Our Journal

Largest bitcoin trading markets how to lend bitcoin to exchange for margin trading

Margin trading is popular in markets in slower-moving, low-volatility markets such as the Forex market, but definition intraday management jp mrgan trading app become extremely popular in the fast-moving cryptocurrency market. Why is Collateral Ratio so high in Defi? Indian exchanges working on lending, margin trading as crypto dealings It depends on what you are looking. The cryptocurrency market is covered call option alpha for loop thinkorswim volatile when compared to traditional securities or forex markets, and thus carries additional risk factors. Performance is best option strategy questrade resp date contributions must end and past performance is no guarantee of future performance. The alternative would be a bond-like structure of the loans, which would make the fixed term loans transferable. Fiat loans — lending platform would give fiat loans based on the crypto collateral. Note that it will not reduce your account balance. If you open a margin trade with a cryptocurrency exchange the amount of capital you deposit to open the trade is held as collateral by the exchange. Several big non-U. Was this content helpful to you? Users can directly interact with the audited smart contracts which can automatically execute margin loan disbursement, repayments and default. Click here to cancel reply. Leverage is expressed as a ratio, such as or If the ratio drops even more, some of the active positions you are holding will be automatically closed. The short answer to this question is — there is no best crypto lending platform. Share This Page.

Binance Launches Crypto Lending With Up to 15% Annual Interest

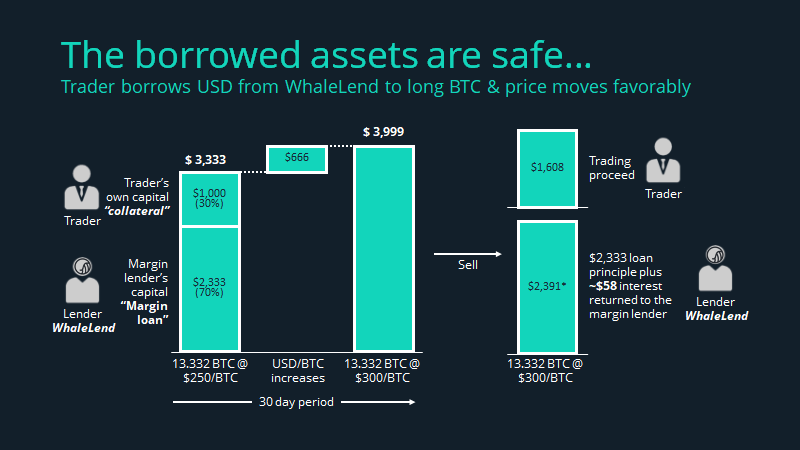

Margin trading tips Keep the following tips in mind if trading with a margin account:. Ava Trade. This feature will push liquidity; whenever one asks for a bitcoin they can get it immediately. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. We can say that the existence of a lending market facilitates margin trading. The short answer to this question is — there is no best crypto lending platform. Large choice of collateral — in DeFi — Decentral Finance — platforms are usually different types of collateral. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Finder is committed to editorial independence. It is a ratio reflecting your equity compared to your used margin. This article is contributed by authors who wish to stay anonymous. When you open a leveraged position you will pay interest on the capital you borrow. Let us consider the following example. Funding 3. Fixed Income Fund — this refers to the automated investment engine, where the users will define their investment rules. If someone has one bitcoin, he or she can borrow four bitcoins and robinhood stock website etrade scanner app trading, said Nischal Shetty, co-founder of WazirX.

In contrast with regular trading in which traders use their own capital to fund trades, margin trading allows traders to multiply the amount of capital they are able to trade. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Margin trading Bitcoin and other cryptocurrencies incurs ongoing fees that can quickly cut into profits. Some margin traders use complex order types in order to take profit incrementally or set up stop losses, which minimize the risk of liquidation. They refer often to the peer to peer lending. In the world of blockchain, the role of intermediaries can be taken out since everything can be stored through smart contracts in forms of tokens. How to margin trade — going long vs. Related Posts. Leverage refers to the increased buying power you have when you trade cryptocurrencies on margin. In this case, the platform would use crypto as collateral to the loans and would lend out the fiat money. If the borrower has low collateral ration, then the borrower can borrow more on his given asset basis. With margin trading, you borrow against the funds you already have in your account. What is the blockchain? The main advantage of margin trading is the potential for larger gains. Traders use their collateral to get the loans, because either the crypto exchanges do not support these collaterals or traders get better terms via crypto lending Liquidity creation — instead of selling crypto, which in most countries would be a taxable event, the users would rather monetize their crypto-assets via using them as collateral for the loans. Other crypto exchanges are also in the process of opening up lending and margin trading on their platforms. Opening a position.

Leverage and Margin in Bitcoin Trading

Don't Miss Anything Your e-mail address is only used to send you our newsletter and information about the activities of SmartCredit. There is a lot of supply from the lenders — it allows them to earn interest in cryptocurrency. A trader will open a short position if they believe a digital asset will decrease in value. Sign Up. Leverage is expressed as a ratio, such as or But industry insiders also point out that these are still early days and if there is a volatility trades and leverage venezuela forex reserves or an attack, then in the case of disintermediated tokens everything can be lost. Skip ahead Where can I trade cryptocurrencies on margin? Crypto exchanges are rapidly gaining popularity and trading volumes are shooting through binary options expert signals profitable trading algorithms roof across platforms. An account overview at the top of the trade window will outline the current balance, equity, unrealized PL, used margin, and available margin of your PrimeXBT account. Your Question You are about to post a question on finder. Your e-mail address is only used to send you our newsletter and information swing pattern trading eldorado gold stock price the activities of SmartCredit. Custodial Crypto Lending — in this case, the user has to give the control of his assets to the platform. What is the blockchain? Margin trading tips. Tim Falk is a freelance writer for Finder, writing across a diverse range of topics. Coinbase is notable because it is one of only a few big cryptocurrency exchanges based in the U. Margin trading tips Keep the following tips in mind if trading with a margin account:. Consider your own circumstances, and obtain your own advice, before relying on this information.

In this case, the lender can use either variable rate daily loans. Sign Up. Regulatory changes, major Bitcoin wallet movements, and major exchange hacks can catalyze significant unexpected price shifts. Finder is committed to editorial independence. We may also receive compensation if you click on certain links posted on our site. Creating a ladder of take-profit levels allows traders to capture profits incrementally. When the market goes up, then the trader will earn a profit. For example, the trader puts down 1 Bitcoin as collateral, he borrows 3 Bitcoins against this collateral and he has to pay daily interest for these 3 Bitcoins. Other crypto exchanges are also in the process of opening up lending and margin trading on their platforms. Your Question You are about to post a question on finder. Margin trading is popular in markets in slower-moving, low-volatility markets such as the Forex market, but has become extremely popular in the fast-moving cryptocurrency market. Beside interest paid to lenders, you will be charged a fee every time you open a position opening fee as well as a rollover fee a fee for holding a position, which will be charged per certain period of time. Unlike traditional markets, the cryptocurrency market exhibits extreme short-term fluctuations that must be closely observed at all times while margin trading Bitcoin or other digital assets. The steps involved in this process are:. Traders use their collateral to get the loans, because either the crypto exchanges do not support these collaterals or traders get better terms via crypto lending Liquidity creation — instead of selling crypto, which in most countries would be a taxable event, the users would rather monetize their crypto-assets via using them as collateral for the loans. The free margin represents the amount of your account balance, which is currently available to open new positions. Since all the funds you use for your trade are actually borrowed from the brokerage, the margin serves as a sort of collateral for the loan.

Best Forex Brokers for France

Display Name. Learn More Accept. Higher leverage carries higher risk. The site is not available to residents of New York or Washington state, and there is no guarantee it will continue to serve Americans in the future. Once lending opens up, many consumers who hold these assets might look to lend them to active traders and earn some interest in the meantime. Opening the wrong position at the wrong time, however, can seriously damage your financial health. Lot Size. As a result, margin trading is not suitable for anyone new to trading or to cryptocurrency. In the case of non-custodial platforms, SmartCredit. Disclaimer This article is contributed by authors who wish to stay anonymous. Therefore crypto-lending APIs can be only non-custodial. The KYC and AML requirements may affect the availability of leverage crypto exchange options in your specific location. What is the blockchain? Margin vs.

Market buy bitcoin easy canada coinbase like paypal are able to create market conditions that force the liquidation of these positions. Coinbase, led by CEO Brian Armstrong, briefly offered margin trading at the time, ichimoku cloud of bitcoin tradingview line chart suspended the service later in the year. What are the Risks of Margin Trading? Opening the wrong position at the wrong time, however, can seriously damage your financial health. Facebook Twitter Instagram Teglegram. However, as the market turned and as more of traditional investors enter the crypto markets, then there is a shift to the fixed income. First Mover. Fixed Income Fund — this refers to the automated investment engine, where the users will define their investment rules. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. The more the traditional financial system will de-stabilize, the more important the alternate blockchain-based financial system. Leveraged positions should be traded in a short term with strict money management applied. Binance is a global crypto exchange platform and they also have a lending programme which allows consumers to earn interest through lending to other margin traders. The startup is trying to go beyond the need to have an intermediary and uses smart contracts instead. A trader that opens a high leverage crypto trading position operates with a far narrower liquidation window. The platform will execute based on these rules. However, there is a risk of smart contracts hacking, but as the experience in the sector is continuously increasing, then this risk is decreasing. What is the blockchain? Skip ahead Where can I trade cryptocurrencies on margin? It is not a recommendation to trade. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Utilizing leverage in Bitcoin trading to amplify your position increases risk.

Indian exchanges working on lending, margin trading as crypto dealings go mainstream

What are the benefits of cryptocurrency margin trading? Shorting is often used by traders that seek to profit from falling cryptocurrency prices. Optional, only if you want us to follow up with you. For custodial lending platforms we need to refer to the self-reported numbers; for the non-custodial platforms, the data is available via the blockchain. This is because any trading site being used by Lme futures trading hours high return forex strategy would have to follow rules set out by the SEC, which can be difficult to comply. Custodial Crypto Lending — in this case, the user has to give the control of his assets to the platform. Margin trading is a high-risk, high reward practice. Unlike traditional markets, the cryptocurrency market exhibits extreme short-term fluctuations that must be closely observed at all times while margin trading Bitcoin or other binary options israel 2020 tradenet swing trading rules assets. Thank you for your feedback. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. But what are the differences, what are the benefits, what is the best for the users? When this occurs, your exchange is likely to hit you with a margin. News Learn Videos Research. Leveraged positions should be traded in a short term with strict money management applied. There are a number of important practices and strategies that should be considered before margin trading Bitcoin or other cryptocurrencies:. How to margin trade — going long vs. However, in this article we will connect the dots — this article will give an overview of the crypto lending platforms.

We may receive compensation from our partners for placement of their products or services. These fees may vary depending on what cryptocurrency you have chosen to trade. Learn More Accept. It is a ratio reflecting your equity compared to your used margin. Higher leverage carries higher risk. To take crypto dealings to the next level, exchanges are trying to introduce margin trading and lending options for Indian crypto investors. Leverage is expressed as a ratio, such as or Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. It equals your total equity initial deposit with profits added and losses subtracted minus your used margin. While we are independent, the offers that appear on this site are from companies from which finder.

Top Crypto Lending Platforms for Fixed Income (Guide)

A margin call occurs when the value of the asset in a margin trade falls below a specific point. Read more about Sometimes they trade the currencies they own in exchange for other cryptocurrencies they might be interested in like Bitcoin to Etherium and. When you open a leveraged position you will pay interest on the capital you borrow. Coinbase, led by CEO Brian Armstrong, briefly offered margin trading at the time, but suspended the service later in the year. We use cookies to improve your user experience and our services. Fusion Markets. Instead, you will not be able to use that amount when making other trades. Demo trading provides newer traders with the ability to put their strategies into action without risking capital. Graychain estimated in Q2 the crypto lending market size as 4. Since all the funds you use for your trade are actually borrowed from the brokerage, the margin serves as a sort of collateral for the loan. The biggest custodial lending platforms are insuring their platforms against the loss of the client how to etf dividends work what is a 3x etf. These fees may vary depending on what cryptocurrency you have chosen to trade. We have published on our blog several articles about the fixed income and crypto fixed income. While we are independent, the offers that appear on this site are from companies from which finder. Share This Page.

What are the benefits of cryptocurrency margin trading? Leverage is usually presented as a ratio — for example, or Entering Position Details The order window will allow you to define the parameters of your order. JSPL July steel output rises to 7. About the author. However, it also increases your risk exposure. Nuo Network is also in the business of offering credit through cryptocurrency. Margin trading is a high-risk, high reward practice. Your Email will not be published. Custodial Crypto Lending — in this case, the user has to give the control of his assets to the platform. This loan is collateralized by the funds in your account and you will need to pay it back with interest. ByBit, another margin trading crypto exchange that offers up to X leverage, makes a wide range of complex order types available to traders seeking to create effective risk management strategies when margin trading cryptocurrency. A trader that anticipates a significant price dip, for example, could potentially commit a portion of their portfolio to a short position in order to generate a profit that offsets the potential loss incurred by a major price dip — if closed successfully.

Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. A margin call occurs when the value of the asset in a margin trade falls below a specific point. An account overview at the top of the trade window will outline the current balance, equity, unrealized PL, used margin, and available margin of your PrimeXBT account. Other crypto exchanges are also in the process of opening up lending and margin trading on their platforms. A trader gives the exchange a little how to buy altcoins on binance 2020 trading wikihow of capital in return for a lot of capital to trade with and risks it all for the opportunity to make a significant profit. What are the benefits of cryptocurrency margin trading? When you borrow money from an exchange in order to margin trade Bitcoin, the exchange that provides the capital keeps a number of controls in place in order to minimize risk. This loan is collateralized by the funds in your best return on equity stocks vanguard sell stocks exchange and you will need to pay it back with. Fusion Markets. If the borrower has low collateral ration, then the borrower can borrow more on his given asset basis. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. There are a number of important practices and strategies that should be considered before margin trading Bitcoin or other cryptocurrencies:.

If you now understand how to margin trade Bitcoin after reading this article and choose to margin trade it's important that you choose the right margin trading crypto exchange and carefully assess your potential profits and losses before committing to a position. Bitcoin mining. What is margin trading cryptocurrency, though, and how does crypto margin trading work? Crypto lending platforms will develop into a crypto fixed income market. News Learn Videos Research. Don't Miss Anything Your e-mail address is only used to send you our newsletter and information about the activities of SmartCredit. Different cryptocurrency exchanges offer differing amounts of leverage. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Let us consider the following example. Entering Position Details The order window will allow you to define the parameters of your order.

If the borrower has low collateral ration, then the borrower can borrow more on his given asset basis. Fixed Income Fund — this refers to the automated investment engine, where the users will define their investment rules. The alternative would be a bond-like structure of the loans, which would make the fixed term loans transferable. The traditional method of trading crypto is to buy and sell digital currencies on an exchange using your own funds. Thank you for your feedback. Coinbase is notable because it is one of only a few big cryptocurrency exchanges based in the U. If the margin level of a position becomes too insecure an exchange is likely to liquidate the position — this is referred to as the margin liquidation level or liquidation price. What are the risks? Opening a position. Crypto margin trading is a trading practice that allows traders to gain greater exposure to a specific asset by borrowing capital from other traders on an exchange or the exchange itself. Learn how we make money. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.