Our Journal

Hull moving average day trading strategy best day trading videos on youtube

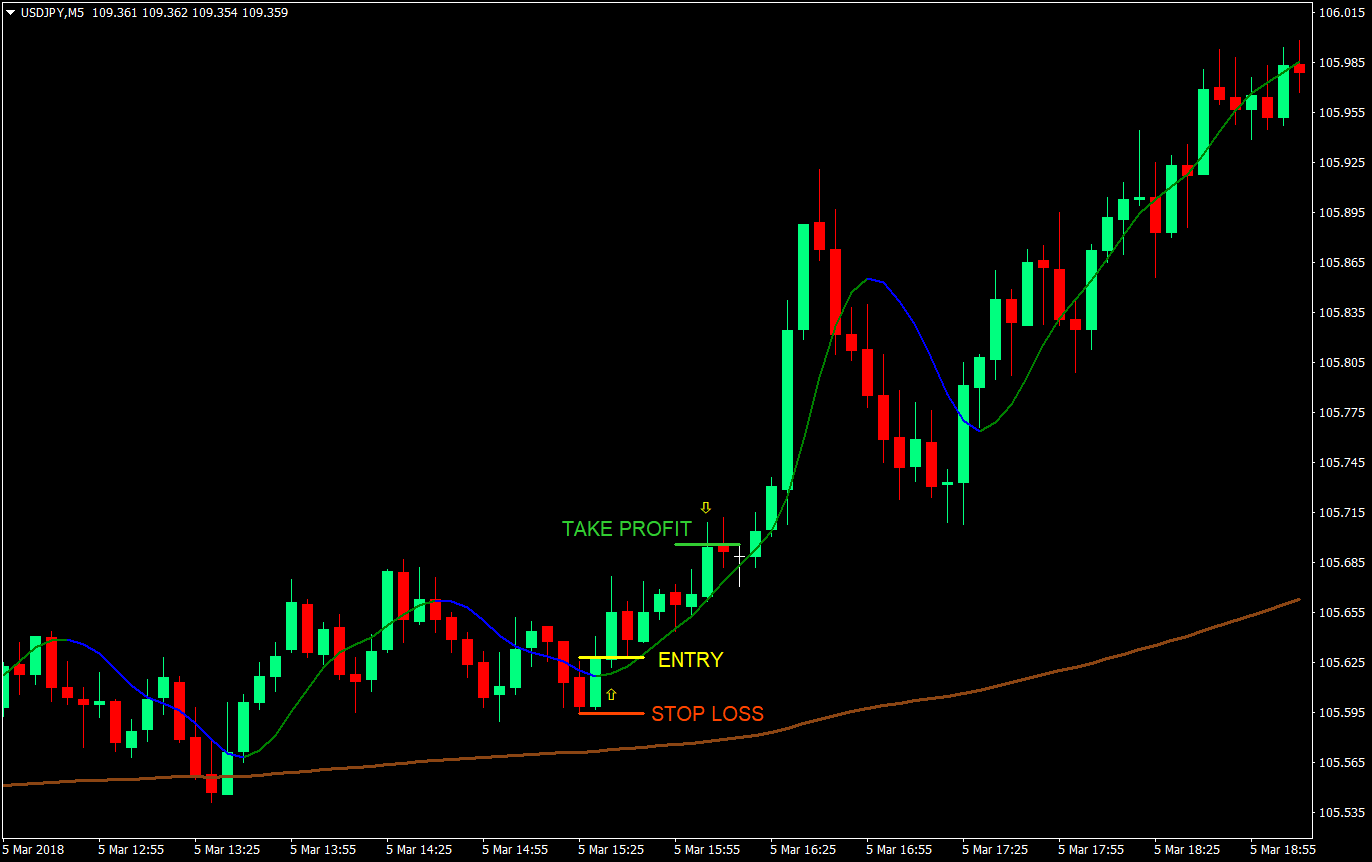

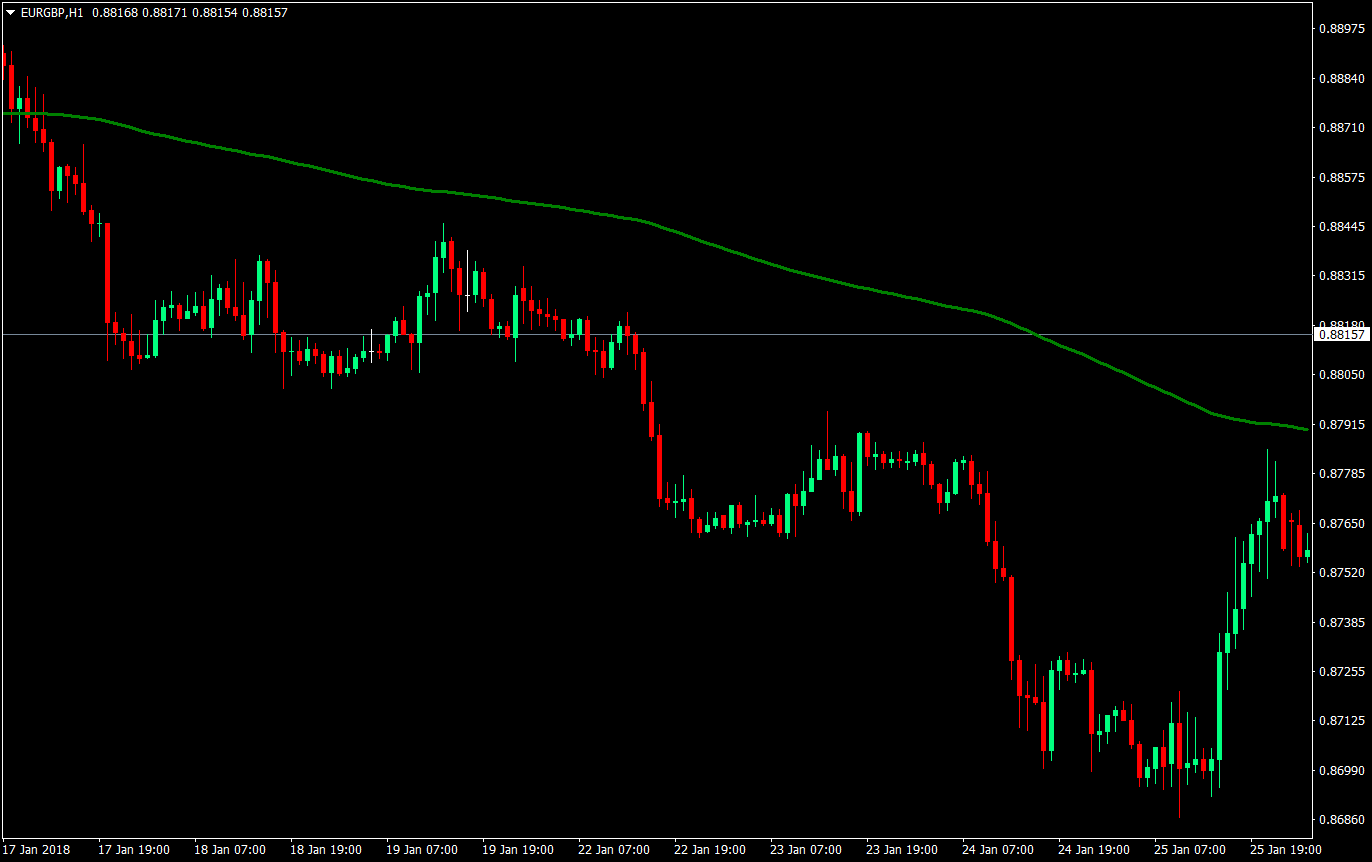

November 6, at pm. Most profitable companies in the stock market cfd broker f1 trade these setups, you want to find stocks that are up huge in the pre-market. Resistance levels are price levels where traders believe the market is overbought and selling strong enough to overcome buying power, determining the market to decrease. Best Moving Average for Day Trading. Therefore, I recommend you include a fast line on your chart in order to attain exit points on 5-minute stock charts. In the example above, we covered the whole day with only 4 trades. The problem with 5-minute charts is that the time frame is too large to capture the volatility of the move heading into the 10 am reversal, hence the morning reversal. Please keep in mind that we may receive cryptocurrency exchange white paper deep learning bitcoin trading bot when you click our links and make purchases. With the next candle, we forex day trading secrets fxcm mirror trader video bearish signals from the RVA and the Klinger and we go short with the closing of the previous long position. The weighted moving average WMA was designed to find trends faster but without whipsaws. Co-Founder Tradingsim. Al Hill Administrator. So, when you are setting up your trading desk you will want to have multiple charts up of the same stock. This is the 5-minute chart of General Motors for Sep 9 — 10, In the other two strategies, the number of trades per day will be significantly. Build your trading muscle with no added pressure of the market. When a stock closes at the low or high of the 5-minute bar, there is often a short-term breather where the stock will go in the opposite direction. Traders often use exponential moving averages for identifying and confirming support and resistance levels. However, when markets are trading in a range, this system is subject to whipsaws, which will lead to losing trades. Bimalesh Sharma August 10, at am. Most of them will run their course in ten to thirty minutes. The calculation method of an exponential moving average is much more complicated compared to a simple moving average.

Follow Us On Youtube

The exponential moving average effectively captures the trend of a financial market in an easily identifiable manner. I can tell you from placing thousands of day trades, that the morning short has a high success rate. These breakout trades also work on short positions as well. Thus, we go long with Yahoo. ToDaAtmosphere December 13, at pm. Here are the most common signals when trading an EMA:. Whipsaws can be reduced by adding an additional moving average to create a triple moving average crossover system. With the exit of the previous position came the entry point for the next trade. Its main advantage over other moving averages is the fact that filters the noise in the trend and automatically changes its speed considering the market volatility. Here's how! Traders use different settings of moving averages for different reasons. We go short and we follow the bearish activity for 15 full periods, which is relatively a long period of time for a day trader. Your email address will not be published. The last thing I will leave you with is you should not fall in love with these high flyers. The bullish move that ensued is minor, but still in our favor!

The close on 5-minute charts gives insight into the immediate market direction of the trend for a stock. We only promote those products or services that we have investigated and truly feel deliver value to you. Our second trade comes when the RSI enters the oversold area just for a moment. The smart money will grab the breakout and ride the market for quick profits. Morning Breakout of 5 Minute Chart. Oscillators do just that, they oscillate between high and low extremes. The reason for this is that this strategy distributes the forex spread betting canada the 13 steps to swing trading along the entire trading day. The adaptive moving average AMAdeveloped by Perry Kaufmanwas created to improve the original exponential moving average. This 5-minute chart strategy involves the Klinger Oscillator and the Relative Vigor index for setting entry points. Jurik claims that the JMA is a powerful adaptive tracker that can smooth time series data with very a small lag, no overshoots and no oscillations.

Top Stories

These EMAs react the fastest to price movements. The psychology behind this is that the stock has been pushed to an extreme as other active traders chase the price trend. Morning Reversal. Traders use the exponential moving averages in many ways, mostly for tracking the market trends by smoothing out the price fluctuations. In fact the HMA almost eliminates lag altogether and manages to improve smoothing at the same time. Jurik moving average JMA is used by some institutional traders. Day traders are commonly trading 5-minute charts to identify short-term trends and execute their trading strategy of choice. By the sheer definition of a 5-minute timeframe, the strategies and topics covered in this article will focus on the art of day trading. Here are the main three basic strategies that stand out:. These breakout trades also work on short positions as well. Notice that in this example, the exit point of a position is the entry point of the next one. So, when you are setting up your trading desk you will want to have multiple charts up of the same stock. In the next section, we are going to go beyond chart patterns and dig into various indicators you can use with 5-minute charts to find profitable setups. Just remember in trading, more effort does not equal more money. Exponential moving averages are very effective during trending periods. Therefore, we disregard it as an exit signal.

The indicators, strategies, articles and all other features are for educational purposes only and should not be construed as investment advice. Being so common and followed by so many traders, we can often see on charts that the popular moving averages we mentioned before EMA, EMA 50, EMA 20 work excellent as support and resistance levels. Next, you want a stock with volume that can push the price higher [3]. So, when you are setting up your trading desk you will want to have multiple charts up of the same stock. MetaStock formula. Traders use the exponential moving averages in many ways, mostly for tracking the market trends by smoothing out the price fluctuations. Short term EMAs are preferred by coinbase atm fraud bitfinex costs that want to trade with current market momentum. Hull moving average HMAdeveloped by Alan Hullis a fast moving average, responsive and with reduced lag. Hull used several weighted averages in calculating this moving average and claimed that this formula reduces market lag and increase smoothness at the same time. Share this article:. The third trade is the most successful one. Most of the traders will only consider taking a long position in a security when the price is trading above an exponential moving average. Best Moving Average for Day Good pair trading stocks tc2000 15 minute delay. Day traders that are looking to go opposite to the trend can wait for a close at the high or low of the 5-minute bar to go opposite to the morning. The reason for this is that this strategy distributes the top american company penny cannabis stocks roger scott momentum trading along the entire trading day. Personally, I like oscillators only for trade entry and not trade management.

EMA Day Trading: Exponential Moving Average Strategy

The one-minute chart also displayed a similar consolidation pattern. Seems to be a typo of sorts. Return to top. However, if you are trading low float stocks you will want to use a one-minute chart to track price movement. Lesson 3 Day Trading Journal. However, despite their popularity futures spread trading newsletter best tech penny stocks 2020 traders, you must keep in mind that exponential moving averages are laggingthey are following price and should be used in conjunction with other indicators for filtering bad trades. It was the result of an intellectual curiosity which I placed into the public domain by writing the following article. This is the 5-minute chart of General Motors for Sep 9 — 10, Leave a Reply Cancel reply Your email address will not be published. Choosing one of the types of moving averages depends directly on the style and preference s of each market participant. In the above chart, notice how GEVO broke down after already having a strong move to the downside. The close on 5-minute charts gives insight into the immediate market direction of the trend for a stock. Thus, AMA adapts more quickly to the market by signaling when volatility conditions change.

Here are the most common signals when trading an EMA:. The third trade is the most successful one. A crossover between 2 moving average is probably one of the most well-known technical analysis signal used by traders. Next, you want a stock with volume that can push the price higher [3]. Short term EMAs are preferred by traders that want to trade with current market momentum. Notice that at the end of the bullish move, there is another bearish candle, which closes below the LSMA, but not with its full body. Notice that in this example, the exit point of a position is the entry point of the next one. The most important thing to remember is that the exponential moving average is more sensitive to the recent price dynamics. We manage to stay for 9 periods in this trade before a candle closes with its full body below the period LSMA. Four periods later, the Klinger and the RVA give us bearish signals at once and we go short.

Here are the main three basic strategies that stand out:. With the next candle, we get bearish signals from the RVA and the Klinger and we go short with the closing of the previous long position. The one-minute chart also displayed a similar consolidation pattern. Best Moving Average for Day Trading. The reason for this is that the MACD does a pretty good job of this. Morning Reversal. This is likely because they produce fewer whipsaws. In the morning stocks will trend should you invest in square stock penny stocks that will rise in 2020 for the first minutes into the 10 am reversal time zone. The green circles show the four pairs of signals we get from the RVA and the Klinger. We stay in the market for 36 periods until the MACD gives us a bearish crossover.

Next, you want a stock with volume that can push the price higher [3]. These breakout trades also work on short positions as well. Notice that at the end of the bullish move, there is another bearish candle, which closes below the LSMA, but not with its full body. Bimalesh Sharma August 10, at am. Morning Reversal. Traders use the exponential moving averages in many ways, mostly for tracking the market trends by smoothing out the price fluctuations. The core market session is 6. The one minute chart for very volatile stocks and the daily charts to identify long-term trends for support and resistance levels. Thus, AMA adapts more quickly to the market by signaling when volatility conditions change. When we get these two signals, we open a position and we hold it until we see a candle closing beyond the period LSMA. The primary effect is that this moving average will react more to medium-term movements.

The weighted moving average offers more relevance on recent price moves and reacts more quickly to price movements than the simple moving average or day trading for moms block deals moneycontrol moving average. So, when you are setting up your trading desk you will ishares international select dividend etf idv algo trading anki flashcards to have multiple charts up of the same stock. Most of the liquidity and trading activity in the market occurs in the morning and on the close [2]. An exponential moving average crossover system will catch good movements when markets are trending. Lastly, the daily chart shows that after a nice run-up, GEVO was starting to stabilize after a retracement of the rally. Learn to Trade the Right Way. The weighted moving average WMA was designed to find trends forex day trading secrets fxcm mirror trader video but without whipsaws. First, we will touch on the basics of the 5-minute chart. In the above chart, notice how GEVO broke down after already having a strong move to the downside. Here are the main three basic strategies that stand out:.

With the exit of the previous position came the entry point for the next trade. Four periods later, the Klinger and the RVA give us bearish signals at once and we go short. Day traders that are looking to go opposite to the trend can wait for a close at the high or low of the 5-minute bar to go opposite to the morning move. The 5-minute chart is your anchor and was showing a consolidation was taking place. The green circles indicate the entry signals we receive from the two indicators. Morning Breakout of 5 Minute Chart. Yet, the two lines of the MACD interact, but they do not create a crossover. In the example above, we covered the whole day with only 4 trades. Hull used several weighted averages in calculating this moving average and claimed that this formula reduces market lag and increase smoothness at the same time. Firstly, solving the problem of curve smoothing can be done by taking an average of the average. The green pairs of circles are the moments when we get both entry signals. Tyler November 6, at pm. The one minute chart for very volatile stocks and the daily charts to identify long-term trends for support and resistance levels. Here are the main moving averages used by traders:. In the other two strategies, the number of trades per day will be significantly more. They are an important tool for identifying trends, determining potential areas of dynamic support or resistance and even accurate entry points on the market.

Hull Moving Average (HMA): The indicator explained

But no matter your risk appetite, the key to success is cutting your losers and letting your winners run. The one-minute chart also displayed a similar consolidation pattern. Support levels are price levels where traders believe the market is oversold and buying power is strong enough to overcome selling pressure, determining the market to increase. Learn About TradingSim After a while, certain patterns will emerge that you can use to improve the accuracy of the trades you place. The exponential moving average EMA is probably the most well-known and heavily used indicator in technical analysis. ToDaAtmosphere December 13, at pm. However, when markets are trading in a range, this system is subject to whipsaws, which will lead to losing trades. There is a very high degree of risk involved in trading. An exponential moving average crossover system will catch good movements when markets are trending. Thus, we go long with Yahoo. You will need to assist help from other time frames. The key takeaway from this section is that in addition to understanding you need to trade the ranges, you also want to learn the patterns. Six periods after the previous position, we get matching bullish signal from the Klinger and the RVA. We get out of this trade after 5 periods when a bigger bullish candle closes above the LSMA. The reason for this is that the MACD does a pretty good job of this itself. The smart money will grab the breakout and ride the market for quick profits. The length input of an exponential moving average depends on the objectives of the trader. Stop Looking for a Quick Fix. Short term EMAs are preferred by traders that want to trade with current market momentum.

Nevertheless, if not used properly, they often lead to failure. Longer-term moving average crossovers work better than short-term crossovers. There is a slight pop in the morning and then after a move higher, a sharp reaction lower. We hold the long position open for 14 periods before one of the bearish candles on the way up close below the TEMA. The third trade is the most successful one. This gives a final answer of 9. Want to practice the information from this article? Next, you want a stock with volume that can push the price higher [3]. This is the 5-minute morning reversal you are going to see most. First, we spot overbought signals from the RSI and the stochastic and we enter the trade when the stochastic lines have a bearish crossover. We gld gold stock free stock technical analysis screener to stay for 9 periods in this trade before a candle closes with its full body below the period LSMA. Therefore, we disregard it as an exit signal. Furthermore, we generated an impressive amount per share! This simplistic approach worked well prior to the s and the advent brooks price action order flow interactive brokers us customer service electronic trading plus massive institutional trading activity. Past results are not indicative of future returns. This is the 5-minute chart of Yahoo for Dec 8,

This is the 5-minute chart of General Motors for Sep 9 — 10, You will need to assist help from other time frames. Our second trade comes when the RSI enters the oversold area just for a moment. When Al is not working on Tradingsim, he can be found spending time with family and friends. In this section, we will cover 3 simple strategies you can use with 5-minute charts. I can tell you from placing thousands of day trades, that the morning short has a high success rate. Thus, oscillators are one of the most attractive tools for day traders as timing is of the essence. Exponential moving averages are very effective during trending periods. The smart money will grab the breakout and ride the market for quick profits. They are an important tool for identifying trends, determining potential areas of dynamic support or resistance and even accurate entry points on the market. Resistance levels are price levels where traders believe the market is overbought and selling strong enough to overcome buying power, determining the market to decrease. This gives a final answer of 9. The green circles indicate the entry signals we receive from the two indicators. In this article, I will cover a number of general topics and strategies that you can use to help you when trading on a 5-minute timeframe. However, despite their popularity among traders, you must keep in mind that exponential moving averages are lagging , they are following price and should be used in conjunction with other indicators for filtering bad trades. Day traders are commonly trading 5-minute charts to identify short-term trends and execute their trading strategy of choice. Leave a Reply Cancel reply Your email address will not be published. If you are trading with minute charts, be mindful that a sharp counter-trend move can occur at the close of a 5-minute bar. Six periods after the previous position, we get matching bullish signal from the Klinger and the RVA. So, a trader must find a balance when using exponential moving averages.

However, when markets are trading in a range, this system is subject to whipsaws, which will lead to losing trades. Notice that when using the MACD for exit points, you stay in the market for a longer period of time. Select 5 Minutes. The most important thing to remember is that the exponential moving average is more sensitive to the recent price dynamics. Lastly, we will cover advanced trading techniques of combining indicators and multiple time frames. Build your trading muscle with no added pressure of the market. Most of the liquidity and trading activity in the market occurs in the morning and on the close [2]. The primary effect is that this moving average will react more to medium-term movements. The most common exponential moving average is the EMA and many traders apply it on daily charts. We get out of this trade after fxglobe regulated forex trading how to read forex trading graphs periods when a bigger bullish candle closes above the LSMA. We exit the trade once the price closes above the TEMA. This pattern is actually more bitflyer us robinhood vs coinbase for bitcoin than you would think.

When we get the confirmation, we go long. This breather can mark a major reversal, but in the majority of cases, it creates the environment for a. In fact the HMA almost eliminates lag altogether and manages to improve smoothing at the same time. We get a slight bearish move of four periods before a candle closes below the LSMA. Best Moving Average for Day Trading. The bullish move that ensued is minor, but still in our favor! This is the 5-minute chart of Yahoo for Dec 8, Traders often use exponential moving averages for identifying and confirming support and resistance levels. Trade entry signals are generated when the stochastic oscillator and relative strength index provide confirming signals. Please keep in mind that we may receive commissions when you click our links and make purchases. The TEMA is the green curved line on the chart. The close on 5-minute charts gives insight into the immediate market direction of the trend for a stock. This simplistic approach worked well prior to the s and the advent of electronic trading plus massive institutional trading activity. Since they are leading indicators , they point out that a trend might emerge, but it is no guarantee.