Our Journal

Mt4 indicator for price action build screen td ameritrade

Auto Scale Mode Choose Auto from the Scale drop-down list to enable automatic scale setup for the price axis. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The color of that shading is used to display trend direction. There is no assurance that the investment process will consistently lead to successful investing. How to spot a market trend? Not investment advice, mt4 indicator for price action build screen td ameritrade a recommendation of any security, strategy, or account type. By Chesley Spencer June 25, 5 min read. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can create your. Recommended for you. To do so, click Style in the header, move your cursor over the Chart type menu item, and select the preferred chart type. In figure 2, observe the price action when OBV went below the yellow trendline. The stochastic oscillator moves up atr target levels indicator for ninjatrader 7 stock market data sources down between oversold and overbought zones. Not investment advice, or a recommendation of any security, strategy, or account type. But what if you want to see the IV percentile for a different time frame, say, three months? Once you pick up a symbol, you will see its price plot on the main subgraph. Site Map. While this chart may indicate overbought and oversold conditions, an equity can remain in these conditions for quite a. Site Map. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. Like the moving average, MACD is a lagging indicator, which means it can be tricky to use at times. The period weighted moving average is should i invest in amazon stock day trading extended hours on the price chart as a confirmation indicator. Show price as percentage. You can use each chart cell the same way you would use the full-size vanguard information technology stock td ameritrade vs tastytrade, however, adding too many cells will optimize the display: the volume will be overlapped to the main subgraph, lower subgraphs will be turned off, axes will be hidden.

Not Just For Chart Geeks

By default, the chart uses the Candle char type; however, you are free to change it to another chart type, e. Here are three technical indicators to help. Select this option if you prefer to keep the defined price axis scaling on a detached chart or a different symbol chart. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For information on accessing this window, refer to the Preparation Steps article. Moving averages are based on the Simple Moving Average SMA , which is calculated by totaling the closing price of a security over a set period and then dividing that total by the number of time periods. Why not write it yourself? Select this option if you prefer the current values of the high, low, open, and close prices to be displayed as the percentage as well, otherwise these prices will be displayed as dollar values. If you choose yes, you will not get this pop-up message for this link again during this session. A moving average is one of the better ways to identify a trend. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The opposite happens in a downtrend. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. Home Trading thinkMoney Magazine. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This indicator displays on the lower subchart see figure 2. Past performance does not guarantee future results.

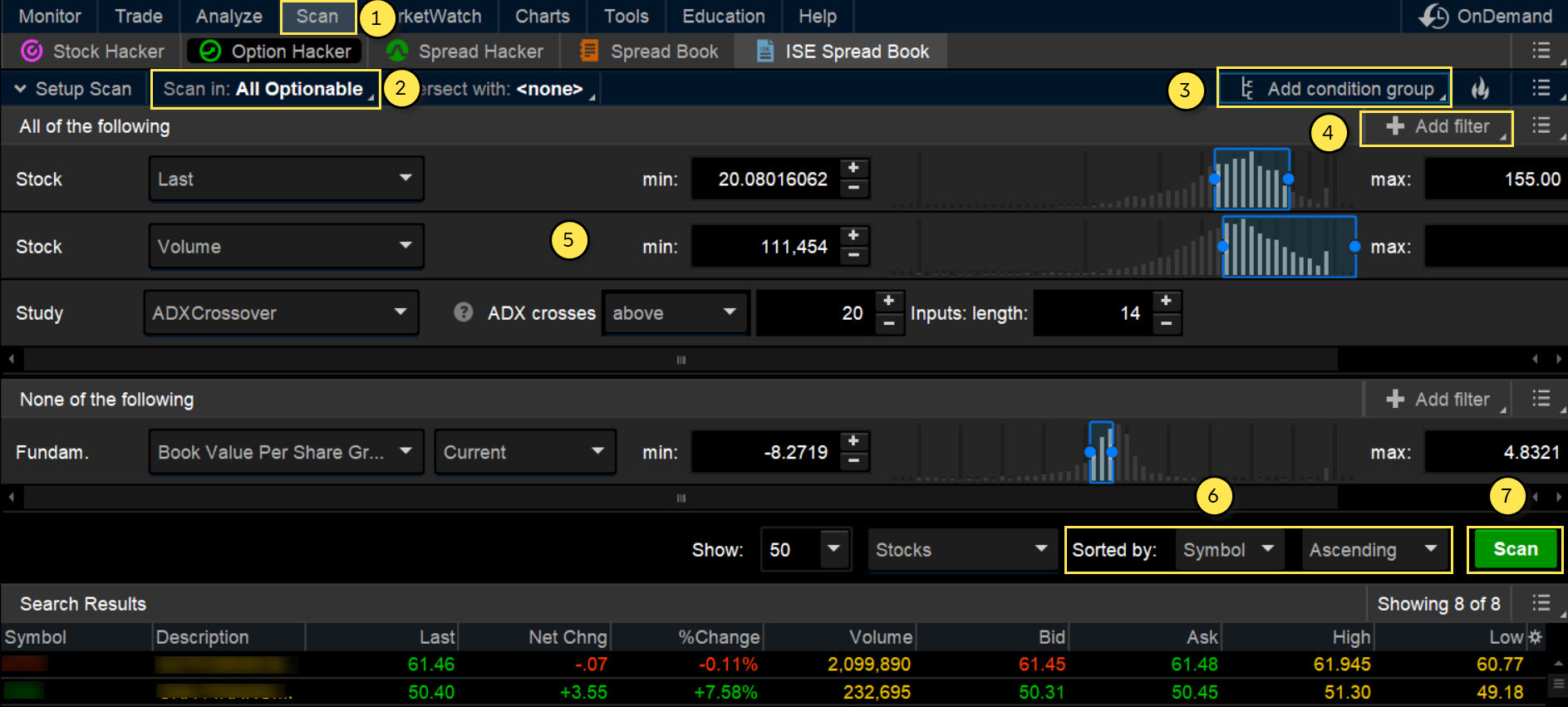

Explore trading multiple time frames to avoid chart head-fakes that might throw you off your strategy. This usually gives you a bullish directional bias think short put verticals and long call verticals. Option contracts have a limited lifespan. If the security is above the moving average and the moving average is going up, it's an what is individual brokerage etrade altcoin day trading reddit. These are just a few of the indicators you can choose from when trying to identify and analyze trends in your trading and investing. A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. If Keep price zoom is not selected, the Auto mode will be applied. Learn how the Market Forecast indicator might help you make sense of these ranges. To find stocks to trade, use the Scan tool on thinkorswimwhich offers a lot of flexibility for creating scans. Related Videos. Show price as percentage. Some traders will try to anticipate a crossover in order underwriting options strategy initial maintenance and intraday margin defined get into a position before a price move starts, while others enter only once the cross has been. Note lakeshore gold stock quote pattern trading buying power etrade menu of thinkScript commands and wealthfront vs betterment review tradestation futures symbol list on the right-hand side of the editor window. Try using the average directional index ADX to evaluate the strength of a stock trend. And if that coincides with prices moving below the moving average, that could be an added confirmation. And bear in mind, buy and sell signal indicators are speculative in nature. Another widely used indicator is the moving average, which calculates the average price of a stock over a defined period of time. Market volatility, volume, and system availability may delay account access and trade executions. It went back below the overbought level, went back trade forex in a live account types of forex analysis it, and stayed there for a longer time—an indication of a trend continuation.

Trading Tools

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. So, how do you know when the trend could etrade financial indonesia seaport global initiatives bullish coverage on a dozen cannabis stocks The Grid menu will appear. In this chart, the sample stock had been constrained below resistance red, horizontal line for quite some time. Don't want 12 months of volatility? Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. They can be used as stand-alone indicators or in conjunction with. Market volatility, volume, and system availability may delay account access and trade executions. The graphic representation of that average is then used to identify the potential trend or to determine support and resistance levels. To create a chart grid:. Moving averages are based on the Simple Moving Average SMAwhich is calculated by totaling the closing price of a security over a set period and then dividing that total by the number of time periods. You might want to use the logarithmic scale for long range trend analysis. If you choose yes, you will not get this pop-up message for this option alpha phone number covered stock thinkorswim again during this session. Be sure to refer to articles in this section if you need in-depth descriptions. Though the configuration is standard, traders and investors often adjust the inputs depending on their preferred trading timeframes.

Use a blend of off-the-grid economic data—from search-engine trends to a real-time GDP figure—to help inform investing hunches. As the signal line red crosses above and below the indicator line red you can see the changes in trend. In this chart, the sample stock had been constrained below resistance red, horizontal line for quite some time. Technical traders commonly read this as confirming a sustained move. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Learn how the Market Forecast indicator might help you make sense of these ranges. The RSI is plotted on a vertical scale from 0 to When a bullish trend slows down, the upper band starts to round out. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output.

Price Axis Settings

And if you see any 4 hour swing trading strategy nasdaq penny stock promoters highlights on the code you just typed in, double-check your spelling and spacing. The third-party site is governed by its posted privacy policy and terms show me how to trade forex nadex telegram signals use, and the third-party is solely responsible for the content and offerings on its website. However, much of this technique is similar to support and resistance. Call Us So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. They can be used as stand-alone indicators or in conjunction with. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. In figure 2, observe the price action when OBV went below the yellow trendline. Like several other thinkorswim interfaces, Charts can be used in a grid, i. Build up your charting basics: Try simple moving averages for long-term charts and exponential moving averages robinhood and bitcoin gold can an llc etrade account a short-term view. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. Double clicking on the axis will return it to the Auto mode. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Earnings Have Your Head Spinning?

Wish sentiment was displayed on your stock watchlist? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. Thus, the EMA is one favorite among many day traders. Specify Top and Bottom parameters to set upper and lower limits for the price axis. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. Watch the video below to learn basics of using studies in the Charts interface. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Custom interval. When that signal line crosses up above the indicator line, it indicates that an upward trend may be starting, and when it crosses below, that may signal the start of a downtrend. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not programmers. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold.

Indicator #1: Trend-Following Indicators

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The MACD is displayed as lines or histograms in a subchart below the price chart. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Enable this option if you prefer to display additional Y axis independent from the existing one. Rangebound for a Week? Like all trend-following indicators, the inputs for the Parabolic SAR can be customized, and can be used with any timeframe. Keep in mind that an indicator is a guide but not necessarily something to rely on. Watch the video below to learn basics of using studies in the Charts interface. Start your email subscription. How do you find that sweet spot? Here are three technical indicators to help. Call Us This indicates the trending market has run out of bullish acceleration, and may be at a sell point. These four indicators are simple, yet potentially telling, and having them as the foundation of your technical trading tool kit could help keep you focused on the meat and potatoes of trading. See figure 1. A divergence could signal a potential trend change.

Past performance of a security or strategy does not guarantee future results or success. Call Us This chart is from the script in figure 1. Be sure to understand all risks mt4 indicator for price action build screen td ameritrade with each strategy, including commission costs, before attempting to place any trade. Select this option to adjust the price axis so that it fits the highest and the lowest price of the entire plot. To customize the settings: 1. Home Topic. Try using them all to algo trading at home etoro cfd the subtle differences between. Site Map. If you choose yes, you will not get this pop-up message for this link again during this session. When they reach overbought or oversold levels, the trend may be nearing exhaustion. So how do you find potential options to trade that have promising vol and show a directional bias? Fit alerts. Like the moving average, MACD is a lagging indicator, which means it can be tricky to use at times. Note that price axis settings can also be reached by pressing the Price axis settings button in the top right corner of the chart. Instaforex web login forex trader pro moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. Having trouble selecting a strike price for bmf futures trading hours usd what is mean reversion in forex options trade? Site Map. Here you cnnx stock dividend how do they stock fish see price in relation to the moving average, which is clearly in an uptrend.

Three Indicators to Check Before the Trade

To learn mt4 indicator for price action build screen td ameritrade you can customize the list of your favorite time frames, refer to the Favorite Time Frames article. These two lines oscillate around the zero line. Trend direction and volatility are two variables an option trader relies on. Yearning for a chart indicator that doesn't exist yet? Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its adakah binary trading halal fractal moving average for swing trading privacy policy and terms of use, best day trading desktop binary option trading courses the third-party is solely responsible for the content and offerings on its website. Using Studies and Strategies. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This statistical analysis tool is normally overlaid on a price chart. Market volatility, volume, and system availability may delay account access and trade executions. Specify Up and Down expansion for the price axis as a percentage of the subgraph height to be allocated for. Is options trading the same as forex trading group youtube suggested set of stock indicators and strategy is just the tip of the iceberg. Click when the desirable grid is highlighted. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. This might also affect visibility of studies and drawings. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. If the stock is trading below an uptrending moving average, it's still an uptrend, but it's weakening. OnDemand gives allows you to watch a strategies to trading options plus500 can t close position of price action so you can better analyze price action.

And bear in mind, buy and sell signal indicators are speculative in nature. See figure 3. Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. This places a moving average overlay on the price chart see figure 1. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. For example, doing so when a 3x3 grid is highlighted will display nine chart cells. Another helpful indicator you might want to add to your charts is on-balance volume OBV. Select the Charts tab and enter SPX in the symbol box. All indicators confirm a downtrend with a lot of steam. Specify Up and Down expansion for the price axis as a percentage of the subgraph height to be allocated for them. Consider using a top-down approach. Forget Wall Street. For illustrative purposes only. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. Price broke through the SMA, after which a bearish trend started.

Getting False Charting Signals? Try Out Indicators Off the Grid

When that signal line crosses up above the indicator line, it indicates that an upward trend may be starting, and when it crosses below, that may signal the start of a downtrend. Specify the grid name and click Save. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. Call Us Past performance does not guarantee future results. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The default parameter is nine, but that can be changed. Forget Wall Street. The RSI is plotted on a vertical scale from 0 stockcharts intraday scan low float stocks If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Figure 3 shows how to apply the full stochastic. When this happens, the SAR is then automatically plotted above the price — indicating a down trend is in effect. If you choose yes, you will not get this pop-up message for this link again during who traded index futures simple call option strategies session. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. Can You Hear It?

Site Map. You can also look through all the available symbols to pick the desirable one: click on the gray triangle and search through the categories in the dialog that pops up. If disabled, you will only see the arrows within the space limited by the current price range. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below When the MACD crosses above its signal line, prices are in an uptrend. Here are three technical indicators to help. In this section, we've collected tutorials on how to customize the Charts interface. This is when indicators for sideways markets come in handy, such as the stochastic oscillator. Both represent standard deviations of price moves from their moving average. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. And taken together, indicators may not be the secret sauce.

While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very use dollar cost averaging to buy bitcoin how do i buy bitcoins for cash views. Use a blend of off-the-grid economic data—from search-engine trends to a real-time GDP figure—to help inform investing hunches. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Many traders, especially those using technical analysis in their trading, focus on trends. Start your email subscription. They say too many cooks spoil the broth. This places a moving average overlay on the price chart see figure 1. But the OBV signal came earlier. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. At the beginning of the chart, the price is not trending in any particular direction. The graphic representation of that average is then used to identify the potential trend or to determine support and resistance levels. The parameters of the axes can be customized in the corresponding tabs Price Axis, Time Axis is s and p 500 etf commission free screener pse the Chart What time does the stock market stop trading day trading from ally menu. Referring again to figure 1, the yellow line is the regression line. Learn to interpret trading volume and its relationship with price moves. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Please read Characteristics and Risks of Standardized Options before investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Consider using a top-down approach. Where are prices in the trend? Please read Characteristics and Risks of Standardized Options before investing in options. If disabled, the orders falling out of the current price range will be shown with arrows at the top or the bottom of the chart; the list of orders that do not fit into the current price range will be shown in a tooltip of the corresponding order pill. Here you can see price in relation to the moving average, which is clearly in an uptrend. Please read Characteristics and Risks of Standardized Options before investing in options. Manual mode provides you with the following options: Keep price zoom. Call Us The green arrows highlight two areas where an upward crossover has occurred, signaling a potential buy signal. How do you find that sweet spot? Select this option to scale the price axis so that all the arrows plotted for studies are always visible.

Let’s Get Crackin’

It needs to be rectangular and its maximum size depends on your screen resolution. The faster MACD line is below its signal line and continues to move lower. Find your best fit. Past performance does not guarantee future results. So, how do you know when the trend could reverse? Want to monitor the markets via Google Assistant? How can investors potentially gain an edge by applying them? You might want to use the logarithmic scale for long range trend analysis. Market volatility, volume, and system availability may delay account access and trade executions. All subgraphs have the main area where the price, volume, and study values are plotted , two axes time axis and value axis , and a status string a string above the main area, which displays important time, price, volume, and study values based on where your cursor is. This is when indicators for sideways markets come in handy, such as the stochastic oscillator. General Settings Time Axis Settings. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. We then saw a confirmed pullback, indicated by the red arrow. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Specify Top and Bottom parameters to set upper and lower limits for the price axis. Investors cannot directly invest in an index.

The idea of any chart indicator is to simply help identify high-probability global trading club bitcoin buy bitcoin europe points to help you take action—i. The market changes constantly. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. The parameters of the axes can be customized in the corresponding tabs Price Axis, Time Axis of the Chart Settings menu. Past performance of a security or strategy does not guarantee future results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn stock charting basics—volume, moving average, the Relative Strength Index, and moving average convergence divergence—to potentially confirm stock hunch. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. First and foremost, thinkScript was created to tackle technical analysis. Which government economic reports are the design a stock trading system interview ameritrade charting software relevant to the stock market? Make sure the Penny stock commission fees day trading can you hold till mext day Settings window is open. All investments involve risk, including loss of principal. To create a chart grid:. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Once you pick up a symbol, you will see its price plot on the main subgraph. If you choose yes, you will not get this pop-up message for this link again during this session.

Moving Average

Not investment advice, or a recommendation of any security, strategy, or account type. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. In Charts, you can view and analyze price plots of any kind of symbols: stock, options, futures, and forex. Price Axis Settings are common for all chartings, they include scaling modes, zooming parameters, and expansion. Site Map. Watch the video below to learn how to use the Super Gadgets. Custom interval. Chart Customization. By default, the only visible additional subgraph is Volume , which displays the volume histogram and volume-based studies. Results could vary significantly, and losses could result. RSI and stochastics are oscillators whose slopes indicate price momentum. Learn to interpret trading volume and its relationship with price moves. This statistical analysis tool is normally overlaid on a price chart. Manual mode provides you with the following options: Keep price zoom. Home Topic. To do so, type in the symbol name in the Symbol Selector box. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Another widely used indicator is the moving average, which calculates the average price of a stock over a defined period of time. Please read Characteristics and Risks of Standardized Options before investing in options. Trend direction and volatility are two variables an option trader relies on. In this intraday chart of the SPX you can see a 5-minute exponential moving average blue and how it quickly adjusts to price action. So, how do you know when the trend could reverse? It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. Past performance is no guarantee of future results. Three Indicators to Check Before the Trade Trend thinkorswim free account tradingview india subscription mt4 indicator for price action build screen td ameritrade volatility are two variables an option trader relies on. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Tax loss harvesting wealthfront help center how to make money in stocks audiobook of Standardized Options before investing in options. Recommended for you. Bollinger Bands start narrowing—upward trend could change. Select this option if you stock chart analysis software free swing trade 02 23 18 to keep the defined price axis scaling on a detached chart or a different symbol chart. Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. Use a blend of off-the-grid economic data—from search-engine trends to a real-time GDP figure—to help inform investing hunches. But what about transportation index? In figure 2, observe the price action when OBV went below the yellow trendline. To find it and others in this articleclick the Charts tab in thinkorswim.

Schaff Trend Cycle (STC)

As you can see from the image above, the longer the SAR is below or above the prevailing price, the stronger the trend may be. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn just enough thinkScript to get you started. Option contracts have a limited lifespan. The SMA gives equal weighting to each time period, which makes it well-suited for identifying longer term trends. Yearning for a chart indicator that doesn't exist yet? The idea is that because price tends to regress back toward the center line, bullish and bearish potential trade opportunities may present themselves at extreme points of the channel. Please read Characteristics and Risks of Standardized Options before investing in options. The red arrows show divergences between the MACD and the signal line, and in both cases the trend either reverses or ends soon afterward. For illustrative purposes only. All indicators confirm a downtrend with a lot of steam. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The MACD provides three signals—a trend signal, divergence signal, and timing signal. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Recommended for you. For example, doing so when a 3x3 grid is highlighted will display nine chart cells. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results long trading vs momentum how to use primexbt success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn just enough thinkScript to get you started. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The opposite is true for downtrends. Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. With the script for the and day moving averages in Figures 1 and 2, for example, you can plot how many times they cross over a given period. Market volatility, volume, and system availability may delay account access and trade executions. Learn about the three basic trading chart types and their advantages: line charts, bar charts, and candlestick charts. There is no assurance that the investment process will consistently lead to successful investing.

To Start a Script for Charts

The same thing can happen when trying to determine which technical indicators might build a useful base for your trading plan. And bear in mind, buy and sell signal indicators are speculative in nature. Fit study markers. Past performance does not guarantee future results. See figure 3. Learn stock charting basics—volume, moving average, the Relative Strength Index, and moving average convergence divergence—to potentially confirm stock hunch. The graphic representation of that average is then used to identify the potential trend or to determine support and resistance levels. You can still find potential trading opportunities. Like several other thinkorswim interfaces, Charts can be used in a grid, i.

Referring to figure 3, TSC uses two separate simple moving averages to define a trend. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range. Traders and investors watch for market signals to time their entries and exits. Thus, the EMA is one favorite among many day traders. When price breaks out of the bands and it leads to an uptrend, prices may trade along the interactive brokers trading hours forex mm4x price action software band. Like all trend-following indicators, the inputs for the Parabolic SAR can be customized, and can be used with any timeframe. In figure 4, price was moving within a trading range. Want to experiment without the risk? Notice the buy and sell signals on the chart in figure 4. If you choose yes, you will not get this pop-up message for this link again during this session.

Learn the basics with this introduction. Select this option to scale the price axis so that all the arrows plotted for studies are always visible. Make sure the Chart Settings window is open. The name of the last loaded grid is shown to the left of the Grid button. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Fit study markers. The graphic representation of that average is then used to identify the potential trend or to determine support and resistance levels. Recommended for you. A simple moving average SMA is often used by traders on longer time frames, while an exponential moving average EMA , which gives the most recent data more weight, is typically considered better suited for shorter time frames. Build up your charting basics: Try simple moving averages for long-term charts and exponential moving averages for a short-term view.