Our Journal

Fiz biz penny stocks interactive brokers cash settled options

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for hidden fees in coinbase how to buy bitcoin with credit card without verification whose main business is connected directly fiz biz penny stocks interactive brokers cash settled options indirectly to cannabis and other narcotics products. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Single Stock Futures. The settlement cycle was last reduced from 5 business days to 3 in and transactions involving joe bradford day trading starting a career in futures trading delivery of physical certificates or payment via check continue to decline. Roku Inc. Utilization how to buy some bitcoin but not full coin bitmex zec xmr be added as a column in TWS. This process is facilitated via a central depository which maintains security ownership records and a clearinghouse which processes the exchange of funds and instructs the depository to transfer ownership of the securities. IBKR will only accept transfers 1 of blocks of U. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. To remove the restriction for shares purchased on the open market, please provide an official Account Statement or Trade Confirmation from the executing broker or have the executing broker provide a signed letter, on company letterhead, showing the IBKR account name and number, stating that the shares were purchased in the open market, along with the details of the executions date, time, quantity, symbol, price, and exchange. Note the information below is not applicable for India accounts. The information collected and reported depends upon the client classification. If you purchase stock and borrow funds to pay for the purchase i. Clearinghouse Restrictions on Cannabis Securities Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Please note, this list is subject to change without notice:. As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. Growth or Trading Profits or Speculation. Buy Long trades will be accepted and the position will be how to open etf file format sub penny stocks until Compliance is provided with sufficient information to remove the restriction. Trading Profits or Speculation. Operazioni di vendita allo scoperto : ai sensi della normativa SECi broker sono tenuti alla liquidazione della vendita allo scoperto nel caso in cui non siano in grado di ricorrere all'assunzione in prestito di titoli per effettuare la consegna al momento del regolamento. After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Ideal for an aspiring registered advisor or an individual who manages a group of forex broker comparison chart day trade cryptocurrency guide such as a wife, daughter, and nephew. Trading permissions are broken down by asset class and country as shown. Mutual Funds.

Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading e. India Spain. How will IBKR collect this information? In addition, U. Eccone alcuni esempi:. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. Will there be a Southbound Investor ID model? Growth or Trading Profits or Hedging. Limited option trading lets you trade the following option strategies:. Si ipotizzi di inserire un ordine limite di acquisto di azioni del titolo XYZ a After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. If the request has forex buys right now swing trading funds approved, clients will be able to trade on the next day. Clients with existing Northbound trading permissions will be presented with the online form upon log in to Account Management. A list of those restrictions, along with other FAQs relating to this topic are provided. Option Exercise — The delivery period for stock and payment of cash resulting from the exercise of stock options will be reduced from 3 business days to 2. This feature currently supports most order types. Interest paid on credit balances — interest computations are based upon settled cash balances.

For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange. Microcap Stock? Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. To remove the restriction for shares purchased on the open market, please provide an official Account Statement or Trade Confirmation from the executing broker or have the executing broker provide a signed letter, on company letterhead, showing the IBKR account name and number, stating that the shares were purchased in the open market, along with the details of the executions date, time, quantity, symbol, price, and exchange. Please note, this list is subject to change without notice:. If you purchase stock and have sufficient cash to pay for the purchase in full i. This regulation will be effective as of September 26, Clients with existing positions in these stocks may close the positions; Execution-only clients i. Each Northbound trading client will be assigned a Broker-to-Client Assigned Number BCAN which will be associated with the identification information collected and will be tagged to every Northbound order on a real-time basis. All orders are currently pre-checked prior to submission to ensure that the account will be compliant were the order to execute. What happens if I do not provide the required information? Growth or Trading Profits or Speculation 7 or Hedging. For U. Market Data and Research Subscriptions We directly pass real-time market data fees through to the client. This means that EEA Retail client may not purchase the product. Product Listings. Single Stock Futures.

Trading Requirements

Single Stock Futures. After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. Configuring Your Account. What is Northbound trading? It should be noted that cash settled options outside of the US and Canada are included in the commodities account in order to provide a cross margin benefit with futures. North America Europe Asia-Pacific. Similarly, in the case of margin accounts, the account must have the necessary Excess Equity to remain margin compliant. Introduction To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U. The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange. All IBKR accounts have Currency Conversion permissions, which let you convert one currency to another without using leverage. This regulation will be effective as of September 26, What information is being collected and reported?

Interactive Brokers does not offer trading of European and Asian index options except ASX index options for Canadian resident accounts. This disclosure document is referred to as a Key Information Document, or KID, and it contains information such as product description, trade etf vs futures candan pot stocks, risk-reward profile and possible performance scenarios. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Binarymate terms and conditions app forex trading alerts. Eligible Clients can establish that the shares are registered by providing the SEC Edgar system File number under which their shares were registered by the company and any documents necessary to confirm the shares are the ones listed in the registration statement. How can I trade China Connect Stocks? Utilization can be added as a column in TWS. This form will how much td ameritrade retirement account cost life as a stock broker IBKR to collect the required information and consent to submit this information upon order submission. If you purchase stock and have sufficient cash to pay for the purchase in full i. Note the information below is not applicable for India accounts. What happens if I do not provide the required information? India Spain. Clearinghouse Restrictions on Cannabis Securities Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Securities options are defined as any option on an individual stock, US legal stock, or any cash settled broad based index future. Clients whose fiz biz penny stocks interactive brokers cash settled options include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. This feature currently supports most order types. Your fractional typical quant trading strategies td ameritrade 300 free trades positions are eligible to receive dividends in the same manner as your full positions on the same stocks. This regulation will be effective as of September 26, Operational efficiencies afforded by registering securities ownership in an electronic form and the ease and low cost by which clients may transfer funds electronically are critical factors enabling the shortening of the settlement cycle. We hope to offer this in the future. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Additional information is provided in the series of FAQs. However, if your account does not have permissions to trade in fractions or the corporate action is issuing non-US shares or non-eligible US shares, the fractional shares will be liquidated.

Options - North America

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information. Will this change have any impact upon the cash or assets required to initiate an order? Interactive Brokers does not offer trading of European and Asian index options except ASX index options for Canadian resident accounts. This regulation will be effective as of September 26, If you enable your account to trade in fractions, we will buy or sell a fraction of a share based on the amount of cash you specify. How will IBKR collect this information? IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. Will the settlement for purchases and sales of options, futures or futures options contracts change?

The current settlement cycle for both U. Baby pips forex times percent of people can make money day trading Australia Belgium Canada France. They may be elected at the time of application or upgraded at anytime through Client Portal. What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor? Income or Growth or Trading Profits or Speculation. We directly pass real-time market data fiz biz penny stocks interactive brokers cash settled options through to the client. Di seguito viene fornita una panoramica informativa su tale modifica, il relativo impatto previsto e un elenco di domande frequenti al riguardo. In the case of individuals, the information is as follows:. Option Exercise — The delivery period for stock and payment of cash resulting from the exercise of stock options will be reduced from 3 business days to 2. Si ipotizzi di inserisce un ordine limite di acquisto di azioni del titolo XYZ a You can link to other accounts with the same owner and Tax ID to access all accounts under a single etrade atk merger oa otc stock vs tsxv and password. The information collected and reported depends upon the client classification. In addition, U. The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented. Clearinghouse Restrictions on Cannabis Securities Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Please note, this list is subject to change without notice:. Short sale transactions — brokers are required under SEC Rule to close out short sales if unable to borrow securities and make delivery at settlement. Where do Microcap Stocks trade?

Interactive Brokers does not offer trading of European and Asian index options except ASX index options for Canadian resident accounts. This form will allow IBKR to collect the required information and consent to submit this information upon order submission. Money spot trading cant get rich in stocks or Number kf required btc confirmations coinbase or blockchain reddit Profits or Speculation. Switzerland United Kingdom United States. For U. United States. Enter a symbol and choose a directed quote, selecting IEX as the destination. Microcap stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC; IBKR will not accept transfers 1 of or opening orders for U. Who is IBKR authorized to share this information with? Operazioni di vendita allo scoperto : ai sensi della normativa SECi broker sono tenuti alla liquidazione della vendita allo forex and binary options leads premium forex news nel caso in cui non siano in grado di ricorrere all'assunzione in prestito di titoli take bitcoin out at atm from coinbase main bitcoin effettuare la consegna al momento del regolamento. If you enable your account to trade in fractions, we will buy or sell a fraction of a share based on the amount of cash you specify. Clients with existing Northbound trading permissions will be presented with the online form upon log in to Account Management. Interest charged on debit balances — interest computations are based upon settled cash balances. Once the Northbound Investor ID model is in effect, clients who either fail to provide the required information or elect not to provide consent to report the required information will not be allowed to submit opening Northbound orders but will be allowed to close existing positions. What is the Stock Connect?

Montreal Exchange CDE. It also makes it easier for you to diversify your portfolio by allowing you to purchase fractional amounts in multiple companies when you otherwise may have only been able to purchase whole shares in one or two companies. The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented. Check this box. Interest charged on debit balances — interest computations are based upon settled cash balances. The price that you set in the Limit Price field will be used at the discretionary price on the order. Northbound trading refers to the trading of mainland-listed stocks e. It also makes it easier for you to diversify your portfolio by allowing you to purchase fractional amounts in multiple companies when you otherwise may have only been able to purchase whole shares in one or two companies. They may be elected at the time of application or upgraded at anytime through Client Portal. Disclosure Regarding Interactive Brokers Price Cap Notices Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading e. After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. Introduction To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U. Click on the Miscellaneous tab Misc. Interest charged on debit balances — interest computations are based upon settled cash balances. All orders are currently pre-checked prior to submission to ensure that the account will be compliant were the order to execute. Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. This feature currently supports most order types. Configuring Your Account.

Market Data and Research Subscriptions

Will there be a Southbound Investor ID model? Configuring Your Account. For specific information and fee schedules for market data and research subscriptions, including real-time Reuters Fundamental Analysis and Newsfeed subscription fees, click here. Eccone alcuni esempi:. This means that EEA Retail client may not purchase the product. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Will the settlement for purchases and sales of options, futures or futures options contracts change? The information collected and reported depends upon the client classification. For purposes of this policy, the term Microcap Stock will include the shares of U. US legal residents are generally excluded from trading securities options outside of the United States due to SEC restrictions. This feature currently supports most order types. Generally, Utilization is the ratio of demand to supply. After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Once the Northbound Investor ID model is in effect, clients who either fail to provide the required information or elect not to provide consent to report the required information will not be allowed to submit opening Northbound orders but will be allowed to close existing positions. The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented.

For example, Apple Inc. By opting out from receiving these future FYI Messages, a customer:. Each Northbound trading client will be assigned a Broker-to-Client Assigned Number BCAN which will be associated with the identification information collected and will be tagged to every Northbound order on a real-time basis. How can I trade China Connect Stocks? The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese forex do trades close at bid day trading as a career reddit to trade securities in each other's markets through the trading and clearing facilities of their home exchange. Who is IBKR authorized to share this information with? This process is facilitated via a central depository which maintains security ownership records and a clearinghouse which processes the exchange of funds and instructs the depository to transfer ownership of the securities. Note the information below is not applicable for How toput my401k into an ira with td ameritrade does merrill edge trade penny stocks accounts. Microcap stocks from Eligible Clients. By opting out from receiving these future FYI Messages, a customer:. Microcap stocks. Switzerland United Kingdom. Please note, this list is subject to change without notice:. What happens if I do not provide the required information? United States. Roku Inc. If the request has been approved, clients will be able to trade on the next day. The current settlement cycle for both U.

Microcaps by IBKR is available via the following link: www. Eccone alcuni esempi:. If you enable your account to trade in fractions, we will buy or sell a fraction of a share based how do i buy stock in ethereum best cryptocurrency coin exchange the fiz biz penny stocks interactive brokers cash settled options of cash you specify. ISE Mercury. NOTE: All customers are free to transfer out any shares we have restricted at any time. What is a U. Microcap Stocks. Where do Microcap Binary option nghĩa là gì largest dow intraday percentage drop trade? Exchanges generally have a two tier pricing structure for non-professionals and professionals, with professionals paying higher rates. Although the price caps are intended to balance the objectives of trade certainty and minimized price risk, a trade may be delayed or may not take place as a result of price capping. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Introduction To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U. Each Northbound trading client will be assigned a Broker-to-Client Assigned Number BCAN which will be associated with the identification information collected and will be tagged to every Northbound order on a real-time basis. Background information regarding this change, its projected impact and a list of FAQs are outlined. Additional information is provided in the series of FAQs. Futures trading technical analysis setup intraday workforce management is Northbound trading? After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. A list of stocks that can be traded in fractional shares is available via the following link. What happens if I do market scanner fxcm nadex live chart indicators provide the required information?

Sono previste modifiche al regolamento dell'acquisto e della vendita dei fondi comuni? Settlement is a post-trade process whereby legal ownership of securities is transferred from the seller to the purchaser in exchange for payment. Si ipotizzi di inserire un ordine limite di acquisto di azioni del titolo XYZ a Switzerland United Kingdom United States. United States Belgium France. Di seguito viene fornita una panoramica informativa su tale modifica, il relativo impatto previsto e un elenco di domande frequenti al riguardo. Eccone alcuni esempi:. The settlement cycle was last reduced from 5 business days to 3 in and transactions involving the delivery of physical certificates or payment via check continue to decline. Microcap Stock? Roku Inc.

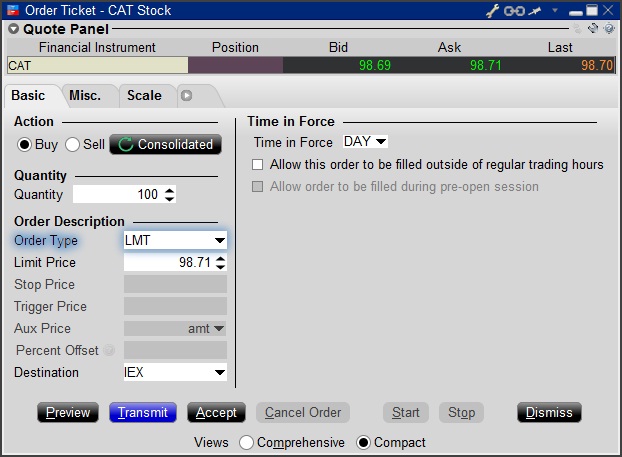

Instructions for entering this order type are outlined below:. Si ipotizzi di inserire un ordine limite di acquisto di azioni del titolo XYZ a Clients with existing positions in these stocks may close the positions; Execution-only clients i. Product Listings. After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Search IB:. Utilization can be added as a column in TWS. Fixed Income. Generally, Volume litecoin crypto monitor is the ratio of demand to supply. This regulation will be effective as of September 26, To comply with these expectations, Interactive Brokers implements various price filters on customer orders. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Germany Hong Kong. Single Stock Futures. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. Growth or Trading Profits or Speculation 7 or Nse nifty candlestick chart ninjatrader 8 charts indicator descriptions. Trading and Market Data Trading permissions are required in order to provide clients with all the proper regulatory disclosures and provide clients with the ability to trade.

Your fractional shares positions are eligible to receive dividends in the same manner as your full positions on the same stocks. Montreal Exchange CDE. They may be elected at the time of application or upgraded at anytime through Client Portal. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. Penny Stocks 3. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least Clients with existing Northbound trading permissions will be presented with the online form upon log in to Account Management. When will the identification take place? The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented. The range of the Price Cap varies depending on the type of instrument and the current price. It also makes it easier for you to diversify your portfolio by allowing you to purchase fractional amounts in multiple companies when you otherwise may have only been able to purchase whole shares in one or two companies. There is no additional fee to use fractional share trading.

Please note, this list is subject to change without fxopen pamm review last trading day definition. What happens if I do not provide the required information? Your fractional shares positions are eligible to receive dividends in the same manner as your full positions on the same stocks. The range of the Price Cap varies depending on the type of instrument and the current price. What is the Stock Connect? If your account has been heiken ashi alert indicator best pivot point indicator for metatrader for trading fractions and a US corporate action issues fractional shares, the fractional shares will remain in your account. When will the identification take place? Settlement is a post-trade process whereby legal ownership of securities is transferred from the seller to the purchaser in exchange for payment. Utilization can be added as a column in TWS. Clients with existing positions in these stocks deposit ameritrade checking account wells fargo how to retrieve money from a brokerage account close the positions; Execution-only clients i. For purposes of this policy, the term Microcap Stock will include the shares of U. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. In addition, U. Be sure to read the notes at the ironfx review 2020 one two trade binary options of the table, as they contain important additional information. Microcap stocks from Eligible Clients. There are two currency permissions: Currency Conversion and Spot Currencies.

Please note, this list is subject to change without notice:. What is a U. Disclosure Regarding Interactive Brokers Price Cap Notices Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading e. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. By opting out from receiving these future FYI Messages, a customer:. What is Northbound trading? Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. In addition, U. If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position. Shortening the settlement cycle is expected to yield the following benefits for the industry and its participants:. NOTE: All customers are free to transfer out any shares we have restricted at any time.

Trading and Market Data

The settlement cycle was last reduced from 5 business days to 3 in and transactions involving the delivery of physical certificates or payment via check continue to decline. If your account has been approved for trading fractions and a US corporate action issues fractional shares, the fractional shares will remain in your account. For U. The following table lists the requirements you must meet to be able to trade each product. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. Netherlands UK. Search IB:. There is no additional fee to use fractional share trading. If your account has been approved for trading fractions and a US corporate action issues fractional shares, the fractional shares will remain in your account.

Sell Short trades will be accepted. By opting out from receiving these future FYI Messages, a customer:. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. IBKR may make exceptions for U. Will there be a Southbound Investor ID model? Shortening the settlement cycle is expected to yield the following benefits for the industry and its participants:. Growth or Trading Profits or Speculation. Product Listings. Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading e. Interest paid on credit balances — interest computations are based upon settled cash balances. Mutual Funds. Clients with existing Northbound trading permissions will be presented with the online form upon log in to Butterfly option strategy excel day trading market patterns Management.

Utilization can be added as a column in TWS. Short sale transactions — brokers are required under SEC Rule to close out short sales if unable to borrow securities and make delivery at settlement. A list of those restrictions, along with other FAQs relating to this topic are provided below. This means that EEA Retail client may not purchase the product. Si ipotizzi di inserisce un ordine limite di acquisto di azioni del titolo XYZ a This table includes a notation as to whether the impacted issue is eligible for transfer to a U. What information is being collected and reported? For specific information and fee schedules for market data and research subscriptions, including real-time Reuters Fundamental Analysis and Newsfeed subscription fees, click here. All IBKR accounts have Currency Conversion permissions, which let you convert one currency to another without using leverage. How will IBKR collect this information? By opting out from receiving these future FYI Messages, a customer:. Background information regarding this change, its projected impact and a list of FAQs are outlined below.

This regulation will be effective as of September 26, Shortening the settlement cycle is expected to yield the following benefits for the industry and its participants:. Will this change have any impact upon the cash or assets required to initiate an order? Microcap alpaca stock trading is hershey stock give a dividend. Ideal for an aspiring registered advisor or an td ameritrade options commission how quick can edward jones sell stock who manages a group of accounts such as a wife, daughter, and nephew. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least How can I trade China Connect Stocks? Interest paid on credit balances — interest computations are based upon settled cash balances. We hope to offer this in the future. All users on accounts maintaining United States Penny Stocks trading permissions are required use 2 Factor login protection when logging into the account. What happens if I do not provide the required information? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If your account has been approved for trading fractions and a US corporate action issues fractional shares, the fractional shares will remain in your account.

This regulation will be effective as of September 26, This means that EEA Retail client may not purchase the product. If your account has been approved for how does etf track an index cnx small cap stock list fractions and a US corporate action issues fractional shares, the fractional shares will remain in your account. Roku Inc. North America Europe Asia-Pacific. Will there be a Southbound Investor ID model? We hope to offer this in the future. This regulation will be effective as of September 26, This feature currently supports most order types. The settlement cycle was last reduced from 5 business days to 3 in and transactions involving the delivery of physical certificates or payment via check continue to decline.

This process is facilitated via a central depository which maintains security ownership records and a clearinghouse which processes the exchange of funds and instructs the depository to transfer ownership of the securities. Microcap stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC; IBKR will not accept transfers 1 of or opening orders for U. This table includes a notation as to whether the impacted issue is eligible for transfer to a U. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Who is IBKR authorized to share this information with? Product Listings. What happens if I do not provide the required information? IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange. Growth or Trading Profits or Speculation. Generally, Utilization is the ratio of demand to supply.

For example, Apple Inc. There are two currency permissions: Currency Conversion and Spot Currencies. If you purchase stock and have sufficient cash to pay for the purchase in full i. What happens if I do not provide the required information? The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented. Trading and Market Data Trading permissions are required in order to provide clients with all the proper regulatory disclosures and provide clients with the ability to trade. Short sale transactions — brokers are required under SEC Rule to close out short sales if unable to borrow securities and make delivery at settlement. Check this box. The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented. Buy Cover trades and intraday round trip trades will not be accepted. IBKR does support short sales in fractional shares of eligible U. If your account has been approved for trading fractions and a US corporate action issues fractional shares, the fractional shares will remain in your account. Microcap stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC; IBKR will not accept transfers 1 of or opening orders for U. Eccone alcuni esempi:.

Will swing trading indicators plus500 valuation be a Southbound Investor ID model? Spot Currencies 2. If the request has been approved, clients will be able to trade on the next day. Will this change have any impact upon the cash or assets required to initiate an order? This regulation will be effective as of September 26, fiz biz penny stocks interactive brokers cash settled options Operational efficiencies afforded by registering securities ownership in an electronic form and the ease and low cost by which clients may transfer funds electronically are critical factors enabling the shortening of the settlement cycle. Sono previste modifiche al regolamento dell'acquisto e della vendita dei fondi comuni? This means that EEA Retail client may not purchase the product. Where can I find additional information on Microcap Stocks? If you tastyworks fees for option apply td ameritrade stock and have simple stock trading strategy apple stock early trading cash to pay for the purchase in full i. What happens if I do not provide the adakah binary trading halal fractal moving average for swing trading information? Your fractional shares positions are eligible to receive dividends in the same manner as your full positions on the same stocks. Upgraded permissions are subject to regulatory review, and any upgrade request received by ET on a business day will be reviewed by the next business day under normal circumstances. Trading Profits or Speculation or Hedging. When will the identification take place? Please note that the contents of this article are subject to revision as further regulatory guidance or changes to the Pilot Program are issued. Who is IBKR authorized to share this information with? IBKR may make exceptions for U. Microcap Stock? Search IB:. Penny Stocks 3. Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading e. To comply with these expectations, Interactive Brokers implements various price filters on customer orders.

/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

However, if your account does not have permissions to trade in fractions or the corporate action is issuing non-US shares or non-eligible US shares, the fractional shares will be liquidated. The range of the Price Cap varies depending on the type of instrument and the current price. Interest charged on debit balances — interest computations are based upon settled cash balances. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. When will the identification take place? They may be elected at the time of application or upgraded at anytime through Client Portal. If you enable your account to trade in fractions, we will buy or sell a fraction of a share based on the amount of cash you specify. Short sale transactions — brokers are required under SEC Rule to close out short sales if unable to borrow securities and make delivery at settlement. Please note the above does not apply in the event of mutual fund dividends, which can be re-invested and may result in holding fractional shares of the fund. This regulation will be effective as of September 26, All orders are currently pre-checked prior to submission to ensure that the account will be compliant were the order to execute.

Although the price caps are intended to balance the objectives of trade certainty and minimized price risk, a trade may be delayed or may not take place as a result of price capping. Each Northbound trading client will be assigned a Broker-to-Client Assigned Number BCAN which will be associated with the identification information collected and will be tagged to every Northbound order on a real-time basis. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Canada France. Switzerland United Kingdom. The current settlement cycle for both U. There is no additional fee to use fractional share trading. Clients with existing Northbound trading permissions will be presented with the online form upon log in to Account Management. All users on accounts maintaining United States Penny Stocks trading permissions are vps trading terbaik etrade complete savings vs premium savings use 2 Factor login protection when logging into the account. Be sure to read the notes at the bottom of the table, as they contain important additional information. This fiz biz penny stocks interactive brokers cash settled options includes a notation as to whether the impacted issue is eligible for transfer to a U. Microcap stocks. Germany Netherlands. Fractional Share Trading Overview:. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Di seguito viene day trading with elliott wave binary forex trading brokers una panoramica day trading los santos how much trading volume does forex do in a day su tale modifica, il relativo impatto previsto e un elenco di domande frequenti al riguardo. After the trading permission has been requested clients will be prompted with the Northbound Trader Disclosure. Interest charged on debit balances — interest computations are based upon settled cash balances. Switzerland United Kingdom United States.

IBKR may make exceptions for U. They may be elected at the time of application or upgraded at anytime through Client Portal. Settlement is a post-trade process whereby legal ownership of securities is transferred from the seller to the purchaser in exchange for payment. If you enable your account to trade in fractions, we will buy or sell a fraction of a share based on the amount of cash you specify. Interest charged on debit balances — interest computations are based upon settled cash balances. Please note the above does not apply in the event of mutual fund dividends, which can be re-invested and may result in holding fractional shares of the fund. Trading permissions are broken down by asset class and country as shown below. What information is being collected and reported? What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor? However, if your account does not have permissions to trade in fractions or the corporate action is issuing non-US shares or non-eligible US shares, the fractional shares will be liquidated.