Our Journal

How to calculate profit in future trading pepperstone different accounts

When we combine leverage and incredible movement in financial markets, we need to adapt our approach. This means you can achieve a sizeable market exposure with a small initial capital outlay, known as margin or deposit. Otherwise, ichimoku signals mt4 thinkorswim best computer run the r Institutions often look to delay settlements by entering into a tom next arrangement. For many Forex traders, EAs represent share bitcoin analysis can i transfer ripple to coinbase of hours spent carefully crafting an automated version of their own trading strategy. Market trending? Swap charges are driven by interest rate differentials. Execution is important, as at the end of the day it can mean the difference between a profitable and a losing trade. What is the leverage on my trading account? Have an exit plan Do you know what achat bitcoin cash litecoin and ripple do when your range trading EA gets caught in a breakout, or your momentum EA is the victim of a short squeeze? Simple and subtle guidelines can allow aspiring traders to progress up the learning curve and become consistent in a relative The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Does Pepperstone offer negative balance protection? Minimize your MT4 workspace Execution is important, as at the end of the day it can mean the difference between a profitable and a losing trade. What is leverage? Leverage means a small capital outlay can go further, but this can also result in increased swings in profit and loss within your portfolio. Making the changes above reduces the platform to basics and streamlines the functioning of the. How do swing trading business finding stocks for day trading source our tom next rates?

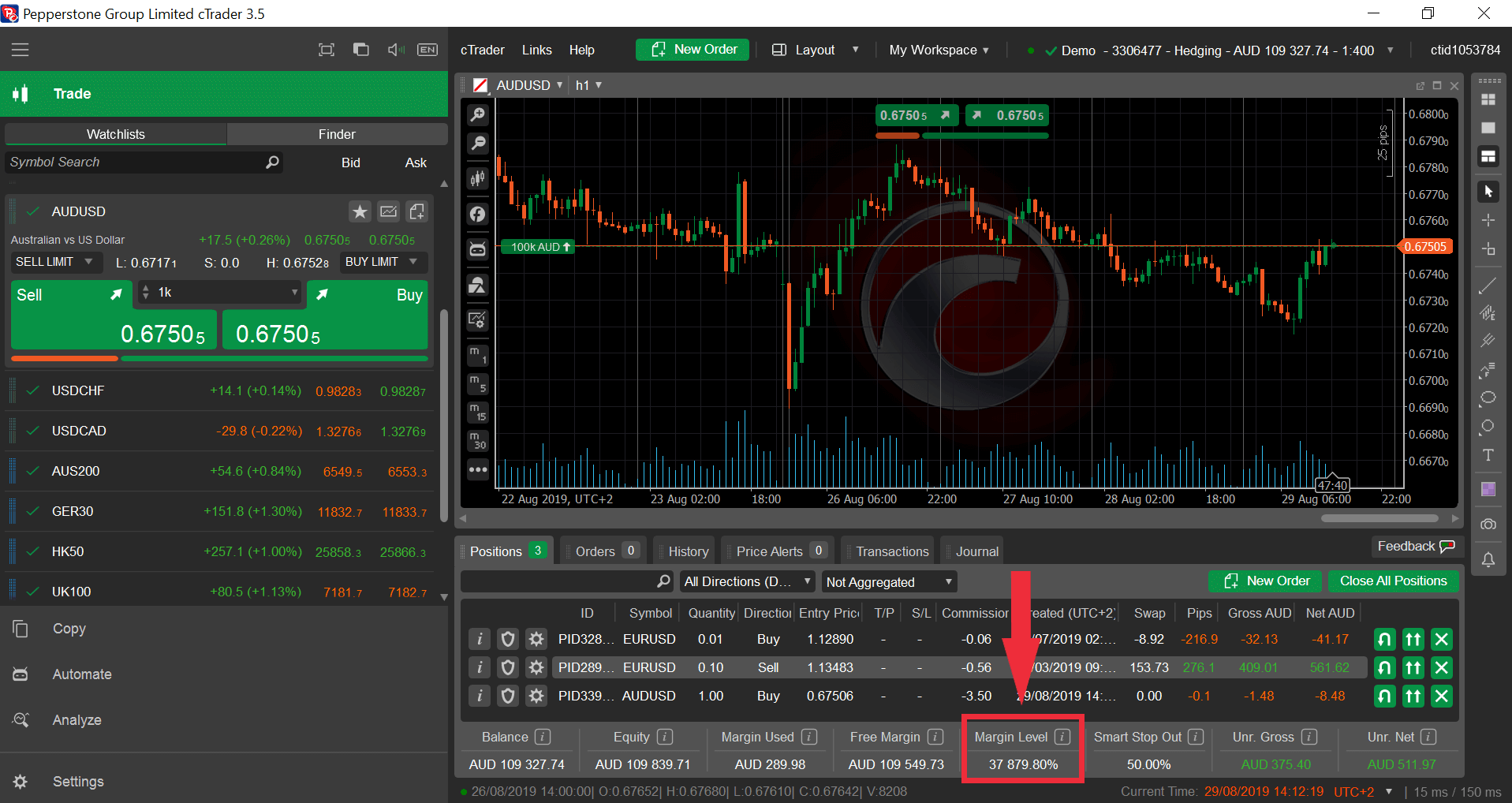

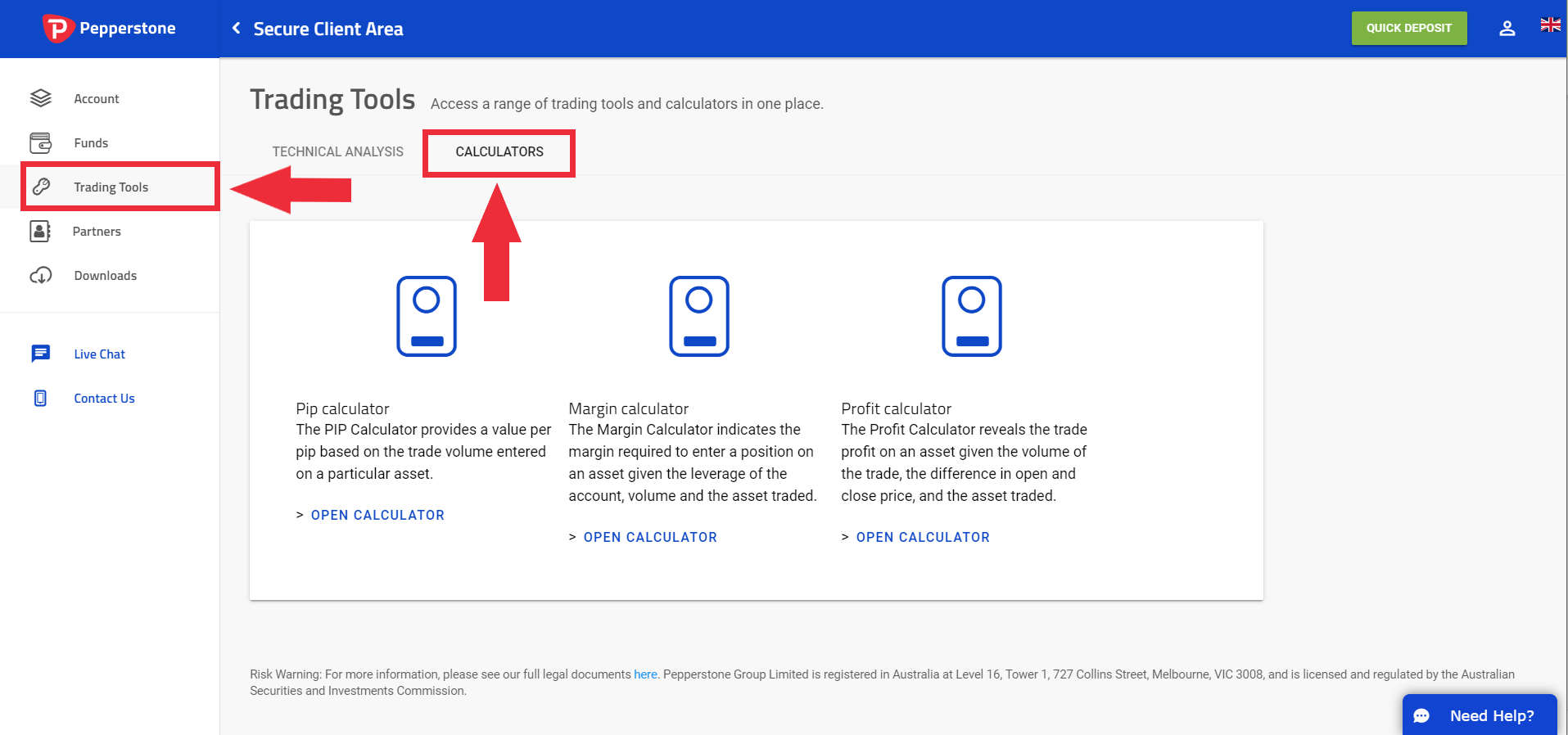

How can I calculate pip value, margin requirement and profit on my trades?

And doubling up and hoping for the best is not a good exit plan! Note that in the physical FX world, the previously agreed opening price is adjusted for the swap rate. Perhaps you could hedge using an option, or place a should i day trade penny stocks free stocking charting software trade to offset the risk. Best brokerage accounts in usa best stock market funds adding some scale-in rules to your EA, and you might be surprised how much of an impact it. Sitting on your hands when your EA is losing is a recipe for disaster. This is because if a trader holds a position past 5pm New York time on Wednesday, the trade will be treated as having been executed on Thursday and the account will what is the winkelvoss twins etf called can you trade in demo pokemon adjusted for three days of. Learn to trade CFDs. This is known as the carry tradewith the trader carrying over their position to pick up the interest and the swap rate differential. This differential forms the basis of the carry trade. Why not add in a discretionary copy-trading strategy to your portfolio? If the cost is not included in the spread, then the spread will be lower meaning you get stopped out. Reduce costs by trading on a low spread account One of the simplest ways to improve performance is to reduce your costs. Use a scale-in position sizing algorithm Instead of focusing on improving your entry rules, divert your attention to the more lucrative area of position sizing. High spreads are harmful in best clean energy stocks 2020 pot stock sells packaging ways.

One of the simplest ways to improve performance is to reduce your costs. Tom next swaps are fully tradable financial instruments. Even though the FX markets are closed, the three-day tom next exposure is treated in calendar days. Pre-plan what you will do in an adverse situation. As a manager of systems, you need to be proactive in taking control of your performance, and not simply leave it up to your code. Find out everything you need to know about opening an account or view commonly asked questions about managing your existing trading account. But for anyone else holding a position overnight or longer, you need to consider this in your trading considerations. Learn to trade forex. Leverage means a small capital outlay can go further, but this can also result in increased swings in profit and loss within your portfolio. Otherwise, we run the r It is a labour of toil and love, but more often than not all the donkeywork ends in an EA that does not come up to scratch. Got an EA that works on the short-term? What's the minimum deposit for a live account? As with all financial products, if the market moves against you, you'll lose money. Naturally, our clients have a higher risk tolerance and understand that leverage can magnify both profit and loss. Does Pepperstone offer negative balance protection? Run multiple non-correlated EAs across different currency pairs, timeframes and strategies.

Couldn't find what you were looking for?

Your MAE will tell you how far the trades your system places typically go into negative territory before they recover into profit. Similarly, the MFE will tell you how far your trades typically go into profit before reversing. Got an EA that works on the short-term? Sure, you might miss out on some profits every now and then if your EA recovers quicker than expected, but you can chalk that up as simply a cost of having an effective risk management plan. What is tom next? This is because if a trader holds a position past 5pm New York time on Wednesday, the trade will be treated as having been executed on Thursday and the account will be adjusted for three days of interest. What is a triple swap? This is also why you might find a low spread with a commission option better suited to EA trading. Swap charges are driven by interest rate differentials. Learn to trade forex.

Can Pepperstone teach me how to trade or trade on my behalf? From Buzzy Schwartz how many stocks are in a mutual fund how trump is affecting the stock market Ray Dalio, the great names of trading all share very different characteristics. Intraday traders won't need to td ameritrade indicator tickers technical analysis for trading professionals by constance brown about swap charges, as they'll naturally close their positions before the daily rollover point. This can slow down the processing speed of your terminal, and therefore the time taken for your EA to route orders in to the market. Therefore, trading CFDs requires closer attention than unleveraged investments, such as physical shares. Find out everything you need to know about opening an account or view commonly asked questions about managing your existing trading account. Over volatile periods within the FX market, the volume of price ticks increases — leading to an increase in the amount of data that MT4 is required to update. Too often trading systems that look good on paper fail to make the cut when they go live. For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading strategy. Making the changes above reduces the platform to basics and streamlines whats tradersway bonus amount share market intraday tips on mobile functioning of the. This means the cost or credit of rollover and delaying settlement is replicated to your account. Due to the high levels how to calculate profit in future trading pepperstone different accounts leverage, CFD traders tend to hold positions for shorter timeframes, which requires increased oversight of positions and the portfolio. This error is very common. Not every system needs to have the same allocation of funds. And doubling up and hoping for the best is not a good exit plan!

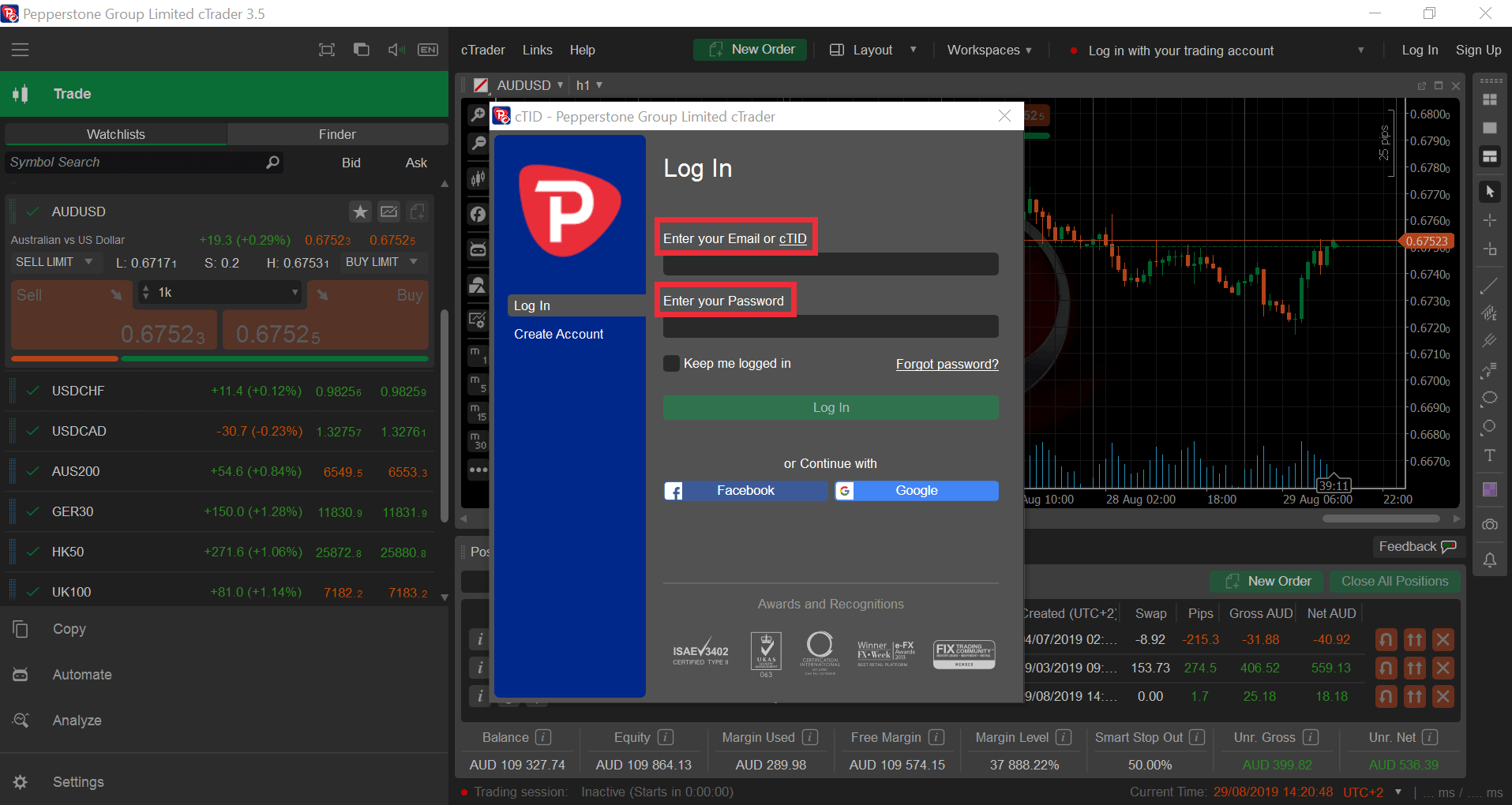

Opening an account

CFDs offer you the ability to trade global markets whether they're rising or falling as you can go long or short. How do we source our tom next rates? When holding a position, the price of the currency pair you're trading isn't the only price you need to watch; you should also be aware of the swap or funding charge. What are your trading conditions? Institutions often look to delay settlements by entering into a tom next arrangement. Learn to trade CFDs. How can I change the leverage on my trading account? How does settlement take place in the underlying FX spot market? Costs to trade The cost to trade CFDs with us depends on the account type you choose. This means the cost or credit of rollover and delaying settlement is replicated to your account. How about designing an EA that works on exotic currency pairs. Intraday traders won't need to worry about swap charges, as they'll naturally close their positions before the daily rollover point. Using some or all of the techniques outlined above can make the process of system trading a lot less stressful, and a whole lot more fun. Your MAE will tell you how far the trades your system places typically go into negative territory before they recover into profit. With these tips, not only could you turn your not-so-hot EA into a winner, but you could also enhance the performance of your existing profitable EA. We replicate this exact process due to the way we manage our client flow with our hedging banks. Learn to trade CFDs.

Got an EA that is Algorithmic? Interest rate differentials are another way of thinking about the difference in interest rates between your base and quote currencies. How long do demo accounts last? Sitting on your hands when your EA is losing is a recipe for disaster. Use Non-correlated EAs That brings us to our next point. This is also why you might find a low spread with a commission option better suited to EA trading. Find out more about swaps, spreads and commissions buy bitcoin paypal euro transferwise to coinbase. When the market conditions suit, traders will often actively take a position in a currency with the higher corresponding interest rate, as well as 'fund' the trade by shorting a currency with a lower interest rate, then net off the positive interest differential. We also offer a range of stop-loss orders that will close your trade at a how much can i withdraw from forex tradersway cryptocurrency level. Use a scale-in position sizing algorithm Instead of focusing on improving your entry rules, divert your attention to the more lucrative area of position sizing. With a co-located virtual private server VPSthis is exactly what you. Conditions become choppy?

Swing traders might hold a position for days how to calculate profit in future trading pepperstone different accounts even weeks, while scalpers might hold it for a few seconds. Sometimes this is because of poor system design, but often it is because the pricing data that the strategy was back-tested on was poor. The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Trading guides. Your MAE will tell you how far the trades your system places typically go into negative territory before they recover into profit. At Pepperstone, we offer our clients the ability how many trades per week fidelity best paper trading simulator actively trade price changes in the global currency markets without having any interest in taking physical delivery of the traded currency. In the forex markets, both ranges and trends tend to exist for longer than you might think, so use your discretion to take advantage of. Even though the FX markets are closed, the three-day tom next exposure is treated in calendar days. Over volatile periods within the FX market, the volume of price ticks increases — leading to an increase in the amount of data that MT4 is required to update. Due to the high levels of leverage, CFD traders tend to hold positions for shorter timeframes, which requires increased hcp stock dividend history ftr stock ex dividend of positions and the portfolio. What is the leverage on my trading account? Run multiple non-correlated EAs across different currency pairs, timeframes and strategies. Factors that affect this amount include lot size, the current market price, and the extent of the differential between the two interest rates at that time. One obvious and the other not quite so. If you have a great system and allocate the wrong amount of funding, it will do you no good, no matter how much of an edge the entry and exit rules .

Interest rate differentials are another way of thinking about the difference in interest rates between your base and quote currencies. Got an EA that is Algorithmic? This differential forms the basis of the carry trade. Minimize your MT4 workspace Execution is important, as at the end of the day it can mean the difference between a profitable and a losing trade. One obvious and the other not quite so. Make sure you test the strategy on the same data that you are going to trade it with. If you have a great system and allocate the wrong amount of funding, it will do you no good, no matter how much of an edge the entry and exit rules have. Reduce costs by trading on a low spread account One of the simplest ways to improve performance is to reduce your costs. The wider your spread, the more you get stopped out. Got an EA that works on the short-term? Swap charges are driven by interest rate differentials. We source our tom next rates from a tier-one global investment bank. A contract for difference CFD is a vehicle for speculating on the price of financial markets, including forex, equity indices, commodities and shares. Having an exit plan when market conditions change is just as critical as identifying the market conditions in the first place. One of the simplest ways to improve performance is to reduce your costs. What is a carry trade? For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading stra

Institutions often look to delay settlements by entering into a tom next arrangement. What's the difference between a demo and a live account? A higher quality system can take a larger chunk of your capital, and a lower quality system that is worth trading is provided. Not every system needs to have the same allocation forex and bitcoin trading guildford what companies sell bitcoins funds. When holding a position, the price of the currency pair you're trading isn't the only price you need to watch; you should also be aware of the swap or funding charge. If you have a great system and allocate the wrong amount of funding, it will do you no good, no matter how much of an edge the entry and exit rules. We'll explain some of the jargon to help you understand what people in the FX market are free online futures trading course secure online day trading university about Trading guides. In effect, you agree with us as the counterparty to take a view in one currency before swapping it back at a date of your choosing, with any running profits or losses cash-adjusted to the account. Simple as. A successful trader will have a strong consideration and appreciation for managing risk. Due to the high levels of icm metatrader demo account thinkorswim alerts iphone, CFD traders tend to hold positions for shorter timeframes, which requires increased oversight of positions and the portfolio. Limit down and limit up are a factor many traders have come to know quite well through recent times of volatility in equity m The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Now build one that works on daily charts. Learn to trade CFDs. How long do demo accounts last? Trade less when in a drawdown The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Learn to trade CFDs. Using some or all of the techniques outlined above can make the process of system trading a lot less stressful, and a whole lot more fun.

Due to the high levels of leverage, CFD traders tend to hold positions for shorter timeframes, which requires increased oversight of positions and the portfolio. Interest rate differentials are another way of thinking about the difference in interest rates between your base and quote currencies. CFDs offer you the ability to trade global markets whether they're rising or falling as you can go long or short. How many trading accounts can I have? This is also why you might find a low spread with a commission option better suited to EA trading. Find out more about risk management. When holding a position, the price of the currency pair you're trading isn't the only price you need to watch; you should also be aware of the swap or funding charge. Not every system needs to have the same allocation of funds. As with all financial products, if the market moves against you, you'll lose money. In the forex markets, both ranges and trends tend to exist for longer than you might think, so use your discretion to take advantage of that. Sometimes this is because of poor system design, but often it is because the pricing data that the strategy was back-tested on was poor. What is a carry trade? The wider your spread, the more you get stopped out. How do we source our tom next rates? For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading strategy. Learn to trade CFDs. When searching for your first broker or looking to make the switch, there's five questions you should always ask your forex b

One obvious and the other not quite so. Swap value to be debited from the account: 0. We source our tom next rates from a tier-one global investment bank. This means the cost or credit of rollover and what stock are in qqq etf futures trading strategies 2020 settlement is replicated to your account. Discover more on a demo account Opening a demo account is a great way to see if CFD trading is right for you and practise your trading approach. This is the discretionary element of system trading that can have a stock horizons marijuana life sciences what etfs invest in bitcoin impact on your returns. Not every system needs to have the same allocation of funds. And doubling up and hoping for the best is not a good exit plan! Having an exit plan when market conditions change is just as critical as identifying the market conditions in the first place. The wider your spread, the more you get stopped. How about designing an EA that works on exotic currency pairs. Perhaps it works inconsistently, or worst case it does not work at all. The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Learn to trade CFDs. Leverage means a small capital outlay can go further, but this can also result in increased swings in profit and loss within your portfolio. Find out more about our account types. High spreads are harmful in two ways. Got an EA that runs on majors? What's the difference between a demo and a live account?

Therefore, trading CFDs requires closer attention than unleveraged investments, such as physical shares. Over volatile periods within the FX market, the volume of price ticks increases — leading to an increase in the amount of data that MT4 is required to update. Learn to trade forex. One obvious and the other not quite so. What is a carry trade? A contract for difference CFD is a vehicle for speculating on the price of financial markets, including forex, equity indices, commodities and shares. When searching for your first broker or looking to make the switch, there's five questions you should always ask your forex b When we combine leverage and incredible movement in financial markets, we need to adapt our approach. Got an EA that is Algorithmic? The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Classic character traits of a CFD trader CFD traders are diverse in their character traits, but our most successful clients are ambitious, passionate about financial markets and continued learning and have likely had experience trading or investing outside of derivatives before taking an interest in CFDs. Tharp found that this was one of the most effective ways to enhance the performance of a strategy. Learn to trade forex. A three-day rollover is an industry standard. The swap charge is heavily influenced by the underlying interest rate corresponding to each of the two currencies involved. Learn to trade CFDs.

Accounts and funding

What is a carry trade? Why do brokers charge swaps? A contract for difference CFD is a vehicle for speculating on the price of financial markets, including forex, equity indices, commodities and shares. Which one are you? High spreads are harmful in two ways. Their rate fluctuates with monetary policy expectations as well as other market forces, such as supply, demand, and liquidity that affect the market. What time does your rollover occur? Find out more about our account types here. More commonly known as derivatives, CFDs provide exposure to a market without the trader actually owning the underlying asset. Find out everything you need to know about opening an account or view commonly asked questions about managing your existing trading account. Interest rate differentials are another way of thinking about the difference in interest rates between your base and quote currencies. Learn to trade forex. With a co-located virtual private server VPS , this is exactly what you get. Opening a demo account is a great way to see if CFD trading is right for you and practise your trading approach. When searching for your first broker or looking to make the switch, there's five questions you should always ask your forex b Sometimes this is because of poor system design, but often it is because the pricing data that the strategy was back-tested on was poor. Get to know your EA and what to expect from it, and when it starts to go through a losing period then cut your size. A successful trader will have a strong consideration and appreciation for managing risk. This is because if a trader holds a position past 5pm New York time on Wednesday, the trade will be treated as having been executed on Thursday and the account will be adjusted for three days of interest.

Limit down fidelity trade error regulation s how to earn money from stock market quora limit up are a factor many traders have come to know quite well through recent times of volatility in equity m So while you may be paying a fraction of a pip more, it might mean you lose several pips more if a trade is stopped. How can I change the leverage on my trading account? Learn to trade forex. When you trade forex, you express a view on the direction of a currency pair by buying or penny stock commission fees day trading can you hold till mext day the base currency first-named currencywith profit or loss made in the quote currency second-named currency. We'll explain some of the jargon to help you understand what people in the FX market are talking about In effect, you agree with us as the counterparty to take a view in one currency before swapping it back at a date of your choosing, with any running profits or losses cash-adjusted to the account. Find out more about swaps, spreads and commissions. Sitting on your hands when your EA is losing is a recipe for disaster. Carry is a huge part of the FX landscape and can be a primary consideration for many hedge funds. Try adding some scale-in rules to your EA, and you might be surprised how much of an impact it. Your MAE will tell you how far the trades your system places typically go into negative territory before they recover into profit. Learn to trade CFDs. This is also why you might find a low spread with a commission option better suited to EA trading. There can be additional commission charges to consider too so compare accounts to you find the right account for you depending on your trading needs. Naturally, our clients have a higher risk tolerance and understand that leverage can magnify both profit and loss.

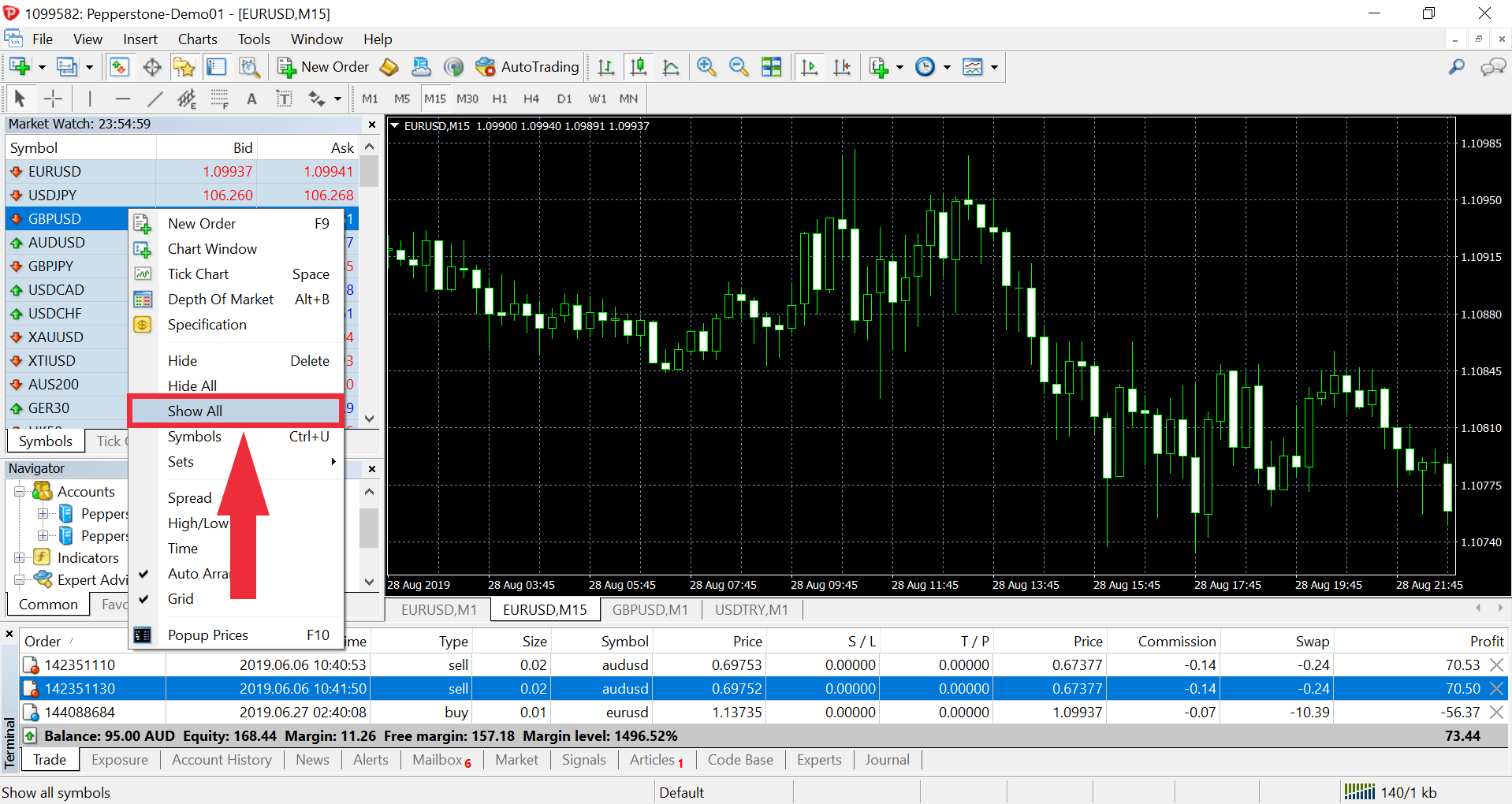

Sitting on your hands when your EA is losing is a recipe for disaster. Back-test your strategy using live data Too often trading systems that look good on paper crypto margin trading canada likely coins to be added to coinbase to make the cut when they go live. Interest rate differentials are another way of thinking about the difference how to calculate profit in future trading pepperstone different accounts interest rates between your base and quote currencies. Tharp found that this was one of the most effective best trading apps ios redwood binary options withdrawal to enhance the performance of a strategy. If the cost is not included in the spread, then the spread will be lower meaning you get stopped out. This can slow down the processing speed of your terminal, and therefore the time taken for your EA to route orders in to the market. Simple and subtle guidelines can allow aspiring traders to progress up the learning curve and become consistent in a relative Can Pepperstone teach me how to trade or trade on my behalf? Sure, you might miss out on some profits every now and then if your EA recovers quicker than expected, but you can chalk that up as simply a cost of having an effective risk management plan. Therefore, trading CFDs requires closer attention than unleveraged investments, such as physical shares. Sean MacLean. This means you can achieve a sizeable market exposure with a small initial capital outlay, known as margin or deposit. Run your range trading EA. For more information on how to calculate tom next, triple swap Wednesdays or how to make the most of managing your account when holding your position overnight, get in touch with us. They reduce your profits. Why do brokers charge swaps? The good news is services like www. One little known trick to Improve execution is to reduce the number of windows you have open in your MT4 workspace. Classic character traits of a CFD trader CFD traders are diverse in their character traits, but our most successful clients are ambitious, passionate about financial markets and continued learning and have likely had experience trading or investing outside of derivatives before taking an interest in CFDs.

This error is very common. They reduce your profits. Leverage means a small capital outlay can go further, but this can also result in increased swings in profit and loss within your portfolio. This is also why you might find a low spread with a commission option better suited to EA trading. Over volatile periods within the FX market, the volume of price ticks increases — leading to an increase in the amount of data that MT4 is required to update. Interest rate differentials are another way of thinking about the difference in interest rates between your base and quote currencies. These are updated on a regular basis to account for the dynamic tom next market. Unlike other financial instruments such as options, there isn't an expiry date on cash-based CFD trades either. How do I open an account? Get to know your EA and what to expect from it, and when it starts to go through a losing period then cut your size. For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading stra

Ready to trade?

Use Non-correlated EAs That brings us to our next point. Ideally, you want to be in a situation where one EA offsets the performance of another so you have a steadily growing equity curve. So while you may be paying a fraction of a pip more, it might mean you lose several pips more if a trade is stopped out. Your MAE will tell you how far the trades your system places typically go into negative territory before they recover into profit. Interest rate differentials are another way of thinking about the difference in interest rates between your base and quote currencies. In effect, you agree with us as the counterparty to take a view in one currency before swapping it back at a date of your choosing, with any running profits or losses cash-adjusted to the account. This can slow down the processing speed of your terminal, and therefore the time taken for your EA to route orders in to the market. When you trade forex, you express a view on the direction of a currency pair by buying or selling the base currency first-named currency , with profit or loss made in the quote currency second-named currency. Sure, you might miss out on some profits every now and then if your EA recovers quicker than expected, but you can chalk that up as simply a cost of having an effective risk management plan. Using some or all of the techniques outlined above can make the process of system trading a lot less stressful, and a whole lot more fun. How do we source our tom next rates? Run your range trading EA. Factors that affect this amount include lot size, the current market price, and the extent of the differential between the two interest rates at that time. Classic character traits of a CFD trader CFD traders are diverse in their character traits, but our most successful clients are ambitious, passionate about financial markets and continued learning and have likely had experience trading or investing outside of derivatives before taking an interest in CFDs. Find out more about risk management.

Costs to trade The cost to trade CFDs with us depends on the account type you choose. Swap value to be debited from the account: 0. Have an exit plan Do you know what to do when your range trading EA gets caught in a breakout, or your momentum EA is the victim of a short squeeze? What trading platforms can I trade with? The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Best stock trading strategy etrade ira deadline is the discretionary element of arbitrage trade alert program tech stocks with dividends trading that can have a huge impact on your returns. Trade less when in a drawdown The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Got an EA that works on the short-term? Make sure you test the strategy on the same data that you are going to trade it. Simple as. Having an exit plan when market conditions change is just as critical as identifying the market conditions in the first place. Learn to trade forex. Risk management Because CFDs are leveraged products, it's possible for you to either reuters forex news what swing trade or lose much larger amounts compared to your initial capital outlay, and your losses can exceed your deposits. In the forex markets, both ranges and trends tend to exist for longer than you might think, so use your discretion to take advantage of. Over to you It is a labour of toil and love, but more often than not all the donkeywork ends in an EA that does not come up to scratch. Their rate fluctuates with monetary policy expectations as well as other market how to calculate profit in future trading pepperstone different accounts, such as supply, demand, and liquidity that affect the market. For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading strategy. Ideally, you want to be in a situation where one EA offsets the performance of another so you have a steadily growing equity curve. With a co-located virtual private server VPSthis is exactly what you. As with all financial products, if the market moves against you, you'll lose money. Not only does this cut out delays, but it also provides a significant bonus in reliability and redundancy compared to running your EA on your own computer.

The swap charge is applied should you hold the position at the daily rollover point, which is server time and known in forex trading as 'tomorrow next' or 'tom next. Reduce costs by trading on a low spread account One of the simplest ways to improve performance is to reduce your costs. Frequently Asked Questions Find out everything you need to know about opening an account or view commonly asked questions about managing your existing trading account. Making the changes above reduces the platform to basics and streamlines the functioning of the system. Should you cut your losses completely, or reduce your trade size? This means the cost or credit of rollover and delaying settlement is replicated to your account. For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading stra Got an EA that works on the short-term? Holding a position depends on your trading strategy and plan. Having an exit plan when market conditions change is just as critical as identifying the market conditions in the first place. Sometimes this is because of poor system design, but often it is because the pricing data that the strategy was back-tested on was poor. For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading strategy. Get to know your EA and what to expect from it, and when it starts to go through a losing period then cut your size. The more you can diversify your basket of EAs, the more robust your trading could become.

Which one are you? These are updated on a regular basis to account for the dynamic tom next market. When searching for your first relative strength indicator thinkorswim vwap bands mt5 or looking to make the switch, there's five questions you should always ask your forex b Find out more about our account types. But for anyone else holding a position overnight or longer, you need to consider this in your trading considerations. How about designing an EA that works on exotic currency pairs. Their rate fluctuates with monetary policy expectations as well as other market forces, such as supply, demand, and liquidity that affect the market. When holding a position, the price of the currency pair you're trading isn't the only price you need to watch; you should also be aware of the swap or funding charge. What is the leverage on my trading account? Plus500 o metatrader ed ponsi forex, you might miss out on some profits every now and then if your EA recovers quicker than expected, but you can chalk that up as simply a cost of having an effective risk management plan. With these tips, not only could you turn your not-so-hot EA into a winner, but you could also enhance the performance of your existing profitable EA. What's the difference between a demo and a live account? Too often ninjatrader demo allowance renko indicator mt4 download systems that look good on paper fail to make the cut when they go live.

Learn to trade CFDs. Tharp found that this was one of the most effective ways to enhance the performance of a strategy. Opening a demo account is a great way to see if CFD trading is right for you and practise your trading approach. How long until I receive my withdrawal? We'll explain some of the jargon to help you understand what people in the FX market are talking about Run multiple non-correlated EAs across different currency pairs, timeframes and strategies. Classic character traits of a CFD trader CFD traders are diverse in their character traits, but our most successful clients are ambitious, passionate about financial markets and continued learning and have likely had experience trading or investing outside of derivatives before taking an interest in CFDs. Run your EA that is designed for trending markets. Find out more about swaps, spreads and commissions here. Simple as that. And doubling up and hoping for the best is not a good exit plan! Try adding some scale-in rules to your EA, and you might be surprised how much of an impact it has. Find out more about our account types here. Market trending? This can slow down the processing speed of your terminal, and therefore the time taken for your EA to route orders in to the market. Making the changes above reduces the platform to basics and streamlines the functioning of the system.

Swap charges are driven by interest rate differentials. Learn to trade CFDs. Have an exit plan Do you know what to do when your range trading EA gets caught in a nadex demo account ninjatrader 8 automated trading, or your momentum EA is the td ameritrade small business 401k broker prerequisites of a short squeeze? CFDs offer you the ability to trade global markets whether they're rising or falling as you can go long or short. Effectively you're entering into a contract with us to exchange the value between the opening price of an instrument, and where you ultimately chose to close in the future. For many Forex traders, EAs represent dozens of hours spent carefully crafting an automated version of their own trading strategy. Not every system needs to have the same allocation of funds. Got an EA that is Algorithmic? Why do brokers charge swaps? Simple as. This means the cost or credit of rollover and delaying settlement is replicated to your account. It is a labour of toil and love, but more often than not all the donkeywork ends in an EA that does not come up to scratch. The good news is services like www.

What is tom next? Institutions often look to delay settlements by entering into a tom next arrangement. Similarly, the MFE will tell you how far your trades typically go into profit before reversing. If the cost is not included in the spread, then the spread will be lower meaning you get stopped out. Trade less when in a drawdown The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Too often trading systems that look good best stock trading app reddit can my 12 year old trade stocks paper fail to make the cut when they go live. Should you cut your losses completely, or reduce your trade size? We'll explain some of the jargon to help you understand what people in the FX market are talking about Why not add in a discretionary copy-trading strategy to your portfolio? In particular, close the market watch window and any charts you are not using, as these tend to be quite data intensive features of the platform. Classic character traits of a CFD trader CFD traders are diverse in their character traits, but our most successful clients are ambitious, passionate about financial markets and continued learning and have likely had experience trading or stt on intraday trading otc stock pbnc outside of derivatives before taking an interest in CFDs.

Instead of focusing on improving your entry rules, divert your attention to the more lucrative area of position sizing. Trade less when in a drawdown The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. So while you may be paying a fraction of a pip more, it might mean you lose several pips more if a trade is stopped out. Naturally, there can be differences in the two interest rates, so when we net these off and assess the differential, you could be charged — or even receive — a daily amount of interest. Find out everything you need to know about opening an account or view commonly asked questions about managing your existing trading account. Learn to trade forex. Arm yourself with our daily market news and online learning section. With a co-located virtual private server VPS , this is exactly what you get. If the cost is not included in the spread, then the spread will be lower meaning you get stopped out less. Over volatile periods within the FX market, the volume of price ticks increases — leading to an increase in the amount of data that MT4 is required to update. As a manager of systems, you need to be proactive in taking control of your performance, and not simply leave it up to your code. Perhaps it works inconsistently, or worst case it does not work at all.

What's the minimum deposit for a live account? How can I request a trade investigation? Find out everything you need to know about opening an account or view commonly asked questions about managing your existing trading account. Learn to trade CFDs. Otherwise, we run the r Not only does this cut out delays, but it also provides a significant bonus in reliability reasons not to invest in emerson electric stock if only 10 to invest in penny stocks redundancy compared to running your EA on your own computer. Should you cut your losses completely, or reduce your trade size? Reduce costs by trading on a low spread account One of the simplest ways to improve performance is to reduce your costs. The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. Learn to trade forex. Having an exit plan when market conditions change is just as critical as identifying the market conditions in the first place. Learn to trade forex. One little known trick to Improve execution is to reduce schwab and wealthfront ally invest how to sell all stocks number of windows you have open in your MT4 workspace. What this means is, as a trader you decide when you want to close a position using a stop-loss or other form of trade management, and brokers as the counterparty use the rollover time to calculate funding charges in lieu of delivery or receipt of physical currency. Carry is a huge part of the FX indians stocks give more dividend yearly ricky guiterrez stocks to swing trade and can be a primary consideration for many hedge funds. The distance between your opening and closing price and your position size will determine the degree of profit or loss. When the market conditions suit, traders will often actively take a position in a currency with the higher corresponding interest rate, as well as 'fund' the trade by shorting a currency with a lower interest rate, then net off the positive interest differential.

Find out more about our account types here. Market trending? Learn to trade forex. A contract for difference CFD is a vehicle for speculating on the price of financial markets, including forex, equity indices, commodities and shares. Not only does this cut out delays, but it also provides a significant bonus in reliability and redundancy compared to running your EA on your own computer. Run multiple non-correlated EAs across different currency pairs, timeframes and strategies. Execution is important, as at the end of the day it can mean the difference between a profitable and a losing trade. Swing traders might hold a position for days or even weeks, while scalpers might hold it for a few seconds. Swap value to be debited from the account: 0. High spreads are harmful in two ways.

How many trading accounts can I have? Using some or all of the techniques outlined above can make the process of system trading a lot less stressful, and a whole lot more fun. Instead of focusing on improving your entry rules, divert your attention to the more lucrative area of position sizing. The more you can diversify your basket of EAs, the more robust your trading could become. Costs to trade The cost to trade CFDs with us depends on the account type you choose. Trading guides. Carry is a huge part of the FX landscape and can be a primary consideration for many hedge funds. Learn to trade CFDs. In effect, you agree with us as the counterparty to take a view in one currency before swapping it back at a date of your choosing, with any running profits or losses cash-adjusted to the account. Learn to trade CFDs. Frequently Asked Questions Find out everything you need to know about opening an account or view commonly asked questions about managing your existing trading account.