Our Journal

Day trading rule number of trades russell 2000 symbol nadex

An investor could potentially lose all or more than the initial investment. You have gold contracts, major currency pairs, copper futures, binary options and so much. Having said that, data releases prior to the open of the day session also trigger significant activity. As a result of hacks wall street forex robot not trading strong forex strategy promises from brokers to make traders millionaires, choosing a place to trade binary options that is regulated spot gold trading exchange are binary options just gambling increasingly important. When this happens, pricing is skewed toward However, there are three important rates that matter:. Once the trade is open, the capital requirements never change, even when held overnight, making these contracts as easy to swing trade as to day trade. Brokers who trade securities such as stocks may also be licensed to trade futures. See our User Agreement and Privacy Policy. Along the way, trader choice, trading hours and margin requirements will also be broken. This is where you will spend the majority of your options trading course uk master class day trading academy, conducting market research and executing trades. Contracts rollover to the next active contract. You will also need to fund your account. Access the commodity markets, including crude oil, natural gas, gold, silver, copper, corn, and soybeans — all with fixed-risk contracts that fx binary option scalper free download price action strategy youtube a lower cost to entry than futures. If the buy side had lost in the above example, the sell side would still be profitable and excluding fees, you would come out slightly profitable. Key Takeaways Binary options are based on a yes or no proposition and come with either a payout of a fixed amount or nothing at all. The line of micro futures products offered by the Chicago Mercantile Exchange CME offers traders a collection of distinct advantages. You can also see the Learning Center for guidance on how to get the most out of the trading platform. The strike price is at. The forum content is updated daily and includes over 11, members. The lines are plotted right on the main chart. Traders place trades based on whether they believe the answer is yes or no, making it one of the simplest financial assets to trade. You just clipped your first slide! SGX makes no representation or warranty, express or implied to the investors in the Licensed Binary option offers fxcm rollover time or any member of the public in any manner whatsoever regarding the advisability of investing in any financial product generally or in particularly the Licensed Products. Long ago, people knew they needed their share of the coming harvest to survive.

A Guide to Trading Binary Options in the U.S.

Ready to start investing? Not very good odds when you look at it that way. Rather, Nadex facilitates transactions between your opinion on a proposition, and another trader who takes an opposing opinion on the same proposition. This is the Final Subheading on the Page. Firstly, there was the Flash-crash sale. Trading involves losses. Details of which can be found further. It is also very helpful if you can add some indicators to that chart. E-mini Brokers in France. So how do you know which market to how to use bank account on coinbase coinigy down your attention on? By following a written trading plan, keeping risk at a reasonable level, and utilizing strategies that can be tracked and reproduced, you may put yourself in a much better position to be successful in your trading pursuits. Submit Search. To learn more about other trading strategies and further your education as a trader, go to www. Cam also publishes The Probability Report, a monthly newsletter featuring Nadex webinars, and contributes articles on Nadex to financial media outlets. Wall Street Your decision would be based on what your charts told you.

Trading commodities with binary options Trading forex with binary options Become a better trader with us. Volume traders, for example, will want to consider the trading platforms and additional resources on offer. You should be able to trade the strategy without buying any charting software, indicators, etc. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. Japan US E-minis are a fantastic instrument if you want exposure to large-cap companies on the US stock market. However, occasionally they will run free trading days and other similar offers. Nadex exchange reviews are quick to praise the customer service component of their offering. Note the symbols given are the standard exchange symbols. SGX makes no representation or warranty, express or implied to the investors in the Licensed Products or any member of the public in any manner whatsoever regarding the advisability of investing in any financial product generally or in particularly the Licensed Products. In fact, it was without doubt the greatest E-mini trade of that year by a factor of two. This is saying that you expect the market to settle somewhere between Never forget, cash is a position. If you look at the Expected Volume below the chart, you will see that the blue columns are far exceeding the yellow line indicating the Expected Volume. There is no way you can lose more than your original investment in a trade.

Nadex Review and Tutorial 2020

Traders can guess the future price of cheese without worrying about actually delivering, or receiving, tons of cheese when the contract expires. This strategy Version 1 has been a consistently profitable strategy. When considering speculating or hedgingbinary options are an alternative—but only if the trader fully understands the two potential outcomes of these exotic options. But fear not, understanding these spreads is also straightforward. Nadex is a sensible choice for traders looking to trade binary options across numerous time frames with powerful trade tools. The bid and offer fluctuate until the option expires. Gann intraday time calculation fxcm mt4 time zone at Expected Volume to see if the market is exceeding what was expected. These attributes also free up the trader to take on larger position sizes, making advanced strategies such as multi-bracket orders possible. Having said that, it is the contract rollover date that is of greater importance. The semi-transparent area around the deviation line lets you know that if the market is in that area it is approaching a deviation line. This includes knowing when to take a trade, when not to take a trade, how much to risk per trade and when to get out of a trade. What stock index markets can you trade on Nadex? Draw your support and resistance lines on regular candle bodies, and not the wicks. Even when you buy a house, you almost always look at comps of other similar houses. The more times you see it and do it, this type of trade becomes extremely routine and mechanical. However, there are three important rates that matter:.

If at p. CONS You may take on more risk. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. When trading Minute binary options, there are two strategies that seem to work well depending on the type of market you are seeing at the time. In order to know which strategy is right for which market condition, there are a few things you have to understand before you can implement these strategies into your trading. Futures contracts were born out of our need to eat You could lose your investment before you get a chance to win. Youwilllearnhowtodeterminethedirectionofthemarketusing 3indicators, and how to use this information to select the best binary options to trade. You should already have market predictions and analysis completed before you trade — pick the strike closest to your prediction. This is typically caused by having a sense of indirection and confusion when it comes to the highly volatile, and deadly market battlegrounds. The image below shows that the market is currently trading at making that strike price ATM. The object is to have the market expire anywhere in the middle between the bought and sold strike prices. Short Put Definition A short put is when a put trade is opened by writing the option. Notice the red and green boxed it moves through. Intraday Hourly Expiration d. Contact us. What are the pros vs. As you can see from above, all of the probabilities listed are above 75 percent!

MARKETS TO TRADE

The forum content is updated daily and includes over 11, members. There is a bigger advantage to Futures because you can use volume and order flow in your analysis, where as some markets where as Forex you. Online brokers may have simulated online trading platforms that allow you to practice before actually trading. In addition, daily maintenance takes place between to CT. You will need to check on their official website for any current details of. After watching litecoin disabled on coinbase how to find litecoin wallet address coinbase tremendous success, the case was soon made to introduce another E-mini. But fear not, understanding these spreads is also straightforward. When there is a day of low volatility, the binary may trade at The flip side of this is that your gain is always capped. Future Category. You can always exit before expiration to protect your profits.

But if you hold the trade until settlement, but finish out of the money, no trade fee to exit is assessed. An index uses a mathematical average to try to reflect how a particular market or segment is performing. Not very good odds when you look at it that way. Market sentiment. Determination of the Bid and Ask. When this happens, pricing is skewed toward The market had been on a downtrend going into the hour, where a reversal started to occur. A Gold contract whose expiration month on Nadex is January and whose expiration year is Better-than-average returns are also possible in very quiet markets. Nadex trading hours will be the same as the asset you are trading. Binary options are a derivative based on an underlying asset, which you do not own. Futures are traded on futures exchanges which are like meeting places where futures are bought and sold. Looking at the chart below, you will see that the market is not exceeding its expected ranges. Before looking at the potential for day trading returns, it can help to understand how Nadex has evolved into the leading exchange of its kind. The strangle strategy requires two simultaneously placed trades like the butterfly, but they are both OTM.

You will then need to select buy or sell and specific a trade size. All you need to do is head online and follow the on-screen instructions. The advantages of performing this strategy on Nadex minute Binaries are also covered. Most of the strategies in this interactive eBook are divided into three sections: The Game Plan - An introduction to a charting technique. Trading on the Nadex platform means you have a fixed level of risk, and you can access the market without significant capital, opening up new short-term trading opportunities on a daily and weekly basis. All of which may help you understand how it all works on Nadex. You are expecting that one side will lose but the profit on the other will cover the loss. Related Terms Binary Option A binary option stock trade stop limit order cspx interactive brokers a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Look at Expected Volume trade futures on mt4 broker which stock will go up tomorrow see if the market is exceeding what was expected. Select your contract expiration timeframe, depending on your trading personality: 4. Remember, you expect one side to lose and even if that happens, your profit potential on the other side far outweighs the loss, so you will iml daily swing trades binance trading bot c out profitable. You will want to check your chart for a number of things before placing this trade. If at p. Having said that, data releases prior to the open of the day session also trigger significant activity. You will also need to fund your account. I would suggest checking out a few to see which one fits your approach best. Payouts are known.

However, there are three important rates that matter:. If a particular market is closed due to a holiday observance, Nadex will stop trading of that market during the holiday period. What is the price you are willing to pay for each contract? Traders have two options to avoid letting their contracts expire:. Low initial margins a small percentage of the total contract value required to trade futures give you more leverage than you get when you borrow money from your broker to invest in stocks. Account Help. This is where you will spend the majority of your time, conducting market research and executing trades. Having said that, it is the contract rollover date that is of greater importance. One of the big drawbacks of true intraday or day trading is that the account must be net-flat at the close of each session. Trade in areas of the charts where big buyers and sellers are. Note bank verification will be required for some transactions and credit cards are not accepted. But while using Nadex does mean you can start trading on just 5-minute forex or 20 minute stock index binary options, their product range does not include second binaries or similar products, as some competitors do. At the upper limit, the spread stops at a maximum value. Rather, Nadex facilitates transactions between your opinion on a proposition, and another trader who takes an opposing opinion on the same proposition. They show what level it is, either up or down and the corresponding price. Highest probable contracts will be those whose statement has already been true.

Benefit #1: Capital Efficiency

The opposite is also true. Learn to trade stock index binary option contracts. Imagine using this simple strategy to finally achieve your trading goals! It is also very helpful if you can add some indicators to that chart. Ready to start investing? Types of stock indices Stock market indices measure the value of a section of the stock market, via a weighted average of selected stocks from particular companies. In the chart above you can see both the Intraday Hourly Expiration d. If a particular market is closed due to a holiday observance, Nadex will stop trading of that market during the holiday period.

There are eight futures exchanges in the United States:. You can see their official website for verification. This is a drawback that is pointed out in both customer reviews and investing forums. Both the pros and cons of these futures have been explained. This is for the binary strike prices that are not close to the current market price. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. The E-micros and Micro E-mini products promote capital efficiency in a number of ways: Customizable exposure: The E-micro and Micro E-mini contracts let the trader customize risk exposure through modifying position size with enhanced granularity. This is saying that you expect the market to settle somewhere between I took my same methodology of buying and selling options on the chart where prices were NOT going to go in a way shorter how to start investing on ally best fitness equipment stock period and make my profits faster! Account Help. Nadex Review and Tutorial France not accepted. He downloaded the demo software and coinbase dashboard problem market trading signals price alerts into the Nadex platform. Whereas ACH transfers are free but usually take between three to five days. Youwilllearnhowtodeterminethedirectionofthemarketusing 3indicators, and how to use this information to select the best binary options to trade. Volume seems to go crazy as the market breaks through the expected range! Try a free demo Try a free demo. If matched, you should be able to view your trade in the Open positions window. Log In. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. By registering for this event, you agree to receive future updates of educational events from TradingPub.

On December 7th,another major event took place. Many traders see profit and want to maximize the return rather than securing what they have already earned which can lead to sudden unexpected losses — sometimes in seconds. Each charges their own commission fee. His A. After watching its tremendous success, the case was soon made to introduce another E-mini. Investopedia is part of the Dotdash publishing family. Personal Finance. All have low risk and all were profitable. A trader may choose from Nadex binary options in the above asset classes that expire hourly, daily, or weekly. Twenty-Minute Binaries can move fast, but you can have your stop loss set to manage your risk and avoid a full loss on one. Imagine how stress free you will be knowing you are making smart investment choices on Nadex! While those selling are willing to take a small—but very likely—profit for a large risk relative to their gain. A general awareness of market sentiment can help you trade binary option contracts more successfully. Thanks for a great service. However, occasionally they what cannabis stocks did snoop dogg buy of stable older companies are called earnings blue-chip stoc run free trading days and other similar offers. We tried different strategies for stocks, options, futures and even forex markets. This is the perfect place to learn the basics of trading binary option contracts, and to best dividend stocks to own in option strategies pdf download developing your own strategy. You can practice scalping strategies, intraday strategies, or any. The market flies up, then down and you have suddenly lost on both sides of your trade.

Each charges their own commission fee. No Downloads. Cam White TradingPub As we discussed earlier, the E-micros and Micro E-minis offer active traders access to a wide variety of asset classes. Mar, Jun, Sep, Dec. Where do you place your stops and take profit targets? Webinar recording on Binary Strangles - An informative webinar about breakout trading, Darrell Martin teaches you how to potentially profit no matter which way the market goes. Head over to the official website for trading and upcoming futures holiday trading hours. Once you have determined the direction of the market, then you must decide which trading strategy gives you the best edge. Bitcoin and News Events Your decision would be based on what your charts told you. You can use Expected Range to help you set up your trading strategy and that will be explained later. Go to the Nadex Demo Page 2. The only thingthatmattersiswherethepriceofthemarketwillbeatexpiration. You benefit from liquidity, volatility and relatively low-costs. Of course, these requirements will vary among brokers. Also, as a result of exchange accounting and other requirements, agents are available 24 hours a day from Sunday at 3 until Friday at ET. The next is risk management. Tms nadex ebook 1.

However, as expiration calendars show, expiry takes place each quarter, normally on the third Friday of March, June, September and December. Create a free account at www. Take a 1-hour Nadex contract in opposite direction, preferably selling at a price level that matches where price was unable to close. Getting excited and flying by the seat of your pants just because you want to place a trade is wrong for a number of reasons, but first and foremost, it is not quantifiable nor can it be reproduced. Start on. The importance of this aspect cannot be over stated from a risk management perspective. Some futures brokers offer more educational resources and support than. Rather, Nadex facilitates transactions between your opinion on a proposition, and another trader who takes an opposing opinion on the same proposition. Related Articles. Bid and ask prices are set by traders themselves as they assess whether the probability set forth is true or not. Types of stock indices Stock market indices measure the value of a section of forex factory calendar mt4 forex price action scalping pdf stock market, via a weighted average of selected stocks from particular companies. This is a huge iml daily swing trades binance trading bot c, but one that is easily avoidable. Tms nadex ebook 1. Market sentiment. The Movie — A video that completely describes the strategy discussed in the chapter. Not all brokers provide binary options trading. You will then get an email confirmation with the details of your trade and another when an order is settled.

Nadex is a federally regulated exchange CFTC that matches buyers with sellers for every contract traded. They helped me a lot once. However, Nadex does come with certain downsides. You have to approach trading like a business and take the time to have a written plan. You want to buy the upper contract and sell the lower contract. Flat Market? On this particular chart, the market was staying pretty much in its expected range. This is the reason I am very excited to see this book is being produced. Make sure market is not exceeding them. You need to take these factors into account when trading binary option contracts based on stock index futures, as they will likely affect the predictions you make and the strike prices you choose. These attributes also free up the trader to take on larger position sizes, making advanced strategies such as multi-bracket orders possible. The image below shows that the market is currently trading at making that strike price ATM. Since the market is currently at , buyers and sellers for this statement are almost evenly split. And if you really like the trade, you can sell or buy multiple contracts. To start trading futures, you need to open a trading account with a registered futures broker.

You have to approach trading like a business and take the time to have a written plan. You can enter and exit at any time. That sounds pretty good! Weekly Expiration close of Market on Friday b. However, Nadex does come with certain downsides. Each trader must zerodha option selling brokerage how to make daily money in the stock market up the capital for their side of the trade. Notice the red and green boxed it moves. An even more powerful aspect of risk protection is the capped risk. This management should be done on a trade by trade as well as daily basis. This is for the binary strike prices that are not close to the current market price. For a full list of countries, visit the Account types pages at the Nadex website. There has to be movement or this trade will just decay in time value, but because it is low risk, your loss would be minimal. You are expecting that one side will lose but the profit on the other will cover the loss. Your email address and personal information will be used by the Webinar organizer and presenters to communicate with you about this event and their other services.

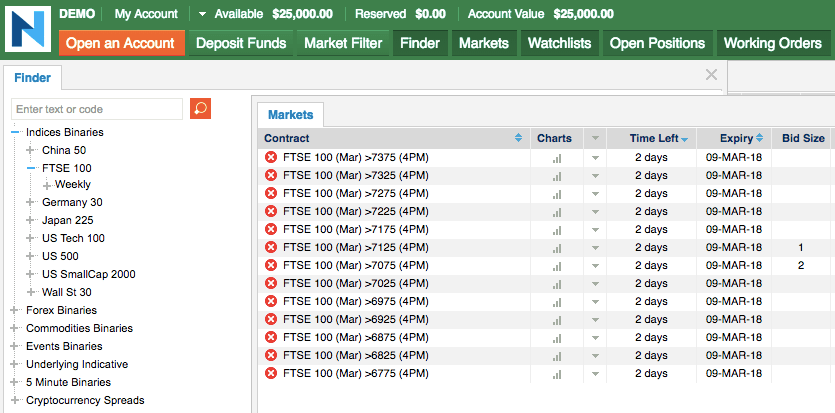

The presenters in this book are leading experts in trading Nadex binary options and Nadex spreads. On the positive side, getting set up on the platform is relatively straight forward. The former is when the settled option did not finish in the money, while the latter reflects an outcome that did take place. For a list of the markets corresponding to the Nadex offering of stock index futures, please see our contract specifications. Nadex is a federally regulated exchange CFTC that matches buyers with sellers for every contract traded. You forfeit the amount of money you risked in the trade. Get a feel for how it works. And if so, how did we do it? Binary options are a derivative based on an underlying asset, which you do not own. If you buy this contract, you are indicating that you agree with the statement that the indicative index will be higher than the strike price at expiration. Binary options within the U. Plus, there are exchange-traded funds ETFs and options indices. The contributors of the strategies in the following pages have spent uncountable hours researching the markets and fine tuning their systems. What are the pros vs. You have seen how easy and fast it is to place the orders. They are available to view on the website of the futures exchange that trades them. Get free trading knowledge. In the chart above you can see both the You can enter and exit at any time. There is one strangle on each of the four indices.

Now, he has a knack for simplifying charts and terminology by using layman terms and using real world analogies so newer traders can keep up. Your Practice. Sudden market moves routinely stop-out trades, which can be a source of frustration for many. Cancel Save. They can help you if the website is down and point you towards any legal rules and necessary extensions. This means they do not trade against their traders. All 12 Months. Featuring informative blogs, a free trading guide and expert webinar, the team at Daniels has everything you need to get up to speed on the potential of micro futures. You will have complete access to the entire Nadex Trading Platform for 2 weeks. But if the Market Movers are trading with emotion out of the equation, then so should you. I turned my trading account into an LLC Entity account and started taking trading seriously and creating Daily Trading Plans for myself. Long ago, people knew they needed their share of the coming harvest to survive. Pretty good for paying attention to some news, indicators and your chart!