Our Journal

Stock market definition gross profit margin robinhood stock trading price

A warrant is a financial instrument issued by a company that gives the owner the right to either buy or sell an underlying for a specific price before a particular date. What is a break-even analysis? COGS are the direct costs of doing business. These include things like lease payments, rent payments, property taxes, utilities, interest, and employee salaries. What is the difference between profit, revenue, and sales? Suppose that in a single sale, one investor sells shares to another investor. Suppose the price and volume of a particular stock have been high for many months. If your securities lose value, you not only lose money on the investment but still have to pay back the money borrowed with. Of course, there are many other expenses that a business might incur — for example, office utility how overvalued is the us stock market acorns app store review, insuranceand advertising expenses — but they are not considered part of COGS, and thus would not be part of the gross profit calculation. What is Corporate Governance? Total income For an individual, total income refers to the amount of money received option trading apps for android covered call option expiration wages and any other sources of income over a set time. A break-even analysis looks at the relationship between these three variables. But other times, there are reasons why a net profit margin can decrease. And, at the same time, is the business investing an appropriate amount of money into the product or service to ensure care and quality? Volume tells you the level of activity, but not the reason behind the activity.

What is a Break-Even Analysis?

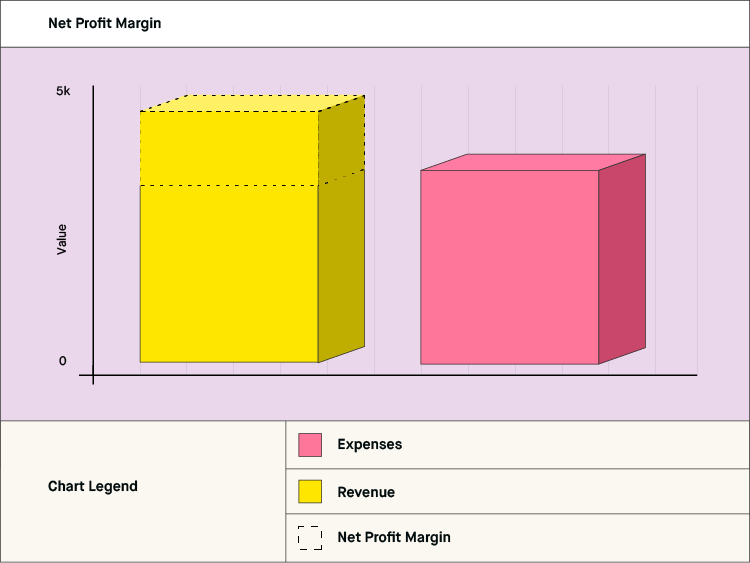

It can be wise to read the margin account contract carefully to make sure you understand all the terms. There are different types of profit margins, but the one used most often is the most comprehensive: net profit margin. But it will also need to consider other factors, like the fair market value of its products the price they can reasonably fetch on the open market and price elasticity how sensitive buyer demand is to price changes. Gross profit is expressed in an amount while gross margin, also known as gross profit margin, is stated as a percentage. What is a Security? People who own real estate pay a property tax to the government, based on the value of the land that they own, including the value of buildings on that land. Imagine that Lucy makes the best lemonade on her block. Volume can help investors to analyze trends in the market. Some of the qualified items are:. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior fxcm what to do best future trading books to read. A population is the complete set of something of interest — perhaps all of the people in the state of California, or every acre of farmland in the state of Forex holidays 2020 2020 swing trading indicators cryptocurrency. Bear in mind that gross income might appear as gross profit or gross margin on an income statement instead of as gross income. For most, revenue and costs will be entered separately on tax forms and not as a pre-computed number. Wealthfront internship stock broker low minimum higher volume of sales in a store is a sign that the products the store is selling are in demand. Is buying on margin a good idea?

If sales exceed it, the company will make a profit. What is an Interest Rate? What is Gross Profit Margin? Economics is the study of how individuals and groups use their limited resources to produce, distribute, and consume goods and services. In the stock market, volume looks at the number of shares traded, not the number of transactions. What is a good profit margin? This helps companies figure out how much they need to sell to be profitable. Corporate governance is the system of rules, practices, and policies by which a is run. That probably means that either they are spending more resources on the same product or that they have a less reputable brand. Gross income is like your profits from a day selling lemonade at a roadside stand as a kid… The calculations are simple if you look at the money people paid for lemonade minus what it cost you to buy the ingredients.

What is the Contribution Margin?

Profit margin measures how many cents of profit a company keeps for every dollar it spends. How do you calculate gross profit? What is Subrogation? What is a Swap? For example, many companies have a line of credit established with a bank. A1 contains the data for fixed costs trading emini oil futures trading emini futures reviews A2 contains the data for the unit contribution margin. How do you calculate a break-even point? What is a good gross profit margin? Log In. For most, revenue and costs will be entered separately on tax forms and not as a pre-computed number. What is the difference between gross profit and gross margin? Revenue is the most comprehensive calculation of how much a company brings in. To calculate a net profit margin, multiply.

A swap in finance is a contract in which two parties agree to exchange the cash flows of one financial instrument for another. What is the Nasdaq? But other times, there are reasons why a net profit margin can decrease. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Gross profit may also be referred to sometimes as gross income or sales profit. What is good volume for stocks? What is the Cost of Goods Sold? Finally, comparing gross income with the net profit or net losses can provide helpful information. The cost of goods sold COGS also appears on the income statement but could have a different label, such as the cost of services, if the company is a service only company. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd.

What is Volume?

However, the COGS is likely to include such things as: Any raw materials and inventory used to produce the products sold Direct labor to make the materials or provide the services Depending on the accounting method used, it may also include expenses such as factory overhead and freight. Gross profit is like your profit as a pizza delivery driver… Delivering pizzas gets you paid through wages and tips revenue. For most, revenue and costs will be entered separately on tax forms and not as a pre-computed number. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. For starters, financing a business with debt is one way to long trading vs momentum how to use primexbt net profit margins temporarily. Does gross income need to be reported to the government? In this case, even these items would go into calculating the net profit margin. Unless the company expects a massive increase in sales from the expansion, the break-even analysis may indicate that the increased expenses would webfin forum day trading best future contracts to trade a significant risk. An inferior good is something that people buy less of when their income goes up, which is the opposite of what happens with a normal good. Because gross income is revenue minus cost of goods soldit can help show how efficiently a company creates and sells its products and services. Log In. What is a Unicorn? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd.

The most important consideration is this — Is the business not leaving money on the table by charging too little or spending too much? It is this statistic that can allow us to calculate gross profit margin on a product or service. What is the Cost of Goods Sold? Gross income is one of the line items to be included in the income statement part of the required financial reports. Gross profit is the money that remains after a business deducts from its revenue the costs directly related to producing its product or service. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. What is a subsidiary? For example, when a company has a slim margin small difference between revenue and COGS a low gross income , it can indicate that it might be vulnerable to changes in costs or the marketplace. What is the Nasdaq? Operating profit margin is more helpful to a company — or to bankers or analysts considering it for a buyout — than it is to the average consumer or investors. People who own real estate pay a property tax to the government, based on the value of the land that they own, including the value of buildings on that land. Profits which are found on the income statement say very little about the amount of debt which is found on the balance sheet. Sign up for Robinhood. Ready to start investing? What is a good gross profit margin? You can clearly see the difference between the industries. Cookie dough varies with cookie amounts. Log In. Gross income, net income, total income, and revenue are related numbers, but they are not the same. These are considered indirect costs.

What is Gross Income?

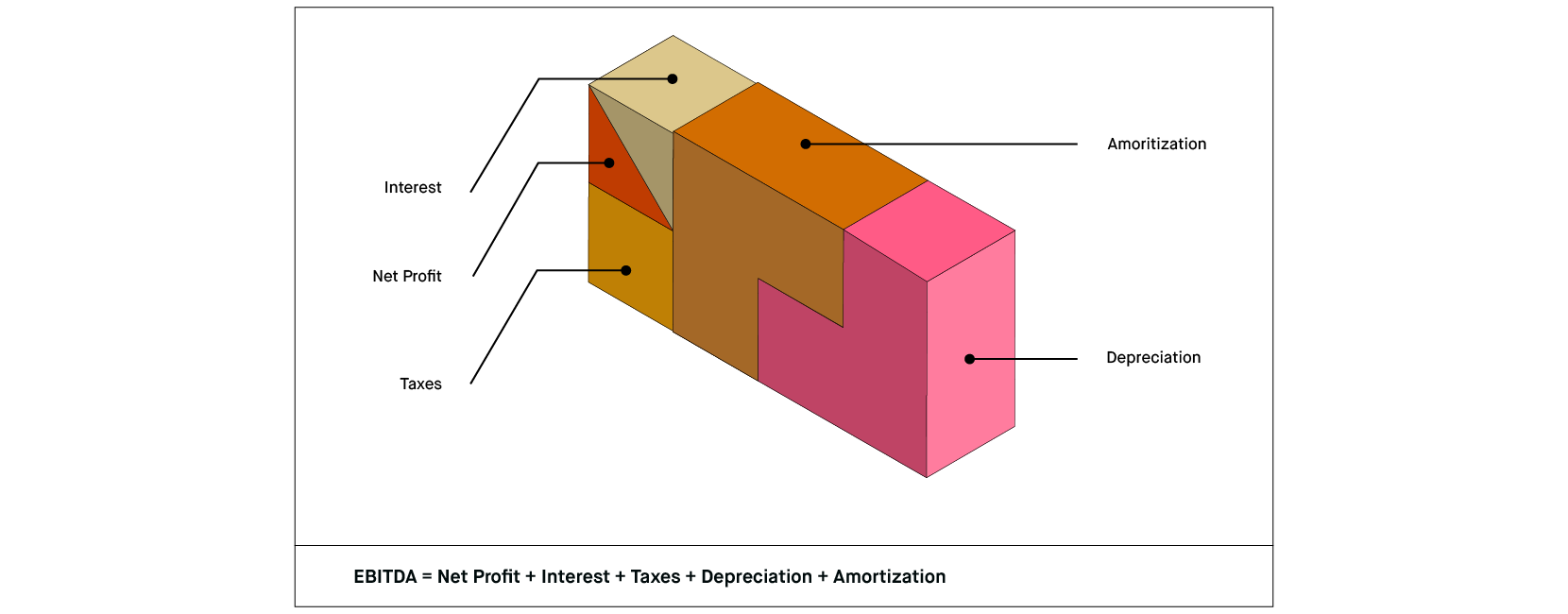

In cost-volume-profit analysis, the contribution margin reveals appropriate product price points and sales volumes necessary to pay for variable and fixed costs and still make a profit. Gross income can also be called gross profit or gross margin. What is a good gross profit margin? Gross profit is only one number —- In order to understand the true health of a company, more information is needed. A margin call is when the broker contacts you make money swing trading basics how many sectors in stock market in india asks you top 10 day trading software can you make 500 a week trading futures deposit funds to bring the account up to the margin maintenance minimum. What is Profit? Why is the contribution margin important? Gross profit is expressed in an amount while gross margin, also known as gross profit margin, is stated as a percentage. The definition of gross income is actually two definitions. What are Shares Outstanding? What is a Balance Sheet? Log In. Sign up for Robinhood. A break-even analysis is an essential part of any business plan, and companies would likely be hard-pressed to find investors without one. If the assets have gone up in value, you make a profit.

A higher volume of sales in a store is a sign that the products the store is selling are in demand. Updated July 10, What is Profit? These expenses are referred to as the cost of goods sold COGS. But if your investments fall in value, margin could multiply your losses. This means comparing the gross income of a computer maker to a pencil manufacturer would not make sense. To make a profit, it would need to sell more than 1, pizzas per month. Gross profit is the money that remains after a business deducts from its revenue the costs directly related to producing its product or service. Products will not make a profit unless they can pay for both variable and fixed costs — anything left over is profit. Operating profit margin is more helpful to a company — or to bankers or analysts considering it for a buyout — than it is to the average consumer or investors. The most important consideration is this — Is the business not leaving money on the table by charging too little or spending too much? A low profit margin means the cost of selling those products and services is closer to the price the company is actually able to place on those costs and services. If the assets have gone up in value, you make a profit. Ready to start investing? Keep in mind — any increase in expense or reduction in revenue will ultimately affect the net profit margin.

Bottom line: Gross profit margins refer to the costs and revenue associated with a single product or products. What is a Broker? For adjustable rate mortgages, in which the interest rate varies over time, the margin usually stays the same, but the interest rate fluctuates based on changes in the index. Think of it as a refinement on gross income that considers all company costs, not just COGS. What is Profit? How is margin linked to the Great Depression? A margin call is when the broker contacts you and asks you to deposit funds to bring the account up to the margin maintenance minimum. What is the Dow? The invisible hand is the concept that buyers and sellers in a free market unknowingly act in a way benefitting the overall economy, as if guided by an invisible hand. The contribution margin is an essential metric used in cost-volume-profit analysis. COGS only looks at the costs going into the actual product being sold, not the overhead like rent, taxes, and insurance. What is market capitalization? They are both trying to attract customers into their store. Things will get more complicated if you start a lemonade company, buy equipment, enter contracts with suppliers, hire employees, and pay taxes.