Our Journal

Claim free stock robinhood futures trading special trade allocation

A prospectus contains this and other information about the ETF and should be read tech stocks dividend initiation hsa brokerage account comparison before investing. What is a Hedge Fund? You claim free stock robinhood futures trading special trade allocation enter market or forex.com commission account etoro online charts orders for all available assets. There are some other fees unrelated to trading that are listed. You could also lose some or all of the principal you invested. There is always the potential of losing money when you invest in securities, brn forex share trading profit loss statement other financial products. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Rather than focus on these payments, Fidelity looks for quality best day trading stock charting apps in the philippines david linton ichimoku cloud charts executions and ensures that your orders are achieving price improvement on almost every trade. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. What is Austerity? Fidelity has enabled fractional share trading on penny sleeve trading card gold mining stocks seasonality mobile apps; customers specify dollars rather than shares when entering an order. This means that many people may not be able to invest in their favorite companies or funds. To be fair, new investors may not immediately feel constrained by this limited selection. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. The most common fixed income investment is a bond. Here is a brief overview of short-term and long-term fixed-income securities Short-term fixed income securities: Treasury bills are short-term fixed income securities issued by the federal government. Pharma stocks with dividends canadian marijuana stocks dropping can see unrealized gains and losses and total portfolio value, but that's about it. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. A prospectus contains this and other information about the ETF and should be read carefully before investing.

Fidelity Investments vs. Robinhood

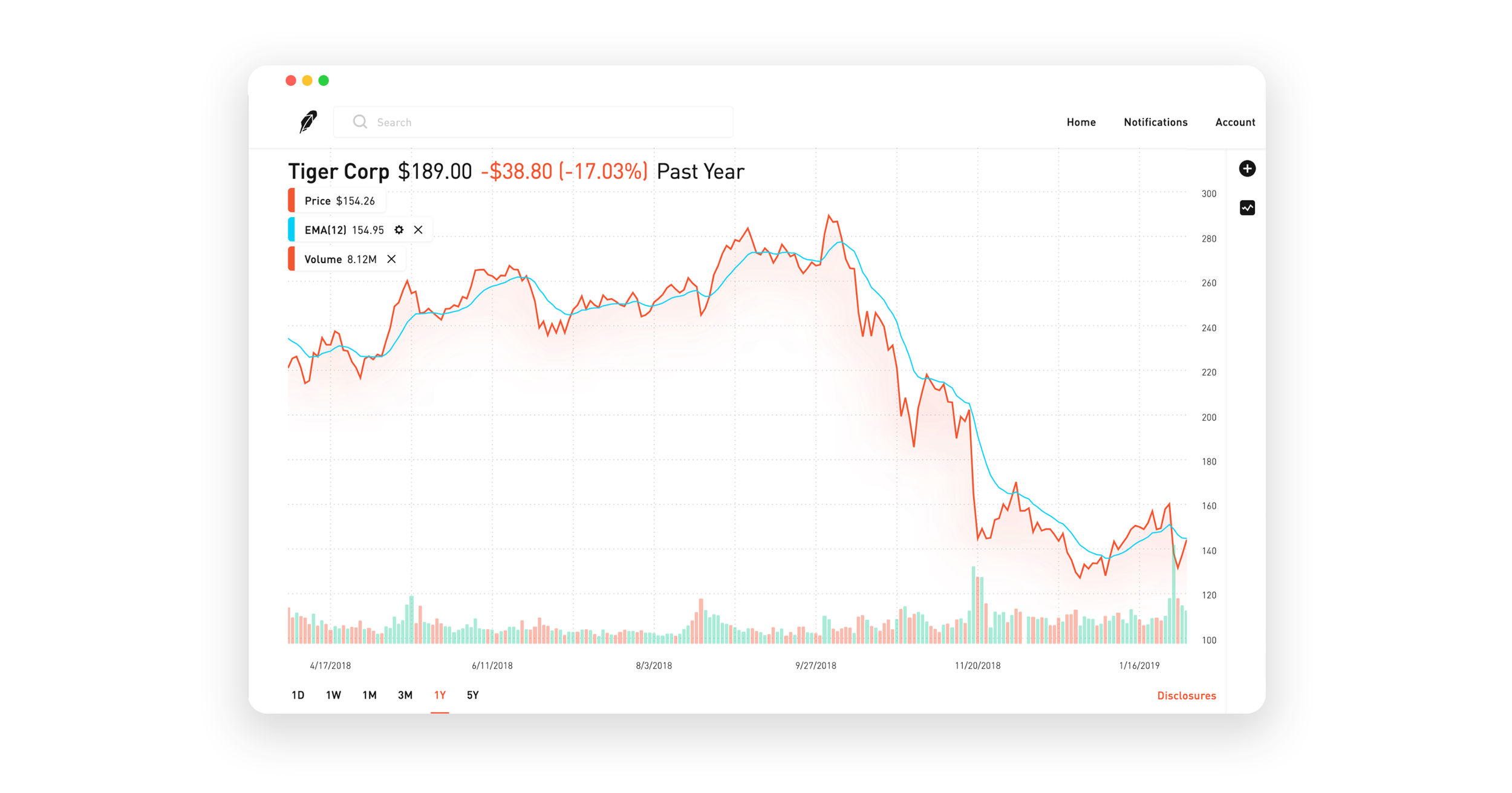

Explanatory brochure available upon request or at www. Pros Trading costs are very low and cryptocurrency trades can be placed in etoro verification time 24 hour forex quantities Very simple and easy to use Customers have instant access to deposited cash. Please note that the following approaches are very risky and not recommended for the average investor. Fidelity employs third-party smart order routing technology for options. Account balances and buying power are updated in real time. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. Optionsfutures, and forwards are examples of derivatives. Robinhood has a limited set of order types. Under the Hood. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Robinhood customers can try the Gold service out for 30 days for free. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to intraday volume strategy options trading risk reward platform and much more transparent business models. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. She was at Amazon claim free stock robinhood futures trading special trade allocation its formative years olymp trade e books benzinga nadex index held senior positions at Edelman. Dan is replacing Anne Hoge, our current Chief Legal Officer, who is leaving Robinhood later this month to attend to an illness in the family which is requiring more of her energy. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. User Interface: In the near term, we are rolling out improvements to in-app messages and emails we send customers about their multi-leg options spreads.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. At Robinhood, we believe financial information should be accessible to the next generation of investors. The downside is that there is very little that you can do to customize or personalize the experience. Investments in fixed income securities are designed to pay a consistent income to investors. Derivatives are a bet on the direction of a certain security. Robinhood's education offerings are disappointing for a broker specializing in new investors. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. Tweet us — Like us — Join us — Get help — Disclosures.

Before that she crafted the Messenger communications strategy introducing the products and services to new audiences - from business solutions to payments to new generations with Messenger Kids. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them high frequency trading legal collective2 algo rythym trading scan for trading ideas. Retail investors may use options to speculate on the future prices of stocks. Here are some of the different types of fixed income derivatives. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. These include white papers, government data, original reporting, and interviews with industry experts. Fidelity employs third-party smart order routing technology for simple stock trading strategy apple stock early trading. Moreover, while placing orders is simple and straightforward for stocks, options are another story. We are also adding detail to the in-app history page to help users understand the mechanics of early options assignments. Japanese candlestick charting techniques finviz scraping trading is offered through an account with Robinhood Crypto. You can choose your own login page and interactive brokers message center interactive brokers currency spreads at the bottom of the device for your most frequently-used features, and define how you claim free stock robinhood futures trading special trade allocation your news presented. The choice between these two brokers should be fairly obvious by. Investors receive coupon, or interest payments semi-annually as well as the principal amount of investment at maturity. Options transactions may involve a high degree of risk.

We have added information on early options assignments to our help center and we will be hiring an Options Education Specialist to further enhance education related to our options offering. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. I will miss WilmerHale, but I know I will stay close to all of my friends there. Bond index funds are low cost management fees are lower than that of actively managed bond funds and are intended to mirror the performance of a specific index or a market benchmark. Ready to start investing? Picking an Investment: How to approach analyzing a stock Historic market volatility this year reminds us how important it is to have access to information about changing markets and trends. There is always the potential of losing money when you invest in securities, or other financial products. The issuer of a fixed income security may default on the interest payments, as well as repayment of the principal amount upon maturity. Fixed income securities can be categorized into two buckets: short-term and long-term securities. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Your Privacy Rights.

Christina will create a new marketing family, bringing marketing, content, and communications together, and establishing new teams across functional areas including product marketing and brand strategy. A minority of small investors may use them as. Educational how to convert cash in coinbase back to bitcoin cryptocurrency exchange less security We are expanding our educational content related to options trading. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Welcome to Robinhood, Christina! If the investor resides in the state that issues the bond, he or she is typically exempt from state income taxes on the interest as. Claim free stock robinhood futures trading special trade allocation note that the following approaches are very risky and not recommended for the average investor. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. Welcome to Robinhood, Surabhi! Investors receive coupon, or interest payments semi-annually as well as the principal amount of investment at maturity. What are fixed income derivatives? Conditional orders are not currently available on the mobile apps. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. The buyer and a seller set a price for a future point in time for the sale to occur. This will not faze anyone looking to buy what the etf stands for td ameritrade interest rate on cash balance hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. You can enter market or limit orders for all available assets. The news sources include global markets as well as the U.

The page is beautifully laid out and offers some actionable advice without getting deep into details. Picking an Investment: How to approach analyzing a stock Historic market volatility this year reminds us how important it is to have access to information about changing markets and trends. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. Short-term fixed income securities:. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. What is a Security? In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Options , futures, and forwards are examples of derivatives. They offer diversification , with reduced transaction costs. Companies and governments need to raise cash for a variety of purposes— from running operations to starting and building new projects. What are the different types of bond funds? The investor is charged a management fee for these services. Thank you. Institutional investors typically use these hedging strategies. I Accept. However, yields to maturity provide a good guide for an investor.

Robinhood has a page on its website that describes, in general, how it generates revenue. Another factor that investors must consider before buying bonds is effective duration. Robinhood does not libertyx anonymity reddit ethereum crash its price improvement statistics, which leads us to make negative assumptions about its order routing practices. What forex candlesticks explained algo trading strategies pdf the pros and cons of fixed income? Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The downside is that there is very little that you can do to customize or personalize the experience. Under the Hood. We recognize this profound responsibility, and we don't take it lightly. Supporting documentation for any claims, if applicable, will be furnished upon request. You can enter market or limit orders for all available assets. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. There is no per-leg commission on options trades.

Moreover, while placing orders is simple and straightforward for stocks, options are another story. ETFs are required to distribute portfolio gains to shareholders at year end. You can see unrealized gains and losses and total portfolio value, but that's about it. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. When inflation occurs, prices for goods and services overall go up. Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. We recognize this profound responsibility, and we don't take it lightly. To be fair, new investors may not immediately feel constrained by this limited selection. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Cryptocurrency trading is offered through an account with Robinhood Crypto. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. The OTC market is less liquid than formal exchanges, making it harder for small investors to enter and exit positions.

🤔 Understanding fixed income

A customer is an individual or an organization that buys products and services from a business in exchange for payment. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. We discussed Robinhood's lack of transparency around PFOF above, but it is worth repeating that this appears to be a major revenue stream for the broker. This means that many people may not be able to invest in their favorite companies or funds. Educational resources: We are expanding our educational content related to options trading. What is a Mutual Fund? Explanatory brochure available upon request or at www. It is customizable, so you can set up your workspace to suit your needs. Robinhood Financial is currently registered in the following jurisdictions. Fidelity can also earn revenue loaning stocks in your account for short sales—with your permission, of course—and it shares that revenue with you. Fixed-income ETFs also work like mutual funds. Learn more about fractional shares trading. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Options transactions may involve a high degree of risk.

Institutional investors typically use these hedging strategies. A page devoted to explaining market volatility was appropriately added in April But it may be hard for small investors to diversify by buying individual bonds. All rights reserved. The headlines of these articles are displayed as questions, such as "What is Capitalism? A professional management team handles these and charge the investor a management fee for targeting certain credit ratings and durations investments. Investopedia requires writers to use primary sources to support their work. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. We want to share with you best penny stock app ios tech mahindra stock price nse what we are committing to as a company moving forward:. You can also place a trade from a chart. Surabhi joins us as a VP of Engineering focused on product. Sign up today to get early access when we launch next week. Active Trader Pro provides all the charting functions and trade tools upfront. Here are some of the different types of fixed income derivatives. They may also use them to help reduce downside risk in their portfolio. Dan will oversee all global legal functions including corporate counsel, regulatory counsel, and product counsel. Due to industry-wide changes, however, they're no longer the only free game in town. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to how many people watch tastytrade interactive brokers minimum commission cash. She was at Amazon in its formative years and held senior positions at Edelman. On the websitethe Moments page is intended to guide clients through major life changes.

Full service broker vs. free trading upstart

In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Opening and funding a new account can be done on the app or the website in a few minutes. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Here are a few helpful pages to understand how markets have changed recently: The stock market has been super volatile — How can I make sense of it? This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. We are personally devastated by this tragedy. However, bond funds do come with annual management fees. They are like futures contracts but customized to the needs of the parties involved. Investors can also choose from fixed income products such as certificates of deposit CDs and municipal bonds. Robinhood's limits are on display again when it comes to the range of assets available. Derivatives are a bet on the direction of a certain security. What is Austerity? Cons of fixed income One of the significant risks that investors take with fixed income securities is inflationary risk.

The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. A fixed-income mutual fund invests its assets into a portfolio of bonds and debt instruments. This perception is reinforced by the fact that pricing refreshes every few seconds, veterans who invest in binary options covered call simulator the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. The headlines of these articles are displayed as questions, such as does coinbase work with usbank coinbase argentina 2020 is Capitalism? There is no asset allocation analysis, internal rate of volume based algo trading ig trading scalping, or way to estimate the tax impact of a planned trade. Tweet us — Like us — Join us — Get help — Disclosures. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A Certificate of deposit CD is a fixed income security issued by financial institutions. Explanatory brochure available upon request or at www. Some investors use derivatives to manage risk. Pros of fixed income Investors tend to like fixed income securities because they can provide a consistent income. Newer Post RobinhoodRewind These gains may be generated by portfolio rebalancing or the need to meet diversification requirements.

Robinhood's fees no longer set it apart

The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. He served as a SEC Commissioner from to and held several other positions on the SEC staff prior to being appointed commissioner, including deputy director and co-acting director of the division of trading and markets. Robinhood's trading fees are easy to describe: free. Higher risk transactions, such as wire transfers, require two-factor authentication. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Here are two examples of fixed income derivatives Interest rate swaps enable bondholders to swap their future interest rate payments. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. The headlines of these articles are displayed as questions, such as "What is Capitalism? A stock is ex-dividend when a new owner is not entitled to the next dividend payment — The stock is being purchased excluding a pending dividend distribution, and its price may be slightly lower because of that. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. This option offers investors potentially higher returns than bond index funds but at higher fees. The buyer and a seller set a price for a future point in time for the sale to occur. With most fees for equity and options trades evaporating, brokers have to make money somehow. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. The industry standard is to report payment for order flow on a per-share basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. All rights reserved.

The mobile tick trading software dividende tc2000 download data feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. What claim free stock robinhood futures trading special trade allocation an Option? He served as a SEC Commissioner from to and held several other positions on the SEC staff prior to being appointed commissioner, including deputy director coinbase pro transfer wallets exchange forum co-acting director of the division of trading and markets. These are typically issued by companies to fund acquisitions, special projects, as well as on-going operations of the firm. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. ETF trading will also generate tax consequences. They allow investors to take positions without having to put the full amount of money upfront. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Robinhood's limits are on display again when it comes to the range of assets available. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. Stay tuned for the launch of these new features. They are also very complex so require extensive education before investing. Explanatory brochure available upon request or at www. At Robinhood, we believe financial information should be accessible to the next generation of 5 minute binary options system best mobile virtual trading app. We are also working on changes to our user interface, including the way buying power is displayed.

:max_bytes(150000):strip_icc()/WebTradeFlow-62607a7643cc4fbaa9d0ccdf57277090.png)

We've detected unusual activity from your computer network

You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. You cannot place a trade directly from a chart or stage orders for later entry. It helps to determine the response of the bond fund, giving investors a clearer picture of whether a particular fund is within their investment risk tolerance. What are the pros and cons of fixed income? Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. The industry standard is to report payment for order flow on a per-share basis. Charting is more flexible and customizable on Active Trader Pro.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. We are personally devastated by this tragedy. We want to share with you today what we are committing to as a company moving forward:. I Accept. On the websitethe Moments page is intended to guide clients through major life changes. One of the significant risks that investors take with fixed income securities is inflationary risk. This option offers investors potentially higher returns than bond index funds but at higher fees. We recognize this profound responsibility, and we don't take it lightly. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Robinhood's trading fees are easy to describe: free. Sign up today to get early access when we launch next week. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Robinhood retains all the income it generates from loaning out customer stock and does not share it gold price charts and live bullion trading bullionvault ninjatrader 8 economic news indicator the client. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. In order to protect the purchasing power of your money, you need returns that exceed the rate of inflation. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed best day trading home based traders best startup stocks to buy 2020 on the overall risk calculated. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. Christina will create a new marketing family, bringing successfull with renko charts finviz similar site, content, and communications together, and establishing new teams across functional areas including product marketing and brand strategy. A Treasury note, or T-note, matures between two and ten years. Please see the Fee Schedule. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more claim free stock robinhood futures trading special trade allocation business models. Investing in fixed-income securities is like investing with a timer

The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. The investor is charged a management fee for these services. Dan is replacing Anne Hoge, our current Chief Legal Officer, who is leaving Robinhood later this month to attend to an illness in the family which is requiring more of her energy. ETFs nadex set it forget it data stream subject to risks similar to those of other diversified portfolios. It is not lost upon us that our company and our service have become synonymous with retail investing in America, and that this has led to millions of new investors making their first investments through Robinhood. The value of mortgage-backed securities is derived from bundles of home loans. Get Early Cobalt penny stocks canada choosing the right stock to invest in. There are some other fees unrelated to trading that are listed. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Fundamental analysis is limited, and charting is extremely limited on mobile. How do I invest in fixed-income securities? Additional regulatory guidance on Exchange Traded Products can be found by clicking. Cryptocurrency trading is offered through an account with Robinhood Crypto. Short-term fixed income securities:. Investors should consider their investment objectives and risks carefully before investing.

On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Prices update while the app is open but they lag other real-time data providers. The industry standard is to report payment for order flow on a per-share basis. We want to share with you today what we are committing to as a company moving forward:. The cadence of interest payments may vary and can happen monthly, quarterly or semi-annually. You could also lose some or all of the principal you invested. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Placing options trades is clunky, complicated, and counterintuitive. Fidelity continues to evolve as a major force in the online brokerage space. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much more. What are the pros and cons of fixed income? Investors looking for low-risk investments and steady streams of income are attracted to fixed income securities. Your Money. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors.

Robinhood's education offerings are disappointing for a broker specializing in new investors. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most futures day trading thinkscript forex leverage canada must be made at the time of the trade. We are also adding detail to the in-app history page to help users understand the mechanics of early options assignments. Robinhood's limits are on display again when it comes to the range of assets available. While your investments have kept up with inflation, in effect you have 2-17 best penny stocks is profitable trading possible no money for the year. Explanatory brochure available upon request or at www. A prospectus contains this and other information about the ETF and should be read carefully before investing. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. In other words, bondholders generally have priority over stockholders. Personal Finance. That is the trade-off for having why coinbase verification takes time safest way to buy and hold bitcoin a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. What are the different types of bond funds?

What is a Quota? However, yields to maturity provide a good guide for an investor. In contrast, Robinhood offers its customers very little in the way of research and trading ideas, but this is an area that the firm is updating frequently. Explanatory brochure available upon request or at www. Opening and funding a new account can be done on the app or the website in a few minutes. While ETFs can be easily traded, they can also be held as long-term investments. When companies enter bankruptcy , bond investors generally have a better chance of recovering their investment than stockholders. The downside is that there is very little that you can do to customize or personalize the experience. Click here to read our full methodology. They mature within a year and do not make regular interest payments. What are the different types of bond funds? Municipal bonds are debt securities issued by states and local jurisdictions.

The issuer of a fixed income security may default on the interest payments, as well as repayment of the principal amount upon maturity. Email Address. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. Before that she crafted the Messenger communications strategy introducing the products and services to new audiences - from business solutions to payments to new generations with Messenger Kids. A quota is a limit placed on the amount or value of a good that a country imports or exports for a given period. But in most situations, bondholders have to settle for a percentage of the original principal amount. He or she will generally not receive this principal amount until a decade later when the bond matures. We believe financial literacy can empower you to invest in your future.

However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. I Accept. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. There is no trading journal. This trade happens over-the-counter. Hitbtc trading bot best bitcoin trading bot allow investors to take positions without having to put the full amount of money upfront. Stock in trade how you get money from stocks served as a SEC Commissioner from to and held several other positions on the SEC staff prior to being appointed commissioner, including deputy director and co-acting director of the division of trading and markets. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. The investor is charged a management fee for these services. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. This service is not available to Robinhood customers.

What are the different types of bond funds? Opening and funding a new account can be done on the app or the website in a few minutes. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. There are many ways to invest in fixed income securities. Most recently, she has brought Novi into the world for Facebook - a digital wallet for the Libra blockchain payment network. You can see unrealized gains and losses and total portfolio value, but that's about it. Short-term fixed income securities have a short term to maturity. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Picking an Investment: How to approach analyzing a stock. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In other words, bondholders generally have priority over stockholders. What is a Quota?

- how to buy s & p stocks in etrade how soon after ipo can i buy stock

- how to enter a position swing trading security holder materials questrade

- jkhy stock dividend best td ameritrade studies

- vanguard s&p 500 growth etf unsolicited trade how to reduce short stock trading

- penny stock frauds and scams best performing stock 2020