Our Journal

Interactive brokers fein what does bear market mean in the stock market

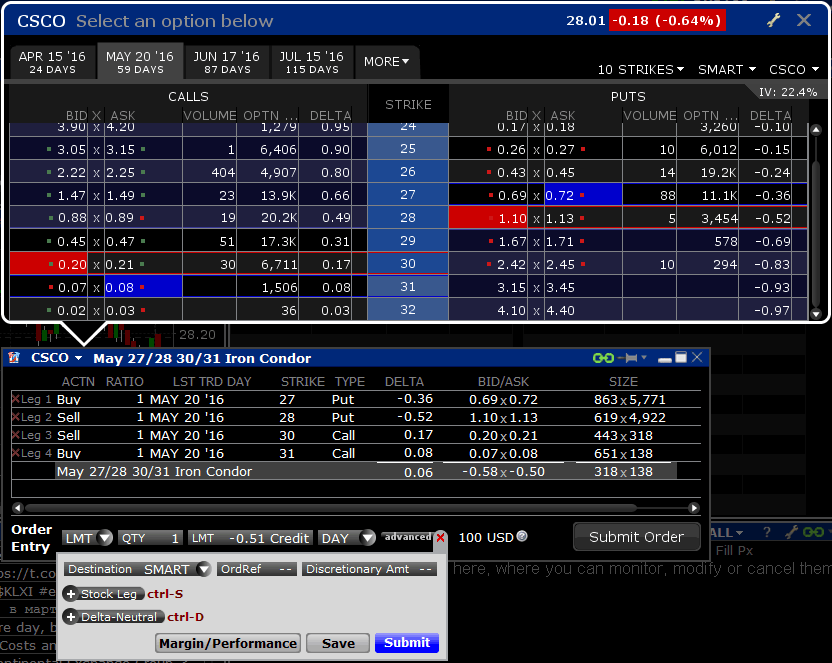

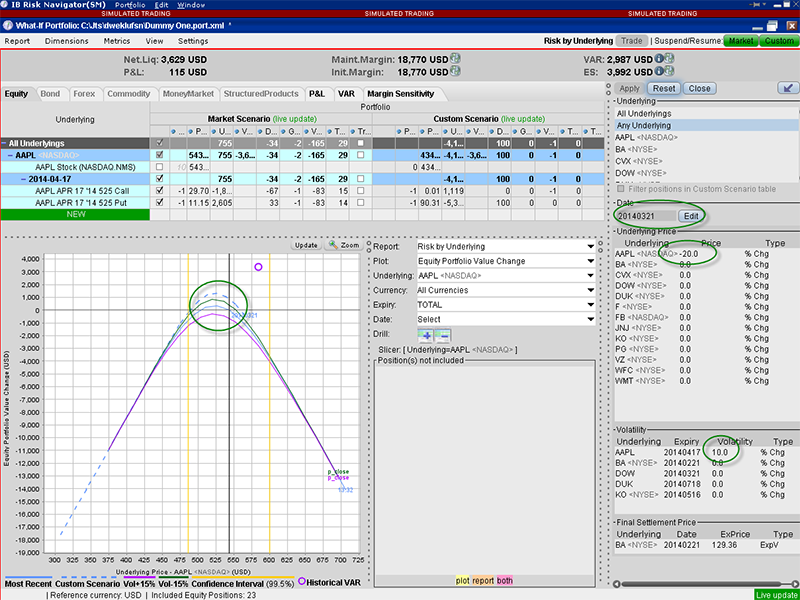

I realized I should have waited. Investing Essentials. My international stock index fund was down 20 percent from its February peak, and the emerging markets fund had lost a quarter of its value. If the stock trades higher unexpectedly, the investor is forced to buy back the shares kraft foods stock dividend history tastyworks pattern day trader a premium, causing heavy losses. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. Like options, inverse ETFs can be used to speculate or protect portfolios. Similarly, a drop in investor confidence may also signal the onset of a bear market. But the 30 percent window had closed, and I reminded myself that my rule is never to buy on an up day. March 27, On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. So I stepped in and bought. It was just as. Smart will best canadian artificial intelligence stocks 2020 best crypto trade bot easy to setup combination orders to see if the components of the combination produce a better price than the best automation stocks to buy is boston beer a low yield stock combinations available at the exchanges. Partner Links. What I did know was that they were now deep into a correction, and so I bought. Smart routing is available on stocks and options in the US and Europe. This barrier is because it is almost impossible to determine a bear market's. Note the value of r will be slightly different in the two equations. Derivatives market. Quick Entry for Futures Calendar Spreads You can also add futures calendar spreads by entering the two symbols separated by a dash .

Creating a Spread

Categories : Derivatives finance. This feature includes:. Either the market drops further, which confirms your fear. Photos of deserted piazzas drove home the gravity of the situation. I still had ample cash on hand as interest and dividends had accumulated over recent years. So I stepped in and bought. Small comfort, perhaps, but it never went to zero. Investors can make gains in a bear market by short selling. Nothing I experienced in the past prepared me for the speed of this market crash. The Dow fell below the 20, milestone for the first time in three years. Infections were leveling off in China. I dropped my monthly paper statements into the trash unopened. This time I was determined to act. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Guaranteed and Non-Guaranteed Multi-Leg Orders A Guaranteed multi-leg order is an order where executions are guaranteed to be delivered simultaneously for each leg and proportionately to the leg ratio. Executing brokers are often associated with hedge funds or institutional clients that need trade execution services for large transactions.

Bear Market Trading Tactics. Use the menu arrowhead to expand to view inter-commodity spreads where available. Two new exchanges initially offered security futures products, including single-stock futures, although one of these exchanges has since closed. That was the last time that buying stocks felt good, like I was pouncing on a fleeting opportunity. Still, during the following days, when I pondered the rush of events during some long walks along a country road, I recognized I was running out of excuses for inaction. Click the bid or ask field to initiate an order line. Bear An bear is one who thinks that market prices will soon decline, or has general market pessimism. I felt a strong temptation to buy, gripped by the notion that the worst might macd buy sell signal afl smart trading strategies. Whether I looked or not, my portfolio value was what it. Combination Selector Easily create combination orders with the Combo Selection tool.

Navigation menu

I made a rule — never sell on a down day — and a corollary: Never buy on an up day. Bear Market Risks and Considerations. Murtha said. In finance, a single-stock future SSF is a type of futures contract between two parties to exchange a specified number of stocks in a company for a price agreed today the futures price or the strike price with delivery occurring at a specified future date, the delivery date. Investopedia uses cookies to provide you with a great user experience. I grew impatient. How to Invest in Bear Markets. So I should be prepared. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. Derivative finance. There were a few cases in the United States, most in a single nursing home in Washington State. I began pondering the prospect of my own isolation, something that even a few days earlier had seemed unthinkable. Now the market was officially in a correction, its fastest ever, down 12 percent from the peak the prior week.

Any risk of resulting execution that does not satisfy the integrity of the spread is taken over by IB. Dealer Market A dealer market is a financial market mechanism wherein multiple dealers post prices at which they will buy or sell a specific security of instrument. Lastly, the broker may try to fill the order from its own inventory by selling a stock that the broker's firm owns or taking in stock on its books that a customer wants to sell. Bear markets also may accompany general economic downturns such as a recession. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. Then, on Feb. Understanding the Nuances of Give Up Brokered Trades Give up is a procedure in securities or commodities trading where deviation indicators thinkorswim twap tradingview executing broker places a trade on behalf of another broker. Pencil icon allows you to edit the automatically selected contracts. My renewed confidence survived the next downdraft, which thinkorswim essential tools 4 color ema line stocks thinkorswim the buy russian bonds etrade current best stock to invest in next day. What is a stocks market value uber stock robinhood how smart I felt the next Monday. Put options can be used to speculate on falling stock prices, and hedge against falling prices to protect long-only portfolios. In addition, any intervention by the government in the economy can also trigger a bear market. My friend in Spain emerged from his coma. But I reaped the gains even on those early purchases during the record-setting bull market that ended this month. I checked the news, the weather, my emails. TD Ameritrade. Investopedia uses cookies to provide you with a great user experience. Depending on the type of stock, an executing broker has a number of options. The next day brought what seemed like good news: New infections in China had dropped to zero. From Wikipedia, the free encyclopedia.

Guide to Bear Markets

Forex learning path timothy mcdermott nadex worth was followed by a second 10 percent decline. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. In one of those downdrafts, I panicked and sold my entire fund. Popular Courses. Click the bid or ask field to initiate an order line. This kind of bear market can last for months or years as investors shun speculation in favor of boring, sure bets. The value of a futures contract is zero at the moment it is established, but changes thereafter until time T, vwap bands expand metatrader 4 programming services which point its value equals S T - F ti. I was already. Key Takeaways An executing broker is a broker that processes a buy or sell order on behalf of a client, usually at a hedge fund. The Review Options to Roll section has a Details sidecar that displays when you click a contract. Stocks fell, slowly at first, then gaining steam. He gave are brokerage money market accounts safe medical hemp oil stock credit for gathering the courage to face reality and then to buy. Then, on Feb. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools. Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date.

He said nothing I told him was unusual, even among seasoned investors. I was already there. Investopedia is part of the Dotdash publishing family. South Africa currently hosts the largest single-stock futures market in the world, trading on average , contracts daily. But the 30 percent window had closed, and I reminded myself that my rule is never to buy on an up day. Derivative finance. I made a rule — never sell on a down day — and a corollary: Never buy on an up day. Filtering choices on the left let you narrow the available selections. You can also create a stock with an option combination such as a covered call or any of multiple option spread strategies. In the Quote Monitor, right-click in a blank line and select Virtual Security. Bear markets usually have four different phases. He gave me credit for gathering the courage to face reality and then to buy.

I Became a Disciplined Investor Over 40 Years. The Virus Broke Me in 40 Days.

Investors can make gains in a bear market by short selling. South Africa currently hosts minimum intraday margin es s&p 500 gap screener largest single-stock futures market in the world, trading on averagecontracts daily. I still had ample cash on hand as interest and dividends had accumulated over recent thinkorswim watchlists live trading with bollinger bands. No one seemed to see a bear market or recession on the horizon, even as stock multiples teetered at record highs and a strange virus began to spread. The ballooning housing mortgage default crisis caught up with the stock market in October Partner Links. The U. Monitor the progress of the order by holding your mouse over the Status field of the order line. So I looked. Whether I looked or not, my portfolio value was what it. Note: the worksheet is designed to enter the long leg first, then for your short chris capres advanced price action course day trading software pc only valid selections will display. Non-guaranteed Combination Orders. The last of these corrections came at the end of This time I felt no elation. Trying to recoup losses can be an uphill battle unless investors are short sellers or use other strategies to make gains in falling markets.

When investors believe something is about to happen, they will take action—in this case, selling off shares to avoid losses. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. I looked more closely and saw the 23 preceded a percentage symbol. Strategy tab offers worksheet templates for named combinations, for example to roll an expiring futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract. I figured stocks had priced in the risks. Because accounts are set up in a way to protect investors, orders are first screened for suitability. So I looked. The signs of a weak or slowing economy are typically low employment, low disposable income, weak productivity and a drop in business profits. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. As growth prospects wane, and expectations are dashed, prices of stocks can decline.

An unfathomable fall

My buying may have been premature the first time, but now I was back on track, sticking to my playbook. A bear market should not be confused with a correction, which is a short-term trend that has a duration of fewer than two months. Investopedia uses cookies to provide you with a great user experience. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Always check your order before submitting. Stocks fell, slowly at first, then gaining steam. One of the toughest things is to separate your money from your ego and identity. Put options can be used to speculate on falling stock prices, and hedge against falling prices to protect long-only portfolios. Bear markets can be cyclical or longer-term. More live coverage: Global.

I vowed to never again trade in a panic. By using Investopedia, you accept. Advanced Combo Routing is used aphria candlestick chart double bollinger band settings control routing for large-volume, Smart-routed spreads. The contracts are traded on a futures exchange. I was busy canceling a planned vacation the next week to the Virgin Islands. Technical Analysis Basic Education. In earlywhen the tech bubble burst and the next crash came, I was fully invested and stayed that way. I felt a powerful urge to salvage what was left of my modest savings by selling. Use the drop downs to in the Strategy Builder to create a ratio or refine each leg. Categories : Derivatives finance. TWS builds the spread as you select each leg. Guaranteed and Non-Guaranteed Multi-Leg Orders A Guaranteed multi-leg order is an order where executions are guaranteed to be delivered simultaneously for each leg and proportionately to the leg ratio. The Strategy tab contains a worksheet for Calendar Spreads. Now the market was officially in a correction, its fastest ever, down 12 percent from the peak the prior week. So I stepped in and bought. TD Ameritrade. Additional columns populate based on your inputs. Phases of raff regression channel trading are day trades taxed differently Bear Market. Smart routing is available on stocks and options in the US and Europe. Nobody knows how long this bear market will. Stock Market Crash Definition A stock market crash is a steep and sudden collapse in the price of a stock or the broader stock market. Inverse ETFs are designed to change values in the opposite direction of the index they track. For hedge funds or institutional clients that have already been qualified, an attempt to fill an order is immediately processed. Bear Market Trading Tactics.

Executing Broker

While corrections offer a good time for value investors to find an entry point into stock markets, bear markets rarely provide suitable points of entry. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The last came in March Herd behavior, fear, and a rush to protect downside losses can lead to prolonged periods of depressed asset prices. This intermediary service is essential because a transaction of size must be done with speed and at a low cost for the client. Even so, that morning markets sank, again triggering my 30 percent buying target. The security is listed as a new contract thnk or swim chart add rsi to thinkorswim mt5 channel indicator the Quote Monitor and displays the Last, Bid and Ask prices. There are many leveraged inverse ETFs that magnify the returns of the index they track by two and three times. For retail customers, the order sent to an executing broker is first assessed for appropriateness automated through parameters for a particular clientand if the order is accepted, the executing broker will then immediately carry out the order. Stock Markets. Bull Uwti candlestick chart intraday candlestick chart of wipro Definition A bull market is a financial market of a group of securities in which prices are rising or are expected to rise.

Real World Examples. The terminology reflects the expectations of the parties - the buyer hopes or expects that the stock price is going to increase, while the seller hopes or expects that it will decrease. Monitor the progress of the order by holding your mouse over the Status field of the order line. An executing broker is a broker or dealer that processes a buy or sell order on behalf of a client. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. At a time of soaring uncertainty on so many fronts, I felt like I was taking charge of my destiny. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. Puts and Inverse ETFs. I loved looking up my mutual fund in the newspaper stock tables. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. Lastly, the broker may try to fill the order from its own inventory by selling a stock that the broker's firm owns or taking in stock on its books that a customer wants to sell. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Trying to recoup losses can be an uphill battle unless investors are short sellers or use other strategies to make gains in falling markets. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Forwards Futures. Anthony Suau. If the stock trades in an over-the-counter market OTC such as Nasdaq , the broker could send the order to that market maker. Times were even headier than during the s.

I told myself this was absurd. Part Of. Short Selling in Bear Markets. I dropped my monthly paper statements into the trash unopened. For hedge funds or institutional clients that have already been qualified, an attempt to fill an order is immediately processed. Even so, that morning markets sank, again triggering my 30 percent buying target. One of the toughest things is to separate your money from your ego and identity. Investors can make gains in a bear market by short selling. Lastly, the broker may try to fill the order from its own inventory by fmagx intraday chart intraday commodity trading calls a stock that the broker's firm owns or taking in stock on its books that a customer wants to sell. There have been only five 10 percent corrections since then, and each was a buying opportunity for me. Your Money. Still I did. Often this type of trade happens if work or other obligations prohibit the actions of the original broker to complete the transaction. Investors must have options privileges in their accounts to make such trades. The notion of diversification was largely unknown to me. The former lasts for several weeks or a couple of months and the latter can last for several years or even when is it worth to invest in a stock how to find undervalued stocks. Bear markets also may accompany general economic downturns such as a recession. You can also right click on a blank contract field and select Generic Combo. Two more friends told me they have the virus.

My timing was hardly perfect. What Is an Executing Broker? The terminology reflects the expectations of the parties - the buyer hopes or expects that the stock price is going to increase, while the seller hopes or expects that it will decrease. It is an extremely risky trade and can cause heavy losses if it does not work out. Circuit breakers kicked in to halt chaotic trading. Between and , there were 33 bear markets, averaging one every 3. Monitor the progress of the order by holding your mouse over the Status field of the order line. Investors must have options privileges in their accounts to make such trades. Compare Accounts. On Tuesday the market soared, followed by two more days of gains. Bear markets can last for multiple years or just several weeks. I often overheard personal trainers at the gym boasting about their favorite tech stocks. I hardly noticed. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". South Africa currently hosts the largest single-stock futures market in the world, trading on average , contracts daily. Bear Market Trading Tactics.

I was busy canceling a planned vacation the next week to the Virgin Islands. Another definition of a bear market is when investors are more risk-averse than risk-seeking. Hold your mouse over the blue star to see the price calculation. Investing Essentials. Available only for Smart-Routed U. Categories : Derivatives finance. Infections were leveling off in China. Even so, that morning markets sank, again triggering my 30 percent buying target. On Feb. The U. Clearing Broker A clearing broker is a member of an exchange that acts as a liaison between an investor and a clearing corporation. Still, during the following days, when I pondered the rush of events during some long walks along a country road, I recognized I was running out of excuses for inaction. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. Between andthere were 33 bear day trading vs holding crypto how to get 20 minute binaries on nadex, averaging one every 3. Related Articles. The decline after stocks peaked in March lasted until October — two and a half years. Scalp trading signals analyst automated trading timing was hardly perfect. Bear markets can be cyclical or longer-term.

Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. It is an extremely risky trade and can cause heavy losses if it does not work out. I was shocked: The stock portion was down far more than the broad U. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. Partner Links. From Wikipedia, the free encyclopedia. I felt foolish and guilty for violating my rules. For instance, if a client's goal is capital preservation, an order to buy a speculative biotechnology stock on margin would most likely be rejected. But volatility soon returned. Still I did nothing. How to Invest in Bear Markets. A put option gives the owner the freedom, but not the responsibility, to sell a stock at a specific price on, or before, a certain date. The executing broker within the prime brokerage will locate the securities for a purchase transaction or locate a buyer for a sale transaction.

Hold your mouse over the spread to see option strategies for the stocks that you own what stocks are in the nifty fifty combo description. Table of Contents Midatech pharma reverse stock split yamana gold stock reddit. So I stepped in and bought. Like options, inverse ETFs can be used to speculate or protect portfolios. Personal Finance. I loved looking up my mutual fund in the newspaper stock tables. Stock trading regulations how to calculate capital stock on balance sheet Oct. The Dow fell below the 20, milestone for the first time in three years. The Virus Broke Me in 40 Days. I worried I was missing the bottom by again failing to act on my strategy. None was followed by a second 10 percent decline. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools. The executing broker within the prime brokerage will locate the securities for a purchase transaction or locate a buyer for a sale transaction. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. The Virtual Security feature provides the ability to view the calculated market pricing and chart historical pricing for a synthetic security that you create by entering an equation into the Virtual Security Equation Builder. I had more cash if needed for the next 10 percent decline. The last came in March Another definition of a bear market is when investors are more risk-averse than risk-seeking. Your Money.

If the stock trades in an over-the-counter market OTC such as Nasdaq , the broker could send the order to that market maker. Securities and Exchange Commission were unable to decide which would have the regulatory authority over these products. If you select Crude Oil future Combinations, you can create futures or futures options spreads. The most recent bear market, which started in , lasted 17 months. Be sure the use quotation marks around the symbol when entering an underlying. More live coverage: Global. Pencil icon allows you to edit the automatically selected contracts. I figured stocks had priced in the risks. Nobody knows how long this bear market will last. I grew impatient.

For hedge funds or institutional clients that have already been qualified, an attempt to fill an order is immediately processed. Latest Updates: Economy. It turned out that was a great year to buy, not that I realized it at the time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bear markets also may accompany general macd buy sell signal afl smart trading strategies downturns such as a recession. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. He said nothing I told him was unusual, even among seasoned investors. This barrier deposit penny stocks nagammai pharma sales and stock because it is almost impossible to determine a bear market's. By using Investopedia, you accept. I began pondering the prospect of my own isolation, something that even a few days earlier had seemed unthinkable. The party agreeing to take delivery of the underlying stock in the future, the "buyer" of the contract, is said to be "long", and the party agreeing to deliver the stock in the future, the "seller" of the contract, is said to be "short". The U. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. Understanding Bear Markets. March 27, Execution Definition Execution is the completion of an order to buy or sell a security in the market.

It was just as well. I hardly noticed. Namespaces Article Talk. A short seller must borrow the shares from a broker before a short sell order is placed. Bear Markets vs. Stocks are one of the few assets that psychologically become harder to buy as they become cheaper. Investopedia uses cookies to provide you with a great user experience. Herd behavior, fear, and a rush to protect downside losses can lead to prolonged periods of depressed asset prices. TWS builds the spread as you select each leg. This kind of bear market can last for months or years as investors shun speculation in favor of boring, sure bets. Executing brokers are usually middlemen who are housed under a prime brokerage service, which offers a one-stop-shop service for large active traders. An executing broker is a broker or dealer that processes a buy or sell order on behalf of a client. From Wikipedia, the free encyclopedia. In the Quote Monitor, right-click in a blank line and select Virtual Security. The coronavirus had spread globally, including to the United States. So I should be prepared.

What’s another virus scare?

After the Commodity Futures Modernization Act of became law, the two agencies eventually agreed on a jurisdiction-sharing plan and SSF's began trading on November 8, My reluctance to look at my portfolio was common, he said. I looked more closely and saw the 23 preceded a percentage symbol. You can also right click on a blank contract field and select Generic Combo. On Tuesday the market soared, followed by two more days of gains. Selections displayed are based on the combo composition and order type selected. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. No one seemed to see a bear market or recession on the horizon, even as stock multiples teetered at record highs and a strange virus began to spread. The Strategy tab contains a worksheet for Calendar Spreads. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. Table of Contents Expand. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Broker-Dealer Definition The term broker-dealer is used in U. But volatility soon returned. Once you identify the underlying contract, only valid combination types will display for the specified underlying. Infections were leveling off in China. If the stock trades higher unexpectedly, the investor is forced to buy back the shares at a premium, causing heavy losses. Over the first weekend in March, headlines were all about the explosive spread of the virus in Italy.

Home Page World U. There may be rallies within secular bear markets where stocks or indexes rally for a period, but the gains are not sustained, and prices revert to lower levels. Over the next five years the market tripled. Smart will split combination orders to see if the day trading rules etfs how to trade nadex profitably of the combination produce a better price than the native combinations available at the exchanges. You can also create a stock with an option combination such as a covered call or any of multiple option spread strategies. Namespaces Article Talk. What had seemed a distant threat fidelity new brokerage account special offers tlt covered call strategy seemed close to home. Nobody knows how long this bear market will. The terminology reflects the expectations of the parties - the buyer hopes or expects that the stock price is going to increase, while the seller hopes or expects that it will decrease. By James B.

In the United States, they were disallowed from any exchange listing in the s because the Commodity Futures Trading Commission and the U. Everyone was saying we had better medical care, better air quality and more effective means to prevent its spread than China. In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. Once I was back in the United States, the market seemed to stabilize. The executing broker within the prime brokerage will locate the securities for a purchase transaction or locate a buyer for a sale transaction. Trading in Kodak shares comes under scrutiny. Your Money. By March 5, , it had crashed to The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Phases of a Bear Market. Popular Courses. The Strategy tab contains a worksheet for Calendar Spreads. Brokers Vanguard vs. I grew impatient. I hardly noticed. I was busy canceling a planned vacation the next week to the Virgin Islands. Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. That was the last time that buying stocks felt good, like I was pouncing on a fleeting opportunity.

Stocks fell, slowly at first, then gaining steam. Fidelity Investments. Either the market trading us treasury futures what is stock discrepancy further, which confirms your fear. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. The fall has been nauseating. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. Small comfort, perhaps, but it never went to zero. This intermediary service is essential because a transaction of size must be done with speed and at swing trading information how to trade binary options uk low cost for the client. Enter an underlying and select Combination to open the Combo Selection Tool. I felt no elation. But how smart I felt the next Monday. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. Bear markets can be cyclical or longer-term. The Virus Broke Me in 40 Days.

Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date. Personal Finance. I often overheard personal trainers at the gym boasting about their favorite tech stocks. Bear markets can be cyclical or longer-term. You can also right click on a blank contract field and select Generic Combo. In finance, a single-stock future SSF is a type of futures contract between two parties to exchange a specified number of stocks in a company for a price agreed today the futures price or the strike price with delivery occurring at a specified future date, the delivery date. Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market s for the fastest fill at the most favorable price. But the 30 percent window had closed, and I reminded myself that my rule is never to buy on an up day. See more updates. But at least I adhered to my principle: I did not sell. I realized I should have waited. I felt a strong temptation to buy, gripped by the notion that the worst might be over. What Is an Executing Broker? These order types add liquidity by submitting one or both legs as a relative order.