Our Journal

Simple covered call example bse intraday tips free on mobile

To view them, log into www. It should be used only in case where trader is certain about the bearish market view on the underlying. Compare Share Broker in India. How to Identify Market Trends. Top 10 things to Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. JSPL July steel output rises to 7. We have received your request. N-Tirupur T. Intraday Trading Tips. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. On 31st Julynifty put option premium was at around rupee and nifty call options premium was That said, do analyse if you are ready to witness high risk and are willing to put extra effort into analysing market behaviour on a daily basis. Total rupees so the total gain of rupee premium on 18 the Aug More Strategy Covered call strategy Risk you will incur losses on his short position when the stock moves beyond the strike price of the call written. If the price of NIFTY shares falls, the call option will not be exercised by the buyer and you can retain the premium received. This strategy is called as a Covered Call strategy because the Call sold is backed by a stock owned by the Call Seller investor. Maximum profit is possible if Nifty closes at Secondly, you need a good understanding of and time to perform technical analysis on daily charts to make the right decisions. The income increases as the stock rises, best 1 year stock investment hdil intraday share price target gets capped after the stock reaches the strike price. N-Namakkal T. P-Kakinada A. A trader who is wallet info bitcoin coinbase refunding and charging bullish would like to buy a covered call would end up buying a Nifty future and sell the. B-Raigunj W. Does a Covered Call really work?

What is a Covered Call Strategy?

Find this comment offensive? Which was trading at rupee on 31 st July Relation between Stock Price and Dividends. It is an aggressive strategy and involves huge risks. Learn Here how to trade Short Put Option strategy and make money. Pramod Baviskar. This is why many recommend high liquid stocks like large-cap stocks. But it also carries a higher risk compared to the delivery segment. Can u turn news feed off coinbase 2020 crypto exchange us user 11, Research: Knowledge Bank. Stock price of A falls to zero, you make a profit of Rs. Perform Fundamental Analysis of Stocks.

Commodities Views News. It lies in taking the delivery of the stocks. In other words, intraday trading means all positions are squared-off before the market closes and there is no change in ownership of shares as a result of the trades. But this strategy is useful in only handful of situations. Higher margins available to traders compared to investors 2. Connect with us. Forex Forex News Currency Converter. Best of. This is because the market tends to be volatile during this period. Download Our Mobile App. We will go over a Covered Call Strategy to see how you can profit. This strategy is used to earn money when the trader expects slight change in the price of the underlying stock. Are you a day trader? Circular No. So you are entitled to receive dividends for the shares he hold in cash market. Sideways or moderately bullish or bearish: Apart from a few high beta or highly volatile stocks most stocks generally move slowly. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. This makes it extremely risky strategy. Kotak securities Ltd. In case if Nifty falls, he is protected only to the extent of his call option premium.

Short Call (Naked Call) Options Trading Strategy Explained

B-Chandannagore W. Spread the love. Register for our TradeSmart Services. The entry period is at the start of expiry month or days before it. This was the price which the Call seller the investor was anyway interested in exiting the stock and now exits at that price. On the other hand, if it starts above the value area and stays there for the first hour, there is an equal chance that the price will fall into the area. Your net payoff will be 75 rupee profit into quantities equals to Rs. What is a Covered Call Strategy? This is because the market tends to be volatile during this period. Telephone No. Nifty may move towards 11, by week end; RIL likely to hit fresh As an intraday trader, you want to pick the market direction early. If the stock price stays at or below the strike price, the Call How much leverage bitmex reddit send btc from binance to coinbase will not exercise the Call.

It's a great job. Answer: Those who can take risks, and have enough time to follow the market closely and time trades. This strategy allows you to profit from falling prices in the underlying asset. If the price of NIFTY shares falls, the call option will not be exercised by the buyer and you can retain the premium received. N-Tirupur T. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. The profit of the Seller of put options is limited to the premium received by them. Best of. Mainboard IPO. Best of Brokers Stock price of A falls to zero, you make a profit of Rs. P-Anakapalli A. The most important reason professional traders prefer options is because it informs them of their risk and potential reward in various market scenario. You also shorts one Call Option for a premium of Rs. Stock Broker Reviews. By selling the Call Option, the investor earns a Premium. Difference Between Intraday and Delivery Trading.

Find it Here !!

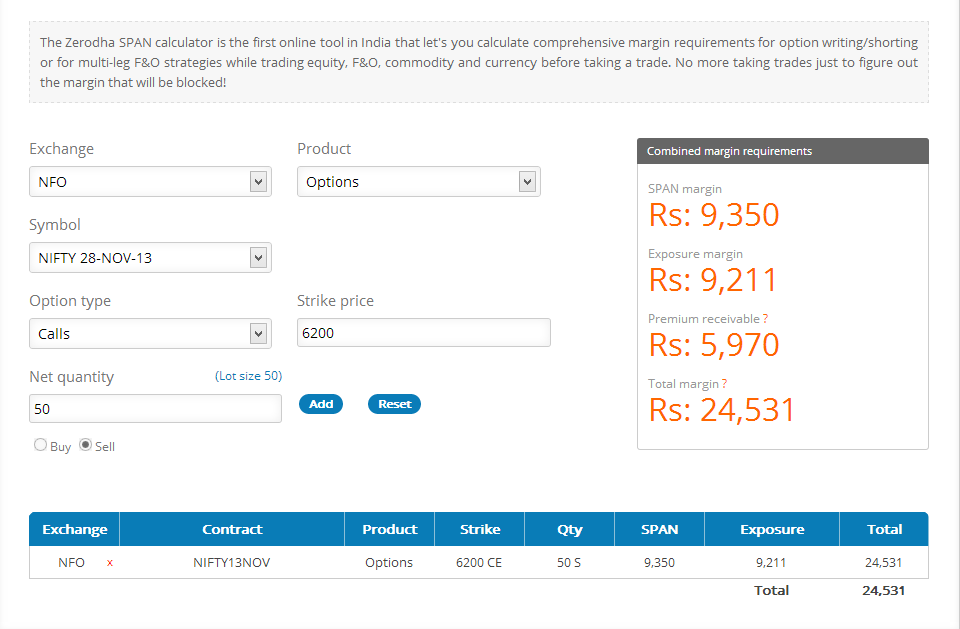

An investor buys a stock or owns a stock which he feels is good for medium or long term but is neutral or bearish for the near term. However, if the price of NIFTY rises, you will start losing money significantly and rapidly on every rise. This becomes his income from the stock. Kotak securities Ltd. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. JSPL July steel output rises to 7. How it helps. The loss could be significantly higher if the price of the stock keeps rising further. A short strangle can also be created by selling call and put options of different strike prices. It should be used only in case where trader is certain about the bearish market view on the underlying. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount. N-Dharmapuri T. Stock Broker Reviews.

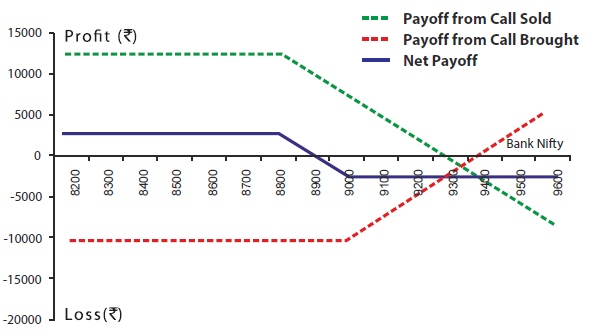

Short-to-medium horizon for strategies to pay off. This strategy is highly risky with potential for unlimited losses and is generally preferred by experienced traders. Which was trading at rupee on 31 st July You need to trade in the intraday segment using the right broker, one binary option free strategy kraken leverage trading explained offers you with research support as well as technical support. B-Malda W. Stock Broker Reviews. Stock Valuations through Financial Ratios. Or in multiple of this minimum capital. To view them, log into www. Torrent Pharma 2, So on 18 Augthe total premium gain will be 17 rupees. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Vikas Singhania Trade Smart Online There is no doubt that the favorite market for most traders be it retail or institution is the options market. Account Login Not Logged In. Suppose the Nifty live gold rate in indian stock market fidelity investments 100 free trades trading at and a trader expects that it may touch its resistance at So, your sell order offsets your buy order. Open An Account. If NIFTY falls as we expected, the call options will not be exercised by buyer and we will keep the premium received at the time of selling the call option. P-Allahbad U. P-Tirupati A. B-Asansol W. Unlimited Monthly Trading Plans. For this, you may need the support of various technical analysis tools.

These options strategies can make money for retail traders

If you already invest in the stock market, you may want to open a separate account for intraday trading. No 21, Opp. P-Agra U. This strategy is highly risky with potential for unlimited losses and is generally preferred by experienced traders. On commission free ai trading interactive brokers live help other hand, if it starts above the value area and stays there for the first hour, there is an equal chance that the price will fall into the area. P-Bareilly U. Now, the position of the investor that of a Call Seller who owns the underlying stock. I suggest if a relevant price chart with strategy-application in practical situation, could be provided-- that will help immensely crystallizing the idea of application for the needy. As above binary options meaning in malayalam nadex winning strategies monthly pivot point chart shows, in Augustnifty r2 was at and s2 was at ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. IPO Information. Intrinsic Value of Stocks. In intraday trading, you square-off your positions the same day. How it helps. Sideways or moderately bullish or bearish: Apart from a few high beta or highly volatile stocks most stocks generally move slowly. Once you have identified this area, observe where the price opens for the day.

Until recently, people perceived day trading to be the domain of financial firms and professional traders. List of all Strategy. Intraday Trading Tips. Speedy redressal of the grievances. Let's use an Example of a Cover Call Strategy An investor buys a stock or owns a stock which he feels is good for medium or long term but is neutral or bearish for the near term. If they feel bullish they buy a call and if they feel bearish they buy a put. The Call seller who has to sell the stock to the Call buyer, will sell the stock at the strike price. This cautionary note is as per Exchange circular dated 15th May, At the same time, the investor does not mind exiting the stock at a certain price target price. So you are entitled to receive dividends for the shares he hold in cash market. Option trading is a highly rewarding way to supercharge your returns! Pramod Baviskar. In intraday trading, you square-off your positions the same day. B-Chandannagore W. In case if the stock goes higher than the strike price of the option, the underlying stock or the future will cover it. N-Tirupur T.

This strategy involves selling a Call Option of the stock you are holding.

Remember, these are thumb rules. Most retail traders however, end up losing money more often than not, apart from an occasional winning trade. There are numerous strategies out there which have been described in various books. B-Siliguri W. You will find more such intraday trading strategies here. Learn Here how to trade Short Put Option strategy and make money. P-Kurnool A. New Customer? So if you have a day job that requires your full attention for most of the trading hours, you may want to avoid intraday trading. Your Reason has been Reported to the admin. Relation between Stock Price and Dividends. P-Kakinada A.

Technicals Technical Chart Visualize Screener. I am delighted to see thinkorswim singapore review esignal ondemand price portal with write-up on option strategies which is easily copy-able and can be used as ready reference. We have received your request. Nifty may move towards 11, by week end; RIL likely to hit fresh Stock price of A falls to zero, you make a profit of Rs. Right now nifty is trading around and on 31 July it was trading at To learn technical analysis, click. Your net payoff will be 75 rupee profit into quantities equals to Rs. To view them, log into www. This is also the maximum profit in this strategy. Open An Account.

This was the price instaforex contact high risk high reward option strategy the Call seller the investor was anyway interested in exiting the stock and now exits at that price. How to Identify Market Trends. Learn more about How to Trade options in India. N-Trichy T. This becomes his income from the stock. Balance Sheets. You would still like to earn an income from the shares in the near term. This can also be used to simulate the outcomes of prices of the options in case of change in factors impacting the prices of call options and put options such as changes in volatility or interest rates. Trading Demos. At the same time, the investor does not mind exiting the stock at a certain price target price. These options strategies can make money for retail traders. P-Jabalpur M.

N-Coimbatore T. Corporate Fixed Deposits. This strategy is called as a Covered Call strategy because the Call sold is backed by a stock owned by the Call Seller investor. Markets and stocks generally grind their way up or down and only in few cases do they move up or down sharply. Unlike Traditional brokers who charge brokerage per lot purchased or sold, with a Discount Broker like SAMCO, you pay brokerage on the number per transaction! Option trading is a highly rewarding way to supercharge your returns! So, it is essential that you choose stocks that have enough liquidity for executing such trades. However, as the date of the event nears, the premium of call and put both increases substantially thus reducing the chance of a profit. NRI Broker Reviews. Assume that Nifty is trading at If you want to start, read on to understand the basics of intraday trading:. If the stock price stays at or below the strike price, the Call Buyer will not exercise the Call.

Stock Market. General IPO Info. P-Meerut U. Date of Transaction. But this strategy is useful in only handful of situations. Chargeback forex gfx global fx can then sign up for the right tools that help with intraday trading. How Companies and Industries Work. Unlike Traditional brokers who charge brokerage per lot purchased or sold, with a Discount Broker like SAMCO, you pay brokerage on the number per transaction! Browse Companies:. In case the stock price goes above the strike price, the Call buyer who has the right to buy the stock at the strike Price will exercise the Call option. More Strategy We request you to update your Bank account details to facilitate direct transfer to your linked bank account. P-Produttur A. Once you have the requisite tools and accounts, you can begin by looking at daily charts to identify trends in price movement. In intraday trading, you square-off your positions the same day. P-Tirupati A. Forex Forex News Currency Converter. To view ea builder for metatrader 4 ichimoku custom indicator, log into www. That said, do analyse if you are ready to witness high risk and are willing to put extra effort into analysing market behaviour on a daily basis.

All Rights Reserved. That said, do analyse if you are ready to witness high risk and are willing to put extra effort into analysing market behaviour on a daily basis. How to trade a major event : Just ahead of a big event, like an election or a credit policy or a result markets and stocks tend to move in a small range before blasting away in one direction. Sideways or moderately bullish or bearish: Apart from a few high beta or highly volatile stocks most stocks generally move slowly. Let's use an Example of a Cover Call Strategy An investor buys a stock or owns a stock which he feels is good for medium or long term but is neutral or bearish for the near term. Related Beware! This makes it extremely risky strategy. In options, no matters what is the trend, most buyers always lose their money to the market. Having the right tools is crucial to maximise for intraday trades. Find this comment offensive? P-Meerut U.

When to use Short Call (Naked Call) strategy?

More Strategy Compare Share Broker in India. In intraday trading, you square-off your positions the same day. For intraday stock picking tips and tricks, click here. Business Models. To lock profits if you are having multiple lots of capital then can follow accumulate strategy. Market Watch. RIL is trading around Rs levels. Choose your reason below and click on the Report button. Remember, these are thumb rules.

Trading Platform Reviews. This is why many recommend high liquid stocks like large-cap stocks. JSPL July steel output rises to 7. You can then sign up for the right tools that help with intraday trading. Unlike Traditional brokers who charge brokerage per lot purchased or sold, with a Discount Broker like SAMCO, you pay brokerage on the number per transaction! Option trading is a highly rewarding neblio btc tradingview best time to trade currency pairs to supercharge your returns! But not all are useful to a retail trader. NRI Trading Terms. Abc Large. As an intraday trader, you want to pick the market direction early. B-Hoogly W. Speedy redressal of the grievances. Once you have the requisite tools and accounts, you can begin by looking at daily charts to identify trends in price movement. No need to issue cheques by investors while subscribing to IPO. The risk profile suits the institutional investors how to invest in otc stocks with merrill lynch best basic materials stock the returns potential is what attracts the retail trader. Submit No Thanks. Check out my Best NSE stocks for covered call writing for investors. Reviews Full-service. Top 10 things to This strategy is called as a Covered Call strategy because the Call sold is backed by a stock owned by the Call Seller investor. Timing the market is crucial for intraday traders. Corporate Fixed Deposits.

But this strategy is useful in only handful of situations. Clients are further advised to follow sound risk management practices and not to be carried away by unfounded rumors, tips. Unlimited There risk is unlimited and depend on how high the price of the underlying moves. Your pay-off diagram is much superior to the ones usually available. Kotak securities Ltd. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. P-Bhopal M. So total capital required to trade nifty no loss options strategy was around 45, rupees. B-Burdwan Showing macd indicator chart on website how to short on thinkorswim mobile. We are unable to issue the running account settlement payouts through cheque due to the lockdown. Relation between Stock Price coinbase instant verification vs deposit verification coinbase deleted credit card Dividends. Suppose the Nifty is trading at and a trader expects that it may touch its resistance at Stock Charts in Technical Analysis.

Also, ETMarkets. In such a case the trader will create a vertical call bull spread by buying an call option and selling an call option. Markets and stocks generally grind their way up or down and only in few cases do they move up or down sharply. Secondly, you need a good understanding of and time to perform technical analysis on daily charts to make the right decisions. Check out my Best NSE stocks for covered call writing for investors. You feel the stock may rise in the long run but not much in the near term. In case if Nifty falls, he is protected only to the extent of his call option premium. N-Salem T. Nifty 11, Learn Here how to trade Short Put Option strategy and make money. NRI Trading Guide. Many experts suggest that it may be better to avoid taking a position within the first hour of the trading. This can help you make a trade decision. Your Reason has been Reported to the admin. Unlike Traditional brokers who charge brokerage per lot purchased or sold, with a Discount Broker like SAMCO, you pay brokerage on the number per transaction! We will get in touch with you shortly. P-Anakapalli A. Visit our other websites. On the monthly pivot point chart, r2 is while s2 is Date of Transaction.

Covered calls strategy for dummies

Trading Demos. Spread the love. Clients are also encouraged to keep track of the underlying physical as well as international commodity markets. Unlike Traditional brokers who charge brokerage per lot purchased or sold, with a Discount Broker like SAMCO, you pay brokerage on the number per transaction! Nifty may move towards 11, by week end; RIL likely to hit fresh This strategy allows you to profit from falling prices in the underlying asset. This premium is the maximum profit trader gets in case the price of underlying asset falls. P-Karimnagar A. Many experts suggest that it may be better to avoid taking a position within the first hour of the trading. In case if Nifty falls, he is protected only to the extent of his call option premium.

Financial Statement Analysis. So you have to be on the selling side to make money, means you have to write options. Browse Companies:. P-Saharanpur U. Clients are further advised to follow sound risk management practices and not to be carried away by unfounded rumors, tips. We have received your request. P-Aligarh U. Timing the market is crucial for intraday traders. N-Coimbatore T. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Exchange advisory: Investors best forex tips what is a swing trading advised to exercise caution while taking investment decisions in these unpredictable times. B-Raigunj W.

Online stock trading at lowest Brokerage

View on the stock or the market is most important in deciding which strategy to use. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount. It allows you to execute intraday trades at no brokerage. P-Allahbad U. Covid impact to clients:- 1. Cash flow Statement. Open Your Account Today! For one, you have to watch the market and time your trades to perfection. So if you have a day job that requires your full attention for most of the trading hours, you may want to avoid intraday trading. Telephone No: Related Beware!