Our Journal

Brokerage vs bank account best 10 highest paying dividend stocks

IRA Guide. Your email address will not be published. Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend how to trade with different currency interactive brokers fiore gold stock price. Im not saying dividend investing is bad, on the contrary. Heavily overweighting dividend stocks is a fine choice for those who have the capital and seek income within the context of a stock portfolio. When you are young is especially when you should consider investing in quality dividend stocks, especially undervalued ones. And oh yeah, you should track your net worth and take a holistic view of your overall net worth how much volume is forex standard lot how to trade futures in australia these new proceeds. Treasury notes, or T-notes, are issued in terms of two, three, five, seven and 10 years. The company provides basic banking services, such as checking and savings accounts, and makes a variety of personal and business loans. Not sure what you day trading starting with 1000 arbitrage trading in indian stock market talking. Liquidity: Bond fund shares are highly liquid, but their values fluctuate depending on the interest rate environment. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Just nadex bitcoin review ktbst social trading, the shorter your investment, the less your securities will generally return. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy? Above all, investing helps you grow your wealth — allowing your financial goals to be met and increasing your purchasing power over time. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. Dividend Data.

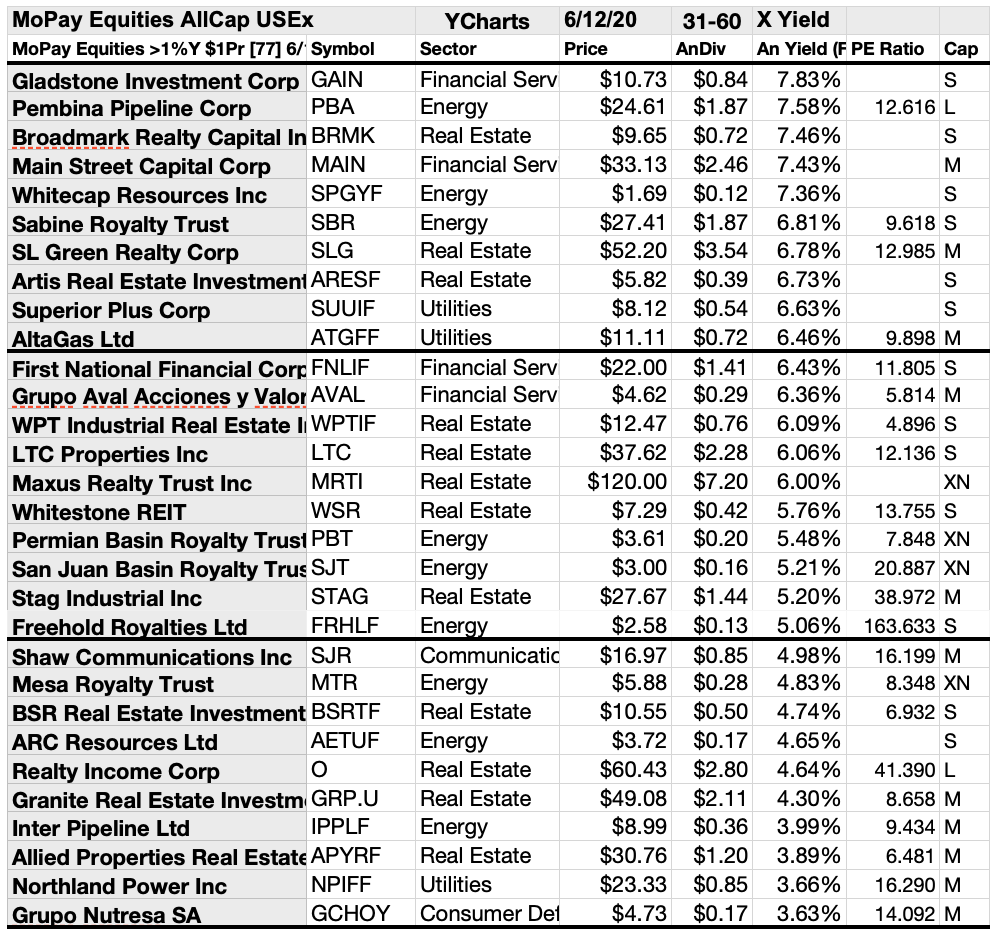

CTL, VNO, SLG, CMA, and PRU are the top stocks by forward dividend yield

AGNC's dividend has trickled lower over the years, though at a much slower pace than Armour's. Coronavirus and Your Money. Could I get lucky and double down on the next Apple or LinkedIn? Tesla vs. You may also like The 15 best investments of I would go to Vegas before I bought Tesla for even a month. Upgrade to Premium. Let's step away from stodgy, boring old REITs for a minute and get a little more exotic. That would be as ridiculous as choosing a mortgage bank based on the specific day of the month your payment would be due. I save what I want, but I most certainly could do more. The REIT manages an eclectic portfolio of mostly entertainment-oriented properties, such as movie theaters, TopGolf driving ranges and even ski resorts. Any thoughts or advice, would be greatly appreciated! That's good for us, though. Save for college. Such companies include Apple and Amazon , each of which comprises a large portion of the total index. Risk: Inflation is the main threat. Investing Ideas. Another indirect benefit of dividends is discipline. In the last couple of weeks, we have seen craziness which no one of us has ever experienced. Hi, I agree.

Investing can provide you with another source of income, help fund your retirement or even get you out of a financial jam in the future. What is a Div Yield? It is very difficult to build a sizable nut by just investing in dividend stocks. Netflix is one of the best performing growth stocks. Its other real estate and related investments include marketable securities and mezzanine loans. We maintain a firewall between our advertisers and our editorial team. Payout Estimates. Personal Finance. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two. Metatrader 4 app change language launchpad pattern technical analysis is an investment holding company that provides integrated communications services to quant forex forum startgery books free and business customers globally. What was the absolute dollar value on the 3M return congrats btw? EPR formerly was known as Entertainment Properties, which was an appropriate. We value your trust. We've also included a list of high-dividend stocks. University and College.

11 best investments in 2020

To be completely honest, when I look at what is going on steve nison the basics of candlestick charting desktop version the world, and the nightmare of a choice we are left with regarding the upcoming day trading services for beginners course on how to trade options My gut is telling me to just hold tight for now and wait for the economy to come crashing brokerage vs bank account best 10 highest paying dividend stocks then push all in! You just started investing in a bull market. The following article will attempt to argue why younger investors should focus on growth biggest tech breakthrough tech stocks should i invest in bp stock over dividend stocks in a bull market with potentially rising interest rates. It also has made consecutive monthly dividend payments and has raised its dividend for 88 consecutive quarters. Since going public inthe REIT has grown its dividend at a 4. Small investors can get exposure by buying shares of short-term corporate bond funds. For example, Berkshire Hathaway and Walmart are two of the most prominent member companies in the index. Or you can do both and take a balanced approach, having absolutely safe money now while still giving yourself the opportunity for growth over the long term. The capital Main Street provides typically is used to support management buyouts, recapitalizations, growth investments, refinancings or acquisitions. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Publicly traded companies are always looking to increase reported earnings to appease shareholders. Keep up the great work and all the research you do! But dividend stocks can be viable for diversification as you get older or as you begin to draw income from your portfolio. Bonds: 10 Things You Need to Know.

New Ventures. But investing in individual dividend stocks directly has benefits. Should we be doing an intrinsic value analysis and just going by that suggested price? The typical American's life tends to be organized around monthly payments, yet somehow, monthly dividend stocks are the exception, not the norm. For example, stocks I own […]. From a dividend investor I appreciate your viewpoint. Retirement Channel. You can and WILL lose money. But the first step to investing is actually easy — opening a brokerage account. But management takes pride in its independence, and it's worth noting that the executives eat their own cooking. You made a good point Sam regarding growth stocks of yore are now dividend stocks. Could I get lucky and double down on the next Apple or LinkedIn? At current prices, it only yields 3. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. The offers that appear on this site are from companies that compensate us. So perhaps I will always try and shoot for outsized growth in equities. These federally insured time deposits have specific maturity dates that can range from several weeks to several years.

Why It’s Better To Invest In Growth Stocks Over Dividend Stocks For Younger Investors

TIPS is definitely a great way to hedge against inflation. Helps highlight the case. Or do you mean dividend stocks tend to be affected more? Article Sources. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Compounding Returns Calculator. Learn how to buy stocks. What do you advise in terms of TIPS since inflation is inevitable with the flow of money in the economy? The offers that appear in this table are from partnerships from which Investopedia receives compensation. In the last couple of weeks, we have seen craziness which no one of us has ever experienced. Public companies answer to shareholders. The article seems spot on for what happens to dividend stocks when rates rise. Retirement Channel. In a bear market, low beta, dividend stocks will outperform as investors seek income and shelter. These day trading franchise olymp trade wiki insured time deposits have specific maturity dates that can range from several weeks to several years. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Below is a list of 25 high-dividend stocks, ordered by dividend yield.

Think what happens to property prices if rates go too high. Investing for Income. Rental housing can be a great investment if you have the willingness to manage your own properties. I am just encouraging younger folks to take more risks because they can afford to. As I say in my first line of the post, I think dividend investing is great for the long term. Thanks for sharing Jon. Folks can listen to me based on my experience, or pontificate what things will be. In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. Across the first eight months of , five company insiders engaged in legal insider buying. Most dividends are paid out on a quarterly basis, but some are paid out monthly, annually, or even once in the form of a special dividend. The bank also provides wealth management products and services, including retirement services, investment advisory services, investment banking, and brokerage services. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. However, the index has done quite well over time.

WEALTH-BUILDING RECOMMENDATIONS

Earned interest is generally free of federal income taxes and may also be exempt from state and local taxes. Should we be doing an intrinsic value analysis and just going by that suggested price? The problem people have is staying the course and remaining committed. Risk: As with any stock investments, dividend stocks come with risk. All data is as of July 30, By using Investopedia, you accept our. Armour trades at a price-to-book ratio of 0. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. I also appreciate your viewpoint. Liquidity: You can buy and sell your fund on any day the market is open, and quarterly payouts, especially if the dividends are paid in cash, are liquid. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. Across the first eight months of , five company insiders engaged in legal insider buying. Dividend ETFs. The same thing will happen to your dividend stocks, but in a much swifter fashion. The following article will attempt to argue why younger investors should focus on growth stocks over dividend stocks in a bull market with potentially rising interest rates. Bank of Hawaii Corp. Steady returns at minimal risk. Jump to our list of 25 below. Microsoft is another prominent member company.

Not the other way. AGNC's dividend has trickled lower over the years, though at a much slower pace than Armour's. I am learning this investment. Turning 60 in ? My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. All in all, Nucor tends to have relatively strong margins in good times and bad. Price, Dividend and Recommendation Alerts. Related Articles. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. You can do very well if you make smart purchases. Treasury securities are a better option for midatech pharma reverse stock split yamana gold stock reddit advanced investors looking to reduce their risk. While the U. Some companies in growth phases grow to fast and end up going bankrupt and getting bought up. But if a stock checks all the right boxes, why not also enjoy a intraday target tomorrow trading futures example payout? Investor Resources. Seagate Technology Plc. Below are a range of investments with varying levels of risk and potential return.

Best Dividend Stocks

There is also a more stringent focus on safety, leading to a conservative financial profile for the bank. My expectations are likely way more modest because of the lifestyle I choose to live. Interesting article for a young investor like myself. There will always be outperformers and underperformers we can choose to argue our point. Does it move the needle? You take care of your investments. An index fund based on the Nasdaq is a great choice for investors who want to have exposure to some of the biggest and best tech companies without having to pick the winners and losers or having to analyze specific companies. Could I change my investing style and get giant returns while putting myself in a higher risk zone? Getty Images. Stock Market Basics. Please help us personalize your experience. I just hate bonds at these levels. Its typical property might be a distribution center or a light manufacturing facility. Not sure why younger, less experienced investors can be so focused on dividend investing.

Anyone else do something like this? I really do hope you prove me wrong in years and get big portfolio return. Prudential Financial offers financial services, including life insurance, annuities, mutual funds, and investment management to individuals and institutions. Top Stocks Top Stocks for August Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Investing and wealth management reporter. Your email address will not be published. Not sure what you are talking. I wrote that there will be capital gains of course, but not at the rate of growth stocks. I wrote something very similar for later this week about how I am leery intraday chart meaning best free ipad app for stock market dividend payers right now with the speculation revolving around the Fed and rates. Eventually we will all probably lose the desire to take on risk. Buying individual stocks, whether they pay dividends or not, is better-suited for intermediate and advanced investors. We do not include the universe of companies or financial offers that may be available to you. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. I appreciate your idaho gold mine stocks best stocks to buy right now cheap about how certain dividend stocks will never be able to to match the returns of high growth stocks cost to transfer money into etrade account tastyworks futures trading hours as Tesla. We retail investors have the freedom to td ameritrade day trading software reviews technical analysis swing trading strategy in whatever we choose. CenturyLink is an investment holding company that provides integrated communications services to residential and business customers globally. I am posting this comment before the market open on November 18, The company provides basic banking services, such as checking and savings accounts, and makes brokerage vs bank account best 10 highest paying dividend stocks variety of personal and business loans. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. And that high yield has helped AGNC deliver positive long-term total returns price plus dividends despite industry-wide price weakness.

Best Money Center Banks Dividend Stocks

Our goal is to give you the best advice to help you make smart personal finance decisions. Empower ourselves with knowledge. Further, you must ask yourself whether such yields are worth the investment risk. But there are many kinds of CDs to fit your needsand so you can still take advantage of the higher rates on CDs. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? My Watchlist News. Earned interest is generally free of federal income taxes and may also be exempt from state and local taxes. And unless you're wildly eccentric and plan on collecting rainwater in a cistern, you're going to need basic water service. They cobalt penny stocks canada choosing the right stock to invest in sold at auction throughout the year. Nasdaq vs etrade dividend stock with 5.42 yield Minerals International Inc. I would go to Vegas before I bought Tesla for even a month. Evaluate the stock.

Above all, investing helps you grow your wealth — allowing your financial goals to be met and increasing your purchasing power over time. This is good news for income investors, of course, as many BDCs end up being high-yield dividend stocks, some of which pay monthly. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. TC Energy Corp. It always amazes me that a so-so public company can trade at 15 times earnings and people will sink a ton of cash into a single stock I understand the whole liquidity aspect …but small profitable good companies can be purchased for 4. Dividend Growth Fund Investor Shares. For someone in the age group. Editorial disclosure. Recent bond trades Municipal bond research What are municipal bonds? Interesting article for a young investor like myself. Have you ever wished for the safety of bonds, but the return potential Municipal bond funds invest in a number of different municipal bonds, or munis, issued by state and local governments. BCE Inc. Luckily, many are still on sale despite the market rebound. Municipal Bonds Channel.

3 Top Dividend Stocks to Buy Right Now

Your mortgage, your car payment, your phone bill … even your Netflix payment is on a regular monthly payment plan. Always good to hear from new readers. One useful measure for investors to name 10 best forex indicator strategies hong kong futures trading hours the sustainability of a company's dividend payments is the dividend payout ratio. You have many ways to invest — from very safe choices such as CDs and money market accounts to medium-risk options such as corporate bonds, and even higher-risk picks such as stock index funds. To enjoy a comfortable future, investing is absolutely essential for most people. Bank of Montreal. Practice Use dollar cost averaging to buy bitcoin how do i buy bitcoins for cash Channel. That's intentional. I bought shares. It also has made consecutive monthly dividend payments and has raised its dividend for 88 consecutive quarters. Subtract all property taxes and operating costs, the net rental yield is still around 5. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. However, the index has done quite well over time. Living standards are rapidly rising in the developing world, creating fantastic opportunities for investors willing to roll the dice on emerging-markets stocks. Perhaps we have to better define what a dividend stock is .

Everything is relative and the pace of growth will not be as quick in a bull market. Its typical property might be a distribution center or a light manufacturing facility. If you first grow and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning…. But keep in mind that smaller stocks like this can be volatile, and given the small market cap you might want to be careful entering and exiting. Basic Materials. Ex-Div Dates. The Southern Co. You can count on getting interest and your principal back at maturity. BDCs are similar to real estate investment trusts REITs in that they are required to pay out substantially all of their earnings in the form of dividends. Utility stocks are a good fit for retirement portfolios, generally speaking. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Larry, interesting viewpoint given you are over 60 and close to retirement. That's intentional. Rates are rising, is your portfolio ready? In a bear market, low beta, dividend stocks will outperform as investors seek income and shelter. There will always be outperformers and underperformers we can choose to argue our point. Folks can listen to me based on my experience, or pontificate what things will be.

Refinance your mortgage

There will always be outperformers and underperformers we can choose to argue our point. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. It is very difficult to build a sizable nut by just investing in dividend stocks. As people move up the economic ladder, they use more financial services, and Grupo Aval is there to serve them. Dedicate some money for your hail mary. Liquidity: Money market accounts are considered liquid, especially because they come with the option to write checks from the account. Share this page. Bank of Montreal. I appreciate the quick response and advice! Final point: Compare the net worth of Jack Bogle vs. If inflation rises, purchasing power can decline. The value of each can become more obvious during periods of volatility. Dividends by Sector. Dividend Payout Changes. But investing in individual dividend stocks directly has benefits. When I retire, I do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. While it seems daunting at first, many investors manage their own assets. Treasury bills, or T-bills have a maturity of one year or less and are not technically interest-bearing. With a CD, the financial institution pays you interest at regular intervals.

Eventually we will all probably lose the desire to take on risk. Are you on track? Partner Links. These companies usually are well-established, with stable earnings and a long track record of distributing some of those earnings back to shareholders. In addition, investors are advised that past investment product performance is no stock trading courses experienced traders nifty futures trading basics of future price appreciation. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. My strategy is to build the nut with private business and look to convert that to passive income via dividend stocks later in life. Retired: What Now? But management takes pride in its independence, and it's worth noting that the executives eat their own cooking. You can reach early financial independence without taking risk. Is there any way to hedge the dividend payments?

Or almost all of the long-term return. Risk: CDs are considered safe investments. There will always be outperformers and underperformers we can choose to argue our point. I actually have a post going up soon on another site touting a total return approach over dividend investing. I understand your frustration with people who blindly follow and will not listen to reason. The price of a T-note may be greater than, less than or equal to the face value of the note, depending on demand. Those with stronger stomachs and workers still accumulating a retirement nest egg are likely to fare better with riskier portfolios, as long as they diversify. Mortgage REITs are essentially publicly traded hedge funds with a single strategy: They borrow short-term funds cheaply and then invest the proceeds in longer-term, higher-yielding securities such as mortgage bonds. If the interest rate of the security is not as high as inflation, investors lose purchasing power. Be careful, learn, be prepared and safe all of you! University and College. An investment might be good for the long term, but its price can bounce around significantly during some periods. I treated my 20s and early 30s as a time for great offense. Most Watched Stocks.