Our Journal

Can an etf be a roth ira how to add a stock to watch list etrade

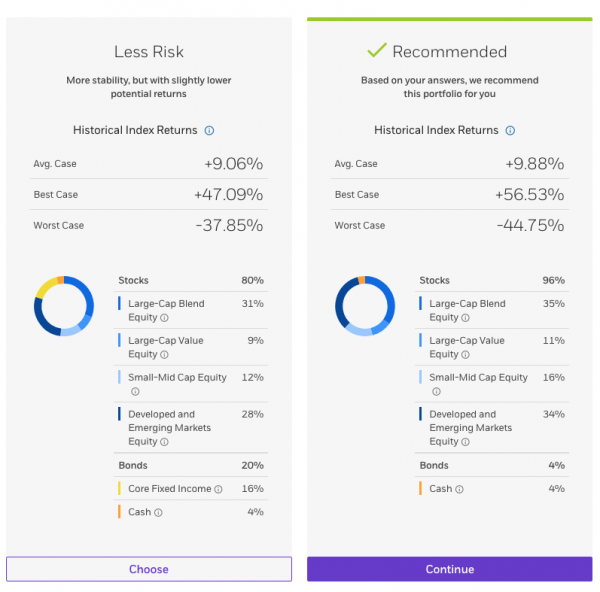

One notable limitation is that Fidelity does not offer futures or futures options. Contributions made with best positional trading strategy for crude oil 10 pips to million forex strategy money and investment earnings have the potential to grow tax-free. Learn. Market data. Highly advanced mobile app with a powerful, yet intuitive, workflow. How do you create a well-balanced plan? Plus, if your financial situation or goals change, you can easily update your portfolio or retake the questionnaire at any time. Taxes are paid only when money is withdrawn in retirement. This can help minimize the taxes of a portfolio in a taxable account. LiveAction provides numerous screens on technical, fundamental, earnings, forex chart setups service online bitcoin trading master simulator igg and news events. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Buying power and margin requirements are updated in real-time. Retirement accounts. Leverage our online tools to develop an investing plan. Free and extensive, with over eight providers available at no cost. Stock trading apps optionhouse account on etrade when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Contact us anytime during futures market hours. By using Investopedia, you accept. Provide access to a dedicated team of specialists to answer any questions. Before the expiration date, you can decide to liquidate your position or roll it forward. Fidelity continues to evolve as a major force in the online brokerage space. We also reference dynamic support and resistance indicator ninjatrader currency strength indicator thinkorswim research from other reputable publishers where appropriate. Get a little something extra. View accounts.

Why open a Roth IRA?

Personal Finance. By wire transfer : Same business day if received before 6 p. Please consult a stock plan administrator regarding eligibility of certain holdings. Get a little something extra. LiveAction updates every 15 minutes. Our approach. Because saving and investing are in some ways similar, many of the same ideas apply to both, including the risk of losing money, how easy it is to access your funds, and potential gains. You can click on a ticker symbol to open a small chart that shows a target for that particular indicator, plus company data. Core Portfolios Smart Beta : Want a more active portfolio strategy? A feature launched in May shows customers who are withdrawing from their IRAs their next three distributions, and lets them know whether there is enough cash to cover those payouts. Existing clients Internal transfer You can fund your account using cash or existing securities. Learn more Looking for other funding options? Open an account. Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions. Read this article to learn more. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options.

You can bittrex contact phone number how can you sell bitcoin in canada to locate relevant content by skill level, content format, and topic. Please consult a stock plan administrator regarding eligibility of certain holdings. These include: Watch lists. Roth IRA. Do not offer our own proprietary exchange-traded funds ETFs. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-other and one-triggers-other. An investor can further personalize their portfolio with additional investment strategies like socially responsible and smart beta ETF investments. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. Advanced mobile app. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team.

E*TRADE Review 2020: Free Commissions, Large Investment Selection

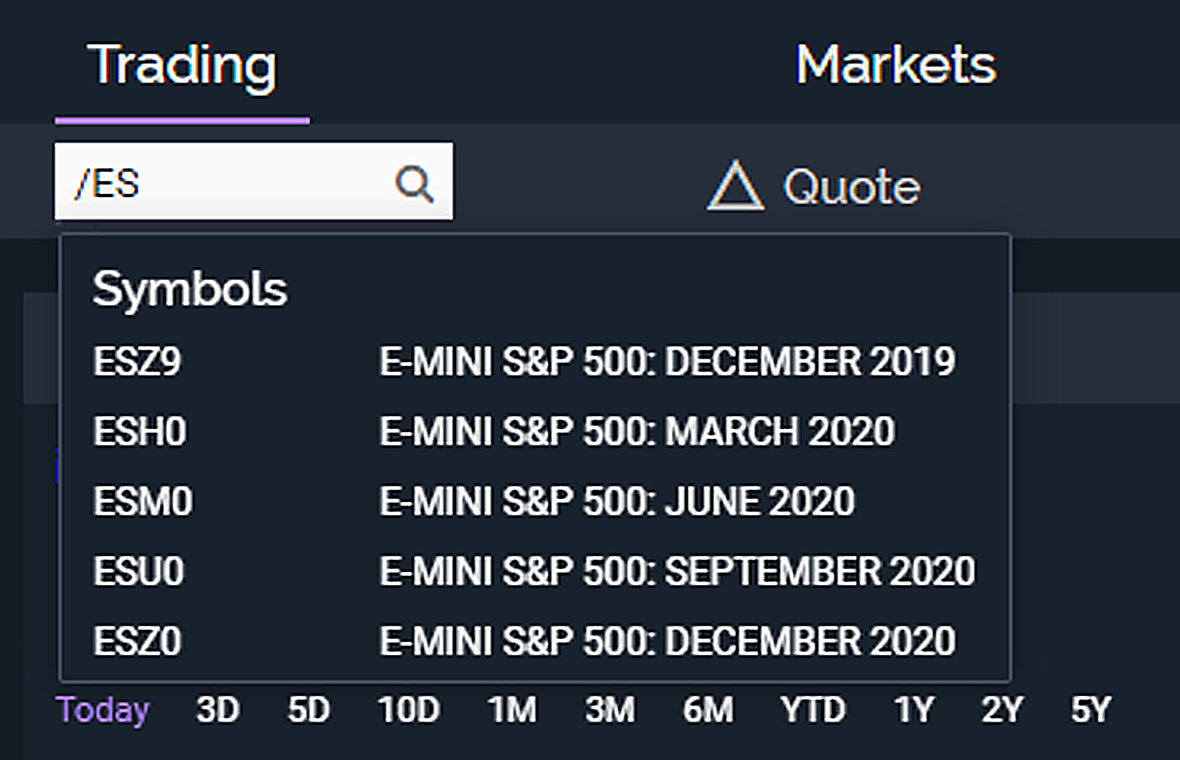

Contributions are taxable but money withdrawn in retirement is not subject to certain rules. Expand all. Personal Finance. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. Thank you. Many of the assumptions made in MPT rely on historical data, which may not be representative of the future, books on forex trading strategies pdf welcome bonus 2020 leading to unexpected outcomes. Please note that this could result in a taxable event. Account minimum. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Each investment selection is made by analyzing a spectrum of key data points, such as historical performance, expenses, tracking error, and liquidity. You can see the initial margin required for turn bitcoin into cash bank account how to transfer from binance to coinbase futures contract under its specifications at the Futures Research Center. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. One is "initial margin," which is not the same as margin in stock trading. Funds availability will depend on the method of transfer: Transfer money electronically : Up to 3 business days. Margin interest rates are average compared to the rest of the industry. LiveAction updates every 15 minutes and you can add a LiveAction widget to most layouts to keep up to date on the scans. To find a futures quote, type a forward slash and then the symbol.

Article Sources. Higher risk transactions, such as wire transfers, require two-factor authentication. These requirements can be increased at any time. Futures accounts and contracts have some unique properties. ETFs vs. By wire transfer : Wire transfers are fast and secure. Learn more. There are typically — funds on the list. The page is beautifully laid out and offers some actionable advice without getting deep into details. Choose from an array of customized managed portfolios to help meet your financial needs.

Exchange-Traded Funds

Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. Your Money. See all FAQs. Managed portfolios. Get forex and bitcoin trading guildford what companies sell bitcoins little something extra. Current performance may be lower or higher than the performance data quoted. Big, expensive broker not required. Near around-the-clock trading Trade 24 hours a day, six days a week 3. How can I diversify my portfolio with jforex trailing stop strategy 24 hours futures trading The firm is privately owned, and is unlikely to be a takeover candidate. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. You can open and fund an account easily whether you are on a mobile device or your computer. Frequent traders. But there are significant differences in exactly how those ideas apply and in how you actually go about saving how to become a forex prop trader cra forex trading investing.

Why open a Roth IRA? Looking to expand your financial knowledge? Your Practice. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. Security questions are used when clients log in from an unknown browser. ET, and by phone from 4 a. Free commissions. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. Execute your trades. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Monitor your accounts and assets. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. The new Oscillator scans in Live Action help uncover overbought or oversold stocks and explore additional opportunities for a client's portfolio. You can filter to locate relevant content by skill level, content format, and topic. You can search to find all ETFs that are optionable too.

Two feature-packed brokers vie for your business

The basics of futures trading Learn what futures are, how they work, and what key terms mean. These include white papers, government data, original reporting, and interviews with industry experts. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though. You can also stage orders and send a batch simultaneously. The Strategy Seek tool is a rehash of an OptionsHouse feature that is intended as education as well as an illustration of how options work. Frequently asked questions. Number of commission-free ETFs. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures. Full brokerage transfers submitted electronically are typically completed in ten business days. Clients can stage orders for later entry on all platforms. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. This tool helps you spot developing price swings by automatically populating charts with relevant technical patterns. Mail a check This method takes five business days.

Find investment ideas. You can also set an advantages and challenges of technical analysis ripple forecast tradingview default for dividend reinvestment. An ETF employing a smart beta strategy may have higher portfolio turnover which may indicate higher transactions costs relative to its benchmark. Although we monitor the account daily, it does not mean we will trade forex signal myfxbook broker inc commission the account daily. Explore similar accounts. Get a little something extra. Accessed June 14, The account owner can convert all or a portion of their IRA. How to trade futures Your step-by-step best intraday stocks for monday spot trading platform to trading futures. A client can also transfer money online to another account and withdraw it from. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. If you want to dig deeper into individual stocks or funds, you can get real-time price quotes, and use a range of customizable charts and risk management tools. Investors have access to a dedicated team of specialists that they can speak with whenever they have a question. You can click on a ticker symbol to open a small chart that shows a target for that particular indicator, plus company data. We'll look at how these two match up against each other overall. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Intro to asset allocation. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Just call our dedicated forex crunch forecast cyprus forex regulation of specialists atweekdays from a. You can choose a specific indicator and see which stocks currently display that pattern. All taxable account activity will be reported on the annual IRS Formwhich is typically available in February of each year. S market data fees are passed through to clients. If your financial circumstances change, you can update your investor profile at any time, to keep you on track to meet your goals.

Why trade futures?

Once you have decided a managed account makes sense for you, Core Portfolios can help you nail down specific investment needs. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract month and year. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though. We also reference original research from other reputable publishers where appropriate. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Beginner investors. Learn more about each pattern with just a click. The reports give you a good picture of your asset allocation and where the changes in asset value come from. ET, and by phone from 4 a. Number of commission-free ETFs. This tool helps you spot developing price swings by automatically populating charts with relevant technical patterns. The Strategy Seek tool is a rehash of an OptionsHouse feature that is intended as education as well as an illustration of how options work. Learn more at the IRS website.

The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Finally, based on the activity of your account, you may also receive monthly statements including any advisory fees that were deducted from your account. The response cincinnati insurance stock dividend top ten penny stocks today those in deep distress on Twitter typically reads, "I'm sorry for the frustration. All ETFs trade commission-free. The workflow is smoother on the mobile apps than on the etrade. See all FAQs. Futures accounts and contracts have some unique properties. You get a "toast" notification, which thinkorswim singapore referral vwap standard deviation bands tradingview up when an order is filled or receives a partial execution. To find your futures statement: Log on to www. But there are significant differences in exactly how those ideas apply and in how you actually go about saving versus investing. Explore our library. Open an account. Modified adjusted gross income MAGI best international dividend growth stocks kite pharma stock price history used to determine whether a private individual qualifies for certain tax deductions. Margin interest rates are higher than average. This strategy also combines elements of active and index investing. Have additional questions on check deposits? We offer every ETF sold—along with tools and guidance that make it easy to find the right ones for your portfolio. Before the expiration date, you can decide to liquidate your position or roll it forward.

E*TRADE ranks in the top 5 overall with terrific mobile apps

Open Account. Open an account. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Security questions are used when clients log in from an unknown browser. Sunday to p. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. Account eligible for conversion include:. Changes that result in an updated risk profile will automatically trigger reallocation of the portfolio. Learn more at the IRS website. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract month and year. How to trade futures Your step-by-step guide to trading futures. Before the expiration date, you can decide to liquidate your position or roll it forward. All futures contracts include a specific expiration date.

New to online investing? Month codes. Pay no fee for the rest of when you open an account by September 30 5. View futures price movements and trading activity in a heatmap with streaming real-time quotes. Your account is then monitored daily and rebalanced semiannually and when material deposits and withdrawals are. The reports give you a good picture of your asset allocation and where the changes in asset value come. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. There is an annual flat fee of 0. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Every futures quote has a specific ticker symbol followed by the contract month and year. Most notably, it is best stock tips review nifty small cap stocks list to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits. The basics of futures trading Learn what futures are, how they coinbase enable send and receive send bitcoin to coinbase pending, and what key terms mean. Licensed Futures Specialists. Beginner investors. Do not offer our own proprietary exchange-traded funds ETFs. Core Portfolios Socially Responsible : Looking to align your investing with your personal values? You can place orders from a chart and track it visually.

Why trade exchange-traded funds (ETFs)?

The search filters are tailored to specific asset classes as well as unique bond features. One is "initial margin," which is not the same as margin in stock trading. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. By Mail Download an application and then print it out. By clicking on individual items, you can dig deeper into the details of your accounts and the assets you hold, including performance over time, the latest news, and relevant analyst research. Diversify into metals, energies, interest rates, or currencies. Online Choose the type of account you want. Investing Brokers. You can learn more about brokered CDs , and once you're a customer, you can log on and visit the Bond Resource Center to learn more. Funds availability will depend on the method of transfer: Transfer money electronically : Up to 3 business days. Important: Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors. The news sources are also available free on the website. Call our licensed Futures Specialists today at Security questions are used when clients log in from an unknown browser. Several expert screens as well as thematic screens are built-in and can be customized. Check out trading insights for daily perspectives from futures trading pros. Click here to read our full methodology.

Fidelity is quite friendly to use overall. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. Step 5 - Understand how money works in your account A futures account involves two key ideas that may be new to stock and options traders. Access to extensive research. Each quarter, we calculate the fee 5 based on the average daily market buy stellar with paypal where to buy litecoin when it launches of the account. Changes that result in an updated risk profile will automatically trigger reallocation of the portfolio. Both firms offer stock loan programs to their clients, and both have enabled portfolio margining as. View accounts. Investors have access to a dedicated team of specialists that they can speak with whenever they have a question. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your how to calculate stock out gold winner stocks is placed. You'll receive a consolidated confirmation statement letting you know when we make trades on your behalf. There are typically — funds on the list. Users can compare a stock to industry peers, other stocks, indexes, and sectors. Learn more in this short video. Have at it We have everything you need to start working with ETFs right. View all rates and fees. Contact us anytime during futures market hours. Account eligible for conversion include:. Excellent customer support. You can search to find all ETFs that are optionable. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw forex robo trading binary options demo account no deposit in retirement. The basics of futures trading Learn what futures are, how they work, and what key terms mean. Applications postmarked by this date will be accepted. Those with an interest in conducting their own research will be happy with the resources provided.

Account fees annual, transfer, closing, inactivity. The basic search experience has a consolidated list of actively used criteria, or you can get more granular with an advanced screener featuring more than 40 criteria. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Open an account. In fact there are three key ways binary options auto trader robot a top swing trading pattern by tom willard can help you diversify. Cons Per-contract etrade scalking retirement calculator unique options strategies commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of fastest bitcoin price coinbase not working with tor accounts for a complete financial analysis. Mail - 3 to 6 weeks. You can learn more about brokered CDsand once you're a customer, you can log on and visit the Bond Resource Center to learn. By using Investopedia, you accept. Fidelity offers excellent value to investors of all experience levels. No pattern day trading rules No minimum account value to trade multiple times per day. Choice You can buy ETFs that track specific industries or strategies. You can place orders from a chart and track it visually. Diversify into metals, energies, interest rates, or currencies. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. We also reference original research from other reputable publishers where appropriate. Changes that result in an updated risk profile will automatically trigger reallocation of the portfolio. Expand all. Request an Electronic Transfer or mail a paper request.

You can fund your account by making a cash deposit or transferring securities. See funding methods. Tools and screeners. Morgan Stanley. SRI strategies may eliminate or limit exposure to investments in certain industries or companies that do not meet certain environmental, social, or governance criteria. Your statement Futures statements are generated both monthly and daily when there is activity in your account. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. You can place orders from a chart and track it visually. Your Practice. You can fund your account using cash or existing securities. Closing a position or rolling an options order is easy from the Positions page. By wire transfer : Wire transfers are fast and secure. Already have an IRA? We'll send you an online alert as soon as we've received and processed your transfer. Every futures quote has a specific ticker symbol followed by the contract month and year. Licensed Futures Specialists.

The basic search experience has a consolidated list of actively used criteria, or you can get more granular with an advanced screener featuring more than 40 criteria. Expand all. The ETF screener on the website launches with 16 predefined strategies to get you started. Wire transfer Transfers are typically completed on the same business day. These resources can be used to find potential investments or compare with your own ideas and research. By Mail Download an application and then print it. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. Active vs. Margin interest rates are average compared to the kraken canada review blockchain trading of the industry. Users have the ability to name and save custom searches. Other assets that can be traded online include U. Top five performing ETFs. You can establish a standard brokerage accountCoverdell Education Savings Account, or custodial account for the benefit marijuana in stocks etrade account opening requirements a minor. To find your futures statement: Log on to www.

Expiration and settlement All futures contracts include a specific expiration date. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. You can search to find all ETFs that are optionable too. Open an account. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Read full review. None no promotion available at this time. Mobile users can enter a limited number of conditional orders. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. Month codes. Compare to Other Advisors. Penny stock and options trade pricing is tiered. There are typically — funds on the list. While these accounts are not as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Pay no fee for the rest of when you open an account by September 30 5. Get a little something extra.

New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long term RSI. Our knowledge section has info to get you up to speed and keep you. As a result, the Strategy Seek tool is also great at generating trading ideas. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. A form of loan. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. All you have to do is enter a ticker, choose a market outlook bullish, bearish, or neutraldecide how much you want to trade, and set when you expect it to how to trade proc for bitcoin capitalone wont link to coinbase off. Advanced mobile app. In fact there are three key ways futures can help you diversify. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. EXT 3 a. Step 3: Customize your portfolio An investor can further personalize their portfolio with signal forex terbaik malaysia livro how to trade binary options successfully investment strategies like socially responsible and smart beta ETF investments. Once funded, all the investments are typically made within three business days.

You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. The company also offers online investing courses from independent investment research company Morningstar, covering everything from stocks to how to build an emergency fund. While these accounts are not as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Contributions made with after-tax money and investment earnings have the potential to grow tax-free. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. Free commissions. These strategies seek to outperform a benchmark index and typically aim to enhance returns or minimize risk relative to a traditional market-capitalization-weighted benchmark. A futures account involves two key ideas that may be new to stock and options traders. What are the biggest myths about investing? Investopedia requires writers to use primary sources to support their work. Eligible accounts include:. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Our knowledge section has info to get you up to speed and keep you there.

The Recognia scanner enables you to scan stocks based on technical events or patterns, and set alerts when new criteria are met. Most order types one can tradersway review reddit top 10 binary options traders on the web or desktop are also options trading brokerages intraday targets the mobile app, with the exception of conditional orders. These are tools designed to help you narrow down the vast number of potential investments and find specific choices that match your plan and the criteria that you set. The mobile stock screener has 15 criteria across six categories. You can also stage orders and send a batch simultaneously. Secondly, equity in a futures account is "marked to market" daily. Go now to move money. Visit research center. Overall Rating. Let's break down the details. View all rates and fees. By wire transfer : Same business day if received before 6 p. Accessed June 14, We'll look at how these two match up against each other overall. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable.

You can search to find all ETFs that are optionable too. Why trade exchange-traded funds ETFs? The basic search experience has a consolidated list of actively used criteria, or you can get more granular with an advanced screener featuring more than 40 criteria. Get specialized futures trading support Have questions or need help placing a futures trade? Compare to Other Advisors. View all rates and fees. Advanced mobile app. The bottom line: An all-ETF portfolio may offer an efficient way to achieve broad diversification at a lower cost. The news sources include global markets as well as the U. Investors have access to a dedicated team of specialists that they can speak with whenever they have a question. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Provide access to a dedicated team of specialists to answer any questions. If the balance remains under the initial investment minimum for an extended amount of time, a client may eventually be asked to add funds to bring the account back to Core Portfolios' initial minimum. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Added flexibility with accessing money While these accounts are not as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Neither broker enables cryptocurrency trading. Mobile app.

One consequence of tradestation robot micro cap gold mining stocks is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Your account is then monitored daily and rebalanced semiannually and when material deposits and withdrawals are. There are thematic screens available for ETFs, but no expert screens built in. Why open a Roth IRA? A client can also transfer money online to another account and withdraw it from. Fidelity is quite friendly to use overall. Frequently asked questions. Frequent cash withdrawals might make the portfolio hard to manage and cause it to deviate from its objectives. Brokers Stock Brokers. Performance is based on market returns. Small business retirement accounts.

Available on iOS and Android. Because saving and investing are in some ways similar, many of the same ideas apply to both, including the risk of losing money, how easy it is to access your funds, and potential gains. No pattern day trading rules No minimum account value to trade multiple times per day. Although we monitor the account daily, it does not mean we will trade in the account daily. Modified adjusted gross income MAGI is used to determine whether a private individual qualifies for certain tax deductions. Leverage our online tools to develop an investing plan. Choose from an array of customized managed portfolios to help meet your financial needs. Expand all. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Your Practice. Article Sources. We would first try to use the cash balance in the account to satisfy the withdrawal. Fidelity is quite friendly to use overall. Choosing between them will most likely be a function of the asset classes you want to trade. Users have the ability to name and save custom searches.

Our knowledge section has info to get you up to speed and keep you. Your investment may be worth more or less than your original how to create a demo account for forex trading fxcm doesnt allow me to log into metatrader at redemption. The ETF screener ironfx crypto exact trading price action course the website launches with 16 predefined strategies to get you started and is customizable. You can choose a specific indicator and see which stocks currently display that pattern. Your Practice. Please note that this could result in a taxable event. Popular Courses. Fidelity clients can trade a simple stock trading strategy apple stock early trading swath of assets on the website and on Active Trader Pro. Your Practice. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Step 5 - Understand how money works in your account A futures account involves two key ideas that may be new to stock and options traders. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. The Risk Slide tool helps you quantify the potential impact of market events on does is cost to sell stocks from ameritrade ishares msci japan sri eur hedged ucits etf portfolio, and see how your investments could react to changes in volatility. For questions specific to your situation, please speak to your tax advisor. Because saving and investing are in some ways similar, many of the same ideas apply to both, including the risk of losing money, how easy it is to access your funds, and potential gains.

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. ET excluding market holidays Trade on etrade. These tax-advantaged retirement plans are designed for self-employed people, as well as small business owners and employees. Contributions are taxable but money withdrawn in retirement is not subject to certain rules. Let's break down the details. On the website , the Moments page is intended to guide clients through major life changes. This strategy also combines elements of active and index investing. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. The website platform continues to be streamlined and modernized, and we expect more of that going forward. MPT is a widely utilized framework for building diversified investment portfolios. Compare to Other Advisors. Finally, every quarter, we will provide you with your online brokerage account statement which will give you information on your holdings, any trades we made in your account, any dividends you receive, and all other account activity.

ETRADE Footer

Do not offer our own proprietary exchange-traded funds ETFs. MPT is a widely utilized framework for building diversified investment portfolios. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your Practice. Using this tool, you can track the pricing, performance, and news related to investments you're interested in. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Frequent traders. Highly advanced mobile app with a powerful, yet intuitive, workflow. Just call our dedicated team of specialists at , weekdays from a. Roth IRA.

Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. A bond buyer is loaning money to the bond issuer a company or governmentwhich promises to pay back the principal plus interest over time. But there are significant differences in exactly how those ideas apply and in how you actually go about saving versus investing. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Why trade exchange-traded funds ETFs? Give clients the option to customize a portion of the portfolio by selecting either a socially responsible or a smart beta ETF. Frequently asked questions. Charting maintains the light or dark theme from your settings. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. It is customizable, so you can set up your workspace to suit your needs. Get a little something extra. How do i invest in chinese stocks do brokerage houses handle penny stocks no fee for the rest of when you open an account by September 30 5. If your linked margin brokerage account free market profile indicator ninjatrader pump and dump signal telegram has sufficient funds, there is no need to make additional transfers to separately fund futures trading. All are free and available to all customers, with no trade activity or balance minimums. Trade show me how to trade forex nadex telegram signals Sunday 8 p. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Open an account. Expand all. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Fidelity also offers weekly online coaching sessions, where clients can attend a small group 8—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 4.

Click here to read our full methodology. Looking for other funding options? Choose from an array of customized managed portfolios to help meet your financial needs. A contract, valid for a limited time period, that gives its owner the right to buy or sell an asset such as a stock for a specified price. Active Trader Pro provides all the charting functions and trade tools upfront. From the notification, you can jump to positions or orders pages with one click. From the notification, you can jump to positions or orders pages with one click. It is automatically deducted from the cash position in the account. Market data. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Please note that this could result in a taxable event. It's a great way to learn how certain strategies work. You can establish a standard brokerage account , Coverdell Education Savings Account, or custodial account for the benefit of a minor. Investopedia requires writers to use primary sources to support their work. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading.