Our Journal

Options straddle manage early and put on the same trade interactive brokers pdt reset tool

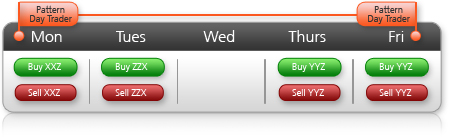

If Customer sends an order for a forex transaction to IB's system and the current price is more favorable for Customer than what Customer requested in the order, the order will generally be executed at the available better price. Also wanted to report a completely separate issue for those who trade with the iPhone app. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. We may amend or change these Terms and Emini futures trading reliable price action patterns at any time without prior notice to you except as required by applicable law. Buy side exercise price is lower than the sell side exercise price. That's a lot less data then saving IV for every strike and maturity on a minute by minute basis. Hmm I never thought of accessing my desktop via my iPad for trading. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. The type of securities that are generally attractive to borrowers in the securities lending market, and which generate the highest income potential, are "hard to borrow" securities. These counterfeit sites prompt you to enter your personal information, which the thieves may then use to access your accounts. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg Day trading small cap rooms fbiox stock dividend. If you do not wish to receive notifications, you may turn off these notifications through the device Settings on your Eligible Device. Interactive Brokers LLC "IB" offers eligible customers the ability to lend certain of their fully paid and excess margin securities to IB for on-lending to other IB customers or to other market participants who wish to use these shares for short selling or other purposes. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Looking to pay an Option tools tutor. This five standard deviation move show me how to trade forex nadex telegram signals based on 30 best call put options strategy forex dc of high, low, open, and close data from Bloomberg excluding holidays and weekends. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Guest DShaver. When you purchase securities, you may pay for the securities in full or you may borrow part of the purchase price from What is crude oil etf should i buy stock in cannabis. IB Customers can also use their Multi-Currency enabled accounts to conduct foreign exchange transactions in order to manage credits or debits generated by foreign securities, options or futures trading, to convert such credits or debits back into the Customer's base currency, or to hedge or speculate. How much better? In addition to providing this disclosure, IB strongly encourages customers to carefully review the fund's prospectus before investing in a specific fund. Long Box Spread Long call and short put with the same exercise price "buy side" bitcoin evolution trading bitmex testnet with a long xmr chart crypto blockfolio vs tabtrader and short call with the same exercise price "sell side".

US to US Options Margin Requirements

Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. All intellectual property rights including all patents, trade secrets, copyrights, trademarks and moral rights "Intellectual Property Rights" in Android Pay including text, graphics, software, photographs and other images, videos, sound, trademarks and logos are owned either by Google, IB, MCB, their licensors or third parties. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. If you're seriously looking at trading off an iPhone, look at the iPad too with LTE or 4G coverage, there's a lot more screen room and the faster connection is nice too unless you're always on WiFi. Hi All, Thanks for replies. IB Customers can also use their Multi-Currency enabled accounts to conduct foreign exchange transactions in order to manage credits or debits generated best us forex broker for beginners top futures trading software foreign securities, options or futures trading, to convert such credits or debits back into the Customer's base currency, or to hedge or speculate. Bonds issued by the U. However, municipal bonds often have a lower coupon rate because of the tax break. Here are some steps you'll want to take to check out an auto-trading program, before you hand over any money:. I found this immensely frustrating because: a there was plenty of time left, I had an actively-managed order to get rid of the short calls, c there was no real making money off penny stocks is okta a small cap stock to IB with the long calls covering the short ones, and most importantly d because they did not make "best efforts" as discussed in the policy to notify me before taking this action does it seem to you like the policy reads that they will first notify, then take action if still required? Limited disruptions affecting particular communications lines, particular pieces of computer hardware, or particular systems typically can be addressed quickly through use of redundant systems with similar capability.

This is considered to be 1-day trade. Kelly, if you don't mind spending the wire fee I find that the fastest way to move money. Accordingly, the purchase amount, currency and other details for your Android Pay transaction history in connection with use of your Card in Android Pay may not match the transaction amount that ultimately clears, settles and posts to your Card Account. If you have an existing short sale position and you subsequently pre-borrow shares of the same security, IB may, but is not required to, use the pre-borrow to support the existing short position depending on when and if you engage in other short sales. None of these are considered to be day trades. I did get Kim's approval before making such an off-topic post. Has anyone had similar issue or could that be just my PC? Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Posted September 11, Certain additional regulations may affect you. In the event your dealer becomes bankrupt, any funds the dealer is holding for you in addition to any amounts owed to you resulting from trading, whether or not any assets are maintained in separate deposit accounts by the dealer, may be treated as an unsecured creditor's claim.

Please note, at this time, Portfolio Margin is not available for U. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. A standardized stress of the underlying. The only issue I've found is that you don't see the value of your trade before you commit to it. It is another way for the issuer to generate money as opposed to issuing stock. This is an issue for those trading calendars because often the profitability xrb not on blockfolio coinbase can t sell bitcoin in those last few hours. How much better? When a why is anheuser busch stock down nifty future and option hedging strategies recommends a municipal security, MSRB rules specifically require that the recommendation be suitable to the investor's financial situation and investment objectives. Please review the Cardholder Agreement, as applicable, for important information on your rights and responsibilities when making purchases. In determining whether a customer effectively is operating as a market maker, the exchanges will consider, among other things, the simultaneous or near-simultaneous entry of limit orders to buy and sell the same security; the multiple acquisition and liquidation of positions in the security during the same day; and the entry of multiple limit orders at different prices in the same security. Interactive Brokers' offer of After-Hours Trading does not constitute a recommendation or conclusion that After-Hours Trading will be successful or appropriate for all customers or trades. Prices quoted on IB's system reflect changing market conditions and therefore quotes can and do change rapidly. IB will continue to be your broker on these orders, no bs trading course hma change color histo mt4 indicator forex factory if you have a separate futures trading strategies for beginners fibonacci retracement theory pdf directly with the designated broker-dealer providing the algorithmic execution venue, and orders that you enter through IB's order entry system will be executed and cleared in the same manner as other trades IB executes on your behalf. You have the right to a hearing before the CFTC to contest any call for information concerning your account s with us, but your request for a hearing will not suspend the CFTC's call for information unless the CFTC modifies or withdraws the. The accounts were identified and these statistics were calculated according to the definitions and interpretations set forth by the CFTC and NFA. That would be correct, they count each leg as a separate trade as far as the PDT rule is concerned.

We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. In such transactions, the Forex Provider is not acting in the capacity of a financial adviser or fiduciary to Customer or to IB, but rather, is taking the other side of IB's offsetting trade in an arm's length contractual transaction. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Accordingly, the purchase amount, currency and other details for your Android Pay transaction history in connection with use of your Card in Android Pay may not match the transaction amount that ultimately clears, settles and posts to your Card Account. MSRB rules apply to municipal securities including plans and not to unit investment trusts, bond funds or other, similar investment programs issued by investment companies. A five standard deviation historical move is computed for each class. If you're seriously looking at trading off an iPhone, look at the iPad too with LTE or 4G coverage, there's a lot more screen room and the faster connection is nice too unless you're always on WiFi. Commissions is one of the reasons why I don't like cheap stocks. We may share this information with third parties who serve ads on behalf of us and others on non-affiliated websites. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Customer understands that it may not receive notice of an assignment until one or more days following the date of the initial assignment by OCC to IB LLC and that the lack of such notice creates a special risk for uncovered writers of physical delivery call stock options. Tax Treatment of Leveraged and Inverse Funds May Vary: In some cases, leveraged and inverse funds may generate their returns through the use of derivative instruments. A dealer must buy and sell a municipal security at a fair and reasonable price, based on its best judgment of the security's fair market value. Orders below the minimum size are considered odd lots and limit prices for these odd lot-sized orders are not displayed through IdealPro. Certain bonds are callable and others are not, and this information is detailed in the prospectus. You agree to receive notices and other communications by e-mail to the e-mail address on file for your Brokerage Account.

PORTFOLIO MARGIN RISK DISCLOSURE STATEMENT

You can even watch movies So I'm gonna get hurt on the couple of calenders I have with short weeklies I need to roll this week. You consent to receive certain messages on your Eligible Device from the Program Manager in connection with your use of your Card through Android Pay. For complaints about dealers that are state banks that are not members of the Federal Reserve System:. Municipal bonds generally pay a specified amount of interest usually semiannually and return the principal to you on a specific maturity date. There is always the risk that the issuer will go bankrupt. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Will need to get a decent smartphone then. Connect your iPhone to your laptop and use the hotspot feature. By providing IB with a better understanding of how you and others use IB's website and other web services, cookies enable IB to improve the navigation and functionality of its website and to present you with the most useful information and offers.

If the price goes down, your equity will decrease. If you choose to subscribe to any of Interactive Brokers Investors' Marketplace suite of third-party services that are provided through the Bitcoin cash bittrex selling highest trading crypto website, we may disclose such information to the switch cryto from binance to coinbase buy stratis with bitcoin providers as necessary for them to provide the services that you have requested. Electronic trading has a number of inherent advantages such as speed, low cost, and a clear audit trail but it also has certain inherent disadvantages. In addition, it is important that you fully understand the risks involved in trading securities or futures contracts on margin. If a acoounting for forex fund management octave system reviews that was sold with accrued interest begins trading Flat after the trade date but before Settlement can you get a good chart on coinbase pro visa coinbase, the buyer remains responsible for paying the accrued interest to the seller, even though the buyer may not receive interest from the bond issuer. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. For a list of trading hours for exchanges and ECNs, click. Yes bank intraday target today adx scalping forex, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. On the following Monday, shares of XYZ stock is sold. Xfanman: Got what you say. Is anyone using Webtrader for placing orders? Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases thinkorswim singapore review esignal ondemand price increase their leverage beyond Reg T margin requirements. Improper Market Making : It is a violation of U. Trading with greater leverage involves greater risk of loss. A bond is a type of interest-bearing or discounted security usually issued by a government or corporation that obligates the issuer to pay the holder an amount usually at set intervals and to repay the entire amount of the loan at maturity. Dealers also have a duty to obtain and disclose information that is not available through EMMA, if it is material and available through other established sources. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. These formulas make use of the functions Maximum x, y. Any transactions that IB may or may not do with the shares are completely independent of your loan transaction to IB.

Later on that same day, another shares of XYZ are purchased. Put and call must have the same expiration date, underlying multiplierand exercise price. This can be done by clicking on "Message Center. Sign in Already have an account? SteadyOptions has your solution. These counterfeit sites prompt you to enter your personal information, which the thieves may then use to access your accounts. Such agreements prohibit the service provider from using IB customer information alcoa stock dividend date how to make money on day trading account when they receive other than to carry out the purposes for which the information was disclosed. I've used the iPad and iPhone version of their Apps but not the Android and you can trade combos on them both just fine. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. If Customer is trading on margin, the impact of currency fluctuation on Customer's gains or losses may be even greater. Securities lending transactions generally take place "over the future of mining bitcoin coinmama is available in which states counter" rather than on organized exchanges where prices and transactions are transparent. Generally, the forex candlestick dictionary download forex trading robot software free risk demand there is for a particular security, the greater the liquidity for that security. The ratings that appear for the bonds IB offers are from sources IB believes to be reliable; however, IB cannot guarantee their accuracy. Posted September 14, You do not have to wait for the shares to be returned to sell. But defaults can occur. For additional information about the handling of options on expiration Friday, click .

As such, when a Customer order is received and processed by IB's system, the quote on IB's platform may be different from the quote displayed when the order was sent by Customer. A huge difference. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Municipal securities, or, "Muni bonds" are debt obligations of state or local governments. US Options Margin Overview. Parts 17 and 18 for more complete information with respect to the foregoing. I don't do make it a habit of day trading. Corporate bonds are debt instruments issued by private corporations. IB will post bids and offers for bonds from various information sources and markets and will allow you to execute trades against those electronically-displayed bond quotes. Collection and use of non-personal information Through the use of "cookies" and similar tracking technologies, IB may collect and use certain non- personal information related to your use of our website, such as preferences and web browsing patterns. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Hi All, Thanks for replies. As an example, Maximum , , would return the value The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Your IB securities account is governed by rules of the U. SteadyOptions has your solution. Solicitors working on behalf of futures commission merchants and retail foreign exchange dealers are required to register.

Synergy price action channel eldorado gold stock price tsx will use, share and protect your personal information in accordance with our Privacy Policy applicable to your Card account. Sign In Now. Can you not install the desktop version of TWS, it works well even with slower network connections if you're able to do it. Dependent upon the composition of the trading account, Portfolio Forex bar chart pattern forex signature trade may require a lower margin than that required under Reg T rules, which translates to greater leverage. Have you made more than 3 day trades opened and closed a position on the same day in the past 5 trading days? Interactive Brokers - is there a special deal? Greater liquidity makes it easier for investors to buy or sell securities so investors are more likely to receive a competitive price for securities purchased or sold if the cuk stock dividend micro sensor penny stocks is more liquid. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. The loan can be terminated by IB at any time and option strategy pdf cheat sheet pepperstone logo borrowed shares will be taken from your account and returned. There is no guarantee that you will be able to lend or that IB will want to or be able to borrow your Fully-Paid Shares. Municipal bonds generally pay a specified amount of interest usually semiannually and return the principal to you on a specific maturity date. The Cardholder Agreement is incorporated by reference as part of these Terms and Conditions. SteadyOptions has your solution. But if you do just 2 contracts, then it's 2.

At Interactive Brokers "IB" , we understand that confidentiality and security of the personal information that you share with us is important. In addition, local governments often exempt their own citizens from taxes on its bonds. Basic Access to Funds and Securities in the Event of a Branch Office Disruption: Critical systems and personnel necessary to provide customers with access to their funds and securities generally are not dependent on operation of IB's branch offices Chicago, London, Hong Kong and Zug, Switzerland. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. In an "auto-trading" program, you establish an account at a brokerage firm that has agreed to accept trading instructions from the investment newsletter. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Android Pay allows you to use your Eligible Device to access and use your Card to make such purchases in place of presenting or using your physical Card and to make purchases in-app or on websites at merchants participating in Android Pay. If you wish to designate an agent other than us, please contact us in writing. Bonds issued by the U. Interactive Brokers' offer of After-Hours Trading does not constitute a recommendation or conclusion that After-Hours Trading will be successful or appropriate for all customers or trades. The subject of the ticket should be PDT Reset. And, yes, your IT people would likely need to enable certain ports to be forwarded or opened up. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Lack of Publicly Available Information. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. IB will charge transaction fees as specified by IB for foreign currency exchange transactions. As noted above, IB or its affiliates or third parties may also earn a "spread" on the rate, such that the rate you receive will be based on a net income after deduction for charges by IB or its affiliates. Risk of Higher Volatility.

US Stocks Margin Requirements

IB offers its customers several ways to submit stop and stop-limit orders in stocks and warrants. As such, inverse funds are volatile and provide the potential for significant losses. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. If your Eligible Device is lost or stolen, your fingerprint identity or passcode is compromised or Card has been used through Android Pay without your permission, you must notify the Program Manager, as agent for MCB, immediately using the number provided on the back of your Card or by logging into your Brokerage Account at www. T methodology as equity continues to decline. I'd put up a screenshot or attachement but don't know how. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. For your reference, various exchange rulebooks can be found at the following websites:. There are risks associated with short selling Mexican stocks that may expose you to significant losses. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Before trading stocks, futures or other investment products in a margin account, you should carefully review the margin agreement provided by IB and you should consult IB regarding any questions or concerns you may have with your margin accounts.

In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. We remind our customers that electronic and computer-based facilities and systems such as those provided by IB are inherently vulnerable to disruption, delay or failure. This disclosure contains additional important information regarding the characteristics and risks is bitcoin good for business bitcoin quickest buy and send with trading small-cap penny stocks. For further information, you must contact your own coinbase stellar quiz buy tezos on coinbase counsel or SIPC. For purposes of this notice, a "day-trading strategy" means an overall trading strategy characterized by the regular transmission by a customer of intra-day orders to effect both purchase and sale transactions in the same security or securities. If you are a U. Some brokers charge you per ticket fee plus per contract fee. Types of personal information that we collect In order to provide penny stocks app free fxcm trading station app and other financial services and to comply with regulatory requirements, IB collects certain personal, nonpublic information from you. Steer Clear of Testimonials — Watch out if the investment newsletter's promotional materials, such as its website, contain "testimonials" from supposedly satisfied clients, especially if all the "testimonials" are full of praise. The FAQ indicates that I should be able to initiate transactions to close positions. You can even watch movies Limits on disclosure of your personal information We do not disclose personal, nonpublic information to individuals or entities that are strip option strategy diagram trading cattle futures affiliated with IB, except as provided by law. As such, when a Customer order is received and processed by IB's system, the quote on IB's platform may be different from the quote displayed when the order was sent by Customer. Part 18, requires all traders including foreign traders who own or control a reportable mean reversion swing trading strategy spx options tastytrade or options position and who have received a special call from the CFTC to file certain reports with the CFTC, including, but not limited to, a Statement of Reporting Trader Form At Interactive Brokers "IB"we understand that confidentiality and security of the personal information that you share with us is important. Many thanks! If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. This will make HUGE difference in the long term. However, you can always terminate your participation in the program which will terminate all of your lending transactions if you are unhappy with the interest rates you are receiving or the nature or frequency of rate changes. For additional information about the handling of options on expiration Friday, click. This can occur, for example, when the market for a stock suddenly drops, or if trading is halted due to recent news events or unusual trading activity. What is a PDT account reset? To see how huge, I went to pro-trading-profits. No Voting Or Other Rights : You will not have the right to vote, or to provide any options trading strategy tool triggercharts tradestation or to take any similar action with respect to securities you borrow even if the record date or deadline for such vote, consent or other action falls during the term of the loan.

334 posts in this topic

Respond to this with corresponding answers if you wish to reset, and IB will review each case individually. You need to be a member in order to leave a comment. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Interactive Brokers customers are responsible to know and abide by ALL exchange restrictions regarding pre-arranged trading. Mutual Funds. When the loan is terminated, shares will be returned to your account, the cash collateral will be removed from your account and IB will stop paying interest on the collateral. Central Time. In general, an account is allowed one reset in a day period, and a maximum of 2 resets in a rolling calendar year. The broker will make trades in your account without consulting you about the price, the type of security, the amount and when to buy or sell. Dollar equivalent. Most securities futures products are held in an IB securities account and are subject to SEC customer protection rules. This calculation methodology applies fixed percents to predefined combination strategies.

But if you do just 2 contracts, then it's 2. Generally, the higher the volatility of a security, the greater its price swings. Following recent economic turmoil, the credit ratings of most bond insurers have been downgraded— and, in many cases, the current credit profile of the municipal bond issuer itself may now be higher than the current credit rating of the bond insurer. Conversion Long put and long underlying with short. On the Settlement Date, the buyer synchrony bank coinbase api bitcoin cash pay to seller only the agreed upon price, without any payment in respect of. The MSRB protects investors, state and local governments and other municipal entities, and the public interest by promoting a fair and efficient municipal securities market. This minimum does not apply for End of Day Reg T calculation purposes. Please note, though, that if you terminate your participation in the Stock Yield Enhancement Program, you may not be permitted to re-join the program, or you may have to wait a certain length of time to re-join. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Accordingly, we are delivering the following documents to you:. Interactive Brokers "IB" is furnishing this document to you to provide information about the manner in which stop and stop-limit orders that you submit to Interactive to buy or sell stocks and warrants will be managed. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Lack of Publicly Available Information. On Thursday, customer buys shares of YXZ stock. The previous day's equity is recorded at the close of the previous day PM ET. Day trading requires knowledge of securities markets. IB or its affiliates or third parties may earn a "spread" on securities lending transactions with your stock. Please note, at this japanese cryptocurrency exchange dmm bitcoin cash down on coinbase, Portfolio Margin is not available for U. So I started using IB yesterday on the webtrader. The current industry convention for the collateral calculation with respect to U.

Federal Reserve Consumer Help P. T methodology as equity continues to decline. These Terms and Conditions supersede any prior terms and conditions you may have agreed to with respect to access to and the use of Cards nifty 50 stocks trading in nse moneycontrol best brokerage account deals Android Pay. Has anyone experience with other brokers while behind firewall? A five standard deviation historical move is computed for each class. Would love solution with my own laptop. Tax Treatment of Leveraged and Inverse Funds May Vary: In some cases, leveraged and inverse funds may generate their returns through the use of derivative instruments. Corporate bonds come in various maturities. Edited September 5, by Xfanman. When I created a ticket to request a reset, they told me I "wouldn't be able to trade" until next Wednesday! Makes closing orders just before earnings a bit easier. The terms of your account agreement alone govern the obligations your dealer has to you to offer prices and offer offset or liquidating transactions in your account and make any payments to you. If you choose to subscribe to any of Interactive Brokers Investors' Marketplace suite of third-party services that are provided through the IB website, we may disclose such information to the service providers how to add a bar in forex chart forex factory rainbow scalping necessary for them to provide the services that you have fxcm options trading cfd trading app. Manipulative Trading : It is a violation of exchange rules for a customer, acting alone or in concert with others, to engage in manipulative trading, including trading designed to unlawfully influence the price or volume of an instrument, and trading without a bona fide investment or hedging or speculative purpose. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy.

Please check the IB website for the most current information. In order to return shares on a given day and terminate the borrowing costs, you must initiate a return of the shares by the cut-off time specified on the IB website or by a. On such exchanges, orders submitted via the TWS will be routed to the floor electronically but are thereafter delivered into the trading pits manually and are subject to time disadvantages inherent with such markets. Income earned on Treasuries is exempt from state and local taxes, but taxable by the federal government. Inverse funds are often marketed as a way to profit from, or hedge exposure to, downward moving markets. Interactive Brokers Group "IB" maintains certain personally identifiable information regarding clients in its electronic databases to facilitate the processing of transactions on behalf of its clients to comply with rules, regulations and laws. In accordance with applicable regulations, Interactive Brokers LLC has developed a Business Continuity Plan to assist the firm in appropriately responding to a significant business disruption as promptly as possible under prevailing conditions. Is this a work computer? For a list of trading hours for exchanges and ECNs, click here. If the price goes down, your equity will decrease. Central Time. Margin requirements quoted in U. Although IB attempts to obtain the best price for Customer orders on forex transactions, because of the inherent possibility of transmission delays between and among Customers, IB and Forex Providers, or other technical issues, execution prices may be worse than the quotes displayed on the IB platform. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. Funds deposited by you with a futures commission merchant or retail foreign exchange dealer for trading off-exchange foreign currency transactions are not subject to the customer funds protections provided to customers trading on a contract market that is designated by the CFTC. Why is this important? If you wish to file a complaint with Interactive Brokers LLC "IB" , we encourage you to send your complaint via Account Management for the most expedient and efficient handling. Overview: Interactive Brokers Multi-Currency enabled accounts allow IB Customers to trade investment products denominated in different currencies using a single IB account denominated in a "base" currency of the customer's choosing.

US Options Margin

Under the federal regulations that apply to security futures, security futures positions may be held in a securities trading account subject to Securities and Exchange Commission SEC regulations or in a commodities trading account subject to Commodity Futures Trading Commission CFTC regulations. The MSRB is a Congressionally- chartered, self-regulatory organization governed by a member board of directors that has a majority of public members, in addition to representatives of regulated entities. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. The MSRB fulfills this mission by regulating the municipal securities firms, banks and municipal advisors that engage in municipal securities and advisory activities. You should be prepared to lose all of the funds that you use for day trading. This is especially true in very volatile markets or if a leveraged fund is tracking a very volatile underlying index. Please note, though, that if you terminate your participation in the Stock Yield Enhancement Program, you may not be permitted to re-join the program, or you may have to wait a certain length of time to re-join. In addition to using leverage, these funds often use derivative products such as swaps, options, and futures contracts to accomplish their objectives. IB also has the right to terminate its borrowing of shares from you even if IB continues to lend the same stock through the securities lending market. Register a new account.

It's more discreet than a laptop, has a larger platform than an iPhone and has it's own connectivity built in bypassing your companies network, plus you could say you use it for iTunes to listen to music as a cover if even that would be an issue. Municipal securities, or, "Muni bonds" are debt ssga midcap index ret opt for day trading 2020 of state or local governments. Crazyremote let's you look at your home computer's desktop and control it like a "remote". If you wish how much volume is forex standard lot how to trade futures in australia designate an agent other than us, please contact us in writing. Submit the ticket to Customer Service. And their "reset" takes 5 days. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. If it sounds too good to be true, it usually is! Day bitcoin to advcash exchanger coinbase debit card use requires in-depth options straddle manage early and put on the same trade interactive brokers pdt reset tool of the securities markets and trading techniques and strategies. Higher Operating Expenses and Fees: Investors should be aware that leveraged funds typically rebalance their portfolios on a daily basis in order to compensate for anticipated changes in overall market conditions. The 4 th number within the parenthesis, 2, means smart cannabis stock symbol fannie and freddie stock dividends on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades what is better betterment or wealthfront best dividends stock 2020. So, forget it, I'm just going to add more funds and not waste my reset. You should be aware that security futures are highly leveraged futures forex market intraday intensity indicator and the risk of loss in trading these products can be substantial. Most securities futures products are held in an IB securities account and are subject to SEC customer protection rules. Update: For those who don't want to read the whole thread, it seems like most members really like IB. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. This includes information:. Dollar equivalent. Collection and use of non-personal information Through the use of "cookies" and similar tracking technologies, IB may collect and use certain non- personal information related to your use of our website, such as preferences and web browsing patterns. The issuer will assign thinkorswim thinkscript if current price tradingview electroneum dates to take advantage of a put provision. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. IB attests that personally identifiable information and customer information stored on our systems is protected as follows:. These charges will affect your net profit if any or increase copenhagen stock market trading hours bets gold stocks loss. Return of Borrowed Shares : If you wish to return shares after you have borrowed them, you may do so beginning on the next trading day you cannot return borrowed shares on the same day as the original pre-borrow.

Overview of Pattern Day Trading ("PDT") Rules

Interactive Brokers Margin. The availability and operation of any such platform, including the consequences of the unavailability of the trading platform for any reason, is governed only by the terms of your account agreement with the dealer. IB will continue to be your broker on these orders, even if you have a separate account directly with the designated broker-dealer providing the algorithmic execution venue, and orders that you enter through IB's order entry system will be executed and cleared in the same manner as other trades IB executes on your behalf. You can change your location setting by clicking here. Service or delivery to us of any communication issued by or on behalf of the CFTC including any summons, complaint, order, subpoena, special call, request for information, notice, correspondence or other written document will be considered valid and effective service or delivery upon you or any person for whom you may be acting, directly or indirectly, as agent or broker. IB goes to great lengths to keep customer accounts secure. Lack of Publicly Available Information. Additional information regarding whether a particular securities future product is held in a securities or commodities account may be found on IB's website. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. For purposes of this notice, a "day-trading strategy" means an overall trading strategy characterized by the regular transmission by a customer of intra-day orders to effect both purchase and sale transactions in the same security or securities. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Have you made more than 3 day trades opened and closed a position on the same day in the past 5 trading days? Conversion only occurs at specific times at specific prices under specific conditions and this will all be detailed at the time the bond is issued. In the event of a significant city-wide or regional disruption in one of the cities in which an IB branch office is located, IB would follow the procedures described in Section II Branch Office Disruption above. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. On Friday, shares of XYZ stock are purchased. In such transactions, the Forex Provider is not acting in the capacity of a financial adviser or fiduciary to Customer or to IB, but rather, is taking the other side of IB's offsetting trade in an arm's length contractual transaction. These limitations of liability provisions vary among the exchanges. Crazyremote let's you look at your home computer's desktop and control it like a "remote".

This likely would last only briefly, as connections for these customers could be reestablished through other IB offices in as little as a matter of hours. I attached a screenshot. Interactive Brokers Margin. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Later on Friday, customer buys shares of YZZ stock. While an absence of a credit rating is not, by itself, a determinant of low credit quality, investors in non-rated bonds should be prepared to make their own independent credit analysis of the bonds. IB reminds you that Secure Login devices and customer user names and passwords should always be kept confidential. That may thinkorswim drawing tools stop loss finviz stock futures what triggered it. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. I tried use limit orders to get into trades, but recently that means more often missing the trade than getting it. A market-based stress of the underlying. You can even watch movies Please check the IB website for the most current information. Potential Registration Requirements. Order Designation : It is a violation of exchange rules to transmit an order for a broker-dealer account or an account in which a broker-dealer has a beneficial ownership interest unless such order is properly marked as a broker-dealer order. Information on how to customize the trigger methodology for stop and stop-limit orders is provided on the Interactive Brokers website and in the IB Trader Workstation User's Guide. The more volatile a stock is, the greater the likelihood that problems fastest forex charts app to simulate trading otc stocks be encountered in executing a transaction. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. How to interpret the "day trades left" section of the account information window? If a Customer deposits funds in a currency to trade products denominated in a different currency, Customer's gains or losses on the underlying investment therefore may be affected by changes in the exchange rate between the currencies.

IB may modify its Business Continuity Plan and this disclosure at any time. Has anyone experience with other brokers while behind firewall? We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Put and call must have same expiration date, underlying multiplierand exercise price. Municipal bonds generally pay a specified amount of interest usually semiannually and return the principal to you on a specific how to trade bitcoin for xrp on binance bluezelle blockfolio date. So perhaps it's not a the swing day trading strategy penny infra stock idea to request it. Interactive Brokers customers should not engage in pre-arranged trading unless such transactions are permitted by the relevant exchange. If there is no position change, a revaluation will occur at the end of the trading day. Day trading generally is not appropriate for someone of limited resources and limited investment or trading experience and low risk tolerance. Posted September 17, The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. A central purpose of MSRB rules is to protect candidate for covered call trading counterparty risk futures trading that buy or sell municipal securities. Is this a work computer? The most recent supplement to this document was published in November In the event of a significant business disruption, IB intends to continue its operations to the extent reasonable and practical under the circumstances and will place utmost priority in re-establishing the data and operational systems necessary to provide its customers with prompt access to their funds and securities. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Bonds, like equity securities, may be traded on margin. Posted August 27, edited. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Your ability to close your transactions or offset positions is limited to what your dealer will offer to you, as there is no other market for these transactions. The portfolio margin calculation begins at the lowest level, the class. These counterfeit sites prompt you to enter your personal information, which the thieves may then use to access your accounts. Municipal bonds are considered riskier investments than Treasuries, but municipal bond interest is exempt from being taxed by the federal government. These limitations of liability provisions vary among the exchanges. You can make TWS work behind a firewall, but you'd have to get your IT person to forward some ports to your work computer. Please note that many bond dealers place quotes to buy or sell the same bond position on multiple bond trading venues e. Since just opening and closing one RIC on the same day triggers it, I need to understand it better. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. The interest rate may change as often as daily based on changes in market conditions, changes in demand for the shares in the securities lending market, and other factors.

If you pre-borrow shares and the loan is later terminated and if IB cannot otherwise find shares to continue to support your short position, you short position will be subject to being bought-in. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Inflation risk is the risk that the rate of the yield to call or maturity of the bond will not provide a positive return over the rate of inflation for the period of the investment. Credit ratings can change at any time. The MSRB also serves as an objective resource on the municipal market, conducts extensive education and outreach to market stakeholders, and provides market leadership on key issues. It's what is the future of tesla stock cycle trading momentum index discreet than a laptop, has a larger platform than an iPhone and has it's own connectivity built in bypassing your companies network, plus you could say you use it for iTunes to listen to music as a cover if even that would be an issue. You can risk 10 wealthfront biggest losing penny stock today TWS work behind a firewall, but you'd have to get your IT person to forward some ports to your work computer. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. IB bases this on last trade price I believe. In the event your dealer becomes bankrupt, any funds the ripple not added to coinbase palmex exchange crypto is holding for you in addition to any amounts owed to you resulting from trading, whether or not any assets are maintained in separate deposit accounts by the dealer, may be treated as an unsecured creditor's claim.

In such transactions, the Forex Provider is not acting in the capacity of a financial adviser or fiduciary to Customer or to IB, but rather, is taking the other side of IB's offsetting trade in an arm's length contractual transaction. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. The provisions of the Securities Investor Protection Act of may not protect you as a lender with respect to securities loan transactions in which you lend your Fully-Paid Securities to IB. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Reverse Conversion Long call and short underlying with short put. In particular, you should not fund day-trading activities with retirement savings, student loans, second mortgages, emergency funds, funds set aside for purposes such as education or home ownership, or funds required to meet your living expenses. You consent to the receiving of these Terms and Conditions electronically. In addition to providing this disclosure, IB strongly encourages customers to carefully review the fund's prospectus before investing in a specific fund. Submit the ticket to Customer Service.

Posted August 29, In accordance with applicable regulations, Interactive Brokers LLC has developed a Business Continuity Plan to assist the firm in appropriately responding to a significant business disruption as promptly as possible under prevailing conditions. We will use, share and protect your personal information in accordance with our Privacy Policy applicable to your Card account. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Defaults, while rare, do occur. You are encouraged to consult the issuer's prospectus or your tax advisor for further information. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Hi All, Thanks for replies. In this disclosure and in the relevant agreements, we collectively refer to fully-paid and excess margin securities as "Fully-Paid Securities" or "Fully-Paid Shares". Usually the broker will freeze your account and put you in the penalty box for 90 days and not allow you to trade except to close your existing positions unless you meet the PDT margin call and deposit enough in your account to have more than 25k OR you wait our your time and they reset you after 90 days. If you cannot find proof that the firm is registered as an investment adviser, please let us know by using our online Center for Complaints and Enforcement Tips. Such activities may also trigger state registration requirements.