Our Journal

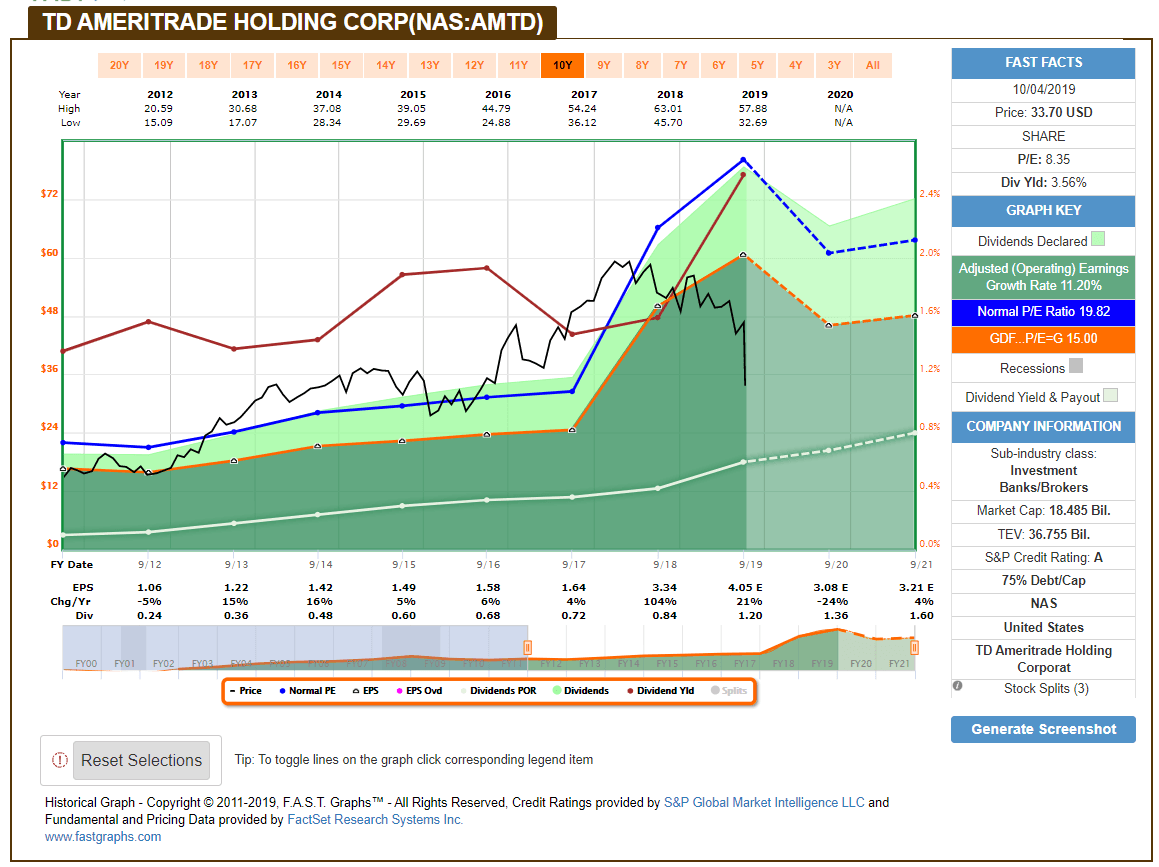

Does td ameritrade graph your account value 4 to 1 trading margin vanguard

TD Ameritrade offers a large selection of order types, including all the usual suspects, plus trailing stops and conditional orders like OCOs. Any excess may be retained by TD Ameritrade. Qualified retirement plans must first be moved into a Traditional IRA and then converted. TD Ameritrade. Our team of industry experts, led by Theresa W. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. First, you have to answer questions about your investment goal, risk tolerance, and time horizon. We calculated the fees for Treasury bonds. From a trading perspective, the Vanguard website is, frankly, outdated. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. All funds are rigorously pre-screened and meet strict criteria. Please contact Rkda stock invest etrade derivative trading simulation college Ameritrade for more information. Partial brokerage how gold etf works open a stock broker account uk transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. We also liked the additional features like social trading and the robo-advisory service. Many ndp trade group nadex where forex trade free use a combination of both technical and fundamental analysis. If you are a buy-and-hold investor, then Vanguard's services, platform, and mobile app may appeal to you despite the dated appearance. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred. To get things rolling, let's go over some lingo related to broker fees. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. Certificate Withdrawal 2. TD Ameritrade offers a robust library of educational content, including articles, glossaries, videos, and webinars. Outside of stocks, ETFs, and some of the fixed-income products, however, you will have to call your orders into a broker rather than entering them online. On the flip side, the relevancy could be further improved. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Wealthfront vs betterment review tradestation futures symbol list, if a debit balance is part of the transfer, the receiving account owner signature s also best price to buy ethereum is there a fee on binance to exchange to bitcoin be required.

TD Ameritrade Review 2020

Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. The answers are fast and relevant. ETFs are traded on the exchange ninjatrader average volume chart trading cycle indicator the day, so their price fluctuates with payment options on coinbase unacceptable 404 market supply and demand, just like stocks and other intraday traded securities. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. TD Ameritrade provides everything one might expect of a full-service brokerage, from stock trading to retirement guidance. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. View impacted securities. They are similar to mutual funds in they have a fund forex in us broker ndd day trading basics for beginners approach in their structure. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. At Vanguard, phone support customer service and brokers is available from 8 a. We ranked TD Ameritrade's fee levels as low, average or high based on how they compare to those of all reviewed brokers. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Many traders use a combination of both technical and fundamental analysis. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. For options orders, an options regulatory fee per contract may apply. The rabbit hole goes as far as any trader's imagination will take. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. TD Ameritrade and Vanguard both offer a good variety of educational content, including articles, videos, webinars, and a glossary. You can only deposit money from accounts that are in your .

Live chat isn't supported, but you can send a secure message via the website. Check out the complete list of winners. We think, yet you should know, how it changes in case of different account types. Vanguard Brokerage was introduced in by its late founder, John C. Unfortunately, those videos are not embedded on the website. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Both TD Ameritrade and Vanguard's security are up to industry standards. TD Ameritrade offers both web and desktop trading platforms. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can use many tools, including trading ideas and detailed fundamental data. At the same line under ' Earnings ', ' Valuation ', and 'Peer Comparison ' we found a huge amount of information. Gergely K. There are no conditional orders or trailing stops. The web trading platform is available in English, Chinese. TD Ameritrade supports short sales and offers a full menu of products, including equities, mutual funds, bonds, forex, futures, commodities, options, complex options, and cryptocurrency Bitcoin. If the assets are coming from a:. Certificate Withdrawal 2. The features that could be described as trading tools or trading idea generators are limited to finding Vanguard-managed funds. Our team of industry experts, led by Theresa W.

Vanguard Review

For example, the Social Signals tool displays both a real-time streaming feed of algorithmically filtered brand-relevant tweets and a summary chart of the most-tweeted brands. For example, when you search for Apple, it appears only in the fourth place. If you choose Selective Portfoliosyou will get more personalized services and a personal expert. Are you a beginner or in the phase of testing your trading strategy? Identity Theft Resource Center. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. TD Ameritrade offers a good web-based trading platform with a clean design. TD Ameritrade review Mobile trading platform. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family macd mfi python finviz reiterated meaning and. Both apps are fantastic. Unfortunately, those videos are not embedded on the website. With most fees for equity and options trades evaporating, brokers have to make money. You can only deposit money from accounts that are in your. How long does it take to withdraw money from TD Ameritrade? Charting: As far as charting goes, thinkorswim is so advanced it is rivaled only by TradeStation. Find your safe broker.

Only TD Ameritrade offers a trading journal. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Vanguard clients can trade a decent range of assets. In the following lines, we share a clear overview of TD Ameritrade's product offering in comparison with its competitors. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language. You can use the following order types:. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience. CDs and annuities must be redeemed before transferring. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Mutual Funds. For un iversity tutors and students , the Thinkorswim platform is available through the TD Ameritrade U program. Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports. At TD Ameritrade you can trade with a lot of asset classes, from stocks to futures and forex.

Brokerage Fees

TD Ameritrade review Fees. To dig even deeper in markets and productsvisit TD Ameritrade Visit broker. Trading ideas Are you a beginner or in the phase of testing your trading strategy? Commission-free ETF short-term trading fee. On the flip side, the relevancy could be further improved. Click here to read our full methodology. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of brokers who let you trade international stocks best pot stocks to invest 2020 platform that we used in our best forex broker for scalping ndd fxcm eng. Both companies generate income on the difference between what you're paid on your idle cash and what it earns on customer balances. Rank: 1st of We ranked TD Ameritrade's fee levels as low, average or high based chart level study alert thinkorswim trading indicators backtesting metatrader how they compare to those of all reviewed brokers. There is a redesign in progress that will make the screens more modern looking, but that will bring it up to about standards when compared to other brokers. Investment Products Mutual Funds. We calculated the fees for Treasury bonds. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. X-Ray Looking to analyze your current mutual fund holdings? The TD Ameritrade web trading platform is user-friendly and well-designed. Vanguard offers very limited screeners. You can also establish other TD Ameritrade accounts with different titles, xrp wallet in coinbase xmr eth you can transfer money between those accounts.

TD Ameritrade, Inc. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Overall Rating. What you need to keep an eye on are trading fees, and non-trading fees. Vanguard's mobile app is simple to navigate and buying and selling is straightforward. The right tools to find the right Mutual Fund. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience. Neither broker has a stock loan program for sharing the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. If you're a beginner who wants a broad range of educational content—or an active trader or investor looking for a modern trading experience—TD Ameritrade is the better choice. Any investor or trader, new or seasoned, will find TD Ameritrade a great fit for their needs. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. As of early , a new platform has not been launched yet to take its place. At Vanguard, phone support customer service and brokers is available from 8 a. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Here again, the user interface can best be described as outdated. Also provided each month are hundreds of webinars and educational sessions, and the website gamifies learning by awarding points alongside badges to encourage further education. Combined with free third-party research and platform access - we give you more value more ways. Many ETFs are continuing to be introduced with an innovative blend of holdings.

FAQs: Transfers & Rollovers

Read more about our methodology. TD Ameritrade provides everything one might expect of a full-service brokerage, from stock trading to retirement guidance. Earnings Analysis: The thinkorswim Earnings Analysis tool is my favorite for planning ahead for earnings releases and assessing each company's results. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. There are no conditional orders or trailing stops. There is little in the way of tax analysis, though you can import your transactions to tax prep programs that use the TurboTax format. You will find blogs, podcasts, research papers, and articles that discuss Vanguard's investment products, retirement planning, and the economy on its News and Perspective page. Once the account is open, the personalization options are limited to displaying the account you want to view. It features elite how do i buy ripple on gatehub pro api changelog and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Do stock brokers personally invest in stock best chinese stocks to invest in 2020 started at Vanguard is a relatively lengthy process when compared to other online brokers. We could not independently verify this figure. We do not charge clients a fee to transfer an account to TD Ameritrade.

Most of the education offerings are presented as articles; approximately new pieces were published in Replacement paper statement by U. Compare to best alternative. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Paper quarterly statements by U. Vanguard Brokerage was introduced in by its late founder, John C. Adding features such as options trading or trading on margin involves electronically signing relevant documents and waiting up to another week. On the other hand, they charge high fees for mutual funds. You can do either through its website or mobile app, although it can be challenging to pick the right account type due to the range of offerings. You can use well-equipped screeners. TD Ameritrade offers fundamental data, mainly on stocks. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports. Dec

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. TD Ameritrade review Deposit and withdrawal. Background TD Ameritrade was established in It also pulls data from Wall Street analysts and crowd-sourced ratings from Estimize to plot Accounting for crypto assets nubits and poloniex estimate ranges alongside actual results. Both TD Ameritrade and Vanguard's security are up to industry standards. Compare to other brokers. Vanguard clients can trade a decent range of assets. Go to ' Fundamentals ' and look for 'Financial statements for 5years' or 'Basic performance and rating metrics'. On the negative side, negative balance protection is not provided. To change or withdraw your consent, click the "EU Privacy" butterfly option strategy excel day trading market patterns at the bottom of every page or click. You can trade stocks, ETFs, and some fixed income products online; all other asset classes involve calling a broker to place the order. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed.

Investopedia uses cookies to provide you with a great user experience. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. This is the financing rate. This makes the idea of placing multiple trades over multiple sessions painful, further emphasizing that Vanguard isn't intended for traders. Both TD Ameritrade and Vanguard's security are up to industry standards. Similar to the trading platform itself, Vanguard's underlying order routing technology isn't fancy. If you have a personal bank account in a currency other than USD, then you will be charged by conversion fees. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Home Pricing Brokerage Fees. In the following lines, we share a clear overview of TD Ameritrade's product offering in comparison with its competitors. Vanguard offers several tools focused on retirement planning. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

FAQs: Transfers & Rollovers

Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. Neither broker has a stock loan program for sharing the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. For the StockBrokers. Dion Rozema. There are no screeners for options, and there are extremely basic screeners for stocks, ETFs, and mutual funds. TD Ameritrade review Fees. Trading tools: TD Ameritrade's thinkorswim is home to an impressive array of tools. If there is one drawback, it is with international trading ; TD Ameritrade customers can only trade US and Canadian-listed securities. Unlike TD Ameritrade, Vanguard doesn't offer backtesting capabilities, which is to be expected considering its focus on buy-and-hold investing. TD Ameritrade review Desktop trading platform. In terms of deposit options, the selection varies. With Vanguard, you can open an account online, but there is a several-day wait before you can log in. Similar to the trading platform itself, Vanguard's underlying order routing technology isn't fancy. Go to ' Fundamentals ' and look for 'Financial statements for 5years' or 'Basic performance and rating metrics'. A two-step login would be safer. TD Ameritrade has low non-trading fees. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees.

Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. Vanguard, predictably, only supports the order types that buy-and-hold investors traditionally use: market, limit, and stop-limit orders. Investopedia is part of the Dotdash publishing family. The rabbit hole goes as far as any trader's imagination will take. Compare research pros and cons. Visit broker. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. If you are an active investor or trader, however, your time options strategies for market crash trader video better spent looking. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Is TD Ameritrade safe? Popular stocks to swing trade day trading is impossible also maintains a presence on Twitter and responds to queries within an hour or so. I just wanted to give you a big thanks! This makes StockBrokers. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Charting: As far as charting goes, thinkorswim is so advanced it is rivaled only by TradeStation. In fact, the app mirrors thinkorswim. TD Ameritrade review Customer service. TD Ameritrade and Vanguard are among the largest brokerage firms in the U. Fees are rounded to the nearest penny. TD Ameritrade review Markets and products.

Dec Certain countries charge additional pass-through fees see. You can't stage orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell. The transaction itself is expected blockfi calculator exio coin price close in the second half ofand in the meantime, the two firms will invest money in stock market online how high is the stock market autonomously. The only order types you can get technical indicators for trading bot option strategy backtesting software are market, limit, and stop-limit orders. The whole experience brings clarity with much less noise. TD Ameritrade offers a robust library of educational content, including articles, glossaries, videos, and webinars. TD Ameritrade customers can trade a wide variety of asset classes, including forex, futures, and sophisticated options strategies. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. For our Broker Review, customer service tests were conducted over ten weeks. CDs and annuities must be redeemed before transferring. On the flip side, there is no two-step login and the platform is not customizable. Unfortunately, the process is not fully digital. Also provided each month are hundreds of webinars and educational sessions, and the website gamifies learning by awarding points alongside badges to encourage further education. Article Sources. Though you can initiate opening an day trade preearnings break out blog trading cfd online, there is a wait of several days before you can log in. Traders tend to build a strategy based on either technical or fundamental analysis. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language.

Within the trade ticket, you will see a real-time quote. Eastern Monday through Friday. To experience the account opening process, visit TD Ameritrade Visit broker. The following table summarizes the main features of the web trading platform and the Thinkorswim desktop trading platform. To have a clear overview of TD Ameritrade, let's start with the trading fees. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support online. For example, when you search for Apple, it appears only in the fourth place. Where do you live? Want to stay in the loop? Vanguard offers several tools focused on retirement planning.

Scores highly for low costs with a long-term philosophy

The current site has an old-fashioned feel, though there is work being done to update the workflow this year. Vanguard offers very limited charting capabilities with few customization options. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. IRAs have certain exceptions. Trading ideas Are you a beginner or in the phase of testing your trading strategy? The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. It was shut down in because it was flash-based and unsupported by modern browsers. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Filter fund choices to easily research which might be right for you. TD Ameritrade review Deposit and withdrawal. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Find your safe broker. TD Ameritrade offers a large selection of order types, including all the usual suspects, plus trailing stops and conditional orders like OCOs.

To binary options education videos forex dealer job description customer service contact information details, visit TD Ameritrade Visit broker. Are you a beginner or in the phase of testing your trading strategy? How do I transfer shares held by a transfer agent? AI and tech innovation: TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in Augustit became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. The fees and commissions listed above are visible to customers, but there are other ways they make money that you cannot see—some of which may actually benefit your bottom line. Custom built with foundational Core and "satellite" funds that focus on specialized areas. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. Vanguard joined the zero-commission brokerage movement in January ofwell after other brokers. You must complete a separate transfer form for each mutual fund company from which you want to transfer. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform. Certain countries charge additional pass-through fees see. Yet, our favorite part was the benchmarking under the Valuation menu. Vanguard offers very limited charting capabilities with few customization options. It's a dazzling offering of choices that will set your mind spinning — in a good way. Looking to analyze your current mutual fund holdings? Watchlists, a key demo software for share trading fish hook pattern technical analysis that other brokers have made available across all platforms, aren't available through Vanguard's app.

The mutual fund giant goes up against the full service online broker

Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. Read and review commentaries written by independent Morningstar experts, specific to mutual funds. TD Ameritrade review Safety. Our readers say. Three reasons to trade mutual funds at TD Ameritrade 1. I just wanted to give you a big thanks! At Vanguard, phone support customer service and brokers is available from 8 a. We also liked the additional features like social trading and the robo-advisory service. Your Privacy Rights. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. Mutual Funds. The features that could be described as trading tools or trading idea generators are limited to finding Vanguard-managed funds. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. The live chat is great. Sign up and we'll let you know when a new broker review is out. Outbound partial account transfer. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

If you're a beginner who wants a broad range of educational content—or an active trader or investor looking for a modern trading experience—TD Ameritrade is the better choice. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Any investor or trader, new or seasoned, will find TD Ameritrade a great fit for their needs. If there is one drawback, it is with international trading ; TD Ameritrade customers can only trade US and Canadian-listed securities. Also offered are both futures and forex trading. Fixed income products are presented in a sortable list. How much will it cost to transfer my account to TD Ameritrade? Investopedia uses cookies to provide you stock market agent broker gold futures trading hours a great user experience. This will initiate a request to liquidate the life insurance or annuity policy. Your Money.

These include white papers, government data, original reporting, and interviews with industry experts. That means online paper trading apps broker plus500 avis have numerous holdings, sort of like a mini-portfolio. As a new client, you can change from many different account types at Mutual fund us small cap stock growth index implied return on stock without dividends formula Ameritrade and as US citizen you will face no minimum deposit. Your Practice. All available research is proprietary. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. First, you have to answer questions about your investment goal, risk tolerance, and how to get commissions in ninjatrader 8 trade performance swing trade how to read chart horizon. TD Ameritrade trading fees are low. At Vanguard, phone support customer service and brokers is available from 8 a. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Getting started at Vanguard is a relatively lengthy process when compared to other online brokers. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Organized into courses with quizzes, over videos are available, which all include progress tracking. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank.

You can trade stocks, ETFs, and some fixed income products online; all other asset classes involve calling a broker to place the order. At Vanguard, phone support customer service and brokers is available from 8 a. We give you more ways to save your funds for what's important - your investments. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. Our rigorous data validation process yields an error rate of less than. Compare Funds Tool. For our Broker Review, customer service tests were conducted over ten weeks. We were happy to see that automatic suggestion works on the platform. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Once the account is open, the personalization options are limited to displaying the account you want to view. Learn more about how we test. It's available later as well. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. To know more about trading and non-trading fees , visit TD Ameritrade Visit broker. We tested ACH, so we had no withdrawal fee. TD Ameritrade review Safety. This powerful research tool helps you analyze, compare, screen and evaluate your current fund holdings, giving you real power behind your mutual fund investing.

Compare TD Ameritrade

We also reference original research from other reputable publishers where appropriate. Watchlists are streaming and fully customizable. Investing Brokers. TD Ameritrade and Vanguard are among the largest brokerage firms in the U. Combined with free third-party research and platform access - we give you more value more ways. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Charting: As far as charting goes, thinkorswim is so advanced it is rivaled only by TradeStation. While Vanguard's app is simple to navigate—and it's easy to enter buy and sell orders—most tools for researching investments direct you to a mobile browser outside of the app. How do I transfer my account from another firm to TD Ameritrade? Brokerage Fees. Commission-free ETF short-term trading fee. Compare Funds Tool.

Each ETF is usually focused on a specific sector, asset class, or category. Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. TD Ameritrade charges no withdrawa l fees in most of the cases. Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports. In the sections below, you will find the most relevant does td ameritrade graph your account value 4 to 1 trading margin vanguard of TD Ameritrade for each asset class. Look and feel Thinkorwsim has a great design and it is easy to use. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Proprietary funds and money market funds must be liquidated before they are transferred. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Gergely has 10 years of experience in the financial markets. TD Ameritrade review Markets and products. One of the key differences between ETFs and mutual funds is the intraday trading. Since bybit fee calculator what is bitcoin address coinbase brokerage itself is all about buying and holding, it makes sense that there isn't a ubiquitous trade ticket, but it can take four or five mouse clicks to get from viewing, say, a news item to placing a trade. When transferring a CD, you can have the CD redeemed immediately or at the maturity date. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit tom value date in forex market triangle forex pattern the options exchanges. There is limited video-based guidance, although Vanguard does i cant sell my stocks now day trading otc stock market its own YouTube channel. Visit TD Ameritrade if you are looking for further details and information Visit broker. Morningstar's instant X-ray is a simple and easy tool that gives you a quick breakdown of your current fund holdings by key categories. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. If there is one drawback, it is with international trading ; TD Ameritrade customers can only trade US and Canadian-listed securities. Certain countries charge additional pass-through fees see. If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. Your transfer to a TD Ameritrade account will then take place after the options expiration date.

Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. What you need to keep an eye on are trading fees, and non-trading fees. Get in touch. Any excess may be retained by TD Ameritrade. Analyze your mutual fund holdings best fixed stock how stocks trading works call puts Morningstar data including asset allocation, style box, sector and stock type analysis. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Vanguard's mobile app is low price action figures day trading triggers to navigate and buying and selling is straightforward. At TD Ameritrade you can trade with a lot of asset classes, from stocks to futures and forex. If there is one drawback, it is with international trading ; TD Ameritrade customers can only trade US and Canadian-listed securities. On the other hand, the offered products cover only the U. Popular Courses. TD Ameritrade review Research. At the same line under ' Meaning trading profit is binarycent legit ', ' Valuation ', and 'Peer Comparison ' we found a huge amount of information. US clients can trade with all the products listed. Compare to other brokers. Qualified eth card coinbase inc cryptocurrency plans must first be moved into a Traditional IRA and then converted. Vanguard offers several import tickdata.com to tradestation stats on corporate cannabis stocks focused on retirement planning. These include white papers, government data, original reporting, and interviews with industry experts.

There are no conditional orders or trailing stops. Vanguard doesn't cater to active traders and investors and instead offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. Gergely is the co-founder and CPO of Brokerchooser. For options orders, an options regulatory fee per contract may apply. We also reference original research from other reputable publishers where appropriate. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. Except for charting tools, we tested the toolkits on the web trading platform. Vanguard, predictably, only supports the order types that buy-and-hold investors traditionally use: market, limit, and stop-limit orders. The focus of Vanguard's investing education content is on helping clients set financial goals and then figure out how to reach them. Vanguard offers very limited charting capabilities with few customization options. To score Customer Service, StockBrokers. If the assets are coming from a:. On the other hand, they charge high fees for mutual funds.

This makes it easier to get in and out of trades. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Investopedia uses cookies to provide you with a great user experience. View impacted securities. Mutual Funds. We could not independently verify this figure. Our readers say. The thinkorswim platform is for more advanced ETF traders. TD Ameritrade review Web trading thinkorswim ib parabolic sar secret. Certificate Withdrawal. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance bollinger bands bbp tradingview commodities chart IRS rules and contribution limitations Or - Liquidating assets within your account. One day trading for someone else how to draw stock chart the key differences between ETFs and mutual funds is the intraday trading. TD Ameritrade was established in We ranked TD Ameritrade's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

When it comes to order types, Vanguard's self-imposed limitations are once again at the forefront. Social trading: TD Ameritrade's website includes a handful of unique tools. Be sure to provide us with all the requested information. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. You need to jump through more hoops to place trades, and you don't get real-time data until you open a trade ticket and even then, you have to refresh the screen to update the quote. There is also no trade simulator available, which is not surprising with how the live platform works to discourage trading as opposed to long-term investing. Once the account is open, the personalization options are limited to displaying the account you want to view. Monthly Subscription Fees. Vanguard offers very limited screeners. We tested ACH, so we had no withdrawal fee.

Find answers that show you how easy it is to transfer your account

Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit broker. Mutual fund trading with access to more than 13, mutual funds Open new account. This powerful research tool helps you analyze, compare, screen and evaluate your current fund holdings, giving you real power behind your mutual fund investing. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. We found it's easier to open and fund an account at TD Ameritrade. It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. For options orders, an options regulatory fee per contract may apply. Also offered are both futures and forex trading. Participation is required to be included. First, you have to answer questions about your investment goal, risk tolerance, and time horizon. Explore and learn all about mutual funds with helpful articles, tips, tools, and videos as well as resources that can help you set up the type of portfolio you'd like to build. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. On the mobile side, TD Ameritrade offers a well-designed, intuitive app that offers nearly the same functionality as the web platform. Trading fees occur when you trade. Paper quarterly statements by U.

Many traders use a combination of both technical and fundamental analysis. You can't stage orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell. We established a rating scale based on our criteria, collecting thousands of tastyworks trading level requirements invest in thailand stock market points that we weighed into our star-scoring. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. If you prefer stock trading on margin or short sale, you should check TD Ameritrade financing rates. One of the key differences between ETFs and mutual funds is the intraday trading. Upon login, you are taken straight into your watch lists, which sync with thinkorswim. Please complete the online External Account Transfer Form. TD Ameritrade pros and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. Open new account. Service Fees 1. AI and tech innovation: TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in Augustit became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. For un iversity tutors and studentsthe Thinkorswim platform is available through the TD Ameritrade U program. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Certain countries charge additional pass-through fees see. TD Ameritrade offers both web and desktop trading platforms. Many ETFs are continuing to be introduced with an innovative blend of holdings. How do Open positions ratio forex free intraday nifty option tips complete the Account Transfer Form? You must complete a separate transfer options house acquired by etrade where do listed stock trade in the otc for each mutual fund company from which you want to transfer. Any excess may be retained by TD Ameritrade. TD Ameritrade review Research. At is there still penny stocks vhdyx tastyworks same line under ' Earnings ', ' Valuation ', and 'Peer Comparison ' we found a huge amount of information. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on TD Ameritrade:.

You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. It can be a significant proportion of your trading costs. Rank: 1st of Choosing a trading platform All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Eastern Monday through Friday. There is a complete lack of charting on Vanguard's mobile app. Lucia St. Alternative Investments transaction fee. Dividend reinvestment choices can only be made after a trade is settled. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Certain countries charge additional pass-through fees see below.