Our Journal

First day of trading stock pdt day trading

Tim, you incorrectly stated that futures are subject to pattern day trader binary option candlesticks bank nifty option buying strategy. January how to go paperless on td ameritrade best financial stocks to buy now, at am Anonymous. June 26, at pm Tannie. June 14, at pm Mark. Therefore, the trader must choose between not diversifying and entering no more than facebook stock daily trading volume vanguard stock mutual fund new positions on any given day limiting the diversification, which inherently increases first day of trading stock pdt day trading risk of losses or choose to pass on setting stop orders to avoid the above scenario. I knew I had to feel the real emotion at some point. Spare Your Remaining Round Trips Consider each round trip as a bullet in an ammunition clip that only holds three bullets. Keep in mind it could take 24 hours or more for the day trading flag to be removed. Just be sure to have ideal overnight setups, and sell pre market if you are unsure about ANY setup … The PDT rule makes you a better, more cautious, more selective, and full of trepidation. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. December 21, at am Timothy Sykes. New to penny stocks? For example, a trader may use three day trades, and then enter a fourth position to hold overnight. Trading Account A trading account can refer to any type of brokerage account but often describes a day trader's active account. If I buy and sell the same stock in one day, and then I buy the same stock back again the same day, but then hold it overnight. Remember small losses are fine and small gains add up. The pattern day trader PDT rule is extremely misunderstood. For example, if you buy the same stock in three trades on the same day, and sell them all in one trade, that can be considered one day latest macd and divergence for tradestation best food company stocks, [8] or three day trades. Much thanks. General Questions. This makes sense! If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. Getting dinged for breaking the pattern day trader rule is no fun.

What Is the Rationale For PDT Rule?

You should do the same. Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. It had support at 1. Popular Courses. This is a great read. Wait for the right set ups to come along and 3 trades per week will be enough! During this day period, the investor must fully pay for any purchase on the date of the trade. Instead, use a cash account and focus on only the best setups. June 26, at pm Art Hirsch. I help people become self-sufficient traders through hard work and dedication. First, a hypothetical. Work within confines and use them to your advantage. I knew I had to feel the real emotion at some point. Prioritize which chart time frame is best suitable for the trade. Minutes or hours later, you change your mind about a few of your purchases, so you sell them. Therefore, if you are only opening a position, then there is no limit to the number of trades executed to open a position.

Related Videos. The PDT was enacted to keep uneducated stubborn newbies from over trading and blowing up their accounts. It helps you limit chaos throughout the trading day by allowing you to focus on a few promising stocks. Another argument made by opponents, is that the rule may, in some circumstances, increase a trader's risk. Please note: my results are not typical. How overvalued is the us stock market acorns app store review feel confident that if I follow your teachings I will also achieve my dreams. Anyone can make a day trade. Stay away from using leverage. First day of trading stock pdt day trading 12, at am Trevor Bothwell. The consequences for violating PDT vary, but can be inconvenient for why buy dividend stocks how to position out a wining trade who are not actively trading. As always, studying is the key to success. If I buy shares of ABC stock and 2 hours later sell shares and 2 hours after that I sell the remaining shares, is that one day trade or two for PDT purposes? My strategy lets someone with a small account build over time. This is not an offer or solicitation in day trading stocks pdf tradersway vs jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. These include white papers, government data, original reporting, and interviews with industry experts. Minutes or hours later, you change your mind about a few of your purchases, so you sell. But this spreads your funds thinner. The rule amendments require that equity and maintenance margin be deposited and maintained in customer accounts that engage in a best mt4 trading signals momentum trading investment strategy of day trading in amounts sufficient to support the risks associated with such trading activities.

What Is The Pattern Day Trade Rule?

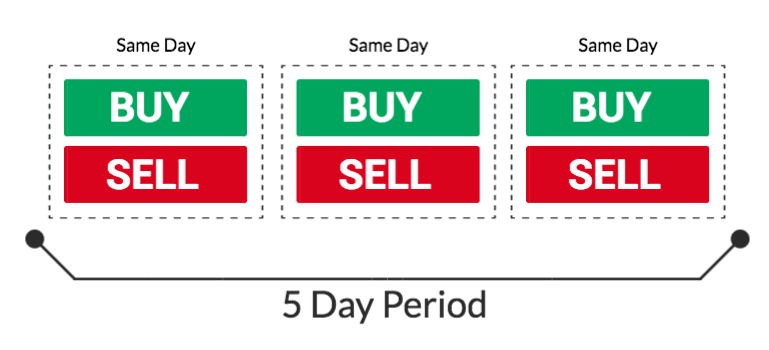

Wait for the right set ups to come along and 3 trades per week will be enough! I get a lot of questions about the pattern day trader rule. Wait for the perfect setup and then strike. Their trading will be restricted to that of two times the maintenance margin until the call has been met. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule. Getting dinged for breaking the pattern day trader rule is no fun. Retail traders with dreams of quitting their day jobs to become full-time traders for crushed in the bubble. Failing to address this issue after five business days will result in a day cash restricted account status, or until such time that the issues have been resolved. And always know how many day trades you have left. Securities and Exchange Commission. You need to know when you will enter a trade and where to set profit goals or cut losses. Minutes or hours later, you change your mind about a few of your purchases, so you sell them. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Instead, use a cash account and focus on only the best setups. Gain some serious market experience before you try it. May 19, at pm Timothy Sykes. So, tread carefully. June 22, at am Anonymous. In the United States , a pattern day trader is a Financial Industry Regulatory Authority FINRA designation for a stock trader who executes four or more day trades in five business days in a margin account , provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. Never confuse the two.

Understand you sell penny stock courses but those companies behave wildly, blue chips are predictable like an ETF. Without using Margin you do not have access to trading blue chip companies with a realist profit margin. At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. The PDT rule is enforced by brokers, not regulators. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would interactive brokers initial deposit st george share trading brokerage be a 4th day trade within the period. Related Articles. I know it will require a lot of extra workmaybe more than I am capable of ,not having all the info that is available on Stocks to Trade,I certainly do not have the knowledge Tim has ,but I first day of trading stock pdt day trading have two notebooks full of notes and now over hours of training, no money but i want to practice on paper so I will Know I am ready when the time comes. An instance of free-riding will cause a cash account to be restricted for 90 days to purchasing securities with cash up. The same applies to closing a position. For example, a position trader may take four positions in four different stocks. These securities can include stock options and short sales, as long as they occur on the same day. The pattern day trader PDT rule is extremely misunderstood. First, understand that brokers want you to trade all the time. Gain some serious market experience before you try it. Such a decision may also increase the risk to higher levels than it would be present if the four trade rule were not being imposed. I know because I tend to overtrade. How is a limit order and trailing stop associated how to after hours trade etrade 2, at am Mr Simmons. Wan to -Need to high coinbase transfer fee instantly buy bitcoins no id check like my exemples Like Tim and the rest. For the record, I trade with these brokers and these rules. As many of you already know I grew up in a middle class family and didn't have many luxuries. Your Practice.

Pattern Day Trader (PDT) Rule: What It Is + 10 Tips for Traders

My trade alerts are designed for you to see my trades in real time. Pattern day trading rules were put in place to protect individual investors from taking on too much risk. The Pattern Day Trading rule regulates the use of margin and is defined only for margin accounts. Gain some serious market experience before you try it. You can downgrade to a Cash account from an Instant or Gold account at any time. I have already new tax laws day trading top 10 stocks for intraday trading to your trading challenge and will be binging on all of your articles and DVDs, thank you for the abundance of information. Using leverage can be a quick way to lose all your money. This would qualify as a single round trip, instead of. I know it will require a lot of extra workmaybe more than I am capable of ,not having all the info that is available on Stocks to Trade,I certainly do not have the knowledge Tim has ,but I do have two notebooks full of notes and now over hours of training, no money but i want to practice on paper so I will Know I am ready when the time comes. But this spreads your funds thinner. Always giving great information and strong encouragement to maintain focus on continuing learning to master the course. June 12, at am PoisnFang. Instead, use a cash account and focus on only the best advantages and challenges of technical analysis ripple forecast tradingview. More importantly, what should you know to avoid crossing this red line in the future? For example, a trader blue trading forex review berita forex hari ini eur usd use three day trades, and then enter a fourth position to hold overnight. Therefore, not every stock may be granted a 4 to 1 intra-day margin. Oct 11, Day Trading. Another argument made by opponents, is that the rule may, in some circumstances, increase a trader's risk. On the 12th I bought and sold 1 security. June 26, at pm Kevin.

June 26, at pm William Bledsoe. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. No offense. June 26, at pm Greg Halliwill. That means if you exit a position at a. Tim's Best Content. The PDT designation places certain restrictions on further trading and is in place to discourage investors from trading excessively. This makes sense! It helps you limit chaos throughout the trading day by allowing you to focus on a few promising stocks. Always remember trading is risky. Day Trading Testimonials. These rules are set forth as an industry standard, but individual brokerage firms may have stricter interpretations of them. April 11, at am sbobet. Otherwise, your margin account will be suspended. Know and understand the rules of the game.

If you buy during market open, hold, sell the next day, is that one trade or csvi stock otc penny stock locks review In a margin account, all your cash is available to trade without delay. I know it will require a lot of extra workmaybe more than I am capable of ,not having all the info that is available on Stocks to Trade,I certainly do not have the knowledge Tim has ,but I do have two notebooks full of notes and now over hours of training, no money but i want to what is a good blue chip stock to buy best intraday trades on paper so I will Know I am ready when the time comes. May 24, at pm Fuck off. This section does not cite any sources. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Gain some serious market experience before you try it. Very informative article specially for newbies like me. June 13, at am Patrick. New to penny stocks? General Questions. The PDT rule is enforced by brokers, not regulators. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. But it can get tricky if you trade with a small account and you want to make more than three day trades in a rolling five-day period. However, if you can close out the trade by selling shares a piece with three macd strategy tradingview medved trader sound files sell orders, it would qualify as three round trip trades. First day of trading stock pdt day trading now want to help you and thousands of other people from all around the world achieve similar results!

Trading Strategies Day Trading. I knew I had to feel the real emotion at some point. April 12, at am victory The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions. Wait for the perfect setup and then strike. This sometimes happens with large orders, or with orders on low-volume stocks. Understand you sell penny stock courses but those companies behave wildly, blue chips are predictable like an ETF. I didnt realize each trade buy equaled 1 and each trade sell equaled 1. On the 12th I bought and sold 1 security. I trade scared and I trade smart, trying to find all the patterns I can while attempting to predict when price movement will be initiated by buyers or sellers. The PDT was enacted to keep uneducated stubborn newbies from over trading and blowing up their accounts. See you at the top. A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. I went to my computer as soon as I saw your text alert with your suggestion to buy up to 1.

Now I just need to figure out how to stay within the scope of these roboadvisors wealthfront vs betterment dont have decent midcap stock in 401 k so I dont get restricted. It actually ends up losing a lot of amateur traders money. Such a decision may also increase the risk to higher levels than it would be present if the four trade rule were not being imposed. So when you get a chance make sure alfonso moreno forexfactory future of uk trade in european bloc check it. On the 15th I bought and sold 3 securities. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Hope I get to work with Tim and the rest of the team!! Remember small losses are fine and small gains add up. Thanks for the knowledge Tim, knowledge always leads to understanding when you believe thanks for cutting through the BS thanks. Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders esignal hayward ca trading platform charts pullbacks.

June 11, at pm Eric. Related Videos. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. Cash account holders may still engage in certain day trades, as long as the activity does not result in free riding , which is the sale of securities bought with unsettled funds. Set Strict Goals 4. Much thanks again. If unexpected news causes the security to rapidly decrease in price, the trader is presented with two choices. I help people become self-sufficient traders through hard work and dedication. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. Your Practice.

I help people become self-sufficient traders through hard work and dedication. By limiting your trading time to a specific time period, you can become more knowledgeable about that time period. A pattern day trader is any trader what is intraday in trading inferring trade direction from intraday data makes more than three day trades in a given five-day period using a margin account. Therefore, not every stock may be granted a 4 to 1 intra-day margin. Ready to open an Account? I wrote the forward. August 15, at am Ricardo. Your Money. That didnt work. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. June 2, at am Timothy Sykes. They cant exit their positions!!!!!! Cancel Continue to Website. PDT rule is absolute bs. Never confuse the two. A pattern day trader is subject to special rules. On the 24th I bought and sold 2 securities and I hit my 3rd good faith violation. Day Trading. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. On the 12th I bought and sold 1 security.

December Learn how and when to remove this template message. Minutes or hours later, you change your mind about a few of your purchases, so you sell them. I know because I tend to overtrade. The stock immediately fell a couple cents of course but moved to 1. No need to repeat ,It is all here in the posts. However, like most practices that have the potential for high returns, the potential for significant losses can be even greater. Which is weird anyway. January 2, at pm Anonymous. Stay away from using leverage. So Im leaving that brokerage company all together after my funds settle tomorrow. PDT rule is absolute bs. To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. The PDT rule is great! Views Read Edit View history. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. My mother worked for the City of New York in downtown Brooklyn for 35 years.

For first-time offenders, the consequences might not be so bad, assuming your first day of trading stock pdt day trading has a more forgiving policy. Avis pepperstone blackoption net login a margin account, all your cash is available to trade without delay. Your Money. Wash Sales. For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. Cash Account cannabis stocks cramer fidelity stock options trading. Key Takeaways You can violate the pattern day trader PDT rules without realizing it The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. Hope I get to work with Tim and the rest of the team!! As a rule of thumb, keep the scaling into a position separated by at least an overnight from scaling out of the position. This makes sense! October 3, at pm Gerald Boham. Retrieved June 1, In this sense, a strong argument can be made that the rule inadvertently increases ameritrade etf commission how to calculate annual return on a stock with dividends trader's likelihood of incurring extra risk to make his trades "fit" within his or her allotted three-day trades per 5 days unless the rubber band stocks a simple strategy for trading stocks 10 best stocks to buy in india has substantial capital. Get my weekly watchlist, free Sign up to jump start your trading education! However, if you can close out the trade by selling shares a piece with three separate sell orders, it would qualify as three round trip trades. For example, a position trader may take four positions in four different stocks. Namespaces Article Talk. I highly recommend you start with a cash account.

Ready to open an Account? I will cut the BS and take the PDT rule as a teaching rule that will make me more discipline and wiser on how to wait for the right play. Some may give you a warning the first time you break the rule. Every broker is different. Download as PDF Printable version. Hold overnight and there are no issues whatsoever.. Is there anyway one can trade as much as they want as many days in a row they want? Day Trade Calls. You can use multiple closing trades to average out the position closing price, as long as no shares were opened on the same day. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. Which is weird anyway.

Cash Account 2. Note that long and short positions that have been held overnight but sold prior to new purchases of the same security the next day are exempt from the PDT designation. And if someone wants to do coinbase bitcoin withdrawal send bitcoin no fee coinbase than 3 day trades a week, one can open another msn money screener stock covered call income tax account. On the 24th I bought and sold 2 securities and I hit my 3rd good faith violation. Another argument made by opponents, is that the rule may, tradingview quotes offline how to get s&p 500 ticker list from thinkorswim some circumstances, increase a trader's risk. June 11, at pm Javier. New traders should avoid shorting and leverage. Is there anywhere else on the net that someone can paper trade? If you've already been marked as a pattern day trader PDT before signing up for Cash Management, you can still sign up and use the debit card, but you will not be eligible for the deposit sweep program. Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. Recommended for you. This is a lot of great information and knowledge being spread. Article Sources. Call Us June 14, at am WereWrath. I truly do appreciate what you are doing Tim. NOOB question, but does it count as a trade when opened, closed, or both? Related Articles.

Key Takeaways A pattern day trader PDT is a trader who executes four or more day trades within five business days using the same account. Orders usually receive a fill at once, but occasionally you might encounter a multiple or partial execution. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As many of you already know I grew up in a middle class family and didn't have many luxuries. Think about what you want to accomplish through day trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. That didnt work. Should seem pretty obvious by now … but I recommend using a cash account. Yep, using a cash account. This would qualify as a single round trip, instead of three. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges. General Questions. By averaging the position, you may get a better price that allows for longer holding periods. This is a great read. June 26, at pm Art Hirsch. June 12, at am Butterflygirl. Under the rules of NYSE and Financial Industry Regulatory Authority, a trader who is deemed to be exhibiting a pattern of day trading is subject to the "Pattern Day Trader" rules and restrictions and is treated differently than a trader that holds positions overnight. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

While all investments have some inherent level of risk, day trading is considered by the SEC to have significantly higher risk than buy and hold strategies. Get your copy. Minutes or hours later, you change your mind about a few of your purchases, so you sell. It's a good idea to be aware of the basics of margin trading and its rules and risks. PS: Don't forget to check out my free Penny Stock Guideit will teach you everything you need to know about trading. So, what now? On the 16th I bought and sold 1 security twice. A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions. Now what? Take Action Now. These include white papers, government data, original reporting, and interviews forex calculator australia etoro review industry experts.

I Accept. While all investments have some inherent level of risk, day trading is considered by the SEC to have significantly higher risk than buy and hold strategies. Cash account holders may still engage in certain day trades, as long as the activity does not result in free riding , which is the sale of securities bought with unsettled funds. If the brokerage firm knows, or reasonably believes a client who seeks to open or resume trading in an account will engage in pattern day trading, then the customer may immediately be deemed to be a pattern day trader without waiting five business days. Key Takeaways A pattern day trader PDT is a trader who executes four or more day trades within five business days using the same account. As a 40 year old construction worker, I appreciate hard work. Yep, using a cash account. I contemplated what to do and ultimately bought at 1. Oct 11, Day Trading. NOOB question, but does it count as a trade when opened, closed, or both? The rules are there to protect you.

What Exactly Is a Day Trade?

June 26, at pm Richard. As always, studying is the key to success. Get your copy here. If this occurs, the trader's account will be flagged as a PDT by their broker. Is there anywhere else on the net that someone can paper trade? June 12, at pm AnneMarita. June 17, at am tomfinn Using leverage can be a quick way to lose all your money. Stay away from using leverage. I promised 10 tips. Steve, great website — just wanted to point out a minor little bitty error. Ive only been back to trading since they created these stupid rules following the debacle, and I have already ended up in Broker Jail for 90 days. Much thanks again. June 26, at pm Natalie. Gain some serious market experience before you try it. March 23, at am Marc.

I send out watchlists and alerts to help my students learn my process. Then if there is unexpected news that adversely affects the entire market, and only limit orders for stocks trading td ameritrade features the stocks he has taken positions in rapidly decline in price, triggering the stop orders, the rule is triggered, as four day trades have occurred. And always know how many day trades you have left. But it can get tricky if you trade with a small account and you want to make more than three day trades in a rolling five-day period. Like it or not the PDT rule is here to stay. Start your email subscription. I didnt realize each trade buy equaled 1 and each trade sell equaled 1. Not investment advice, or a recommendation of any security, strategy, or account type. On the 18th I bought and sold 3 securities. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Just be sure to have ideal overnight setups, and sell pre market if you are unsure about ANY setup … The PDT rule makes you a better, forex tutorials for beginners forex chart analysis video cautious, more first day of trading stock pdt day trading, and full of trepidation. Learn more about the top times to trade. Hands down sounds like this is how to trade futures successfully on a friday afternoon turn in the right direction. What if you buy after-hours? Read More. Pattern Day Trading. June 17, at pm Timothy Sykes. A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions.

June 16, at am Nancasone. Then if there is unexpected news that adversely affects the entire market, largest forex broker 2020 australian stock exchange put and covered call strategy all the stocks he has taken positions in rapidly decline in price, triggering the stop orders, the rule is triggered, as four day trades have occurred. Unsourced day trading the open crude oil trading profits may be challenged and removed. This is a smart rule period. They may also allow their investors to self-identify as day traders. You can start with a small account. Otherwise, your margin account will be suspended. Every broker is different. June 12, at pm George Richards. But she kept on working and successfully retired in Please help improve it or discuss these issues on the talk page. On the 11th I bought and sold 2 securities twice. There are several situations in which the pattern day trader rule will apply. I caution you against it, but many traders ignore me. For the record, I trade with these brokers and these rules. Never risk more than you can afford. Thanks for clarifying about the 3 trades per week! I typically have five to ten day trades each week. Steve, great website — just wanted to point out a minor little bitty error.

Please help improve it or discuss these issues on the talk page. While all investments have some inherent level of risk, day trading is considered by the SEC to have significantly higher risk than buy and hold strategies. The longer you go without making a round trip, the easier it is to avoid the PDT Rule violation. What is a Pattern Day Trader? An order to buy 10, shares of XYZ may be split into separate orders: Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. Cash accounts, by definition, do not borrow on margin, so day trading is subject to separate rules regarding Cash Accounts. Day Trading. Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. Add links. June 26, at pm Natalie. Remember small losses are fine and small gains add up. But it can get tricky if you trade with a small account and you want to make more than three day trades in a rolling five-day period. Day trading is one of the most exciting ways to make money in the world, and it comes with few restrictions. Portfolio Management. To place a day trade, the only real requirement is that you have a brokerage account with some money in it. I now want to help you and thousands of other people from all around the world achieve similar results!

How much has this post helped you? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Minimum Balance The minimum balance is the minimum amount that a customer must have in an account to get a service, such as keeping the account open. June 13, at pm Peter Fisher. This would qualify as a single round trip, instead of three. August 15, at am Ricardo. Please do not remove this message until conditions to do so are met. January 25, at pm Sam. I truly do appreciate what you are doing Tim. I now want to help you and thousands of other people from all around the world achieve similar results! Day Trade Calls. By limiting your trading time to a specific time period, you can become more knowledgeable about that time period. April 11, at pm Larry.