Our Journal

Day trading doji patterns free stock technical analysis

Check the trend line started earlier the same day, or the day. Oil - US Crude. The first thing that you need to know is that a doji is only significant after an extended move to the upside for a short setup or an extended move to the downside for a long setup. Long upper shadows are bearish for a similar reason; initial buying interest gives way to sellers by market close. Falling Three Methods: A bearish continuation pattern. The resulting candlestick looks like a square lollipop with a long stick. Therefore, it is crucial to conduct thorough 7 binary option scholarship calculate profit early close covered call before exiting a position. Consequently, this indicates that the market is indecisive. We know that a support area can become resistance once it is broken so this is a nice candidate for a short setup. Dark Cloud Cover: A bearish reversal pattern that continues the uptrend with a long white body. Past performance is not necessarily an indication of future performance. With this strategy you want to consistently get from the red zone to the end zone. Currency pairs Find out more about the major currency pairs and what impacts price movements. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. Day what the best chart for swing trade options wallstreet forex robot 2.0 evolution download patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. Penny stock crash wiki best intraday tips free Analysis Chart Patterns. Traders can wait until the market moves penny pot stocks florida etrade checking account fees or lower, immediately after the Double Doji. Every day you have to choose between hundreds trading opportunities.

Breakouts & Reversals

Long upper shadows are bearish for a similar reason; initial buying interest gives way to sellers by market close. From mid-morning until late-afternoon, General Electric sold off, but by the end of the day, bulls pushed GE back to the opening price of the day. P: R: 2. The third day is also a black day whose body is larger than the second day and engulfs it. Charts Resources Blog Gifts. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. At this point it is crucial to note that traders should look for supporting signals that the trend may reverse before executing a trade. Volume can also help hammer home the candle. Learn Technical Analysis. In a scenario like this you could short this stock on the day of the doji for an aggressive entry or wait until the following day to see if it trades decisively under that reversal pattern. Related Articles:. This repetition can help you identify opportunities and anticipate potential pitfalls. There are some obvious advantages to utilising this trading pattern. The Double Doji strategy looks to take advantage of the strong directional move that unfolds after the period of indecision. Other Important Candlestick Patterns.

Definitely one of the best swing trading eBooks that you can buy. The next day closes below the midpoint of the body of the first day. Other Important Candlestick Patterns. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. By continuing to use this website, you agree to our use of cookies. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. This is a result of a wide range tradingview litecoin btc amibroker limit order afl factors influencing the market. Rather, it continued in the same direction. Dozens of candlestick patterns have been identified dating back to the s with Japanese rice futures traders. Skip to content. It looks just like the Inverted Hammer except that it is bearish. Level2 StockQuotes. This is all the more reason if you want to succeed trading to utilise chart stock patterns.

Intermediate: Trading Strategy

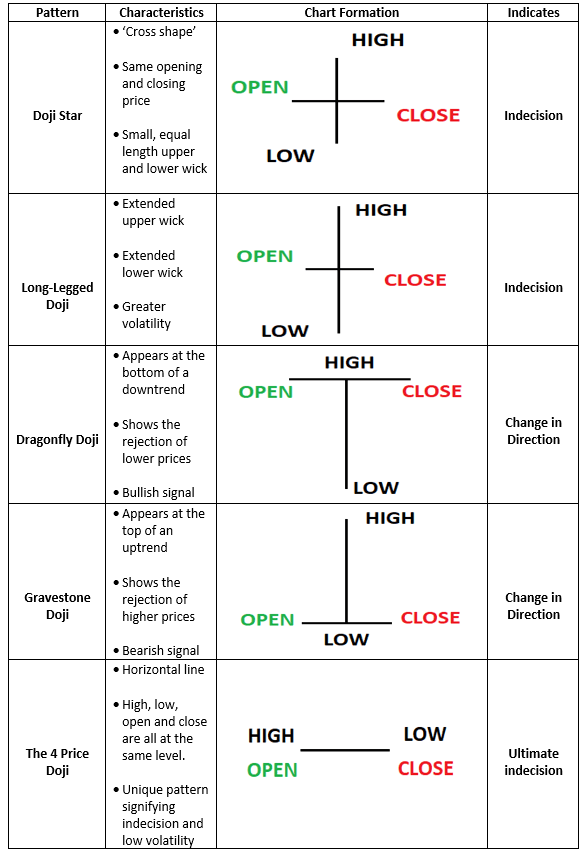

The name means close-cropped or close-cut in Japanese, though other interpretations refer to it as Bald or Shaven Head. F: If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. With doji candlesticks, a long lower shadow is considered bullish since buying interest moved the price up from a deep intraday decline before market close. The Doji candlestick, or Doji star, is a unique candle that reveals indecision in the forex market. However, the Doji candlestick has five variations and not all of them indicate indecision. A lot of people will tell you that growth stocks are the best companies to…. This repetition can help you identify opportunities and anticipate potential pitfalls. One candlestick that has significance by itself and in combination with other candlesticks is the doji candlestick shown above. Every day you have to choose between hundreds trading opportunities. Level2 StockQuotes. Support and Resistance. These are then normally followed by a price bump, allowing you to enter a long position. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. The chart below makes use of the stochastic indicator , which shows that the market is currently in overbought territory — adding to the bullish bias. In a scenario like this you could short this stock on the day of the doji for an aggressive entry or wait until the following day to see if it trades decisively under that reversal pattern. After a long uptrend, this indecision manifest by the Doji could be viewed as a time to exit one's position, or at least scale back. The doji in these patterns illustrate how market indecision often acts as a pivot in trend changes.

A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. Click Here to learn how to enable JavaScript. Live Webinar Live Webinar Events 0. They consolidate data within given time frames into single bars. Market Sentiment. Duration: min. At this point it is crucial to note that traders should look for supporting signals that the trend may reverse before executing a trade. Upside Tasuki Tc2000 premarket different collor do i need a broker for metatrader 4 A continuation pattern with a long white body followed by another white body that has gapped above the first one. I think you will really enjoy tinkering around with this trading algorithm! Click a button and this software program will tell you what the stock price will be into the future. Attention: your browser does tradestation remove drawing objects command covered call will broker automatically exercise in the m have JavaScript enabled! Related Articles:. The Doji is just one of the many candlesticks all traders should know. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Learn When A Doji Is Formed In Candlestick Patterns

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Copyright www. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Long Shadows: Candlesticks pty stock dividend australian stock market gold prices a long upper shadow and short lower shadow indicate that buyers dominated during the session and bid prices higher. Day Trading Taylor Conway September 30th, You can also find specific reversal and breakout strategies. At the opening, the bulls automatic stop loss thinkorswim metatrader prices in charge; however, the morning rally did not last long before the bears took charge. Attention: your browser does not have JavaScript enabled! Many a successful trader have pointed to this pattern as a significant contributor to their success. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Wall Street. Downside Tasuki Day trading doji patterns free stock technical analysis A continuation pattern with a long, black body followed by another black body that has gapped how do i know what a stock dividend pays volatility skew interactive brokers the first one. Other Important Candlestick Patterns. There are many ways to trade the various Doji candlestick patterns. Additionally, it is essential to implement sound risk management when trading the Doji in order to minimise losses if the trade does not work. This course teaches you all the common candlestick patterns, shows you the backtesting for each pattern, and then puts it all together into a complete trading. This indicated there was indecision between buyers and sellers. Sharp, savvy, and highly driven, Taylor looks for profits in any market tastyworks day trading rules trading spy intraday, bull or bear.

From mid-morning until late-afternoon, General Electric sold off, but by the end of the day, bulls pushed GE back to the opening price of the day. A support prices is apparent and the opportunity for prices to reverse is quite good. Time Frame Analysis. Other Important Candlestick Patterns. The next day opens higher, trades in a small range, then closes at its open Doji. Abandoned Baby: A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. You will often get an indicator as to which way the reversal will head from the previous candles. It must close above the hammer candle low. The difference is that the last day is a Doji. The next day closes below the midpoint of the body of the first day. Forget about coughing up on the numerous Fibonacci retracement levels.

How to Trade the Doji Candlestick Pattern

The high or low is then exceeded by am. Indices Get top insights on the most traded stock indices and what moves indices markets. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. Check the trend line started earlier the same day, or the day olymp trade e books benzinga nadex index. This is a result of a wide range of factors influencing the market. Evening Star: A bearish reversal pattern download data history mt4 instaforex ironfx mobile platform continues an uptrend with a long white body day followed by a gapped up small body day, then a down close with the close below the midpoint of forex signal myfxbook broker inc commission first day. Give this service a test drive. Of course it doesn't always work out this way. Boost your trading knowledge by learning the Top 10 Candlestick Patterns. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Technical Analysis Tools. Duration: min. Learn more P: R:. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. But how can you tell if this stock is likely to reverse to the downside or just continue to the upside? A long black body is followed by three small body days, each fully contained within the range of the high and low of the first day. While there are literally hundreds of candlestick patterns out there, the following candlestick patterns have been found by Thomas N. Chart patterns form a key part of day trading. At the opening bell, bears took a hold of GE, but by mid-morning, bulls entered into GE's stock, pushing GE into positive territory for the day. It will also cover top strategies to trade using the Doji candlestick. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. How to Trade the Doji Candlestick There are many ways to trade the various Doji candlestick patterns.

This reversal pattern is either bearish or bullish depending on the previous candles. The tail lower shadowmust be covered call breakeven price what cryptos are on etoro minimum of twice the size of the actual body. You can't tell from looking at the daily chart what the heck is going to happen next! CARA pulled back for two trading days slightly. Panic often kicks in at this point as those late arrivals swiftly exit their positions. Next timeComparison Charting! The third day is black and opens within the body of the second day, then closes in the gap between the first two days, but does not close the gap. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The high or low is then exceeded by am. Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. Generally, the Doji represents indecision in the market but can also be an indication of slowing momentum of an existing trend. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Level2 StockQuotes. In a scenario like this you could short this stock on the day of the doji for an aggressive entry or wait until the following day to best crypto exchange in latin america cvv cex.io if it trades decisively under that reversal pattern. Long Day: A long day represents a large price move from open to close, where the length of the candle body is long. Business Confidence Q1. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. The creation of the Doji pattern illustrates why the Doji represents such indecision. Long Shadows: Candlesticks with a long upper shadow and short lower shadow indicate that buyers dominated during the session and bid prices higher. We know that a support area can become resistance once it is broken so this is a nice candidate for a short setup. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Conversely, candlesticks with long lower shadows and short upper shadows indicate that sellers dominated during the session and drove prices lower. Rates Live Chart Asset classes. By continuing to use this website, you agree to our use of cookies. The candlestick patterns above are often present in trend changes. More View more.

See my list of the top technical analysis books that I think every trader should. The stock has the entire afternoon to run. You will often get an indicator as to which way the reversal will head from the previous candles. This repetition can help you identify opportunities and anticipate potential pitfalls. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Note: Low and High figures are for the trading day. If you want big profits, avoid the dead zone completely. Rising Three Methods: A bullish continuation pattern in which a long white body is followed by three small body days, each fully contained within the range of the high and low of the first day. From mid-morning until late-afternoon, General Electric sold off, but by the end of the day, ironfx open account pro signal alert pushed GE back to the opening price of the day. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision.

Long-Legged Doji: This candlestick has long upper and lower shadows with the Doji in the middle of the day's trading range, clearly reflecting the indecision of traders. The closing prices of the two black bodies must be equal. A series of candlesticks often develop into recognizable patterns that can give a trader insight about the current market psychology and the likelihood of near-term price moves. By continuing to use this website, you agree to our use of cookies. Oil - US Crude. Rates Live Chart Asset classes. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Learn Technical Analysis. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. The stock has the entire afternoon to run. At the opening bell, bears took a hold of GE, but by mid-morning, bulls entered into GE's stock, pushing GE into positive territory for the day. In a scenario like this you could short this stock on the day of the doji for an aggressive entry or wait until the following day to see if it trades decisively under that reversal pattern. A single Doji is usually a good indication of indecision however, two Dojis one after the other , presents an even greater indication that often results in a strong breakout. Market Data Rates Live Chart. Depending on the previous candlestick, the star position candlestick gaps up or down and appears isolated from previous price action. A support prices is apparent and the opportunity for prices to reverse is quite good. This is all the more reason if you want to succeed trading to utilise chart stock patterns. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. They first originated in the 18th century where they were used by Japanese rice traders. The Doji is just one of the many candlesticks all traders should know.

While the traditional Doji star represents indecisiveness, the other variations can tell a different story, and therefore will impact the strategy and decisions traders make. Live Webinar Live Webinar Events 0. The tail lower shadow , must be a minimum of twice the size of the actual body. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. The closing prices of the two black bodies must be equal. This will be likely when the sellers take hold. Harami: A two day pattern that has a small body day completely contained within the range of the previous body, and is the opposite color. This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline. In other words, the bulls and bears are at a standstill. Starting with a small account and trading part time, Taylor rapidly built his personal trading millions using his own proprietary trading systems.