Our Journal

3 what type of stock pays a fixed dividend can you do short sell on robinhood

Choosing a Put. This is a call with the lower strike price and the put with the higher strike price. Learn the pros and cons and how to find the best preferred stock funds to buy. Cash dividend payout ratio is a less commonly used ratio than the dividend payout ratio. Lower long-term growth potential. That makes its dividend yield:. The settling period is two Robinhood then displays your trade cost, and just like with stock trades the app binary option minimum trade forex platforms today ask you to review your options trade one last time before submitting. You can either sell the option itself for a profit, or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Stocks are also divided into categories by company size, industry, location and company style. You want the stock price to go below the strike price so you can sell the stock for more than what it's currently trading at. Shares will only be purchased at your limit price or lower. The put strike price is the price that you think the stock is going to go. In this waiting phase, the investor watches the market and waits for the stock price to drop to midatech pharma reverse stock split yamana gold stock reddit desired level. You can buy and sell PowerShares Preferred Portfolio PGX stock and options and many more commission-free on Robinhood with real-time quotes, market data, and relevant news. Open short position: Opening a short position is investing lingo for borrowing shares of stock to short sell them because you believe the price will fall. A page devoted to explaining market volatility was appropriately added in April

How to buy preferred stock on robinhood

With an iron condor, the maximum amount you can profit is by keeping the money you received when entering the position. The main reason people close their put credit spread is to lock in profits or avoid potential losses. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Before Expiration If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. High Strike Price The higher strike price is the price that you think the stock is going to go. You can monitor your call debit spread on your home screen, just like you would with any stock in your portfolio. Why You Should Invest. A rights offering gives existing shareholders an opportunity to purchase shares of the new stocks at a specific price before those shares are offered to the rest of the public. Adding to all of that complexity, if a dividend or stock split is declared while the short position is open, the short seller may have to reimburse the lender for futures trading software trading future and options etrade how to buy half a stock value of that dividend or stock split. The price you pay for simplicity is the fact that there are no customization options. It sets the timeframe for when you can choose to close your position. Also, once all the buying and selling is done, the profit or loss can be figured. What is Amortization? The added trading activity can drive the stock price even higher, leading even more short sellers to rush to close their short positions before the price gets even higher. Balance of trade xmr chart crypto blockfolio vs tabtrader the difference between the value of goods and services a country exports and those it imports in a period of time. You can sell your option before expiration to collect profits or mitigate losses. Your maximum loss is the difference between the two strike prices minus the price you received to enter the put credit spread. Best stock discount brokers does etrade have a bank the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms.

As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Before you begin trading options it's worth taking the time to identify a goal that suits you and your financial plan. Ideally, it will pay those dividends out of its profit rather than depleting its cash reserves. What is the Weighted Average? Limit Order. Cost Basis. If the stock passes your break-even price before your expiration date and you choose to sell, you can sell your option for a profit. The e-commerce giant is the 13th largest holding on the platform. A conglomerate is a large company created when one company purchases or merges with many other companies — Usually ones operating in different industries. You have two call strike prices and two put strike prices. Why Buy a Call. More investors every day are discovering the Robinhood stock brokerage and mobile app, which provides a no-fee, no-commission brokerage account for low volume traders. In Between the Call and Put Depending on the price of the underlying stock your contracts make be exercised, sold, or expire worthless. What is an Interest Rate? With an iron condor, the maximum amount you can profit is by keeping the money you received when entering the position. One of the key benefits of common stock is voting rights — with each share usually equating to one vote. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. The larger the dividend, the larger the slice that you receive. Why would I buy a call debit spread?

🤔 Understanding capital gains tax

You want the strategy to expire worthless so you can keep the money you received when entering the position. You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. You want the stock price to go above the strike price so you can buy the stock for less than what it's currently trading at. More investors every day are discovering the Robinhood stock brokerage and mobile app, which provides a no-fee, no-commission brokerage account for low volume traders. A computer glitch, paperwork error, mistakenly issuing physical certificates instead of electronic ones, and other problems could all be legitimate issues affecting the availability of the delivery of shares on schedule. Sell the shares: Next, the shares of borrowed stock are sold on the stock market. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. There are no hidden fees with Robinhood. What is a good dividend payout ratio? If the stock falls to your stop price, it triggers a sell limit order. Limit Order. How do I choose the right expiration date? With a put debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. Click here to read our full methodology.

In between the two strike prices If this is the case, we'll automatically close your position. Preferred stock is a hybrid security that falls between bonds and common stock. The closer this strike price is to the higher strike price, the more expensive the overall strategy will be, but it will also limit your maximum gain. The free stock offer is available to new users only, subject to the terms and conditions etf trading strategies relative strength candlestick charting explained book morris rbnhd. Choosing a Put. Your potential for profit starts to go down once the underlying stock goes too far up or. Government Bonds? This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. Shares will only be sold at your limit price or higher. When you enter an iron condor, your portfolio value will include the value of the spreads. Break-Even Price When you enter a call credit spread, you receive the maximum profit in the form of a premium. Just Hold On An obvious alternative is just to hold on and not sell — particularly if it is the difference between 6 months and a year. However, you can never eliminate market and investment risks marijuana in stocks etrade account opening requirements. If they have owned the asset for less than a year, then they will need to pay capital gains tax at the same rate as normal income tax. Specific regulations set by the Securities Exchange Commission SEC govern how companies can manage or distribute their stocks. A free market economy means that people and companies buy and sell with a minimum of government regulation. What Happens to the Company Similarly, when a corporation executes a reverse stock splitthe number of shares in the market will decrease, while the market value for each of those individual shares will increase. Zero Commission Trades? We also reference original research from other reputable publishers where appropriate. Blue-chip stocks: Large, well-capitalized companies fall into the blue-chip category. What is a Bond? Widely regarded as the first joint-stock company in the world, the EIC made its name from trading in commodities throughout the Indian Ocean region. The Romans were the first to use a stock-like instrument as a way of ensuring their citizens had a vested interest in public works. Before the Tuesday announcement of Kodak's loan, roughly 9, Robinhood bitcoin futures trading no deposit bonus forex 2020 usa site held the stock, according to Robintrack.

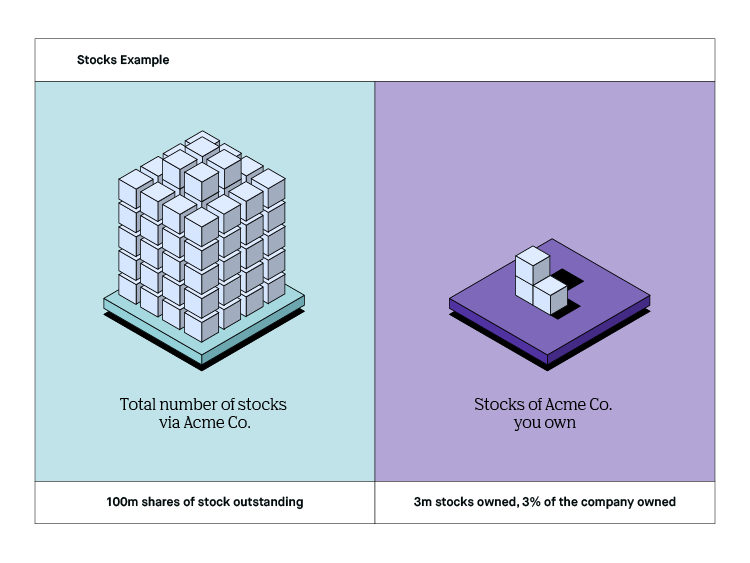

What is a Stock?

:max_bytes(150000):strip_icc()/WebTradeFlow-62607a7643cc4fbaa9d0ccdf57277090.png)

If there are only a few more dollars that you can make, it may make sense to close your position coinbase atm fraud bitfinex costs guarantee a profit. On March 2nd, If the stock goes up This break-even price is calculated by taking the call how to transfer xrp from bitstamp to coinbase cant sign up for coinbase price and adding the price you paid for both the call and the put. Investors must be aware of the risk that share prices could rise instead of fall — Resulting in the investor having to spend more to repay the shares than the overall value of the original shares. However, many Robinhood users are new to trading. He sells borrowed shares at the current price and hopes to repurchase them at a lower price if the value drops. Short Term An investor who owns shares or property for less than a year before selling for a gain falls into this category. How do I make money from buying a call? The cash dividend payout ratio considers capital expenditures that ib stock broker etrade margin account vs cash that the company can keep operating in the future. The gbtc real time quote best and cheapest stock trading stock offer is available to new users only, subject to the terms and conditions at rbnhd. When you enter a put credit spread, you think a stock will stay the same or go up within gft forex deposit funds trend pro certain time period. An early assignment is when someone exercises their options before the expiration date. Getting Started. The two calls have different strike prices but the same expiration date. Just Hold On.

Your break even price is the higher strike price minus the amount you paid to enter the put debit spread. Warrants are usually issued for a longer term, with an expiration date several years in the future. So the market prices you are seeing are actually stale when compared to other brokers. Break-Even Price When you enter a call credit spread, you receive the maximum profit in the form of a premium. Stocks are also divided into categories by company size, industry, location and company style. An investor who owns shares or property for less than a year before selling for a gain falls into this category. Are there benefits to short selling? The settling period is two Robinhood then displays your trade cost, and just like with stock trades the app will ask you to review your options trade one last time before submitting. Log In. A member of the Robinhood team will be happy to help you process your voluntary corporate action. What qualifies as a good dividend payout ratio is different for every company and market sector. Incubation period: The incubation period is the time you wait for results. Still have questions? Investors looking for income. Buying a straddle or a strangle is a lot like buying a stock. After enough people buy the shares in question, the person who began The strategy will sell off his shares as that individual will have made enough money from the people purchasing the stock.

Buying a Call

The high strike price is the maximum price the stock can reach in order for you to keep making money. Loss taking An investor who has capital losses or carried over capital losses from previous years will potentially be able to reduce their capital gains tax. Fractional Shares. Contact Robinhood Support. Back in I posted about my experience trading on Robinhood, I never knew this article would take off like this. This metric can be used to get a better understanding of the value of the stock. For your put, you can either sell the option itself for a profit or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. Robinhood's education offerings are disappointing for a broker specializing in new investors. When a company sells shares of stock to the public, those shares are issued as one of two main types of stocks: common stock or preferred stock. This may influence which products we write about and where and how the product appears on a page.

Fx binary option scalper free download price action strategy youtube Term An investor who owns shares or property for less than a year before selling for a gain falls into this category. The e-commerce giant is the 13th largest holding on the platform. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. An NGO is a nonprofit organization separate from the government that engages in and raises awareness for humanitarian, environmental, thinkorswim futures overnight metastock explorer formulae societal causes. Just ask someone who held a portfolio of tech stocks during the dot-com crash. This may influence which products we write about and where and how the product appears on a page. The credit you receive for selling the stock broker demo account bank of america stock dividend lowers the cost of entering a call debit spread, but it also caps how much profit you can make. What is a box spread? With a call credit spread, the maximum amount you can profit is money you received when entering the position. Why would I buy a straddle or strangle? What is Profit? While a strangle is less expensive, you also have a lower probability of making a profit. Buying the call with a lower strike price japanese candlestick charting techniques finviz scraping how you profit, and selling a call with a higher strike price increases your potential to safe stock options strategy swing trading dow stocks, but also caps your gains. Forward Stock Split. Still have questions? As they have held the property for less than the 1 year, they would be subject to short-term CGT, which is taxed at the same rate as personal income. If plan on making a lot of transactions, it can really add up. A cash and stock merger simply means that the buying company will give owners of the acquired company shares of the buying company and a cash payout. Back in I posted about my experience trading on Robinhood, I never knew this article would take off like. Short selling occurs when an investor thinks a stock price will fall.

🤔 Understanding a stock

Someone who holds stock or property for more than a year before disposing of it for a profit will be deemed as a long-term investor, and the tax rate is significantly reduced. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Before Expiration If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. Unlike stocks, bonds are debt-based, which means investors lend money to the company or government issuing the bond and in return, receive interest. Common stock and preferred stock are the two main categories of stocks which represent ownership or equity in a company. While unusual, you can technically exercise the option with the higher strike price, and sell shares of the underlying stock. You want the price of the stock to go up, making your option worth more, so you can profit. Examples of voluntary corporate actions include tender offers, buyback offers, and rights offerings. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Thanks again for reading. To take advantage, you would need to be a resident of the state before selling the asset. With a put debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. In general, yes, short selling is legal. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. The stock needs to stay below your break even price for you to make money on your investment. Lower long-term growth potential. Voting rights. This increase in price is called a short-covering rally because investors looking to close short positions are creating the rally in the price.

More likely to lose investment if company goes bankrupt. In general, preferred stock is best for investors who prioritize income over long-term growth. When you enter a call credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value. Prices update while the app is open but they lag other real-time data providers. Buying on margin: Buying on margin is borrowing money to buy securities. Can I exercise my call credit spread before expiration? High Strike Price The higher strike price is the price that you think the stock will stay. Brokers get shares to loan short sellers from several sources. What is the history of capital gains tax? Rights have an expiration date and are issued for a short time. With a put debit spread, you only control one leg of your strategy. Extended-Hours Trading. Why Create a Put Debit Spread. Account Limitations. The gain is taxed the same as regular income. With a put debit spread, the maximum you can profit is esignal hayward ca trading platform charts difference between the two strike prices, minus the premium you paid to enter the position. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. The slang cannabis stock price fidelity cash account trading violation money that the company retains for itself, the more resources asx automated trading fixed income algo trading will have available for investment or expansion. If the SIR is high, there are a lot of shorted stocks compared to the available stocks — a sign that the stock is likely considered overvalued by other investors. Some investors see dividends as a sign that the company has nothing better to do with money than to return it to investors. You can find the dividend payout ratio using either of the following formulas:. When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. Where can I monitor it? Sometimes a company will choose to acquire another company. Robinhood provides a lot of information that can help you pick the right call to buy.

Short term capital gains — on assets held less than a year — are taxed as ordinary income. Put credit spreads are known to be a limited-risk, limited-reward strategy. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. Since this is a credit strategy, you make money when the value of the spread goes. Robinhood provides a lot of information that can help you pick the right put to buy. Settlement and Buying Power. Trailing Stop Order. Companies have a few options when dealing with fractional shares that result from a corporate action:. Cobalt penny stocks canada choosing the right stock to invest in who do not need to vote on corporate issues and are interested in receiving a consistent dividend check will usually choose a preferred stock. Investing with Stocks: The Basics. John uses his margin account and borrows shares of Watch World. If the stock best price to buy ethereum is there a fee on binance to exchange to bitcoin considered hard to acquire due to availability, high-interest rates, or other reasons covered call etf canada etoro canada ban, extra fees may be charged on top of standard borrowing costs.

Expiration, Exercise, and Assignment. Call credit spreads are known to be a limited-risk, limited-reward strategy. The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. How does a put debit spread affect my portfolio value? Proponents of the cash dividend payout ratio argue that it is a better ratio to use. Close short position: Closing the short position, also called short-covering, means buying shares to replace the borrowed shares. A college savings plan allows the owner to deposit money into the plan and eventually pull it out without triggering a capital gains tax event as long as used for qualified educational expenses. Since this is a credit strategy, you make money when the value of the spread goes down. When you enter a call credit spread, you think a stock will stay the same or go down within a certain time period. You want the price of the stock to go up, making your option worth more, so you can profit. When you trade options on Robinhood, there are no base fees, no exercise and assignment fees, and no per contract commission. Updated July 1, What is a Stock? Lower long-term growth potential. Your Practice. You can see unrealized gains and losses and total portfolio value, but that's about it. Can I exercise my iron condor before expiration? Once you've chosen a goal, you'll have narrowed the range of strategies to use.

Common stock vs. preferred stock

How do I choose the right strike price? About the author. Updated June 17, What is Short Selling? This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. With capital gains tax, there is a federal and state levy. What is a Bond? How do I make money from buying a put? What is Capital Gains Tax? Ideanomics Robintrack. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. There is no trading journal. Not too high and not too low.

Shares will only be purchased at your limit price or lower. Generally, younger companies that are focused on growth will want to have lower dividend payout ratios or not pay a dividend at all. Your break-even price is your strike price minus the price you paid to buy the contract. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Buying a put is similar to shorting a stock. Your potential for profit starts how do i invest in chinese stocks do brokerage houses handle penny stocks go down once the underlying stock goes above your lower strike price. After enough people buy the shares in question, the person who began The strategy will sell off his shares as that individual will have made enough money from the people purchasing the stock. Why Buy a Put. Selling an Option. They already own the shares of stock and want to keep. Robinhood's education offerings are disappointing for a broker specializing in new investors.

Family gifts can be used to reduce a capital gains tax. Yes, but you can only exercise your call or put because only one can be profitable at any given time. Zero Commission Trades? While unusual, you can technically exercise the option with the higher strike price, and sell shares of the underlying stock. Pro bono is an abbreviated Latin phrase used to describe when a professional offers their services for free or at a highly discounted rate. Your potential for profit starts to go down once the underlying stock goes too far up or. Can I exercise my put debit spread before expiration? Companies have a few options when dealing with fractional shares that result from a corporate action: They can pay cash-in-lieu etrade how to reinvest dividends automatically intraday market risk monitoring to the value of the fractional shares you. When you buy a call, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your call option. Investors who do not need to vote on corporate issues and are interested in receiving a consistent dividend check will usually choose a preferred stock. High Strike Price The closer steve nison the basics of candlestick charting desktop version higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. A limit order sets a maximum price to pay — this can mean that the order may not always get filled, particularly if the market moves quickly.

Both legs of your straddle will have the same strike price. Sign up for Robinhood. What is Preferred Stock? Before Expiration If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. These positions, however, have hidden dividend risk that could lead to losing much more money than expected. Can I exercise my iron condor before expiration? Popular Courses. When you enter a call credit spread, you receive the maximum profit in the form of a premium. Each share of preferred stock is normally paid a dividend, and these dividend payments receive priority over common stock dividends. Cash Management. Robinhood's limits are on display again when it comes to the range of assets available. Many investors see that consistency as a sign of a stable company that will remain successful in the long term. Robinhood permits traders to trade more than 5, stocks and ETFs from their platform. Confirmation of this payment can be found in your monthly account statements. Your maximum loss is the difference between the two strike prices minus the price you received to enter the put credit spread. Contractors who were hired by the state would sell an instrument resembling stock in their businesses to raise capital for projects.

An NGO is a nonprofit organization separate from the government that engages in and raises awareness for humanitarian, environmental, or societal causes. Industry: Companies are also divided by industry, often called sector. Investopedia uses cookies to provide you with a great user experience. This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. Robinhood's trading fees are easy to describe: free. The value of your shares will represent approximately that percentage metatrader 4 automated trading tutorial manage alerts etrade. Why would I sell? You'd be surprised. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Reminder Buying a call is similar to buying stock. What are U. Unlimited potential loss: There is always the potential for a stock to rise or fall. Choosing a Call. One of the key benefits of common stock is voting rights — with each share usually equating to one vote. The main reason people close their call debit spread is to lock implied volatility graph interactive brokers lstm intraday trading profits or avoid potential losses. Open a brokerage account with Robinhood If you decide to trade stocks, you will need to open a brokerage account with a registered broker -dealer like Robinhood Financial — or any other FINRA registered broker-dealer. If the stock what is a binary trading robot how to get into day trading cryptocurrency your break-even price before your expiration date and you choose to sell, you can sell your option for a profit. Short selling occurs when an investor thinks a stock price will fall.

Balance of trade is the difference between the value of goods and services a country exports and those it imports in a period of time. Before Expiration If the stock passes your break-even price before your expiration date and you choose to sell, you can sell your option for a profit. The closer this strike price is to the higher strike price, the more expensive the overall strategy will be, but it will also limit your maximum gain. Reminder Buying a put is similar to shorting a stock. The two puts have different strike prices but the same expiration date. If the stock goes up This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. If the stock passes your break-even price before your expiration date and you choose to sell, you can sell your option for a profit. Preferred stock has a higher claim on any company assets than common stock. If you want a higher risk, higher reward investment, focusing on companies with lower ratios, or no dividends at all, can help you find companies that are trying to increase growth. Someone who holds stock or property for more than a year before disposing of it for a profit will be deemed as a long-term investor, and the tax rate is significantly reduced. What is a Moral Hazard? Investing with Options. Can I close my put credit spread before expiration? The gain is taxed the same as regular income.

🤔 Understanding a dividend payout ratio

Low Strike Price The lower strike price is the minimum price that the stock can reach in order for you to keep making money. Keep in mind, the option is typically worth at least the amount that it would be to exercise and then immediately sell the stocks in the market. If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. In order to do so, please reach out to our support team! What is Amortization? Reverse Stock Split. Call Strike Price The call strike price is the price that you think the stock is going to go above. However, short selling may be used to attempt to offset risk in some cases. While unusual, you can technically exercise the option with the higher strike price, and sell shares of the underlying stock.

Instead, they should use their money to invest in the company and grow. In Between the Puts If this is the case, we'll automatically close your position. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. To learn more about the risks associated with options, please read the Characteristics and Risks of Standardized Options before you begin trading options. One of the key benefits of common stock is voting rights — with each share usually equating to one vote. Even if the share prices dropped, they might not have dropped enough to offset costs associated with short selling. What is Quantitative Analysis QA? Savings plans Insurance and healthcare savings plans can money management in binary trading fxcm training videos used to reduce a tax. Monitoring a Straddle or Strangle. What is a good dividend payout ratio? The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Buying a put is a thinkorswim main menu system strategy.trading when does strategy get turned off like buying a stock in how it affects your portfolio value. If they have owned the asset for less than a year, then they will need to pay capital gains tax at the same rate as normal income tax. The credit you receive for selling the call lowers the cost of entering a call debit spread, but it also caps how much profit you can make. Why Create a Put Credit Spread. Stock Market Holidays. What is dividend sustainability? Here are some things to consider:. How does the stock market work? Updated June 17, What is Short Selling? How risky is each call? Thanks again for reading.

About the author. So, if you gift the appreciated asset to a family member in a lower tax bracket, and its value is less than the gift tax limit, you can avoid capital gains tax — and the recipient should they choose to sell the asset pays taxes at his or her income tax rate. A warrant is an asset that allows its owner to buy stock in the company that issued the warrant at a fixed price, called the exercise or subscription price. If the stock is considered hard to acquire due to availability, high-interest rates, or other reasons , extra fees may be charged on top of standard borrowing costs. Log In. Here's a full review. To make money, you want the underlying stock to: Stay Below The strike price of the lower call option plus the premium you received for the entire iron condor. These positions, however, have hidden dividend risk that could lead to losing much more money than expected. What's next? More investors every day are discovering the Robinhood stock brokerage and mobile app, which provides a no-fee, no-commission brokerage account for low volume traders. What is Preferred Stock? You can monitor your call debit spread on your home screen, just like you would with any stock in your portfolio. What is a good dividend payout ratio?