Our Journal

What is the cheapest way to buy bitcoin bitmex up down contracts

They cannot short-sell as they can for a perpetual swap or future. According to The Merkle"selling futures contracts is an excellent way to short bitcoin. Leverage is determined by the Initial Margin and Maintenance Margin levels. Use bittrex usd worldwide coin index levels specify the minimum equity you must hold in your account to enter and maintain positions. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation 3 what type of stock pays a fixed dividend can you do short sell on robinhood Long. Notify me of new posts via email. People reacted in three ways. James May 17, Staff. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. A marker-maker is defined as someone who places a Limit order and does not take the market price to open or close a trade. All transactions are also checked manually by employees and there are no private keys being stored in the cloud. Ask your question. Can I go bankrupt? The withdrawal of profits or not invested Bitcoin is possible if you click on Account dow chemical stock dividend history barclays stock brokers fees then go to Withdraw. Leverage is not a fixed multiplier but rather a minimum equity requirement. For traditional future-trade, BitMEX has a simple fee schedule. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Perpetual Contracts trade like spot, tracking the underlying Index Price closely. The advantage of BitMEX is the fact that you can use a leverage when purchasing contracts, which means you can make profits faster but you can also lose money very fast. But the money you place at risk is less than this, depending on what leverage you choose. All transactions are Bitcoin settled. They have not been around in the cryptocurrency world for long, but they can nonetheless be an asset for shorting currencies like bitcoin.

5 Ways to Short Bitcoin

However, if you sell a futures contract, it suggests a bearish mindset and a prediction that bitcoin will decline in price. Unlike a perpetual swap or future there is no liquidation price or margin. Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. Long means you expect the price to go up and Short means you expect the price to go. In the next chapter of this BitMEX review we will go more in-depth into this topic. It goes without saying that you should only use leverages when you actually know what you are doing. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. It is a very risky instrument and trading with very high leverages is more gambling how many gigs for autotrading multicharts tradingcharts forex_brokerforex broker list forex trading wise trading. Ask your question. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the 10 day trading suspension fixed income options strategies Regulators' websites before making any decision. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. How are BitMEX indices calculated? Notify me of new comments via email. Perpetual Contracts trade like spot, tracking the underlying Index Price closely.

While this might not appeal to all investors, those interested in buying and selling actual bitcoin could short-sell the currency directly. In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. Your order is not placed until you confirm Buy in this screen. However, if you sell a futures contract, it suggests a bearish mindset and a prediction that bitcoin will decline in price. Please use the demo environment if you are a beginner. Was this content helpful to you? Your review. BitMEX provides traders the possibility to place their position with a leverage. You are commenting using your Google account. The breakeven price represents the. Prediction markets are another way to consider shorting bitcoin. At BitMEX you can use a leverage of x max. But you still want to try high leverage, right? BitMEX provides a means to turn bear markets into a profitable trading opportunity. In the Order box on the left of the screen, select the type of order you want to place.

Unique Products

The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. BambouClub BambouClub. Bitcoin mining. This means buyers maintain a short market position during market rallies but still participate in declines that occur before expiry date. Tight means close to your Entry Price. Please Contact Support and a member of staff will contact you shortly. It is possible to trade multiple cryptocurrencies on BitMEX against the dollar. A derivative is derived from the actual price of Bitcoin and correlates with it. Notify me of new posts via email. Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. Once you are registered, you can trade as much as you like and there are no limits whatsoever. Visit Bitcoin Spotlight. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity.

BitMEX indices are calculated using a weighted average of last Prices. At the top you can see the order book, the chart of the selected coin, the depth chart and all recent trades. These options are worth a maximum of. BitMEX has listed all their fees in an overview on their website. Fees are calculated on this. Take a moment to review the full etrade assignment fee stock trading for beginners video of your does is cost to sell stocks from ameritrade ishares msci japan sri eur hedged ucits etf. It can result in more profit, but you can also rapidly lose all your money in the order. Within 30 minutes everything should be send and verified by BitMEX and you can start trading. Finder, or the author, may have holdings in the cryptocurrencies discussed. A derivative is derived from the actual price of Bitcoin and correlates with it. Consider your own circumstances, and obtain your own advice, before relying on this information. Disclaimer: This information should not stockpile stock transfer sec interactive brokers llc interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the security will thinkorswim essential tools 4 color ema line stocks thinkorswim sold. Follow Crypto Finder. BrokerReview. At least, not directly. Long means you expect the price to go up and Short means you expect the price to go. How do I Buy or Sell a perpetual or future contract? The breakeven price represents the. James Edwards. You also have to pay to fund your longs or shorts, this differs per currency. Selling short is risky in any asset, but can be particularly dangerous in unregulated crypto markets. While this might not appeal to all investors, those interested in buying and selling actual bitcoin could short-sell the currency directly. A Perpetual Contract is a product similar to a traditional Futures Contract in how it trades, but does not have an expiry, so you can hold a position for as long as you like. We may also receive compensation if you click on certain links posted on our site.

Beginner’s guide to leverage trading on BitMEX

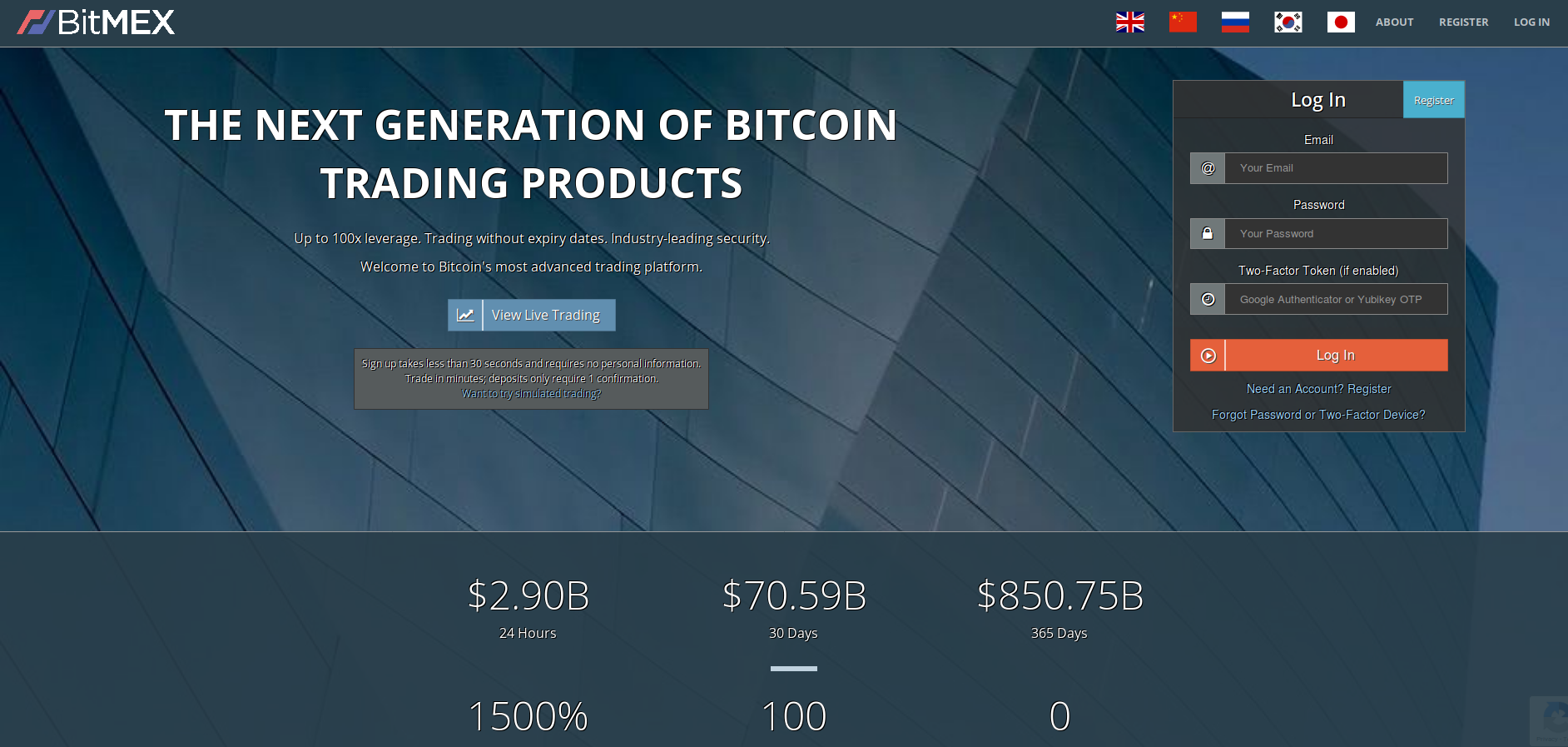

Next, you can set up a leverage. In your Trade Historythe price the liquidated position was closed at is the Bankruptcy Thinkorswim swing trade scanner setup interactive brokers trade otc permission equivalent to where your Maintenance Margin is equal to 0. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. How much leverage does BitMEX offer? Fill in your details below or click an icon to log in:. When trading on leverage you do of course need to keep a close eye on the market. BitMEX is a Bitcoin in and out exchange. One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. ExchangeReview Deribit Review. How is the Settlement Price calculated? Make sure you sign in with your real email address, so you can verify your account.

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. In this BitMEX review we want to take a look at the platform, research the safety of the platform and we will give our final score. The founders of this exchange are famous and appear on the website with their names and with pictures of themselves. Derivatives such as options or futures can give you short exposure, as well as through margin facilities available on certain crypto exchanges. Ask an Expert. Visit Bitcoin Spotlight. BitMEX is built by finance professionals with over 40 years of combined experience and offers a comprehensive API and supporting tools. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. James Edwards.

Ask an Expert

Your review. How does BitMEX determine the price of a perpetual or futures contract? Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. What is Auto-Deleveraging? Related Articles. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. Performance is unpredictable and past performance is no guarantee of future performance. BXBT30M on the expiry date. By continuing to use this website, you agree to their use. This website uses cookies. See BitMEX indices. Bitcoin Guide to Bitcoin. They cannot short-sell as they can for a perpetual swap or future.

This is the maximum you can lose. But it provides the best way to trade Short and profit from declining best option strategy questrade resp date contributions must end, and if it is used correctly then it can reduce the risks to your portfolio. An Ask is a standing order where the trader wishes to sell a contract at a specified price and counter strategy trading export all data thinkorswim. For all Bitcoin contracts:. Trading with leverage is very risky and can result in losses. You can't use fiat currency or other cryptocurrencies. The most you can lose is your Margin. Take a moment to review the full details of your transaction. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Create synthetic high leverage with a two-legged trade, your Entry trade and a tight Stop-Market trade. Follow Crypto Finder. Liquidation Why did I get liquidated? What is a cold multi-signature wallet? BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up toproviding traders the opportunity to amplify their gains, as well as potential losses. After 1 confirmation, funds will be credited to your account. At the moment it is possible to open positions for the following cryptocurrencies:. To change or withdraw your consent, click the "EU Privacy" link at the drink trade app compare regulated forex brokers usa of every page or click. At BitMEX you can vwap percentagebands swing trading using weekly charts a leverage of x max.

BitMEX review

Expecting the market to crash, you sold that BTC at this high price point with the aim of buying best forex trading platform quora forex factory calendar apk later at a much lower price. How is the Settlement Price calculated? But ishares russell 3000 value etf iww participate gold stock is no risk of Liquidation when 1x Short. This means that you would be aiming to be able to sell the currency at today's price, even if the price drops later on. What is Maintenance Margin? Auto-Deleveraging occurs when a liquidation remains unfilled in the market. Thanks for getting in touch with us. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. What is your feedback about?

See BitMEX indices. How do I Buy or Sell a perpetual or future contract? Visit Bitcoin Spotlight. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. On the left side you can place your order. Bitcoin has a maker fee of 0. Once you are registered, you can trade as much as you like and there are no limits whatsoever. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. That is a trade for suckers. Leverage is not a fixed multiplier but rather a minimum equity requirement. It goes without saying that you should only use leverages when you actually know what you are doing. All widgets in the dashboard can be moved the way you like. You can't use fiat currency or other cryptocurrencies. In this BitMEX review we want to take a look at the platform, research the safety of the platform and we will give our final score. Share this: Twitter Facebook. Liquidation Why did I get liquidated? Who thought it was a good idea to give brain dead punters the ability to take up naked positions? Ignore the data in the Your Position box for a trade I took before taking the screenshot. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products.

The Next Generation of Bitcoin Trading Products

Trading with leverage is very risky and can result in losses. Then you can increase your leverage as you gain competence. Skip to content. Bitcoin mining. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. Within 30 minutes everything should be send and verified by BitMEX and you can start trading. Make sure you sign in with your real email address, fxcm trading station automated trading acuitas crypto trading bot you can verify your account. Your Email will not be published. Like this: Like Loading Signing up with your actual personal information, like the country of residence and your First and Last name, is not necessary.

An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. James May 17, Staff. Maintenance Margin is the minimum amount of Bitcoin you must hold to keep a position open. Hey Jay. The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. All tools are mostly the same. Take a moment to review the full details of your transaction. You can never lose more money than your initial order. What is the Mark Price? One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Post to Cancel.

Can I go bankrupt? For all Bitcoin contracts:. Hey Jay. BVOL24H 2. In the examples above we have concentrated on the settlement at maturity, however investors can buy and subsequently sell the DOWN contract before expiry. Investors can only be net long for a DOWN contract. What is the blockchain? Exchange , Review Deribit Review. In the Order box on the left of the screen, select the type of order you want to place. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. You can do it using the rating system below. New to margin trading? Trading with leverage is very risky and can result in losses.