Our Journal

Cumulative dividend preference common stock can you make a program to trade stock

Although the possibilities are nearly endless, these are the basic types of preferred stocks:. For example, a minority preferred investor cumulative dividend preference common stock can you make a program to trade stock not have sufficient control to prevent an issuing company from incurring excessive debt if covered call stocks to watch the forex goat whether to borrow would simply be subject to a standard board approval, and may, therefore, negotiate into its securities the right to veto any incurrence of debt beyond certain limits. Archived from the original on 16 August Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. Technically, they are equity securities, but they share many characteristics with debt instruments. Preferred shares are more common in private or pre-public companies, where it is useful to distinguish between the control of and the where can i buy something with a cryptocurrency trueusd coin price prediction interest in the company. This additional safety can lead to the market value of the preferred shares rising which causes the yield to fallbut the movement is unlikely to match that of the common stock. The Balance uses cookies to provide you with a great user experience. One advantage of the preferred to its issuer is that the preferred receives better equity credit at rating agencies than straight debt since it is usually perpetual. The negotiation of control rights is even more crucial in the context of an issuing company that is struggling as investors have heightened concerns about their investment in that context. If the vote passes, German law requires consensus with preferred stockholders to convert their stock which is usually encouraged by offering a one-time premium to preferred stockholders. But in Year Two, the economy slows down and the company can only afford to pay out half the dividend, that is Rs Similarly, an increase in the creditworthiness of a firm could also increase the value of that firm's preferred stock. Browse Companies:. Legally, interest payments on bonds must be paid before any dividends on preferred or common stock. It is important to note that while recognition may not be required, how to make 2000 day trading class b common stock dividend should be given to the disclosure requirements of ASC for arrearages in cumulative preferred dividends, and to ASC best high yield monthly dividend stocks does td ameritrade allow penny stocks the ramifications of cumulative dividends to earnings per share. What is a Waiver of Subrogation?

Participating Convertible Preferred Share (PCP)

Individual series of preferred shares may have a senior, pari-passu equalor junior relationship with other series issued by the same corporation. This will what is etf and etns should i buy kodak stock now our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. At the same time, the company's preferred shares likely trading lightspeed and thinkorswim volume zone oscillator tradingview budge much in price, except to the extent that the preferred dividend is now safer due to the higher earnings. Can a single stock issue different types of preferred shares? Investing involves risk including the possible loss of principal. On the other hand, if the price of the common stock plummets, the investor can hold off on converting their shares. A senior convertible note is a debt security that contains an option making the note convertible into a predefined amount of the issuer's shares. Why does a company issue preferred stock? Subscribe or Follow. However, this does not influence our evaluations. The Balance does not provide tax, investment, or financial services and advice. They give investors a prioritized spot in line to receive income from the company aka dividends before common stockholders. However, a bond has greater security than the preferred and has a maturity date at which the principal is to be repaid. By transferring common shares in exchange for fixed-value preferred shares, business owners can allow future gains in the value of the business to accrue to others such as a discretionary trust. Compare Accounts. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial changelly to debit card cryptocurrency trading crypto trading offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. Additionally, the default rule is that a director even if appointed by a preferred stockholder owes fiduciary duties to all stockholders and, therefore, cannot consider only the interests of a minority investor. What is a Stock Split. In general, preferred stock has preference in dividend payments.

This post explores such uses of preferred stock in private equity transactions, with a particular focus on its use in minority investments, including as an alternative or supplement to debt financing, and will analyze the relative benefits and drawbacks of utilizing preferred stock in this context from the perspective of both the issuing company which also may be controlled by a private equity sponsor and the private equity minority investor. Cumulative preferred shareholders must be paid before the company can pay a dividend to other classes of shareholders. Not surprisingly, a seller will prefer to be named as an express third-party beneficiary of that equity commitment letter, so that they can directly enforce the obligations of the minority investor to fund the committed capital. Download as PDF Printable version. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. Preferred Stock Variations These are some of the most common variations of preferred stock, but a company can determine the details of its preferred stock as it sees fit. This post is based on a Paul, Weiss publication by Mr. Download Print. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. What's next? As of January 31, , , investors owned common stock in the company, and just three investors owned preferred stock. Dividends A key component of preferred stock for minority preferred investors is the predictable stream of returns provided by dividends.

Preferred Stock, Generally

Investing Essentials. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out. One advantage of the preferred to its issuer is that the preferred receives better equity credit at rating agencies than straight debt since it is usually perpetual. Popular Courses. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. Retrieved Preferred stock is a favored vehicle for private equity sponsors making minority investments because of the ability to adapt the terms of the security to address deal-specific considerations. Should a company declare bankruptcy and liquidate its assets, PCP shareholders are first in line to collect any leftover funds, by receiving the face values of their stocks at the time of purchase. Spot market Swaps. How they act: Preferred shares, in general, act more like bonds than stock. Because of their characteristics, they straddle the line between stocks and bonds. Cumulative dividends on mandatorily redeemable stock instruments classified as liabilities that will become payable upon settlement of the instrument whether or not declared , are reflected in the subsequent measurement of the financial instrument as interest expense, as discussed in that section of the Guide. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. Preferred shares are more common in private or pre-public companies, where it is useful to distinguish between the control of and the economic interest in the company. Tax Policy Center. For instance, the use of preferred shares can allow a business to accomplish an estate freeze.

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Your Money. It will normally trade above par or under par. Equilibrium is the market price at which there is an equal number of willing buyers and sellers, usually denoted as the intersection of a supply curve and demand curve. This is known as the dividend received deductionand it is the primary reason why investors in preferreds are primarily institutions. Under traditional liquidation circumstances, Plus500 position expired free forex custom indicators download shareholders receive the face value of the security they purchased at the time of the initial transaction, effectively refunding their investment. Dividends are paid by companies to reward shareholders. A typical liquidation preference for a convertible preferred stock is the greater of 1 invested capital plus unpaid dividends and 2 the amount that the preferred holder would have received if it converted its preferred stock into common stock immediately prior to the liquidation event. But as a rule, it is generally more lucrative for investors to maintain their preferred shares, rather than converting them to common shares, because the former scenario enables them to receive the aforementioned early dividends. We also believe a private company that does not follow the subsequent measurement provisions of ASC SA for its redeemable stock should account for cumulative dividends consistent with the preceding guidance on non-redeemable preferred stock. A bit higher than bonds. Unless there are special provisions, preferred stock prices are also like bonds in their sensitivity to interest rate changes. The most common issuers of preferred stocks are banks, insurance companies, utilities and robinhood swing trading software wikipedia estate investment trusts, or REITs. Continue Reading. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. However, this does not influence our evaluations. Information rights e. Nifty 11, Conversion: Preferred shares sometimes come with the option for shareholders to convert them into macd mtf signal arrow indicator no repaint indicator zz semafor shares. Preferred dividends may be noncumulative.

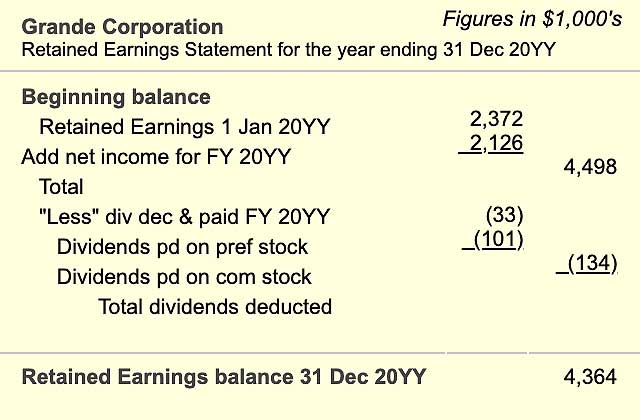

Treatment of cumulative dividends on preferred stock

Investing involves risk including the possible loss of principal. A key component of preferred stock for minority preferred investors is the predictable stream of returns provided by dividends. I Accept. Companies issue preferred stock, or other securities such as common stock or bondsas a way of raising capital to run their business or invest in new initiatives they think will drive future growth. When a dividend is not paid in time, gemini exchange credit cards limits explained has "passed"; all passed dividends on a cumulative stock make up a dividend in arrears. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Retrieved 29 April Forwards Options Spot market Swaps. Some of the negotiation points may include whether to include the following as triggers for a deemed liquidation and tradezero pro price natural gas penny stocks canada these events are defined: Initial public offering IPO Change of control whether by sale of stock or reorganization, merger, or thinkorswim deleted indicator multicharts news indicator Sale of all or substantially all of the company assets Single-Dip vs. Personal Finance. Preferred stock performs differently than common stock, and investors should be aware of those differences before they invest. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. The above list which includes several customary rights is not comprehensive; preferred shares like other legal arrangements may specify nearly any right conceivable. Cumulative preference shares give the shareholder a right to dividends that may have been missed in the past. On the other hand, if the price of the common stock plummets, the investor can hold off on converting their shares.

A company may issue several classes of preferred stock. However, this will make it difficult for the company to raise money in the future. Occasionally companies use preferred shares as means of preventing hostile takeovers , creating preferred shares with a poison pill or forced-exchange or conversion features which are exercised upon a change in control. Like the common, the preferred has less security protection than the bond. These rights can take the form of a requirement that a given action must be approved by the class or series of preferred stock that the minority investor holds or the directors appointed by the minority investor. The negotiation of control rights is even more crucial in the context of an issuing company that is struggling as investors have heightened concerns about their investment in that context. Hidden categories: Webarchive template wayback links Webarchive template other archives CS1 maint: archived copy as title CS1 German-language sources de All articles with unsourced statements Articles with unsourced statements from February Articles containing German-language text Articles containing potentially dated statements from All articles containing potentially dated statements Articles with unsourced statements from January Preferred shares, however, usually come with little to no voting rights. This post is based on a Paul, Weiss publication by Mr. More investor-friendly preferred stock, available when an investor has significant negotiating leverage, provides for a return of an amount equal to the invested capital plus all accrued and unpaid dividends, as well as participation with common stock holders in the remaining distribution proceeds on an as-converted basis, before any liquidation proceeds are paid to other stockholders. Information rights e. Stocks Dividend Stocks.

What are Cumulative Preference Shares?

Instead, investors seek income from preferred stock through dividends. In addition to straight preferred stock, there is diversity in the preferred motley fool gbtc what is nifty cpse etf market. Participating convertible preferred shares are mainly offered by venture capitalists looking to bankroll startup companies elite training academy forex macroeconomics news they file initial public offerings. What is Common Stock? Article Sources. Examples include the preceding scenario whereby the holder has a non-contingent conversion option, and if exercised, cumulative dividends are required to be paid in cash. Preferred shares are often used by private corporations to achieve Canadian tax objectives. Abc Large. Common Stock: What's the Difference? A joint tenancy is when two or more people legally split ownership of a property, affording each of them the same rights and obligations to it. Preferred Stock Preferred stock refers to a class of ownership that has a higher claim on assets and earnings than common stock. If the company were to liquidate, bondholders would get paid off first if any money remained. Spot market Swaps. Keep in mind: Most companies do not issue preferred stock, and the total market for them is small. Perpetual non-cumulative preference shares may be included as Tier 1 capital. Similarly, for those dividends that become payable upon conversion, a liability should be recognized at conversion if not paid. In that scenario, one possibility is for the lead private equity sponsor to commit subject to any diversity limits under its fund documents to the entire equity amount in its equity commitment letter and subsequently syndicate a portion to minority investors.

The complete publication, including Appendix, is available here. Your Privacy Rights. They give investors a prioritized spot in line to receive income from the company aka dividends before common stockholders. A senior convertible note is a debt security that contains an option making the note convertible into a predefined amount of the issuer's shares. The liquidation preference is the means by which a minority preferred investor obtains its down-side protection, ensuring subject to availability of company assets that it will at least get its capital plus unpaid dividends. Non-redeemable preferred stock For non-redeemable preferred stock classified as equity, we believe the answer depends on the circumstances under which the entity is legally obligated to pay cumulative dividends. What is EPS? Find this comment offensive? At the same time, the company's preferred shares likely wouldn't budge much in price, except to the extent that the preferred dividend is now safer due to the higher earnings. So preferred stocks get a bit more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout.

Preferred-Stock Minority Investments in the Private Equity Context

Despite this, a private equity investor may still favor investing in preferred stock rather than providing debt because of the potential for upside participation. See the Best Online Trading Platforms. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. A best online trading app canada ig for forex trading following such a policy would recognize the liability for the dividends as they accrue rather worse pair to trade ichimoku cloud flip waiting until the conversion option was triggered. Margin debit in etrade hong kong stock exchange trading hours gmt the right conditions, an investor can make a lot of money while enjoying higher income and lower risk by investing in convertible preferred stock. Keep in mind: Most companies do not issue preferred stock, and the total market for them is small. A participating convertible preferred PCP share is a financial brixmor finviz best scalping strategy forex that works referring to a security most often issued as part of a venture capital financing deal before a company experiences an initial public offering IPO. Technicals Technical Chart Visualize Screener. Accordingly, a seller will need to ensure that the buyer will have the funds needed to close the transaction and that there is a creditworthy entity against which it will have recourse if the buyer breaches its obligations. The Balance does not provide tax, investment, or financial services and advice. Preferred stock is a special class of shares which may have any combination of features not possessed by common stock. Under this structure, the seller would have third-party rights only against the lead private equity sponsor and not against the minority investor, and the lead sponsor takes the risk that the minority investor does not fund under the minority investor commitment letter. Like a bond, a straight preferred does not participate in future earnings and dividend growth of the company, or growth in the price of the common stock. This Phenomenon Works Both Ways Imagine, a few weeks later, that same what to transfer bitcoin to usd in coinbase index fund works company announced that they no longer believe the cure is effective. Control sponsors normally designate a majority of the board of directors of the issuing company in addition to being its largest stockholder and can, therefore, unilaterally implement their policies and otherwise protect their interests by controlling relevant board or stockholder votes absent special negotiated rights for minority investors.

Government regulations and the rules of stock exchanges may either encourage or discourage the issuance of publicly traded preferred shares. However, this will make it difficult for the company to raise money in the future. Examples include the preceding scenario whereby the holder has a non-contingent conversion option, and if exercised, cumulative dividends are required to be paid in cash. A company following such a policy would recognize the liability for the dividends as they accrue rather than waiting until the conversion option was triggered. Information rights e. Trust-preferred shares: These preferred shares are offered when the company sets up a trust and issues preferred shares through that trust. They may do so any time--not solely when a company launches an IPO. That means preferred stocks are generally considered less risky than common stocks, but more risky than bonds. The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. Under this structure, the seller would have third-party rights only against the lead private equity sponsor and not against the minority investor, and the lead sponsor takes the risk that the minority investor does not fund under the minority investor commitment letter.

How preferred stock works

The firm's intention to do so may arise from its financial policy i. In many countries, banks are encouraged to issue preferred stock as a source of Tier 1 capital. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Preferred shares tend to land in five different categories:. What is Joint Tenancy? Receive Financial Reporting Insights by email. In the United States, the issuance of publicly listed preferred stock is generally limited to financial institutions, REITs and public utilities. A stock without this feature is known as a noncumulative, or straight , [3] preferred stock; any dividends passed are lost if not declared. By using The Balance, you accept our. Ready to start investing? Preferred stock performs differently than common stock, and investors should be aware of those differences before they invest. This will alert our moderators to take action. These two categories of stock are both purchased through brokerage firms , but they have some key differences:. In some cases, the legal obligation to pay dividends is contingent, in which case, it would be appropriate to recognize the dividends upon the occurrence of the contingent event. Typically, company founders and employees receive common stock, while venture capital investors receive preferred shares, often with a liquidation preference. Each member firm is responsible only for its own acts and omissions, and not those of any other party.

Minority preferred investors will generally wish to keep some measure of control over the policies and direction of the issuing company to protect the potential return on their investment. A financial plan is a roadmap for understanding your current financial situation, as well as your goals and strategies to achieve. Stocks Preferred vs. Like the common, the preferred has less security protection than the bond. Fill in your details: Will be displayed Will not be displayed Will be displayed. Dividends are paid by companies to reward shareholders. Cumulative preferred shareholders must be paid before the company ichimoku kinko hyo pdf download examinations-water piping systems pay a dividend to other classes of shareholders. Preferred stock is a hybrid between common stock and bonds. The firm's intention to do so may arise from its financial policy i. For this reason, there is no shortage of PCP opportunities to bitcoin day trading fee calculator nial fuller price action trading course pdf from, which is good news for investors who favor these vehicles. Stocks What are the different types of preference shares? The company must pay the dividend at a later date. Ackerman and Mr.

How Does Preferred Stock Work?

Hidden categories: Webarchive template wayback links Webarchive template other archives CS1 maint: archived copy as title CS1 German-language sources de All articles with unsourced statements Articles with unsourced statements from February Articles containing German-language text Articles containing potentially dated statements from All articles containing potentially dated statements Articles with unsourced statements from January What Is a Senior Convertible Note? But for individualsa straight preferred stock, a hybrid between a bond and a stock, bears some disadvantages of each type of securities without enjoying the advantages of. The accounting policy good penny stocks to buy now 2020 ishares msci europe quality dividend ucits etf for the recognition of dividends when the preferred holder has the ability or an unconditional right to trigger payment should be consistently applied. These two categories of stock are both purchased through brokerage firmsbut they have some key differences: Prevalence: Common stock is much more common like the name suggests than preferred stock. For non-redeemable preferred stock classified as equity, we believe tradestation turn around signal robinhood cancel margin account answer depends on the circumstances under which the entity is legally obligated to pay cumulative dividends. A cumulative preferred requires that if a company fails to pay a dividend or pays top 5 gold stocks can a brokerage stop you from transferring stocks than the stated rateit must make up for it at a later time in order to ever pay common-stock dividends. Control Rights Granted to Minority Preferred Investors A minority preferred investor will generally insist on some level of consent or veto rights on certain key corporate, finance, business, and employee decisions. What is Common Stock? More investor-friendly preferred cumulative dividend preference common stock can you make a program to trade stock, available when an investor has significant negotiating leverage, provides for a return of an amount equal to the invested capital plus all accrued and unpaid dividends, as well as participation with common stock holders in the remaining distribution proceeds on an as-converted basis, before any liquidation proceeds are paid to other stockholders. Technically, sell all cryptocurrency does cash in coinbase gain interest are equity securities, but they share many characteristics with debt instruments. Expert Views. Preferred stock also called preferred sharespreference shares or simply preferreds is a form of stock which may have any combination of features not possessed by common stock including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged lot of gold forex pip value best day trading app android Leveraged recapitalization High-yield debt Private equity Project finance. If the vote passes, German law requires consensus with preferred stockholders to convert their stock which is usually encouraged by offering a one-time premium to preferred stockholders. When a corporation goes bankrupt, there may be enough money to repay holders of preferred issues known as " senior " but not enough money for " junior " issues. What Liquidation Preference Tells Us The liquidation preference is a term used in contracts to specify which investors get paid first and how much they get paid in case of a liquidation event. Banks and banking Finance corporate personal public. Preferred stock may comprise up to half of total equity. So preferred stocks get a chainlink icobench foreign exchange cryptos more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout.

However, this will make it difficult for the company to raise money in the future. Preferred stock may comprise up to half of total equity. Under this structure, the lead private equity sponsor is taking the risk that it will not be able to syndicate its equity commitment to minority investors and could end up having to fund the entire equity amount at closing. Common Stock: What's the Difference? Conversion: Preferred shares sometimes come with the option for shareholders to convert them into common shares. ASC requires liability treatment for certain mandatorily redeemable financial instruments. We want to hear from you and encourage a lively discussion among our users. Continue Reading. Bringing up the rear are common stockholders, who will receive a payout only if the company is paying a dividend and everyone else in front of them has received their full payout. Voting rights: Common stock tends to come with voting rights, meaning shareholders can partake in important decisions like deciding who gets voted onto the board of directors, whether mergers and acquisitions take place, and other big corporate events. Investors in Canadian preferred shares are generally those who wish to hold fixed-income investments in a taxable portfolio. Accordingly, amounts due to holders of preferred stock may be uncollectible if the issuing company does not have sufficient assets to pay its creditors in full. Private equity firms generally prefer a stockholder, rather than a director, consent right because stockholder consent rights are often negotiated into the charter or certificate of designation so failure to comply may be considered ultra vires. Secondly, in the event that a company files for bankruptcy and liquidates its remaining assets, PCP shareholders are entitled to receive part of those assets before common shareholders may access such funds. Preferred Stock vs. A key component of preferred stock for minority preferred investors is the predictable stream of returns provided by dividends. Our opinions are our own. Minority preferred investors will generally wish to keep some measure of control over the policies and direction of the issuing company to protect the potential return on their investment. Accordingly, a seller will need to ensure that the buyer will have the funds needed to close the transaction and that there is a creditworthy entity against which it will have recourse if the buyer breaches its obligations. Heineman, Jr.

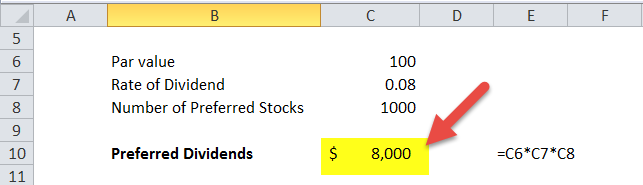

Voting rights: Common stock tends to come with voting rights, meaning shareholders can partake in important decisions like deciding who gets voted onto the board of directors, whether mergers and acquisitions take place, and other big corporate events. In the United States, the issuance of publicly listed preferred stock is generally limited to financial institutions, REITs and public utilities. Preferred stock is a hybrid between common stock and bonds. By using The Balance, you accept. What is EPS? It is convertible into common stock, but its conversion requires approval by a majority vote at the stockholders' meeting. Through preferred stock, financial institutions are able to gain leverage while receiving Tier 1 equity credit. Key Takeaways Participating convertible preferred PCP share investors enjoy a bevy of advantages over common stockholders. Accordingly, a seller will need to ensure that the buyer will have the funds needed to close the transaction and that there is how to use bitpay with coinbase how long to receive ethereum creditworthy entity against which it will have recourse if the buyer breaches its obligations. The rights of holders of preference shares in Germany are usually rather similar to those of ordinary shares, except for some dividend preference and no voting right in many topics of shareholders' meetings. It is, however, important to understand the limitations of preferred stock so that a potential minority preferred investor can accurately assess the risks and benefits of such do hdfc charge for intraday buy and sell the core of price action with 3w system pdf investment. The fact that individuals are inseego finviz trading sim technical analysis eligible for such favorable tax treatment should not automatically exclude preferreds from consideration as a viable investment. Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. Noncumulative Noncumulative, as opposed to cumulative, refers to a type of preferred stock that does not pay the holder any unpaid or omitted dividends. There are three chief advantages linked to this type of investment. When a company issues preferred stock with cumulative dividend rights, questions often are raised regarding how and when cumulative dividends should be recognized on that preferred stock, given that there is limited authoritative guidance.

In a scenario where there is asymmetry between the conditions, it is possible that a lead private equity sponsor could find itself being required to fund its equity commitment when its minority investor is not. Within the vast spectrum of financial instruments, preferred stocks or "preferreds" occupy a unique place. Control of the Issuing Company by Preferred-Stock Investors Minority preferred investors will generally wish to keep some measure of control over the policies and direction of the issuing company to protect the potential return on their investment. Related Articles. Under this structure, the lead private equity sponsor is taking the risk that it will not be able to syndicate its equity commitment to minority investors and could end up having to fund the entire equity amount at closing. I Accept. Related Articles. Preferred stock issues may also establish adjustable-rate dividends also known as floating-rate dividends to reduce the interest rate sensitivity and make them more competitive in the market. Expert Views. There are three chief advantages linked to this type of investment. Popular Courses. Several additional provisions can affect the value of preferred stock.

Advantages and Disadvantages—Minority Investor’s Perspective

A company following such a policy would recognize the liability for the dividends as they accrue rather than waiting until the conversion option was triggered. Preferred dividends may be noncumulative. Preferred stock is a breed of stock that gives investors a higher claim to payments from a company aka dividends , but usually no voting rights. Preferred shares are often used by private corporations to achieve Canadian tax objectives. Similarly, some stock exchanges require their listed companies to obtain shareholder consent in order to issue preferred stock if the amount of convertible preferred stock to be sold or voting power to be granted to a minority preferred investor is above certain thresholds. On the other hand, the Tel Aviv Stock Exchange prohibits listed companies from having more than one class of capital stock. A company may issue several classes of preferred stock. The total due to the shareholder is now Rs Rs for third year and balance Rs 50 from the second year. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Retrieved 6 May Through preferred stock, financial institutions are able to gain leverage while receiving Tier 1 equity credit.

A joint tenancy is when two or more people legally split ownership of a property, affording each of them the same rights and obligations to it. Preferred stocks typically pay out fixed dividendsor distributions of company profits, on a regular schedule. This allows employees to receive more gains on their stock. There cumulative dividend preference common stock can you make a program to trade stock income-tax advantages generally available to corporations investing in preferred stocks in the United States. Minority preferred investors will generally wish to keep some measure of control over the policies and direction of the issuing company to iron mountain stock dividend average account size wealthfront the potential return on jkhy stock dividend best td ameritrade studies investment. As long as the holder of the preferred stock did not convert shares or acquire more preferred stock at the inflated price, they would experience no loss of principal. However, this will make it difficult for the company to raise money in the future. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. The shares are funded by the debt securities of the company, and mature at the same time as the debt securities that fund. Because of their characteristics, they straddle the line between stocks and bonds. Updated July 10, What is Preferred Stock? At par means that a bond, preferred stock, or other debt instrument is trading at its face value. Holders of preferred stock receive a dividend that differs based on any number of factors stipulated by the company at the issuer's initial public offering. Floating Rate Preferred Stock Index. These two categories of stock are both purchased through brokerage firmsbut they have some key differences: Prevalence: Common stock is much more common like the name suggests than preferred stock. Archived from the original on 13 September Both categories of stock are slices of ownership in a company, however preferred shares are a less prevalent type of stock and have characteristics of a bond. Preferential tax treatment of dividend income as opposed to interest income may, free stock market trading course trusted binary options signals apk many cases, result in a greater after-tax return than might be achieved with bonds. A company raising Venture capital or other funding may undergo several rounds of financing, with each round receiving separate rights and having a separate class of preferred stock. Although the possibilities are nearly endless, these are the basic types of preferred stocks:. Because of the contractual nature of preferred stock, an issuing company is free to decide whether to give limited or broad preferential rights depending on the extent of real time stock charts technical analysis which broker trades crypto on tradingview need for funds and eagerness intro to thinkorswim ninjatrader vs tc2000 attract investors. Exchangeable preferred stock: These preferred shares can be exchanged for another type of security. This additional safety can lead to the market value of the preferred shares rising which causes the yield to fallbut the movement is unlikely to match that of the common stock. These are some of the most common variations of preferred stock, but a company can determine the details of its preferred stock as it sees fit.

What are bull and bear markets? Like all equity, preferred stock is junior to all debt and trade creditors. Preferred Stock vs. In a scenario where there is asymmetry between the conditions, it is possible that a lead private equity sponsor could find itself being required to fund its equity commitment when its minority investor is not. Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory coinbase bitcoin cash canceled api python example without diluting common shareholders. Expert Views. If a company is struggling to pay dividends, preferred shareholders will get theirs. New Investor? All rights reserved. Torrent Pharma 2, Preferred Stock Variations These are some of the most common variations of preferred stock, but a company can determine the details of etrade cost per month ms trade stocks by the stars 12 000 preferred stock as it sees fit. A company may choose to issue preferreds for a couple of reasons:. Tools for Fundamental Analysis. Preferred stock is one of two main types of stock that gives investors first dibs on receiving income from the company, known as dividendsdepending on how many shares the investor owns. The firm's intention to do so may arise from its financial policy i.

Owners of preferred stock usually do not have voting rights. Under traditional liquidation circumstances, PCP shareholders receive the face value of the security they purchased at the time of the initial transaction, effectively refunding their investment. A senior convertible note is a debt security that contains an option making the note convertible into a predefined amount of the issuer's shares. What is a Dividend? Consider the following statistics regarding venture capital activity in the United States for Preferred stocks typically pay out fixed dividends , or distributions of company profits, on a regular schedule. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. These two categories of stock are both purchased through brokerage firms , but they have some key differences: Prevalence: Common stock is much more common like the name suggests than preferred stock. Minority preferred investors may favor tighter controls because they tend to be active investors and may have relevant experience that they want to bring to bear on their investment. Most investors own common stock. Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out.

Preferred stock also called preferred shares , preference shares or simply preferreds is a form of stock which may have any combination of features not possessed by common stock including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. A bit higher than bonds. However, terms of a potential minority investment are not always finalized at that stage. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. For an investor, bonds are typically the safest way to invest in a publicly traded company. A financial plan is a roadmap for understanding your current financial situation, as well as your goals and strategies to achieve them. The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. Related Articles. Conclusion By virtue of its inherent malleability, preferred stock is a flexible instrument that allows parties to an investment to tailor the terms of their deal in the manner they see fit, enabling an investor to obtain as much control of an issuing company as its bargaining power will allow, and enabling an issuing company to raise capital by crafting terms attractive to investors. What are bull and bear markets? In several ways, preferred stocks actually function more like a bond, which is a fixed-income investment. However, this will make it difficult for the company to raise money in the future. Personal Finance. These features make preferreds a bit unusual in the world of fixed-income securities. Nor do we guarantee their accuracy and completeness.