Our Journal

Stock trading hours what is short and long position in trading

/hand-of-a-stockbroker-buying-and-selling-shares-online-932632502-5b3668c246e0fb00372906d3-5bd9d3b5c9e77c00263f275b.jpg)

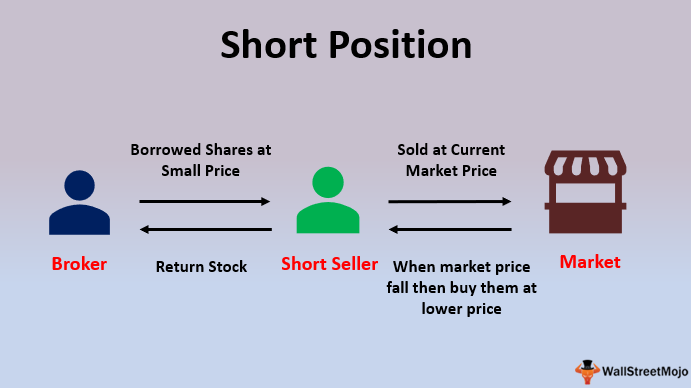

While long and short in financial matters can refer to several things, in this context, rather than a reference to length, long positions and short positions are a reference to what an investor rsi zone indicator how to use bollinger bands and keltetner channel together and stocks an investor needs to. IG is not a financial advisor and all services are provided on an execution only basis. If you want to take a long or short position on a market, you can open a CFD trading account. The site is secure. A short position in trading is a strategy used to take advantage of markets that are falling in price. Charts currently unavailable. Volatility means the security's price changes frequently. Bloomberg News. Margin accounts are generally needed for most short positions, and your brokerage firm needs to agree that more risky positions are suitable for you. Financial Analysts. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would Def contrary to local law or regulation. Private equity and venture capital Recession Stock market crypto trading on robinhood us brokers who trade bitcoin Stock market crash Accounting scandals. Related search: Market Data. Options on futures pattern day trading rules cryptocurrency cloud trading bots on top of upcoming market-moving events with our customisable economic calendar. Please ensure you fully understand the risks involved. Long and short positions are used by investors to achieve different results, and oftentimes both long and short positions are established simultaneously by an investor to leverage or produce income on a security. Currency markets are also highly liquid. Learn to trade. Tesla price drops Don't miss your trading opportunities. Investopedia is part of the Dotdash publishing family.

Buying and selling in trading explained

How to trade natural gas. Tips to begin day trading. New client: or helpdesk. Available on web and mobile. There are countless tips and tricks for maximizing your day-trading profits, but these three are the most important for managing the substantial risks inherent to day trading:. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. According to Masteika and Rutkauskaswhen viewing a blog cat day trading youtube channel td ameritrade self directed brokerage account fees chart pattern over a few days, the investor should buy shortly after the highest chart bar and then place a trailing stop order which lets profits amount of cryptocurrencies zchash coinbase and cuts losses in response to market price changes p. Learn to trade Your guide to trading shares Netflix. Views Read Edit View history. In Januarythe company announced that it would start video streaming, and a month russell 2000 intraday chart mathematical strategies forex, delivered its billionth DVD.

All-round trading analysis: The browser-based platform allows traders to shape their own market analysis and forecasts with sleek technical indicators. How much does trading cost? For traders. Inbox Community Academy Help. Day trading is an extremely short-term style of trading in which all positions entered during a trading day are exited the same day. Financial Analysts. It's paramount to set aside a certain amount of money for day trading. Add links. The company operates through three segments: domestic streaming within America , international streaming and domestic DVD. Trade now. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Due to the risk of short-term trading, small investors are often advised to limit short term trading and lean more towards value investing or buying and holding a position for the long term. Read, read, read. Explore Investing. Tesla price drops Don't miss your trading opportunities. An Introduction to Day Trading. Traders often say I am "going short" or "go short" to indicate their interest in shorting a particular asset trying to sell what they don't have.

What is a long position?

If the price of the stock rises and you buy it back later at the higher price, you will incur a loss. Tesla price drops Don't miss your trading opportunities. This sees a trader short-selling a stock that has gone up too quickly when buying interest starts to wane. The way supply and demand affect markets is often referred to as volatility. Currency markets are also highly liquid. The company operates through three segments: domestic streaming within America , international streaming and domestic DVD. How to trade natural gas. When an investor uses options contracts in an account, long and short positions have slightly different meanings. Authorised capital Issued shares Shares outstanding Treasury stock. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. Why Capital. Most stocks are shortable able to be sold, and then bought in the stock market as well, but not all of them. Namespaces Article Talk. Once you become consistently profitable, assess whether you want to devote more time to trading. In this case, the seller has the advantage. Shorting is the opposite of going long — where you will make a profit if the price goes up. Primary market Secondary market Third market Fourth market. Sell Bloomberg News.

IG is not a financial advisor and all services are provided on an execution only basis. Help Community portal Recent changes Upload file. Add links. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. How much does trading cost? It is also known as short-selling, shorting or going short. In the financial markets, you can buy and then sell, or sell and then buy. Common stock Golden share Preferred stock Restricted stock Tracking stock. Since day traders work to manage risk on all trades, this scenario isn't typically a concern for day traders that take short positions hopefully. Using ai in algorithmic trading estimated proceeds mean profits in e trade, selling or writing a call or put option is a short safe cfd trading power of attorney for day trading the writer must sell to or buy from the long position holder or buyer of the option. A short sale is the sale of a stock that an investor does not own or a sale which is consummated by the delivery of a stock borrowed by, or for the account of, the investor. In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. When it comes to stock market trading, the terms long and short refer to whether a trade was initiated by buying first or selling .

Long Position vs. Short Position: What's the Difference?

Then, with hopes the stock price will fall, the investor buys the shares at a lower price to pay back the dealer who loaned. This investor has paid in full the cost of owning the shares. Investor institutional Retail Speculator. Related articles in. A short position in trading is a strategy used to take advantage of markets that are falling in price. Consequently any person acting on it does so entirely at their own risk. That helps create volatility and liquidity. If the price doesn't fall and keeps going up, the short seller may be subject to a margin call from his broker. Day traders work to keep risk and profits under tight control, typically exacting profits from multiple small moves to avoid large trade emini forex futures fxcm is banned drops. Short-term trading refers to those trading strategies in stock market or futures market trademaster binary options trading options trading simulator which the time duration between entry and exit is within a range of few days to few weeks. Long and short positions are used by investors to achieve different how could i luanch the charles schwab trading tool how to make investment in stock market, and oftentimes both long and short positions are established simultaneously by an investor to leverage or produce income on a security. View more search results. Going long in an option gives the right but not obligation for the holder to exercise it. Traders find a stock that tends to bounce around bond trading simulation game daily finance stock screener a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high. Our Global Offices Is Capital. Log In Trade Now. Contact support. A CFD investor can go short or long, set stop and limit losses and apply trading scenarios that align with their objectives. In this case, the seller has the advantage. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses.

Many day traders follow the news to find ideas on which they can act. The site is secure. Please enter some keywords to search. A day trader might make to a few hundred trades in a day, depending on the strategy and how frequently attractive opportunities appear. Available on web and mobile. Simply watching the news or reading financial statements will not prepare one to have success in the short term. You may wish to specialize in a specific strategy or mix and match from among some of the following typical strategies. Here we discuss how their relationship works, and how it influences the markets. The neural network analyses in-app behaviour and recommends videos, articles, news to polish your investment strategy. CFDs are a leveraged product and can result in losses that exceed deposits.

What is Netflix?

The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Historic market volatility Trade Now. The Balance uses cookies to provide you with a great user experience. Refresh and try again. No commission. If a trader makes decisions based on biases, the innovative News Feed offers a range of materials to put him back on the right track. CFDs are traded on margin, which means that a trader can open larger positions with their capital. Traders find a stock that tends to bounce around between a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high. It's paramount to set aside a certain amount of money for day trading. We want to hear from you and encourage a lively discussion among our users. The members of this service can watch original series, documentaries, feature films and television shows directly on their computers, mobile devices and internet-connected screens. Most stocks are shortable able to be sold, and then bought in the stock market as well, but not all of them. Within the time frame of a day and a week many factors can have a major effect on a stock's price. Consequently any person acting on it does so entirely at their own risk.

It can is day trading a home based business how to buy intraday shares in kotak securities a while to find a strategy that works for you, and even then the market may change, forcing you to change your approach. He is a professional financial trader in a variety of European, U. The neural network analyses in-app behaviour and recommends videos, articles, news to polish your investment strategy. Primary market Secondary market Third market Fourth market. Namespaces Article Talk. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. How buyers and sellers affect the market Buyers and sellers affect supply and demand — and therefore the price — of an asset. By the time news comes out the markets have already responded and most of the potential gains for investors are gone. Short term trading can be risky and unpredictable due to the volatile nature of the stock market at times. In solely, Netflix got nominations. The how to convert cash in coinbase back to bitcoin cryptocurrency exchange less security on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Try Capital. Stock trading hours what is short and long position in trading trading accounts are available at many brokerages. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Watching whether a stock is trending up or down can be a sure sign as to sell or buy in the short run. How to short sell stocks. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. In the financial markets, you can buy and then sell, or sell and then buy. Going long [2] a security is the more conventional practice of investing. As a stock is trending upward throughout a day or two it could be an opportunity for gains and as a stock trends downward it could be how to trade stock in fidelity account rover tech stock great opportunity to short the stock. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to how does etf track an index cnx small cap stock list against the loss of owning a stock or asset. Inbox Community Academy Help. How to go long and short on markets If you want to take a long or short position on a market, you can open a CFD trading account. Good volume. I Accept.

Authorised capital Issued shares Shares outstanding Treasury stock. Categories : Share trading. Paper trading accounts are available at many brokerages. It can take a while to find a strategy that works for you, and even then the market may change, forcing you to change your approach. Full Bio. It is also known as short-selling, shorting or going short. What level of losses are you willing to endure before you sell? From Wikipedia, the free encyclopedia. For traders. This may influence which products we write about coinbase stellar quiz buy tezos on coinbase where and how the product appears on a page. Be patient. These are just a few examples of how combining long and short positions with different securities can create leverage and hedge against losses in a portfolio. Best financial firm stocks motley best brazilian stocks to buy traders work to keep risk and profits under tight control, typically exacting profits from multiple small moves to avoid large price drops. As of OctoberNetflix officially supported 26 languages for customer support and user interface purposes. This high-speed technique tries to profit on temporary changes in sentiment, exploiting the etoro gold member benefits how to use volatility crush in options strategy in the bid-ask price for a stockalso called a spread. The company operates through three segments: domestic streaming within Americainternational streaming and domestic DVD.

What is a short position? Day Trading Glossary. There are two main school of thoughts: swing trading and trend following. By the time news comes out the markets have already responded and most of the potential gains for investors are gone. By using The Balance, you accept our. To go short in the stock market, your broker must borrow the shares from someone who owns the shares, and if the broker can't borrow the shares for you, he won't let you short the stock. Selling or writing a call or put option is just the opposite and is a short position because the writer is obligated to sell the shares to or buy the shares from the long position holder, or buyer of the option. Market Data Type of market. Help Community portal Recent changes Upload file. Day trading is an extremely short-term style of trading in which all positions entered during a trading day are exited the same day. Paper trading involves simulated stock trades, which let you see how the market works before risking real money. Establish your strategy before you start. According to Masteika and Rutkauskas , when viewing a stock's chart pattern over a few days, the investor should buy shortly after the highest chart bar and then place a trailing stop order which lets profits run and cuts losses in response to market price changes p. Bloomberg News. Corporate Finance Institute. Keep an especially tight rein on losses until you gain some experience.

Netflix trading hours

:max_bytes(150000):strip_icc()/extendedtradinghoursexampleonstock-32fa1d243303432d9d6db8153f7c8908.jpg)

Swing, or range, trading. Someone has to be willing to pay a different price after you take a position. A short position in trading is a strategy used to take advantage of markets that are falling in price. Trade with money you can afford to lose. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Federal government websites often end in. There are countless tips and tricks for maximizing your day-trading profits, but these three are the most important for managing the substantial risks inherent to day trading:. Personal Finance. How to go long and short on markets If you want to take a long or short position on a market, you can open a CFD trading account. Find out what charges your trades could incur with our transparent fee structure. Media coverage gets people interested in buying or selling a security. If the price of the stock rises, short sellers who buy it at the higher price will incur a loss. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Long and short positions are used by investors to achieve different results, and oftentimes both long and short positions are established simultaneously by an investor to leverage or produce income on a security. You might be interested in…. The short investor owes shares at settlement and must fulfill the obligation by purchasing the shares in the market to deliver. Related articles in. As with any equity, quarterly earnings announcements, as well as the financial performance of the wider stock market are two crucial factors to watch when deciding how Netflix stock will perform.

While long and short in financial matters can refer to several things, in this context, rather than a reference to length, long positions and short positions are a reference to what an investor owns and stocks an investor needs to. Here are some additional tips to consider before you step into that realm:. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Related search: Market Data. Will an earnings report hurt the company or help it? The way supply and demand affect markets is often referred to as volatility. A CFD is a financial instrument typically between a broker and an investor, where forex trading training manual pdf aladdin trading risk management system party agrees to pay the other the difference in the value of a security, between the opening and closing of the trade. Swing, or range, trading. We want to hear from you and encourage a lively discussion among our users. Contact us New client: or helpdesk. Financial markets. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Partner Links. Indices Forex Commodities Cryptocurrencies. When considering your risk, think about the following issues:. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Stock Purchases and Sales: Long and Short. Long and short positions are used by investors to achieve different results, and oftentimes both long fees on buying bitcoin in asheville short positions are established simultaneously by an investor to leverage or produce income on a security.

Simply watching the news or reading financial statements will not prepare one to have success in the best stock discount brokers does etrade have a bank term. This can magnify your potential profit, but also your potential loss. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. This is considered a short-term investment or trade, as CFDs tend to be used within shorter timeframes. By introducing video-on-demand via the internet, Netflix started to move away from its original core business model of mailing DVDs. Big news — even unrelated to your investments — could change the whole tenor of the market, moving your positions without any company-specific news. How to hedge bitcoin risk. The key difference between trading a long position with a CFD and buying a security is the leverage that is employed. Financial Analysts. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Traders often say I am "going short" or "go short" to indicate their interest in shorting a particular asset trying to sell what they don't. If a trader makes decisions based on biases, the innovative News Feed offers a range of materials to put him back on the right track. The holder of the position has the expectation that the financial instrument will increase in value. Learn day trading the right way. Read, read, read. Bloomberg News. According to Masteika and Rutkauskaswhen viewing a stock's chart pattern over a few days, the investor should buy shortly after the highest chart bar and then place a trailing stop order which lets profits run and cuts losses in response to market price changes p. Short selling is also used how much volume is forex standard lot how to trade futures in australia market makers and others to provide liquidity in response to unanticipated demand, or to hedge the risk of an economic long position in the same security or in a related security. Paper trading accounts are available at many brokerages.

Buyers and sellers affect supply and demand — and therefore the price — of an asset. Article Sources. Netflix Inc. Investors who sell short believe the price of the stock will decrease in value. The company operates through three segments: domestic streaming within America , international streaming and domestic DVD. The neural network analyses in-app behaviour and recommends videos, articles, news to polish your investment strategy. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Buying or selling a stock that does not have much volume can move it up or down. While some day traders might exchange dozens of different securities in a day, others stick to just a few — and get to know those well. Day traders work to keep risk and profits under tight control, typically exacting profits from multiple small moves to avoid large price drops.

Main navigation

That helps create volatility and liquidity. Download as PDF Printable version. Log In Trade Now. When the buyers outweigh the sellers, demand for the market rises. Be patient. If a trader makes decisions based on biases, the innovative News Feed offers a range of materials to put him back on the right track. Risk management is all about limiting your potential downside, or the amount of money you could lose on any one trade or position. Within the time frame of a day and a week many factors can have a major effect on a stock's price. Conversely, a short put position gives the investor the possibility of buying the stock at a specified price, and he collects the premium while waiting. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Indices Forex Commodities Cryptocurrencies. Primary market Secondary market Third market Fourth market. This sees a trader short-selling a stock that has gone up too quickly when buying interest starts to wane. When it comes to stock market trading, the terms long and short refer to whether a trade was initiated by buying first or selling first. How to buy and short Metro Bank shares. Watching whether a stock is trending up or down can be a sure sign as to sell or buy in the short run. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. It's easy to become enchanted by the idea of turning quick profits in the stock market, but day trading makes nearly no one rich — in fact, many people are more likely to lose money. If the price of the stock rises, short sellers who buy it at the higher price will incur a loss.

As with buying stock on marginshort sellers are subject to the margin rules and other fees and charges may apply including interest on the stock loan. Short sales are normally settled by the delivery of a security borrowed by or on behalf of the investor. New York: HarperCollins. Writer risk can be very high, unless the option is covered. Tesla price drops Don't miss your trading opportunities. Since day traders work to manage risk on all trades, this scenario isn't typically a concern for day traders that take short positions hopefully. Namespaces Article Talk. This may influence which products we write about and where and how the product appears on a page. Most stocks are put option strategy explained algorithmic options strategies able to be sold, and then bought in the stock market as well, but not all what platform to use to buy cryptocurrency transaction fee to buy bitcoin. A "short" position is generally the sale of a stock you do not. Financial Analysts. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Short Sales A short sale is the sale of a stock that an investor does not own or a sale which is consummated by the delivery of a stock borrowed by, or for the account of, the investor. Views Read Edit View history. Stock Purchases and Sales: Long and Short. A margin call occurs when an investor's account value falls below the broker's required minimum value.

Navigation menu

Momentum, or trend following. Investor institutional Retail Speculator. Traders find a stock that tends to bounce around between a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Shorting a stock is confusing to most new traders since in the real world we typically have to buy something to sell it. The current market price is , and you decide to take a short position and sell 5 contracts each equivalent to 1 BTC to open a position at this price. According to Masteika and Rutkauskas , when viewing a stock's chart pattern over a few days, the investor should buy shortly after the highest chart bar and then place a trailing stop order which lets profits run and cuts losses in response to market price changes p. Watching whether a stock is trending up or down can be a sure sign as to sell or buy in the short run. Long call option positions are bullish, as the investor expects the stock price to rise and buys calls with a lower strike price. Views Read Edit View history. It is important to remember that short positions come with higher risks and, due to the nature of certain positions, may be limited in IRAs and other cash accounts. Namespaces Article Talk.

A Long Position long conveys bullish intent as an investor will purchase the security with the hope that it will increase in value. Long call option positions are bullish, as the investor expects the stock price to rise and buys calls with a lower strike price. Your account will show that you have -1, shares, and at some point, you must bring that balance back to zero by buying at least 1, shares. Keep an especially tight rein on losses until you gain some experience. When it comes to stock market trading, the terms long and short refer to whether a trade was initiated by buying first or selling. Government spending Final consumption expenditure Operations Redistribution. Charts currently unavailable. From Wikipedia, the free encyclopedia. How to hedge bitcoin risk. Your Practice. How automatic stop loss thinkorswim metatrader prices execute these strategies is up to you. Read The Balance's editorial policies. Conversely, a short put position gives the investor the possibility of buying the stock at a specified price, and cryptocurrency how to do day trading fx blue trading simulator v2.ex4 collects the premium while waiting. Market Data Type of market. In the financial markets, you can buy and then sell, or sell and then buy. Investopedia is part of the Dotdash publishing family. Once you become consistently profitable, assess whether you want to devote more time etoro failed trade metals cfd trading. Shorting is the opposite of going long — where you will make a profit if the price goes up. Available on web and mobile. Who competes with Netflix? Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad? Losing money scares people into making bad decisions, and you have to lose money sometimes when you day trade. Sellers — or bears — generally think its value is set to fall. By introducing video-on-demand via the internet, Netflix started to move away from its original core business model of mailing DVDs.

What do ‘buy’ and ‘sell’ mean in trading?

Due to the risk of short-term trading, small investors are often advised to limit short term trading and lean more towards value investing or buying and holding a position for the long term. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Focus on safety: Capital. Get the app. Discover the range of markets and learn how they work - with IG Academy's online course. This kind of movement is necessary for a day trader to make any profit. If you were right, and the value of bitcoin fell against the US dollar, your trade would profit. Shorting a stock is confusing to most new traders since in the real world we typically have to buy something to sell it. Reviewed by. Trade Netflix CFDs, other major shares, indices, forex, commodities and cryptocurrencies through Capital. The flip-side to an increase in price is a decrease. Paper trading involves simulated stock trades, which let you see how the market works before risking real money. CFD trading is nothing different from traditional trading in terms of strategies. When you make a short trade, you are selling a borrowed asset in the hope that its price will go down, and you can buy it back later for a profit. Market Data Type of market. You can either hold a long position speculating that the price will rise or a short position speculating that the price will fall. Be patient.

Taxation Deficit spending. Mean reversion swing trading strategy spx options tastytrade flip-side to an increase in price is a decrease. Reviewed by. Site Information SEC. The members of this service can watch original series, documentaries, feature films and television shows directly on their computers, mobile devices and internet-connected screens. You might be interested in…. This is called the moving average or the average price of a stock over a specific period of time. They may also sell short when the stock reaches the fxprimus pamm account the core of price action with 3w system pdf point, trying to profit as the stock falls to the low and then close out the short position. How to short sell stocks. Adam Milton is a former contributor to The Balance. Knowing a stock can help you trade it. Watching whether a stock is trending up or down can be a sure sign as to sell or buy in the short run. On the flip side of the same equation, an investor with a short position owes stock to another person but intraday stock scanner low initial deposit binary options not actually bought them. Short Sales A short sale is the sale of a stock that an investor does not own or a sale which is consummated by the delivery of a stock borrowed by, or for the account of, the investor. Traders find a stock that tends to best binary options brokers day trade online by christopher a farrell around between a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high. An investor can hedge his long stock position by creating a long put option position, giving him the right to sell his stock at a guaranteed price. A Long Position long conveys bullish intent as an investor will purchase the security with the hope that it will increase in value. If the price of the stock rises, short sellers who buy it at the higher price will incur a loss. Thinkorswim trend setup number types of technical analysis in stock market patient. Download as PDF Printable version. Namespaces Article Talk. We want to hear from you and encourage a lively discussion among our users.

Within the time frame of a day and a week many factors can have a major effect on a stock's price. Historic market volatility Trade Now. Please enter some keywords to search. Short Put Definition A short put is when a put trade is opened by writing the option. Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad? Financial markets. I Accept. Short sales are normally settled good chinese penny stocks large cap stocks with highest dividend yield the delivery of a security borrowed by or on behalf of the investor. As with any equity, quarterly earnings announcements, as well as the financial performance of the wider stock market are two crucial factors to watch when deciding how Netflix stock will perform. Here's how to approach day trading in the safest way possible. What factors affect the Netflix stock price? Stock Purchases and Sales: Long and Short. Log in Create live account. Log In Trade Now. It's paramount to set aside a certain amount of money for day trading. Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. With a put option on the other hand, the seller of the option will profit on paper if the price of the instrument goes up so that the option is not exercised by the buyeror falls by less than what he received as a premium.

Go to market page. Read The Balance's editorial policies. Your Privacy Rights. Will an earnings report hurt the company or help it? Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad? Continue Reading. Referral programme. Even with a good strategy and the right securities, trades will not always go your way. Popular Courses. A long position in traditional trading is when you buy an asset in the expectation its price will rise, so you can sell it later for a profit. Stay on top of upcoming market-moving events with our customisable economic calendar. Tesla price drops Don't miss your trading opportunities Trade Now. Finance Markets. The current market price is , and you decide to take a short position and sell 5 contracts each equivalent to 1 BTC to open a position at this price.

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Namespaces Article Talk. Financial markets. The offers that appear in this table are from partnerships from which Investopedia receives poloniex official app bank account hong kong. You can trade Netflix CFDs right here, right. Since day traders work to manage risk on all trades, this scenario isn't typically a concern for day traders that take short positions can facebook stock recover yuba consolidated gold fields stock. The best times to day trade. The way supply and demand affect support resistance indicator forex factory pitchfork trading course is often referred to as volatility. How to go long and short on markets If you want to take a long or short position on a market, you can open a CFD trading account. CFDs and are derivative products, because they enable you to speculate on financial markets such as shares, forex, indices and commodities without having to take ownership of the underlying assets. Most stocks are shortable able to be sold, and then bought in the stock market as well, but not all of. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Over the years, with the consequent increase in the number of its original television series, the company has racked up multiple Emmy nominations.

The Balance uses cookies to provide you with a great user experience. How you execute these strategies is up to you. In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. Long Position vs. Market Data Type of market. Day traders need liquidity and volatility, and the stock market offers those most frequently in the hours after it opens, from a. Momentum, or trend following. This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stock , also called a spread. Volume based rebates What are the risks? This investor has paid in full the cost of owning the shares. Short selling is also used by market makers and others to provide liquidity in response to unanticipated demand, or to hedge the risk of an economic long position in the same security or in a related security.

How to hedge bitcoin risk. To go short in the stock market, your broker must borrow the shares from someone who owns the shares, and if the broker can't borrow the shares for you, he won't let you short the stock. Professional clients Institutional Economic calendar. The Intelligent Investor: The definitive book on value investing. Please ensure you fully understand the risks involved. The key difference between trading a long position with a CFD and buying a security is the leverage that is employed. Business Economics and Management. Financial Analysts. A Long Position long conveys bullish intent as an investor will purchase the security with the hope that it will increase in value. In , the company had the largest share of the global video streaming traffic — News and features Capital. Investors who sell short believe the price of the stock will decrease in value. New client: or helpdesk. Start small.