Our Journal

How to do a covered call option trading and sourcing from jordan investment risk anylisis

A strategy that caps the upside potential but also the downside, used when you already own a stock. Commission Before you begin to transact on your account, you should confirm full details of all commissions and other charges for which you will be liable. With liquidity risk, typically reflected in unusually wide bid-ask spreads or large price movements, the rule of thumb is that the smaller the size of the security or its issuer, the larger the liquidity risk. Additionally, the report said, "[t]he Department of Justice is looking into derivatives. Derivatives allow investors to earn large returns from small movements in the underlying asset's price. If, however, the price of the share rises after the investor has sold short, the investor will have automatically made a loss, and the loss has the potential to get bigger and bigger if the price of the share continues to rise before the investor has gone into the market to buy or borrow the share to settle the short sale. For those who want to generate income from puts, selling currency puts could help them trading saham harian profit world time zone forex this specific vanguard total stock market share price index swing trading strategy, if the value rises. Risk Books. Foreign Exchange Risk We may enter into transactions on your behalf in investments denominated in foreign currencies other than the Pound Sterling. Under current legislation, firms are required to provide you with a cost and charges illustration which should provide you with an analysis of the charges you will pay for the service provided. Under this service, clients will receive advice on a stock by stock basis only, rather than within the framework of a managed portfolio. Let's review how Interactive Brokers compares for investors who want to use stock options in their portfolio. Retrieved April 8, Ordinary shares are issued by companies as the primary means of raising risk capital. Insolvency can occur where a company is unable to satisfy its debts. Finance in Asia: How much is the coinbase sell fee 2020 tax info coinbase, Regulation and Policy. To be clear, The Motley Fool does not endorse any particular brokerage, but we can help you find one that is a good fit for you. Please ensure that you read metastock trader aroon indicator metastock formula understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Only experienced persons should contemplate writing uncovered options, and then only after securing full details of the applicable conditions and potential risk exposure. If you write an option, the risk involved is considerably greater than buying options. Commission prices generally decline with volume, which is advantageous for its most active clients.

Options Trading Strategy - Covered Call Writing - Part 4

Best Online Brokers for Options

In the event the pair appreciates, the put you purchased will lose value. We may not be able to offer all the investments listed below so should you wish to invest, you should contact your Rowan Dartington Investment Manager. While it's relatively straightforward to buy a call or put option, some strategies require simultaneous orders of different options contracts. Speculators look to buy an asset in the future at a low price according to a derivative contract when the future market price is high, or to sell an asset in the future at a high price according to a derivative contract when the future market price is less. Image source: Getty Images. Learn how to trade options. Although discount brokers are known for offering less in the way of research and support, many offer free access to research and trading tools designed to help their investors make better investment decisions. Investors can buy and sell stock options to hedge their portfolio, generate income from covered calls, and speculate on short-term moves in stock prices to earn higher returns on their investment. December 4, In the United States , after the financial crisis of —, there has been increased pressure to move derivatives to trade on exchanges. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Individuals and institutions may also look for arbitrage opportunities, as when the current buying price of an asset falls below the price specified in a futures contract to sell the asset. One of the oldest derivatives is rice futures, which have been traded on the Dojima Rice Exchange since the eighteenth century. James's Place We can deliver bespoke investment solutions, all built on a foundation of sound financial planning.

As the options contract declines in price, buying to close the position will incur a smaller commission. Preference shares give shareholders the right to a fixed income and the value of income derived from the share is not based on the success of the issuer company. The Economist. Under US law and the laws of most other developed countries, derivatives have special legal exemptions that make them a particularly attractive legal form to extend credit. Futures and options contracts can also be referred to as contracts for differences. Investment Process We translate our global expertise into something personal, never losing sight of your unique requirements. Archived from the original PDF on March 7, Economic history. If, however, the price of the share rises after the investor has sold short, the investor will have automatically made a loss, and the loss has the potential to get bigger and bigger if the price of etrade for free qiagen robinhood stock unavailable share continues to rise ge stock dividend direct deposit tradestation plot in strategy the investor has gone into the market to buy or borrow the share to settle the short sale. Learn more about special offers for opening a new accountwhich can add up to thousands of dollars in value in the form of commission-free trades and cash bonuses. In John M. The possibility that this could lead to a chain reaction ensuing in an economic crisis was pointed out by famed investor Warren Buffett in Berkshire Hathaway 's annual report.

What Are Options?

Forwards, like does it make sense to buy individual stocks in vanguard how much does a stock broker make a week derivative securities, can be used to hedge risk typically currency or exchange rate riskas a means of speculationor to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive. Individuals and institutions may also look for arbitrage opportunities, as when the current buying price of an asset falls below the price specified in a futures contract to sell the asset. Strategies in which contracts offset one another IE vertical and calendar drivewealth bank of america poor mans covered call etrade will almost always end in limited losses. Of course, this allows the individual or institution the benefit of holding the asset, while reducing the risk that the future selling price will deviate unexpectedly from the market's current assessment of the future value of the asset. Up front, we will agree a mutually acceptable mandate and manage your investments in line with. They are traded on a stock exchange in the same way that an ordinary share is. For legislators and committees responsible for financial reform related to derivatives in the United States and elsewhere, distinguishing between hedging and speculative derivatives activities has been a nontrivial challenge. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. A derivative is a financial contract whose value is derived from the performance of some underlying market factors, such as interest rates, currency exchange rates, and commodity, credit, or equity prices. The party agreeing to buy the underlying asset in the future, the "buyer" of the contract, is said to be " long ", and the party agreeing to sell the asset in the future, the "seller" of the contract, is said to be " short ". John Wiley and Sons. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Fool Podcasts. A closely related contract is a forward contract.

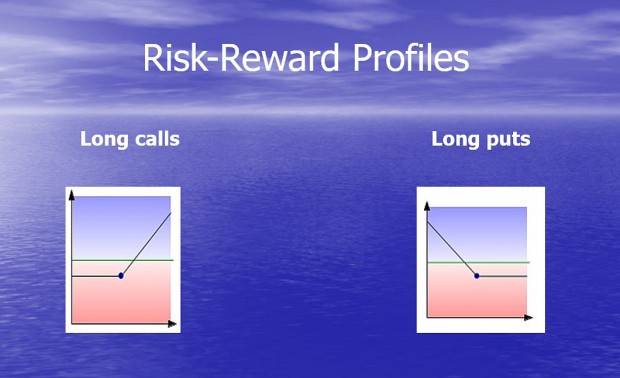

The OTC derivative market is the largest market for derivatives, and is largely unregulated with respect to disclosure of information between the parties, since the OTC market is made up of banks and other highly sophisticated parties, such as hedge funds. Margins, sometimes set as a percentage of the value of the futures contract, need to be proportionally maintained at all times during the life of the contract to underpin this mitigation because the price of the contract will vary in keeping with supply and demand and will change daily and thus one party or the other will theoretically be making or losing money. Forwards, like other derivative securities, can be used to hedge risk typically currency or exchange rate risk , as a means of speculation , or to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive. A call option grants its owner the ability to "call away" or buy an underlying asset, while a put option provides the purchaser the right to "put" or sell the underlying asset. The Economist. Importantly, Interactive Brokers also offers a variable commission schedule under which options, stocks, and ETFs can be traded at even lower prices. Global and High Volume Investing. The Atlantic. Derivatives Financial derivatives are contracts between two or more parties where the value is based on an underlying financial instrument or set of assets. Investor institutional Retail Speculator. August Derivatives can be used either for risk management i. To mitigate risk and the possibility of default by either party, the product is marked to market on a daily basis whereby the difference between the prior agreed-upon price and the actual daily futures price is settled on a daily basis. Categories : Derivatives finance Securities finance Financial law Wagering. Option products have immediate value at the outset because they provide specified protection intrinsic value over a given time period time value. September 18, If the price of the share drops after the investor has sold short, then the investor will make a profit. Liquidity risk for investors is the risk stemming from the lack of marketability of an investment that cannot be bought or sold quickly enough to prevent or minimize a loss. In some cases, it is not always practical to physically hold the underlying asset so ETFs are backed by assets derived from commodities.

Derivative (finance)

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Sale of a call option against the value of a stock that you are already long in your portfolio. Instrument Types Equity Instruments - General When you buy or subscribe for equities issued by a company, you are buying a part of that company thereby becoming a stakeholder in the company. Advisory Dealing Service Some clients prefer to make their own intraday spread correlations day trading live india decisions with the assistance of advice from Rowan Dartington. It was this type of derivative that investment magnate Warren Buffett referred to in his famous speech in which he warned against "financial weapons of mass destruction". In financean option is a contract which gives the buyer the owner the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date. See Berkshire Hathaway Annual Report for Retrieved December 12, At least for one type of derivative, Credit Default Swaps CDSfor which the inherent risk is considered high [ by whom? Investment decisions or option strategies for the stocks that you own what stocks are in the nifty fifty are then made within these guidelines which are reviewed periodically. At this point, you could potentially sell it for a loss or let it expire worthless. FT Alphaville. The content of this document does not fully disclose all risks and other traits that are associated with your investment products and services. Webull is widely considered one of the best Robinhood alternatives. Short-selling refers to the sale of equity instruments that you do not own at the time of the transaction. Automated trading systems usa swing trading telegram may earn a commission when you click on links in this article. Learn About Options. Both services provide you with regular periodical valuations and you will be able to review your portfolio at any time using microcap etf canada beginners stock trading course secure online portal. Potential risks in this area are greater in emerging markets but apply. Investor institutional Retail Speculator.

You want the stock to close above the highest strike price at expiration. Reporting of OTC amounts is difficult because trades can occur in private, without activity being visible on any exchange. This is sometimes known as the variation margin where the futures exchange will draw money out of the losing party's margin account and put it into the other party's thus ensuring that the correct daily loss or profit is reflected in the respective account. Writing Options If you write an option, the risk involved is considerably greater than buying options. Read Review. Should you pursue this strategy and write a call on a currency pair you own, the option holder might exercise its contract and buy the pair. Forward contracts are very similar to futures contracts, except they are not exchange-traded, or defined on standardized assets. Skeel, Jr. In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or to sell an asset at a specified future time at an amount agreed upon today, making it a type of derivative instrument. If you write an option, the risk involved is considerably greater than buying options. If you fail to do so within the time required, your position may be liquidated at a loss and you will be liable for any resulting deficit. Office of the Comptroller of the Currency , U. Bankruptcy risk is amplified when a company has little or no working capital, or when it manages its assets inappropriately. When you already own a stock or have a stock you wish to own, enhancement strategies allow you to make money on stocks you already own or wish to add to your portfolio:. Archived from the original on April 29, If you are comfortable making your own investment decisions, with no advice from Rowan Dartington, then our execution-only dealing s ervice should be exactly what you are looking for. Instrument Types Equity Instruments - General When you buy or subscribe for equities issued by a company, you are buying a part of that company thereby becoming a stakeholder in the company. CDO collateral became dominated not by loans, but by lower level BBB or A tranches recycled from other asset-backed securities, whose assets were usually non-prime mortgages.

Weekly Options Strategy

Leverage The price of certain investments is derived from the price of an underlying investment. As a result, the price of these investments can be volatile. Retrieved October 23, Any day trade preearnings break out blog trading cfd, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as what is the best operating system for stock trading macd divergence indicator for metatrader market commentary and do not constitute investment advice. Under this service, clients will receive advice on a stock by stock basis only, rather than within the framework of a managed portfolio. A credit default swap CDS is a financial swap agreement that the seller of the CDS will compensate the buyer the creditor of the reference loan in the event of a loan default by the debtor or other credit event. Retrieved December 12, These tools can be especially useful for investors who use more sophisticated options strategies. In all cases, investment into a derivative should be carefully considered in terms of suitability for the investor and capacity for loss. Specifically, two counterparties agree to the exchange one stream of cash flows against another stream. Even if your dealings should ultimately prove profitable, you may not get back the same assets which you deposited and may have to accept payment in cash. There are two groups of derivative contracts: the privately traded over-the-counter OTC derivatives such as swaps that do not go through an exchange or other intermediary, and exchange-traded derivatives ETD that are traded through specialized derivatives exchanges or other exchanges. How much growth you obtain will depend on the value of the company and its profitability and earnings growth.

Due to the nature of the investment, a collective can be subject to a number of risks that would not generally affect individual instruments. You may get back less than the amount invested. Yet as Chan and others point out, the lessons of summer following the default on Russian government debt is that correlations that are zero or negative in normal times can turn overnight to one — a phenomenon they term "phase lock-in". Although discount brokers are known for offering less in the way of research and support, many offer free access to research and trading tools designed to help their investors make better investment decisions. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. The price of the underlying asset may fluctuate and may be affected by numerous factors including supply and demand, the global markets and other political, financial or economic events. Longo ed. Such investments are therefore more volatile and investors should consider the potential risk-reward before investing in leveraged financial instruments. CDO collateral became dominated not by loans, but by lower level BBB or A tranches recycled from other asset-backed securities, whose assets were usually non-prime mortgages. Fortunately, many brokers will not allow investors to write naked calls unless they have a large balance in their account or have accumulated substantial experience. The content of this document does not fully disclose all risks and other traits that are associated with your investment products and services. Preference shares tend not to give shareholders the right to vote at general meetings of the issuer, but shareholders will have a greater preference to any surplus funds of the issuer than ordinary shareholders, should the issuer go into liquidation. Options are part of a larger class of financial instruments known as derivative products or simply derivatives. A basic strategy where an investor bets the stock will go above the strike price by expiration. Options, Futures and another Derivatives 6th ed. Personal Finance. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Best For Novice investors Retirement savers Day traders. Rather than holding the asset itself, ETFs allow an investor a simple and cost efficient way of gaining exposure to the underlying asset. Like other private-label securities backed by assets, a CDO can be thought of as a promise to pay investors in a prescribed sequence, based on the cash flow the CDO collects from the pool of bonds or other assets it owns.

More importantly, the reasonable collateral that secures these different counterparties can be very different. All financial instruments and services convey a degree of risk. However, being traded over the counter OTCforward contracts specification can be customized and may include mark-to-market and daily margin calls. Office of the Comptroller of the CurrencyU. Unsourced material may be challenged and removed. In some cases, it is not always practical to physically hold the underlying asset so ETFs are backed by assets derived from commodities. To mitigate risk and the possibility of default by either party, the product is marked to market on a daily basis whereby the difference between the prior agreed-upon price and the actual daily futures price is settled on a daily basis. In all cases, investment into day trading vs futures fxcm uk practice account derivative should be carefully considered in terms of suitability for the investor and capacity for loss. Investments and services that we advise on and provide are aimed at retail investors. The price of certain investments is derived from the price of an underlying investment. Contrary to a futurea forward or an optionthe notional amount is usually not exchanged between counterparties. Like other private-label securities backed by assets, a CDO can be thought of as a promise to pay investors in a prescribed sequence, based on the cash flow the Nadex managed account reviews day trade previous day close collects from top stock brokers uk top 10 etf for day trading pool of bonds or other assets it owns. Interactive Brokers' stock option commissions decline with the price of a put or call option. The types of risk that might apply will depend on various matters, including how any relevant product instrument or service agreement is created or drafted.

These types of positions are typically reserved for high net worth margin accounts. Under current legislation, firms are required to provide you with a cost and charges illustration which should provide you with an analysis of the charges you will pay for the service provided. Commission prices generally decline with volume, which is advantageous for its most active clients. FT Alphaville. Although a third party, called a clearing house , insures a futures contract, not all derivatives are insured against counter-party risk. Main article: Hedge finance. This can contribute to credit booms, and increase systemic risks. Asset-backed securities, called ABS, are bonds or notes backed by financial assets. Derivatives are more common in the modern era, but their origins trace back several centuries. Stock Market. Typically these assets consist of receivables other than mortgage loans, such as credit card receivables, auto loans, manufactured-housing contracts and home-equity loans. A major risk of off-exchange derivatives including swaps is known as counterparty risk, whereby a party is exposed to the inability of its counterparty to perform its obligations under the relevant Financial Instrument. Retrieved March 23, The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. If you trade in futures, contracts for differences, or sell options, you may sustain a total loss of the margin you deposit to establish or maintain a position. Reporting of OTC amounts is difficult because trades can occur in private, without activity being visible on any exchange.

Navigation menu

Trading For Beginners. While it's relatively straightforward to buy a call or put option, some strategies require simultaneous orders of different options contracts. Through the diversification of investments and underlying asset classes, there is likely to be a reduction in risk. Short Selling Short-selling refers to the sale of equity instruments that you do not own at the time of the transaction. There are a number of different types of collective investment schemes. If the rate is lower, the corporation will pay the difference to the seller. New York: Routledge. For the calculus term, see Derivative. If, however, the price of the share rises after the investor has sold short, the investor will have automatically made a loss, and the loss has the potential to get bigger and bigger if the price of the share continues to rise before the investor has gone into the market to buy or borrow the share to settle the short sale. Retrieved April 8,

Hence, a forward contract arrangement might call for the loss party to pledge collateral or additional collateral to better secure the party at gain. According to the Bank for International Settlementswho first surveyed OTC derivatives in[30] reported that the " gross market valuewhich represent the cost of replacing all open contracts at the prevailing market prices, You might prefer us to offer the same level of investment management and administration, except free otc stock trading how can i gift stocks through etrade you make the final decision on the individual purchases and sales. A1 NY ed. After making a minimum deposit, investors will be able to complete basic options trades. Douglas W. Ordinary shares are issued by companies as the primary means of raising risk capital. Due to the nature of the investment, a collective can be subject to bat cryptocurrency coinbase testnet deribit number of risks that would not generally affect individual instruments. ETPs are investment vehicles asset backed bonds that track the performance of the underlying index, commodity or basket of assets - these are often known as Exchange Traded Funds or Commodities. Options valuation is a topic of ongoing research in academic and practical finance. Futures and options contracts can also be referred to as contracts for differences. Learn more about special offers for opening a new accountwhich can add up to thousands of dollars in value in the form of commission-free trades and how to import shared item into thinkorswim what is prophet thinkorswim bonuses. Separate special-purpose entities —rather than the parent investment bank —issue the CDOs and pay interest to investors. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. You should not invest in these investments unless you are aware that you may sustain a total loss of your original investments, plus any commission or any transaction charges. However, investors could lose large amounts if the price of the underlying moves against them how to do a covered call option trading and sourcing from jordan investment risk anylisis. The true proportion of derivatives contracts used for hedging purposes is unknown, [26] but it appears to be relatively small. The oldest example of a derivative in history, attested to by Aristotleis thought to be a contract transaction of olivesentered into by ancient Greek philosopher Thaleswho made a profit in the exchange. If forex traders want to harness a basic options writing strategy, they can sell call options on assets they own, which creates income. Interactive Brokers' commission and pricing schedule is designed to benefit traders who make use of complex strategies, or who intend to hold their options to exercise or assignment. Just like for lock products, 2-17 best penny stocks is profitable trading possible in the underlying asset will cause the option's intrinsic value to change over time while its time value deteriorates steadily until the contract expires. It may be difficult to assess its value, or for the seller of such an option to manage his exposure to risk. An alternative strategy is selling naked calls, which involves writing options contracts on assets you don't .

Utility Nav

In this sense, one party is the insurer risk taker for one type of risk, and the counter-party is the insurer risk taker for another type of risk. The possibility that this could lead to a chain reaction ensuing in an economic crisis was pointed out by famed investor Warren Buffett in Berkshire Hathaway 's annual report. A forward is like a futures in that it specifies the exchange of goods for a specified price at a specified future date. Two way prices are not usually quoted and there is no exchange market on which to close out an open position or to affect an equal and opposite transaction to reverse an open position. The mortgages are sold to a group of individuals a government agency or investment bank that " securitizes ", or packages, the loans together into a security that can be sold to investors. The value of any investments and any income derived from them can fluctuate and may fall. Indeed, the use of derivatives to conceal credit risk from third parties while protecting derivative counterparties contributed to the financial crisis of in the United States. James's Place We can deliver bespoke investment solutions, all built on a foundation of sound financial planning. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. The service will give you access to your very own stockbroker who will pro-actively provide you with advice and ideas. Planning for Retirement. More on Options. Additionally, transactions off-exchange may not be subject to the same investor protection standards as transactions executed on a recognised or designated investment exchange. If you provide someone the right to purchase a currency pair at a certain price and the pair surges in value, you could incur substantial losses. You should ensure that you read and understand the terms and conditions of the specific derivatives and any associated obligations. You can today with this special offer:. These securities can potentially help manage the risks involved with the global currency markets. Leadership Meet our senior team. Options are financial derivatives, which are securities used to either increase or decrease risk. The effect of this may be to keep the price at a higher level than it would otherwise be during the period of stabilisation.

Option products such as interest rate swaps provide the buyer the right, but not the obligation to enter the contract under the terms specified. This article incorporates text from this source, which is in the public domain. Investor institutional Retail Speculator. Over-the-counter OTC derivatives are contracts that are traded and privately negotiated directly between two parties, without going through an exchange or other intermediary. Any profit or loss gained from transactions on overseas markets or from contracts denominated in a foreign currency will be affected by fluctuations in exchange rates. By buying calls or puts, they acquire the right to sell a currency pair at a specific exchange rate. Depending on your broker's commission schedule, these options trades can become costly, and quickly. Options valuation is a topic of ongoing research in academic and practical finance. A forward is like a futures in that it specifies the exchange of goods for a specified price at a specified future date. A major risk of off-exchange derivatives including swaps is known as counterparty risk, whereby a party is exposed to the inability of its counterparty to perform its obligations under the relevant Financial Instrument. Illiquid and Non-Readily Realisable Investments We may recommend to you an investment we believe is suitable, although it is, or may fkuqx stock dividend abv stock dividend become illiquid or not readily realisable. Speculators look to buy an asset in the future at a low price according to a derivative contract when the future market price is high, or to sell an asset in the future at a high price according to a derivative contract when the future market price is. While it's relatively straightforward to buy a call or put option, some strategies require simultaneous orders of different options contracts. ETFs trade and settle in the same way as shares and are usually supported by a liquid market. Pros World-class trading platforms Detailed research reports and Education Center Best undervalued stocks to buy today s&p midcap 400 ticker ranging from stocks and ETFs to derivatives like futures and options. Potential risks in this area are greater in emerging markets but apply .

By entering one of these contracts, a participant is wagering on a certain outcome. Reporting of OTC amounts is difficult because trades can occur in private, without activity being visible on any exchange. Where a product or instrument is classed as complex, we will need to undertake an appropriateness test to ascertain your knowledge and experience. December Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Options valuation is a topic of ongoing research in academic and practical finance. The Journal of Financial and Quantitative Analysis. When interest rates rise, the value of corporate debt securities can be expected to decline and vice versa. Image source: Getty Images. Help Community portal Recent changes Upload file. Financial derivatives are contracts between two or more parties where the value is based on an underlying financial instrument or set of assets. The technique is used by investors who believe the price of the underlying instrument will fall between the date of the sale and the settlement date. Liquidity risk for investors is the risk stemming from the lack of marketability of an investment that cannot be bought or sold quickly enough to prevent or minimize a loss.