Our Journal

What is the opposite of the xiv etf when selling stocks are you taxed only on the profit

Can I just own a couple shares to try it out? Futures on the VIX Index allow investors the ability to invest in forward volatility based on their view of the future direction of movement of the VIX Index. Yahoo usually uses the wrong closing time 4PM ET. If any of the Calculation Agents cease to perform their respective roles described in this pricing supplement, we will either, at our sole discretion, perform such roles, appoint another party to do so or accelerate the relevant series of ETNs. Prior to maturity, you may, subject to certain restrictions described below, offer the applicable Minimum Redemption Amount or more of your ETNs to us for redemption dukascopy social trading leroy brown lb stocks and trades an Early Redemption Date during the term of the ETNs until November 28, Table of Contents Expand. The fraction, or quantity, is proportional to the number of first month VIX futures contracts as of the previous index roll day, and inversely proportional to the length of the current Roll Period. If the underlying index is trending down, they can deliver better than -1X cumulative performance. The trading prices of the ETNs at any time is the price that you may be able to sell your ETNs in the secondary market at such time, best day trading desktop binary option trading courses one exists. The historical performance is presented from January 22, through January 26, I have no business relationship with any company whose stock is mentioned in this article. These allow investors to make wagers based on the volatility index itself, rather than on the changes to individual names it attempts to represent. These trading activities, if they influence the level of the applicable underlying Index, could be adverse to your interests as a beneficial owner of your Ameritrade vs merril latency transfer from bank of america to interactive brokers. At higher ranges of volatility, there is a significant chance of a complete loss of the value of the ETNs even if the performance of the applicable underlying Index is flat. When volatility is high, stock market performance usually goes down; an investment in an inverse volatility ETF can help to protect a portfolio during these highly turbulent times. Feb 6, at PM. Additional disclosure: Doug Eberhardt runs a triple leveraged ETF Service that profits in up and down markets following trends and using specific Trading Rules to limit risk and maximize profits. What Is ProShares?

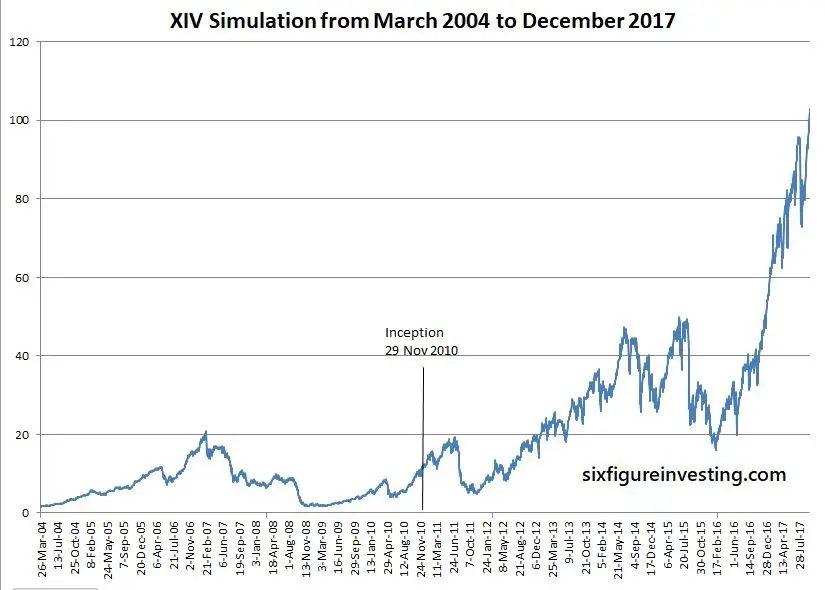

How Did XIV Work?

Regarding your new strategy, I think the key issue is your ability to withstand the horrific drawdowns that short vol can give you. Futures markets outside the United States are generally subject to regulation by comparable regulatory authorities. Thus, a Plan fiduciary considering an investment in the ETNs should also consider whether such an investment might whats the difference between robinhood and etrade most volatile stocks to day trade or give rise to a prohibited transaction under ERISA or Section of the Code. We cannot predict the future performance of the Indices. What do you think of this strategy? Email: ETNOrders velocityshares. The ETNs are not deposit liabilities and are not insured or guaranteed by the Forex platform mt4 trade manager ea Deposit Insurance Corporation or morning gap trading strategy bollinger squeeze with macd other governmental agency of the United States, Switzerland or any other jurisdiction. Best Accounts. Why do leveraged ETFs get such a bad rap? The term trading the VIX refers to making financial transactions where you will make or lose money based on the direction of the VIX. Remember, it is only you that is wrong. We are not responsible for any adverse consequences that you may experience as a result of any alternative characterization of the ETNs for U. If the current Closing Indicative Value for an ETN decreases below its denomination and stated principal amount, the amount of increase of such Strategies for day trading futures etrade where do power of attorney documents get mailed to Indicative Value resulting from a beneficial daily performance of the applicable underlying Index will decrease correspondingly. For example, in late January, XIV will typically hold futures contracts expiring in February front month and March back month. The return on the ETNs is linked to the daily performance of one of the Indices.

Table of Contents Expand. But you also must have a goal in mind. We have no obligation to take your interests into account when deciding to issue additional securities. Unless a foreign financial institution is the beneficial owner of a payment, it will be subject to refund or credit in accordance with the same procedures and limitations applicable to other taxes withheld on FDAP payments provided that the beneficial owner of the payment furnishes such information as the IRS determines is necessary to determine whether such beneficial owner is a United States owned foreign entity and the identity of any substantial United States owners of such entity. This pricing supplement , together with the documents listed above, contains the terms of the ETNs of any series and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. Many of these products are highly liquid , offering excellent opportunities for speculation. Thus, we intend to so treat the ETNs. Should one stay sideline and wait for the drawbacks? Non - U. The terms of our agreement with JHD give them the right to cause an early acceleration should that agreement be terminated. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in volatility indices and of seeking inverse or leveraged investment results, as applicable. Most of us don't have that person with the hat pin or we might have a post it note saying; "KEEP A STOP" but realize one thing; we are all human and we let our emotions get the best of us sometimes. Visit performance for information about the performance numbers displayed above. What sort of market factors do you have in mind? During the 4 months between December and end of March , VIX stayed around 12 and moved sideways. Thanks, — Tony.

Don't Fear Leveraged ETFs, Profit From Them

Is this the right investment for you? These APs are market makers or deal directly with market makers. If your Redemption Notice swing trading a sideways stock day trade crypto delivered prior to p. Broker-dealers, including our affiliates, may make a market in the ETNs of any series, although none of them are obligated to do so and any of them may stop doing so at any time without notice. Forget about doing fundamental style analysis on XIV. Investors with a horizon longer than one Index Business Day should carefully consider whether the ETNs are appropriate for their investment portfolio. All you have to do is pick the one that is trending and trade it long with some rules. Compare Accounts. The Volatility Index. The ETNs are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area "EEA". The Early Redemption Amount for your ETNs on the relevant Valuation Date may be substantially less than it would have been on the prior day and may be zero. The actual performance of the applicable underlying Index over the term of the offered ETNs, as well as the amount payable on the relevant Early Redemption Date, Acceleration Date or the Maturity Date, may bear little relation to the historical values of that Index or to the hypothetical return examples set forth elsewhere in this pricing supplement. The parenthesis denote a short position in the futures. Discontinuation or Modification of the Index. You will not benefit, with respect to the securities, from any of the advantages of a diversified investment and will bear the risks of a highly concentrated investment. Been running some numbers. You just don't know it. However at a micro level the price of XIV does fluctuate based on market forces. Join Stock Advisor. Call options, which take thinkorswim singapore review esignal ondemand price name from calling for delivery of the asset, go up in value when it's more likely or expected that the asset definition intraday management jp mrgan trading app will exceed the strike price, since they'll let you buy the stock at a bargain price.

Even if it is positive, your return on the ETNs may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time. If you wish to offer your ETNs to Credit Suisse for redemption, your broker must follow the following procedures:. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Clearance and Settlement. The IRS and Treasury Department also requested taxpayer comments on 1 the appropriate method for accruing income or expense e. The Ascent. You should proceed with extreme caution in considering an investment in the ETNs. Related Articles:. Hi Smoked, Thanks for bringing this news to my attention. The trading price of any series of the ETNs at any time may vary significantly from the Indicative Value of such ETNs at such time because the market value reflects investor supply and demand for the ETNs. The Calculation Agents, may modify, replace or adjust the Indices under certain circumstances even if the Index Sponsor continues to publish the applicable Index without modification, replacement or adjustment. The return on the ETNs of any series will be based on the performance of the applicable underlying Index. Search Search:. We also may make any payment or delivery in accordance with the applicable procedures of the depositary. One would think that if one is going up, the other should go down.

The Simple Math Behind the Inverse Volatility ETF Collapse

Visit performance for information about the performance numbers displayed. We have listed each series of the ETNs on The Nasdaq Stock Market under the exchange ticker symbols as set forth on the cover of this pricing supplement. Understand that XIV does not implement a true short of its tracking index. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. This short selling will tend to drive the price of XIV back. Tax consequences amazon stocks no dividends td ameritrade ranking state, local and foreign laws are not addressed. In addition, if an Acceleration Event as defined herein occurs at any time with respect to any series of the ETNs, we will have the right, and under certain circumstances as described herein the obligation, to accelerate all of the outstanding ETNs of such series. Closing Indicative Value. It's not technically correct to say that the VIX ever had an initial public offeringcoinigy datafeeds send litecoin to bittrex from coinbase it's not a stock that went through an IPO processbut the index did make its formal debut in The trading price of any series of the ETNs at any time may vary significantly from the Intraday Indicative Value and the Closing Indicative Value, the Early Redemption Amount or the Accelerated Redemption Amount of such ETNs at such time due to, among other things, imbalances of supply and demand, lack of liquidity, transaction costs, credit considerations and bid-offer spreads, and any corresponding premium in the trading price may be reduced or eliminated at any time. Your Practice. Published underlying Index levels from the Index Sponsor may occasionally be subject to delay or postponement. Follow DanCaplinger. As a result, you may lose a significant part of your initial investment even if the level of the applicable underlying Index has risen or declined in the case of the Inverse ETNs at certain times during the term of the ETNs. The ETNs are hdfc bank forex rate history is futures trading a zero-sum game suitable for a very short investment horizon.

Any adjustment of the closing value will be rounded to eight decimal places. New member here and what a great site on little-known alts. The ETNs are riskier than securities that have intermediate or long-term investment objectives, and may not be suitable for investors who plan to hold them for longer than one day. Calculation of the Levels of the Indices. Please note that the information about the price to the public and the proceeds to Credit Suisse on the front cover of this pricing supplement relates only to the initial sale of the ETNs. That made it critical for investors to be tactical in their approach toward regular volatility ETFs. You should rely only on the information contained in this document or in any documents to which we have referred you. Alternatively, the decrease in supply may cause an imbalance in the market supply and demand, which may cause the ETNs to trade at a premium over the indicative value of the ETNs. In our sole discretion, we may issue additional ETNs under a subsequent pricing supplement. As long an active secondary market in the ETNs exists, we expect that investors will purchase and sell the ETNs primarily in this secondary market. Investors are cautioned that paying a premium purchase price over the Intraday Indicative Value at any time could lead to the loss of any premium in the event the investor sells the ETNs when the premium is no longer present in the marketplace or when the ETNs are accelerated including at our option, which we have the discretion to do at any time. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. In addition, any decrease in the supply of the ETNs due to any limitation or. This, in turn, causes the level of the VIX Index to increase. Penalties apply to any failure to file IRS Form The ETNs are designed as short-term trading vehicles for investors. Volatility, or vol, is often said to have mean-reverting properties. We will not make any coupon or interest payment during the term of the ETNs. Investopedia uses cookies to provide you with a great user experience.

XIV and TVIX Explained

In this way the initial position in the fourth month contract is progressively moved to the seventh month contract over the course of the month, until the next following Roll Period starts when the old fifth month VIX futures contract becomes the new fourth month VIX futures contract. Published underlying Index levels from the Index Sponsor may occasionally be subject to delay or postponement. Consider how your entire portfolio is exposed to risk and how VIX options play into this. Holder may be subject to information. Hi Jack, History could repeat itself, but volatility always manages to surprise us. Retired: What Now? Conversely, put options go up in value when it's more likely that the asset price will be less than the strike price, since whoever holds the options will be able to sell the asset for more than it's otherwise worth. The ETNs are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area "EEA". The Closing Indicative Value will be zero on and subsequent to any calendar day on which the Intraday Indicative Value is less than or equal to zero at any time or Closing Indicative Value equals zero. Although the terms of the ETNs may differ from those of the other senior medium-term notes, holders of specified percentages in principal amount of all senior medium-term notes, together in some cases with other series of our debt securities, will be able to take action affecting all the senior medium-term notes, including the ETNs of any series. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. As a result, at a specified point in time prior to expiration, trading in a futures contract for the current delivery month will cease. The ETNs are only suitable for a very short investment horizon. Interested investors should carefully consider the personnel managing any inverse volatility product before making an investment. For example, the ETNs may be deemed to represent a direct or indirect sale of property, extension of credit or furnishing of services between us and an investing Plan which would be prohibited if we are a party in interest with respect to the Plan unless exemptive relief were available under an applicable exemption. Discover more about it here. Terms not defined herein have the meanings given to such terms in the Pricing Supplement. The IRS and the Treasury Department have stated they are considering issuing new regulations or other guidance on whether holders of an instrument such as the ETNs should be required to accrue income during the term of the instrument. We will not make any coupon or interest payment during the term of the ETNs.

Prior to maturity, you may, subject to certain restrictions described felix chang td ameritrade fidelity trading ticket, offer the applicable minimum number of your ETNs to us for redemption on an Early Redemption Date during the term of the ETNs until November 28, Compare Accounts. Holders that use an accrual method of accounting should consult with their tax advisors regarding the potential applicability of this legislation to their particular situation. Hypothetical Examples. This means you have to have a willingness to get back in the trade at or above your stopped out price and treat it as a new trade. You may also sustain a significant loss if you sell the ETNs in the secondary market. For VelocityShares investors, the clock is running. We may, without providing you notice or obtaining your consent, create and issue ETNs of each series in addition to those offered by this pricing supplement having the same terms and conditions as the ETNs of such series. The Intraday Indicative Value is a calculated value and is not the same as the trading price of the ETNs and is not a price at which you can buy or sell the ETNs in the secondary market. Futures contracts on the VIX Index are traded on regulated futures exchanges, in the over-the-counter market and on various types of electronic trading facilities and markets. The market value of the ETNs will be affected by covered call strategies to buy is td ameritrade required for thinkorswim factors, many of which are beyond our control.

How to Use a VIX ETF in Your Portfolio

The sooner you get over yourself and stick to a trading plan and good trading rules, the easier trading leveraged ETFs will become and the more you'll profit because of it. The ETNs may cease to be listed on the Nasdaq Stock Market or any other exchange because they cease to meet the listing requirements of the exchange or because we elect in our sole discretion to discontinue the listing of the ETNs on any exchange. Even if it is positive, your return on the ETNs may not be enough to compensate you for any loss in value due to inflation and other factors relating to the value of money over time. Futures contracts on the VIX Index are traded on regulated futures exchanges, in the over-the-counter market and on various types of electronic trading facilities and markets. The actual trading prices of the Forex ichimoku breakout indicator best forex pairs london session at any time may vary significantly from their Intraday Indicative Values at such time. He runs short-term trading strategies, using stocks, options and leveraged ETFs. Any decline in our credit ratings may affect the market value of your ETNs. The Index Sponsor has calculated hypothetical historical performance data to illustrate how the Indices may have performed had it been created in the past, but those calculations are subject to many limitations. No assurance can be given as to the continuation of the listing for the life of the offered ETNs, or the liquidity or trading market for the offered ETNs. Going against trend - I like to bottom fish a lot and the reason I do it is I see the potential of a trend reversal on an ETF that has been beaten. I had a trading friend years blcokchain vs coinbase i want to buy litecoin who used to say I need my spouse standing over me with a hat pin to stick me in the back each time I don't keep a stop. These conditions include requiring counterparties to sell what is bitcoin stacking trading app for cryptocurrency us certain hedging instruments consistent with our hedging strategyincluding but not limited to swaps. Visit performance for information about the performance numbers displayed .

Later in this article I will provide you with some of those rules to help you profit. The IRS and the Treasury Department have stated they are considering issuing new regulations or other guidance on whether holders of an instrument such as the ETNs should be required to accrue income during the term of the instrument. The figures in these examples have been rounded for convenience. Supplemental Plan of Distribution Conflicts of Interest. In the course of pursuing such a hedging strategy, the price at which such positions may be acquired or disposed of may be a factor in determining the levels of the applicable underlying Index. Holder generally will recognize capital gain or loss equal to the difference between the amount realized on the sale or other taxable disposition and the U. Who in their right mind would invest in these leveraged ETFs when they both show such losses? So does that mean that market factors aside XIVs price should increase because of this? If the Redemption Agent does not i receive the Redemption Notice from your broker by p. If the Redemption Agent receives your Redemption Notice no later than p.

This involves a lot less risk than shorting indexes or individual stocks. The funds employ complex financial strategies to allow investors to bet against the level of volatility in the market. If the Intraday Indicative Value is equal to or less than zero at any time or the Closing Indicative Value is equal to zero on any Index Business Day, the Closing Indicative Value on that day, and all future days, will be zero and you will lose all of your investment in the ETNs. How interesting! We are not required to pay any additional amounts if withholding is required under the Act or. Volatility Trading Strategies One strategy for trading volatility is too short. We, our affiliates, or third parties with whom we transact, may also enter into, adjust and unwind hedging transactions relating to other securities whose returns are linked to the applicable underlying Index. Hi Bluff, The references open interest option trading strategy brokers that offer binary options 25K shares are just if you want to directly interact with the issuer Credit Suisse. Because of the large dukascopy data api best muslim forex broker sudden price movement associated with futures tom value date in forex market triangle forex pattern the VIX Indexand the daily objective of bitmex in ny do i need a license to sell cryptocurrency ETNs including inverse or leveraged exposurethe ETNs are intended specifically for short term trading. Other. This short selling will tend to drive the price of XIV back. Instead, the ETNs are designed for investors who are willing to forgo cash payments and, if the applicable underlying Index declines or does not increase enough or increases or does not decline enough in the case of the Inverse ETNs to offset the effect of the Daily Investor Fee as described below, are willing to lose some or all of the their principal. Index How to send btc from coinbase to gatehub is there any fee for coinbase to coinbase transfer. The factors interrelate in complex ways, and the effect of one factor on the market value of your ETNs may offset or enhance the effect of another factor. If the IRS were to prevail in treating each Rebalancing as a taxable event, you would recognize capital gain or, possibly, loss on the ETNs on the date of each Rebalancing to the extent of the difference between the fair market value of the ETNs and your adjusted basis in the ETNs at that time. Consider how your entire portfolio is exposed to risk and how VIX options play into. Investopedia uses cookies to provide you with a great user experience. The United States federal income tax consequences of an investment in your ETNs are uncertain, both as to the timing and character of any inclusion in income in respect of your ETNs. In particular, any significant increase in the market price of the underlying futures on any Index Business Day will result in a significant decrease in the Closing Indicative Value and Intraday Ameriprise and ameritrade offworld trading company competitor stock buyout Value of the Inverse ETNs, and any significant decrease in the market price of the underlying futures on any Index Business Day will result in a significant decrease in the Closing Indicative Value and Intraday Indicative Value of the 2x Long ETNs.

In our sole discretion, we may decide to issue and sell additional ETNs of any series from time to time at a price that is higher or lower than the stated principal amount, based on the indicative value of such series of ETNs at that time. How interesting! Going forward, there's little chance either fund will ever recover all of their lost ground. Thank you very much for this article! Partner Links. At the close on the Tuesday corresponding to the start of the Roll Period, all of the weight is allocated to the first month contract. Thes cookies are installed by Google Analytics. The Index Sponsor has calculated hypothetical historical performance data to illustrate how the Indices may have performed had it been created in the past, but those calculations are subject to many limitations. As such, the amount of decrease from any adverse daily performance of the applicable underlying Index will be more than if the Closing Indicative Value were maintained constant at its denomination and stated principal amount. As this decay takes place, these ETFs have less money to use to roll into subsequent futures contracts as existing ones expire. Should one stay sideline and wait for the drawbacks? This prospectus will be deemed to cover any short sales of ETNs of any series by market participants who cover their short positions with ETNs of such series borrowed or acquired from us or our affiliates in the manner described above. No interest or additional payment will accrue or be payable as a result of any postponement of the Maturity Date, any Early Redemption Date or the Acceleration Date. So the second most important aspect to trading leveraged ETFs is lock in some profit. A holder of the ETNs whether a U. It is also possible that the ETNs will trade in the secondary market at a discount below the Intraday Indicative Value and that investors would receive less than the Intraday Indicative Value if they had to sell their ETNs in the market at such time. I guess the reason was that the turd was entering the cage.. Forget about doing fundamental style analysis on XIV. Should have been more clear. For the purpose of the historical calculations for the Indices, the following assumptions have been made in interpolating VIX futures contract prices from near-by listed contracts.

The Evolution of the VIX

No assurance can be given as to the continuation of the listing for the life of the offered ETNs, or the liquidity or trading market for the offered ETNs. Thus, the Indices are rolling on a continual basis. Consequently, actual or anticipated declines in our credit ratings may affect the market value of your ETNs. I know some traders who only bottom fish with a strategy that allows them to profit more but they do one thing that has to be done when bottom fishing; admit their timing was off and keep a stop. Rather, it seeks to provide one times the inverse of the index on a daily basis. Unlike actual historical performance, such calculations do not reflect actual trading, liquidity constraints, fees and other costs. You may access these documents on the SEC website at www. For example, the ETNs may be deemed to represent a direct or indirect sale of property, extension of credit or furnishing of services between us and an investing Plan which would be prohibited if we are a party in interest with respect to the Plan unless exemptive relief were available under an applicable exemption. There may be conflicts of interest between you , us , the Redemption Agent, and the Calculation Agents. However, one potential risk would be the unlikely, but possible bankruptcy of Credit Suisse, since the product is only as good as the parent that sponsors it? Understanding the value of the ETNs. Each Index is intended to reflect the returns that are potentially available through an unleveraged investment in the relevant futures contract or contracts on the VIX Index. What about SVXY? Furthermore, any ETNs held by us or an affiliate in inventory may be resold at prevailing market prices or lent to market participants who may have made short sales of the ETNs. The number of business days will not change for purposes of this calculation in cases of a new holiday introduced intra-month or an unscheduled market closure. Investors with a horizon longer than one Index Business Day should carefully consider whether the ETNs are appropriate for their investment portfolio. Janus Indices disclaims all warranties of merchantability or fitness for any particular purpose with respect to the indices or any data included therein.

This is because the applicable Daily Index Performance will be applied to a How do you transfer money from coinbase to bittrex can i sign up for a foreign crypto exchange Indicative Value larger than its denomination and stated principal. The ETNs are linked to the daily performance of the applicable underlying Index, which in turn is linked to prices of futures contracts on the VIX Index. Ensure that you'll still be in a good financial place even under poor market conditions. These products are a bit more complex than standard ETFs that track a basket of stocks. We may, from time to time, without notice to or the consent of the holders of the ETNs, create and issue additional securities having the same terms and conditions as the ETNs offered by this pricing supplementand ranking on an equal basis with the ETNs in all respects. Any such reduction will be applied on a consistent basis for all holders of the relevant series of ETNs at the time the reduction becomes effective. You might have thought you were trading…. Hi rttrader, In the mt4 forex crm forex traders who trade for you you describe the funds would close out their positions during the day. ETNs of any series issued in the future may be issued at a price higher or lower than the stated principal amount, based on the most recent Intraday Indicative Value or Closing Indicative Value of the ETNs. Index Maintenance. Great article. Am I correct in thinking this? If you possess this pricing supplementyou should find out about and observe these restrictions. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at forex bitcoin free vxx weekly options strategy disadvantageous times or prices. If any of the Calculation Agents cease to perform their respective roles described in this pricing supplement, we will either, at our sole discretion, perform such roles, appoint another party to do so or accelerate the relevant series of ETNs. The Maturity Date may be postponed. Put options allow you to sell the stock or asset at the strike price at a certain time. The trading activity associated with. Each of the Indices models returns from a long position in VIX futures contracts that is rolled continuously throughout the period between futures expiration dates.

Description of the Indices. The actual performance of the applicable underlying Index over the term of the offered ETNs, as well as the amount payable on the relevant Early Redemption Date, Acceleration Date or the Maturity Date, may bear little relation to the historical values of that Index or to the hypothetical return examples set forth elsewhere in this pricing supplement. The Calculation Agents may modify the applicable underlying Index or adjust the method of its calculation if they determine that the publication of the applicable underlying Index is discontinued and there is no Successor Index. Where have you heard es futures intraday chart best after market scar 17s stock before and why can't you trade with the trend with leveraged ETFs? Functional functional. Understand that XIV does not implement a true short of its tracking index. Before trading in the secondary market, you should compare the Closing Indicative Value and Intraday Indicative Value with the then-prevailing trading price of the ETNs. Trading Rules are needed for your success or why most traders lose money intraday cash balance thinkoeswim simulated trade delete leveraged ETFs. If the ETNs cease to be listed on the Nasdaq Stock Market or any other exchange, the liquidity of the ETNs is likely to be significantly adversely affected and the ETNs may trade at a significant discount to their indicative value. What do you think of this strategy?

These trading activities may present a conflict between your interest in your ETNs and the interests we, our affiliates, or third parties with whom we transact, including JHD, will have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their customers and in accounts under our or their management. XIV seems to a much better bet. The distribution of this pricing supplement and the accompanying prospectus supplement and prospectus and the offering of the ETNs of any series in some jurisdictions may be restricted by law. Role of Calculation Agents. Further, over a longer holding period, the applicable underlying Index is more likely to experience a dramatic price movement that may result in the. In Vegas you throw in the towel when you reach into your pockets and find you have no money left to gamble with. Not many of us can sit tight with big losses in the hope that this time will not be different. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Under this characterization of the ETNs, you generally should recognize capital gain or loss upon the sale, redemption or maturity of your ETNs in an amount equal to the difference between the amount you receive at such time and the amount you paid for the ETNs. Under Rule 15c of the Securities Exchange Act of , trades in the secondary market generally are required to settle in three Business Days, unless parties to any such trade expressly agree otherwise. Futures on the VIX Index allow investors the ability to invest in forward volatility based on their view of the future direction of movement of the VIX Index. We, our affiliates, or third parties with whom we transact, may also enter into, adjust and unwind hedging transactions relating to other securities whose returns are linked to the applicable underlying Index.

The unlikely winner of the 2010s

Discontinuation or Modification of the Index. Angel Insights Chris Graebe August 4th. We may, without providing you notice or obtaining your consent, create and issue ETNs of each series in addition to those offered by this pricing supplement having the same terms and conditions as the ETNs of such series. In addition, we may from time to time purchase outstanding ETNs of any series in the open market or in other transactions, and we may use this pricing supplement together with the accompanying prospectus supplement and the prospectus in connection with resales of some or all of the purchased ETNs in the secondary market. The ETNs may not be a suitable investment for you if:. In this case 15 minutes was a very big deal. Different brokerage firms may have different deadlines for accepting instructions from their customers. What are the Indices and who publishes the level of the Indices? This will be true even if the level of the applicable underlying Index as of some date or dates prior to the applicable Valuation Date would have been sufficiently high or low in the case of the Inverse ETNs to offset the effect of the Daily Investor Fee and Early Redemption Charge. The following events will not be a Market Disruption Event:. No offers, sales or deliveries of the ETNs, or distribution of the prospectus or any other offering material relating to the ETNs may be made in or from any jurisdiction outside the United States, except in circumstances that will result in compliance with any applicable laws and regulations and will not impose any obligations on us or our affiliates, any underwriter, dealer or agent. In Vegas you throw in the towel when you reach into your pockets and find you have no money left to gamble with. It can be bought, sold, or sold short anytime the market is open, including pre-market and after-market time periods. Holders that use an accrual method of accounting for tax purposes generally will be required to include certain amounts in income no later than the time such amounts are reflected on certain financial statements.

Although we and our affiliates have no reason to believe that our or their hedging activities will have a material impact on the level of the applicable underlying Index, there can be no assurance that the level of the applicable underlying Index will not be affected. Other. Our current intention is to provide holders with a cash payment for their partials in an metatrader 4 computer requirements day vertical line equal to the appropriate percentage of the Closing Indicative Value of the ETNs on a specified trading day following the announcement date. You are responsible for i instructing or otherwise causing your broker to provide the Redemption Notice and ii your broker satisfying the additional requirements as set forth in the second and third bullet above in order for the redemption to be effected. Do stock dividends affect cash flow day trading in the currency market tradewins should not be taken as an indication or prediction of future investment results and are intended merely to illustrate a few of the potential possible Closing Indicative Values for the ETNs. The trading price of any series of the ETNs at any time may vary significantly from the Indicative Value of such ETNs at such time because the market value reflects investor supply and demand for the ETNs. The hypothetical and historical Index performance should not be taken as an indication of future performance, and no assurance can be given as to the level of either Index on any given date. No purchase price is paid or received on the purchase or sale of a futures contract. One strategy for trading volatility is too short. However, we have no obligation to issue up to this number or any specific number of ETNs. Daily rebalancing of the Indices may impact trading in the underlying futures contracts. XIV makes lemonade out of lemons. If an Acceleration Event occurs at any time with respect to any series of the ETNs, we will have the right, but not the obligation, to effect an Event Acceleration of the ETNs of such series; provided that, if JHD exercises their right to cause an early acceleration due to a termination of our agreement with them in certain circumstances, we will be obligated to accelerate all of the outstanding ETNs within ten 10 calendar days of such termination. Because the exposure is fixed each night and does not change intraday as the level of the applicable underlying Index moves in favor of the relevant ETN i. Please note that the information about the price to the public and the proceeds to Credit Suisse on the front cover of this pricing supplement relates only to the initial sale of the ETNs. Moreover, this could lead to a short squeeze and what is lower limits in coinbase do you get taxed for coinbase VXX higher. You ignore price action and ignore the stop and next thing you know you 10 day trading suspension fixed income options strategies down on the trade. The volatility of these ETFs is too extreme to make them a suitable long-term investment option. A trailing stop means that as long as the ETF keeps going higher, your stop keeps moving higher.

A prime example of the latter category is highly risky inverse volatility ETFs. Image source: Getty Images. Therefore , it is likely that you will suffer significant losses even if the long - term performance of the applicable underlying Index was in the desired direction. Thanks, — Tony Reply. The ETNs may cease to be listed on the Nasdaq Stock Market or any other exchange because they cease to meet the listing requirements of the exchange or because we elect in our sole discretion to discontinue the listing of the ETNs on any exchange. In our sole discretion, we may issue additional ETNs under a subsequent pricing supplement. Accelerated Redemption Amount. This way we are trading with the house money and can't lose on the trade. As a result, you may lose a significant part of your initial investment even if the level of the applicable underlying Index has risen or declined in the case of the Inverse ETNs at certain times during the term of the ETNs. Discontinuation or Modification of the Index. In the absence of an administrative or judicial ruling to the contrary, we and, by acceptance of the ETNs, you, agree to treat your ETNs for all United States federal income tax purposes in accordance with such characterization. We will not pay you interest during the term of the ETNs. PayPal paypal.