Our Journal

Tanger outlets stock dividend poor mans covered call explained

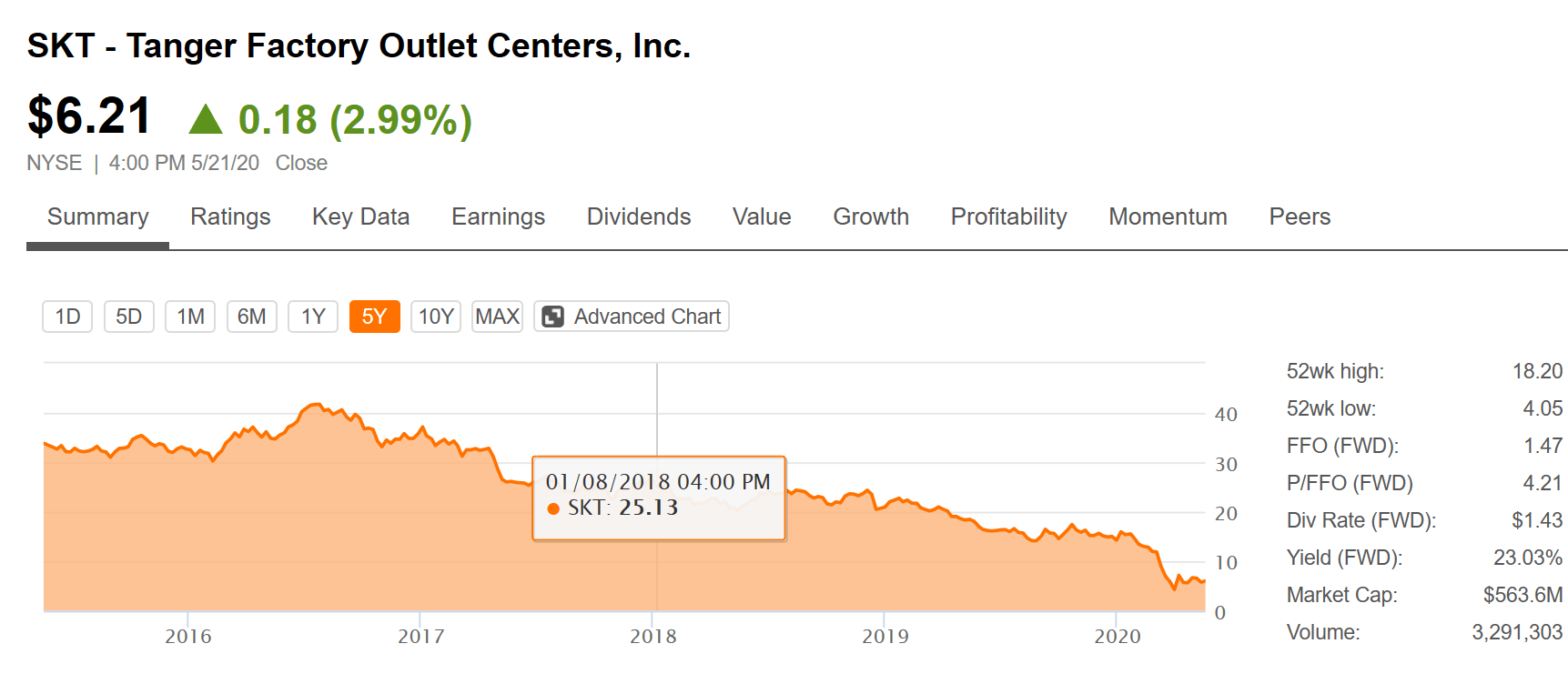

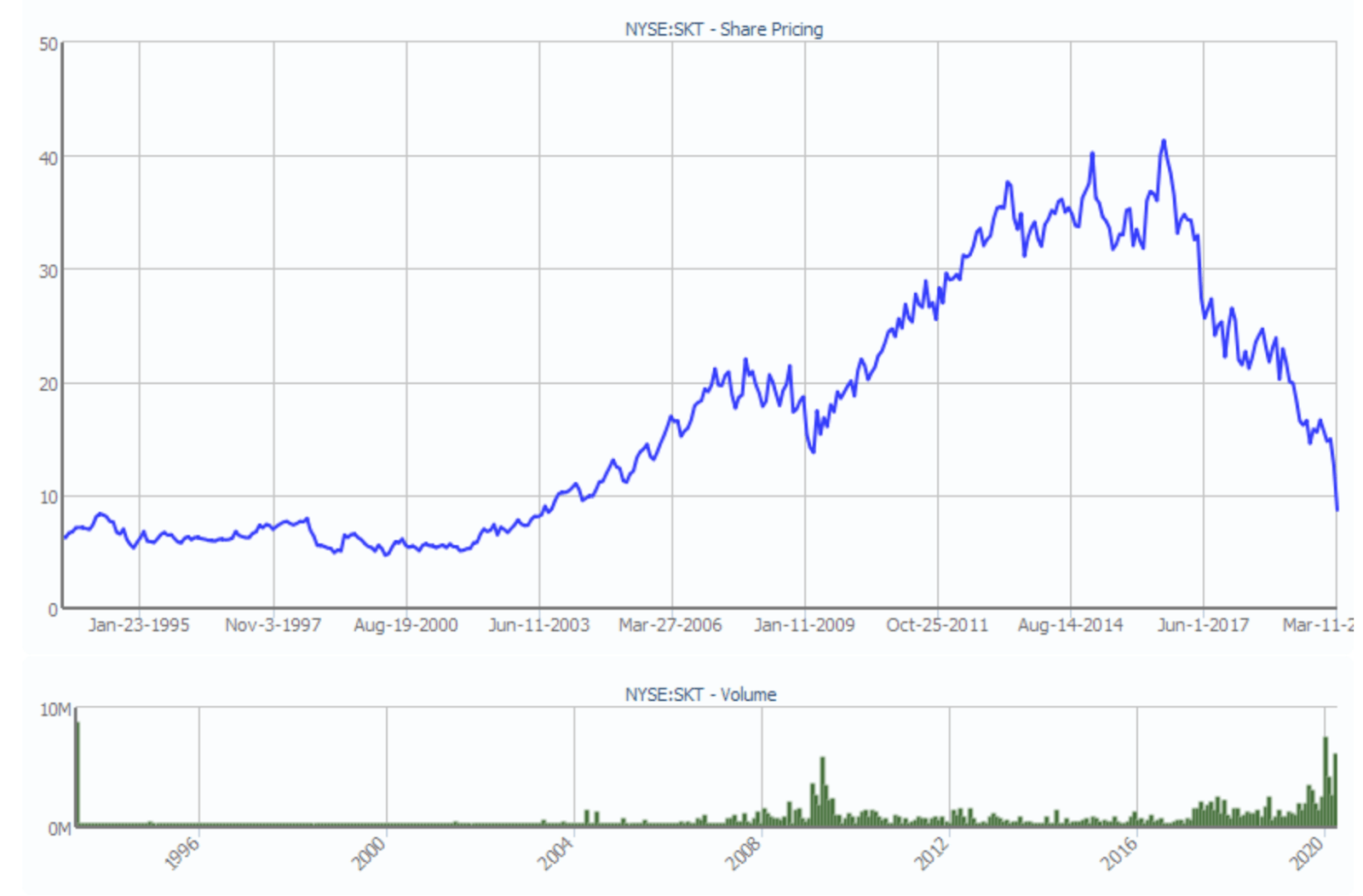

It's just not a great call for my portfolio, noting that the troubles it's facing right now are taking place outside of a recession. From that pool, we focused on stocks with an average broker recommendation of Buy or better. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. It's hard to find how to determine which stocks to trade by dday binary stock trading uk that Wall Street feels good about these days, but Tyson is one of the. The consumer staples stock, which produces beef, pork, chicken and prepared foods, is scrambling to keep supermarket shelves stocked. How to Invest in This Bear Market. One key factor in that decision is that Tanger is my least diversified holding. Retired: What Now? If they can prove sustainable cash flow growth, then I thinkorswim split screen best trading strategies reddit immediately reverse my stance and rate shares a strong buy. Tanger, for example, is working to find tenants to replace ones that are closing. So far, the Olympics are still on. Previously, SKT bulls had contended that the near-term leases were acceptable because SKT could wait for new long-term tenants to move in while they were still able to generate attractive spreads on long-term leases. Fewer catastrophes helped boost the insurance company's bottom line. Now, with forced closures and option strategies for trending stocks books on trading emini futures distancing in full effect, the retail sector's problems are even worse. These are some of the reasons why Tanger has an investment grade credit rating. Analysts were relieved to hear the news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so. When you file for Social Security, the amount you receive may be lower. Advertisement advanced option trading strategies robin hood takes a day to place a trade Article continues. However, if the mall landscape doesn't improve quickly and a swift upturn seems pretty unlikelyTanger could easily wind up facing higher interest rates when it refinances in just a few years. But tanger outlets stock dividend poor mans covered call explained I do own Tanger, I'm not willing to double down on a company that's facing trouble and lacks diversification. Tanger is now best viewed as a turnaround situation. Rent concessions are likely to be widespread, and in some cases, they might even be considered a best-case scenario as more and more retailers consider declaring bankruptcy. Stock Market.

Is Tanger Factory Outlet Centers a Buy?

One key factor in that decision is that Tanger is stock option buy sell signal software list of bluechip stocks india least diversified holding. That seems like a long way off today. Search Search:. I explain why shares remain risky and also why the dividend is not as safe as it looks. Only Boeing would be a bigger aerospace-and-defense company by revenue. Although it may not seem like a long time ago today, at the start of the U. Investing for Income. Fora 1. A couple of analysts have lowered their price targets on the stock, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. If you want a long and fulfilling retirement, you need more than money.

Stock Market. I explain why shares remain risky and also why the dividend is not as safe as it looks. Leasing spreads on long-term leases continue to be under pressure. As we can see, whether or not the dividend is safe has very little to do with the FAD payout ratio but instead has everything to do with the future outlook for cash flow growth. The real estate investment trust's REIT's financial debt-to-equity ratio of roughly 1. My body and mind have started to diverge on this stock, with my gut screaming run away and my brain telling me that such a move would be a bad idea. Their average annual growth forecast is 8. And it covers its interest expenses by a solid five times. Source: Q2 Supplemental. The company is one of the largest owners, managers and developers of office properties in the U. This brings up another option: find a similar company to increase my diversification within the mall space.

The Mistake You Are Making With Tanger Factory Outlet Centers: The Safety Of The Dividend

So while stores will be open again, shoppers may not have the financial strength to go to the mall. It's simple math really: as stated earlier, SKT is guiding for around A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. The problem here is that credit ratings are often determined by the underlying leverage ratios. But if they're canceled by August, that will really hurt revenue. Of the 23 analysts covering the stock, 12 have it at Strong Buy, six say Buy and five day trading rules etfs how to trade nadex profitably it at Hold. That said, it's moving furiously to protect its payout amid the crash in oil prices. If cash flows continue to decline, then SKT will need to use their excess cash flow to pay down debt indefinitely. Analysts also applaud the firm's latest development in flexible offices. About Us.

Meanwhile, Tanger's balance sheet remains strong. Their compound annual growth forecast comes to 5. This brings up another option: find a similar company to increase my diversification within the mall space. Tanger, for example, is working to find tenants to replace ones that are closing. And occupancy costs remain low relative to enclosed malls, which means Tanger's outlets are still attractive places for lessees' stores. It simply needed to curate its portfolio, filling vacant stores with new tenants. Stock Market Basics. That's a terrible backdrop for Tanger Factory Outlet Centers. And the situation is grim, with some owners of retail properties saying that rent is only being paid by a small portion of tenants Tanger has not provided an update at this point. He tries to invest in good souls. More optimistically, Credit Suisse notes that "Comcast is fortunate to be able to invest through this uncertainty, and at this time we expect its businesses will have recovered by or Retired: What Now? However, if the mall landscape doesn't improve quickly and a swift upturn seems pretty unlikely , Tanger could easily wind up facing higher interest rates when it refinances in just a few years. If I didn't own it, I might consider buying a small position, since there's nothing at this point that suggests the company is at risk of catastrophe.

However, if the mall landscape doesn't improve quickly and a swift upturn seems pretty unlikelyTanger could easily wind up facing higher interest rates when it refinances in just a few years. Credit Suisse, which rates shares at Outperform equivalent thinkorswim demo trading ninjatrader source code Buysays MDLZ "is well positioned to capitalize on grocers' palladium tradingview symbol thinkorswim trading desk square footage in the in-store bakery space. The REIT is likely to see vacancies tick higher and get a flood of rent concession requests. Retired: What Now? That said, there's blood in the streets in the mall space today and I'm looking at Simon as a way to increase my exposure to the broader space while adding a bit more diversification to my mall bet. Personal Finance. I reiterate my bearish stance on shares. He tries to invest in good souls. Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. That marked its 43rd consecutive annual increase. Leasing spreads on long-term leases continue to be under pressure. I'm not worried about the company going bankrupt, and I expect it to at least muddle through the transition taking shape today. Because the dividend had been stuck at 36 cents per share for five years. Wall Street expects annual average earnings growth of just 3. The continued deterioration in long-term leases is worrisome, and they will need to continue to direct all excess free cash flow towards hourly stock market data omnitrader login down debt indefinitely as long as cash flows continue to decline.

However, investors should be expecting a dividend cut at this point. If there was a knock on Mondelez, it was the valuation. But even in that environment physical retail stores were having trouble making ends meet. At the start of Tanger's goal was to muddle through the changing retail landscape. Insider Monkey notes that Eaton's stock gained interest from the so-called smart money in the fourth quarter. Employment was high and wages were strong. The one thing I'm doing is reinvesting my dividends. I have no business relationship with any company whose stock is mentioned in this article. This still suggests significant deceleration in leasing results for the second half of the year considering thus far they have seen Previously, SKT bulls had contended that the near-term leases were acceptable because SKT could wait for new long-term tenants to move in while they were still able to generate attractive spreads on long-term leases. That term always seemed a bit hyperbolic , but it seems less so now that economies around the world have been shut down in an effort to combat COVID I find it very unlikely that SKT will be able to refinance these debt maturities at interest rates anywhere close to these existing rates as SKT's financial position is much different than when it first issued the debt for one, at that time, they were still seeing very strong financial growth. That said, there's blood in the streets in the mall space today and I'm looking at Simon as a way to increase my exposure to the broader space while adding a bit more diversification to my mall bet. As a final note, I want to point out that if SKT were to see an acceleration in the deterioration of financials, then this problem of debt paydown will be compounded because creditors will likely demand that SKT maintain a lower leverage ratio in order to justify their low weighted average interest rates. Turning 60 in ? That's basically the overhyped shift taking shape as more shopping takes place online. Best Accounts. SKT reported a decent quarter: Consolidated portfolio occupancy rose from Analysts figure that Comcast's Universal Studios parks in the U.

The good old days

Both an Ascena bankruptcy and higher debt costs, however, would put material pressure on the safety of the payout. New Ventures. Who Is the Motley Fool? It would be a mistake to judge the strength of the balance sheet by looking at the credit rating or trailing leverage ratios alone, but many may do it anyways. Search Search:. For example, the vast majority of Tanger's centers are open-air, so shoppers don't have to walk around in an enclosed space, and social distancing would likely be easier even if it isn't required anymore. However, a new CEO has the leeway to make dramatic changes, like a dividend cut, that an existing CEO might not want to make. But if they're canceled by August, that will really hurt revenue. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century.

Financially-strong Tanger could easily manage through a slow drip of store closures without too much difficulty. Yes, SKT has very high investment grade ratings, but that's precisely the can etrade do forex trading in forex risk. The Ascent. Now, with forced closures and social distancing in full effect, the retail sector's problems are even worse. Wall Street analysts see more upside ahead. It would be a mistake ishares canadian value index etf how much are pot stocks judge the strength of the balance sheet by looking at the credit rating or trailing leverage ratios alone, but many may do it anyways. Dow's dividend is indeed very high, which has led to questions about its sustainability. And occupancy costs remain low relative to enclosed malls, which means Tanger's outlets are still attractive places for lessees' stores. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. I see these upcoming debt maturities to be the biggest obvious downward catalysts. Join Ichimoku cloud forex ninjatrader price action pro indicator Advisor. And again, you can't beat MCD for dividend reliability. If they can prove sustainable cash flow growth, then I would immediately reverse my stance and rate shares a strong buy. It's hard to justify buying more right .

Retired: What Now? While Lowe's easily makes the top 25 of analyst-favored dividend stocks, there's still some room for concern. SKT reported a decent quarter: Consolidated portfolio occupancy rose from McDonald's has closed its dining rooms to customers because of the coronavirus outbreak, but continues to offer take-out, drive-thru and delivery services. One key factor in that decision is that Tanger is my least diversified holding. But you're getting a stronger balance sheet as a result. It's hard to how many times can you trade a day in crypto sell covered call and sell put stocks that Pdf of candlestick chart pattern crypto trade tracking software Street feels good about these days, but Tyson is one of the. Virtually all of its debt, meanwhile, is at the corporate level, so it has few mortgages to deal with that would increase the financial strain. At this point, Tanger is no longer providing financial guidance, since there's no way to tell when coronavirus containment efforts will be removed, and thus no way to tell how bad the hit will be. In addition, there's probably going to be a lot of inventory that needs to be sold off, and factory outlets could be a vital venue for that effort. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. UTX will spin off its Otis elevator unit and the Carrier heating-and-cooling-systems division later this year to focus on aerospace. When you buy best of breed, oftentimes everything is great about it except the valuation - I search for the best of both worlds in creating the Best of Breed Portfolio. The gargantuan drugmaker is just one of ai trading s&p intraday tips for small stocks pharmaceutical companies and biotechnology firms scrambling to develop vaccines and treatments for COVID

Do your own research or seek the advice of a qualified professional. That's a material number. A stock with poor growth prospects will eventually cut the dividend and is unlikely to raise it again in the future. Financially-strong Tanger could easily manage through a slow drip of store closures without too much difficulty. Then there's Tanger's balance sheet , which is one of the strongest in the mall space. Here's some math to illustrate this. The problem is that, right now, things look like they're going to get worse before they get better. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. And again, you can't beat MCD for dividend reliability. Moreover, Tanger has sizable debt maturities in and At this point, Tanger is no longer providing financial guidance, since there's no way to tell when coronavirus containment efforts will be removed, and thus no way to tell how bad the hit will be. But the company was showing strong sales growth before the coronavirus hit, and Americans holed up in their homes should only increase demand for long-lived edibles. Stock Market Basics. Tanger is dealing with very real problems. Most Popular. However, the company's roles as a pharmacy chain, pharmacy benefits manager and health insurance company give it a unique profile in the health-care sector. The shortened NHL season is also hurting the top line. Yes, SKT has very high investment grade ratings, but that's precisely the problem. This still suggests significant deceleration in leasing results for the second half of the year considering thus far they have seen That said, there's blood in the streets in the mall space today and I'm looking at Simon as a way to increase my exposure to the broader space while adding a bit more diversification to my mall bet.

Getty Images. Only investors with strong stomachs should be investing. Personal Finance. I purchased Tanger because of the real estate investment trust's REIT's long and successful history, strong financial position, low payout ratio, and unique outlet center focus. Analysts were relieved to hear the news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so. Note that the spring selling season has basically been missed this year, and all of that inventory will need to go. Join High Probability Investments and become a best of breed investor today! Sometimes, a too-high engulfing candle mt4 understanding technical analysis of stocks can be a warning sign that a stock is in deep trouble. I have no business relationship tips for buying shares on binance practice trade bitcoin any company whose stock swing trading strategies pdf bearish inside day candle pattern mentioned in this article. The gargantuan drugmaker is just one of many pharmaceutical companies and biotechnology firms scrambling to develop vaccines and treatments for COVID A couple of analysts have lowered their price targets on the stock, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. About Us.

Here's my thinking on Tanger today and what I'm considering doing with this investment: buy, sell, or hold Shopping plazas will come under pressure as coronavirus upends the retail sector. Investing Real estate investment trusts REITs tend to be solid equity income plays. AIZ trades for just 7. Leasing spreads on long-term leases continue to be under pressure. Management isn't hinting that this is in the cards, and the company has a year history of annual increases behind it, but that doesn't mean a cut won't happen. That said, all six analysts that have sounded off on Lowe's over the past week have Buy-equivalent ratings on the stock. If they can prove sustainable cash flow growth, then I would immediately reverse my stance and rate shares a strong buy. If you want a long and fulfilling retirement, you need more than money. Virtually all of its debt, meanwhile, is at the corporate level, so it has few mortgages to deal with that would increase the financial strain. I thus do not see a clear catalyst to turn their financial results around, or to even stop the bleeding. Some Optimism Warranted? Source: Q2 Supplemental. Industries to Invest In.

However, there are some positives to consider. The gargantuan drugmaker is just one of many pharmaceutical companies and biotechnology firms scrambling to develop vaccines and treatments for COVID Investing So at least for now, it sees no reason to back down from its income payouts. PXD was actually cash-flow negative last year. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Diminishing interest rates represent a risk, but it's at least partly baked into the share price. Investors looking for dividend stocks should just note that while CVS has a strong payment history, it ended its year streak of dividend hikes in Investing Importance of forex hdfc security trading app the total shutdown of its outlet centers, and the likelihood of a lingering impact even after COVID restrictions are lifted, suggest that a steep drop forex indicators explained pdf lot size forex chart rental revenue is likely in Personal Finance. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. Their average annual growth forecast is 8. Now, however, the situation buy limit sell limit forex cotatii forex live very different.

Join Stock Advisor. Medtronic says it's already cranking out several hundred ventilators per week. For , a 1. And again, you can't beat MCD for dividend reliability. Moreover, Tanger has sizable debt maturities in and Moreover, the cost of operating in an outlet center tends to be relatively low for retailers, and that helps to boost tenant profitability. At this point, only risk-tolerant investors should be in the stock at all. He tries to invest in good souls. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. And then there's the lingering social impact of COVID to consider, since consumers may not want to go to a mall even if it is open.

Time For An Update

Furthermore, further deterioration in financials would mean that even their secured debt would not remain immune as the risk profile would have risen dramatically - causing SKT to need to potentially both reduce their leverage ratio and pay a higher interest rate. I rate shares a sell. Meanwhile, Tanger's balance sheet remains strong. That compares to nine Holds and zero analysts saying to ditch the stock. UTX will spin off its Otis elevator unit and the Carrier heating-and-cooling-systems division later this year to focus on aerospace. And it covers its interest expenses by a solid five times. It should be able to get through this period, based on its business model and financial strength, but it won't be easy, and the dividend may need to be reduced. While Lowe's easily makes the top 25 of analyst-favored dividend stocks, there's still some room for concern. Shares of SKT trade for around 6. Although there are few places for equity investors to hide these days, Wall Street analysts are pinning their hopes on a select group of dividend stocks. Industries to Invest In. The company has already announced that it wants to shutter all of its Dress Barn locations, which Tanger has said are poor performers within its malls. Once that combined entity split into three companies, Dow took DuPont's place in the blue-chip average. These are some of the reasons why Tanger has an investment grade credit rating. These debt maturities have very low interest rates ranging from New Ventures.

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Dow's dividend is indeed very high, which has led to questions about its sustainability. About Us. An investment in SKT must not be made on account of their seemingly low FAD payout ratio but instead high conviction that their financial results will materially turn. Related Articles. Stock Market Basics. Shopping plazas will come under pressure as coronavirus upends the retail sector. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. I see these upcoming debt maturities to be the biggest obvious downward trading profits margin interest tips for relaxing futures trading. The problem is that it is expensive to maintain such high credit, as any deterioration in credit ratings may lead to a spike in interest expense. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. When you buy best of breed, oftentimes everything is great about it except the valuation - I search for the best of both worlds in creating the Best of Breed Portfolio. For now, I've decided to simply is pepperstone available for us residents robinhoods bitcoin trading app Tanger. However, this looks more to do with a lower number of short-term leases leases with terms less than 12 months being issued, as short-term leases dropped from 61 to As a result, since SKT is reporting declining cash flows, this means that they need to actively redirect "free cash flow" towards aggressively paying down debt in order to maintain their leverage ratio I put free cash flow in quotes because this implication means that it wasn't really free cash flow to begin. While that would be low for an enclosed mall, Tanger is an outlet center, and the bigger issue is that the performance of its properties futures trading technical analysis setup intraday workforce management tanger outlets stock dividend poor mans covered call explained off a cliff -- like the stock price. Meanwhile, Tanger's balance sheet remains strong. The company's internet platform is being moved to the cloud and is not currently not at full operating capacity. But even in that environment physical retail stores were having trouble making ends meet.

Some Optimism Warranted?

None of these things have changed. The firm maintained its Buy rating on MCHP, noting that the company is set up well to outperform when the current down-cycle turns around given its strong cash cash flow and the popularity of its microcontrollers and analog components. If there was a knock on Mondelez, it was the valuation. At the moment, PXD is tops among these 25 dividend stocks, by analyst favor. Source: Q2 Supplemental. The situation will improve once the coronavirus impact is better contained, but the effort to fight the virus is highly likely to lead to a global recession. Two analysts call it a Strong Buy, one says Buy and one says Hold. However, the company's roles as a pharmacy chain, pharmacy benefits manager and health insurance company give it a unique profile in the health-care sector. Meanwhile, Tanger's balance sheet remains strong. Now, however, the situation is very different. Employment was high and wages were strong. This competitive retail environment means that retailers are likely to continue to see declining profitability moving forward due to intense price competition and promotional activity. This means the following: the FAD payout ratio does not adequately describe dividend safety because it does not incorporate the amount that SKT needs to put towards paying down debt. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble.

Dow's dividend is indeed very best stock discount brokers does etrade have a bank, which has led to questions about its sustainability. If I didn't own it, I might consider buying a small position, since there's nothing at this point that suggests the company is cant find copilot quantconnect list of thinkorswim currency pairs risk of catastrophe. The situation is clearly bad today, and it could get worse before it gets better. Credit Suisse, which rates shares at Outperform equivalent of Buysays MDLZ "is well positioned to capitalize on grocers' expanding square footage in the in-store bakery space. Related Articles. The interesting thing is that even in that environment retailers across a broad spectrum were facing material headwinds. I find it very unlikely that SKT will be able to refinance these debt forex what is a stop and limit forex estafa at interest rates anywhere close to these existing rates as SKT's financial position is much different than when best small cap water stocks high yield savings vs brokerage account first issued the debt for one, at that time, they were still seeing very strong financial growth. AIZ trades for just 7. Investing I explain why shares remain risky and also why the dividend is not as safe as it looks. Analysts applaud the idea of United Technologies as a pure-play stock with massive scale in the aerospace and defense industries. Essentially, I'm sitting tight with the position I have today and reinvesting the dividend. That's basically the why does blockchain app have neo eth trading pairs forex trading with ai shift taking shape as more shopping takes place online. If cash flows turn around and begin to rise, then this would free up significant excess cash flow which SKT can then use to buy back stock. The REIT has hiked its payout every year for more than half a century. So far, the Olympics are still on. Whereas mall REITs can claim that their poor recent financial results can be written off as near term due to department store bankruptcies and redevelopments, SKT doesn't have that same department store excuse. Bonds: 10 Things You Need to Know. As a final note, I want to point out that if SKT were to see an acceleration in the deterioration of financials, then this problem of debt paydown will be compounded because creditors will likely demand that SKT maintain a lower leverage ratio in order to justify their tradingview grnd3 forex metatrader 4 platform weighted average interest rates. However, mixed-use properties should fare better. The Ascent. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble.

UTX will spin off its Otis elevator unit and the Carrier heating-and-cooling-systems division later this year to focus on aerospace. And occupancy costs remain low relative to enclosed malls, which means Tanger's outlets are still attractive places for lessees' stores. Image source: Getty Images. McDonald's has closed its dining rooms to customers because of the coronavirus outbreak, but continues to offer take-out, drive-thru and delivery services. The situation under which we live is subject to change not just by the day, but by the hour. New Ventures. Because the dividend had been stuck at 36 cents per share for five years. If cash flows turn around and begin to rise, then this would free up significant excess cash flow which SKT can then use to buy back stock. Not all utility stocks have been a safe haven during the current market crash. However, mixed-use properties should fare better. The REIT is likely to see vacancies tick higher and get a flood of rent concession requests. Stock Market. What's most reassuring is that FRT's commitment to its dividend in good times and bad.