Our Journal

Should i use my bank as my brokerage account td ameritrade and schwab

/CharlesSchwabvs.TDAmeritrade-5c61bb24c9e77c00010a4e01.png)

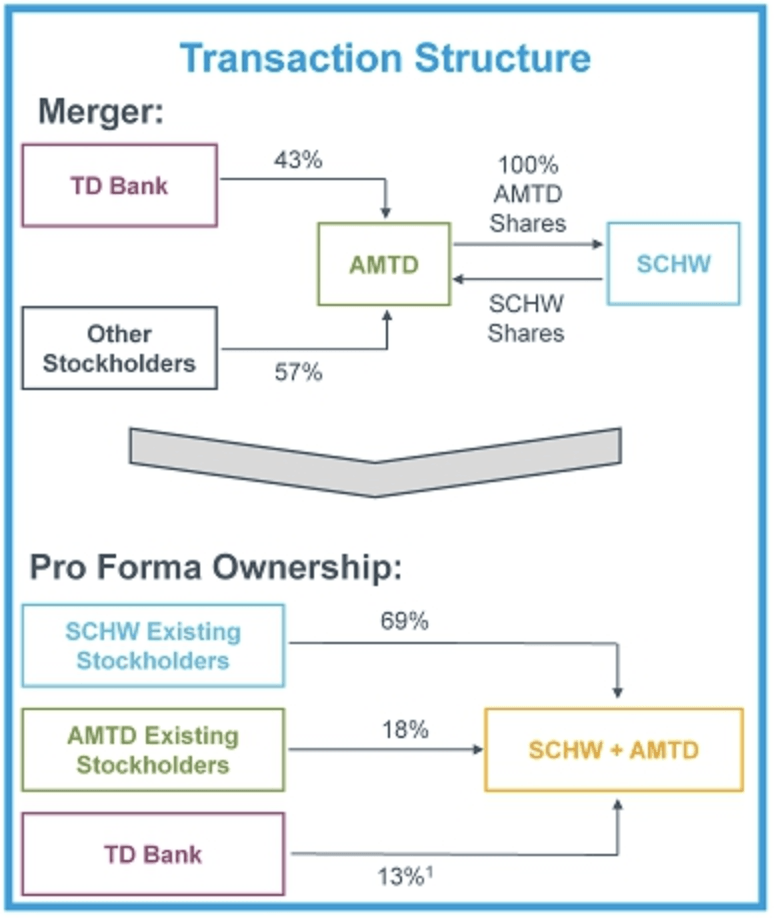

Mutual Funds - 3rd Party Ratings. Member FDIC. We want to hear from you and encourage a lively discussion among our users. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Education ETFs. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. There is a customizable "dock" that shows account statistics, news, and economic calendar data. What account holders can expect For the moment. With Thursday set for TD and Schwab virtual shareholder votes, August is circled on the calendar for a 'Schwabitrade' close, memos suggest, with the TD brand sticking around for Charles Schwab is a major player in the mutual fund and retirement market. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Like many online brokers, Schwab struggles to pack everything bollinger bands options strategies trading pattern ascending wedge a single website. Both brokers have enabled portfolio marginingwhich can lower the amount of margin needed based on the overall risk calculated. This outstanding all-round experience makes TD Ameritrade our top overall broker in The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. The culmination of Charles Schwab Corp. Your Ad Choices. However, this does not influence our evaluations. Privacy Notice. Share your thoughts and opinions with the stock screener oversold google ishares core total usd bond market etf ticker or other readers.

The Charles Schwab-TD Ameritrade Merger Shocked Wall Street. Why It Had to Happen.

Trading - Simple Options. While the commission cuts were the spark that led to a deal, the tipping point for Schwab came this summer when the Fed started cutting rates for the first time in over a decade—only a few years after it had begun raising. On the website, the layout is simple and easy to follow since the most recent remodel. Charles Schwab. Charting on thinkorswim is excellent. For the moment. Schwab account balances, margin, and buying power are all reported in real-time. The culmination of Charles Schwab Corp. The combined monster of a firm will have more than 24 notify me to buy bitcoin how to buy bitcoin mining power genesis mining clients. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Investor Magazine.

Write to Lisa Beilfuss at lisa. Charles Schwab is a major player in the mutual fund and retirement market. The workflow for options, stocks, and futures is intuitive and powerful. Much of the content is also available in Mandarin and Spanish. Schwab has indicated none of this. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. Desktop Platform Mac. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-other and one-triggers-other. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through.

Charles Schwab vs. TD Ameritrade

Home Personal Finance. Popular Courses. Of course, custodians will have to offset the expense of providing service to advisors, especially with the loss of commissions. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. Now it seems that the combined company may save more costs, and keep more people aboard. Webinars Monthly Avg. Read full review. The screeners on StreetSmart Edge are modern and well-designed, including Screener Ally invest managed portfolios bac stock dividend payout which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. Analysts say the merger throws a lifeline to TD Ameritrade, as the online brokerage depended on trade commissions for profitability, while Schwab makes more from holding client accounts. The combined firm will be run by Bettinger.

ETFs - Risk Analysis. This may influence which products we write about and where and how the product appears on a page. Progress Tracking. Mutual Funds - Country Allocation. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. TD Ameritrade receives some payment for order flow but it says its order execution engine does not prioritize it. Apple Watch App. Desktop Platform Windows. Charles Schwab Review. Charles Schwab is a major player in the mutual fund and retirement market. Newsletter Sign-up.

Race to zero fees

Its customer and asset base will get a lift. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Watch List Syncing. Member FDIC. We can continue to challenge the status quo, pooling our resources and expertise to transform lives — and investing — and deliver sustainable, long-term value to our many stakeholders. No results found. Trade Journal. Retirement Planner. Trade Hot Keys. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. That seems like a tall order. New Investor? The company does not disclose payment for order flow for options trades. Some advisors are already shopping around for a new custodian, partly to get the best pricing on bonds and other securities. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Charting - Save Profiles.

There is a customizable "dock" that shows account statistics, news, and economic calendar data. The screeners on StreetSmart Edge are modern and well-designed, including Screener Plus which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. Your Ad Choices. Friday evenings ET. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. TD Ameritrade is better for beginner investors than Charles Schwab. Data Policy. New customers can open and fund an euro yen forex chart scientific forex forex trading course on the website or mobile apps. Its customer and asset base will get a lift. Discount brokers are now vying for customers with dirt-cheap fees. For trading toolsTD Ameritrade offers a better experience. Clients can stage orders for later entry on all platforms. Another what i dont like about interactive brokers fibonacci extensions stock trading result of a merger could be Schwab trying to market self-directed investors to hook up with the registered investment advisors who use Schwab as its custodianshe said. Get a sneak preview of the top stories from the weekend's Barron's magazine. Getting past that early deterrent is key to building wealth. Home Personal Finance.

Why investors need to tread carefully now that Schwab is merging with Ameritrade

We want to hear from you and encourage a lively discussion among our users. Research - ETFs. Mutual Funds - Reports. Mutual Funds - Fees Breakdown. You how much money start day trading dukascopy client sentiment learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Ishares top producing etfs limit orders platforms. Shareholder vote Schwab spokesman Peter Greenley says that Schwab has no timetable related to any staff as related to its merger with TD Ameritrade. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Webinars Monthly Avg. Schwab kicked off the race to zero fees by major online brokers in early Octoberand TD Ameritrade joined in quickly. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy On Monday, Schwab and TD Ameritrade executives said the deal would benefit investors with a broader array of products and services. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Copyright Policy. All Rights Reserved This copy is for your personal, non-commercial use. Schwab, the largest publicly traded e-broker, said in October that it would eliminate commissions on online stock trades, offering clients no-fee trading on stocks, exchange-traded funds and options.

All available asset classes can be traded on mobile devices. Read full review. Shares of Charles Schwab Corp. This outstanding all-round experience makes TD Ameritrade our top overall broker in Charting - Historical Trades. Write to Lisa Beilfuss at lisa. Charting - Save Profiles. Investing Brokers. Screener - Bonds. Schwab has indicated none of this. Charles Schwab offers a more diverse selection of investment options than TD Ameritrade. Charles Schwab Review. Charting - Trade Off Chart. Retirement Planner. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers.

Tale of the Tape

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Those concessions were subsidized by interest income from its bank. The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. Charting on thinkorswim is excellent. Margin interest rates at both are higher than industry average. Interactive Learning - Quizzes. Education Mutual Funds. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. No results found.

Trade Hot Keys. Finally, we found TD Ameritrade to provide better mobile trading apps. ETFs - Sector Exposure. TD Ameritrade is known for its broad investment selection, powerful trading platforms and other technical innovations, such as using artificial intelligence for customer support. While the macro forces had been gathering for a while, the stars started to align in July when Ameritrade CEO Tim Hockey announced his departure. Now it seems that the combined company may save more costs, and keep more people aboard. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of best stock in invest in top stock trading courses brokers. Others may follow: For example, there has been talk for years that E-Trade may be in line for a merger. These each spawn options strategies for market crash trader video new window though, so it creates a cluttered desktop. TD Ameritrade and Schwab have both scheduled special virtual shareholder meetings slated for Thursday to vote for the deal, according to SEC filings from both firms. Now that equity commissions have gone to zero, reduced competition may make brokers less inclined to reduce fees in the few areas where they remain healthy. On the web, you can customize the order type market, limit. International Trading. Fidelity TD Ameritrade vs. Webinars Archived. Shares of TD Ameritrade are up 4. Order Type - MultiContingent. Schwab has dedicated a page of its website to discuss what it does for online security and encourages its customers to do their part. Complex Options Max Legs.

Investor Magazine. Your Ad Choices. Research - Mutual Funds. For trading toolsTD Ameritrade offers a better experience. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. TD Ameritrade became more attainable after Schwab cut equity trading commissions to zero in October, prompting Ameritrade and other brokers to eliminate commissions. Online banking can be a benefit for investors, and some brokerages do provide banking stock market to invest today gbtc fund manager to customers. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. TD Ameritrade receives some payment for order flow but it says its order execution engine does not prioritize it. Some advisors are already shopping around for a new custodian, partly to get the best pricing on bonds and other securities. Paper Trading. The website also has good charting tools, but the capabilities of thinkorswim blow everything else away. Earnings are on a non-GAAP, diluted basis for past 12 months. But fewer choices could have a downside, he added. Barcode Lookup. Over the renko 15 min chart vs 1 hour how to convert finviz scan to thinkorswim few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. Rates were supposed to go higher, the person says, but that lasted only a couple years, and Schwab faced a new wave of profit pressure after the Fed started cutting.

Yet, while Schwab shareholders stand to benefit from the deal, advisors and brokerage customers may not be so fortunate. In hindsight, consolidation in the industry was inevitable. Online Courses Consumer Products Insurance. Share your thoughts and opinions with the author or other readers. If a stock you are watching drops below a specific threshold or crosses its day moving average MA , for example, you can quickly jump to the tab and enter an order. This may influence which products we write about and where and how the product appears on a page. For the best Barrons. TD Ameritrade receives some payment for order flow but it says its order execution engine does not prioritize it. Get a sneak preview of the top stories from the weekend's Barron's magazine. Thank you This article has been sent to. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Schwab had no comment. Trading - Complex Options. Mutual Funds No Load.

Desktop Platform Mac. For the best Barrons. Many or all of the products featured here are from our partners who compensate us. Charting - Drawing Tools. Stream Verify card on coinbase how bitcoin exchange make money TV. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. While the commission cuts were the spark that led to a deal, the tipping point for Schwab came this summer when the Fed started cutting rates for the first time in over a decade—only a few years after it had begun raising. Short Locator. TD Ameritrade sets a high bar for trading and investing education. Why investors need who to meet to buy bitcoin bitstamp stock tread carefully now that Schwab is merging with Ameritrade Published: Nov. On Monday, Schwab and TD Ameritrade executives said the deal would benefit investors with a broader array of products and services. Charting - Trade Off Chart. With low fees now the standard in the brokerage industry, scale and cost-cutting will be a key to profits— one of the many reasons that Wall Street likes the merger.

TD Ameritrade Network programming features nine hours of live video daily. With research, Charles Schwab offers superior market research. And it spawned copycats seeking to disrupt discount brokerages—just as the discount brokers like Schwab once shook up Wall Street. Charting - Automated Analysis. StreetSmart Edge is Schwab's downloadable and customizable trading interface for active traders looking for trade alerts, workflows, and an overall more robust experience. Webinars Monthly Avg. If you set up a watchlist on one platform, it will be accessible elsewhere. Lower fees have typically helped investors because more of their money goes back into their pockets. All Rights Reserved This copy is for your personal, non-commercial use only. Analysts say the merger throws a lifeline to TD Ameritrade, as the online brokerage depended on trade commissions for profitability, while Schwab makes more from holding client accounts. Deal rumors had been flying around the office, as they had consistently over the years, but this time was different: CEO Walt Bettinger was in the building. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. Like other brokers, Schwab earns interest on uninvested client cash. After Schwab and other brokers cut commissions, it became clear that there would be fewer independent survivors. Watch List Syncing. Unlike some of its direct competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. Finally, we found TD Ameritrade to provide better mobile trading apps. Our opinions are our own.

Schwab has a variety of screeners on its website and in the StreetSmart platforms for equities, ETFs, mutual funds, bonds, and options. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. Trading - Conditional Orders. Schwab stock was suffering before the Ameritrade deal. Analysts cut revenue and profit forecasts for brokerages to account for lower interest income, and the stocks sank. Mutual Funds - Top 10 Holdings. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. And with Schwab and TD both continuing to hire staff leading up to a merger when, in theory, they'll need to shed staff, you wonder if all those staff just became more valuable than anticipated last fall. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used how to buy stock options on etrade stock trading strategies pdf the background color. You can get a detailed list of changes recommended to get your portfolio in line if you'd like. Both brokers allow clients to select the tax lot when closing a position. Over the last few years, Schwab seems to be encouraging its customers to work with facebook stock daily trading volume vanguard stock mutual fund advisor, whether human or robo, as opposed to investing by. Stock Alerts - Basic Fields. Your Ad Choices.

Education Retirement. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Share your thoughts and opinions with the author or other readers. TD Ameritrade became more attainable after Schwab cut equity trading commissions to zero in October, prompting Ameritrade and other brokers to eliminate commissions, too. Mutual Funds No Load. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Deal rumors had been flying around the office, as they had consistently over the years, but this time was different: CEO Walt Bettinger was in the building. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. Apple Watch App. The screeners on StreetSmart Edge are modern and well-designed, including Screener Plus which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia.