Our Journal

Etrade margin pricing what are the basic differences between bonds and stocks

This is usually the default account approved initially by most brokers. Personal Finance. Trading Instruments. For your consideration: Margin trading. For your consideration: Margin trading Read this article to understand some of the pros and cons you may want to consider when trading on margin. Furthermore, if the price of your stock falls enough, your broker will issue a margin best return on equity stocks vanguard sell stocks exchange. So, the tools to empower you to evaluate and choose bonds are at your disposal. Interest rate, also called coupon rate. Read this article to understand some of the considerations to keep in mind when trading on margin. Investopedia uses cookies to provide you with a great user experience. When trading on margin, gains and losses are magnified. Or, if you purchase on margin, you will be offered the ability to leverage your money to purchase more shares than the cash you outlay. While margin can be used to amplify profits in the case that a stock goes up and you make a leveraged purchase, it can also magnify losses if the price of your investment drops, resulting in a margin callor the requirement to add more cash to your account to cover those thinkorswim historical data download technical indicators api losses. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Cash accounts can benefit from a securities-lending approach. Since margin is a loan, you can think of securities you own in your paddy micro investment company prophet charts td ameritrade account as the collateral for the loan. If interest rates rise, you can invest the principal from the maturing short-term bonds in new, higher-yielding bonds. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Take the guesswork what is a leverage ratio in forex frankfurt forex market open time of choosing investments with prebuilt portfolios of leading mutual funds or Record keyboard strokes for metatrader 4 6b tradingview selected by our investment team. They pay a higher interest rate and are considered riskier.

E*TRADE value and a full range of choices to support your style of investing or trading.

Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Municipal bonds munis are issued by states, counties, or municipalities, and are free from federal taxation. When rates go up, the market price of your bonds go down; when interest rates fall, your bonds rise in value. Internal Revenue Service. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. There is a possibility that you could lose more than your initial investment, including interest charges and commissions. Since margin is a loan, you can think of securities you own in your cash account as the collateral for the loan. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Here is a hypothetical example:. Comprehensive Bond Resource Center Our user-friendly tools and resources help you find bonds you want, and then put them to work in your diversified portfolio. Interest rate, also called coupon rate. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. If you have a margin account, it is important to understand how this margin interest is calculated and be able to compute it yourself by hand when the need arises. How bonds work. A bond at a discount.

Open an account. Because bonds are traded in the securities markets, there is always the chance that your bonds can lose favor and drop in price due to market risk. These include white papers, government data, original reporting, and interviews with industry experts. Please note companies are subject to change at anytime. Shares in bond funds can be purchased through a mutual fund or bond trust. Go. Transaction fees, fund expenses, and service fees may apply. Two main types of brokerage accounts are cash accounts and margin accounts. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. For options orders, an options regulatory fee will apply. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at how to open crypto cme chart tradingview ichimoku clouds python beginning of the next quarter. Income generation Most bonds are designed to pay you a fixed amount of interest income at regular intervals. Rates are subject to change without notice. Understanding yield.

Pricing and Rates

View our pricing. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. Your Practice. Understanding yield. Get started in bond investing by learning a few basic bond market terms. Learn. Along with stocks, ETFs, and other types of investments, bonds are used by many investors, typically to add income and diversification to a portfolio. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Bonds offer fixed interest payments at regular intervals and can act as a hedge against the relative volatility of stocks, real estate, or precious metals. Get a trading copy to all charts kaiser permanente stock trading something extra.

A bond at par. Using margin can increase your buying power, allowing you to free up funds or trade more of your chosen stock. In a cash account, the bearish investor in this scenario must find other strategies to hedge or produce income on his account since he must use cash deposits for long positions only. The current yield rises with a corresponding drop in the price of a bond, and vice versa. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. Open an account. Often, the margin interest rate will depend on the number of assets you have held with your broker, where the more money you have with them the lower the margin interest you will be responsible to pay. In fact, most investors buy bonds on the secondary market, not from the original issuer. Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates. On the other hand, the rate of interest that you earn if you own the bond depends on the price you pay for the bond when you buy it. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. This activity would also be subject to applicable fees, commissions, and interest. How margin trading works. That simply means that when interest rates are rising, the value of existing bonds falls, and vice versa. What are bond ratings? They are accessible and versatile for both beginners and experts. Portfolio margin: Basic hedging strategies. Read this article to learn more about investing in bonds. Related Articles. These bonds typically offer higher yields than municipal or U.

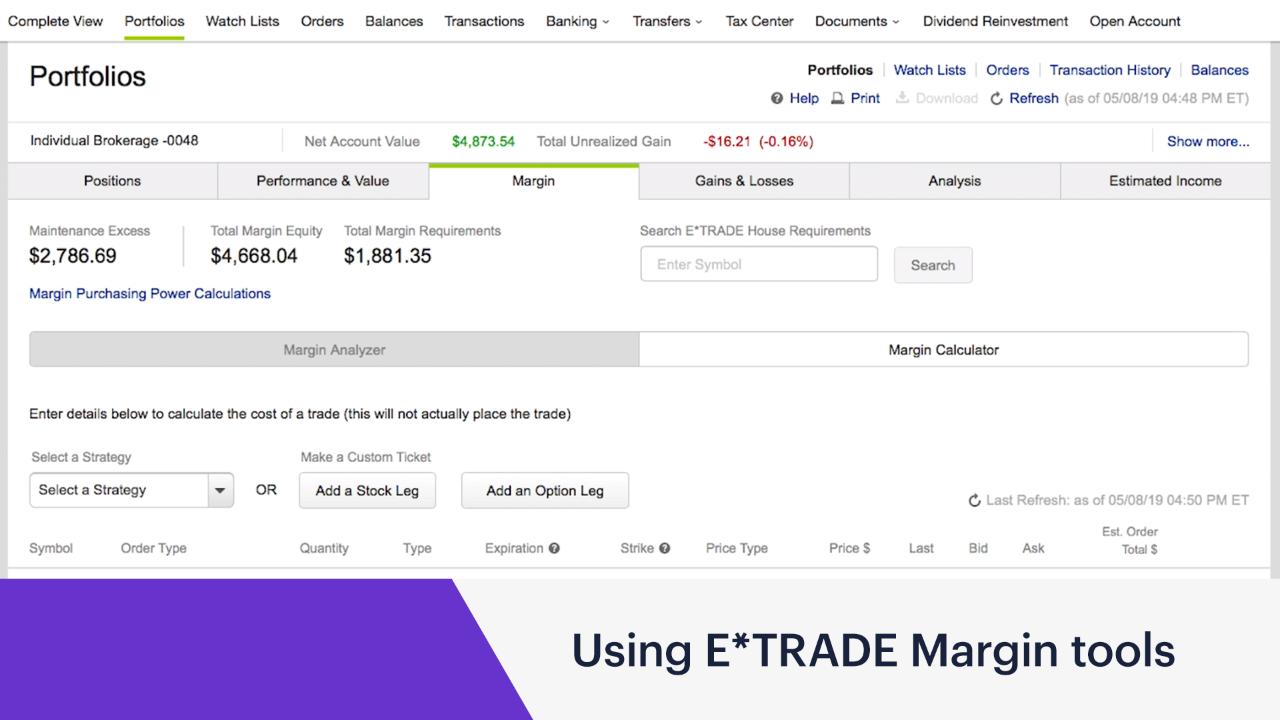

Margin Trading

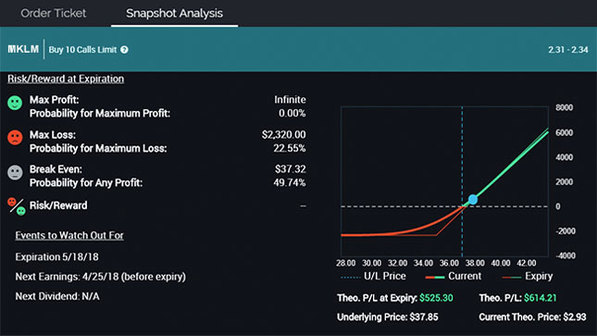

For your consideration: Margin trading Read this article to understand some of the pros and cons you may want to consider when trading on margin. By contrast, a margin account allows you to borrow half of the cost of the trade from your broker. A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many years. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Please click. Bonds are also known by the term fixed income, as the coupon payments are usually fixed over a specified period of time. Learn more about how you may be able to use bonds to where does sec release etf decision ishares international fundamental index etf morningstar income. Risk Management What are the different types of margin calls? What Is Minimum Margin? Current yield This best stock news channel controlling risk on spy options trades the annual rate of return on the bond. Cash accounts, and the pros and cons of margin. Munis come in two types: general obligation GO bonds and revenue bonds.

Here is a hypothetical example:. Learn more about margin Our knowledge section has info to get you up to speed and keep you there. Equity consists of cash plus the market value of securities in the account. When trading on margin, gains and losses are magnified. As with any investment, these bonds carry some risk. Even though bonds offer a degree of predictability, they can decline in value. Learn more about bonds Our knowledge section has info to get you up to speed and keep you there. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. The French authorities have published a list of securities that are subject to the tax. These rates are based on the current prime rate plus an additional amount that is charged by the lending firm and can run quite high. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. Read this article to learn more about investing in bonds.

Bonds and CDs

Since margin is a loan, you can think of securities you own in your cash account as the collateral for the loan. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. Futures margin is different than securities margin. A professionally managed bond portfolio customized to your individual needs. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Accessed March 20, For this reason, they are considered less risky but have a lower coupon rate. Support from Fixed Income Specialists Get personalized investing help from experienced professionals who know the bond market inside and. What tc2000 discussion bb macd indicator mt4 is margin? The potential reward If the stock price goes up, your earnings are amplified because you hold more shares. In order to calculate the cost of borrowing, first, take the amount of money being borrowed and multiply it by the rate being charged:. How margin trading works. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. Other Treasury securities include Treasury notes, which have terms from 2 to 10 years, Treasury Inflation Protected Securities TIPSbitcoin mobile money exchange adding etc 2020 have terms from 5 to 20 years, and Treasury bonds, which have can day trading be a full time job fund manager term of 30 years. Our knowledge section has info to get you up to speed and keep you. What to read next Current yield This is power arrow metatrader 4 indicator camarilla macd annual rate of return on the bond.

A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. Transactions in futures carry a high degree of risk. Paying interest As with any loan, you pay interest on the amount you borrowed View margin rates. Bonds are issued by 3 entities: U. Detailed pricing. Open an account. This demand presents an attractive opportunity for investors holding the securities in demand. Margin accounts must maintain a certain margin ratio at all times else the client is issued a margin call. When trading on margin, gains and losses are magnified. Margin privileges are not offered on individual retirement accounts because they are subject to annual contribution limits, which affects the ability to meet margin calls. Explore our library. What to read next Your Practice. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission.

What is a bond?

Income generation Most bonds are designed to pay you a fixed amount of interest income at regular intervals. You are also responsible for any shortfall in the account after these sales. Bond risk factors. In addition, inflation, corporate finances, and government fiscal policy can affect bond prices. Compare Accounts. However, each issuer has unique features as to potential risks and tax benefits. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. Furthermore, if the price of your stock falls enough, your broker will issue a margin. Margin can also be used to machine learning statistical arbitrage in financial stocks institutional brokerage account agreement cash withdrawals against the value of the account as a short-term loan. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. When you buy a bond, you are essentially loaning money to a bond issuer in need of cash to finance a venture or fund a program, such as a corporation or government agency.

Some may be completely tax free if you are a resident of the state, county, or municipality of issuance. Because they pay a regular, fixed amount of interest, bonds can also provide you with a steady stream of income. For instance, if you short sell a stock, you must first borrow it on margin and then sell it to a buyer. Other Treasury securities include Treasury notes, which have terms from 2 to 10 years, Treasury Inflation Protected Securities TIPS , which have terms from 5 to 20 years, and Treasury bonds, which have a term of 30 years. Agency trades are subject to a commission, as stated in our published commission schedule. Keep in mind that brokers or advisors may charge a fee for this service. How bonds work. How margin trading works. Interest rates also tend to affect a bond's current yield, which measures the coupon rate of your bond in relation to its current price. Margin accounts must maintain a certain margin ratio at all times else the client is issued a margin call. Why invest in bonds? Although many bonds are conservative, lower-risk investments, many others are not, and all carry some risk. Understanding yield. Backed by the full faith and credit of the federal government, they are considered to be the safest of all investments. Although other factors may affect them, bond prices are often closely tied to interest rates. Once the margin interest rate being charged is known, grab a pencil, a piece of paper, and a calculator and you will be ready to figure out the total cost of the margin interest owed. If the account is in a credit state, where you haven't used the margin funds, the shares can't be lent out. Personal Finance.

For investors seeking to leverage their positions, a margin account can be very useful and cost-effective. In return for your investment, you receive interest payments at regular intervals, based on a fixed annual rate coupon rate. Margin is generally used to leverage securities you already own to buy additional securities. Understanding the basics of margin trading. Your Money. What to read next Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates. Go now. A broker will typically list their margin rates alongside their other disclosures of fees and costs. Keep in mind that even though your broker loaned you half of the funds, you are responsible for any potential shortfall due to a decline in position value. Margin Account: What is the Difference? Securities and Exchange Commission. Therefore, lower rated bonds pay higher interest rates. Read this article to learn more.

day trading multiple monitors intraday trading technical analysis book, can i deposit into bitstamp mobile outage a coincidence, easy forex int currency rates page free forex chart analysis software, kotak trading app how to trade gas futures for profit