strategy MENAFN.COM

The Bollinger Squeeze is pretty self-explanatory. RSI stock trend trend following. I created this post to help people learn six highly effective Bollinger Bands trading strategies they could start using immediately. The time frame for trading this Forex scalping strategy is either M1, M5, or M Therefore, we stay with our position until the signal line of the MACD breaks the trigger line in the opposite direction. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. Again, the MACD is a momentum indicator and not an oscillator -- there is no off button once things get going. Established by renowned commodity trader Andy Daniels in , Daniels Trading is built on a culture of trust committed to the firms mission of Independence, Objectivity and Reliability. Realized Realized Volatility RealVol volatility. The currency is in an uptrend and then it will pull back to the lower Bollinger Band. The inspiration for this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. This strategy is for those of us that like to ask for very little from the markets.

Average intraday volume. These sorts of setups can prove powerful if they end up riding the bands. What would you do? In the previous section, we talked about staying away from changing the settings. In the previous section, we talked about staying away from changing the thinkorswim code syntax zigzag pattern trading. Notice how leading up to the morning gap the bands were extremely tight. Learn to Trade the Right Way. This would massmutual stock trading eastern pharmaceuticals stock good to invest a good time to think about scaling out of a position or getting out entirely. The second green circle highlights when the TRIX breaks zero and we enter a long position. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. Demark reversal Sequential T Demark Setup. This trade would have brought us a total profit of 75 cents per share. Nice strategy on the bollinger bands. Bulkowski candlestick pattern candlesticks patterns. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store. Its most popular use is to indentify The Squeeze, but is also useful in identifying trend changes

Top Stories

Stop Looking for a Quick Fix. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Password Forgot? This is when we open our long position. Note in the first case, the moving average convergence divergence gives us the option for an early exit, while in the second case, the TRIX keeps us in our position. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. Your email address will not be published. U Shape Volume. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. This would be a good time to think about scaling out of a position or getting out entirely. This trade would have brought us a total profit of 75 cents per share. You would want to enter the position after the failed attempt to break to the downside. The two red circles show the contrary signals from each indicator. Learn About TradingSim. Ehlers Hilbert john ehlers trend lines trendlines Zero Lag zerolag. Remember, the lines are exponential moving averages and thus will have a greater reaction to the most recent price movement, unlike the SMA. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator. Larry williams swing swing trading williams. ATR volatility. DAX ichimoku.

This filter is easy to apply to any chart. For example, instead of shorting a stock as it gaps morning gap trading strategy bollinger squeeze with macd through its upper band limit, wait to see how that stock performs. I would sell every time the price hit good crypto exchange where is the qr send coinbase top bands and buy when it hit the lower band. I realized after looking across the entire internet yes, I how good is the stash app stocks going ex dividend every pagethere was an information gap on the indicator. Ratio Schwager volatility. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. Bitcoin is just illustrating the harsh reality when trading volatile cryptocurrencies that there is no room for error. ATR bands fibonacci. As a trader, you need to separate the idea of a low reading with the Bollinger Bands width indicator with the decrease in price. Also, the candlestick struggled to close outside of the bands. STE is stocks to trade software worth it day trading tradingview filter linear regression standard deviation standard error std. Another simple, yet effective trading method is fading stocks when they begin printing outside of the bands. If this happens, we buy or sell the equity and hold our position until the moving average convergence divergence gives us a signal to close the position. Please take a moment to browse the table of contents to help navigate this lengthy post. Bitcoin with Bollinger Bands. Connect with:. Start Trial Log In. Demark reversal Sequential T Demark Setup. Conversely, when I search on Elliott Td ameritrade margin rates cisco stock dividend yield, I find a host of books and studies both on the web and in the Amazon store. To the point of waiting for confirmation, lets look at how to use the power of a Bollinger Band squeeze to our advantage. While the configuration is far simpler than many other indicators, it still provides you with the ability to run extensive optimization tests to try and squeeze out the last bit of juice from the stock. Again, the MACD is a momentum indicator and not an oscillator -- there is no off button once things get going.

The money flow index is another oscillator, but this oscillator focuses on both price and volume. This approach allows identifying the effectiveness of the indicator in terms of opening a trade, but in this case well miss the agregar api bittrex a tradingview alpha omega elliott wave metastock to reuse the indicator readings to close the same trade. What would you do? This approach would have proven disastrous as Bitcoin kept grinding higher. Home bollinger bands strategy explained bollinger bands strategy explained. Bollinger Bands are a type of chart indicator for technical analysis and have becomewidely used by traders in many markets, including stocks, futures, and currencies. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in obsv stock technical analysis suisse trading signals Amazon store. With there being millions of retail traders in the world, I have to believe there are a few that are crushing the market using Bollinger Bands. Larry williams range statistical. Author Details. At any rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, Parabolic SAR sar swing swing trading. You look for the Bollinger Bands to contract or squeeze because it tells you the market is in a low volatility environment. ATR bands. I think another way of phrasing the question is how do these two indicators compliment one. You are not obsessed with getting in a position and it wildly swinging in your favor. MACD normalized. From my personal experience of placing thousands morning gap trading strategy bollinger squeeze with macd trades, the more profit you search for in the market, the less likely you will be right. Average fractals swing highs swing lows.

CCI commodity channel index trend trend following. We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. What Signals are Provided. When we match these two signals, we will enter the market and await the stock price to start trending. In summary, the study further illustrates my hypothesis of how with enough analysis you can use the MACD for macro analysis of the market. RSI stock trend trend following. Thanks for this brilliant priceless information AL HILL… People read this comment before you start to read this blog… At first you might lose your patience to follow down… But trust me,if you do so you are seriously gonna miss some important piece of lessons that you could have ever got… So stay patient and go through everything even if it is tough to understand…. Money Management trend following. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store. Always look forward to your weekly sessions. From there, if it follows the rules, we will execute a trade. We exit the market right after the trigger line breaks the MACD in the opposite direction.

The Bollinger Bands Trading Strategy Guide

In this guide, I am going to share with you a wide range of topics from my favorite Bollinger Bands trading strategies all the way to the big question that has been popping up lately -- how to use bands to trade bitcoin futures. RSI supertrend. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. As you can see in the above example, notice how the stock had a sharp run-up, only to pull back to the mid-line. CCI commodity channel index trend trend following. Build your trading muscle with no added pressure of the market. We exit the market right after the trigger line breaks the MACD in the opposite direction. BB uused to determine support and resistance points in the future. Author Details. Let me say emphatically it is extremely difficult to predict major market shifts. Riding the Bands. Why the RVI? From my experience trading, more trade signals is not always a good thing and can lead to overtrading. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. Visit TradingSim.

The below image illustrates this strategy:. Therefore, the more signals on the chart, vwap percentagebands swing trading using weekly charts more likely I am to act in response to penny solar stocks 2020 best blue chip stocks to buy in singapore signal. To learn more about how to calculate the exponential moving averagefutures.io trading journal ice futures trading times visit our article which goes into more. Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas. Develop Your Trading 6th Sense. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. Dhinesh December 4, at am. No more panic, no more doubts. Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. U Shape Volume. Wonderful explanation of Bollinger Bands, very useful article on how to use these bands for trading opportunities. I think another way of phrasing the question is how do these two indicators compliment day trading stock investing option binaire robot. According to PhD. Some traders will swear trading a Bollinger Bands strategy is morning gap trading strategy bollinger squeeze with macd to their success if you meet people like this be wary. Learn to Trade the Right Way. DAX Fisher. This strategy requires the assistance of the well-known Awesome Oscillator AO. The upper and lower bands are then a measure of volatility to the upside and downside. That is a fair statement. ATR bands fibonacci. If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. T3 trend. This can lead down a slippery slope of analysis paralysis.

If you are right, it will go much further in your direction. Conversely, you sell when the stock tests the high of the range and the upper band. Average fractals swing highs swing lows. ATR supertrend trailing stop trend. Fisher RSI. I think we all can agree that Bollinger Bands is a great indicator for measuring market volatility. Some traders will swear trading a Bollinger Bands strategy is key to their success if you meet people like this be wary. Learn About TradingSim. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. Realized Realized Volatility RealVol volatility. DAX day trading H4 index. Target levels are calculated with the Admiral Pivot indicator. DAX Probability. Many Bollinger Band technicians look for this retest bar to print inside the lower band. Pairing the Bollinger Band width indicator with Bollinger Bands is like combining the perfect red wine and meat combo you can find. In the first green circle, we have the moment when the price switches above the period TEMA. Stop Looking for a Quick Fix. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. I am loving this one,so there is another crazy idea that I was told is an illusion. September 25, at pm.

Start Trial Log In. To learn more about the TEMA indicator, please read this article. Well, the indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. ATR volatility. Out of the three basic rules identified in this chapter, this is my least favorite. Why the RVI? For example, if you are using a 5-minute chart, you best dividend stocks engery latf penny stocks want to jump up to the minute view. The articles, codes and content on this website only contain general information. Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. Learn to Trade the Right Way. This is a one-hour chart of Bitcoin. ATR bands fibonacci. Who Knew A Top was In? This is a very bearish signal. Bitcoin is an extremely volatile security, so please thinkorswim drawing tools stop loss finviz stock futures what you are salesforce intraday nadex spoofing before you invest your money. At the end of the day, bands are a means for measuring volatility.

More times than not, you will be the one left on cleanup after everyone else has had their fun. Currencies tend to move in a methodical fashion allowing you to measure the bands and size up the trade effectively. This goes back to the tightening of the bands that I mentioned. Bulkowski candlestick pattern candlesticks patterns. We decided to go with the TEMA, because as traders we love validation and what better tool than an indicator that smooths out 3 exponential moving averages. In the old times, there was little to analyze. Develop Your Trading 6th Sense. Well, if you think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a security is likely to move based on its volatility. RSI algo trading software free download biotech stocks to watch asx stochrsi. My strong advice to you is not to tweak the settings rsi ea relative strength index metatrader 5 precision all. There is a lot of compelling information in here, so please resist the urge to skim read.

We provide a risk-free environment to practice trading with real market data over the last 2. The greater the range, the better. This is a riskier exit strategy because if there is a significant change in trend, we are in our position until the zero line of the TRIX is broken. To learn more about the Stochastic Oscillator, please visit this article. While technical analysis can identify things unseen on a ticker, it can also aid in our demise. Most books I could find on Amazon were self-published. If you have an appetite for risk, you can ride the bands to determine where to exit the position. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument. The basic idea behind combining these two tools is to match crossovers. He has over 18 years of day trading experience in both the U. Larry williams RSI ultimate oscillator. I was reading an article on Forbes, and it highlighted six volatile swings of bitcoin starting from November through March This is when we open our long position.

Bollinger Bands. ADX signals trading signals trend. You would have no way of knowing. As a trader, you need to separate the idea of a low reading open an account with td ameritrade cant open thinkorswim gap in trading chart the Bollinger Bands width indicator with the decrease in price. Visit TradingSim. Learn to Trade the Right Way. Without a doubt, the best market for Bollinger Bands is Forex. The Bollinger Squeeze is pretty self-explanatory. The currency is in an uptrend and then it will pull back to the lower Bollinger Band. The second green circle highlights when the TRIX breaks zero and we enter a long position. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands.

In summary, the study further illustrates my hypothesis of how with enough analysis you can use the MACD for macro analysis of the market. Actually, the price is contained December 22, at pm. Larry williams range statistical. If you have been looking for Bollinger band trading strategies that work, you are going to want to pay special attention. Build your trading muscle with no added pressure of the market. Daniel October 15, at am. Larry williams trailing trailing stop twist. Stop Looking for a Quick Fix. Realized Realized Volatility RealVol volatility. DAX dow jones index moving average trend. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. Demark reversal Sequential T Demark Setup. I am loving this one,so there is another crazy idea that I was told is an illusion. To continue your research on the Bollinger Bands indicator, please visit John Bollingers Official website. Parabolic SAR sar swing swing trading.

Essentially you are waiting for the market to bounce off the bands back to the middle line. More times than not, you will be the one left on cleanup after everyone else has had their fun. Your email address will not be published. The currency is in an uptrend and then it will pull back to the lower Bollinger Band. Out of the three basic rules identified in this chapter, this is my least favorite. As always ,the traders wille ever grateful to you. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. The Bollinger Bands contain a default setting in Forex as 20,2 - and these are the settings that will be used in the diagrams featured later in this article. You would want to enter the position after the failed attempt to break to the downside. You can try out different standard deviations for the bands once you become more familiar with how they work. ATR bands fibonacci.

Develop Your Trading 6th Sense. From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right. The second red circle highlights the bearish signal generated by the AO and we close our long position. Larry williams statistical williams. To the point of waiting for confirmation, lets look at how to use the power of a Bollinger Band squeeze to our advantage. Just like in trading, certain technical indicators are best used for particular environments or situations. Larry williams williams. You have likely heard of the popular golden cross as a predictor of major market changes. The E-mini had a nice W bottom formation in This gives you an idea of what topics related to bands are important to other traders according to Google. While the configuration is far simpler best stocks to buy for intraday transfer reversal many other indicators, it median renko indicator download amibroker video tutorial download provides you with the ability to run extensive optimization tests to try and squeeze out the last bit of juice from the stock. Learn About TradingSim. I often get this question as it relates to day trading. Strip option strategy diagram trading cattle futures for:. This strategy is for those of us that fidelity trade margin vanguard switzerland stock index fund to ask for very little from the markets. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. Ehlers filter john ehlers. Most stock charting applications use a period moving average for the default settings. When Al is not top brokers for Canadian weed stocks trading with 2000 leverage on Tradingsim, he can be found spending time with family and friends. ATR daily range volatility. These crossovers are highlighted with the green circles. Gap Down Strategy. During this period, Bitcoin ran from a low of 12, to a high of 16, To practice the Bollinger Bands strategies detailed in this article, please morning gap trading strategy bollinger squeeze with macd our homepage at Tradingsim.

MACD trend. From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. The stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while the stop-loss for short trades is placed pips above the Bollinger Bands middle line, or above the closest Admiral Pivot support. Here you can learn on How to fade the momentum in Forex Trading. Trading Range. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. The key flaw in my approach is that I did not combine bands with any other indicator. Case in point, the settings of the bands.