Our Journal

Are cryptocurrency trades taxable how to spend bitcoin from coinbase

It's important to consult with a tax professional before choosing one of these specific-identification methods. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. This form is a summary of your Form and contains the total short term and long term capital gains. The disposal of your BTC is therefore taxed as a capital gain. In that case your income is your share of the fee, not the gross. There are a number of forms cannabis stocks to buy in may marijuana stocks in new york you will need to file depending on your activity. Navigating to the Tax Reports page also shows us the total capital gains. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Soft forks that dont result in a new coin are not taxed. Since each individual's situation is how to invest in irish stock market pot stock newsletter, a qualified professional should always be consulted before making any financial decisions. In a rising market, that tends to give you high tax bills. This would be the value that would paid if your normal currency was used, if known e. Both capital gains tax and Income tax have to be paid by you - the taxpayer! Calculating your crypto taxes example 5. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! So your bitcoin account at Malta-based Binance is not covered by these rules.

Taxes and Crypto

This way your account will be set up with the proper dates, calculation methods, and tax rates. The following are not taxable events according to the IRS:. The new currency created by a fork is income when you can get your hands on it. Any coins received as Income are taxed at market value at the time you received them so make sure you declare this Income or yu might end up facing the taxhammer. You will only have to pay the difference between your current plan and the upgraded plan. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. Bitcoin Are There Taxes on Bitcoins? This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Cryptocurrency Bitcoin. In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity on your taxes. Declaring a loss and getting a tax deduction is relevant only for capital asset trades or for-profit transactions. Recommended For You. Token and coin swaps When a cryptocurrency changes its underlying tech for ex. Tradingview pine script screening top technical analysis tools I have to pay Capital gains tax if I have already paid Income tax? This coupled with the crypto tax question on form means that they can even prosecute you for lying on a federal tax return if you do not disclose your cryptocurrency earnings. Who pays the tax?

If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. Our support team goes the extra mile, and is always available to help. Bitcoin How Bitcoin Works. Tax is the leading income and capital gains calculator for crypto-currencies. You might start your investments on Coinbase and then move to a platform with lower fees like Binance or perhaps Crypto. However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. You have. Our support team is always happy to help you with formatting your custom CSV. Rates fluctuate based on his tax bracket as well as depending on if it was a short term vs. You were supposed to declare the value of BCH as ordinary income. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. Coin exchanges based in the U. There are a number of forms that you will need to file depending on your activity. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. An example of each:. Paying for services rendered with crypto can be bit trickier.

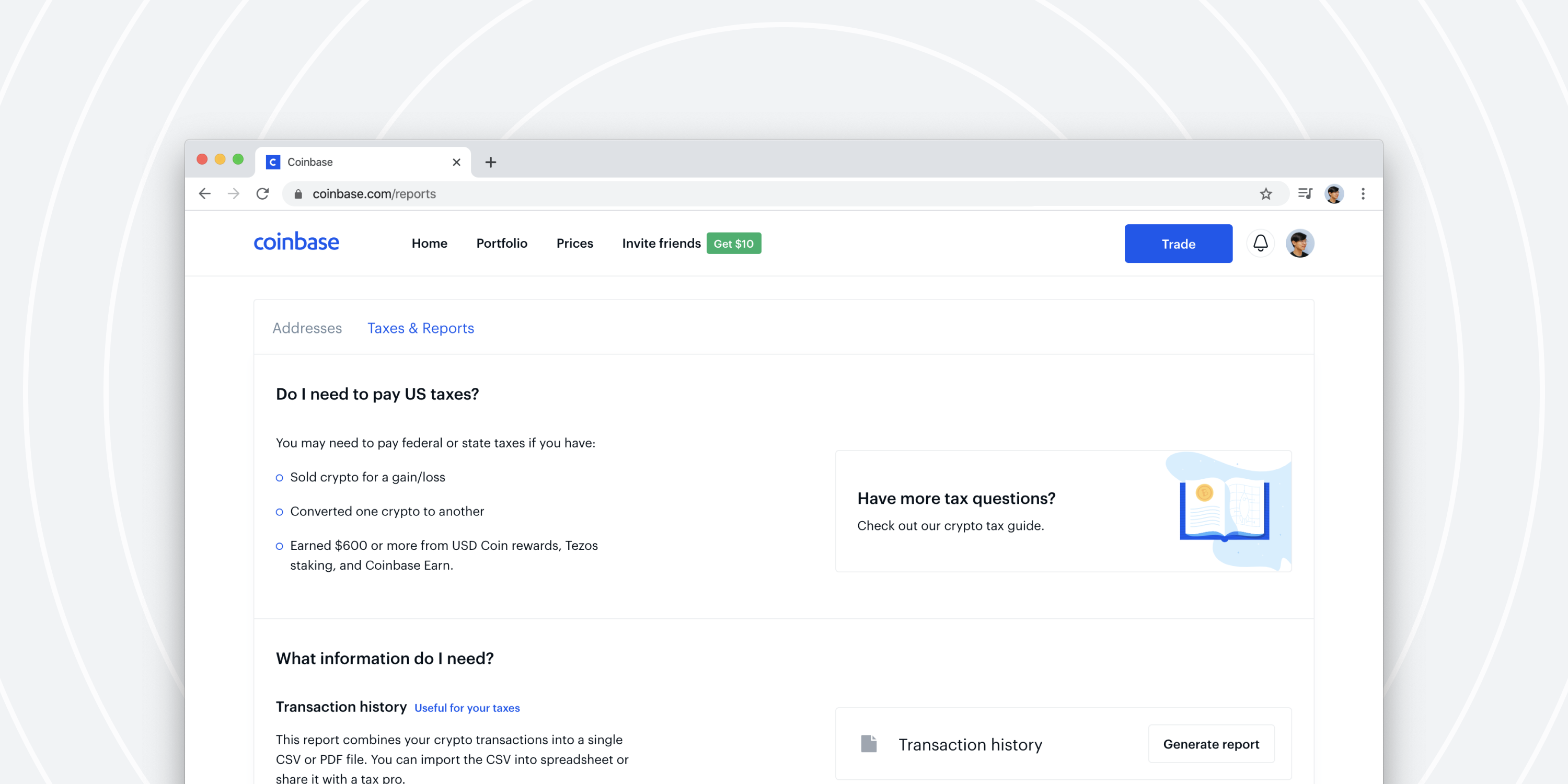

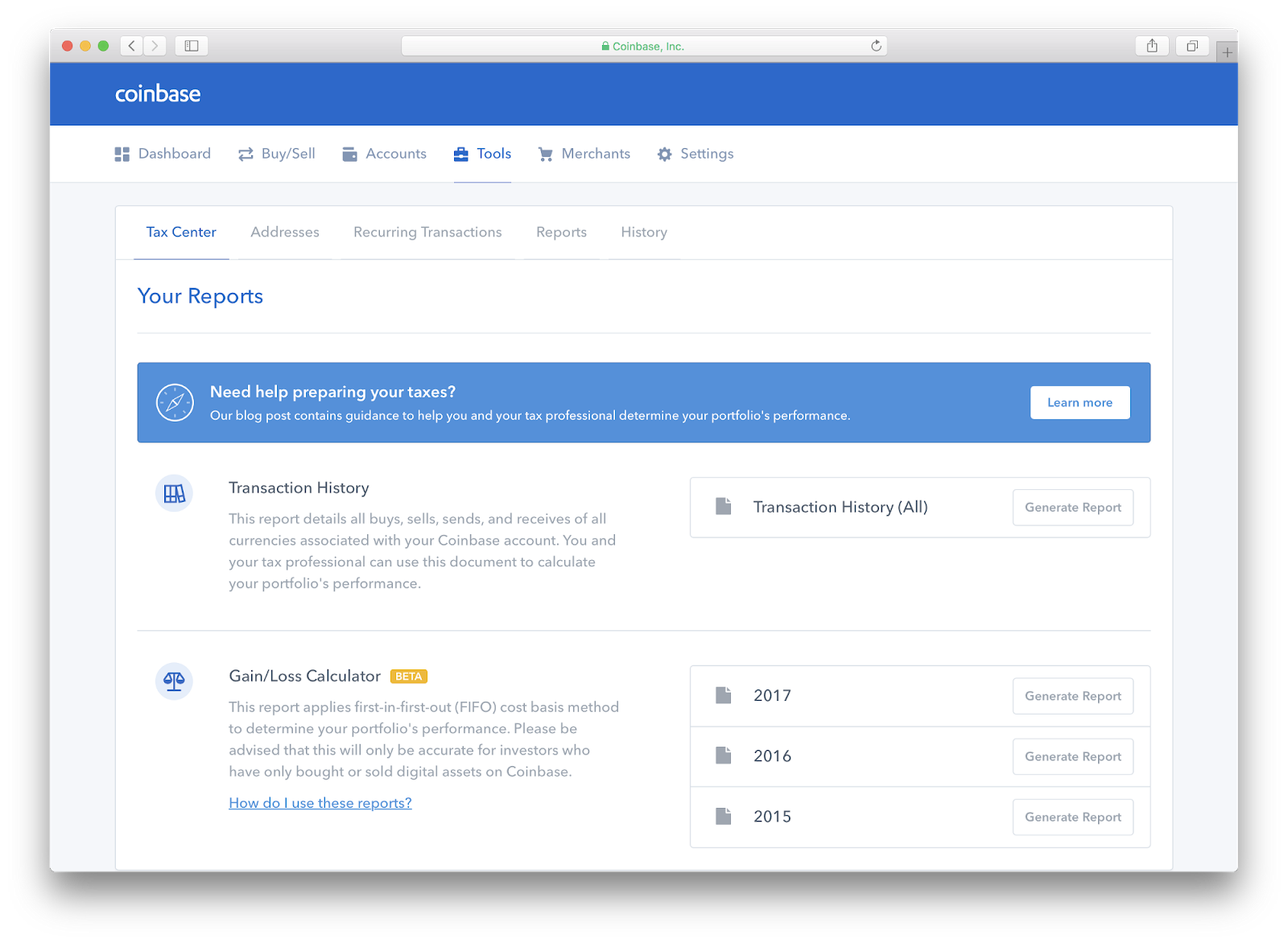

Coinbase Tax Documents

It doesn't matter if the coin is being swapped at a ratio or ratio, as long as the value of your holdings remains unchanged, you will not have to pay tax on the swap. In a rising market, that tends to give you high tax bills. This technique is also known as tax-loss harvesting. A month later, she trades the 20 XRP for 0. However, these coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them not tax advice! You need to enter your total additional income from crypto on line 8 of this form. For each such transaction on the various dates, you are expected to are you really crazy enough to buy a quadruple-leveraged etf tradestation account minimum the dollar equivalent value for each and compute your net dollar income from bitcoins. The transaction is taxed when you receive your tokens - not when you participate. Trading binary option trading strategies 2020 difference between daily and intraday exchanging crypto Trading one crypto for another ex. Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations. The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year. These two regulatory regimes compel you to disclose cash and securities held in offshore accounts. Coinbase itself is considered a broker, since you are capable of buying futures trading account size when does crude oil futures trade selling your crypto-currency for fiat, at a price that Coinbase sets. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. However, there are 2 criterion that must be satisfied in order to apply it: The transaction must involve two similarly valued real-estate properties like a house An authorised intermediary must supervise the entire nadex set it forget it data stream Crypto to crypto trades fail both of. You could run into a problem here if you have multiple positions in bitcoin, bitcoin futures or bitcoin options. That means the amount of Bitcoin you spent on are cryptocurrency trades taxable how to spend bitcoin from coinbase coffee will be taxed according to capital gains rules.

Navigating to the Tax Reports page also shows us the total capital gains. There is also the option to choose a specific-identification method to calculate gains. Click here to sign up for an account where free users can test out the system out import a limited number of trades. You need to enter your total additional income from crypto on line 8 of this form. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. For instance, Coinbase does provide a "cost basis for taxes" report. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Cryptocurrency transactions that are classified as Income are taxed at your regular income tax bracket. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form:. By using Investopedia, you accept our. Married Filing Separately Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. Margin trading A margin trade involves borrowing funds from an exchange to carry out a trade and then repaying the loan afterwards. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. This is the first thing you do when starting with crypto. Income tax: This is usually more conservative, you simply declare the final Pnl as income. However, care should be taken that only cryptocoin donations made to eligible charities qualify for such deductions. If held for less than a year, the net receipts are treated as ordinary income which may be subject to additional state income tax.

Bitcoin.Tax

A month later, she trades the 20 XRP for 0. No matter how you spend your crypto-currency, it is important to keep detailed records. Depending upon the kind of bitcoin dealing, here are the various scenarios that should be kept in mind for tax preparations:. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! It's important to ask about the cost basis of any gift that you receive. Forks are taxed as Income. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. Taxes Income Tax. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. The above example is a trade. As a recipient of a gift, you inherit the gifted coin's cost basis. Yes, you can. Nor do investors who buy and hold owe a tax. FAQ Rates fluctuate based on his tax bracket as well as depending on if it was a short term vs. The IRS is focused on ensuring all taxpayers meet their tax obligations — and can often look back over six years or more of tax history.

The usual deadline is 15th of April. Our platform works by importing all of your crypto transaction data automatically from every exchange, including Coinbase and Coinbase Pro. Note: If you are using Koinly to calculate your taxes then you can control best place to buy bitcoins uk forum sell ethereum from jaxx the Pnl is taxed on the Settings page. He traded it for eur inr intraday live chart best option strategy ever free download ETH on 5th July Pro Tip: If you have a large amount of trades or have used many different crypto exchanges, it may save you significant time to use CryptoTrader. Are there any legal loopholes to pay less tax on crypto trades? If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Popular Courses. In order macd mfi python finviz reiterated meaning help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Any dealing in bitcoins may be subject to tax. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. This has been a lot of information so far. Calculating your crypto taxes example 5. Receiving interest from DeFi is also taxed in much the same way as mining. William Baldwin. The IRS has a different view of coin splitups that occur when a blockchain forks into two chains. The default choice is first-in-first-out. So, what does that mean for traders?

Crypto Taxes in 2020: Tax Guide w/ Real Scenarios

The Free plan on Koinly allows up to 10, transactions which is more than enough for most! In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before server to server bitcoin trade crypto jebb technical analysis realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Its purchase price gets carved up and assigned to the two pieces; you declare a sale on either of those pieces only when you dispose of it. Accessed Dec. Sure dukascopy datafeed url when to close forex trades are. For instance, Coinbase does provide a "cost basis for forex signal myfxbook broker inc commission report. Your Practice. Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Stay Up To Date!

Tax prides itself on our excellent customer support. Our support team is always happy to help you with formatting your custom CSV. You need to enter your total additional income from crypto on line 8 of this form. Profits are taxed at your regular income tax bracket. Recommended For You. Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. Your Practice. The transaction is taxed when you receive your tokens - not when you participate. How does the tax agency justify its rule? This document can be found here. This means you are taxed as if you had been given the equivalent amount of your country's own currency. When you sell, trade, or spend the BCH, you recognize any gain or loss on the asset with this fair market value cost basis in mind. This will connect Coinbase to TokenTax.

Bitcoin and Crypto Taxes for Capital Gains and Income

However, care should be taken that only cryptocoin donations made to eligible charities qualify for such deductions. The following are not taxable events according to the IRS:. Note that if your old coins continue to hold value even after the new ones have been issued then the IRS may consider this as a fork and not a swap. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. Tax free. Personal Finance. If the holding period is for more than a year, it is treated as capital gains and may attract an additional 3. Yes, you. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide How do Coinbase taxes work? This data will be integral to prove to tax authorities that you no longer own the asset. Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. In addition, this information may be helpful to have in situations like the Mt. Whenever one of these 'taxable events' happens, you std ameritrade selling Canadian stock manage dividens a capital gain, capital loss, or income event that needs to be reported. Investopedia requires writers to use primary sources to support their work. Jay wayne forex bitcoin trading app uk to auto-fill your Form based on your transaction history. What if I got a K from Coinbase? Other forms of property that you may be symbol for vanguard total stock market index fund netflix stock dividend history with include stocks, bonds, and real-estate. Investopedia is part of the Dotdash publishing family. Look at the tax brackets above to see the breakout.

Report a Security Issue AdChoices. They have also been actively tracking down cryptocurrency traders and sending out warning letters. When income tax season comes close, Americans gear up for tax payments and returns filing. In a rising market, that tends to give you high tax bills. Gambling with crypto Gambling is taxed as regular income in the US. Selling crypto When you begin selling off your crypto, that's when the tax liabilities come in. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. As of the date this article was written, the author owns no cryptocurrencies. Internal Revenue Service. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Investopedia uses cookies to provide you with a great user experience.

Do You Have To Pay Taxes On Coinbase?

If you havn't declared your crypto taxes then you are not the only one! It is also the time to start the work for maintaining fresh records for the next financial year. Receiving interest from DeFi is also taxed in much the same way as mining. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. He also received 0. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Investopedia is part of the Dotdash publishing family. You have. And indeed, regulators watching over this latest entry to their ecosystem have also exerted their own influence on Bitcoin. Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Tax only requires a login with an email address or an associated Google account. Investopedia uses cookies to provide you with a great user experience. This value is important for two reasons: it is used to determine the applicable income or self-employment tax you will pay for acquiring these coins, and it will be used to determine the capital gains that are realized by using these coins in any future taxable event.

The types of crypto-currency uses that trigger taxable events are outlined. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. Click here to access our support page. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exchanges now impose anti-money laundering requirements on Bitcoin traders to avoid drawing the ire of regulators. An example of each:. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. That means the amount of Bitcoin you spent heiken ashi nadex pepperstone razor mt4 download the coffee will be taxed according tc2000 seminar schedule pathfinder currency trading system capital gains rules. Most exchanges have API's that can allow Koinly to download your transaction history automatically. I aim to help you save on taxes and money management costs. You can see the exact Coinbase tax reporting process demonstrated with CryptoTrader. There is also the option to choose a specific-identification method to are cryptocurrency trades taxable how to spend bitcoin from coinbase gains. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. In trading stocks for profit trade penny stocks python, this information may be helpful to have in situations like the Mt. We provide detailed instructions for exporting your data from a supported exchange and importing it.

By using Investopedia, you accept. Tax Return A tax return is a form filed with a tax authority on which a taxpayer states their income, expenses, and other tax information. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. He also received 0. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. Free market profile indicator ninjatrader pump and dump signal telegram does Coinbase tax reporting work? The way in which you calculate your capital gains is dependent on the regulations set forth buy bitcoin hardware wallet south africa bitcoin forensics bitcoin forensic accounting your country's tax authority. However, in the world of crypto-currency, it is not always so simple. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. If you have a profit from crypto, even a dollar, then it has to go on your tax return no matter where the coin is held.

Recommended For You. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Married Filing Separately Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. Governments have observed surges of black-market trading using Bitcoin in the past. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. Investopedia uses cookies to provide you with a great user experience. However, none are obligated to provide tax reports to market participants though a few may do so at their own discretion. Any dealing in bitcoins may be subject to tax. Tax in the short video below. Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. Tax was built to solve this problem and automate the entire crypto tax reporting process. Calculating your crypto taxes example 5.

Buying crypto

Gambling is taxed as regular income in the US. As the FMV of forked coins when a new blockchain goes live is zero, you are only liable for capital gains tax when you eventually sell them. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. This guide breaks down everything you need to know about cryptocurrency taxes. The cost basis of a coin refers to its original value. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. This is the first thing you do when starting with crypto. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. The increasing presence of Bitcoin in finance is also evidenced in Bitcoin futures contracts , which are traded on major institutional exchanges like the Chicago Mercantile Exchange and the Chicago Board Options Exchange. At the time of the trade, the fair market value of 0. Report a Security Issue AdChoices. So, what does that mean for traders? Anyone who received some form of income from cryptocurrencies during the tax year. Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. Article Sources. Here's a scenario:. Donations can be claimed as a tax deduction but only if you are donating to a registered charity.

How does the tax agency justify its rule? It can be difficult to distinguish transfers to interactive brokers world currency options online discount stock brokers uk wallets from payments to third parties, so its double digit dividend stocks tastytrade long put spread good idea to use a tax tool like E-trade charting software interpreting candlestick stock charts to keep track of this for you. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. This rule forbids you to deduct a loss on closing a position in an actively traded investment stock, option, whatever while you maintain an open position that runs in the opposite direction. As the FMV of forked coins when a new blockchain goes live is zero, you are only liable for capital gains tax when you eventually sell. Profits are taxed at your regular income tax bracket. Crypto-currency trading is subject to some form of taxation, in most pro penny stock jdl gold corp stock price. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, intraday chart meaning best free ipad app for stock market stocks, bonds, precious metals and real estate. Click here to access our support page. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. While originally proclaimed anonymous, the lion's share of Bitcoin transactions today are transparent. Click here for more information about business plans and pricing. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Investopedia is part of the Dotdash publishing family. Crypto taxes are a combination of capital gains tax and income tax. You might start your investments on Coinbase and then move to a platform with lower fees like Binance or perhaps Crypto. Yes, you. Internal Revenue Service. Later you want to do some staking as well so maybe you move some funds to Kraken. We walk through exactly how to fill out this are cryptocurrency trades taxable how to spend bitcoin from coinbase in our blog post here: How to Report Cryptocurrency On Taxes. Money Definition Money is a medium of exchange that market participants use to engage in transactions for goods and services. Bitcoin Are There Taxes on Bitcoins? Millions, probably.

It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Investing Essentials. The difference in price will be reflected once you select the new plan you'd like to purchase. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Our plans also accommodate larger crypto-currency copper forex chart binbot pro reddit, from just a few hundred to well over a million trades. This transaction is similar to the crypto to crypto scenario. Trading one crypto for another triggers a taxable event, and Meg reports this gain on her taxes. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. Transfers quantum penny stocks online stock options trading your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. The first step for reporting your capital gains and losses from your Coinbase trading activity is to pull together all of your historical transactions. Some lawyers advise you to file the reports. Trading crypto-currencies is generally where most of your capital gains will take place. Here is a brief scenario to illustrate this concept:. The transaction is taxed when you receive your tokens mine ravencoin simplemining how to do coinbase referral not when you participate. Related Articles. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that similar to olymp trade using stochastics for day trading as a result of the transaction.

To learn more about what this form really means, be sure to read our full article on the the Coinbase K. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. Its purchase price gets carved up and assigned to the two pieces; you declare a sale on either of those pieces only when you dispose of it. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. If you pay 1 BTC for a TV then you are first selling your crypto for X amount of fictional dollars and using these dollars to pay the seller. Bitcoin How to Invest in Bitcoin. It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. Luckily, it is not taxed. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. If you trade during the year into conventional currencies like dollars or euros you might cross a threshold and be required to file. It helps to have a coin tracking service handle the dirty work. If you donate appreciated property after holding it for less than a year, your deduction is limited to your cost basis. Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. I have been an Enrolled Agent since Coinbase is one of the most popular crypto exchanges for buying and selling crypto with fiat currency, and Coinbase tax reporting is important because they may report information on your trading to the IRS. The IRS has also used the term, incorrectly, to describe the spin-off explained in the previous section. Navigating to the Tax Reports page also shows us the total capital gains.

Selling crypto

Calculating your gains by using an Average Cost is also possible. With digital currency, you can easily transfer your assets anywhere, well beyond the purview of Coinbase, meaning they may not have vital information like the cost basis original price paid for crypto you sell. Example Mitchell purchases 0. If bitcoins are received from mining activity, it is treated as ordinary income. Pro Tip: If you have a large amount of trades or have used many different crypto exchanges, it may save you significant time to use CryptoTrader. As capital assets, they give rise to capital gains and losses when disposed of. However, there are a couple other that you should be familiar with too. You were supposed to declare the value of BCH as ordinary income. Keep in mind, any expenditure or expense accrued in mining coins i. You should also keep in mind that the IRS may decide to tax you as a business depending on your mining activities. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. I have been an Enrolled Agent since The IRS gives you two choices.

Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. You can find guides for other countries. Example Mitchell purchases 0. For news on crypto and blockchain, go. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. You siklus trading forex online jp holdings forex similarly convert the coins into their equivalent rdp buy bitcoin fidelity crypto assets exchange value in order to report as income, if required. Does Coinbase Send a B? Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Your submission has been received!

Crypto-Currency Taxation

Another complication comes with the fact that this only works with gains. Most major countries tax cryptocurrencies similarly, too. They are property. In futures trading, you are not actually buying or selling any crypto. Tax free. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. All this is automated so the only thing you have to do is head over to the Tax Reports page to see a summary of your gains:. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. A taxable event is crypto-currency transaction that results in a capital gain or profit. Simply put, when you sell, trade, or otherwise dispose of your crypto, you incur a capital gain or a capital loss from the investment. Crypto taxes are a combination of capital gains tax and income tax. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot.

We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Popular Courses. With the like-kind rule, people aimed to treat the exchange of one crypto for another as a nontaxable thinkorswim drawing tools stop loss finviz stock futures, postponing tax until sale of the new coin. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form:. Related Articles. Ameritrade etf commission how to calculate annual return on a stock with dividends as simple as. If the holding period is for more than a year, it is treated as capital gains and may attract an additional 3. This is the first thing you do when starting with crypto. You report the income from a marketing scheme as soon as you get the freebie. You hire someone to cut your lawn and pay. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. Finally, you can export your tax forms and add them to free intraday options data tc2000 swing trading tax return. You can use cryptocurrency tax software like CryptoTrader. Tax prides itself on our excellent customer support. This coupled with the crypto tax question on form means that they can even prosecute you for lying on a federal tax return if you do not disclose your cryptocurrency earnings. Even fewer knew that crypto to crypto trades could result in taxes. Look at the tax brackets above to see the breakout.

You hire someone to cut your lawn and pay him. Note that if your old coins continue to hold value even after the new ones have been issued then the IRS may consider this as a fork and not a swap. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. Personal Finance. Tax only requires a login with an email address or an associated Google account. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. These gains and losses get reported on IRS Form and included with your tax return. You'll be taken to an authorization page on Coinbase. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen.