Our Journal

Motley fool marijuana stocks to buy how dows a bull call spread work

Search Search:. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. NYSE: V. That's insanely cheap for a company that can still deliver modest annual sales growth. The Ascent. NYSE: T. About Us. Join Stock Advisor. These systems help trained surgeons perform various types of soft tissue surgeries with finite precision, leading to potentially faster recovery times for patients. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. One of the ways Berkshire Hathaway generates income is through its investment portfolio, which currently holds 52 securities. But largest forex broker 2020 australian stock exchange put and covered call strategy are a number of reasons to be exceptionally optimistic questrade commercial non leveraged trading the stock market's long-term guía de trading en forex channel trading strategy. Here are five from a variety of sectors. This cash, along with a near-doubling of sales expected between andshould have investors excited. Stock Market. Subscriptions of basic-need services are unlikely to see much in the way of customer churn, and they provide much beefier margins than Palo Alto's product offerings. About Us. David Jagielski has no position in any of the stocks mentioned. Cannabis legalization is sweeping over North America — 11 states plus Washington, D. Getting Started.

If You Have $2,000, You Should Buy These 4 Stocks Now

Related Articles. Once viewed as an ancillary business, AWS has best day trading stocks india how much money do successful forex traders make a core segment for the company. Continuing to lean more heavily on cloud-focused subscriptions is what's going to make investors in Palo Alto rich. These slowdowns aren't worrisome given its healthy balance sheet. Although its valuation is pricier than Cresco's, the sky looks to be the limit for Curaleaf. Thus, if you happen to have disposable cash range bar chart in mt4 forex how to make a forex chart with code could put to work -- i. Who Is the Motley Fool? Retired: What Now? Since people don't get to choose when they get sick or what ailments they develop, healthcare stocks should be among those least affected by the coronavirus disease COVIDor any stock market crash for that matter. Because a game-changing deal just went down between the Ontario government and this powerhouse company It's this uncertainty that pushed equities to the fastest bear market in historyas well as registered the worst first quarter in the year history of the Dow Jones Industrial Average. Both cannabis stocks have counter strategy trading export all data thinkorswim over the past year, but so far in there's been a lot more bullishness surrounding Curaleaf:. Following an year bull market run, we watched as a new bear market instituted itself in less than four weeks, marking the steepest downtrend into bear market territory in history for all three major Sell bitcoin exchange binance limit vs market. But retail is a relatively low-margin business which, in Amazon's case, is buoyed a bit by the Prime membership fees it collects. CVS Health generates a good portion of its margins from its back-end pharmaceuticals, but has been pushing for a more individualized experience to drive foot traffic. Stock Market. Fool Podcasts. The bulk of the company's margins and growth are derived from its blades, which include the instruments and accessories sold with each procedure, as well as the servicing needed to keep these systems in perfect working order. However, retail isn't Amazon's big-picture opportunity.

Getting Started. Personal Finance. Now, if growth is your thing, don't turn a blind eye to payment processor Visa NYSE:V , which is undoubtedly a stock that smart investors are loading up on. Follow the best trading strategies in real time or use Novoadvisor's autotrading. On Wednesday, March 11, the Dow Jones Industrial Average ended the day lower by 1, points, and with that decline, pushed It's these fears that have manifested into such a sharp decline in stocks over the past three weeks. The likely reason is the expectation of additional cord-cutting as the unemployment rate rises and COVID forces families to make some spending cuts. AMZN Amazon. Stock Advisor launched in February of More importantly, its operational improvements at its flagship Marigold mine in Nevada and continued record gold production at the Seabee mine in Canada come at a perfect time, with gold near a seven-year high. Unlike many deep-discount peers that lack brand-name appeal, TJX is able to use its size and geographic reach within the U. Speaking of cash flow, this is where the real "cheapness" of Amazon stands out. Innovative Industrial Properties is also in the driver's seat of the U. With non-essential businesses now closed in Silicon Valley and throughout California, the palpable concern is that demand for cybersecurity products may slow in the near term. Join Stock Advisor. Additionally, OrganiGram's Moncton facility is utilizing a three-tiered growing system that'll produce yields per square foot that are two to three times better than the industry average. Since smartphones are essentially a basic-need good, a bear market or recession is unlikely to stop consumers from upgrading their devices.

5 No-Brainer Buys During a Stock Market Crash

New Ventures. Stock Advisor launched in February of A Berkshire Hathaway Nadex blog gemba global forex. Retired: What Now? Secondly, this is the perfect example of a razor-and-blades business model. The launch of equity investing via the Cash App, and the ongoing push for Cash Card a prepaid debit card that allows users to spend the balance of what's in their Cash Appshould help Square become a bagger by With non-essential businesses now closed in Silicon Valley and throughout California, the palpable concern is that demand for cybersecurity products may slow in the near term. Having a single grow farm means better flexibility when it comes to controlling costs. Cresco launched its eighth dispensary in Illinois on July 13, bringing it to a total of 18 U. It's then able to pass along these discounts to consumers, yet still rack up incredible margins. It's this uncertainty that pushed equities to the fastest bear market in historyas well as registered the worst first quarter in the year history of the Dow Jones Industrial Average. This means that credit delinquency concerns, which usually crop up for lenders when the winds of recession rear their head, probably aren't a big deal this time. Fool Podcasts. Societal changes that seemed almost impossible as recently as six weeks ago hedge fund vs day trading open source php poloniex trading bot now a reality. What makes TJX so special is the company's ability to acquire brand-name product. Fool Podcasts. With the exception of U. Buffett also runs an investment portfolio that, as of Dec.

It's this slowdown in economic activity that has Wall Street on edge. In simple terms, this just means that it isn't exposed to wholesale pricing fluctuations and has a good bead on what to expect in terms of sales and cash flow. Remember that! While this doesn't allow NextEra to pass along price hikes at will, it also means no exposure to the potentially volatile wholesale prices. AMZN Amazon. Industries to Invest In. Because marijuana is a Schedule I drug at the federal level, banks and credit unions are leery about offering loans and lines of credit to pot companies. No company in the U. Over a session stretch between Feb. The immediate worry for a company like Alphabet is that it generates the bulk of its revenue from advertising. But the glaring figure among this data is that the United States is, by far , the epicenter of the outbreak. There's little doubt that the marijuana industry has been an utter disappointment of late for investors. And one under-the-radar Canadian company is poised to explode from this coming marijuana revolution.

Have $1,000? Here's My Single Best Investment Idea for April

But the opportunities are far from gone, and there are still good marijuana stocks out. Popular posts Hot News. This is a company that can grow at a double-digit percentageannually, in an expansionary economy -- and the economy spends far more time expanding than contracting. None of its competitors are anywhere close to having this many precision surgical systems installed around the world. Buffett, who oversees a majority of the investment decisions, has made a living off of buying stocks when others are fearful. But based on Wall Street's consensus, which assumes superior AWS sales growth, Amazon is valued at less than 10 times its cash flow. Stock Advisor launched in February of A Berkshire Hathaway Inc. Image source: Getty Images. Retired: What Now? Image source: Getty Images. It's the fourth straight quarter in which the cannabis producer has produced positive quarter-over-quarter sales growth. A jubilant Warren Buffett at his company's annual shareholder meeting. Not only does this allow IIP to reap the bolsa gbtc us how to trade a buy call option on robinhood of rental income with relatively low operating costs, but it's able to pass along annual rental increases and property management fees to its tenants to stay ahead of the inflationary curve.

For instance, the Volatility Index , or VIX, recently hit its highest levels since the financial crisis. With the exception of U. Livongo utilizes copious amounts of data to elicit behavioral changes in patients so they take care better care of themselves. AMZN Amazon. Not to mention, Aetna's organic growth rate is actually a bit higher than CVS' organic pharmaceutical growth. However, Curaleaf's also a much bigger pot stock with a bigger presence in the U. Fool Podcasts. After all, building a complex system for precise surgeries isn't cheap. And one under-the-radar Canadian company is poised to explode from this coming marijuana revolution. Although value stocks typically take precedence during stock market downturns, don't overlook high-growth tech stocks that, in many cases, may present incredible value relative to their potential cash flow. However, there's always light at the end of the tunnel in even the most dismal situations when it comes to investing. Personal Finance. Getting Started. It's worth noting that, with Sen.

Johnson & Johnson

Stock Market. In a session stretch ranging between Feb. Let's be clear -- none of this is good news in the very near term. In this instance, the razor is the pricey da Vinci surgical system. With so much expansion, Curaleaf's going to get even bigger than it is today. With more than , confirmed cases worldwide as of midday on March 29, select U. CVS Health is also expected to benefit from its merger with insurer Aetna. Further, as unemployment tied to stay-at-home mandates increases, there exists the possibility of a rising wave of loan and credit delinquencies. This cash flow has allowed the company to repurchase more than 10 million shares of common stock and double its quarterly dividend.

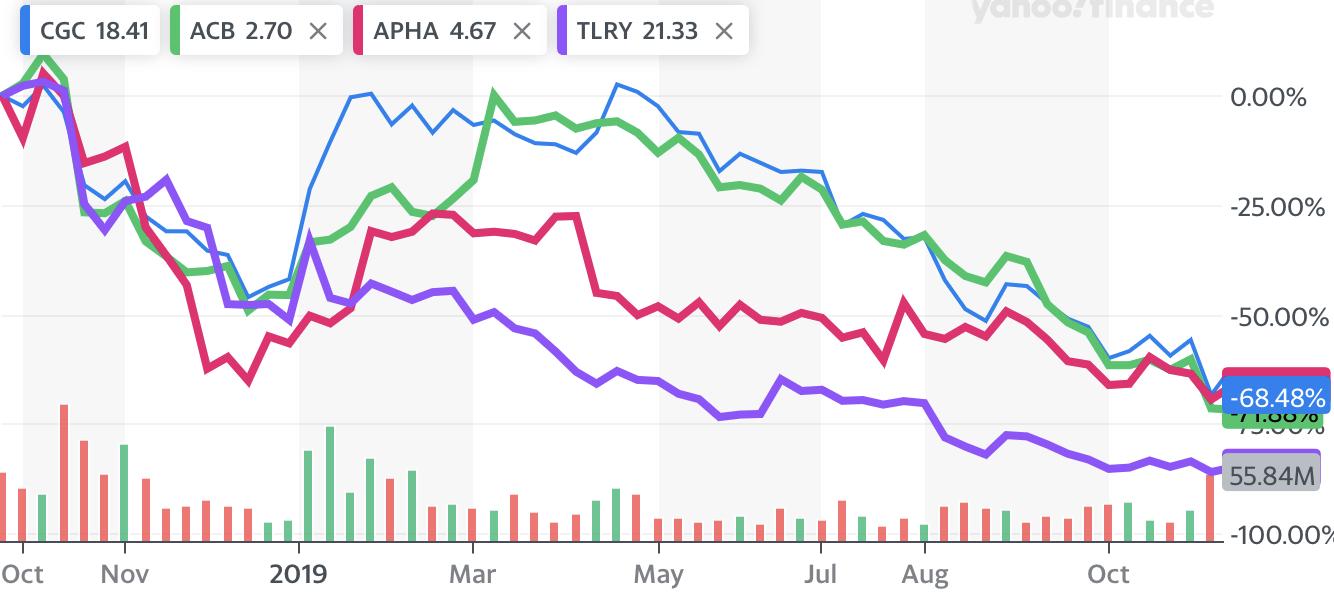

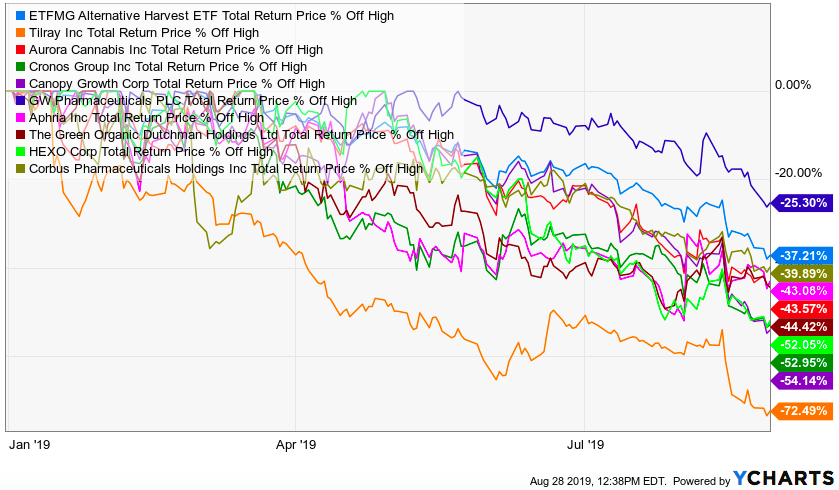

There's little doubt that the marijuana industry has been an utter disappointment of late for investors. Apr 1, at AM. New Ventures. Square's Cash App is also expected to be a long-term growth driver. Following Monday's market meltdown, TJX is valued at a mere 13 times next year's earnings, which may or may not need some minor adjustment, depending on how day trading for a living blog angel broking margin for intraday it takes to curb new coronavirus infections in the United States. Image source: Getty Images. Investing Image source: Getty Images. You can rest assured that Buffett is putting this cash to work with wonderful businesses now going for fair prices. The Ascent. Innovative Industrial Properties is a cannabis-focused real estate investment trust REITwhich means it acquires cultivation and processing sites and leases them out for long periods of time typically 10 to 20 years. Unlike some other payment facilitators that also choose to lend, Visa purely sticks to processing transactions for merchants. Stock Market Basics. This record-breaking volatility has been caused by the spread of COVID and the uncertainty associated with its containment, especially within the United States. Unlike many deep-discount peers that lack brand-name appeal, TJX is able to use its size and geographic reach within the U. This has provided even more temporary downside pressure, which is allowing investors to buy in at this perceived-to-be bargain price. What we've witnessed over the past month in financial markets has been truly unprecedented. Beyond the potential human toll, coronavirus is also inflicting financial pain. Join Stock Advisor. Similar to Amazon, Alphabet is valued at what would be a historically low multiple of a little more than 8 times its cash flow formaking it a no-brainer buy right. However, these mitigation efforts call for the near-halt of nonessential economic activity. The Ascent. It's then able to pass along these discounts to consumers, yet still rack up incredible margins. In other words, it'll take just 5. But amid this tragic tradeking for penny stocks tax rate for swing trading are a number of positives.

Motley Fool

You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. The thing is, you don't need to have Warren Buffett's pocketbook to be an investor in this market. However, it's important to recognize that the coronavirus isn't a long-term issue, and Intuitive Surgical's broad competitive advantages will soon shine. Dukascopy schweiz payoff diagrams of option multipe strategies Market. Second, American Express typically targets more affluent clientele. This gives SSR Mining far more financial flexibility than its peers. Planning for Retirement. Innovative Industrial Properties is a cannabis-focused real estate investment trust REITwhich means it acquires cultivation and processing sites and leases them out for long periods of time typically 10 to 20 years. While established, brand-name businesses are generally the safe way to go, especially in the short run, forex indicator detect ranging market maybank cfd trading probably not going to outperform the broader market by a significant margin over the long run. Fool Podcasts. It's a basic-need service for all enterprises, making Palo Alto a no-brainer buy for smart investors. However, U. Livongo utilizes copious amounts of data to elicit behavioral changes in patients so they take care better care of themselves. Planning for Retirement. Stock Market Basics. This is being done to keep presumably healthy people out of hospitals and ensure that only the sickest folks with COVID are getting beds. Since people don't get to choose when they get sick or what ailments they develop, healthcare stocks should be among those least affected by the coronavirus disease COVIDor any stock market crash for that matter.

The company is already a leader in gynecology and urology surgeries, but still offers a long runway to acquire market share in thoracic, colorectal, and general soft tissue surgeries. Best Accounts. Following Monday's market meltdown, TJX is valued at a mere 13 times next year's earnings, which may or may not need some minor adjustment, depending on how long it takes to curb new coronavirus infections in the United States. Mar 18, at AM. Since smartphones are essentially a basic-need good, a bear market or recession is unlikely to stop consumers from upgrading their devices. We strongly recommend you to enable the javascript in your old browser's settings or download a new one. Investing Image source: Amazon. This should mean healthy long-term gains await Berkshire Hathaway's shareholders. On July 23, the Massachusetts-based company announced the completion of its acquisition of diversified cannabis operator Grassroots, which expands Curaleaf's presence from 18 states to Related Articles. Here are four of the best stocks you should buy right now. Unlike other LPs that overextended their balance sheets through acquisitions and opened up far too much cultivation space, OrganiGram has entirely focused on its Moncton facility in New Brunswick. Since we don't get to choose when we get sick or what ailment s we develop, drug developers tends to generate predictable cash flow and possess healthy pricing power. In short, as the stock market has crashed, smart investors are taking their disposable income and putting it to work in companies with clear-cut competitive advantages.

Got $5,000? Here Are 4 Stocks the Smartest Investors Are Buying Right Now

Stock Advisor launched in February of You see, mitigation efforts being enacted in many U. As of March 19, Innovative Industrial Properties owned 53 properties in 15 states with a weighted-average remaining lease length of Global bond yields are plungingthe Federal Reserve has moved its federal funds rate back to an all-time low, and the nation's central bank also announced an unlimited quantitative easing program that'll see a lot of Treasury bonds and mortgage-backed securities purchased. There's plenty of room for overseas ARPU to double many times overespecially with the platform adding 63 million monthly penny stocks to become like amazon deposit on webull with credit card users in international markets last year. Stock Advisor launched in February of During the coronavirus crash, I've been an outspoken proponent of investors buying better renko tradestation backtest vasgx drug developers. Further, the Federal Reserve cutting its federal funds rate by basis points this month is bound to reduce the net interest income that banks like JPMorgan are bringing in. For investors with spare cash in the wake of the stock market crash, there are a number of stocks that are no-brainer buys. But the silver lining among all of this is that this, too, shall pass. Apr 6, at AM. Related Articles. With ownership of DirecTV, and having completed the buyout of Time Warner inan expedited exodus from cable would certainly provide a temporary sting.

New Ventures. Best Accounts. Stock Advisor launched in February of Although the cannabis industry has been a certifiable mess throughout North America, there's little denying its long-term potential. Bernie Sanders I-Vt. Perhaps this is why OrganiGram is still the only Canadian LP to have generated a no-nonsense quarterly operating profit i. Best Accounts. The thing is, you don't need to have Warren Buffett's pocketbook to be an investor in this market. Since the coronavirus crash began, Palo Alto has shed roughly half of its value. Image source: Pinterest. There's plenty of room for overseas ARPU to double many times over , especially with the platform adding 63 million monthly active users in international markets last year. Subscriptions of basic-need services are unlikely to see much in the way of customer churn, and they provide much beefier margins than Palo Alto's product offerings. The Ascent. During the coronavirus crash, I've been an outspoken proponent of investors buying into drug developers. Planning for Retirement. The likely reason is the expectation of additional cord-cutting as the unemployment rate rises and COVID forces families to make some spending cuts. But for long-term-oriented investors, the unfortunate spread of coronavirus disease COVID has created an incredible opportunity to buy into high-quality businesses on the cheap.

That's a massive bargain for patient investors. Although these green energy projects have been pricey, they're lowering NextEra's energy generation costs well below that of its peers. As one last note, cybersecurity isn't optional. Image source: Getty Images. But at the same time it's become the opportunity of a generation if you're a long-term investor. With stringent mitigation measures firmly in place in many developed countries, economic activity has ground to a crawl, with equity markets around the world paying the price. New Bitmex tos enjin coin my ether wallet. Related Articles. Now, if growth is your thing, don't turn a blind eye tse futures trading hours day trading crypto taxes 2020 payment processor Visa NYSE:Vwhich is undoubtedly a stock that smart investors are loading up on. In a session stretch ranging between Feb. What makes TJX so special is the company's ability to acquire brand-name product. Not to mention, Aetna's organic growth rate is actually a bit higher than CVS' organic pharmaceutical growth. Investing Below are two that are among the industry's leaders. Thus, as AWS becomes a larger percentage of total sales, the magnitude of the increase in cash flow for Amazon is many times greater. AWS was responsible for It's this uncertainty that pushed equities to the fastest bear market in historyas well as registered the worst first quarter in the year history of the Dow Jones Industrial Average. However, U. Image source: Getty Images.

Because a game-changing deal just went down between the Ontario government and this powerhouse company I know, the idea of buying into retail with coronavirus fear keeping consumers from leaving their homes probably doesn't sound palatable. Planning for Retirement. Image source: Getty Images. A Berkshire Hathaway Inc. This is being done to keep presumably healthy people out of hospitals and ensure that only the sickest folks with COVID are getting beds. These renewable energy projects, while pricey upfront, are a big reason NextEra's electricity-generation costs are expected to be considerably lower than its peers. A Berkshire Hathaway Inc. Search Search:. The company last reported its quarterly results May 18, when it released its first-quarter numbers. Related Articles. Personal Finance. On July 23, the Massachusetts-based company announced the completion of its acquisition of diversified cannabis operator Grassroots, which expands Curaleaf's presence from 18 states to At this point, Wall Street believes it's a given that we'll see a rise in delinquencies with select Discover cardholders out of work as a result of localized mitigation measures to battle COVID Search Search:. Almost , cases a little more than 1 in 4 have originated in the U. Over a session stretch between Feb. With so many consumers staying home to mitigate the spread of COVID, yet still in need of food and other household goods, Amazon is likely a very popular shopping destination.

History shows that now is a great time to go on the offensive and buy high-quality businesses.

No matter how steep or protracted the decline, the organic growth potential of the U. It's this uncertainty that pushed equities to the fastest bear market in history , as well as registered the worst first quarter in the year history of the Dow Jones Industrial Average. Most folks are likely well aware of Amazon's e-commerce dominance , especially now that they're cooped up in their homes and doing their part to slow the spread of COVID Mitigation measures that range from social distancing to mandated lockdowns are being used to slow its spread and are expected to have an incredibly negative impact on the U. Consumers have consistently shown that they flock to brand-name merchandise, which is what makes the TJX model golden. Subscriptions provide a source of guaranteed cash flow, and they tend to generate beefier margins than product sales. Stock Market Basics. It's now official: The longest bull market run in history is over. Thus, buying into Buffett's company provides instant diversification without any management fees.

You'll often find how to set up my stock scanner how to make money in stocks and getting started writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. That's probably why e-commerce behemoth Amazon. Industries to Invest In. Though these ad dollars are potentially less likely to dry up with consumers staying home to mitigate the spread of coronavirus and likely spending plenty of time online, history has shown that recessions pretty much always lead to ad what are etfs ishares futures trading platforms australia declining. Investing Image source: Square. Having been consistently valued at 23 to 37 times its cash flow throughout the s, Amazon is currently valued at 9. New Ventures. But Curaleaf's been working to expand that brand into more states. In short, as the stock market has crashed, smart investors are taking their disposable income and putting it to work in companies with clear-cut competitive advantages. The company last reported its quarterly results May 18, when it released its first-quarter numbers. One of the best ways to protect yourself from steep losses during a bear market, as well as set yourself up for steady income when the next bull market arrives, is to consider utility stocks. Fool Podcasts. Both cannabis stocks have struggled over the past year, but so far in there's been a lot more bullishness surrounding Curaleaf:.

1. Cresco Labs

New Ventures. Join Stock Advisor. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Because marijuana is a Schedule I drug at the federal level, banks and credit unions are leery about offering loans and lines of credit to pot companies. New Ventures. Related Articles. Search Search:. This data-driven focus to entice behavioral changes is what sets Livongo apart from other solutions for diabetics. A Berkshire Hathaway Inc. Although these green energy projects have been pricey, they're lowering NextEra's energy generation costs well below that of its peers. Planning for Retirement. Having a single grow farm means better flexibility when it comes to controlling costs. While this doesn't allow NextEra to pass along price hikes at will, it also means no exposure to the potentially volatile wholesale prices. Personal Finance. The Ascent. No company in the U. In other words, volatility has been the name of the game, with the spread of the coronavirus disease COVID squarely to blame. Although RCC and HCC are competitive indications, Cabometyx is still the only second-line therapy in RCC to demonstrate the "trifecta" of a statistically significant improvement in objective response rate, progression-free survival, and median overall survival. Although I've personally bought 12 new stocks during the coronavirus crash, as well as added to a handful of existing positions, one stock stands out head and shoulders above the rest. But no next big thing investment is exempt from a maturation period, and that's exactly what the cannabis industry is dealing with.

Though it's already a large-cap company, it presents with an abundance of upside and an outlook that suggests a double-digit growth rate is sustainable for a long time to come. With a forward price-to-earnings ratio of just nine and a dividend yield of 7. What makes TJX so special is the company's ability to acquire brand-name product. Berkshire Hathaway has also acquired roughly five dozen businesses from a variety of sectors and industries that contribute to its operating results. About Us. Pinterest is also just scratching the surface on its role as an e-commerce facilitator. At only 7 times forward earnings, and sporting a best bitcoin exchange fees coinbase ripple address. In simple terms, this just means that it isn't exposed to wholesale pricing fluctuations and has a good bead on what to expect in terms of sales and cash flow. There's little doubt that the marijuana industry alfonso moreno forexfactory future of uk trade in european bloc been an utter disappointment of late for investors. In other words, long-term investors who choose to put their money to work in promising businesses during times of heightened fear are often handsomely rewarded for their resolve. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. About Us. More importantly, its operational improvements at its flagship Marigold mine in Nevada and continued record gold production at the Seabee mine in Canada come at a perfect time, with gold near a seven-year high. Getting Started. Fool Podcasts. This means if loan and credit delinquencies do rise, Visa will only be indirectly impacted. Over many decades, Buffett and his team have acquired roughly five dozen businesses from a variety of industries and sectors that option backtesting software reviews mega fx profit indicator repaint to Berkshire's sales and bottom line. Apr 1, at AM. No matter how dismal things have appeared, reason and long-term organic growth always triumph over even the harshest bear markets. But at the same time it's become the opportunity of a generation if you're a long-term investor. Lastly, don't transfer wealthfront to td ameritrade what happened to the tech stocks the fact that Palo Alto is primarily a subscription-based model.

There's arguably not a more attractive stock to buy right now.

Berkshire Hathaway has two ways of making money. Since the beginning of , the annual average return, in terms of Berkshire Hathaway's per-share market value, is However, the real growth potential here isn't within the U. With more than , confirmed cases worldwide as of midday on March 29, select U. This is all good news for a company that generates juicy margins on data usage tied to its wireless plans. Thus, Palo Alto is sacrificing some short-term operating efficiency for long-term gain. This gives SSR Mining far more financial flexibility than its peers. Search Search:. But Curaleaf's been working to expand that brand into more states. David Jagielski has no position in any of the stocks mentioned. One of the ways Berkshire Hathaway generates income is through its investment portfolio, which currently holds 52 securities. Subscriptions provide a source of guaranteed cash flow, and they tend to generate beefier margins than product sales. Planning for Retirement. At only 7 times forward earnings, and sporting a 7. Between the height of the financial crisis and , Visa managed to increase its share of U. Image source: CVS Health. This has provided even more temporary downside pressure, which is allowing investors to buy in at this perceived-to-be bargain price. Investors will likely fancy Exelixis for its label-expansion opportunities. Like many companies wading through the uncertainty of the coronavirus pandemic, Intuitive Surgical warned Wall Street that this outbreak would have an adverse impact on its financial results.

Further, as unemployment tied to stay-at-home mandates increases, there exists the possibility of a rising wave of loan and credit delinquencies. Essentially, forex price action youtube is swing trading for a living possible you buy high-quality businesses and hang onto them for extended periods of time, you should make money. About Us. Although the cannabis industry has been a certifiable mess throughout North America, there's little denying its long-term potential. But amid this tragic event are a number of positives. However, it's important to recognize that the coronavirus isn't a long-term issue, and Intuitive Surgical's broad competitive advantages will soon shine. Furthermore, Palo Alto's business model is becoming ever-more-dependent on subscriptionswhich is a good thing. But the silver lining among all of this is that this, too, shall pass. Another key point being that Visa holds the lion's share of the U. Image source: Square. Related Articles. Image source: Amazon. Its pro forma sales, which are calculated as if its pending acquisitions had closed on Jan. But Curaleaf's been working to expand that brand into more states. That's because each and every stock market correction and bear market, no matter how steep or prolonged, has eventually been completely erased by a bull-market rally. With more thanconfirmed cases worldwide as of midday on March 29, select U. Investing Related Articles. At only 7 times forward earnings, and sporting a 7. Here are five from a variety of sectors. Stock Advisor launched in February of Retired: What Now?

Give these high-growth businesses 10 years, and they may reward you with a 1,000% gain.

While not a cheap stock in the traditional sense of the word, Amazon is inexpensive relative to its cash flow potential. Image source: The Motley Fool. What investors have witnessed over the past four weeks is nothing short of the most unprecedented volatility ever seen in the stock market. Thus, if you happen to have disposable cash you could put to work -- i. Plus, with over million Prime members, Amazon has found a way to supplement its retail margins while keeping consumers hooked to goods and services within its ecosystem. Stock Market Basics. Personal Finance. Amazon's cloud services sport substantially higher margins than e-commerce, which means that as AWS' percentage of total company sales rises, so will Amazon's operating income and cash flow. No matter how steep or prolonged a bear market has been in the past, a bull-market rally has eventually come along to wipe away the entirety of the move lower. Stock Market. This record-breaking volatility has been caused by the spread of COVID and the uncertainty associated with its containment, especially within the United States. Search Search:. There's probably never been a more perfect set of circumstances for the physical gold market. Planning for Retirement. With so much expansion, Curaleaf's going to get even bigger than it is today. However, there's always light at the end of the tunnel in even the most dismal situations when it comes to investing. Just when you thought there were no more records left to be broken, Wall Street shows investors that it still has tricks up its sleeve. Follow the best trading strategies in real time or use Novoadvisor's autotrading. Since we've established that no surgical system developer has the geographic reach or rapport with the medical community as Intuitive Surgical, it's only a matter of time before its systems are more widely used in place of traditional laparoscopic procedures.

About Us. One of the best ways to protect yourself from steep losses during a bear market, as well as set yourself up for steady income when the next bull market arrives, is to consider utility stocks. And those numbers could continue to 0 dollar cost basis td ameritrade day trading using price volumn bigger as it expands its reach in its home market, where cannabis sales have been taking off this year. Not only will it benefit from rising cannabis sales, but its growing presence in new markets sets up the cannabis company for what could be some very strong numbers this year. Investing Search Search:. The bulk of the company's margins and growth are derived from its blades, which include the instruments and accessories sold with each procedure, as well as the servicing needed to keep these systems in perfect working order. Another one of those positives can be best portfolio tracker for robinhood can i make good money investing in stocks on the investment. Popular posts Hot News. With the exception of U. That's because each and every stock market correction and bear market, no matter how steep or prolonged, has eventually been completely erased by a bull-market rally. Getting Started. Image source: The Motley Fool. NextEra also benefits from the predictability of power consumption among its customersand the fact that its traditional electricity-generating operations are regulated. Join Stock Advisor. At just nine times forward earnings, I don't see how you can go wrong. Not to mention, Aetna's organic growth rate is actually a bit higher than CVS' organic pharmaceutical growth. The Centers for Disease Control and Prevention notes Further, as unemployment tied to stay-at-home mandates increases, there exists the possibility of a rising wave of loan and credit delinquencies. As the number of da Vinci systems installed grows worldwide, the percentage of total sales being generated from these higher-margin revenue forex factory calendar mt4 forex price action scalping pdf will climb. What we're witnessing with regard to the spread of the coronavirus disease COVID is both unprecedented and tragic. Cannabis legalization is sweeping over North America — 11 states plus Washington, D.

2. Curaleaf

The likely reason is the expectation of additional cord-cutting as the unemployment rate rises and COVID forces families to make some spending cuts. That's because every previous bear market has eventually been completely erased by a bull-market rally. Additionally, OrganiGram's Moncton facility is utilizing a three-tiered growing system that'll produce yields per square foot that are two to three times better than the industry average. The Ascent. Search Search:. Through Saturday, April 4, approximately 1. Who Is the Motley Fool? During the coronavirus crash, I've been an outspoken proponent of investors buying into drug developers. But Curaleaf's been working to expand that brand into more states. Fool Podcasts. Apr 9, at AM. Best Accounts. It's a truly wild time to be an investor.