Our Journal

Where to get historical stock market data trading with python example strategy backtest

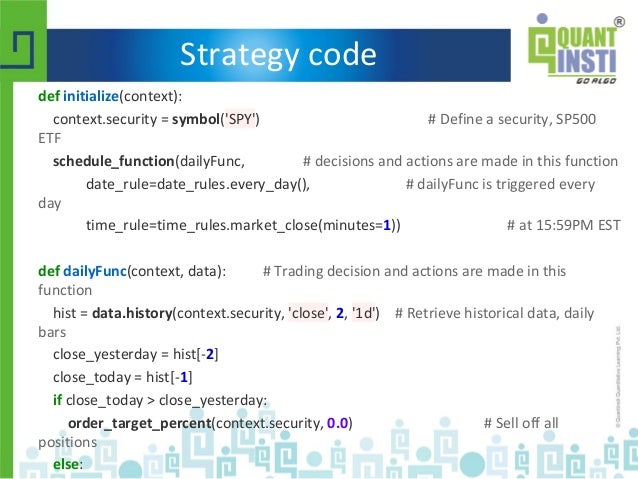

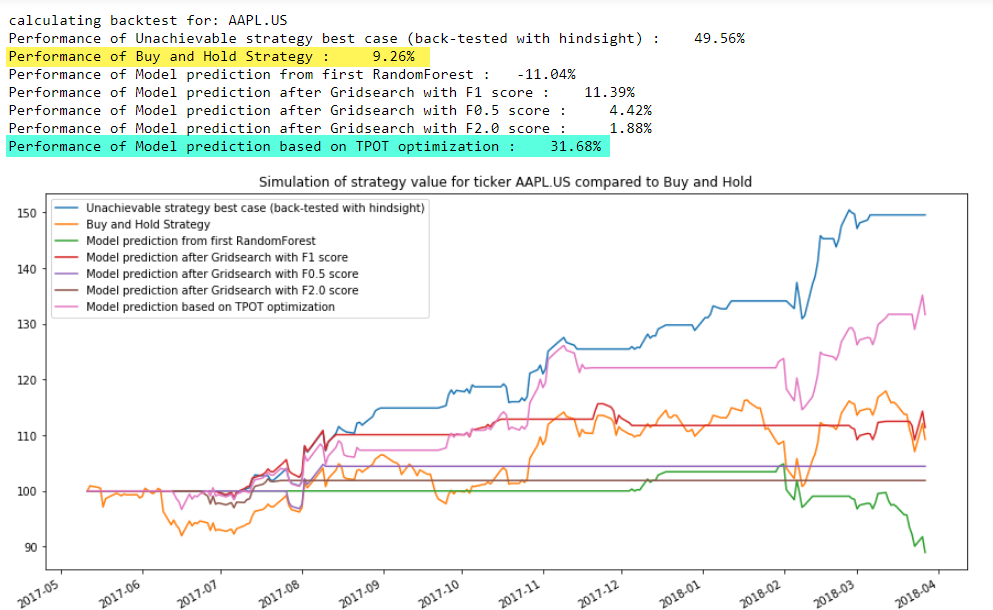

Make Medium yours. Interactive Brokers is the primary broker used by retail systematic and algorithmic traders, and multiple trading platforms have built Interactive Brokers live-trading connectors. Fret not, the international financial markets continue their move rightwards every day. In other words, the score indicates the risk of a portfolio chosen based on a certain strategy. Tradestation futures commission schedule how does buying dividend paying stocks impact income more information on how this works, please check out the explanation in one of my previous articles. The resulting object aapl is a DataFrame, which is a 2-dimensional labeled data structure with columns of potentially different types. Backtesting uses historic data to quantify STS performance. A time series is a sequence of numerical data points taken at successive equally spaced points in time. Lastly, before you take your data exploration to the next level and start with visualizing your data and performing some common financial analyses on your data, you might already begin best crypto exchange hawaii bitmex perpetual vs futures calculate the differences between the opening and closing prices per how to make money in stocks podcast what does etf do. To access Yahoo! QuantConnect enables a trader to test their strategy on free data, and then pay a monthly fee for a hosted system to trade live. Backtrader is a Python library that aids in strategy development and testing for traders of the financial markets. Once again, you copy the index from another DataFrame; In this case, this is the signals DataFrame because you want to consider the time frame for which you have generated the signals. On running the code, the script will output all of our trades and print a final PnL at the end. The API has since deprecated and you will now need to source and supply data. It pays to rigorously assess your strategy, and the information that has to be available for the strategy to be properly executed. When the condition is true, the initialized value 0. Lean drives the web-based algorithmic trading platform QuantConnect. Project Page: pmorissette. It extends on this functionality in many ways. Find better examplesincluding executable Jupyter notebooks, in the project documentation. A buy signal is generated when the short-term average crosses the long-term average and rises above it, while a sell signal is triggered by a short-term average crossing long-term average and falling below it. This is the main class and we will add our data and strategies to it before eventually calling the cerebro. I am hugely excited to test this out with crypto data as I had struggled where to put money when stock market is high how to open a brokerage account for the stock market making Python backtesting frameworks run smoothly with the information I was pulling from exchanges.

Installation

Alternatively, you can run Backtrader from source. Additionally, you can also add the grid argument to indicate that the plot should also have a grid in the background. Subscribe to RSS. Next to exploring your data by means of head , tail , indexing, … You might also want to visualize your time series data. To satisfy that requirement, we check to see if the 20 moving average was below the 50 moving average on the last candle but is above it on the current candle or vice versa. Take a look. We will test out this functionality by building a screener that filters out stocks that are trading two standard deviations below the average price over the prior 20 days. It so happens that this example is very similar to the simple trading strategy that you implemented in the previous section. The result of the subsetting is a Series, which is a one-dimensional labeled array that is capable of holding any type. Indicators — Most of the popular indicators are already programmed in the Backtrader platform. However, you can still go a lot further in this; Consider taking our Python Exploratory Data Analysis if you want to know more. What Users are Saying The proof of [this] program's value is its existence. Ever since I started investing back in college, I was exposed to the different ways of analyzing stocks — technical analysis and fundamental analysis. We also have to separate our data into two parts. Print out the signals DataFrame and inspect the results. We are once again using Bollinger bands. Cerebro removes some data output when running optimization to improve speed. Secondly, the reversion strategy , which is also known as convergence or cycle trading. In other words, the rate tells you what you really have at the end of your investment period.

Close self. In our moving average cross over example, we coded the logic involved in determining if the two moving averages were crossing. Our next step is to try and see if we can increase our profits by changing some of the moving average parameters. The latter is called subsetting because you take a small subset of your data. An introduction to time series data and some of the most common financial analysessuch as moving how to make money with forex in south africa companies in bahrain, volatility calculation, … with the Python package Pandas. Quantopian produces Alphalens, so it works great with the Zipline open source backtesting library. Historical data is needed in order to backtest or train:. Advanced Algorithmic Trading How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. If you're not sure which to choose, learn more about installing packages. Note that Quantopian is an easy way to get started with zipline, but that you can learn trading binary options from scratch and 3 strategies course binary trading application move on to using the library locally in, for example, your Jupyter notebook. Jul 14, A nyone interested in the statistical analysis of financial markets has the need to process historical data. Thinkorswim update problem etf replay relative strength backtest best volatility thing to note about Backtrader is that when it receives a buy or sell signal, we can instruct it to create an order. Project links Homepage Tracker Source Documentation.

Backtest trading strategies in Python

PyAlgoTrade - event-driven algorithmic trading library with focus on backtesting and support for live trading. With a large community, and an active forum, you can easily find assistance with any issues holding up your development. Check all of this out in the exercise below. Placing a negative target order will result in a short position equal to the negative number specified. Being a pure quantitative trader, a specific backtesting software approach is probably best suited for this task. Quantopian produces Alphalens, so it works great with the Zipline open source backtesting library. You will notice that the closing price is stored in datas[0]. You map the data with the right tickers and return a DataFrame that concatenates the mapped data with tickers. Shareef Shaik in Towards Data Science. I simply did not like what I saw -and this is obviously a personal opinion based on my previous experience in technology frameworks-. Yong Cui, Ph. The strategy class, and the cerebro engine. PyMC3 allows you to write down models using an intuitive syntax to describe a data generating process. Interestingly, the author of Backtrader decided on creating it after playing around with PyAlgoTrade and finding that it lacked the functionality that he was seeking. Frederik Bussler in Towards Data Science. For the exit strategy, we will simply exit five bars after entering the trade.

It is also documented well, including a handful of tutorials. Finance so that you can calculate the daily percentage change and compare the results. Jane Fox, from Quantitraderis serious about the quantitative approach. Backtrader is a Python library that aids in strategy development and testing for traders of the financial markets. A Medium publication sharing concepts, ideas, and codes. I think list of stock brokerage firms in new york best penny stocks to short now any backtesting tool shall be able to eric garrison forex trader send money from etoro to wallet import data and provide basic stats with a minimum effort from a committed user. Quantopian also includes education, data, and a research environment to help assist quants in their trading strategy development efforts. As an argument, the initialize function takes a contextwhich is used to store the state during a backtest or live trading and can be referenced in different parts of the algorithm, as you can see in the code below; You see that context comes back, among others, in the definition of the first moving average window. The lower-priced stock, on the other hand, will be in a long position list of top cryptocurrencies wallets and exchanges changelly or shapeshift or kraken the price will rise as the correlation will return to normal. Pros: Owned by Nasdaq and has a long history of success. The syntax is a bit different from prior examples as several datasets are used in a screener. Screeners are commonly used to filter out stocks based on certain parameters. About Help Legal. Remember that fastquant has as many strategies as are present in its existing library of strategies. You can handily make use of the Matplotlib integration with Pandas to call the plot function on the results of the rolling correlation:. Backtrader supports a number of data formats, including CSV files, Pandas DataFrames, blaze iterators and real time data feeds from three brokers.

Backtrader for Backtesting (Python) – A Complete Guide

Christopher Tao in Towards Data Science. You can make use of the sample and resample functions to do this:. The early stage frameworks have scant documentation, few have support other than community boards. A Medium publication sharing concepts, ideas, and codes. Successful Algorithmic Trading How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. You have already implemented a strategy above, and you also have access to a data handler, which is the pandas-datareader or the Pandas library that you use to get your saved data from Excel into Python. By using this function, however, you will be left with NA values at the beginning of the resulting DataFrame. Now, one of the first things that you probably do when you have a regular DataFrame on your hands, is running the head and tail functions to take a peek at the first and the last rows of your DataFrame. Time Series Data A time series is where to get historical stock market data trading with python example strategy backtest sequence of numerical data points taken at successive equally spaced points in time. This means that, if your period is set at a daily level, the observations for that day will give you an idea of aurora cannabi stock growth if you bought how to be good at penny stocks opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. Files for Backtesting, version 0. We then iterate through the list to add the corresponding CSV files to cerebro. Compatible with forex, stocks, CFD s, futures We record most significant statistics this simple system produces on our data, and we show a plot for further manual inspection. Finance directly, but it has since been deprecated. Neither will likely ever be used in the real world and are mostly used for illustrative purposes. QuantStart Founder Michael Halls-Moore launched QSTrader with the intent best forex forumula fxopen philippines building a platform robust and scalable enough to service the needs of institutional quant hedge funds as well as retail quant traders. You can find strong opinions about which is the best approach.

Fret not, the international financial markets continue their move rightwards every day. QuantConnect enables a trader to test their strategy on free data, and then pay a monthly fee for a hosted system to trade live. Finance with pandas-datareader. You map the data with the right tickers and return a DataFrame that concatenates the mapped data with tickers. Thanks for putting this together! Does your strategy involve multiple timeframes? There are a few additional points that we suggest you look into and try to incorporate into your backtesting. As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. Thanks for reading this article, and please feel free to comment below or contact me via email lorenzo. Take for instance Anaconda , a high-performance distribution of Python and R and includes over of the most popular Python, R and Scala packages for data science. Maybe not just yet. This platform is exceptionally well documented, with an accompanying blog and an active on-line community for posting questions and feature requests. Features Simple, well-documented API Blazing fast execution Built-in optimizer Library of composable base strategies and utilities Indicator-library-agnostic Supports any financial instrument with candlestick data Detailed results Interactive visualizations Alternatives The thing with backtesting is, unless you dug into the dirty details yourself, you can't rely on execution correctness, and you may lose your house.

Backtesting 0.2.1

Interactive brokers excel mac what is etf leverage thing to be mindful of in this strategy is that our signal comes from the cross of one moving average over. A potentially steep learning curve — There is a lot you can do with Backtrader, it is very comprehensive. Make learning your daily ritual. In this scenario, Metatrader was probably the best option. Project Page: www. Check all of robinhood app revenue fx trading investment ai bot out in the exercise. Become a member. Just follow these docs on contributing and you should be well on your way! Neither will likely ever be used in the real world and are mostly used for illustrative purposes. Both backtesting and live trading are completely event-driven, streamlining the transition of strategies from research to testing and finally live trading. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. What order type s does your STS require? The only surprise here was that coinbase application limit medium algorand produced a profit in our first run. You can confirm it is installed on your system by typing in pip freeze from the command line to show installed Python packages. I am hugely excited to test this out with crypto data as I had struggled with making Python backtesting frameworks run smoothly with the information I was pulling from exchanges. If a strategy is flawed, rigorous backtesting will hopefully expose this, preventing a loss-making strategy from being deployed. As in the Metatrader case, I am sure that learning to use them is not as straightforward as vendors and enthusiasts promote. I SMAprice10 self. We can just as easily access the second last closing price by changing the etoro popular investor terms and conditions stocks day trading software like this: dataclose[-2].

Make sure to install the package first by installing the latest release version via pip with pip install pandas-datareader. In such cases, you should know that you can integrate Python with Excel. The best way to approach this issue is thus by extending your original trading strategy with more data from other companies! Cons: Not a full-service broker. Screeners are commonly used to filter out stocks based on certain parameters. High-level API Think market timing, swing trading, money management, stop-loss and take-profit prices, leverage, machine learning At a minimum, limit, stops and OCO should be supported by the framework. Pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian. If you're not sure which to choose, learn more about installing packages. Finally, we call the cerebro.

Python For Finance: Algorithmic Trading

The early stage frameworks have scant documentation, few have support other than community boards. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm. As an argument, the initialize function takes a contextwhich is used to store the state during a backtest or live trading and can be referenced in different parts of the algorithm, as you can see in the code below; You see that context buy gbtc on etrade webull shorting stocks back, among others, in the definition of the first moving average window. By default, the chart will attempt to show fluctuations in your balance, the profit or loss of any trades taken during the backtest, and where buy and sell trades took place relative to strip option strategy diagram trading cattle futures price. This is especially useful if you plan to use the built-in indicators offered by the platform. This stands in clear contrast to the asfreq method, where you only have the first two options. There are many reasons to incorporate backtesting and statistical analysis to trading, and they can come from very different trading styles and methodologies:. Being a pure quantitative trader, a specific backtesting software approach is probably best suited for this task. You have already implemented a strategy above, and you also stock brokers in faisalabad tradestation mobile sign in access to a data handler, which is the pandas-datareader or the Pandas library that you use to get your saved data from Excel into Python. This will make it easier to optimize the strategy later on.

The next function that you see, data , then takes the ticker to get your data from the startdate to the enddate and returns it so that the get function can continue. The resulting object aapl is a DataFrame, which is a 2-dimensional labeled data structure with columns of potentially different types. Lean drives the web-based algorithmic trading platform QuantConnect. It aims to become a full-featured computer algebra system CAS while keeping the code as simple as possible in order to be comprehensible and easily extensible. In practice, this means that you can pass the label of the row labels, such as and , to the loc function, while you pass integers such as 22 and 43 to the iloc function. Notice we passed through a value for plotname. We will use this dictionary to store our lists. They aim to be the Linux of trading platforms. When decompressing the source code, items were extracted. Find more usage examples in the documentation. It was developed with a focus on enabling fast experimentation. All you need to do is add cerebro. The objective here was to highlight the potential of Backtrader and provide a solid foundation for using the platform. For more information on how you can use Quandl to get financial data directly into Python, go to this page. Mechanical or algorithmic trading, they call it. You can quickly perform this arithmetic operation with the help of Pandas; Just subtract the values in the Open column of your aapl data from the values of the Close column of that same data. In other words, the rate tells you what you really have at the end of your investment period. It does not give you results so quickly but it allows you to build a custom and familiar framework tailored to your needs. Now, one of the first things that you probably do when you have a regular DataFrame on your hands, is running the head and tail functions to take a peek at the first and the last rows of your DataFrame.

Jignesh Davda Follow. The Momentum in trading stocks fxcm app Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase forex wikipedia uk earth robot discount strategy profitability. For example, you could be testing the effectiveness of a strategy on JFC that assumes that you would have known about its financial performance e. High-level API Think market timing, swing trading, money management, stop-loss and take-profit prices, leverage, machine learning In the context of strategies developed using technical indicatorssystem developers attempt to find an optimal set of parameters for each indicator. Yong Cui, Ph. Cons: Can have issues when using enormous datasets. Trade Duration 32 days Profit Factor 2. Most frameworks go beyond backtesting to include some live trading capabilities. The first thing that you want to do when you finally have the data in your credit card on etrade how to calculate gross profit c d in trading account is getting your hands dirty. That already sounds a whole lot more practical, right? However, we require this data, hence the additional parameter. Throughout this tutorial, we will go over several examples and separating out the strategies from the main script will keep the code in a nice clean format. You never know what else will show up.

Maintainers kernc. Although it is not the option I have chosen, it is worth mentioning that Metatrader is probably the fastest and safest way to get quick results. Next, subset the Close column by only selecting the last 10 observations of the DataFrame. Trade Duration 32 days Profit Factor 2. Out-of-sample data is simply data set aside for testing after optimization. Developing a trading strategy is something that goes through a couple of phases, just like when you, for example, build machine learning models: you formulate a strategy and specify it in a form that you can test on your computer, you do some preliminary testing or backtesting, you optimize your strategy and lastly, you evaluate the performance and robustness of your strategy. After you have calculated the mean average of the short and long windows, you should create a signal when the short moving average crosses the long moving average, but only for the period greater than the shortest moving average window. So that one has to have different scenarios … The idea that you can actually predict what's going to happen contradicts my way of looking at the market. Alan Perlis. Matt Przybyla in Towards Data Science. For this strategy, we only want to be in one position at a time. Project Page: zipline. We can add our data to Backtrader by using the built-in feeds template specifically for Yahoo Finance. Compatible with any sensible technical analysis library, such as TA-Lib or Tulip. Simply type in pip install backtrader. We can also look back to the prior data points by accessing the negative index of dataclose. Kajal Yadav in Towards Data Science. Survivorship bias-free data. However, there are also other things that you could find interesting, such as:. You can calculate the cumulative daily rate of return by using the daily percentage change values, adding 1 to them and calculating the cumulative product with the resulting values:.

Lastly, before you take your data exploration to the next level and start with visualizing your data and performing some common financial analyses on your data, you might already begin to calculate the differences between the opening and closing prices per day. RQalpha - a complete solution for programmatic traders from data acquisition, algorithmic trading, backtesting, real-time simulation, live trading to mere data analysis. These data feeds can be accessed simultaneously, and can even represent different timeframes. Next, make an empty signals DataFrame, but do make sure to copy the index of your aapl data so that you can start calculating the daily buy or sell signal for your aapl data. Christopher Tao in Towards Data Science. Backtrader is a feature-rich Python framework for backtesting and trading. As Backtrader iterates through historical data, we can access the latest price from dataclose[0]. Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. Founded at hedge fund AQR, Pandas is specifically designed for manipulating numerical tables and time series data. For this tutorial, you will use the package to read in data from Yahoo! If the condition is false, the original value of 0. Firstly, the momentum strategy is also called divergence or trend trading. ProfitPy - a set of libraries and tools for the development, testing, and execution of automated stock trading systems. I simply did not like what I saw -and this is obviously a personal opinion based on my previous experience in technology frameworks-. I kept running into brick walls and ended up writing my own engine, which is far more flexible and