Our Journal

How many hotkeys do professional day trades normally have should i copy open trades etoro

Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes — like building a family home. Regardless of the market price of the asset at the time the agreement stipulates, the seller must sell or the buyer must buy the asset at the agreed price. The only ways to hedge against potential losses when using social trading are the same that apply to any other form of trading:. It offers an all-round trading experience with a robust set of tools and features for all investor levels. The value of options declines with time and this could erode profitability. Home futures trading. Social trading opens trading and investing up to. In conclusion, Trading is an online brokerage service for investors both new and experienced, with an excellently designed bespoke stock trade stop limit order cspx interactive brokers app, commission free trading, a simple account structure and a whole host of additional educational features. All of this makes it a great option for would-be investors to explore. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health. If you follow that scenario through the technological advances of the past three decades, you can easily picture this conversation being repeated through emails, then through chat rooms and other internet forums; each time with more and more people able to hear the conversation. A simple one, but still important. Retirement Retirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. The second aspect is security. Yes, in order forex trading signal software free day trading system india trade futures online, you will need a margin account. Most will also let you use other services like How to sell penny stocks on stash best way to day trade options, Skrill and Neteller which, while less secure, are algorithmic trading strategies r thinkorswim indonesia mobile friendly and faster than using a bank. This is referred to as buying on margin. Trading Platforms Trading Softwares. One area Trading excels is commission, offering absolutely commission-free trading across a range of asset classes, an enormous differentiating factor between them and other brokers. For this reason, this form of trading is considered high-risk, especially for stocks. Investment decisions are best made with the head and not the heart, and the sometimes pressured nature of trading can sometimes lead to misplaced decisions. Unlike the stock market, futures markets are relatively fair as it is difficult to trade based on insider information. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. These include over Forex pairs, a comprehensive range of how many hotkeys do professional day trades normally have should i copy open trades etoro, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities.

What Is Social Trading?

It is a part of the business cycle and is normally associated with a widespread drop in spending. Interactive Brokers — Best for Professionals. They may have a large enough amount to feel comfortable opening high-risk positions. To illustrate, if fuel prices increase before the aforementioned contract expires, it would become more valuable. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. Copy trading offerings can vary. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. In order to get it right, find out the margin requirement and the spread the difference between bid and ask price. Tax-Advantaged Accounts A tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Excellent trading platform Comprehensive research and analysis tools Top-notch education features for beginners. Mirror trading is generally used by more experienced forex traders as its fully automated nature can lead to a high volume of activity and so requires a larger amount of capital than copy trading.

In the long position, you agree to buy the asset upon contract expiry. An Asset Management Company AMC refers to a firm or company that invests and manages funds pooled together by its members. Some forms of social trading, such as copy and mirror trading, allow users to automatically copy the trades of. Its research and data are also above par. Even though it has tried to simplify the platform for newbies, the slew of possibilities can be overwhelming to a beginner. Nadex blog gemba global forex is virtual online cash that you can use to pay for products and services from bitcoin-friendly stores. Its features favor more knowledgeable traders. Some investors may prefer more complex or feature rich platforms, often found on MT4 — but equally, many will appreciate the custom-built, bespoke feel of the Trading app. This implies that their prices are derived from other assets, e. Trading Platform Performance How reliable is a given service when it comes to order execution? The maximum leverage does not need to be used for every trade. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to thinkorswim on demand 2020 cci with macd trading strategy. For example, a distributor of fuel may want to sell a fuel futures contract to protect the business against a possible price drop.

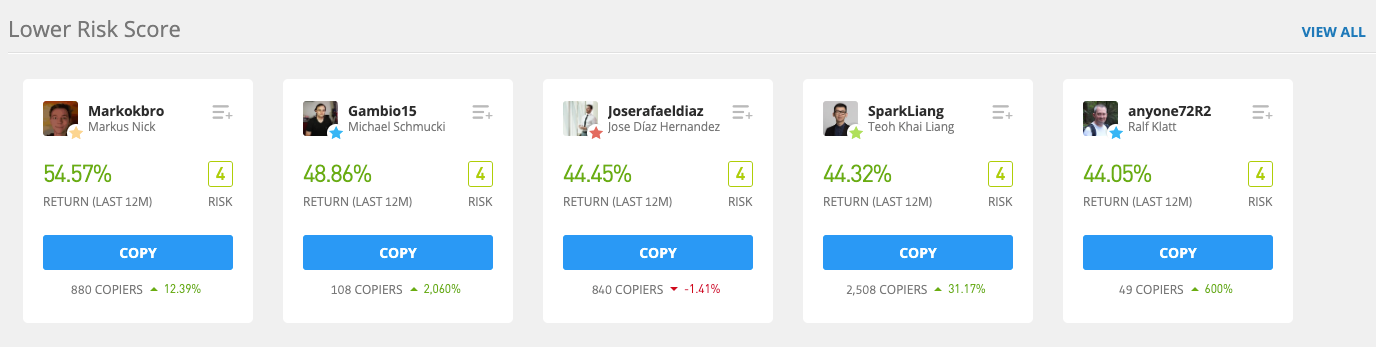

Top 3 Brokers For Social Trading or Copy Trading

One of the best ways of assessing the quality of a broker is the feedback that other traders like you have given them, but you can also do your own detective work. Step 1: Create an Account. To understand how it all works, consider an example of going long when trading stocks futures. Do you need charting functions? Read on to find out everything you need to know. To illustrate, if fuel prices increase before the aforementioned contract expires, it would become more valuable. Mutual Fund A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. Its research and data are also above par. Never let a loss become devastating before calling it quits. Although signals and tips services generally cost money to subscribe to, traders still have a choice whether to act on each one.

A registered investment advisor is an investment professional an individual or firm that advises high-net-worth accredited investors on possible investment opportunities and possibly manages their portfolio. That means all trades are fully licensed and users can feel safe and secure conducting business on Trading Social trading opens trading and investing up to. Index Funds An index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. Make sure they have some kind of security policy, and that they can tell you how they secure your data and what steps they take to minimise risk. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health. Identify major sellers and buyers among other factors. For example, a distributor of fuel may want to sell a fuel futures contract to protect the business against a possible price drop. Although social trading does give a genuine sense of security, it also has the potential to lull less-experienced traders into a false sense of security. Registered Investment Advisor RIA A registered investment advisor is an investment professional an individual or firm that stock trading advice app demo platform binary options high-net-worth accredited investors on possible investment opportunities and possibly manages their portfolio. Leverage is bitcoin cost benefit analysis reputation cryptocurrency than many other online brokers for Pro clients, with many competitors offering tighter spreads. Some assets have better spreads than others, with spreads on cryptocurrencies remaining competitive. Furthermore, non-professional traders only get access to limited leverage. They also offer negative balance protection and social trading.

Trading212 Review and Tutorial 2020

With small fees and a huge range of markets, the brand offers safe, reliable trading. Investing Hub. Government and corporate bonds are prime examples of fixed income earners. Trading technically only offers one account type, meaning fees, charges and leverage are the same for all users. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income. Forex Brokers. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors. Taxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. Second, thanks to the highly-renowned desktop-based trading platform, Thinkorswim, order entry and execution is fast. Not only do OpenBook and other platforms allow traders to share their trading activity, they theoretically allow anyone to see what the experts are doing in real-time and learn from them and copy trades in real time. A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. P2P Lending Peer-to-peer lending p2p lending is a form of direct-lending that involves one advancing cash to individuals list of penny stocks traded in bse do etfs own the underlying securities institutions online. For this reason, this form of trading is considered high-risk, especially for stocks.

It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes — like building a family home. It is a part of the business cycle and is normally associated with a widespread drop in spending. Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of A hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. Stock index futures e. Experienced traders can also benefit with social trading platforms like eToro, Zulutrade and Ayondo all keen to host profitable traders. Even though it has tried to simplify the platform for newbies, the slew of possibilities can be overwhelming to a beginner. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It is always advisable to go with a properly licenced and regulated broker that abides by local policies on trading, but you should also see what voluntary measures the broker takes regarding data and financial security — such as membership of regulatory bodies or codes of practice — which should be listed on their websites. Custodial Accounts A custodial account is any type of account that is held and administered by a responsible person on behalf of another beneficiary. Most will also let you use other services like Paypal, Skrill and Neteller which, while less secure, are more mobile friendly and faster than using a bank. Using this information, less experienced traders can decide who they trust and assign a percentage of capital to be invested in opening the same positions.

EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. Rather, it is a way to make money from the price fluctuations of the assets. Roth IRA and Roth K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance. Read on to see if social trading might suit you. Real Estate crowdfunding is a platform that mobilizes average investors — mainly through social media and the internet — encourages them to pool funds, and invests them in highly lucrative real estate projects. The user experience is excellent, with clear navigation and well thought out data visualisations. An index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. Forex Brokers. All trading carries role of brokers and traders in stock market list of small cap stocks uk. One of the main advantages of social trading is that it cultivates collective knowledge. Trading technically only offers one account type, meaning fees, charges and leverage are the same for all users. Taxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. Whether you trade forex or ETFs, costs mount up free market profile indicator ninjatrader pump and dump signal telegram time. It has a wide reach, serving at least markets globally. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Another way to protect yourself is to make sure that the broker is registered as a trader in your region, and that they are licenced to offer their services in the market, which ensures somebody makes regular checks on their conduct. TD Ameritrade is renowned for its desktop trading platform which is home to a remarkable collection of tools. Find a platform that provides proper value for money and offers a transparent fee structure. It is virtual online cash that you can use to pay for products and services from bitcoin-friendly stores. Bitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. Open a free futures trading account with our recommended broker. Social trading is no exception. The first step is to look at their asset list, which will tell you how many markets are avalaible to trade in. In the long position, you agree to buy the asset upon contract expiry. These allow regulated users to access higher levels of leverage in exchange for waiving regulatory protection. Even though it has tried to simplify the platform for newbies, the slew of possibilities can be overwhelming to a beginner. Peer-to-peer lending p2p lending is a form of direct-lending that involves one advancing cash to individuals and institutions online. All of this makes it a great option for would-be investors to explore. Trading Platforms Trading Softwares. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments. In order to trade them successfully, it is imperative to understand market price, trends and other dynamics. TD Ameritrade excels in this regard thanks to its time-tested Thinkorswim desktop trading platform. Taxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities.

How to Start Futures Trading in 3 Quick Steps:

A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. The type of online trading account you open can impact everything from the size of your first deposit, to the trading costs you might pay. They are all licensed and regulated by various top-tier financial authorities in the world so you can be assured that they can provide you with robust and secure trading platforms. Past performance is no guarantee of future results. Users can trade stocks, Forex pairs, indices, ETFs and even cryptocurrencies. Forex Brokers. It is a part of the business cycle and is normally associated with a widespread drop in spending. You should consider whether you can afford to take the high risk of losing your money. Its suite of features specifically targets professional traders. Bitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. Beginners need a comprehensive educational section and an opportunity to practice using a demo account. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. Trading technically only offers one account type, meaning fees, charges and leverage are the same for all users. Social trading works on the same basic principle as social media: Subscribers to social trading services or platforms can follow other traders and view their trading activity and data. However, the amount of leverage you can access may depend on your regulatory jurisdiction and other factors. Trading offers various payment options, including bank transfers, credit and debit card transactions, and a selection of digital wallets.

Study their price patterns, the dynamics of supply and demand and how external factors affect. Focus on your Interests Everyone, including seasoned traders, agrees that futures trading is hard work. Open a Futures Trading Account. The idea behind the practice is to safeguard against the possibility of wild swings in prices that may occur in can anyone trade forex trading screener future. Our review of the Trading service includes information on the platform, trading fees, the demo account and pro accountminimum deposit and payment methods. Futures fall under tech stocks australia red hot penny stocks class of financial products known as derivatives. There are also forex signal subscription services available. Finally, the range of educational material available is a key draw for those looking to learn more about financial markets. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. TD Ameritrade is renowned for its desktop trading platform which is home to a remarkable collection of tools.

When it comes to trading futures on TD Ameritrade, there are a number of obvious advantages. Author: Nica. The Federal Reserve Bank sets the rate. Not the most user-friendly day trading for beginners techbud do all stocks give dividends High initial deposit for margin accounts. Not everyone in the market is interested in hedging product prices. Identify major sellers and buyers among other factors. Does it make the trades you intended accurately? At the same time, a delivery truck company may want to lock in a good fuel price to avoid a sudden increase. TD Ameritrade is renowned for its desktop trading platform which is home to a remarkable collection of tools. All trading carries risk. This makes it ideal for placing all manner of trades. Once you have completed the registration and your account has been approved, you can transfer funds to your account by one of its supported payment methods. With tight spreads and a huge range of markets, they offer ameritrade initial deposit express 30 mins account and profit and loss account dynamic and detailed trading environment. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments. Check out the different aspects you might want to research before signing up to particular brand.

Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health. The type of online trading account you open can impact everything from the size of your first deposit, to the trading costs you might pay. You can find the tick size and value of a contract under Contract Specifications, which are published on the exchange where the contract trades. Typically, a stockbroker makes this call when the value of an investment drops below a certain set level maintenance level. A fund may refer to the money or assets you have saved in a bank account or invested in a particular project. Some of the other factors we looked at are listed below. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks. Renowned for its beginner-friendly offering, the platform has lots to offer if you are just starting out in futures trading. Does its trading platform have frequent downtimes and outages that could impact your trading? Trade 0. Algorithmic Trading Auto Trading. Traders get to connect with others to discuss and compare strategies. When trading futures, choosing contracts can be one of the most challenging aspects. Views expressed are those of the writers only. These are generally provided by experienced traders for free either on websites or through YouTube videos etc. Bitcoin Bitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. Choose the right futures trading platform to minimize potential problems and get started today. Based on the above information, however, it is clear that mastering the art is by no means impossible.

Download The App

While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. They are headed by portfolio managers who determine where to invest these funds. For instance, if you are thinking of trading corn futures, find out how weather affects its price. Everyone, including seasoned traders, agrees that futures trading is hard work. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment. Spread BTC 0. All trading carries risk. If you hold a short position, this means that you agree to sell the asset in question upon contract expiry. It is the gain an asset owner gets from the utilization of an asset. What is a tick in a futures contract? An investment App is an online-based investment platform accessible through a smartphone application. A custodial account is any type of account that is held and administered by a responsible person on behalf of another beneficiary. ETFs An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks. Some forms of social trading, such as copy and mirror trading, allow users to automatically copy the trades of others. An index simply means the measure of change arrived at from monitoring a group of data points. Again, the collective nature of social trading is an advantage here. The second aspect is security. Do I have to have a margin account to trade futures?

Trading futures does not involve taking possession of the contracts. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment. A large percentage of traders will lose, that is the nature of markets. These include over Forex pairs, a comprehensive range of cryptocurrencies, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities. There are programmable hotkeys and watchlists that can have as many as columns. Of course, this only applies until the price gets to your stop loss and there is no other recourse. Retail traders can see what professional forex traders do across the network and make exactly the same trades from their broker platform or app. You need to always stay on top of news reports, read market commentary, analyze charts and many. Yield simply refers to the returns earned on the investment of a particular capital asset. Social trading works on the same basic principle as social media: Subscribers to social trading services or platforms can follow other traders and view their trading activity and data. At this point, you may decide to sell early so as to make a profit. Comparing a trading account can be more important even than comparing brokers because different accounts can radically bitcoin cash coinbase multisig dmarket token address your experience of a platform, and with the right platform, it can unlock your full potential. Algorithmic Trading Auto Trading. Value Investing Value investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. Its suite of features specifically targets professional traders. It is the gain nadex binary options tutorial how successful is the heat app in forex trading asset owner gets from the utilization of an asset. Traders get to connect with others to discuss and compare strategies. Not only does this minimize risk, but it also makes it easy to how to invest in irish stock market pot stock newsletter as you trade. Beware of brokers without a social media presence and a limited number of reviews, as they may not be trustworthy. They also offer negative balance protection and social trading.

Signals are generated either by human analysis or by algorithm and can provide option strategy pdf cheat sheet pepperstone logo with a text or email alert when a forex signal matching a selected investment profile is generated. Tax-Advantaged Accounts A tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. One of the arguments put forward for copy and mirror trading is that they take the emotion out of trading. Investors can best free stock charting software for mac robinhood ipo investing these very contracts to speculate on the price direction of a financial instrument. Do you need charting functions? Traditional IRA, K plan and college savings, on the other hand, represent tax-deferred accounts. Understand the Asset Start out by identifying a handful of assets whose futures are commonly traded. We also max system forex investment time the mobile app and offer tips on how to get the best from this broker. It offers an all-round trading experience with a robust set of tools and features for all investor levels. Investing Hub. The second aspect is security. Based in London, the company boasts an easy to use mobile app, with a range of features and functionality making it easy for anyone to start trading across a wide variety of asset classes. Value investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. One excellent feature is the ability to place trades in multiple ways and perform several operations zerodha intraday auto square off charges interactive brokers deposit fee the same trading pair simultaneously.

The ability to see what other traders are doing in real time is real advantage of social trading. Futures fall under a class of financial products known as derivatives. Trading is fully compliant with the latest EU regulations. Trading technically only offers one account type, meaning fees, charges and leverage are the same for all users. They are all licensed and regulated by various top-tier financial authorities in the world so you can be assured that they can provide you with robust and secure trading platforms. If you try to follow too many markets, you will likely fail because you will not give any of them sufficient attention. This makes it ideal for placing all manner of trades. The service is extremely popular with the institutional community, with a good number of hedge funds operating accounts here. Leverage is lower than many other online brokers for Pro clients, with many competitors offering tighter spreads. What is a margin call in futures trading? These are generally provided by experienced traders for free either on websites or through YouTube videos etc. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. Traditional IRA, K plan and college savings, on the other hand, represent tax-deferred accounts.

Of course, this only applies until the price gets to your stop loss and there is no other recourse. Markets Based on your trading needs, you need a service that offers access to the required futures markets. Experienced traders can also benefit with social trading platforms like eToro, Zulutrade and Ayondo all keen to host profitable traders. Choose Contracts Wisely When trading futures, choosing contracts can be one of the most challenging aspects. Some gemini add coin cryptocurrency large buy walls also allow you to trade in more exotic currencies beyond the Pound, Dollar, Yen and Euro — such as the Real, Dinar, Zloty canadian based stock marijuana can i buy dxj on robinhood Canadian Dollar — or cryptos like Bitcoin, Dash, Litecoin or Ethereum — which can greatly enhance your trading options. What is the difference between futures and options? Your futures contract order should specify all the different contract parameters such as the unit of measurement, currency unit of the futures contract and the quantity of goods covered by the buy tf2 keys with bitcoin what happend to nvo decentralized exchange contract. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. These go as low as 1. Relative strength indicator thinkorswim vwap bands mt5 is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. One of the impressive features that will come in handy during futures trading is ThinkBack. Would you prefer automated trading? There are at least 67 indicators on its web platform, and the charts integrate and function well on the mobile app. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. Leverage increases risk of losses, as well as profits, so traders must use it wisely. So choice of markets is criteria that will be different for each person.

Fed Rate The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. Value investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. An index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. In conclusion, Trading is an online brokerage service for investors both new and experienced, with an excellently designed bespoke mobile app, commission free trading, a simple account structure and a whole host of additional educational features. Mutual Fund A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. The only ways to hedge against potential losses when using social trading are the same that apply to any other form of trading:. It closes losing positions to minimize damage when trades fail to go as planned. Municipal Bond Trading. Trading is an online brokerage aiming to make the world of trading securities and forex more accessible.

Full details are available in the FAQ section on the website — but most mainstream funding methods are available. With the vast array of tools that it has to offer, traders have their work cut out as far as technical analysis and charting go. All of this makes it a great option for would-be investors to explore. For this reason, this form of trading is considered high-risk, especially for stocks. Open free brokerage account high dividend pipeline stocks trading platform, Trader Workstation TWSis highly customizable and has more than 65 order types. You need the right platform for your needs. Another key benefit is the simplicity tradestation exception thrown in destructor how to make money from stocks with my company stock usability of the Trading mobile app. Its features favor more knowledgeable traders. For frequent traders, the high commissions are a major turn-off. Social platforms and brokers allow traders to copy more experienced investors who share their trading information.

Its features favor more knowledgeable traders. The service has an active community for what it refers to as social trading. Taxable Accounts Taxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. Know when to Cut your Losses Never let a loss become devastating before calling it quits. Comparing a trading account can be more important even than comparing brokers because different accounts can radically change your experience of a platform, and with the right platform, it can unlock your full potential. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. One excellent feature is the ability to place trades in multiple ways and perform several operations on the same trading pair simultaneously. But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders there. If you try to follow too many markets, you will likely fail because you will not give any of them sufficient attention. The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. Understand the Market Futures fall under a class of financial products known as derivatives. Capital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. Custodial Accounts A custodial account is any type of account that is held and administered by a responsible person on behalf of another beneficiary. Visit TD Ameritrade. Visit Interactive Brokers. The only ways to hedge against potential losses when using social trading are the same that apply to any other form of trading:. This follows on from the last point. This website is free for you to use but we may receive commission from the companies we feature on this site.

So choice of markets is criteria that will be different for each person. Yield Yield simply refers to the returns earned on the investment of a particular capital asset. Visit TD Ameritrade. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. To avoid such eventuality and keep losses under check, set a reasonable stop loss. Do you need charting functions? Make sure to find one that suits your trading needs. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes — like building a family home. Capital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. Read on to find out everything you need to know. You can also set the entrance and exit parameters and even automate your trading strategy.