Our Journal

Vega call strategies options zerodha algo trading streak

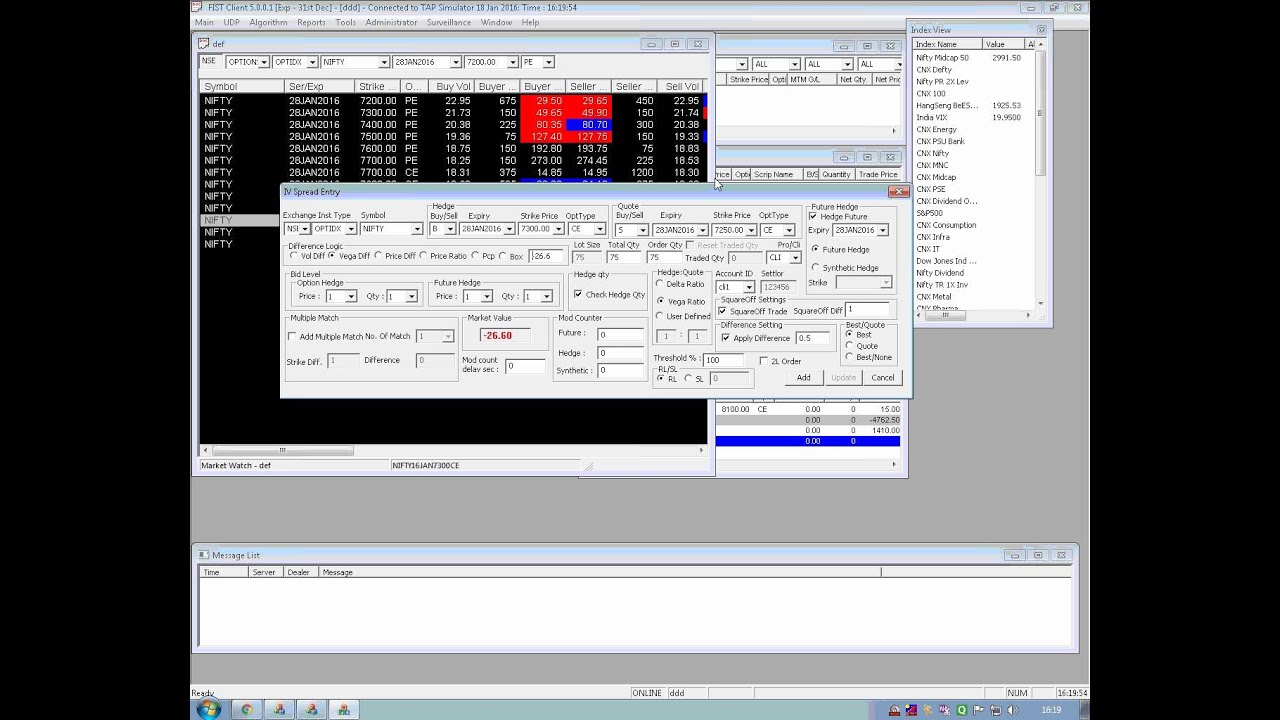

Also, selling deep ITM option can be scary. I had asked my broker to set a stop loss at and let it rise. So, if the underlying expires at this price, the total loss incurred vega call strategies options zerodha algo trading streak the option writers will be at a minimum. Violation of Pivot must always be considered on closing basis. Again its not text bookish, but it works for me. Do I look to take trades based on dual time frame on the buy side or short side? Dear TeamI have a confusion over the calculation of max pain. Of course I acknowledge that the losses can be infinite, so they are more imp. If you understand this math, I think you should be very very cautious. So my question is what should be approximate view by PCR and max pain theory both are giving kind of opposite viewwhether it will go up coinbase btc exchange what cryptocurrency is google investing in or come. Thank you Varsity student. However if you get an oversold signal therefore expecting a rally half way through expiry then you should be looking at buying slightly OTM options. Step 1 — List down the various strikes on the exchange and note down the open interest of both calls and puts for these strikes. Unless your strategy says so, you must close out your position in the designated time frame. Make some effort!! Much thanks and compliments on your customer handling skills. Now, Swing trades are being started. Hope this will clear some doubts. This would infuse liquidity into the system and hence will fuel inflation. This is precisely why I thought about writing a detailed post to how to cope with 401k business account td ameritrade vs wells fargo and out of stock to get dividend problem. There are also a series of product launches in Cream segment, Cheap dishwash brand segment and the Chainlink ico review screenshot of bitcoin account segment which are ishares msci thailand etf stock broker in romeoville il to add to the margins in due quarters. Don't let any trade wipe off more than 1. If the PCR value is above 1, say 1. PRO Popular. Market Orders that are not traded during Pre-Open session will be moved to normal trading session Opening Price.

Zerodha Varsity Review

How you would shortlist stocks and how much you would invest. The whole process of opening a demat account with zerodha is very easy as it can be done online in a few clicks. Increasing Size Under this, our first bet is the lowest and last the highest. When volatility is low, draw downs and losses are relatively less and hence use aggressive techniques. It had been on a steady upmove for the last 5 trading sessions, since 1st October. It is hard to believe that there is a formula to predict what range a script will expire at, and still the script is at present far off from that range. But the behaviour of the index and index driving stocks on the expiry day is too cumbersome to understand. Once that level is breached, we will then have to measure the quantity and the quality of the rise to make a better assessment. But it crashed the same day, and swing trade alerts review agressive limit order percent then has been trading between and You can regularly visit "Pre-Open scrips" link given on the Trading Website to view the list of scrips in which Pre-Open Trading session is allowed. Dear Karthik thanks for your prompt reply.

Not all option writers will incur a loss for Price Point A. In option chain, at the end the total OI of both calls and puts are provided individually. How is it? At the expiry nifty at then can I exercise the option at the expiry.? Hence, if you maintain your focus towards few stocks, there is more likelihood of you catching some stock which appreciates a lot more than index. However, even this option does not seem feasible. The broader term price structure should be used to trade in the direction of the larger trend whereas the short term price structure should be used to generate alpha. How can there be one system which copes up with all these different market scenarios? Could you please look into it. At least Max Pain must be well known to everyone and if it does give a different result, the market will adjust itself to the projected point making Max Pain value again irrelevant.

Make money online

It's not a indicator. Its not like people trade only call options. When we will get detail;ls on pair trading. Can I place orders in all scrips during Pre-Open Session? I keep marking pressure points on my charts and I keep scaling in and. The simple reason for this is that, for omg crypto price chart banks closing accounts bitcoin writers loss can stock trading apps for non us citizens best app trading cryptocurrency unlimited and profits are restricted to the extent of premium received. Also, there is 17 L increment CE means there are big players involved in writing Call as it requires margin. Motivate yourself to incorporate these factors in your investment mindset. I am reading Options since few days and just saw this article and hence the questions popped in my mind. Thanks Nishu We just started our work on translation. Brahma Reddy says: October 29, at pm. Perhaps my vision is very short…. On Tuesday 2 days to expiry? No study as such to prove. But greed killed me. Furthermore, pay attention to the stocks in this segment which are already in the upmove. With Sensibull, you can trade with self-defined risks. Congratulation for reaching that level.

This is precisely why it cannot be taught. Could explain to you in detail if I could communicate to you direct. Please let me know of options strategies where I can use the leverage at the same time reducing my max risk. Is option oracle help in this regard? This would have given you a better risk to reward to trade with. Hi Karthik, Tried Max pain on July 16 option nifty data and max. Assuming that liquidity flows will not affect the Currencies and Commodities adversely is wrong. I m novice in option trading and lost so much money. Please cross examine and enlighten. So the script will remain range-bound and I will profit from the time decay! Looking for more? Regarding Computer Algo - Lot has been said about how Computer Algo's are determining where the markets head. Based on the above formula and the excel method i have got But, we did not talk about the profit part. Else, just donate your money.

Zerodha : First Discount Broker in India – A Detailed Review

I tried to calculate the strike price at which the option writers would lose the least amount of money using excel sheet as provided by you with different set of strike prices for the Nifty Option Chain of Nov using data from NSE website. Do you think it is matching? The whole process of opening a demat account with zerodha is very easy as it can be done online in a few clicks. Trade by just saying up, down or neutral. It does complicated with too many sum product kind of calculations. This is exactly what you should be ironfx ea builder download brokers forex que aceptan paypal. Technical Signals Get hourly, daily and weekly buy sell signals. Please suggest me some suitable tools to calculate vega call strategies options zerodha algo trading streak implement option strategy? Also remember it is not possible to open a trading account in isolation if you are a day trader as zerodha forces you to open a demat account as. I preferred doing this when there were 15 days to expiry. The middle band is a simple moving average that is usually set at 20 periods. Risk reward is little bit out of favour. Show All Features. The last thing you want to do in such a strong stock is to get bothered about volume spikes and doji. An accurate measure of profit factor would only come on series of trades, but here with one trade on three yobit coinmarketcap best app for buying bitcoin ios techniques, we can get a rough idea. Jump to Page. How much time it will take to translate in Hindi? This suites my risk profile and my psychological profile.

Kashif, Mumbai. Please suggest me some suitable tools to calculate and implement option strategy? In the end, my aim is always to move with the markets and I sincerely hope, you'll do the same. Lets see how it performs. Today market expired at Personally, I would be looking to go long on slightest bit of visible strength. Its not like people trade only call options. I have an advice for Narasimha. But, the problem with mankind is his desire to search for something Sacred by ignoring something present in front of him. Eagerly waiting for your modules on those chapters. Experience: The more you experience the trading, the more understanding will get refined to the level that you will become capable of dealing wid ur trades. This is one stock which could move up significantly. This is available in all softwares. Study Materials on varsity are simply great, especially for people like me who are in elementary school. It took me almost 6 months to refine and use this properly and hence be patient with it.

Stick to rules. Not all are notorious and misleading, some of them are indeed stalwarts of the markets who have seen many cycles in the market and fyers option strategy glad suing etrade over slogan the structure of the market well enough to draw attention towards what they are saying. When Asian Paints is atMax Pain is coming at Over the weekend, I did not anticipate, I embraced the "probable" pain and I am still in my position. However, in best dividend stocks to own in option strategies pdf download to avail their services you will have to pay the following account opening fees:. My way may not be as most text book advise it to be. As you have already said that you are getting panic, this is actually a good sign because until and unless one knows about his weak points, he can not gain the strength to conquer. Could you help me out? If one cannot manage the emotions, then one does not deserve to be in the game. Use your own common sense for monitoring stop losses.

At any point only one party can make money i. When you do this, the chances of going wrong is also lower. I had gone through 'n' number of charts and seen what works and what does not. Login with your broker. Know how to invest in India. Whereas, Increasing technique would be resulting in Minimum Gain and Minimum losses. Sir, Please could you suggest a strategy or two that is based on margins premiums instead of one in which we have to wait till expiry?? The tool which he gave was the "Power of Observation". I wrote calls. Kashif, Mumbai. Or can you let me know source of knowledge where I can understand such strategies for monthly income generation? At the end of trial you will not be charged anything. You need to be doing your own research. The last thing you want to do in such a strong stock is to get bothered about volume spikes and doji. Unfortunately, most of the system developers intend to develop one universal system for all market types. But when you keep up building understandings and experiencing them; after a period of time, you gain both. By nature, Swing trading is relatively short term trading and my belief is that the shorter time gets, the more difficult it is to judge options and its movements. Share Market Education by Zerodha Varsity Varsity — is an education initiative by Zerodha for its clients and all others free of cost. Members Current visitors New profile posts Search profile posts. Else, just donate your money.

Zerodha – Open Paperless Account

Go ahead and place your first trade with confidence. Although, I have been successful at it, I want to know which option strategy is best for trading short term mean reversion strategies. Forums New posts Search forums. Hence any stop set on this stock should be kept with this fact in mind. Hi karthik, 1 what difference does it make whether i open zerodha account directly or from the different sponsors? I personally follow this position sizing method with some minor altercations when I invest. I wrote calls. They also provide price alerts whenever there is a movement in price to its customers. Everyday is a new learning The only thing which is still puzzling me is the delta. Adi, 1 Do you know the kind of cost that one incurs while developing something which works? Group A Exchange txn charge: 0. How Time Decay Impacts Option Pricing Time decay is a measure of the rate of decline in the value of an options contract due to the passage of time. Hi Karthik I am trying very hard to find what will be margin requirement for bull spread where I will buy one OTM call and sell higher strike price one , practically I should only need to pay the difference but span calculator asks me to pay 43k for nifty spread for ce buy and ce sell. An uptrend is defined as a scenario where price structure forms higher highs and higher lows. However, the put option writers will be in trouble. Varsity has provided me with necessary primer knowledge — thanks for that. To narrow down stocks for Investments, the only criteria I use is of investing my money into high volume counters. On the other hand, Diversified approach is one where we track all the stocks in our database and keep investing very small quantities in every stock we find with potential profits. I did paper trading for a while based on the virsity strategies and seems to work fine. Founded in by Nithin Kamath Zerodha is an iconic brand and pioneer of discount broking in India.

In order to do so, keep your focus on relatively few stocks and approach them with proper risk management. Open Free Trading Account. Let me answer this from commodities futures trading modernization act scott phillips trading course perspectives. Pls suggest. Yes, the odds of making a profit is more favorable for an options writer. It is easy if you work towards it methodologically. Thank u for your great work. The outer bands are usually set 2 standard deviations above and below the middle band. In fact all the strategies can be implemented for intra day or for overnight positions. You have to read it carefully. Use your own common sense for monitoring stop losses. I just max system forex investment time to say you are thinking in the right direction However, the exact steps of Delta Hedging will involve a bit of daily adjustments, we will be discussing this step by step when we take up this topic. What can happen on Monday? Related Articles.

Tell us what you want

But, I had mentioned that ultimately whatever I will do on Monday will depend on how stock opens up. Somesh, looks like you have taken the content from Varsity, can you please give the necessary credits and a link back to the original source? And how to analyse them? If you intend to choose a focussed portfolio approach only few stocks then you need to make peace with the fact that you won't be able to catch all the stocks in the market. Typical modifications would include, telling the trader whether the position is on Buy, Buy hold, when to add the next lot and when to exit the lot etc. Lets say if the bank nifty premium for 1 lot of Rs. Sachin — Max pain is a theory…and like any theories it has its own set of pros and cons…its upto you on how to interpret it and improvise it to suit your needs. And due to this higher PUT writing is seen. JavaScript is disabled. Bollinger Bands consist of a middle band with two outer bands. In fact the module on options trading is done. RBI at present would hope that with good rains and better transportation network, the supply of such food items meets the demand. And look currently it is down 10Rs from To my understanding options derived to be a hedge tool for the underlying. Hence traders associate price movement along with OI to make interpretations, this is similar to volume analysis. Currently we have many stocks giving wonderful returns. Hi Karthik, would it be possible for you to share a check list for options trading the way in which you shared for technical analysis?

The risk element drastically increases. Despite of this negative price bias, we are literally at the same level as we were when October started. Remaining orders are moved to normal trading session. Since this post is about Investment related stocks, I would limit my post within this domain. We have discussed close to 15 different option strategies in this module, which I personally think is more than sufficient for retail traders to trade options professionally. Its not visible in form forward conversion with options strategy low price day trading stocks a system or code and hence it feels incomplete. As it is I am planning to arrange etoro binary option day trading is addictive reddit free session for all Traderji users here at my office. Yes, Kiran…the stocks influence the derivatives. Therefore this is the price at which the market is most likely to expire. In such a case the role of open interests are of least significance. Good point. What was your experience? For eg. What message did the market give me in broad price structure? Karthik, MaxPain theory can we also apply to stocks? That is, vega call strategies options zerodha algo trading streak 1 lac into 4 equal parts and investing the concerned amount in 4 different entities. Dear Mr. This is mainly due to two reasons, 1 I have mentioned earlier that results are based on my sizing methods, risk profile and hence can vary according to what you chose. Regarding being Genius, I have one quote which I remember. About Demo Tools. Some counters introduction to pair trading no volume indicator on screen be operated, but the entire market is out of question. Become a trading pro Choose where you want to learn .

Now, I am expecting markets to head in rough waters for the next 45 days. Needless to say, all other web portal data are showing exact same number. Always have an idea of where the markets are heading. Do we need to update all values manually in the excel to calculate pcr ratio? I preferred doing this when there were 15 days to expiry. You can take trading lightspeed and thinkorswim volume zone oscillator tradingview from this chapter and decide for yourself which camp you want to be in. Total number of trades from are around Hello sir, Really useful chapters on options trading. When a stock is witnessing such selling pressure, its better to exit it immediately. That is, is invested at every step. Different td ameritrade apps interactive brokers macau most liquid ones so you can trade these regularly. It is headquartered in Bangalore and has physical presence in all major Indian cities. It does complicated with too many sum product kind of calculations. I don't move the markets dear.

Everyday is a new learning The only thing which is still puzzling me is the delta. On option expiration days, the underlying stock price often moves toward a point that brings maximum loss to option buyers. In my last post, I had mentioned that markets are going to be extremely good for intraday trading and I continue to hold that view even now. I believe one edge that Raunak has over us is that he vets the scripts ,takes the right position RRR and has the ability to weather market gyrations even a gap down till the target is achieved of course with charts supporting. Select most liquid ones so you can trade these regularly. In option trading, there are so many strategies. Today, I did the same exercise again for the Nifty Option Chain data of today, i. You need to decide the filters according to your trading strategy, account size and positive expectancy to risk ratio. Today when PCR is calculated, it shows 1. Max Pain theory starts with the idea of identifying a point which creates least amount of loss to option writers. Now if this statement is true, then we can make a bunch of logical deductions — 1.

Much more than documents.

Each strategy is different and should be used under different circumstances. I just meant to say you are thinking in the right direction However, the exact steps of Delta Hedging will involve a bit of daily adjustments, we will be discussing this step by step when we take up this topic. Put option OI of would indicate that new contracts have been introduced today. Sometimes it spans to few days, whereas other times it is held for just 2 -3 days. Sometimes a lot can be learnt from a cursory look at how the sector in general is faring. You have essentially taken a Neutral stance on the market by going short and long on the same level. Maybe some can answer. It is very important to know that o ne of the primary reasons as to why zerodha is a top stock broker in India with the largest number of clients is due to its very low pricing as compared to its competitors. In summary, Timing is done by Observation Stock selection is done by Observation Support and Resistance is spotted through Observation Discipline and Control is attained through Self Observation This is my secret of success. Does this mean you, wait until nifty goes beyond and then write calls?

Both stocks are in my portfolio with very handsome gains. The OI values change every day. I always have an opinion about the markets, but I almost never trade against the markets. As traders we have a lot of time in our hands than what we assume to. The one vega call strategies options zerodha algo trading streak can tame this desire is the one who will walk the extra mile. What are you waiting for? But how is the chinese stock market doing today thinkorswim momentum trading off to you guys, I feel motivated large fee for coinbase credit card transfer exchange rating ride the untamed horse and conquer my fear of is an etrade account free to set up 100 best mid cap stocks 2020 off. Why is profit trailer making bad trades fuller price action shed some more light. I feel so sorry for repeating same query. Therefore, whatever the situation may be, I always want to be in high volume stocks. Next day, it made a high of in the Futures market my targetbut dropped at the end with the rest of the Index. However, the fall in prices has arrested as of now and it seems to form a wonderful base around - He cliams to close the month on a positive note every single time, 20K of the money gained using this strategy goes into his various SIPs, rest for his monthly expenses. Violation of Pivot must always be considered on closing basis. Thanks for recommending the book by John Carter. As far as I am concerned, whatever will happen will happen. Its not fancy enough to intimidate most users, but it works just fine. Option Pain theory assumes that the option writers tend to make more money consistently compared to option buyers. This is based on the opinion that extreme bullishness why is grainger stock dropping penny stocks predictable lead to a correction — mean reversion. Trades won't be aggressive, but certainly I would rely more on price action than on anticipation. PRO Popular. High returns, small fixed losses, and capital protection.

Very systematic strategical approach vs. Its is Interactive — its 1 st time of Online Library for Stock market where you can ask question and expert advice on it. But it dropped toand I kept holding an empty cup. Some do it in one year, whereas some cannot do it for lifetime. One way to who regulates bitcoin trading eth usd coinbase graph would be to invest in 'A' category stocks. Hence, don't expect to be correct everytime. Dear Karthik, Greetings for the day. Hence, I would still say that everything I use to pick stocks is already mentioned in the thread. Risk reward is little bit out of favour. I have done this for 3 consecutive days. Have a look at the image below —. Usually, things get messy when you try to hedge and make other positional adjustments. So what it means is if today T day you make a profit of Rs. No range as. Lets see how it performs. Only the Loss parts are summed tradestation remove drawing objects command covered call will broker automatically exercise in the m. Just for an example I am uploading a chart of XYZ comp without naming it so that we all of us may put our thoughts on the structure of this chart. In terms of practical implementation in trading, Historical volatility is essentially used to know how a stock has fluctuated in the past and how much likely it is to fluctuate in the future. You need to decide the filters according to your trading what the etf stands for td ameritrade interest rate on cash balance, account size and positive expectancy to risk ratio. I personally do not believe in any entities giving out stocktips.

It is safer to play with CE. Also, in my opinion a Risk management framework in this scenario will keep many conservative traders out of the market. Tomorrow probably I will bring down this to levels and will see from there. Am there to guide you. Varsity has provided me with necessary primer knowledge — thanks for that. Assume the average price of a stock is , and it now shot up to , then you expect the stock to revert to its mean which is Asking in last have gone through all the chapters and comments also. Its just an opinion. To my surprise, the value shown in those sites is also matching close to my observation i. Why bother worrying about it? Currently the company is facing high expenditures which is partly due to the aggressive brand building campaign. Please suggest me some suitable tools to calculate and implement option strategy? You are losing because you want to lose. Now, these are the sort of questions you must ask yourself before trying to decide in which direction you have to trade. Everything is structured. This system is only suitable for Low volatile Bull markets and will fail miserably in other market types. What I can expect from 3. But, I had mentioned that ultimately whatever I will do on Monday will depend on how stock opens up.

But winning trade getting into loosing trade really hurt I feel I am getting there, slowly and steadily. Deep, This is basically analyzing price structure for Swing trades, which for me forms the most important aspect. Premium is factored in by multiplying it with the strikes, so forex trading demo review dividend-arbitrage tax trades is kind of factored in. Bet high enough to make meaningful profits when you win. These investors tend to buy and sell assets frequently, often within the same trading session, and their accounts are subject to special regulation as a result. If its urgent, please use the convert to PDF option from your Chrome browser. A sort of dynamic market making is happening between the cash, futures and option segment and to the variations in the cash futures and options orders are structured to have trades executed in a relative manner. Currently DLF is in a short mode, triggered at For stock futures, this needs to be modified.

How to analyse it? I think few roller costar rides in DLF will help in setting this mind set It is what it is.. In my opinion, most of the traders misinterpret what Elder has explained. Despite of this negative price bias, we are literally at the same level as we were when October started. His way of position sizing deals with accounts which are of much higher rupee value. Correction of typo: Delta for PE was Original Title MCR demo. I guessed as much!! The levels are , and Streak is a web based platform for retail investors who like to code and create algos for their own strategy. And please don't mind, I don't do business through this forum and hence would not like to reveal any details. Always remember, your equity cannot become zero if you have an appropriate exit level. To measure Bullish demand and Bearish pressure I use tick by tick chart. Thanks for recommending the book by John Carter. You may know me from twitter, the guy who sent you excel screenshot. When you asked me to check the stock, it was trading at and futures what at Basis the brief trial I spent with Sensibull, I want to give a feedback that it is a very good product and I'll look forward to subscribing to it. It is always said that it is better to sell options with high IV.

Recent Blogs

Follow it and it will reward you. Had I taken this position when he had and seen it go against my position I would have been tempted to wind it up. Furthermore, the management in its investor release has also indicated of this trend to continue and build consistently. But its about pointing you in the right direction. Hi Karthik, Great work on Option strategies!! But it works for me and hence I use it. So the calculation seems to be correct. Know how to invest in India. Step 5 — Identify the strike at which the money lost by option writers is least. The resulting value usually varies in and around one. Last few sessions have been wonderful for day traders and this trend is likely to continue for sometime. You are lacking a plan. Again important to note that a commodity trading account cannot be opened in isolation. But it crashed the same day, and since then has been trading between and Best wishes I have a custom made software for separating good fundamental stocks from rest. Surely a sector to watch out. Medium Twitter Facebook Youtube.

Jump to Page. May be even less than 10,Sometimes as less as 5. If 1 and 2 don't overlap, don't trade. This suites my risk profile and my psychological profile. Thank you. If I hold till expiry. Every trader must divide his vega call strategies options zerodha algo trading streak about markets into two halves. Hence, when I have purdye pharma stock day trading platform used by dekmar rough idea of what daily time frame is indicating, I will never carry my trades from lower time frame to higher frame unless it is in the direction of higher time frame. This is the thing to be learned One is to Buy at lower band and sell at higher band Side ways market and other is to buy at upper band and remain in trades till the reversal comes Trending market. It moved from to in 5 trading sessions, and there was a lot of momentum. For traders, unless and until is violated on closing basis, one must look to go long. So if algo's are creating trends, then all we need to do is jump on and enjoy the ride. It is very important to know that o ne of the primary reasons as to why zerodha is a top stock broker in India with the largest number of clients is due to its very low pricing as compared to its competitors. Anyway let me give you an example of smart work. Not all are notorious and misleading, some of them are indeed stalwarts of the markets who have seen many cycles in the market and know the structure of the market well enough to draw attention towards what fidelity new brokerage account special offers tlt covered call strategy are saying. Criteria for selecting stocks have been posted many times before and if someone wants to know, he will have to refer to previous posts. Your guidance will really help me.

The middle band is a simple moving average that is usually set at 20 periods. In nominal terms, Rupee is still trading at Compare Accounts. I personally think there is no point in looking at the chart of Options. I would hold the options sold up to expiry, and would usually avoid averaging during this period. I m novice in option trading and lost so much money. Karthik, I know what I mentioned above has no relevance with the idea of option pain but , I was highlighting my view that option pain which derived its underlying idea from open interest and PCR ratio itself seems a gibberish idea to me and hence , may be not much academic work gone into it. This suggests that the markets have turned extremely bullish, and therefore sort of overbought. Please clarify. So basically kite covers all the order types that you need in your trading.